VIG Investment 2025 Review: Everything You Need to Know

Executive Summary

This vig investment review shows major concerns about VIG Investment. The company has been marked as a dishonest broker with serious fraud risks, which creates immediate red flags for potential investors. VIG Investment does offer the MetaTrader 5 platform and supports trading in forex, indices, commodities, and CFDs, but these limited benefits cannot overcome the broker's damaged reputation. The company targets investors from the United States, Canada, and the Czech Republic, though the lack of clear regulatory oversight makes this targeting questionable. Negative user feedback and fraud allegations create serious warning signs that potential traders cannot ignore.

The platform gives access to multiple asset classes through the popular MT5 interface. However, these few positive features are completely overshadowed by major credibility problems that affect every aspect of the service. Our detailed analysis shows that potential traders should use extreme caution when considering this broker. The risks far outweigh any potential benefits, making this a poor choice for serious investors. The lack of clear information about account conditions, fees, and regulatory status makes the situation even worse and raises more questions about whether this broker operates legitimately.

Important Notice

Regional Entity Differences: VIG Investment may operate across multiple jurisdictions including the United States, Canada, and the Czech Republic. However, specific regulatory status and compliance measures remain unclear across these regions, which creates confusion for potential clients. Traders should know that regulatory oversight and investor protection may vary significantly between different operational entities, making it difficult to understand what protections they actually have.

Review Methodology: This evaluation uses available information summaries and publicly accessible data. Due to limited regulatory documentation and insufficient user review support, this assessment may not capture the complete operational picture of VIG Investment's services and practices, though the available information already raises serious concerns.

Rating Framework

Broker Overview

VIG Investment operates as an online trading broker offering forex, CFDs, spread betting, and related financial services. However, specific establishment details and company founding information are not clearly documented in available materials, which immediately raises questions about transparency. The broker has been flagged with serious fraud allegations, creating immediate concerns about its legitimacy and operational integrity that potential clients cannot ignore. The company's business model centers around providing access to international financial markets through online trading platforms, specifically targeting retail investors seeking exposure to currency pairs, market indices, and commodity markets, though this targeting seems questionable given the fraud concerns.

Despite these serious allegations, VIG Investment does provide access to the MetaTrader 5 trading platform. This platform is widely recognized in the industry for its comprehensive trading tools and analytical capabilities, representing one of the few positive aspects of this broker. The broker supports trading across multiple asset classes including foreign exchange pairs, stock indices, commodities, and contracts for difference. However, the lack of detailed company background information and unclear regulatory status significantly undermines confidence in the broker's credibility and makes it impossible to recommend. This vig investment review emphasizes that while the platform may offer standard trading instruments, the fundamental questions about the company's legitimacy overshadow any potential trading benefits and create unacceptable risks for traders.

