GYT Review 1

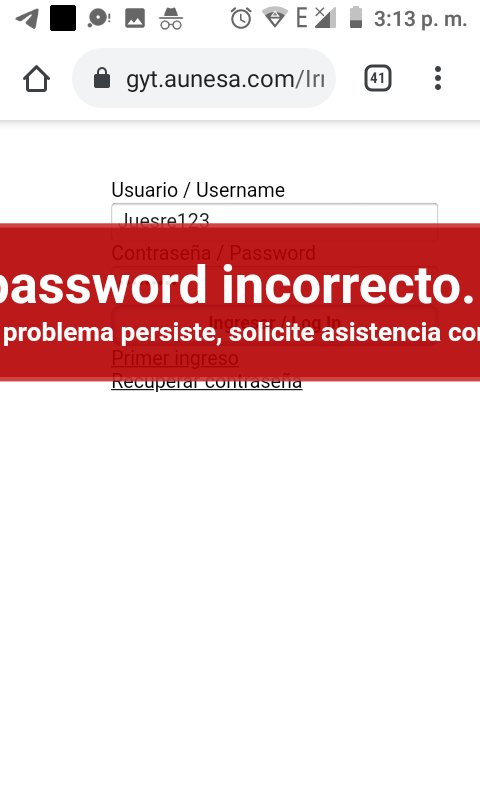

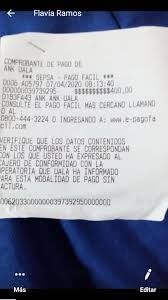

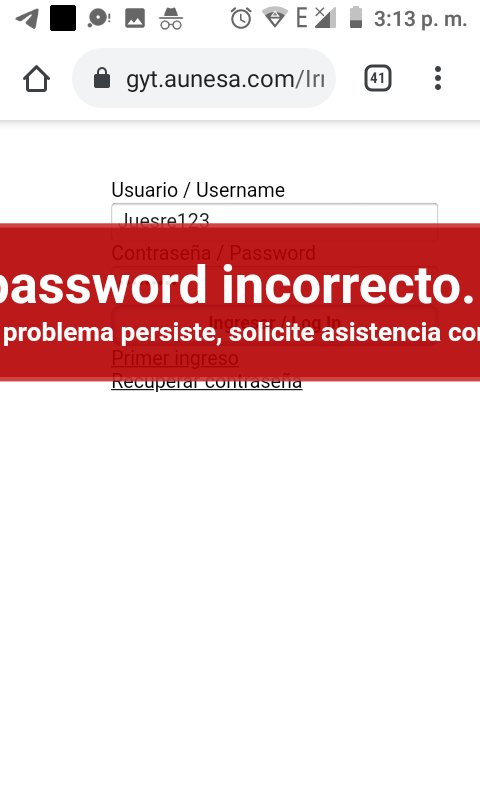

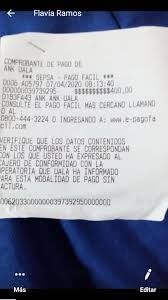

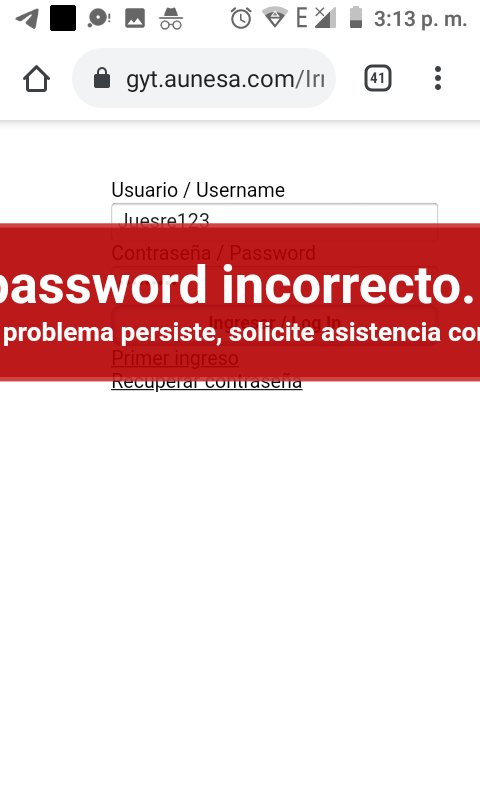

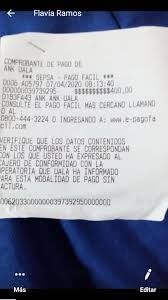

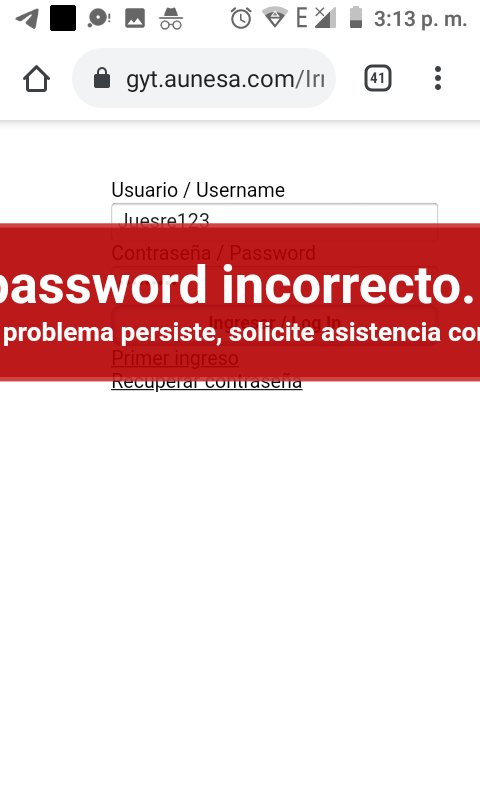

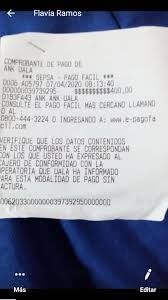

Like many other people, we are so innocent. They messaged me via WhatsApp and promised a return of 50%. So I dpeosited $400. But they never give me money

GYT Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Like many other people, we are so innocent. They messaged me via WhatsApp and promised a return of 50%. So I dpeosited $400. But they never give me money

This comprehensive gyt review provides an in-depth analysis of GYT, a forex brokerage company headquartered in Rosario, Argentina. GYT presents significant concerns for potential traders, primarily due to the lack of effective regulatory oversight and documented financial difficulties. While the broker advertises zero-spread forex trading as a key feature, these benefits are overshadowed by substantial regulatory and financial stability issues that could put trader funds at risk.

Our investigation reveals that GYT Brokers operates without adequate regulatory supervision. This poses considerable risks for client fund protection. Additionally, reports indicate that GYT Plus has announced the need for debt restructuring and inability to fulfill obligations to clients, raising serious red flags about the company's financial health and operational stability. The broker targets users seeking low-commission forex trading opportunities. However, the associated risks may outweigh the potential benefits for most traders.

