ActiveX Markets Review 1

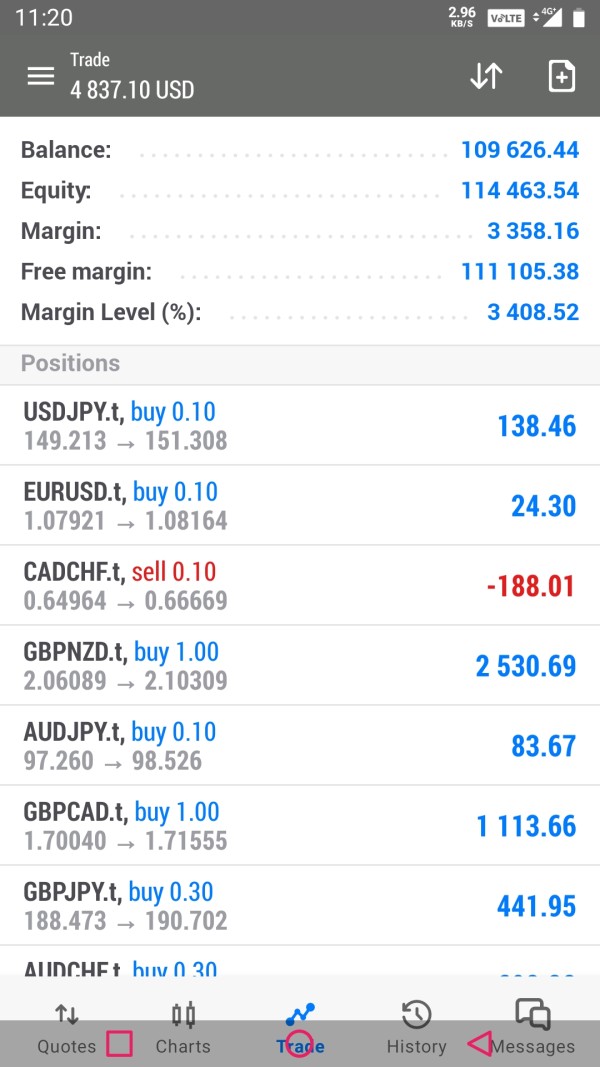

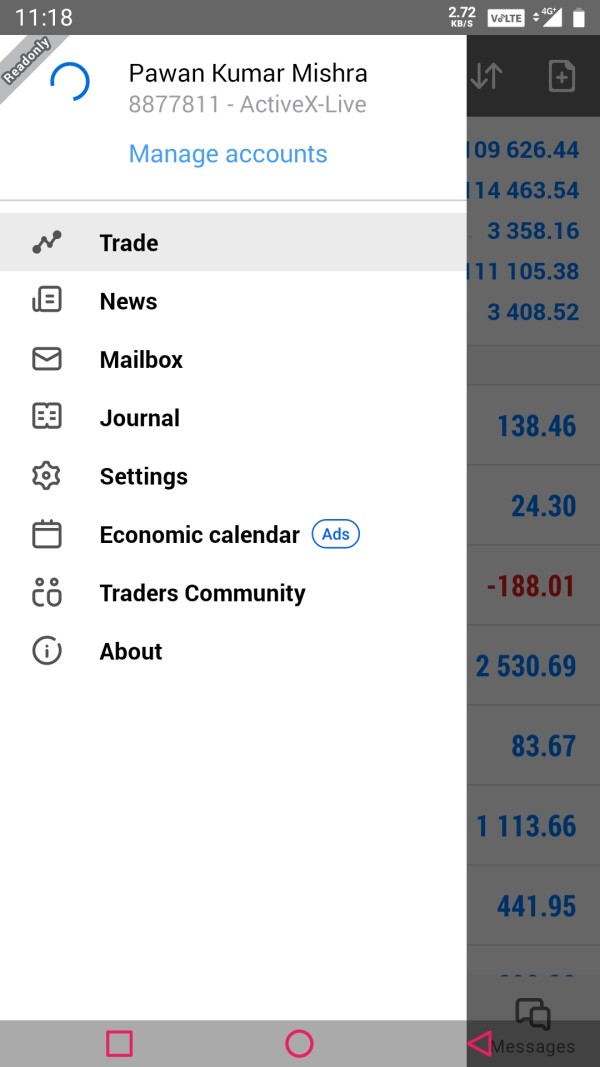

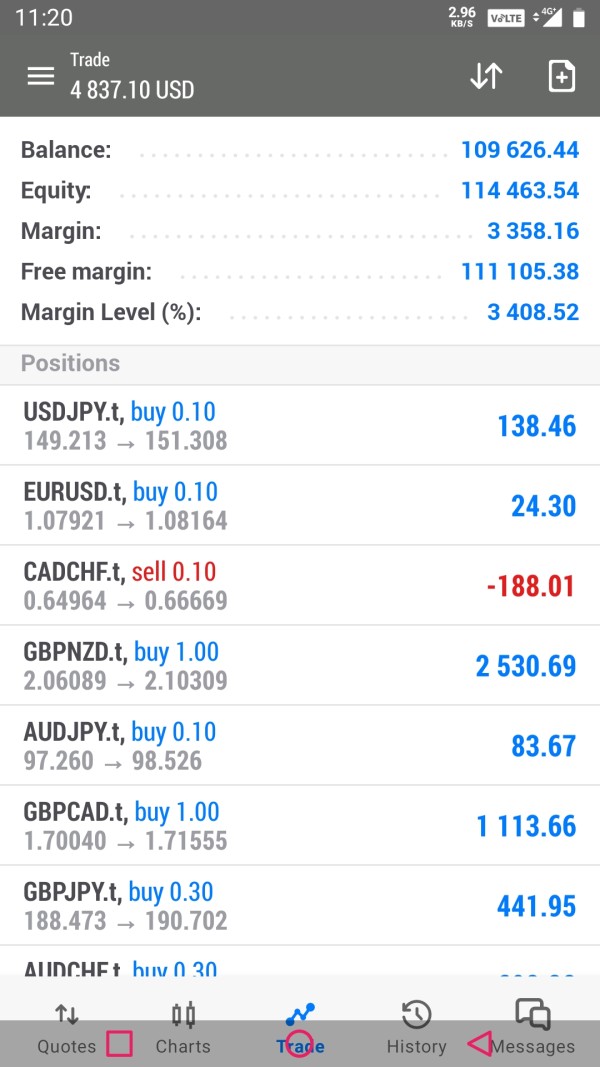

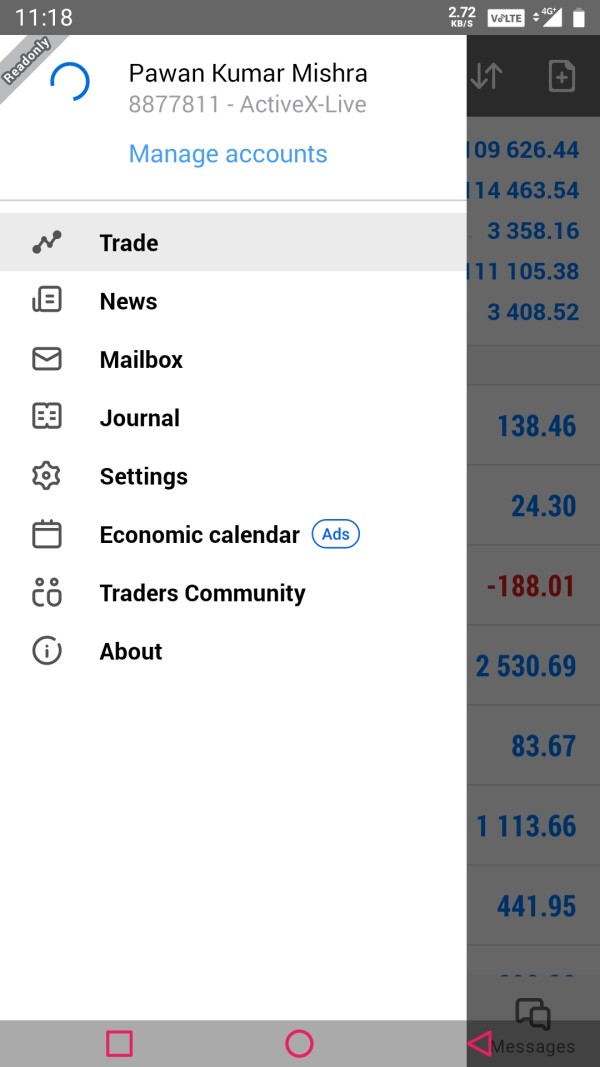

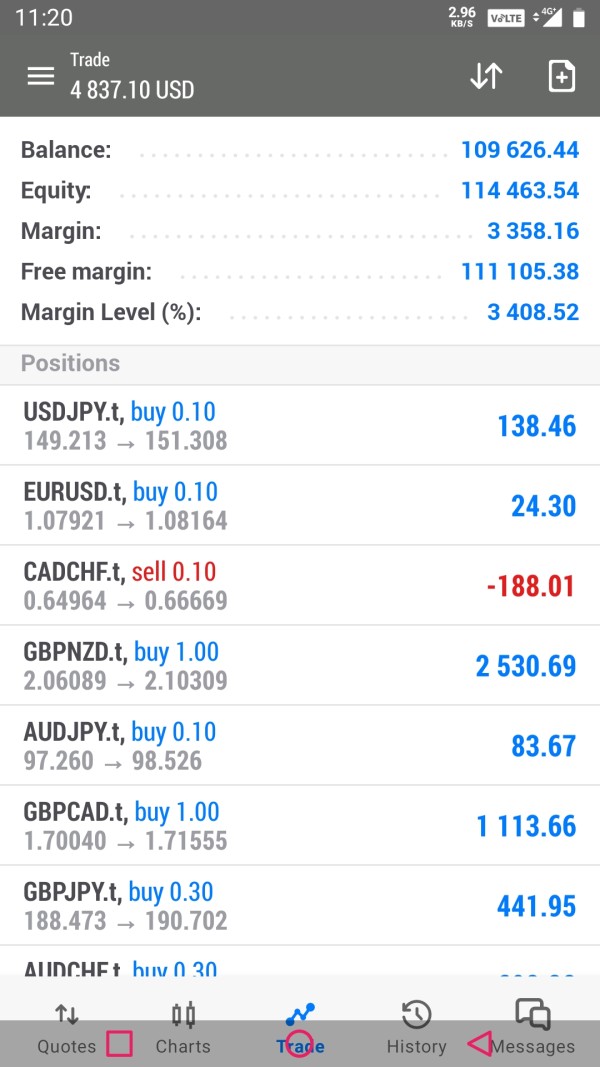

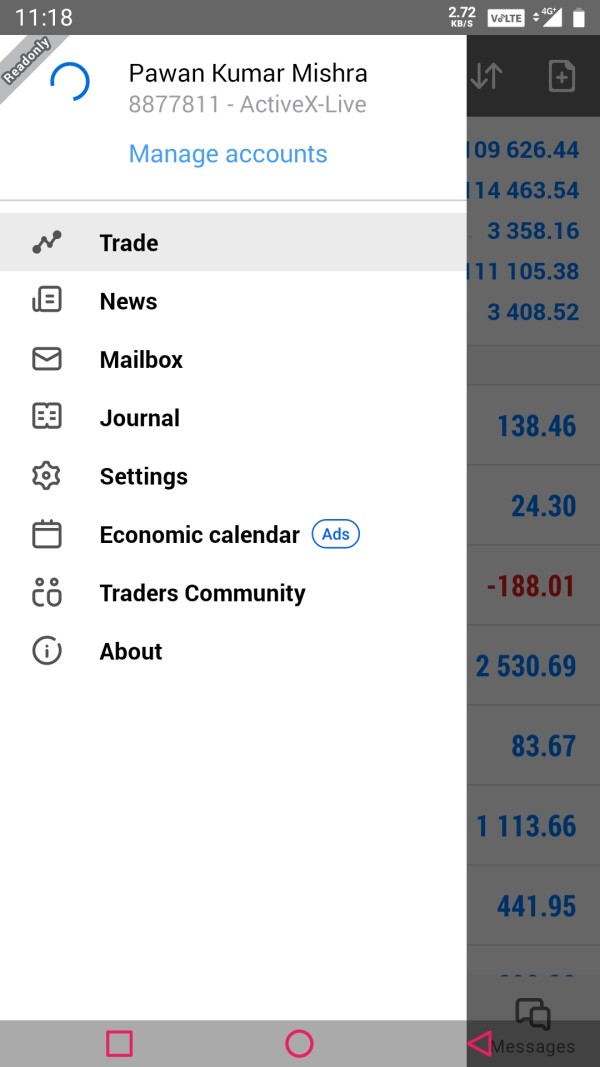

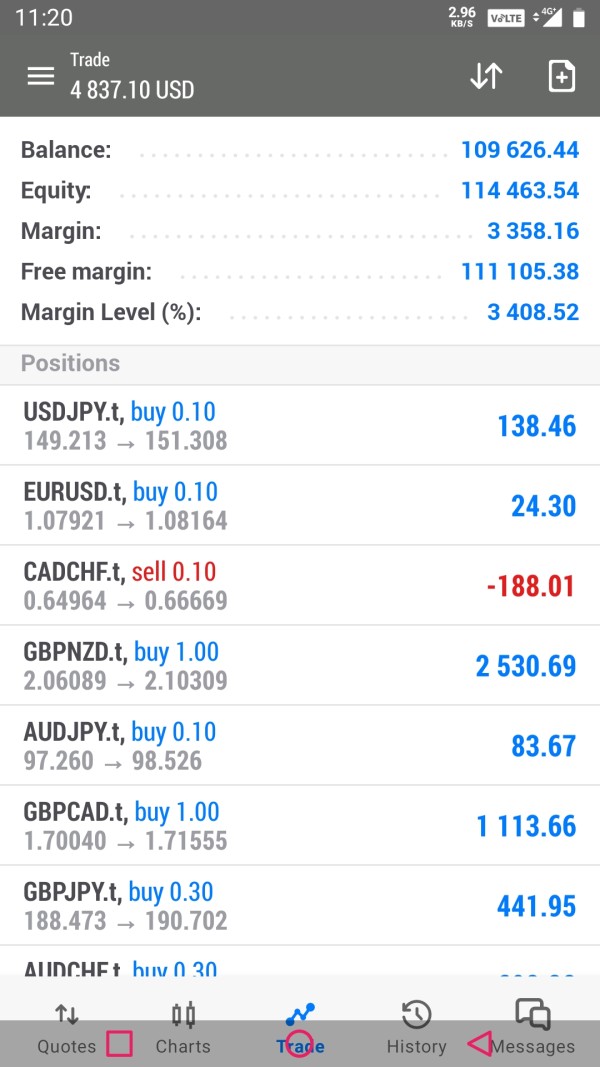

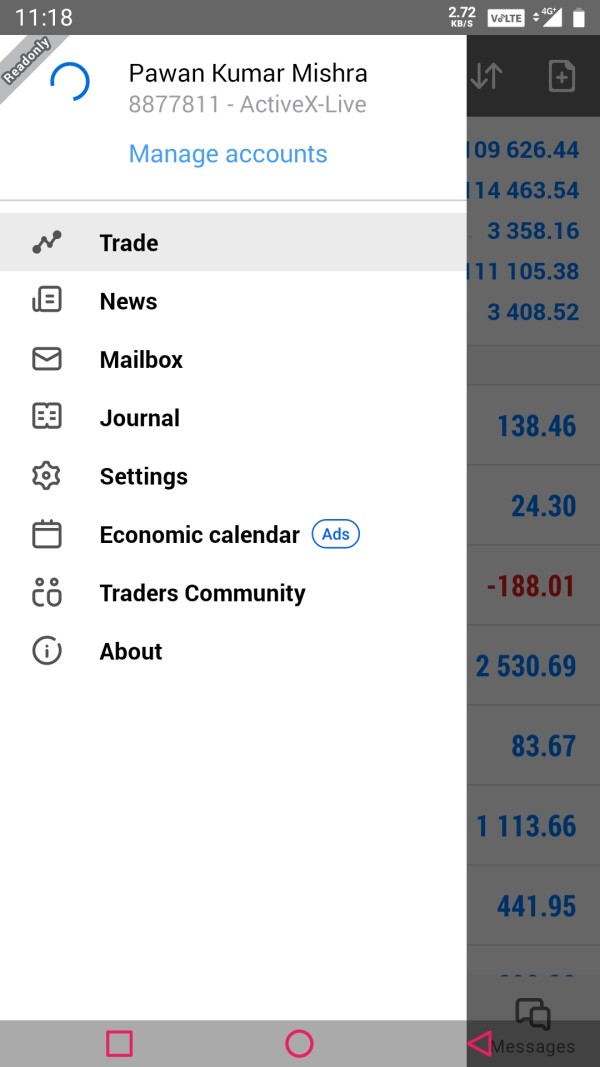

I am not able to withdraw my money from my account .and my myMT 5 app. also become inactive

ActiveX Markets Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

I am not able to withdraw my money from my account .and my myMT 5 app. also become inactive

Summary: Activex Markets has garnered significant negative attention in the forex trading community, primarily due to its lack of regulatory oversight and claims of being based in the UK without proper authorization. Key findings indicate a concerning absence of investor protection mechanisms, making it a risky choice for potential traders.

Note: It is crucial to acknowledge the variations in regulatory frameworks across different regions, which significantly impact the legitimacy of brokers like Activex Markets. This review aims to provide a fair and accurate assessment based on available information.

| Category | Rating (out of 10) |

|---|---|

| Account Conditions | 3 |

| Tools and Resources | 4 |

| Customer Service and Support | 2 |

| Trading Setup (Experience) | 3 |

| Trustworthiness | 1 |

| User Experience | 2 |

We rate brokers based on comprehensive research, user feedback, and expert analysis.