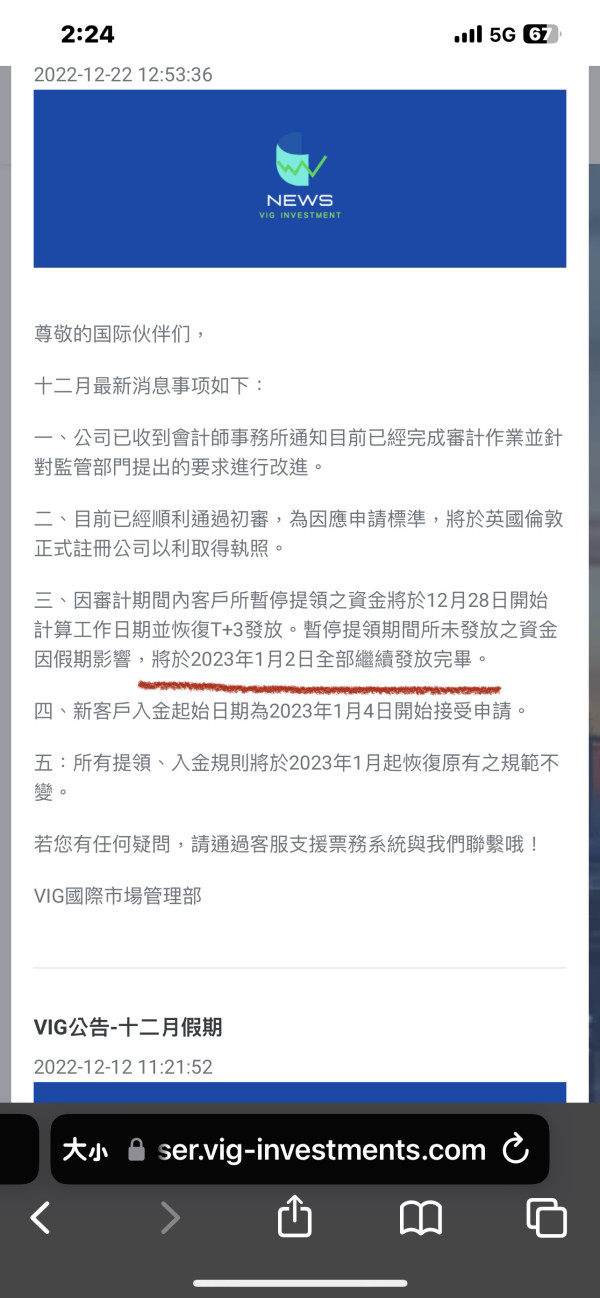

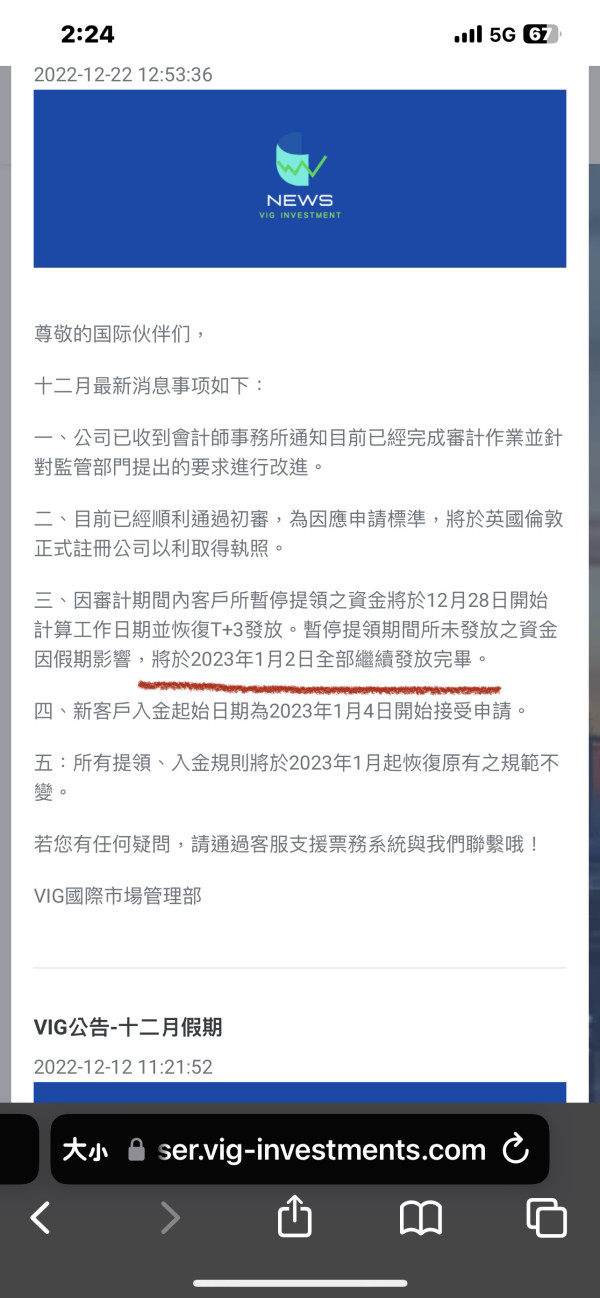

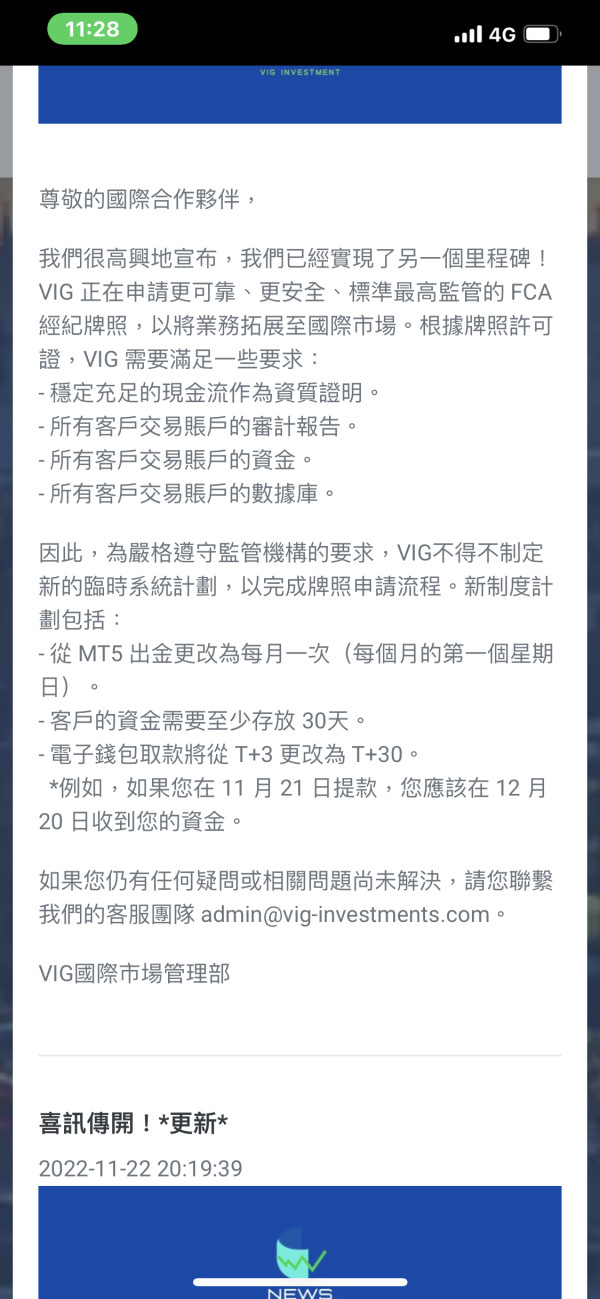

Regulatory Status: Available information does not specify any concrete regulatory authorities overseeing VIG Investment's operations. This represents a significant compliance concern for potential traders and suggests the broker may be operating without proper oversight.