GYTworkz, a related entity, maintains a user rating of 3.8 out of 5, suggesting mixed user experiences. This moderate rating cannot compensate for the fundamental concerns regarding regulatory compliance and financial stability that characterize this gyt review.

Traders should be aware that GYT operates across different regions, and the regulatory risks may vary depending on the jurisdiction. The lack of effective regulation mentioned in available sources suggests that clients in various regions may face similar exposure to regulatory gaps and potential fund security issues that could affect their trading capital.

This gyt review is based on publicly available information, user feedback, and documented reports about the broker's operations. Due to limited transparency from the company itself, some information may be incomplete or subject to change without notice. Potential clients should conduct additional due diligence and consider the significant risks associated with trading through an unregulated broker before making any investment decisions.

| Criterion | Score | Rating |

|---|---|---|

| Account Conditions | 3/10 | Poor |

| Tools and Resources | 2/10 | Very Poor |

| Customer Service and Support | 5/10 | Average |

| Trading Experience | 4/10 | Below Average |

| Trust and Safety | 2/10 | Very Poor |

| User Experience | 4/10 | Below Average |

GYT operates as a forex brokerage company with its headquarters located in the NORDLINK BUILDING in Rosario, Argentina. The company positions itself in the competitive forex trading market by offering various trading services, with a particular emphasis on zero-spread trading opportunities that may appeal to cost-conscious traders. However, the establishment date and detailed company history remain unclear from available public information. This adds to the transparency concerns surrounding this broker.

