XpressTrade 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive xprestrade review reveals significant concerns about this online CFD broker that emerged in 2022. Based on extensive user feedback analysis and available regulatory information, XpressTrade presents substantial risks for potential traders. The platform has received consistently low user ratings. Scores show 3 out of 10 from 129 reviews and an even more concerning 1 out of 10 from 191 reviews, indicating widespread user dissatisfaction.

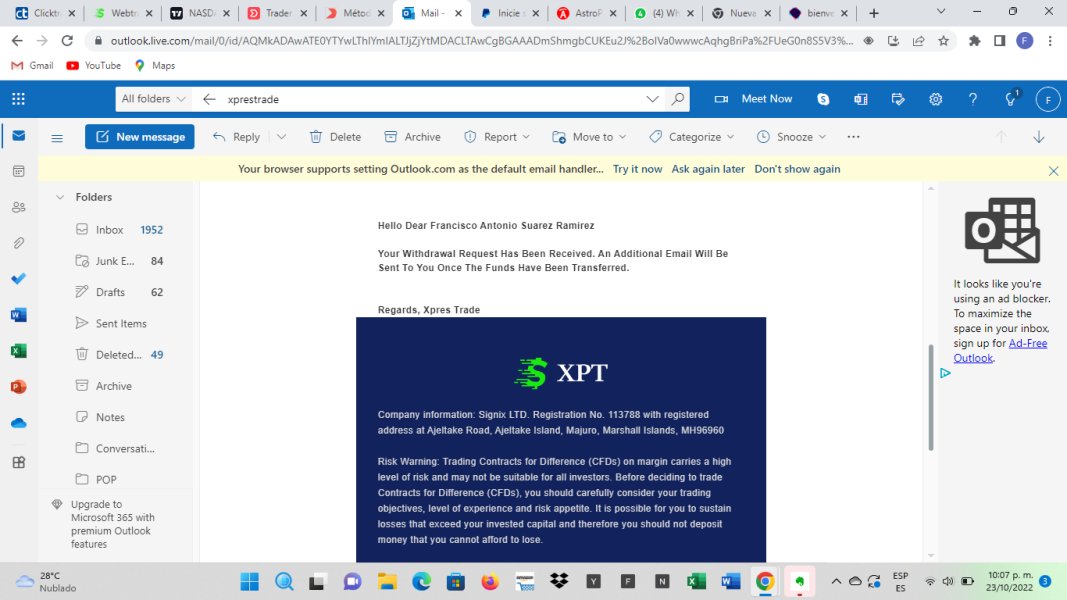

XpressTrade operates as an unregulated broker registered in the Marshall Islands. The company offers CFD and cryptocurrency trading services. The platform has been flagged by multiple sources as suspicious, with numerous reports of misleading promotional practices and poor customer service. While the broker claims to provide access to various markets including stocks and cryptocurrencies with fixed spreads, the lack of regulatory oversight and overwhelmingly negative user feedback raises serious red flags.

The platform appears to target traders interested in high-risk investments. It particularly attracts those interested in cryptocurrency and CFD trading. However, given the substantial concerns regarding trustworthiness and regulatory compliance, this broker is unsuitable for risk-averse investors and those seeking reliable trading conditions.

Important Disclaimers

Regional Entity Differences: XpressTrade is registered in the Marshall Islands. The company operates without regulatory supervision from major financial authorities. This registration location provides minimal investor protection compared to brokers regulated by established financial authorities such as the FCA, CySEC, or ASIC.

Review Methodology: This evaluation is based on publicly available information. We analyzed user feedback from multiple review platforms and conducted regulatory database searches. Due to the broker's unregulated status, some operational details remain unverified and should be treated with caution.

Rating Framework

Broker Overview

XpressTrade entered the online trading market in 2022. The company positions itself as a CFD broker offering access to various financial instruments including stocks and cryptocurrencies. The company promotes itself as providing high returns with low deposit requirements, targeting retail traders seeking exposure to volatile markets. However, the broker's business model has attracted significant criticism from users who report difficulties with withdrawals and poor customer service experiences.

The platform operates primarily through online channels. It claims to offer competitive trading conditions with fixed spreads. XpressTrade focuses heavily on cryptocurrency and CFD trading, appealing to traders interested in speculative investments. Despite these offerings, the broker's reputation has been severely damaged by consistent negative user feedback and concerns about its operational practices.

From a regulatory perspective, XpressTrade operates without oversight from recognized financial authorities. The company is registered in the Marshall Islands, a jurisdiction known for minimal regulatory requirements and limited investor protection measures. This regulatory status significantly impacts the broker's credibility and the security of client funds, making this xprestrade review particularly important for potential users.

Regulatory Status: XpressTrade operates as an unregulated broker with registration in the Marshall Islands. This jurisdiction provides minimal regulatory oversight and limited investor protection compared to major financial centers.