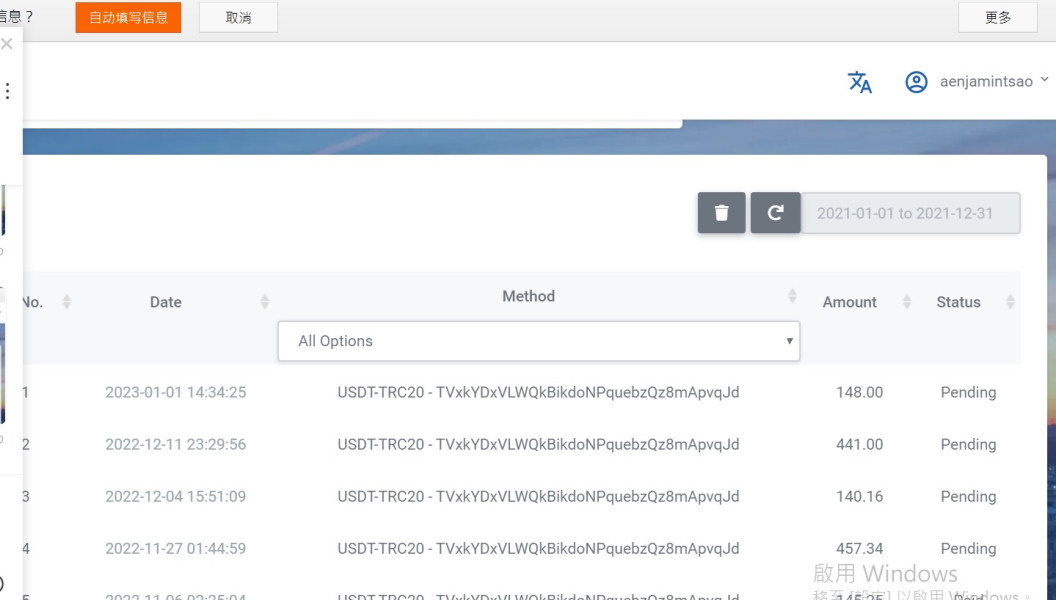

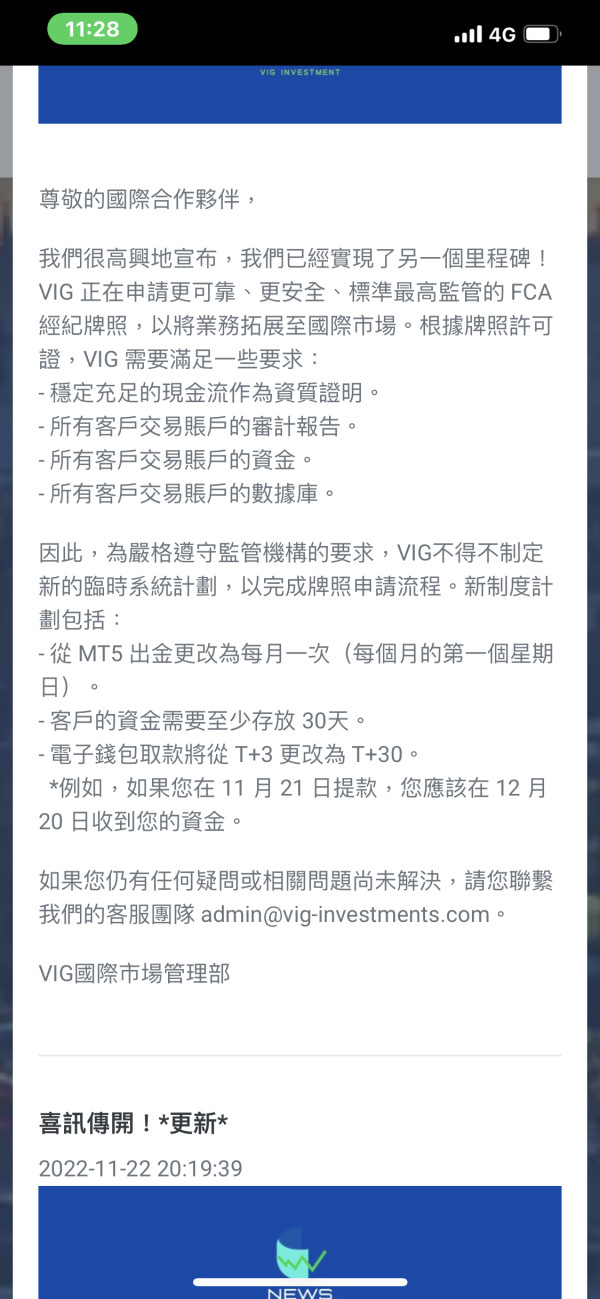

