Free Investment 2025 Review: Everything You Need to Know

Summary

This free investment review looks at commission-free trading platforms and investment options available in 2025. The industry has changed a lot, with commission-free stock and ETF trading becoming standard across most major platforms. The overall picture shows mixed results - while free investment options offer great benefits like zero commission trades and low account fees, investors must think carefully about the lack of clear regulatory information and different service quality across providers.

Key highlights include widespread use of commission-free trading models and competitive fees that make long-term investing easier to access. These platforms mainly target long-term investors, including charitable organizations and family trusts looking for cost-effective investment solutions. However, the lack of detailed regulatory information in many cases may hurt investor confidence and decision-making.

Industry reports show that the best commission-free trading platforms of 2025 offer much more than just free trades. They provide complete investment tools and resources. This free investment review aims to give investors the essential information they need to make smart decisions in today's changing market.

Important Notice

Free investment platforms operate across different regions, so investors may face different legal and compliance risks depending on where they live. Regulatory rules differ a lot between countries, and some platforms may not provide complete regulatory disclosure, which could expose investors to additional uncertainties.

This review uses publicly available information and market analysis from 2025. Given the limited availability of detailed user reviews and complete regulatory information for some platforms, investors should strongly consider doing their own research before making investment decisions.

Rating Framework

Broker Overview

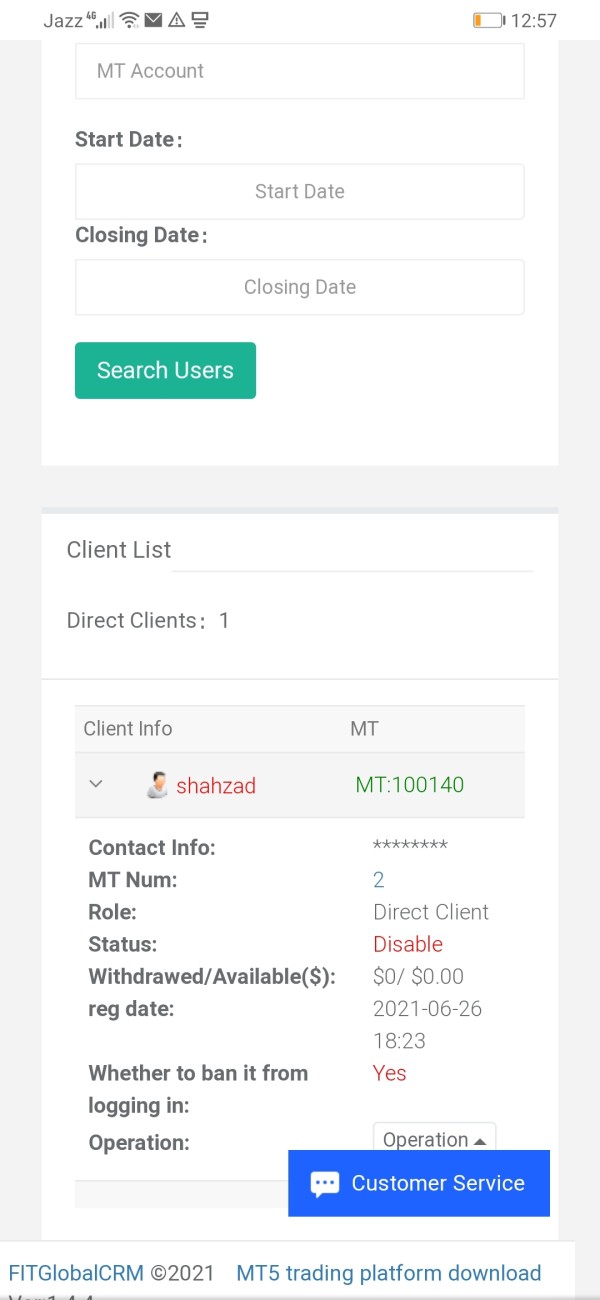

The free investment landscape has changed a lot since the early 2000s, with some services starting as early as 2001. These platforms have grown to focus mainly on independent investment advisory services, targeting long-term goal-oriented clients who want cost-effective investment solutions. The business model centers around serving institutional clients such as charitable organizations and family trusts that need sustained investment strategies without traditional commission costs.

The commission-free trading revolution has completely changed how investors approach portfolio building. It makes it possible to build diversified investment portfolios without paying transaction costs. This shift has made financial markets more accessible and helped smaller investors compete more equally with institutional players.

Modern free investment platforms typically work through multiple online trading interfaces, with platforms like Axos Invest showing the technological progress in this sector. The main focus stays on stock and ETF trading, giving investors access to broad market exposure through cost-effective means. However, complete regulatory information is often not clearly featured in available documentation, which is a big consideration for potential users.

This free investment review shows that while the basic value proposition stays strong, the lack of detailed regulatory disclosure continues to concern investors seeking complete transparency in their platform selection process.

Regulatory Jurisdiction: Available information does not specify complete regulatory oversight details, which may vary a lot by platform and geographic region of operation.

