Is Finotive Funding safe?

Pros

Cons

Is Finotive Funding A Scam?

Introduction

Finotive Funding, a proprietary trading firm established in 2021, has emerged as a notable player in the forex market. It offers traders the opportunity to manage substantial trading capital, with account sizes reaching up to $200,000. However, the allure of high profit-sharing ratios—up to 95%—and minimal initial investment can sometimes cloud the judgment of potential traders. As the financial landscape becomes increasingly saturated with firms promising quick returns, it is essential for traders to exercise caution and thoroughly evaluate the legitimacy of these platforms. This article aims to scrutinize Finotive Funding's operations, regulatory compliance, and overall credibility. We will utilize a combination of qualitative assessments and quantitative data from various reputable sources to provide a comprehensive overview of whether Finotive Funding is safe or potentially a scam.

Regulation and Legitimacy

A crucial aspect of evaluating any trading firm is its regulatory status, which serves as a safeguard for traders. Finotive Funding operates under the legal framework of Hungary, claiming to adhere to local laws. However, it lacks oversight from significant regulatory bodies, raising concerns about its legitimacy. Below is a summary of the core regulatory information pertaining to Finotive Funding:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Hungary | Unverified |

The absence of a license from a reputable regulatory authority, such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC), is a significant red flag. Regulatory bodies are tasked with enforcing compliance and protecting traders from fraud. The lack of oversight means that Finotive Funding operates with minimal scrutiny, increasing the risk for traders. The firms claims of compliance with Hungarian laws do not hold much weight without a credible regulatory framework to back them up. Thus, while there are no explicit indicators of fraudulent activity, the absence of regulation raises serious questions about the safety of funds and the overall trustworthiness of the platform.

Company Background Investigation

Finotive Funding was founded by Oliver Newland, a trader with a vision to empower retail traders by providing them with access to capital. The firm is headquartered in Budapest, Hungary, and operates under the name Finotive Markets LLC. Despite its relatively short history, the company has positioned itself as a solution for traders facing capital constraints. However, transparency regarding its ownership structure and operational history is limited.

Newland's background in trading is a positive aspect, but the lack of detailed information about the management team and their qualifications raises concerns about the firm's governance. Transparency in operations and information disclosure is vital for building trust with clients. Unfortunately, Finotive Funding does not provide comprehensive details about its management team or operational practices, which may deter potential traders from engaging with the platform.

In summary, while the company's mission to support retail traders is commendable, the lack of transparency and detailed information about its management and operational history is concerning. This further complicates the question of whether Finotive Funding is safe for traders looking for reliable platforms.

Trading Conditions Analysis

The trading conditions offered by Finotive Funding are designed to attract a broad range of traders. The firm provides various account types, including classic challenge accounts, one-step challenge accounts, and instant funding options. However, the fee structure and potential hidden costs merit careful consideration. Here's a comparison of core trading costs:

| Fee Type | Finotive Funding | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 0.2 pips | 0.3 pips |

| Commission Model | $4 per round lot | $3 per round lot |

| Overnight Interest Range | Varies | Varies |

While the spreads offered by Finotive Funding are competitive, the commission structure may be higher than the industry average, especially for certain account types. The firm does not refund the initial fees paid for account registration, which is another aspect that traders should be aware of. A non-refundable fee structure can be a deterrent for many traders, as it adds to the financial risk involved.

Moreover, the absence of a demo account limits potential clients' ability to test the platform before committing funds. This lack of flexibility may further amplify the risks associated with trading on the platform, leading to the question: is Finotive Funding safe for those who prefer to trial a service before investing?

Customer Funds Safety

The safety of customer funds is paramount in the trading industry. Finotive Funding claims to implement several measures to ensure the security of client capital. However, the lack of regulatory oversight raises concerns about the effectiveness of these measures. The firm does not provide detailed information regarding fund segregation, investor protection schemes, or negative balance protection policies.