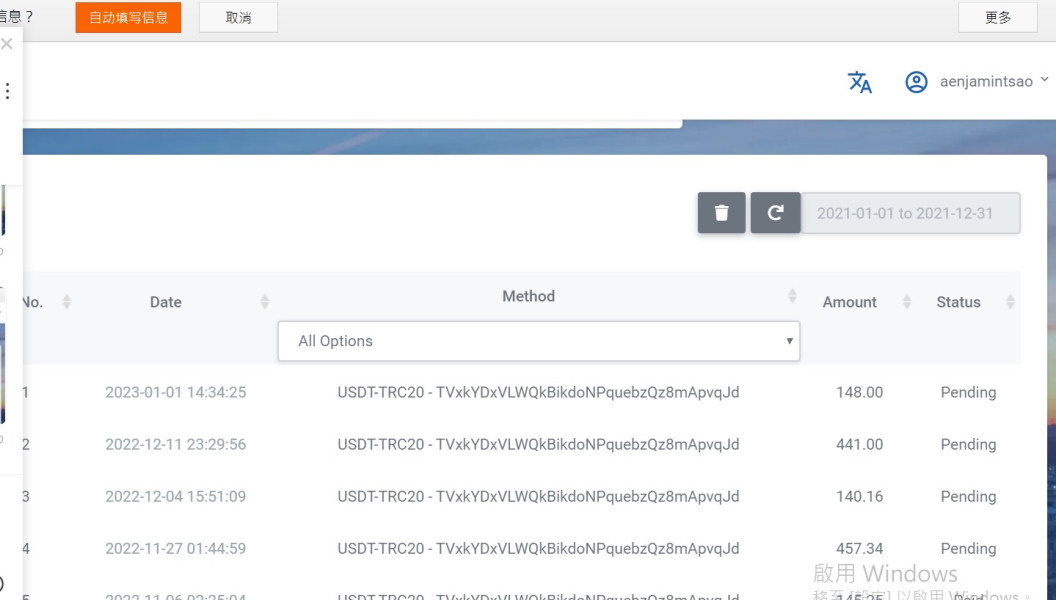

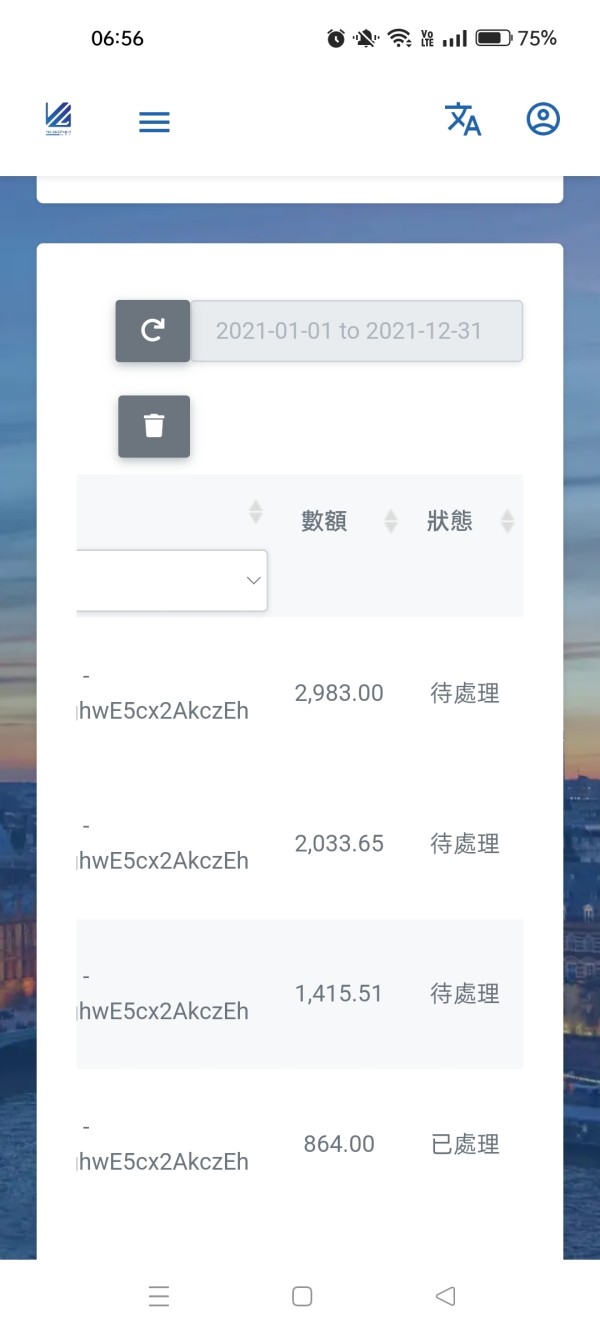