Founded in 2023, Activex Markets claims to be an online forex and cryptocurrency trading platform. It offers a variety of trading instruments, including forex pairs, commodities, and indices. However, the broker has come under scrutiny for its unregulated status, with no clear evidence of authorization from major regulatory bodies like the Financial Conduct Authority (FCA) in the UK. The platform reportedly supports trading through popular interfaces like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), although the quality and reliability of these platforms have been questioned in various reviews.

Regulated Geographical Areas:

Activex Markets operates without any significant regulatory oversight. Reports indicate that the FCA has issued warnings regarding this broker, stating that it is not authorized to provide financial services in the UK. This lack of regulation is a major red flag for potential investors.

Deposit/Withdrawal Currencies/Cryptocurrencies:

The broker supports several payment methods, including bank transfers, Skrill, Neteller, and cryptocurrency options. However, specific details regarding withdrawal times and fees are vague, which is concerning for traders looking for transparency.

Minimum Deposit:

The minimum deposit required to open an account with Activex Markets is $100, which is relatively high compared to other brokers that offer accounts with lower initial deposits. This could deter novice traders looking to enter the market with minimal risk.

Bonuses/Promotions:

There is little to no information available about any promotional offers or bonuses that Activex Markets might provide, which is a common strategy among reputable brokers to attract new clients.

Tradeable Asset Classes:

Activex Markets claims to offer a range of tradable assets, including forex, commodities, and indices. However, the lack of transparency regarding the specifics of these offerings raises questions about their legitimacy.

Costs (Spreads, Fees, Commissions):

There is no clear information on spreads, fees, or commissions associated with trading on Activex Markets. This lack of transparency is a significant concern, as traders need to understand the costs involved in their trading activities.

Leverage:

Activex Markets offers leverage up to 500:1, which is significantly higher than what is permitted by regulated brokers in the UK and EU, where the cap is typically set at 30:1. This high leverage can be enticing but also poses substantial risks, particularly for inexperienced traders.

Allowed Trading Platforms:

While the broker claims to offer MT4 and MT5, user reviews suggest that the trading platform's functionality is generic and lacks advanced features compared to other established brokers. This could limit traders' ability to implement more complex strategies effectively.

Restricted Regions:

There is no specific information on restricted regions, but given its unregulated status, it is advisable for traders in highly regulated jurisdictions to avoid Activex Markets.

Available Customer Service Languages:

Customer support appears to be limited, with reports indicating poor responsiveness and a lack of adequate support resources, which can be detrimental when traders encounter issues.

| Category | Rating (out of 10) |

|---|---|

| Account Conditions | 3 |

| Tools and Resources | 4 |

| Customer Service and Support | 2 |

| Trading Setup (Experience) | 3 |

| Trustworthiness | 1 |

| User Experience | 2 |

Account Conditions:

The minimum deposit of $100 for an account may seem reasonable, but the lack of lower-tier accounts that many reputable brokers offer limits accessibility for new traders. Furthermore, the tiered account structure does not provide sufficient value compared to established brokers.

Tools and Resources:

Activex Markets does not offer advanced trading tools or resources that are commonly found with regulated brokers. The absence of educational resources or market analysis tools is a significant drawback for traders looking to enhance their skills.

Customer Service and Support:

User feedback consistently highlights issues with customer service, citing long response times and inadequate support. This lack of reliable customer service can lead to frustration, especially during critical trading moments.

Trading Setup (Experience):

The overall trading experience is marred by the platform's limitations and the broker's unregulated status. Users have reported difficulties with executing trades and accessing their funds, which can be detrimental to a trader's success.

Trustworthiness:

The lack of regulation is a critical issue, with multiple sources labeling Activex Markets as a potentially fraudulent broker. The FCA's warnings and the absence of any reputable regulatory oversight make this broker a high-risk choice.

User Experience:

Overall user experience is negatively impacted by the platform's limitations and the broker's lack of transparency. Traders seeking a reliable and secure trading environment are likely to find better options elsewhere.

In conclusion, the Activex Markets Review indicates that this broker poses significant risks for potential traders due to its unregulated status, lack of transparency, and poor customer service. Traders are strongly advised to conduct thorough research and consider more reputable alternatives before committing their funds.

FX Broker Capital Trading Markets Review