The company's business model centers on forex brokerage services. It provides multiple trading options for clients interested in currency markets. According to available information, GYT focuses primarily on forex trading rather than diversifying into other asset classes such as commodities, indices, or cryptocurrencies, which limits investment options for traders seeking broader market exposure. This specialized approach may appeal to traders specifically interested in currency markets. However, it also limits portfolio diversification opportunities for clients seeking broader market exposure.

Unfortunately, this gyt review must note that specific details about the trading platform technology, regulatory licenses, and comprehensive service offerings remain largely undisclosed in publicly available sources. This lack of transparency is concerning for potential clients who require detailed information to make informed trading decisions.

Regulatory Status: Available information indicates that GYT Brokers lacks effective regulatory oversight, which represents a significant concern for trader protection and fund security. No specific regulatory bodies or license numbers have been identified in the available materials, creating uncertainty about legal protections for client funds.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods has not been detailed in the available sources. This leaves potential clients uncertain about funding options and processes.

Minimum Deposit Requirements: The minimum deposit amount required to open an account with GYT is not specified in the available documentation. This makes it difficult for potential traders to plan their initial investment.

Bonuses and Promotions: Current promotional offers, welcome bonuses, or ongoing incentive programs are not mentioned in the available sources. This lack of information prevents traders from understanding potential account benefits.

Tradable Assets: The broker focuses primarily on forex trading, offering currency pair trading opportunities to its clients. However, the specific range of available currency pairs and whether other asset classes are available remains unclear from public information.

Cost Structure: One of the few concrete pieces of information available indicates that GYT offers zero-spread trading. However, commission structures, overnight fees, and other potential charges are not detailed in the available sources, making cost assessment difficult.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in the available documentation. This is crucial information for risk management planning.

Platform Options: The specific trading platforms offered by GYT, whether proprietary or third-party solutions like MetaTrader, are not mentioned in available sources. This creates uncertainty about trading technology and capabilities.

Geographic Restrictions: Information about countries or regions where GYT services are restricted or unavailable is not provided in the available materials. This affects potential client eligibility assessment.

Customer Support Languages: The languages supported by GYT's customer service team are not specified in the available documentation. This may limit accessibility for international clients.

This gyt review highlights the significant information gaps that potential clients face when evaluating this broker. These gaps themselves raise concerns about transparency and regulatory compliance.

The account conditions offered by GYT present several challenges for potential traders seeking comprehensive information. The absence of detailed account type descriptions in available sources makes it difficult to assess whether the broker offers different account tiers with varying features and benefits that could meet diverse trading needs. Traditional brokers typically provide multiple account types such as basic, premium, or VIP accounts with different minimum deposits, spreads, and additional services.

The lack of specific minimum deposit requirements mentioned in available sources creates uncertainty for traders planning their initial investment. This information gap is particularly concerning as minimum deposit amounts often indicate the broker's target market and can affect accessibility for retail traders who may have limited capital. Without clear deposit requirements, potential clients cannot adequately plan their trading capital allocation or compare GYT's accessibility with other brokers in the market.

Account opening procedures and verification processes are not detailed in the available documentation. This leaves questions about the complexity and time required to become a trading client. Modern brokers typically provide streamlined digital onboarding processes, but without specific information about GYT's procedures, potential clients cannot anticipate the account setup experience or prepare necessary documentation.

The absence of information about special account features, such as Islamic accounts, demo accounts, or professional trader accounts, further limits the appeal for diverse trading needs. These specialized account options are increasingly standard in the industry. Their absence or lack of promotion may indicate limited service sophistication.

This gyt review must emphasize that the significant information gaps regarding account conditions represent a substantial drawback for potential clients. Transparency and detailed terms are essential before committing to a trading relationship.