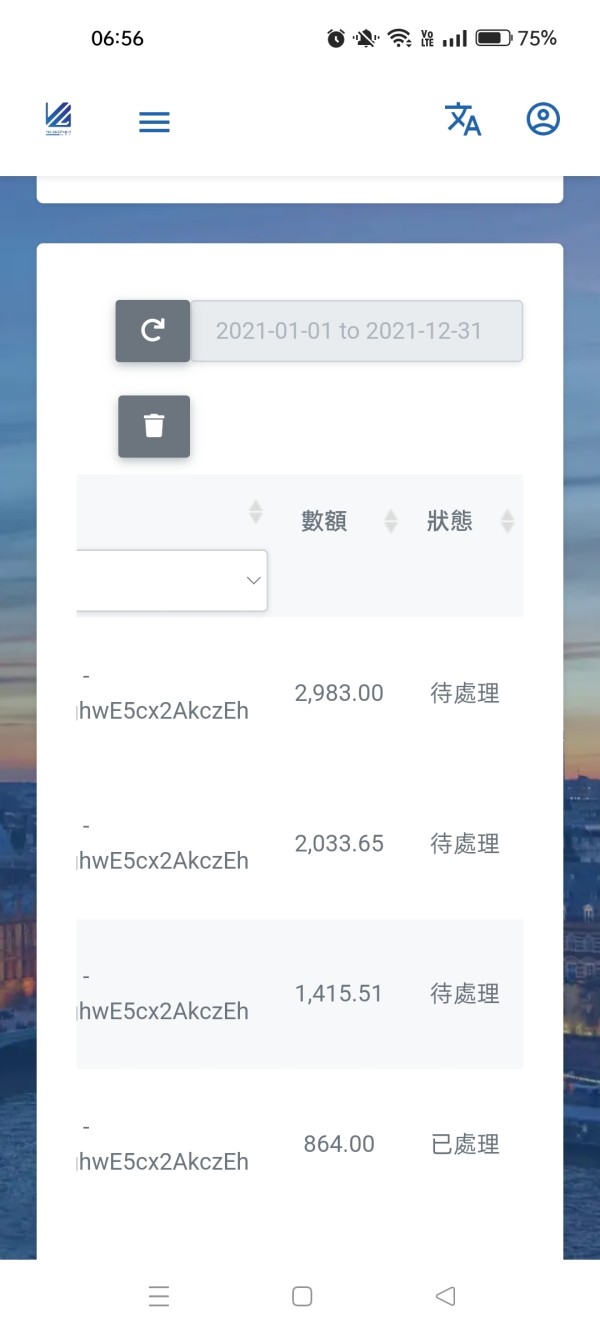

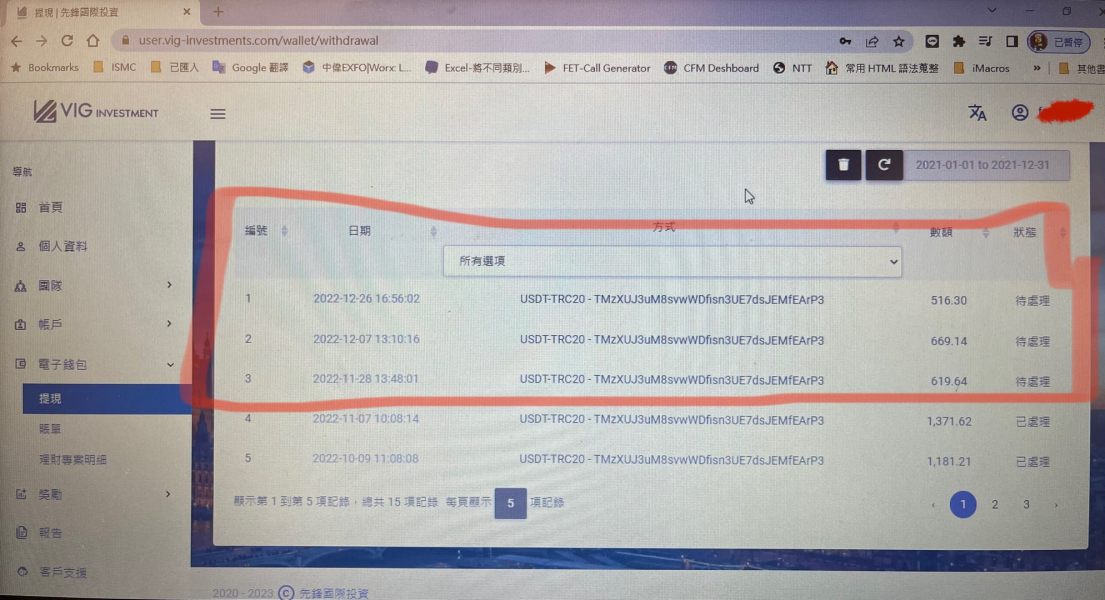