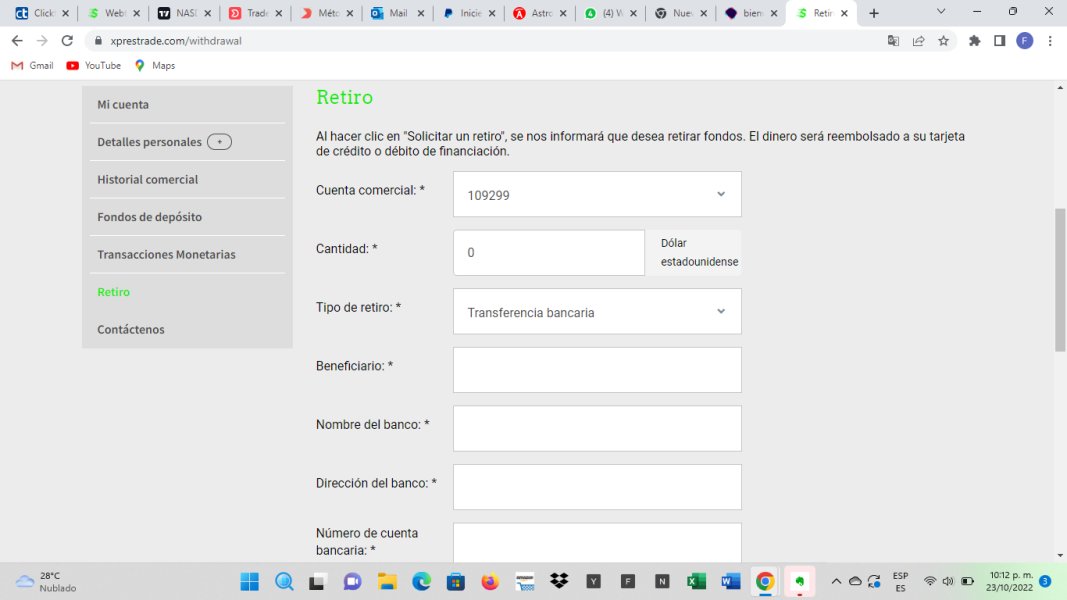

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods was not detailed in available sources. This raises concerns about transparency in financial operations.

Minimum Deposit Requirements: The exact minimum deposit amount is not clearly specified in available documentation. The broker claims to offer low deposit requirements as part of its marketing strategy.

Bonus and Promotions: Available sources do not provide specific details about current bonus offerings or promotional programs. This may indicate limited marketing incentives or lack of transparency.

Available Trading Assets: XpressTrade offers CFD trading across multiple asset classes including stocks and cryptocurrencies. The platform focuses particularly on volatile instruments that appeal to speculative traders.

Cost Structure: The broker advertises fixed spreads across its trading instruments. However, specific spread values and commission structures are not clearly disclosed in available materials. This lack of transparency regarding costs is concerning for potential traders.

Leverage Ratios: Specific leverage information is not detailed in available sources. This represents a significant transparency gap for a trading platform.

Platform Options: The specific trading platform used by XpressTrade is not clearly identified in available documentation. This raises questions about the technological infrastructure.

Geographic Restrictions: Information about specific regional restrictions or availability limitations is not provided in current sources.

Customer Support Languages: The range of supported languages for customer service is not specified in available materials. This potentially limits accessibility for international clients.

This xprestrade review highlights significant information gaps that potential traders should consider when evaluating this broker's suitability for their trading needs.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

XpressTrade's account conditions present several concerns that contributed to the below-average rating in this evaluation. The broker's lack of transparency regarding specific account types and their features creates uncertainty for potential traders. Available sources do not provide clear information about different account tiers, their respective benefits, or the specific requirements for each level.

The minimum deposit requirements are claimed to be low but are not specifically disclosed. This makes it difficult for traders to plan their initial investment. This lack of transparency is particularly concerning given the broker's unregulated status, as traders cannot rely on regulatory requirements for standardized disclosure.

User feedback consistently indicates dissatisfaction with account opening processes and ongoing account management. Many reviewers report difficulties in accessing their accounts and unclear terms and conditions that were not properly explained during the registration process. The absence of detailed information about special account features, such as Islamic trading accounts or professional trader classifications, further limits the broker's appeal to diverse trading communities.

The account verification process appears to lack the robust security measures typically expected from regulated brokers. This xprestrade review found that users frequently complain about unclear documentation requirements and prolonged verification periods that delay trading activities. These issues significantly impact the overall account condition experience and contribute to the low user satisfaction ratings.

XpressTrade's offering of tools and resources receives an average rating. This is primarily due to the basic nature of available trading instruments and the lack of comprehensive analytical resources. The platform provides access to CFD trading across stocks and cryptocurrencies, which covers fundamental market segments but lacks the depth and variety offered by more established brokers.

The absence of detailed information about specific trading tools represents a significant limitation. Professional traders typically require sophisticated analytical tools to make informed decisions, and the lack of transparency about these features suggests limited platform capabilities.

Educational resources appear to be minimal or non-existent based on available information. Modern brokers typically provide comprehensive educational materials, market analysis, and trading guides to support trader development. The apparent absence of these resources limits the platform's value proposition, particularly for novice traders who require guidance and learning materials.

Research and market analysis capabilities are not clearly documented. This is concerning for traders who rely on fundamental and technical analysis for their trading decisions. The platform's focus on cryptocurrency and CFD trading suggests it may cater more to speculative trading rather than informed investment strategies based on thorough market research.

Customer Service and Support Analysis (Score: 3/10)