Deposit and Withdrawal Methods: Specific funding and withdrawal methods are not detailed in available resources, though most platforms typically support standard banking transfers and electronic payment methods.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in current documentation, though many commission-free platforms have reduced or eliminated minimum balance requirements.

Bonus and Promotions: Current promotional offerings are not detailed in available materials, though the commission-free structure itself represents the primary value proposition.

Tradeable Assets: The platform focus centers primarily on stocks and ETFs, providing investors with access to equity markets and exchange-traded funds across various sectors and geographic regions.

Cost Structure: The main appeal lies in commission-free trading for stocks and ETFs, with some platforms maintaining low or eliminated account maintenance fees. This structure particularly benefits long-term investors who prioritize cost efficiency over active trading features.

Leverage Options: Specific leverage ratios and margin trading capabilities are not detailed in available documentation.

Platform Selection: Multiple online trading platforms are available, including established names like Axos Invest, offering investors choice in their trading interface and functionality preferences.

Geographic Restrictions: Specific regional limitations are not outlined in current materials.

Customer Service Languages: Available support language options are not specified in current documentation.

This free investment review highlights the importance of directly contacting platforms for specific operational details not covered in general market overviews.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions for free investment platforms represent one of their strongest value propositions, mainly through eliminating commission fees on stock and ETF trades. This basic shift has made long-term investing much more accessible to retail investors who previously faced large transaction costs that could reduce returns over time. The commission-free structure particularly benefits dollar-cost averaging strategies and frequent rebalancing activities that were previously too expensive.

While specific minimum deposit requirements are not detailed in available documentation, the industry trend has moved toward reducing or eliminating these barriers entirely. Many platforms have recognized that lower entry requirements expand their potential customer base and align with their mission of making investment access more democratic.

The absence of detailed account opening procedures in current materials suggests that investors should expect to provide standard financial information and identity verification, though specific requirements may vary by platform and jurisdiction. Account management features and special functionalities are not completely detailed in available resources.

Compared to traditional full-service brokers, free investment platforms excel in cost efficiency but may offer fewer personalized account management services. This trade-off aligns well with the target demographic of cost-conscious, long-term investors who prioritize expense ratios over premium service features.

The account conditions earn a solid rating in this free investment review, though the lack of specific details about account tiers and special features prevents a higher score.

The tools and resources available through free investment platforms represent a significant strength, with real-time research and market data forming the foundation of their analytical offerings. Industry leaders have invested heavily in providing complete market information that rivals traditional full-service brokers, recognizing that informed investors make better long-term decisions and maintain higher platform loyalty.

Research capabilities typically include fundamental analysis tools, market news feeds, and economic data that support investment decision-making. The quality of these resources has improved dramatically as platforms compete for market share in the commission-free space. Many platforms now offer institutional-grade research that was previously available only to high-net-worth clients.

However, specific details about educational resources and investor training materials are not completely covered in available documentation. The absence of detailed information about automated trading support and advanced analytical tools represents a gap in current market information that potential users should investigate directly with platforms.

Market data access appears robust based on industry trends, though real-time versus delayed data availability may vary by platform and account type. The integration of research tools with trading platforms has generally improved user experience and decision-making efficiency.

The tools and resources dimension receives a strong rating due to the apparent quality of research offerings, though specific feature details would strengthen the evaluation further.