The evaluation of GYT's trading tools and resources reveals concerning gaps in available information that are essential for modern forex trading. Contemporary forex brokers typically provide comprehensive suites of analytical tools, charting capabilities, and market research resources to support trader decision-making and improve trading outcomes. However, specific details about GYT's tool offerings are not mentioned in available sources.

Educational resources represent a critical component of responsible brokerage services, particularly for retail traders who may benefit from market analysis, trading guides, and educational webinars. The absence of information about educational programs, market analysis, or trader development resources suggests either limited offerings or poor communication about available services that could help traders improve their skills. This gap is particularly significant in today's competitive brokerage environment where educational support often differentiates quality service providers.

Research and analysis capabilities, including economic calendars, market news feeds, and technical analysis tools, are standard expectations for modern trading platforms. Without information about these fundamental resources, potential clients cannot assess whether GYT provides the analytical support necessary for informed trading decisions that could impact profitability. The lack of detail about research offerings may indicate insufficient investment in trader support infrastructure.

Automated trading support, including expert advisor compatibility, algorithmic trading capabilities, and API access, represents increasingly important functionality for serious traders. The absence of information about automation features suggests potential limitations in platform sophistication and technological advancement that could restrict trading strategies.

This analysis highlights that the lack of detailed information about tools and resources represents a significant disadvantage in this gyt review. Modern traders expect comprehensive support systems from their chosen brokers.

Customer service quality represents a fundamental aspect of broker evaluation, yet available information about GYT's support services remains notably limited. Modern forex brokers typically provide multiple communication channels including live chat, telephone support, email assistance, and sometimes social media engagement to ensure traders can get help when needed. The absence of specific information about GYT's customer service channels creates uncertainty about accessibility and support quality.

Response time expectations and service availability hours are crucial factors for traders who may need assistance during various market sessions. International forex markets operate around the clock, making 24/7 or extended hour support particularly valuable for traders in different time zones. Without clear information about support availability, potential clients cannot assess whether assistance will be accessible when needed, particularly during volatile market conditions or urgent account issues that require immediate attention.

Service quality indicators, such as staff expertise, problem resolution efficiency, and customer satisfaction metrics, are not detailed in available sources. The moderate GYTworkz rating of 3.8 out of 5 provides some indication of user experience. However, it lacks specific details about customer service interactions or support quality assessments.

Multilingual support capabilities become increasingly important for international brokers serving diverse client bases. The absence of information about supported languages may indicate limited international service capabilities or inadequate communication about available language options that could affect non-English speaking traders. This limitation could particularly affect non-English speaking traders seeking comprehensive support.

The lack of documented customer service case studies, testimonials, or detailed support procedures represents a significant information gap. This prevents thorough evaluation of this critical service component in this gyt review.

The trading experience evaluation for GYT reveals mixed information with significant gaps that affect overall assessment. Platform stability and execution speed represent fundamental requirements for successful forex trading, yet specific performance metrics are not detailed in available sources that would help traders understand system reliability. While some information indicates an average trading speed of 0ms, this technical specification requires additional context about measurement methodology and real-world performance conditions.

Order execution quality, including fill rates, slippage control, and price accuracy, directly impacts trading profitability and user satisfaction. The available information mentions zero spread costs, which could indicate competitive pricing for traders seeking low-cost execution. However, it lacks comprehensive details about execution quality, slippage management, or order processing efficiency during various market conditions.

Platform functionality and user interface design significantly influence daily trading activities, yet specific details about GYT's platform features, charting capabilities, and trading tools are not provided in available sources. Modern traders expect sophisticated platforms with advanced charting, multiple order types, and intuitive interfaces that support efficient trade management and market analysis.

Mobile trading capabilities have become essential for contemporary forex trading, allowing traders to monitor positions and execute trades while away from desktop computers. The absence of information about mobile platform availability, app quality, or mobile-specific features represents a notable gap in service assessment that could affect trader flexibility.

The zero-spread trading feature mentioned in available sources could provide cost advantages for high-frequency traders. However, without comprehensive context about when these conditions apply, potential limitations, or associated commission structures, traders cannot fully evaluate the true cost benefits. This gyt review emphasizes that incomplete trading experience information limits thorough broker assessment.