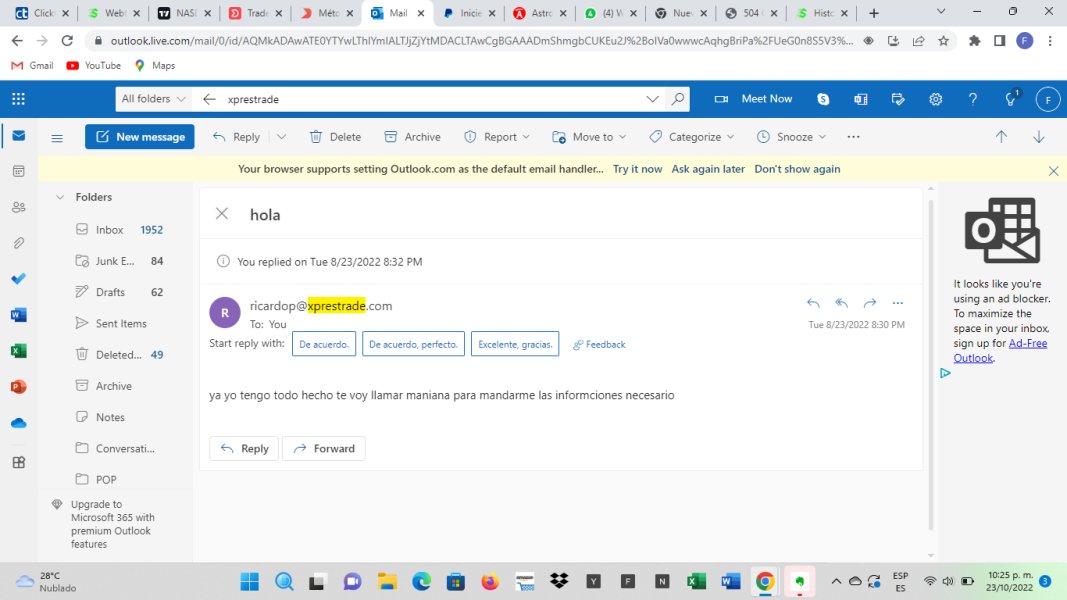

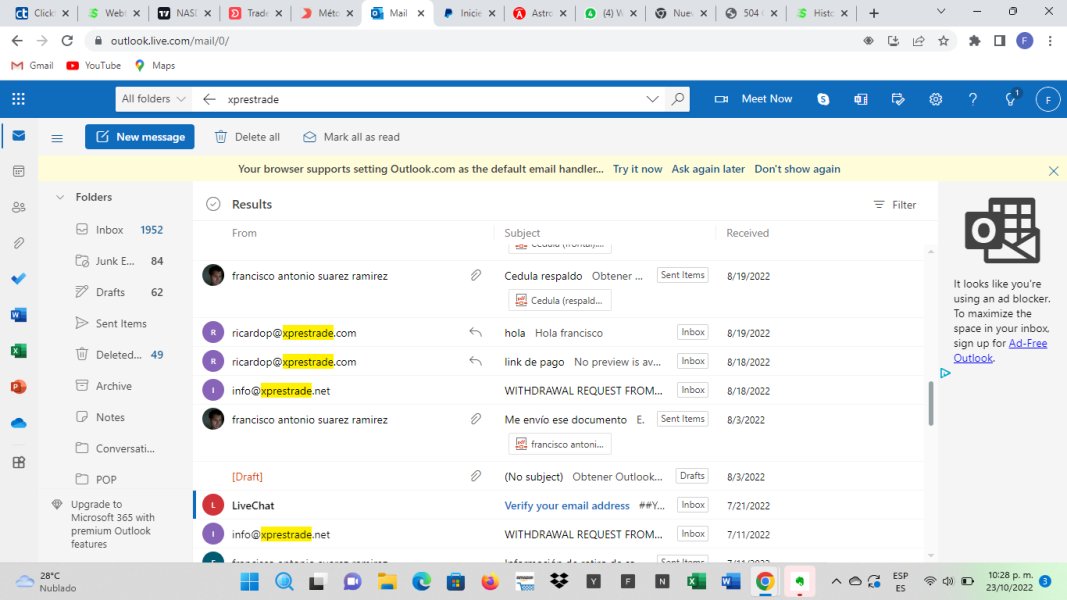

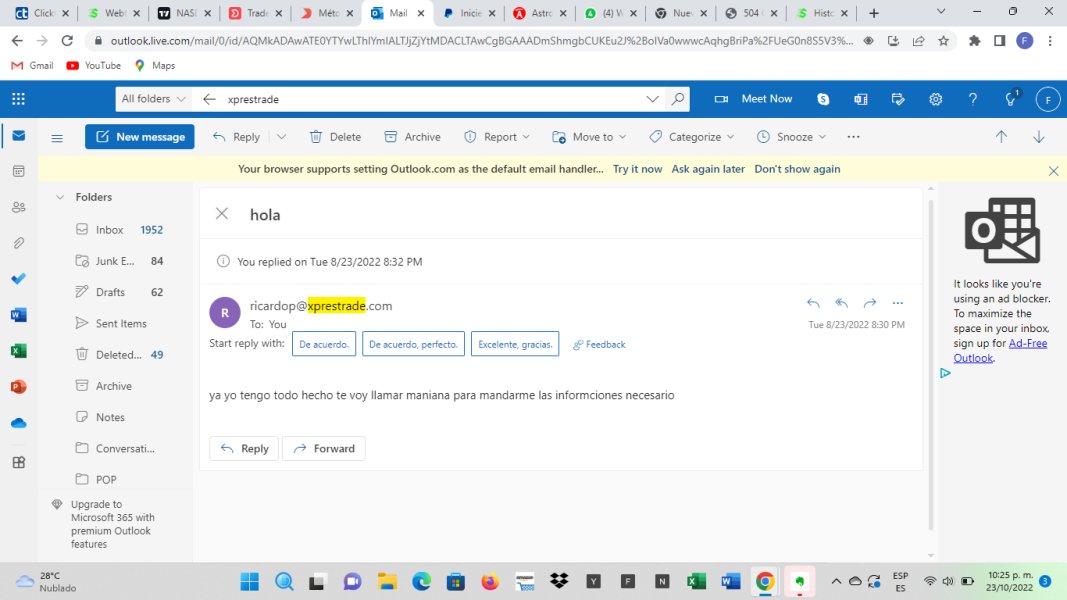

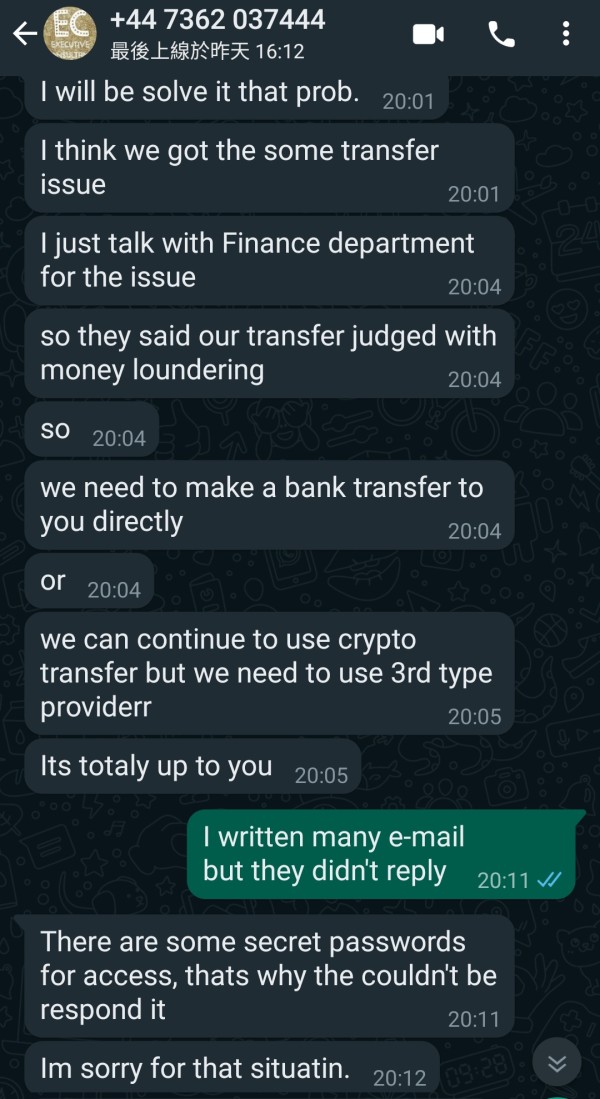

Customer service represents one of XpressTrade's most significant weaknesses. It earns a poor rating based on extensive negative user feedback. Multiple review sources consistently highlight problems with customer support responsiveness, with users reporting prolonged waiting times for basic inquiries and unresolved issues that persist for weeks or months.

The availability of customer service channels is not clearly documented. This raises concerns about accessibility when traders encounter problems. Modern brokers typically offer multiple contact methods including live chat, email, and phone support, but XpressTrade's service options remain unclear based on available information.