Customer Service and Support Analysis

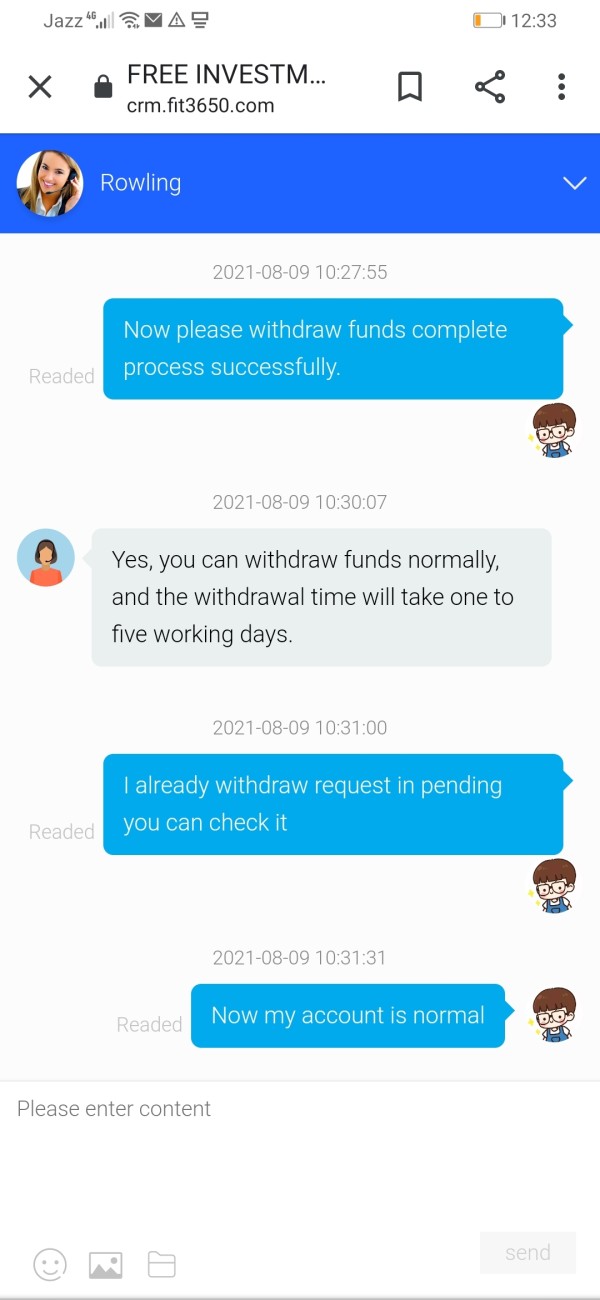

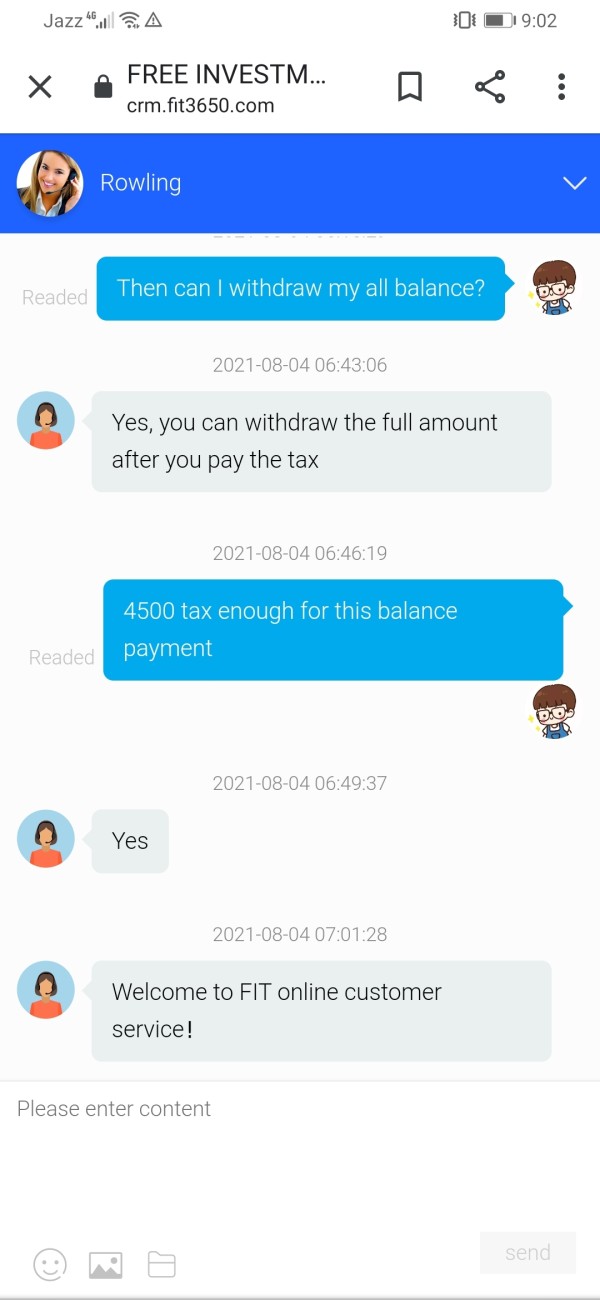

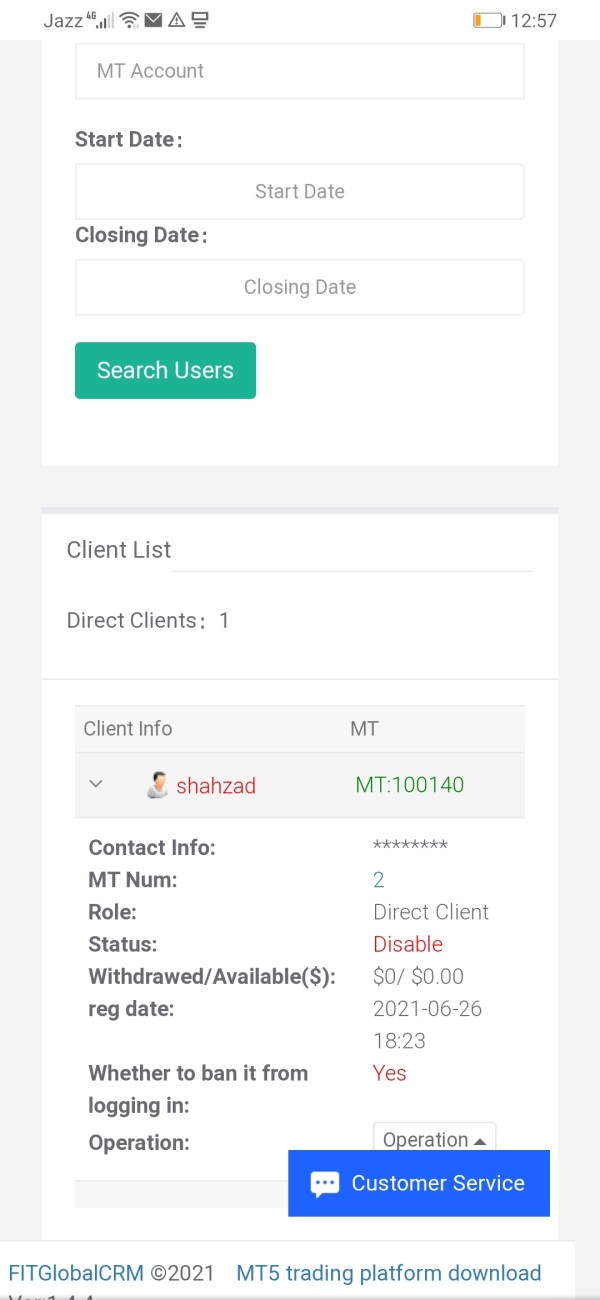

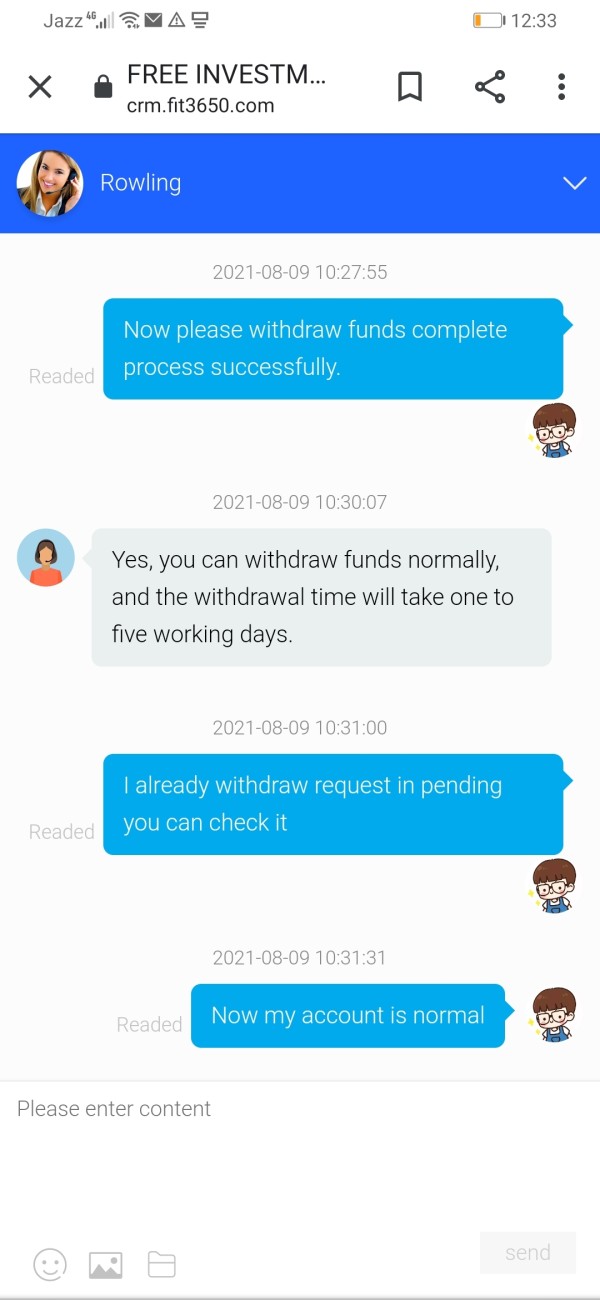

Customer service and support represent areas where detailed information is notably absent from available documentation, creating uncertainty about the quality and availability of user assistance. This information gap is concerning given the importance of reliable support for investment platforms, particularly for users who may encounter technical issues or require assistance with account management.

The lack of specific information about customer service channels, whether through phone, email, chat, or other communication methods, makes it difficult to assess accessibility and convenience for users. Response time expectations and service quality metrics are similarly absent from current materials, preventing a complete evaluation of support effectiveness.

Multilingual support capabilities are not detailed, which could be significant for international users or those preferring service in languages other than English. Customer service hours and availability across different time zones are also not specified in available resources.

Without access to user feedback and testimonials about service experiences, it's challenging to evaluate real-world support quality and problem resolution effectiveness. The absence of documented case studies or service improvement initiatives further limits the ability to assess this dimension completely.

The moderate rating reflects the uncertainty created by limited information rather than evidence of poor service quality, though this lack of transparency itself represents a concern for potential users.

Trading Experience Analysis

The trading experience dimension benefits from the availability of multiple online platforms, providing users with options to select interfaces that match their preferences and trading styles. Platform diversity, including established names like Axos Invest, suggests that the industry has invested in user experience and technological capabilities to compete effectively in the commission-free market.

However, specific information about platform stability, execution speed, and technical performance is not detailed in available documentation. These factors are crucial for evaluating trading experience quality, particularly during periods of high market volatility when platform reliability becomes essential for effective portfolio management.

Order execution quality and trade settlement processes are not specifically addressed in current materials, though industry standards generally ensure reliable transaction processing. The absence of detailed information about mobile trading capabilities represents another gap in available documentation, despite the growing importance of mobile access for modern investors.

