Is Winter safe?

Pros

Cons

Is Winter Safe or Scam?

Introduction

Winter, a forex broker that has emerged in the competitive trading landscape, claims to offer a range of services to traders looking to engage in currency trading. However, the increasing number of unregulated brokers in the market raises concerns among traders about the legitimacy and safety of their investments. It is crucial for traders to carefully assess the credibility of any forex broker before committing their funds. This article aims to provide a comprehensive analysis of Winter, examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. By utilizing a structured evaluation framework, we will determine whether Winter is a safe choice for traders or if it presents potential scam risks.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most significant factors influencing its credibility. A regulated broker is typically subject to strict oversight by financial authorities, which helps ensure transparency and the protection of client funds. Unfortunately, Winter lacks a valid regulatory license, which is a major red flag for potential investors.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Winter does not adhere to any established standards of accountability or transparency. This unregulated status raises concerns about the safety of clients' funds, as there are no legal protections in place to safeguard investors in the event of financial misconduct. Furthermore, the lack of a regulatory history or compliance record with any recognized authority exacerbates the risks associated with trading through Winter.

Company Background Investigation

Winter's company profile reveals a lack of transparency regarding its history and ownership structure. Established recently, the broker does not provide detailed information about its founding members or the management team behind its operations. This opacity is concerning, as a well-established broker typically shares information about its background and leadership to build trust with clients.

Additionally, the absence of a physical address or contact information on the broker's website limits the ability of potential clients to verify its legitimacy. This lack of transparency can be indicative of a broker that may not have the best interests of its clients at heart. Without a clear understanding of who is operating the broker, traders are left vulnerable to potential fraud or mismanagement.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its attractiveness and potential risks. Winter claims to provide a competitive trading environment; however, a closer examination reveals several concerning aspects.

| Fee Type | Winter | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | 2% - 5% |

The lack of transparency regarding spreads and commissions raises questions about the broker's practices. Typically, brokers should disclose their fee structures clearly, allowing traders to make informed decisions. The absence of this information suggests that Winter may employ hidden fees or unfavorable trading conditions that could significantly affect a trader's profitability.

Client Funds Safety

The safety of client funds is paramount when choosing a forex broker. A reputable broker should implement robust measures to protect investor capital. Unfortunately, Winter's lack of regulation raises serious concerns about its fund safety protocols. There is no information available regarding whether client funds are held in segregated accounts or if there are any investor protection schemes in place.

Traders should be wary of brokers that do not offer clear information about their fund safety measures. The absence of a credible track record regarding fund security can lead to significant financial losses for clients, especially if the broker engages in fraudulent activities or misappropriates funds.

Customer Experience and Complaints

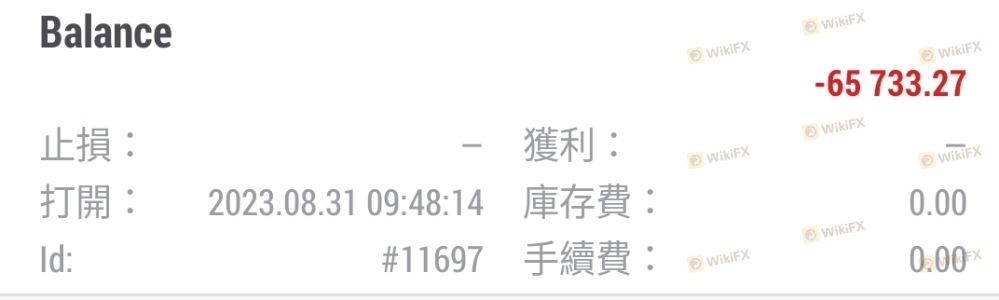

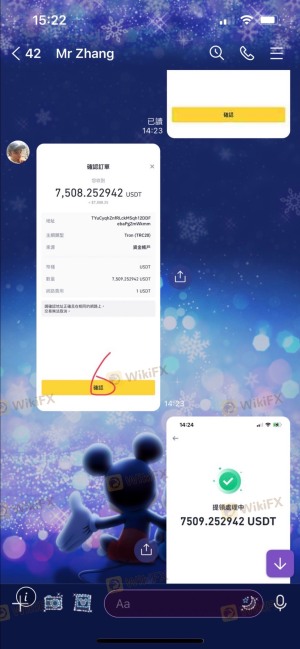

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews regarding Winter paint a troubling picture, with numerous complaints about withdrawal issues and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Poor |

Many users have reported being unable to withdraw their funds, with some alleging that their accounts were frozen without explanation. Such complaints are serious and suggest that Winter may not operate in good faith. The recurring themes of withdrawal difficulties and inadequate customer support further contribute to the perception of Winter as a potentially unsafe broker.

Platform and Execution

The trading platform offered by Winter is a critical component of the trading experience. A reliable and efficient platform is essential for executing trades effectively. While Winter claims to utilize a popular trading platform, there have been reports of instability, slippage, and order rejections.

Traders have expressed frustration over the execution quality, indicating that their orders were not processed as expected. This raises concerns about the broker's operational integrity and whether it manipulates trades to its advantage. Such practices can severely undermine a trader's ability to succeed in the forex market.

Risk Assessment

Engaging with an unregulated broker like Winter carries significant risks. Traders must be aware of the potential for financial loss and the lack of recourse in the event of disputes.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight or protection for clients |

| Fund Safety Risk | High | Unclear safety measures for client funds |

| Execution Risk | Medium | Potential manipulation of trades |

To mitigate these risks, traders should consider utilizing regulated brokers that offer clear protections for client funds and transparent trading conditions. Engaging with a well-regulated broker ensures that traders have recourse in case of disputes and can trade with greater peace of mind.

Conclusion and Recommendations

In conclusion, the evidence suggests that Winter may not be a safe choice for traders. The lack of regulation, transparency issues, and numerous customer complaints indicate potential scam risks. Traders should exercise extreme caution and consider alternative options when seeking a forex broker.

For those looking to trade safely, it is advisable to choose brokers that are regulated by reputable authorities and have a proven track record of reliability. Some recommended alternatives include well-established brokers that prioritize client safety and transparency. Always conduct thorough research and due diligence before investing with any broker. Remember, is Winter safe? The answer appears to lean towards caution.

Is Winter a scam, or is it legit?

The latest exposure and evaluation content of Winter brokers.

Winter Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Winter latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.