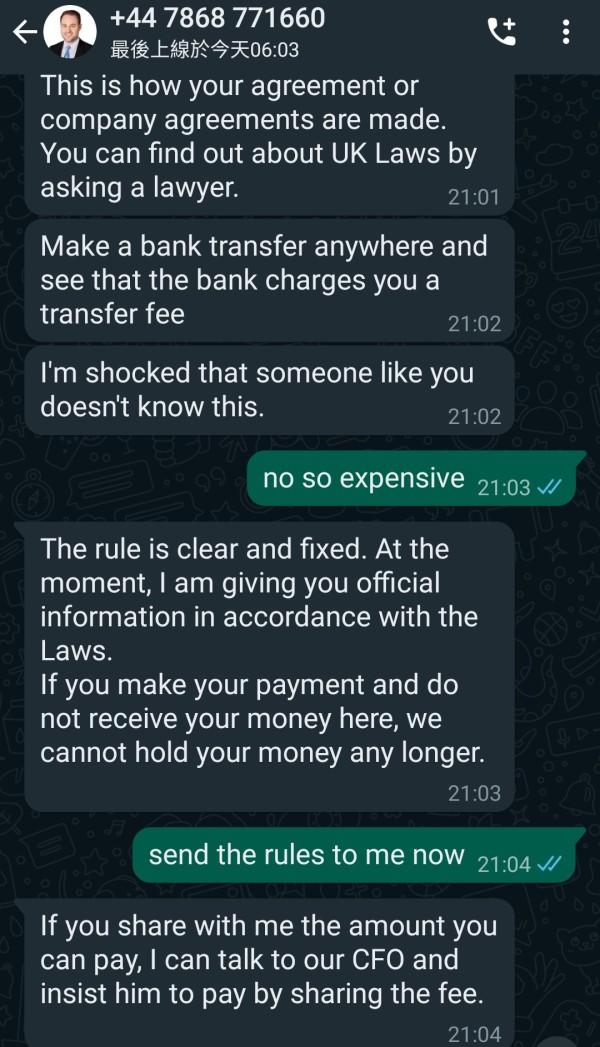

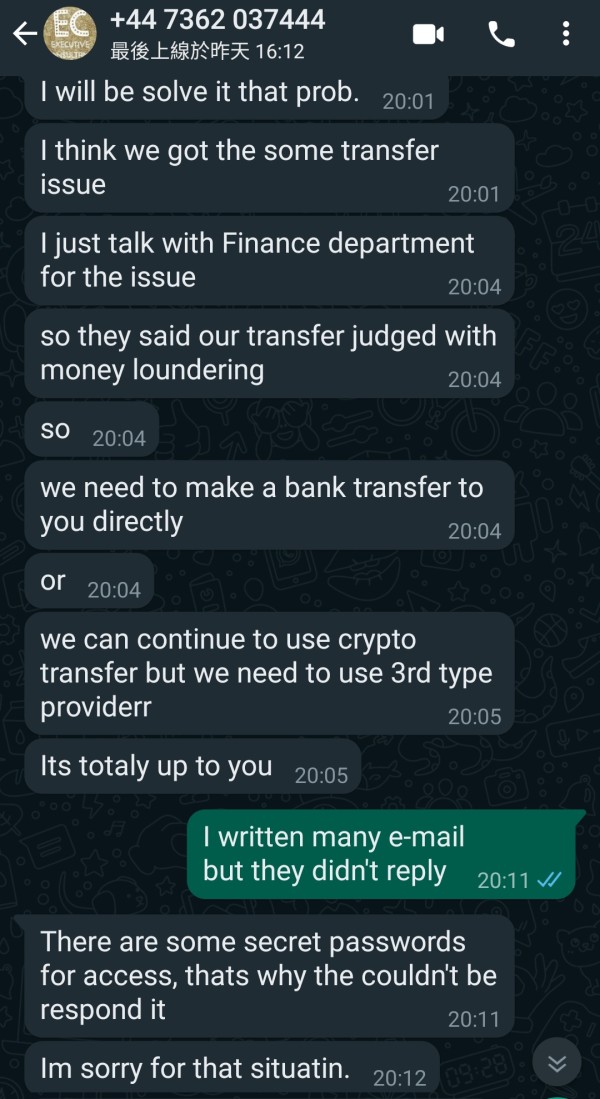

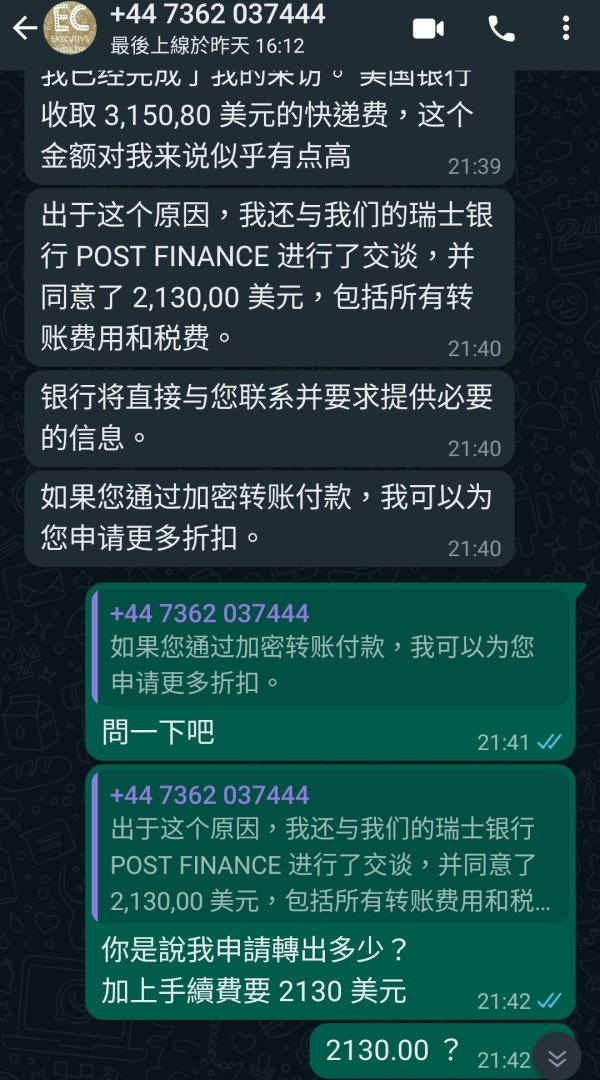

User testimonials frequently mention frustration with the quality of support responses. They describe unhelpful or generic replies that fail to address specific issues. This is particularly problematic for an unregulated broker, as traders cannot escalate complaints to regulatory authorities when internal support fails to resolve problems satisfactorily.

The absence of clear information about customer service hours and multilingual support capabilities further compounds these concerns. International traders require accessible support in their preferred languages and time zones, and the lack of transparency about these basic service features suggests limited customer support infrastructure.