Trading environment features such as advanced order types, portfolio management tools, and integration capabilities with external financial software are not completely covered. The focus on stocks and ETFs suggests a streamlined trading experience optimized for long-term investing rather than active trading strategies.

The trading experience receives a positive rating based on platform availability and industry trends, though specific performance metrics would strengthen the evaluation significantly.

Trust and Reliability Analysis

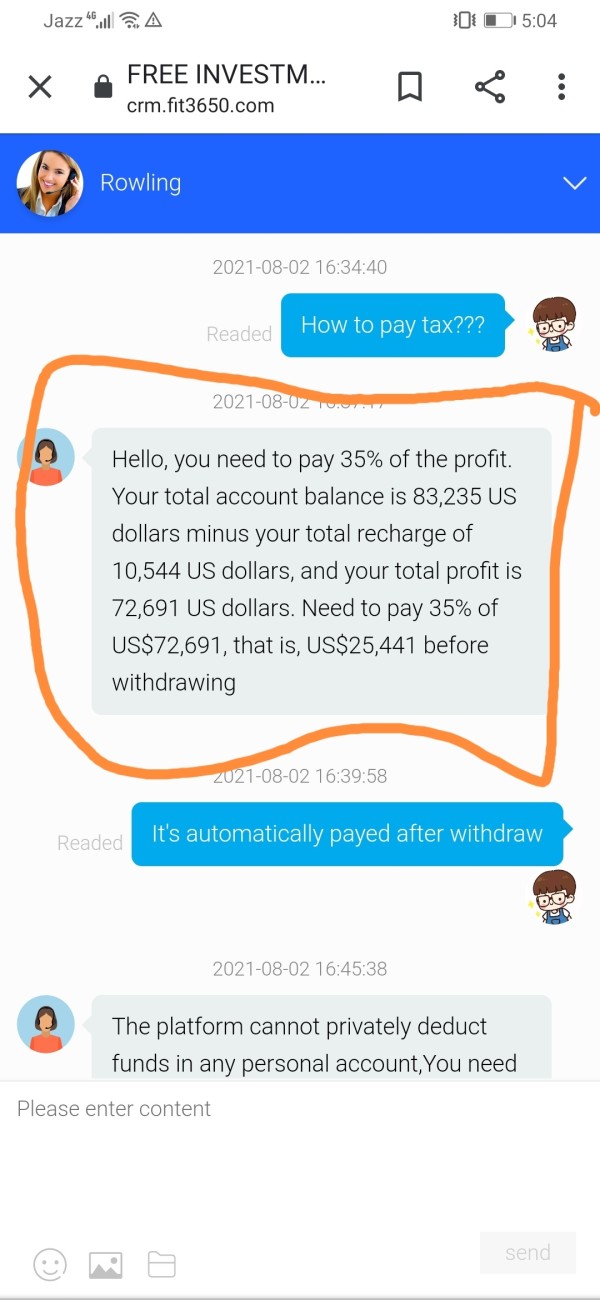

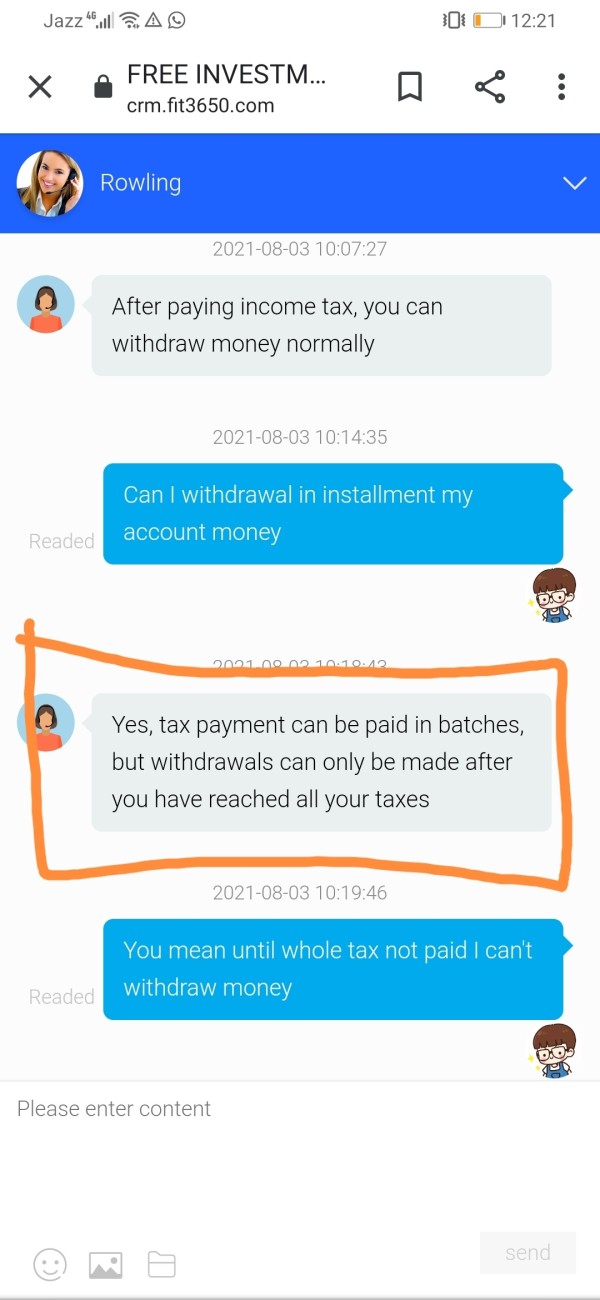

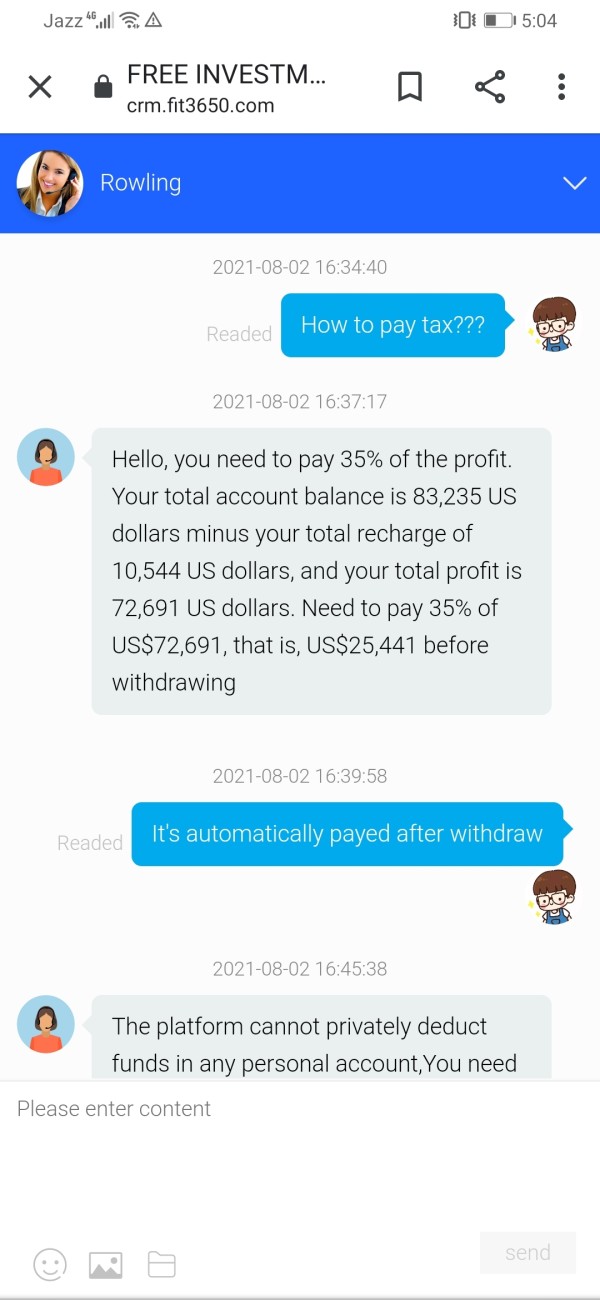

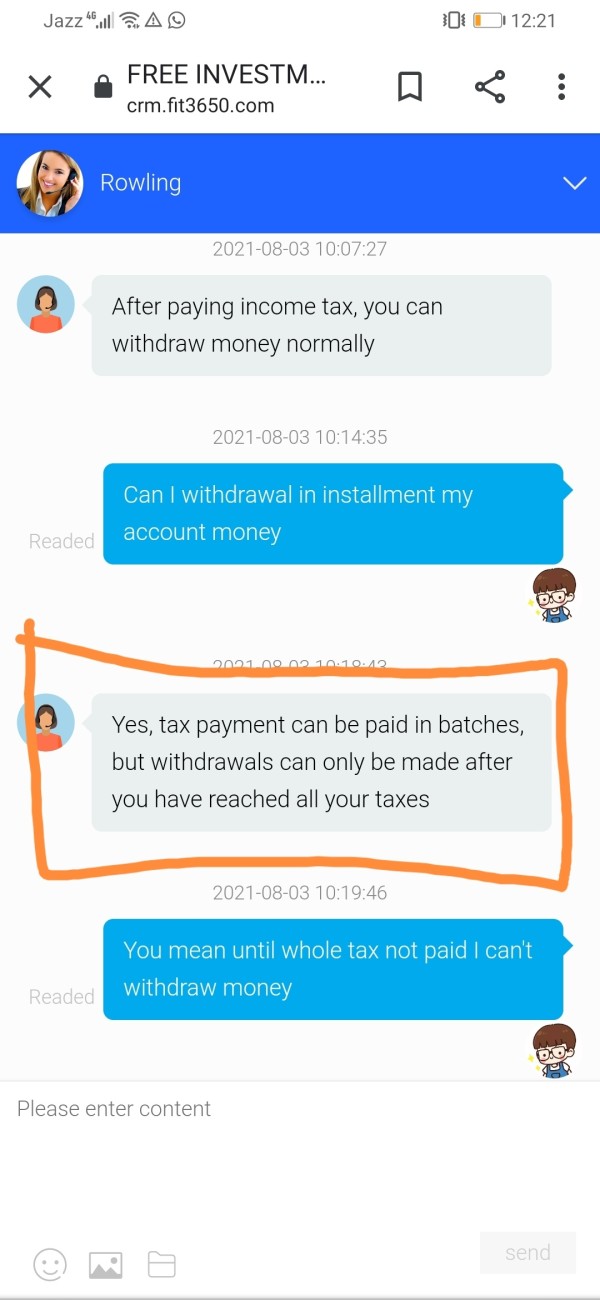

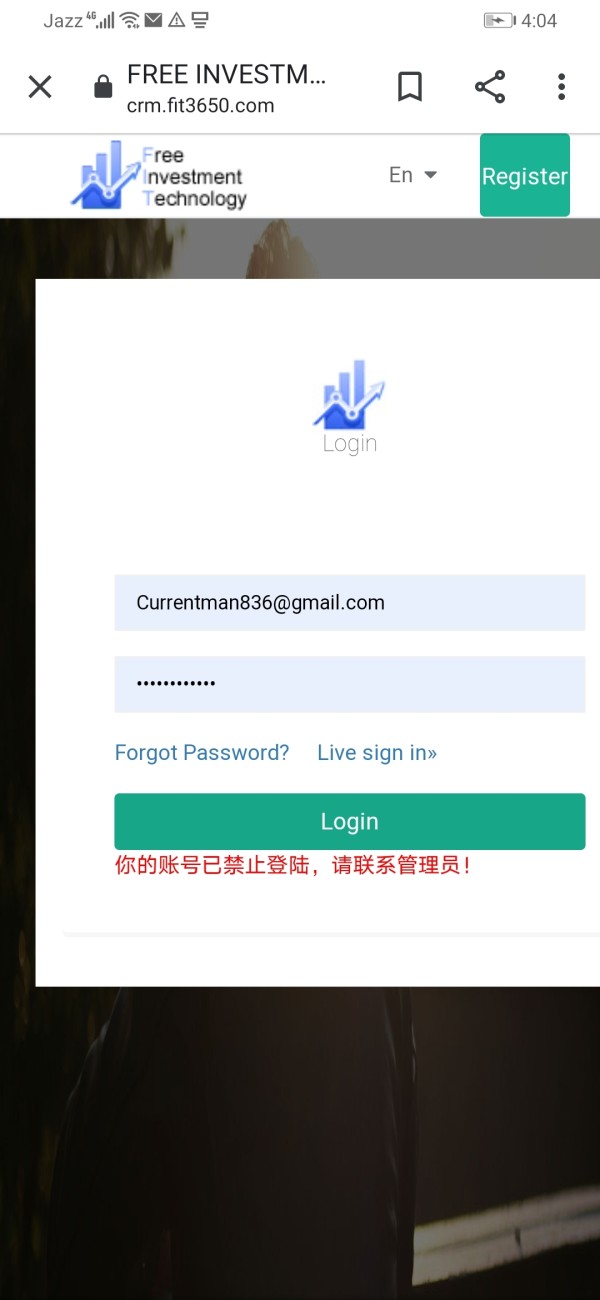

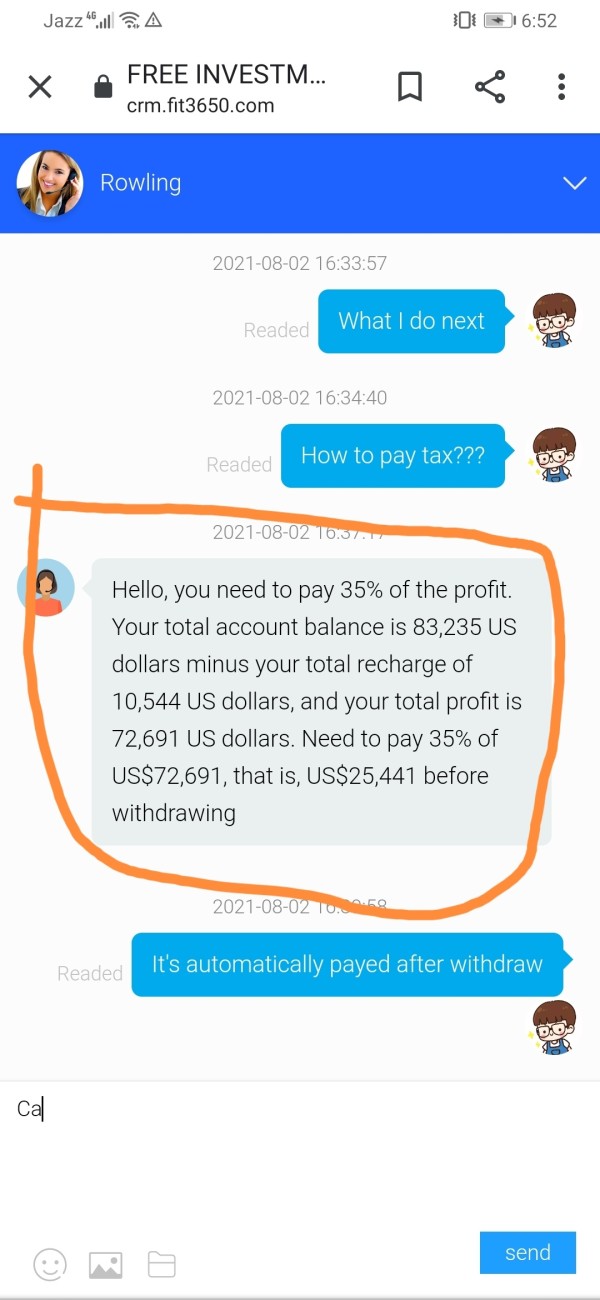

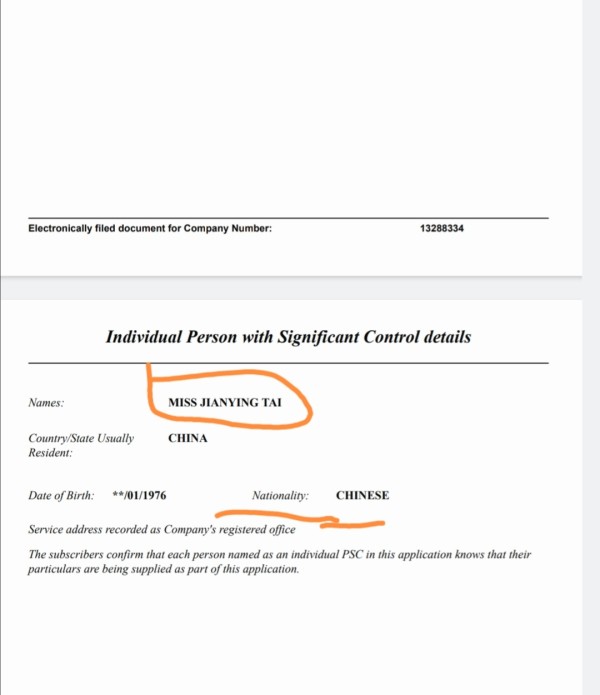

Trust and reliability represent the most concerning aspect of this free investment review, mainly due to the absence of complete regulatory information in available documentation. Regulatory oversight provides essential investor protections and establishes accountability frameworks that are fundamental to financial service credibility.