Without these critical safety measures, traders may find their investments at risk, especially in volatile market conditions. Historically, firms lacking robust regulatory frameworks have been associated with higher instances of fund mismanagement or fraud. Therefore, it is essential for potential traders to carefully consider the implications of trading with an unregulated firm like Finotive Funding.

In conclusion, while Finotive Funding presents itself as a legitimate trading option, the absence of sufficient safeguards for customer funds raises substantial concerns. Traders must weigh the potential risks against the benefits when considering whether Finotive Funding is safe for their trading activities.

Customer Experience and Complaints

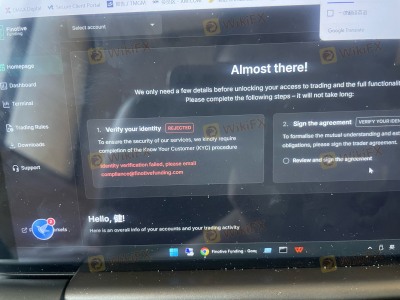

Analyzing customer feedback is a vital component of assessing a trading firm's credibility. Finotive Funding has garnered a mix of reviews, with some praising its trading conditions and others expressing dissatisfaction with customer support and operational transparency. Common complaints include unclear terms regarding trading rules and the handling of withdrawals.

Here's a summary of the main complaint types and their severity assessment:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Confusing Trading Rules | Medium | Limited clarity |

| Customer Support Availability | Medium | Often unresponsive |

One notable case involved a trader who successfully completed the evaluation process but faced challenges in accessing their funded account due to alleged breaches of trading rules. The trader claimed they were misinformed about the rules by company staff, leading to frustration and dissatisfaction. Such experiences highlight the importance of clear communication and adherence to customer service standards.

In summary, while some traders have had positive experiences with Finotive Funding, the prevalence of complaints and the nature of these issues should not be overlooked. This raises questions about whether Finotive Funding is safe for potential clients seeking a reliable trading partner.

Platform and Trade Execution

The trading platform offered by Finotive Funding is MetaTrader 5 (MT5), a widely recognized and user-friendly platform. However, the performance of the platform, including order execution quality and slippage, is critical for traders. Feedback suggests that while MT5 is generally stable, users have experienced issues with order execution, particularly during high volatility periods.

Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes. The absence of evidence indicating platform manipulation is a positive aspect, but the overall execution quality remains a concern. As traders evaluate whether Finotive Funding is safe, the platform's reliability plays a crucial role in their decision-making process.

Risk Assessment

Engaging with Finotive Funding comes with inherent risks that traders must consider. The lack of regulatory oversight, coupled with potential issues related to customer support and fund safety, contributes to an elevated risk profile. Here's a summary of the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from a regulatory body. |

| Fund Safety | High | Lack of clarity on fund segregation and protection. |

| Customer Support | Medium | Mixed reviews regarding responsiveness. |

| Platform Reliability | Medium | Issues with order execution and slippage. |

To mitigate these risks, potential traders should conduct thorough research, consider starting with smaller investments, and maintain strict risk management practices. Additionally, it may be wise to explore alternative trading platforms that offer more robust regulatory frameworks and customer protections.

Conclusion and Recommendations

In conclusion, while Finotive Funding offers attractive trading conditions and opportunities for profit, the lack of regulatory oversight and transparency raises significant concerns about its safety and reliability. Traders must approach this platform with caution, as the absence of adequate safeguards for funds and the mixed customer feedback suggest that Finotive Funding is not entirely safe for all traders.

For those considering engaging with Finotive Funding, it is advisable to start with smaller amounts and thoroughly understand the terms and conditions before committing substantial capital. Additionally, exploring alternative options with established regulatory frameworks, such as FTMO or other reputable proprietary trading firms, may provide a more secure trading environment. Ultimately, the decision to trade with Finotive Funding should be made with a comprehensive understanding of the associated risks and benefits.

Is Finotive Funding a scam, or is it legit?

The latest exposure and evaluation content of Finotive Funding brokers.

Finotive Funding Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Finotive Funding latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.