Trading Experience Analysis (Score: 4/10)

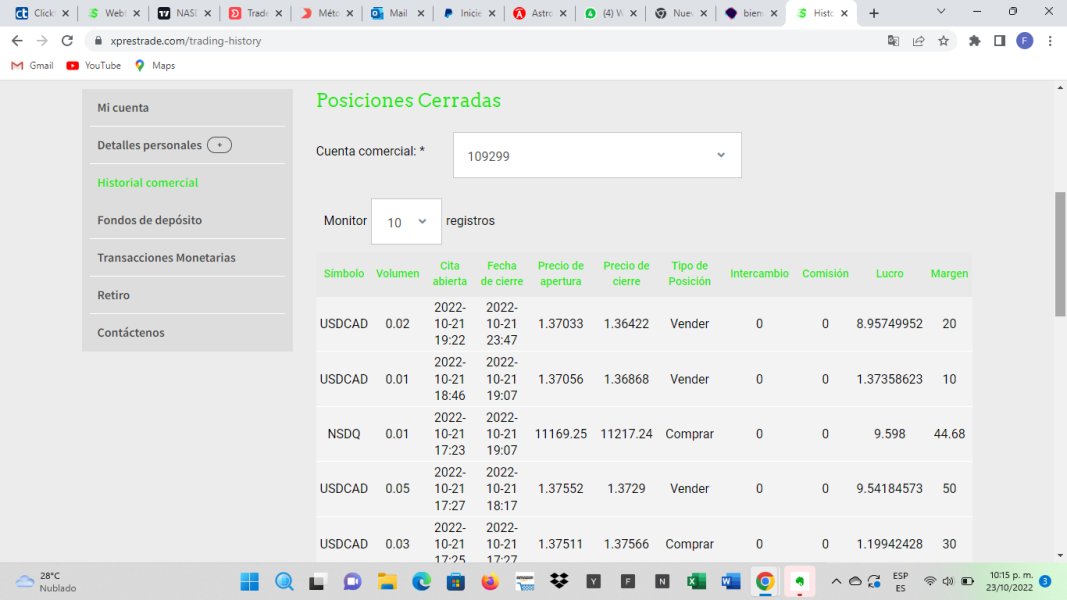

The trading experience with XpressTrade receives a below-average rating due to numerous user complaints about platform performance and execution quality. While the broker offers access to various CFD instruments and cryptocurrencies, the actual trading experience appears to fall short of user expectations based on available feedback.

Platform stability and execution speed are not well-documented. However, user reviews suggest frequent technical issues that interrupt trading activities. Reliable platform performance is crucial for CFD and cryptocurrency trading, where market volatility requires immediate order execution and stable connectivity.