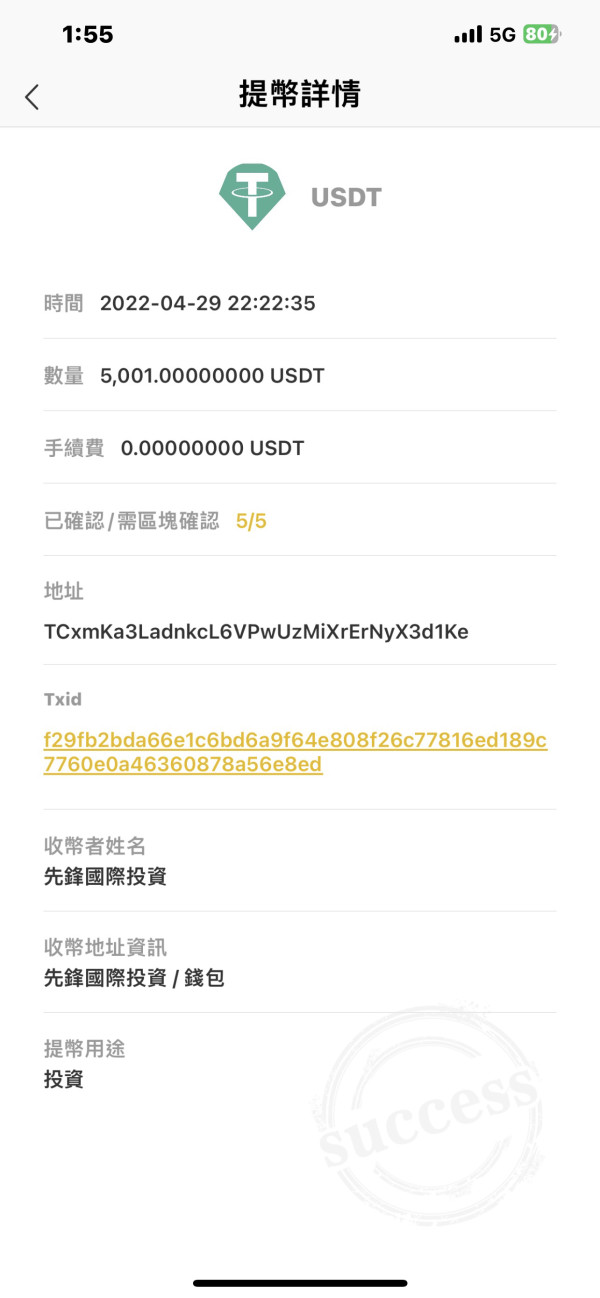

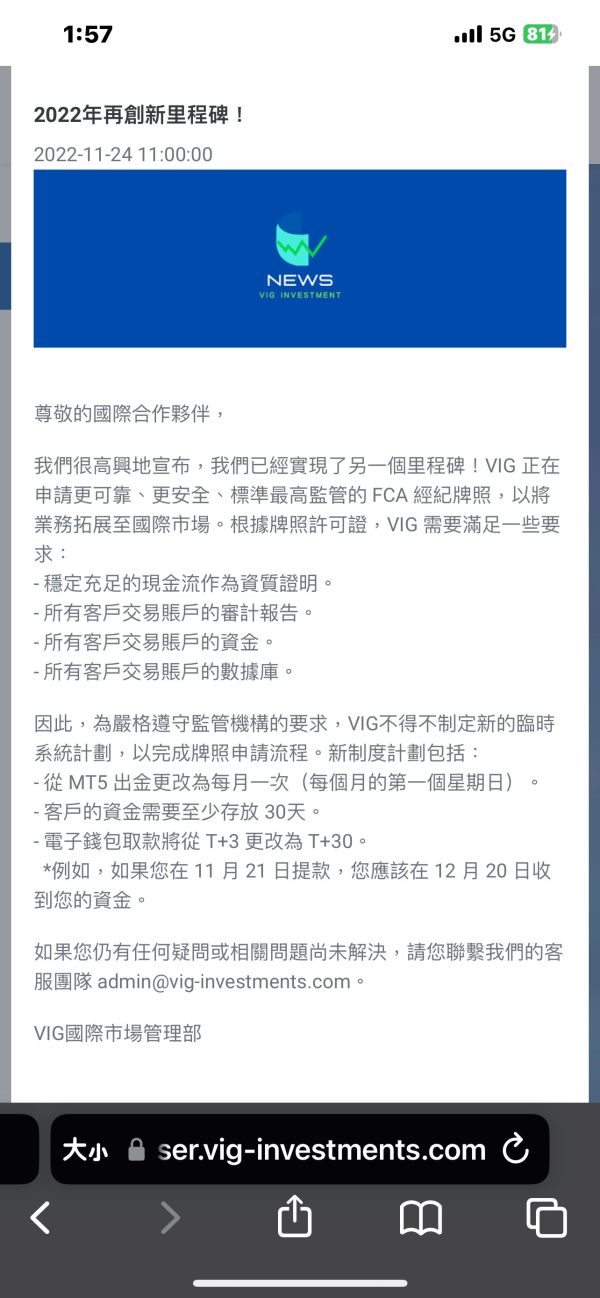

