Is Xprestrade safe?

Business

License

Is Xprestrade A Scam?

Introduction

Xprestrade is an online brokerage that positions itself as a player in the forex market, offering a variety of trading instruments including forex, commodities, indices, and cryptocurrencies. As the trading environment becomes increasingly saturated, it is crucial for traders to carefully evaluate the legitimacy and safety of their chosen brokers. With numerous reports of scams and fraudulent activities in the trading world, a thorough assessment of Xprestrade is necessary to determine if it is a safe platform or a potential scam. This analysis is based on a comprehensive review of available online resources, user feedback, and regulatory information, providing a balanced view of Xprestrade's operations.

Regulation and Legitimacy

The regulatory status of a brokerage is a key indicator of its legitimacy and reliability. Xprestrade claims to operate under the auspices of Signix Ltd, a company registered in the Marshall Islands. However, the Marshall Islands is known for its lax regulatory framework, which raises concerns about the safety of funds and overall transparency in operations.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| GLOFSA (Marshall Islands) | N/A | Marshall Islands | Unregulated |

The absence of a legitimate regulatory license from a recognized authority such as the FCA, ASIC, or CySEC is a significant red flag. Regulated brokers are held to strict standards that protect investors, including regular audits, segregated client accounts, and transparent operations. Xprestrade's lack of regulation indicates a higher risk of potential fraud and mismanagement of funds, leading to the conclusion that Xprestrade is not a safe option for traders.

Company Background Investigation

Xprestrade is owned and operated by Signix Ltd, which has a questionable reputation and limited transparency regarding its management team and operational history. The company was established in 2022, making it relatively new in the forex brokerage landscape. The lack of a robust track record raises concerns about its reliability and the experience of its management team.

Moreover, there is little publicly available information about the individuals behind Signix Ltd, which further obscures the company's credibility. A legitimate brokerage typically provides clear information about its management and operational history, including the qualifications and experience of its leadership. The opaque nature of Xprestrade's ownership structure and the absence of detailed disclosures contribute to the perception that Xprestrade may not be a trustworthy broker.

Trading Conditions Analysis

When evaluating a broker, it is essential to consider the trading conditions it offers, including fees, spreads, and overall cost structure. Xprestrade has been reported to have a high fee structure that may not be competitive compared to industry standards.

| Fee Type | Xprestrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3 pips | 1-1.5 pips |

| Commission Structure | $20 per transaction | Varies by broker |

| Overnight Interest Range | N/A | Varies by broker |

The spread for major currency pairs, such as EUR/USD, is reported to be as high as 3 pips, which is significantly above the industry average. Additionally, Xprestrade imposes a minimum transaction fee of $20, which is considered excessive. These unfavorable trading conditions raise questions about the broker's commitment to providing a fair trading environment, leading to concerns that trading with Xprestrade may not be a cost-effective choice for traders.

Client Funds Security

The security of client funds is paramount when selecting a broker. Xprestrade's operational framework raises several concerns regarding fund safety. The broker does not provide clear information about client fund segregation or investor protection mechanisms.

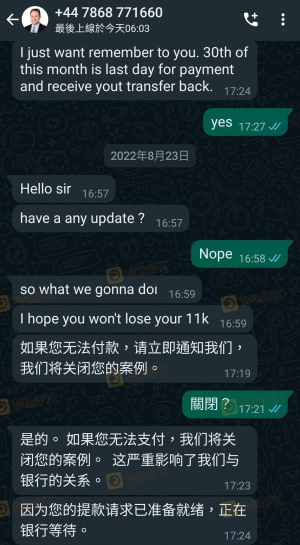

In the absence of regulation, there is no guarantee that client funds are held in segregated accounts, which is a standard practice among regulated brokers. Furthermore, there are no indications of negative balance protection, which could leave traders vulnerable to significant losses. Historical complaints and reports suggest that clients have faced difficulties in withdrawing their funds, indicating potential issues with fund management. As such, it is evident that Xprestrade does not ensure adequate protection for client investments.

Customer Experience and Complaints

User feedback is a vital component of assessing a broker's reliability. Reviews of Xprestrade reveal a pattern of complaints from clients regarding withdrawal issues, high fees, and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| High Fees | Medium | Ignored complaints |

| Lack of Transparency | High | No response |

Many users report being unable to withdraw their funds, often citing excessive delays in processing requests. Additionally, clients have expressed frustration over the broker's lack of transparency regarding fees and trading conditions. In some cases, the company's response to complaints has been inadequate, further eroding trust among users. These complaints highlight significant operational issues that suggest Xprestrade may not prioritize client satisfaction.

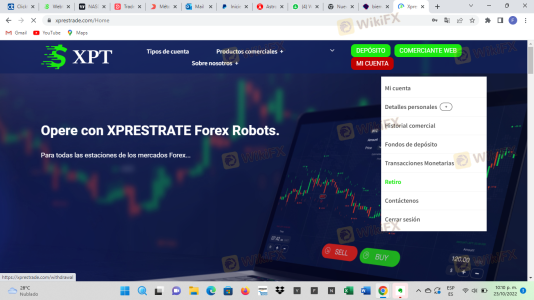

Platform and Trade Execution

The performance of a trading platform is critical for a successful trading experience. Xprestrade advertises its platform as a sophisticated trading interface; however, user experiences indicate otherwise. The platform is described as basic and lacking the advanced features commonly found in reputable trading software like MetaTrader 4 or 5.

Concerns have also been raised about order execution quality, including instances of slippage and rejected orders, which can severely impact trading outcomes. The absence of a mobile trading application further limits user accessibility, making it difficult for traders to manage their positions effectively. Consequently, the overall performance and reliability of Xprestrade's trading platform raise doubts about its ability to deliver a satisfactory trading experience, indicating that Xprestrade may not provide a reliable trading environment.

Risk Assessment

Engaging with Xprestrade presents several risks that potential clients should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases fraud risk. |

| Financial Risk | High | High fees and poor fund security. |

| Operational Risk | Medium | Complaints about withdrawal issues. |

The combination of unregulated operations, high fees, and negative client feedback culminates in a high-risk profile for Xprestrade. For traders considering this broker, it is crucial to weigh these risks against potential rewards. It is advisable to seek alternative options that offer a regulated environment with better protections in place.

Conclusion and Recommendations

In conclusion, the evidence suggests that Xprestrade is not a safe or reliable broker. With its unregulated status, high fees, and numerous client complaints, potential investors should exercise caution. Traders looking for a trustworthy broker should prioritize those with established regulatory oversight, transparent operations, and positive user feedback.

For those seeking safer alternatives, consider brokers regulated by tier-one authorities such as the FCA, ASIC, or CySEC, which provide a higher level of investor protection and accountability. Always conduct thorough research and due diligence before committing funds to any trading platform.

Is Xprestrade a scam, or is it legit?

The latest exposure and evaluation content of Xprestrade brokers.

Xprestrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Xprestrade latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.