Order execution quality appears problematic based on user feedback. Reports include delays and unexpected price variations during trade execution. While specific information about slippage rates and execution statistics is not available, the pattern of user complaints suggests systematic issues with trade processing.

The absence of detailed information about platform features, mobile trading capabilities, and advanced order types indicates limited functionality compared to established brokers. Professional traders require sophisticated tools for risk management and trade execution, and the apparent lack of these features significantly impacts the overall trading experience.

This xprestrade review emphasizes that the trading environment's limitations, combined with the broker's unregulated status, create additional risks for traders seeking reliable execution and platform stability.

Trustworthiness Analysis (Score: 2/10)

Trustworthiness represents XpressTrade's most critical weakness. It earns a very poor rating due to multiple red flags that raise serious concerns about the broker's reliability and legitimacy. The absence of regulatory oversight from recognized financial authorities creates a fundamental trust deficit that affects all aspects of the broker's operations.

The registration in the Marshall Islands provides minimal investor protection and limited recourse for traders who encounter problems. This jurisdiction is known for lenient regulatory requirements and limited oversight capabilities, making it unsuitable for serious financial services operations.

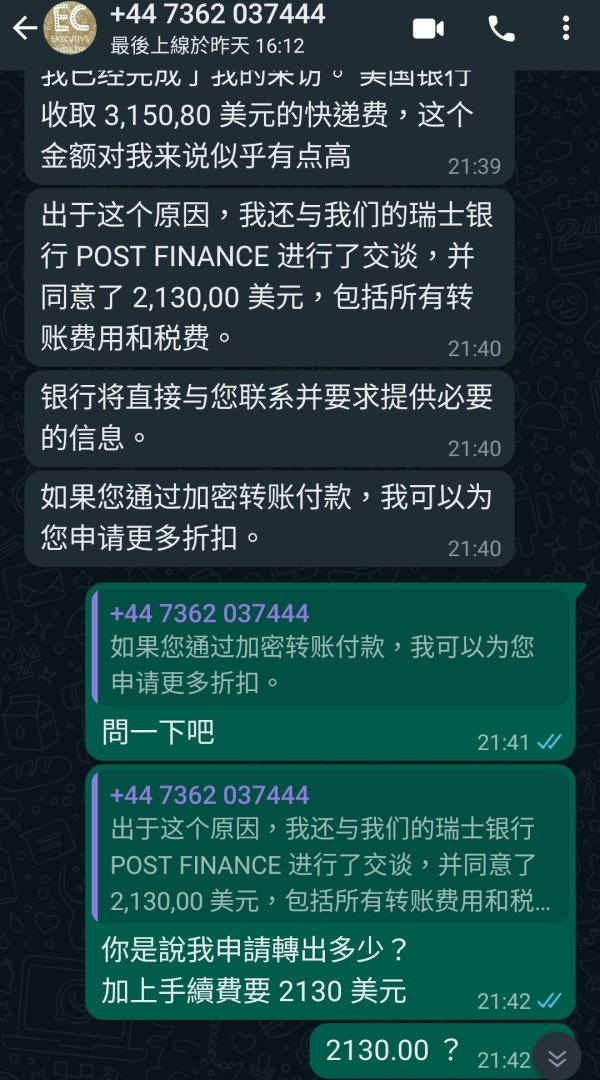

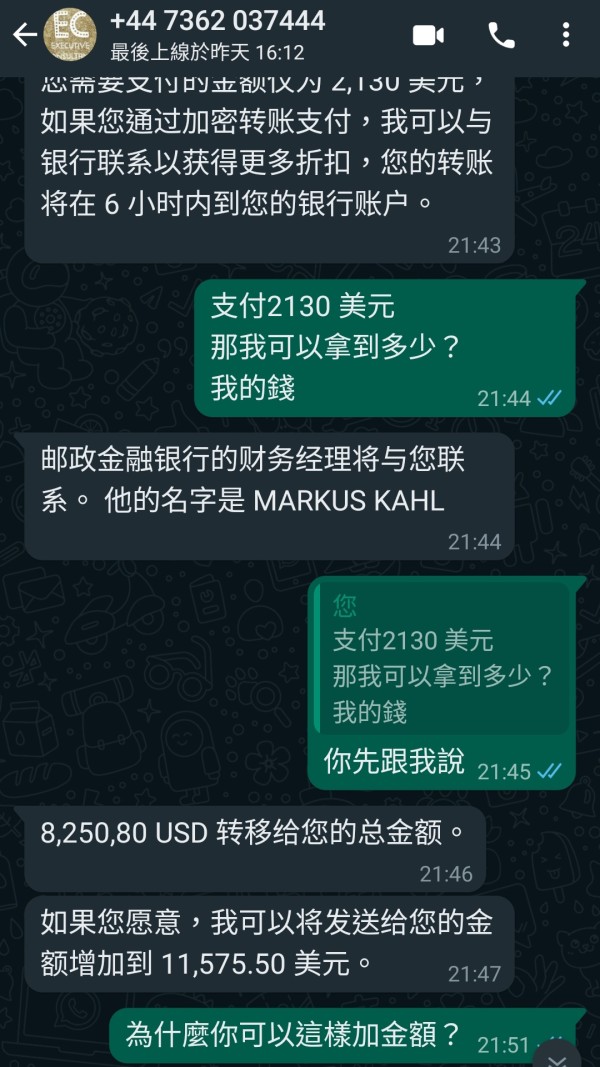

Multiple sources have flagged XpressTrade as suspicious. They warn about potential fraudulent activities and misleading promotional practices. These warnings come from industry watchdogs and user review platforms that monitor broker activities and alert traders to potential risks.