Trust and safety considerations represent the most concerning aspects of this gyt review, with multiple red flags that potential clients must carefully consider. The documented lack of effective regulatory oversight for GYT Brokers creates fundamental concerns about client protection, fund segregation, and dispute resolution mechanisms that are essential for trader security. Regulatory supervision provides essential safeguards for trader funds and ensures brokers operate according to established financial service standards.

Fund security measures, including client money segregation, deposit protection schemes, and operational risk management, are not detailed in available sources. Regulated brokers typically maintain client funds in segregated accounts with tier-one banks and provide compensation scheme coverage, but without regulatory oversight, these protections may not exist or may lack adequate enforcement mechanisms that could leave trader funds vulnerable.

Company transparency issues are evident throughout this evaluation, with significant information gaps about company history, ownership structure, financial statements, and operational procedures. Transparency represents a cornerstone of trustworthy financial service providers. The absence of comprehensive public information raises questions about accountability and operational standards.

The financial stability concerns highlighted by reports that GYT Plus announced debt restructuring requirements and inability to fulfill client obligations represent serious warning signs. These financial difficulties suggest potential risks to client fund security and service continuity that could affect ongoing trading operations. Debt restructuring announcements often indicate significant financial stress that could affect operational capabilities and client service quality.

Industry reputation and third-party evaluations are limited, with minimal independent verification of service quality or operational standards. The absence of recognized industry awards, regulatory commendations, or independent audit results further emphasizes the trust and safety concerns identified in this analysis.

User experience evaluation for GYT presents a mixed picture based on limited available feedback and the moderate GYTworkz rating of 3.8 out of 5. This rating suggests that users have experienced average satisfaction levels, but falls short of the higher ratings typically associated with leading forex brokers in the industry. The moderate score indicates room for improvement across various service aspects while suggesting that some users have found acceptable value in the services provided.

Interface design and platform usability represent critical factors in daily trading activities, yet specific user feedback about platform navigation, feature accessibility, and overall design quality is not detailed in available sources. Modern traders expect intuitive interfaces that facilitate efficient market analysis and trade execution without unnecessary complexity. However, without specific user testimonials about platform experience, comprehensive evaluation remains challenging.

Registration and account verification processes significantly impact initial user experience, but detailed feedback about onboarding procedures, document requirements, and approval timeframes is not available in the sources reviewed. Streamlined registration processes with clear requirements and reasonable processing times contribute to positive initial impressions. Complicated or lengthy procedures often frustrate new clients.

Funding operations, including deposit processing times, withdrawal procedures, and payment method availability, directly affect user satisfaction and trading capability. However, specific user experiences with funding operations are not documented in available sources. This prevents assessment of this crucial service component.

Common user complaints and satisfaction drivers are not comprehensively detailed in available sources, limiting understanding of recurring issues or particularly appreciated features. Without access to detailed user feedback patterns, this gyt review cannot provide specific insights into the most frequent user concerns or positive experience highlights that might guide potential client expectations.

This comprehensive gyt review reveals significant concerns that outweigh the limited benefits offered by this forex broker. While GYT advertises zero-spread trading as a competitive advantage, the fundamental issues surrounding regulatory oversight and financial stability create substantial risks for potential clients that cannot be ignored. The lack of effective regulation combined with documented financial difficulties, including debt restructuring announcements, presents serious red flags that could affect trader fund security.

The broker may appeal to traders specifically seeking low-cost forex trading opportunities in the short term. However, the associated risks make it unsuitable for traders prioritizing fund security and regulatory protection. The significant information gaps throughout this evaluation further emphasize transparency concerns that compound the existing trust and safety issues.

Key Advantages: Zero-spread trading offerings and Argentina-based operations for regional accessibility.

Major Disadvantages: Lack of effective regulatory oversight, documented financial stability issues, limited transparency, and insufficient information about essential service components that traders need for informed decision-making.

Based on this analysis, GYT cannot be recommended for traders seeking secure, well-regulated forex trading services. The combination of regulatory gaps, financial concerns, and transparency issues creates an unacceptable risk profile for most trading requirements and investment goals.

FX Broker Capital Trading Markets Review