Is volofinance safe?

Business

License

Is VoloFinance A Scam?

Introduction

VoloFinance is an online trading platform that positions itself within the forex and cryptocurrency markets. With promises of high returns and advanced trading tools, it has attracted the attention of many potential investors. However, the rise of online trading has also seen a parallel increase in fraudulent schemes, making it imperative for traders to carefully evaluate the credibility of any broker before committing their funds. This article aims to provide a comprehensive analysis of VoloFinance, assessing its legitimacy and safety for potential clients. Our investigation is based on a review of multiple sources, including regulatory filings, customer feedback, and expert opinions, to determine whether VoloFinance is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a trading platform is crucial for ensuring the safety of client funds. VoloFinance claims to operate under the jurisdiction of the United Arab Emirates but does not provide any valid regulatory licenses from recognized authorities. Below is a summary of the regulatory information available for VoloFinance:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of a regulatory license raises significant concerns regarding the safety of funds and the legitimacy of VoloFinance. In many jurisdictions, licensed brokers are required to adhere to strict financial regulations, including maintaining segregated accounts for client funds, providing negative balance protection, and ensuring transparency in their operations. The lack of oversight means that VoloFinance is not subject to the same level of scrutiny as regulated brokers, making it a risky option for investors. Furthermore, the platform's claims of compliance with regulatory standards appear to be misleading, as no evidence supports these assertions.

Company Background Investigation

VoloFinance's corporate background is shrouded in mystery. The company does not provide clear information regarding its ownership structure, management team, or operational history. This lack of transparency is a significant red flag, as reputable brokers typically disclose their corporate information, including the identities of key personnel and their professional qualifications.

The absence of verifiable information about the company's history and management raises concerns about its credibility. Without a known corporate entity backing VoloFinance, traders may find it challenging to hold the broker accountable in the event of disputes or issues. The overall opacity surrounding VoloFinance further contributes to the skepticism regarding its legitimacy and raises questions about whether VoloFinance is safe for trading.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value. VoloFinance presents itself as a provider of forex and cryptocurrency trading services, but the specifics of its fee structure remain ambiguous. Below is a comparison of core trading costs associated with VoloFinance:

| Fee Type | VoloFinance | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Rates | N/A | Varies |

The lack of clarity regarding spreads, commissions, and other fees raises concerns about potential hidden costs that could significantly impact trading profitability. Moreover, reports suggest that VoloFinance may impose unusual fees on withdrawals or account maintenance, which could further diminish the overall trading experience. This opacity in the fee structure is a common tactic employed by fraudulent brokers to exploit unsuspecting traders, making it essential to question whether VoloFinance is safe for trading.

Client Fund Security

The security of client funds is paramount when evaluating a trading platform. VoloFinance does not offer any information regarding its fund security measures, such as segregated accounts or investor protection schemes. Without these safeguards, clients' funds are at risk, particularly given the absence of regulatory oversight.

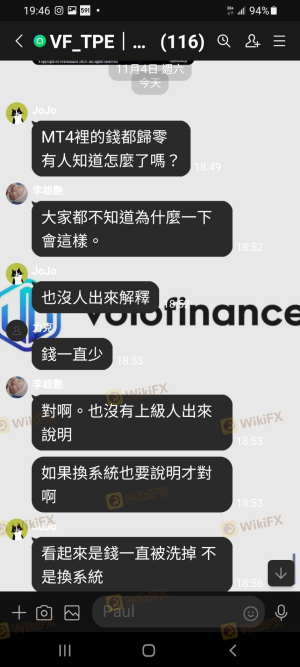

Additionally, there have been numerous complaints from users regarding difficulties in withdrawing funds, which is a common issue associated with scam brokers. The lack of clear policies on fund security and withdrawal procedures raises significant concerns about whether VoloFinance is safe for investors. Historical issues related to fund security and client complaints further emphasize the importance of exercising caution when considering VoloFinance as a trading partner.

Customer Experience and Complaints

Customer feedback provides valuable insights into the operational practices of a broker. VoloFinance has received a mix of reviews, with many users expressing frustration over withdrawal issues and poor customer service. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Poor |

| Lack of Transparency | Medium | Inadequate |

| Misleading Information | High | Ignored |

Many traders report that once they attempt to withdraw their funds, they face numerous obstacles, including excessive fees and lack of communication from the broker. Such practices are indicative of a potential scam, as they align with common tactics used by fraudulent brokers to retain client funds. This pattern of complaints raises significant concerns about the overall reliability of VoloFinance and whether VoloFinance is safe for trading.

Platform and Execution

The trading platform's performance is crucial for a positive trading experience. VoloFinance claims to offer the widely-used MetaTrader 4 (MT4) platform; however, users have reported issues with its functionality and execution quality. Concerns regarding order execution, slippage, and potential platform manipulation have been raised.

A reliable trading platform should provide seamless execution and minimal slippage, but reports suggest that VoloFinance may not meet these standards. The possibility of platform manipulation, where brokers can interfere with traders' orders, further exacerbates the risks associated with trading on VoloFinance. This raises the question of whether VoloFinance is safe for investors looking for a trustworthy trading environment.

Risk Assessment

Engaging with VoloFinance presents several risks that potential investors should consider. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated and lacks oversight |

| Fund Security Risk | High | No fund protection measures |

| Withdrawal Risk | High | Reports of difficulties in withdrawals |

| Transparency Risk | High | Lack of information about the broker |

Given the high level of risk associated with VoloFinance, it is advisable for traders to proceed with caution. Potential investors should consider alternative brokers with established regulatory frameworks and transparent practices. Mitigating these risks involves thorough research and choosing a broker that prioritizes client safety and compliance.

Conclusion and Recommendations

In conclusion, the evidence indicates that VoloFinance exhibits several characteristics commonly associated with scam brokers. The lack of regulatory oversight, ambiguous trading conditions, and numerous customer complaints raise significant concerns about the platform's legitimacy. Therefore, it is crucial for traders to exercise extreme caution and consider whether VoloFinance is safe for their investments.

For those seeking to engage in forex or cryptocurrency trading, it is advisable to explore reputable and regulated alternatives that offer transparency and robust security measures. Brokers regulated by authorities such as the FCA, ASIC, or CySEC provide a safer trading environment and are more likely to prioritize the interests of their clients. Ultimately, protecting your investment should be the top priority, and choosing a trustworthy broker is essential in achieving that goal.

Is volofinance a scam, or is it legit?

The latest exposure and evaluation content of volofinance brokers.

volofinance Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

volofinance latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.