The consistently low user ratings and numerous negative reviews create a pattern of distrust that extends beyond individual complaints to systematic concerns about the broker's business practices. When a significant majority of users report negative experiences, it indicates fundamental problems with the broker's operations rather than isolated incidents.

Fund security measures are not clearly documented. This is particularly concerning for an unregulated broker. Established brokers typically provide detailed information about client fund segregation, insurance coverage, and security protocols, but this transparency is absent from XpressTrade's available materials.

User Experience Analysis (Score: 3/10)

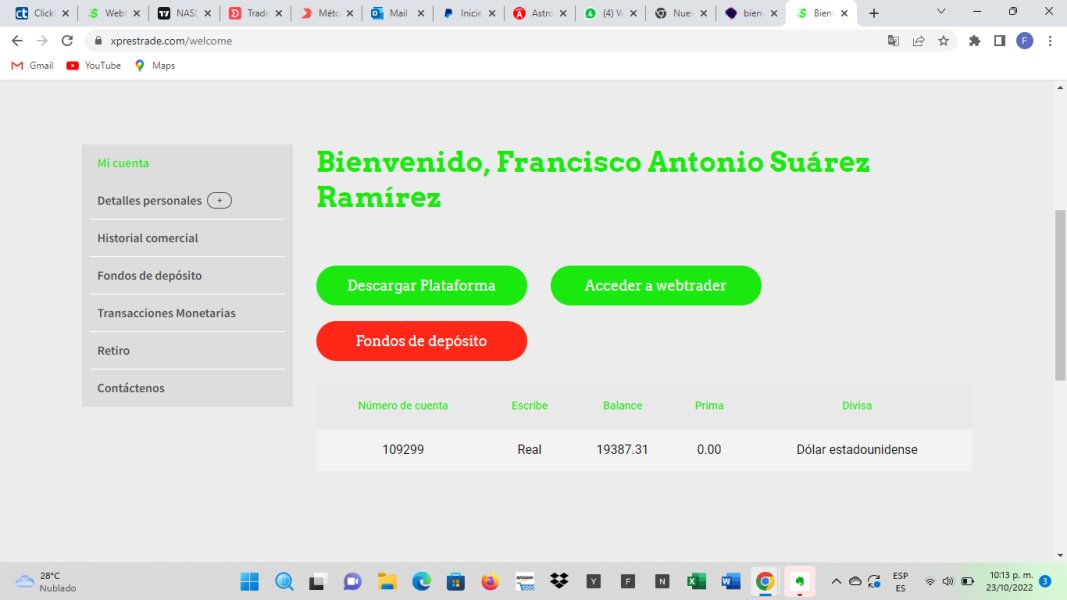

The overall user experience with XpressTrade receives a poor rating based on consistently negative feedback across multiple review platforms. User satisfaction scores of 3/10 from 129 reviews and 1/10 from 191 reviews indicate widespread dissatisfaction that extends beyond isolated incidents to systematic problems with the platform's operations.

Interface design and usability information is limited in available sources. However, user complaints suggest difficulties navigating the platform and completing basic trading functions. A well-designed trading interface is crucial for effective trading, and apparent usability issues significantly impact the overall user experience.

The registration and verification process appears problematic based on user feedback. Reports include unclear requirements and prolonged processing times. These initial negative experiences set a poor foundation for the ongoing trading relationship and contribute to overall user dissatisfaction.