The lack of specific regulatory authority information means investors cannot easily verify licensing, compliance standards, or dispute resolution mechanisms. This transparency gap is particularly significant in the financial services sector, where regulatory oversight provides crucial safeguards for investor funds and establishes operational standards.

Fund security measures and investor protection protocols are not detailed in available materials, creating uncertainty about asset segregation, insurance coverage, and other protective mechanisms that investors typically expect from reputable platforms. Company transparency regarding ownership, management, and operational policies is similarly limited in current documentation.

Industry reputation and third-party validation information is not readily available, preventing assessment of platform standing within the broader financial services community. The absence of information about negative incident handling and resolution procedures further impacts the ability to evaluate trustworthiness completely.

The low rating in this dimension reflects the significant concern created by limited regulatory transparency rather than evidence of actual problems, though this lack of information itself represents a substantial issue for investor confidence.

User Experience Analysis

User experience evaluation is significantly hampered by the absence of complete user feedback and satisfaction data in available documentation. Without access to actual user testimonials and experience reports, it's challenging to assess how well these platforms meet real-world investor needs and expectations.

Interface design and usability information is not detailed in current materials, though the availability of multiple platform options suggests some attention to user preferences and experience optimization. The registration and account verification processes are not specifically described, though industry standards typically involve straightforward online applications with identity verification requirements.

Funding and withdrawal experience details are absent from available documentation, yet these operational aspects significantly impact overall user satisfaction. The efficiency and reliability of money movement processes often determine user retention and platform preference in competitive markets.

Common user complaints and satisfaction pain points are not documented in available materials, preventing identification of potential experience issues or platform limitations. The target demographic of long-term investors suggests that platforms may prioritize stability and cost-effectiveness over advanced trading features that appeal to active traders.

User experience receives a neutral rating due to limited available information rather than evidence of poor design or functionality. The focus on serving long-term investors and institutional clients like charitable organizations suggests a user experience optimized for simplicity and cost-effectiveness rather than advanced trading capabilities.

Conclusion

This free investment review reveals a mixed landscape where commission-free trading and low account fees provide significant value for cost-conscious, long-term investors, while regulatory transparency concerns create notable reservations. The overall assessment remains neutral due to the balance between attractive cost structures and information gaps that impact investor confidence.

The platforms appear most suitable for long-term investors, charitable organizations, and family trusts that prioritize cost efficiency over premium service features. Individual investors focused on building diversified portfolios through regular contributions will likely find substantial value in the commission-free structure and low ongoing costs.

The primary advantages center on eliminated transaction costs and reduced account fees that can significantly improve long-term investment returns. However, the lack of complete regulatory disclosure and limited transparency about operational details represent substantial drawbacks that potential users must carefully consider before committing funds to these platforms.