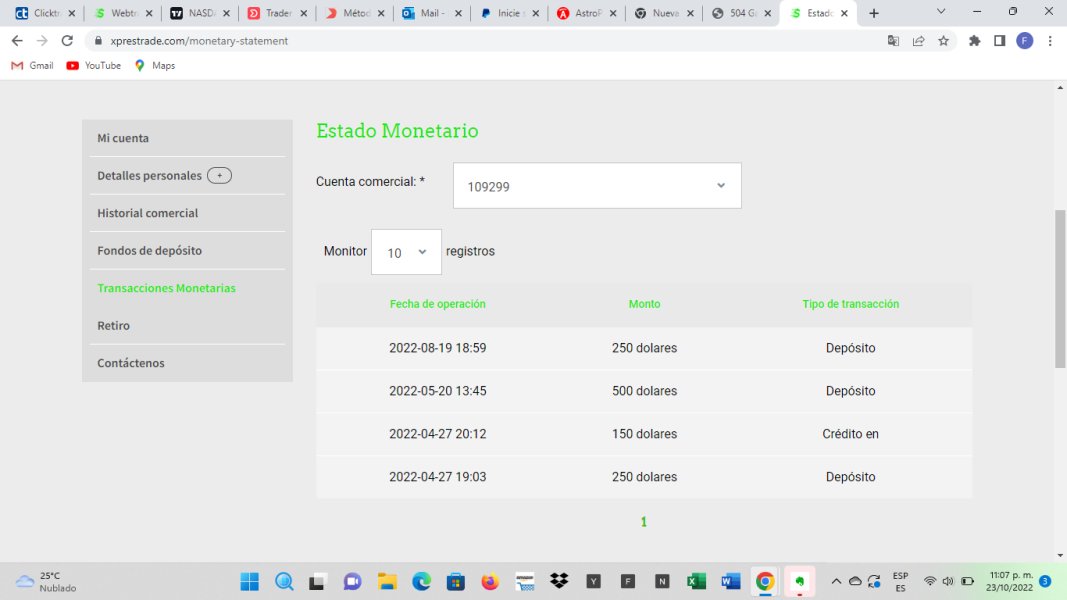

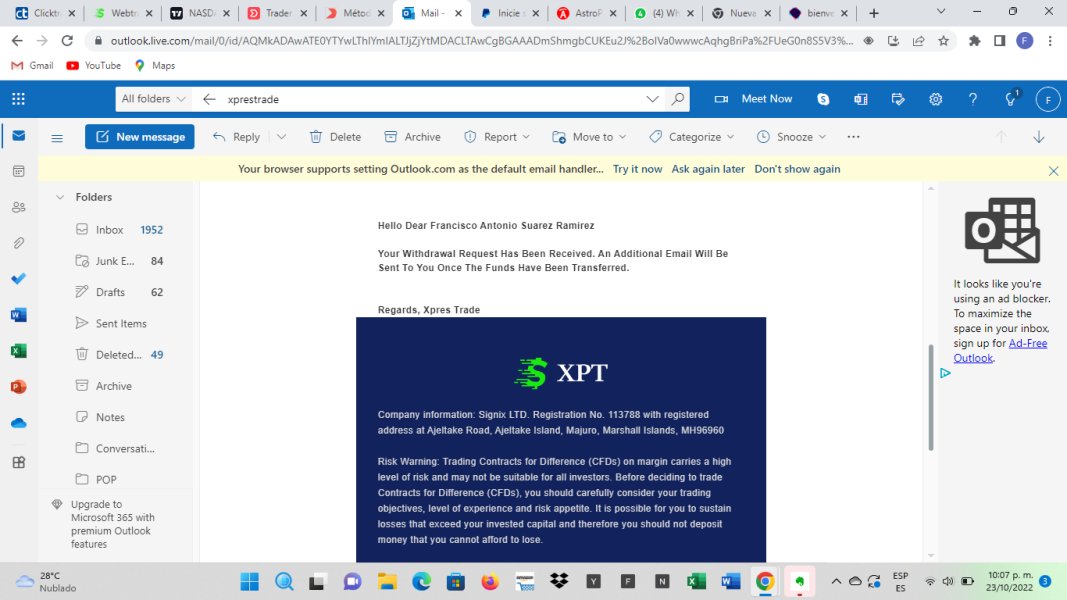

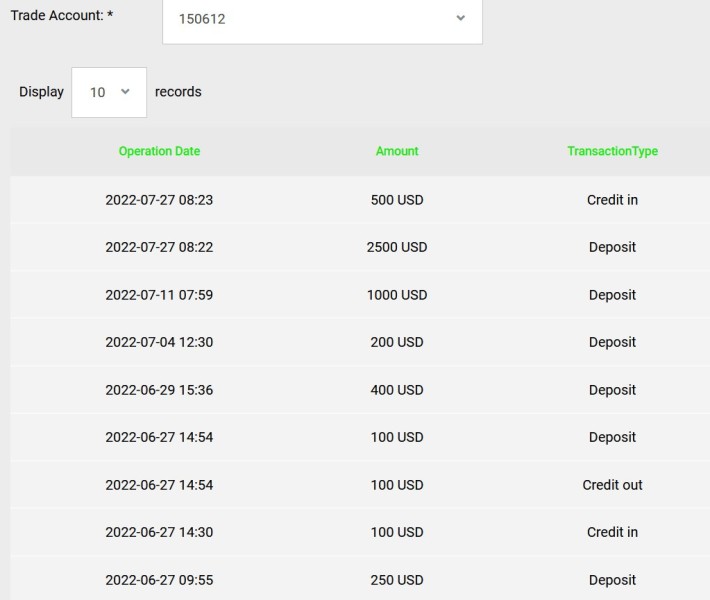

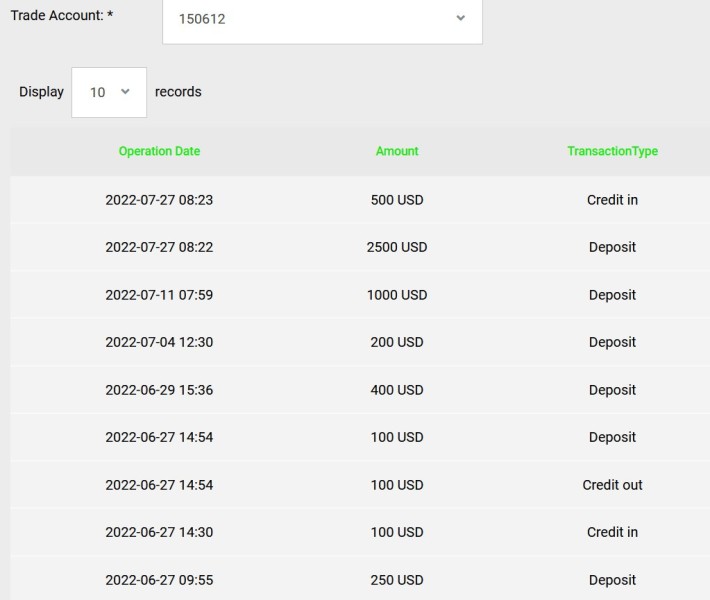

Fund management operations, including deposits and withdrawals, represent a significant source of user complaints. Many reviews mention difficulties accessing funds and unclear procedures for financial transactions, which are fundamental requirements for any trading platform.

The pattern of negative user feedback suggests that XpressTrade fails to meet basic expectations for a modern trading platform. The combination of technical issues, poor customer service, and lack of transparency creates a user experience that falls well below industry standards and expectations.

Conclusion

This comprehensive xprestrade review reveals a broker with significant concerns that outweigh any potential benefits. XpressTrade's unregulated status, combined with consistently negative user feedback and multiple warning flags from industry sources, makes it unsuitable for most traders seeking a reliable trading environment.

The broker's registration in the Marshall Islands provides minimal investor protection. The absence of transparency regarding basic operational details raises serious questions about legitimacy and trustworthiness. The consistently low user ratings across multiple platforms indicate systematic problems rather than isolated incidents.

Risk-averse traders should avoid XpressTrade entirely. Even risk-tolerant traders should carefully consider the substantial risks associated with an unregulated broker that has received numerous negative reviews and suspicion flags. The lack of regulatory oversight means that traders have limited recourse if problems arise, making this broker unsuitable for serious trading activities.