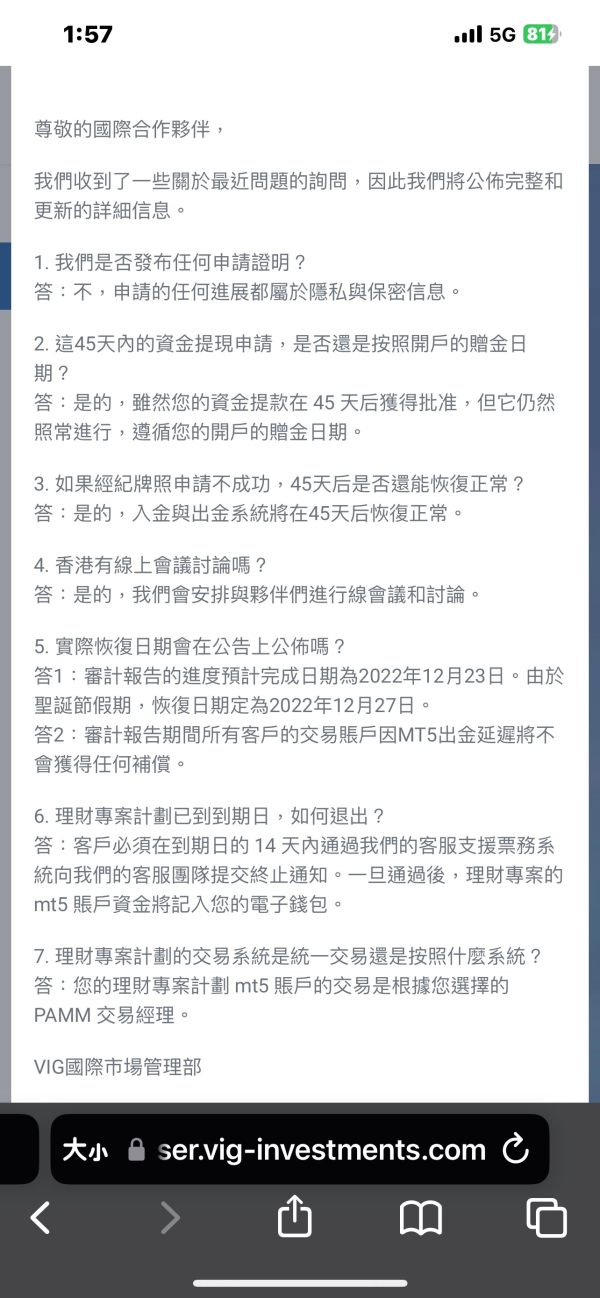

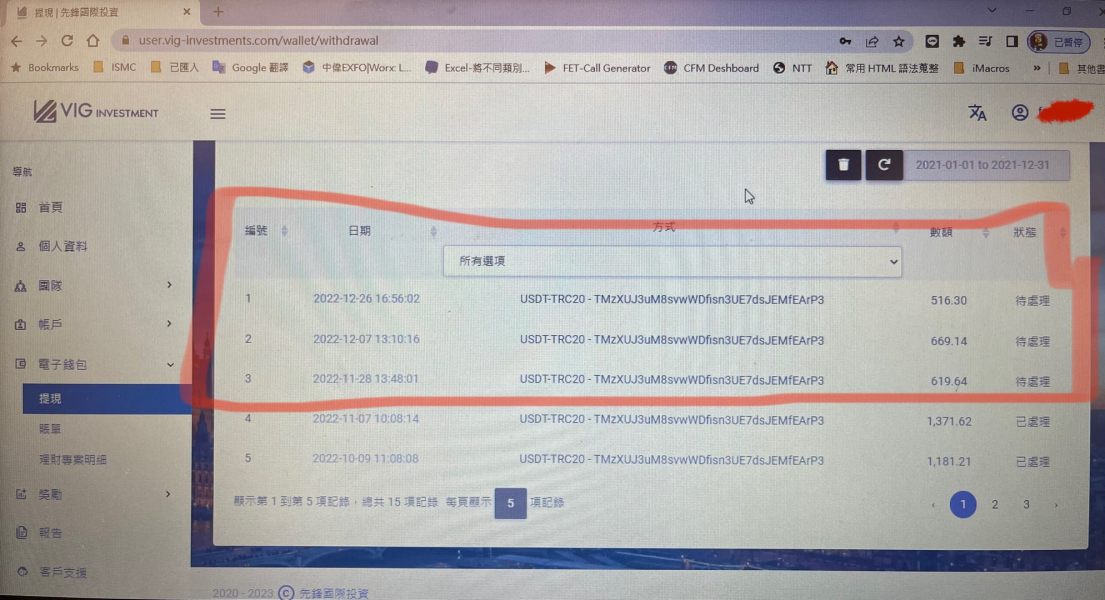

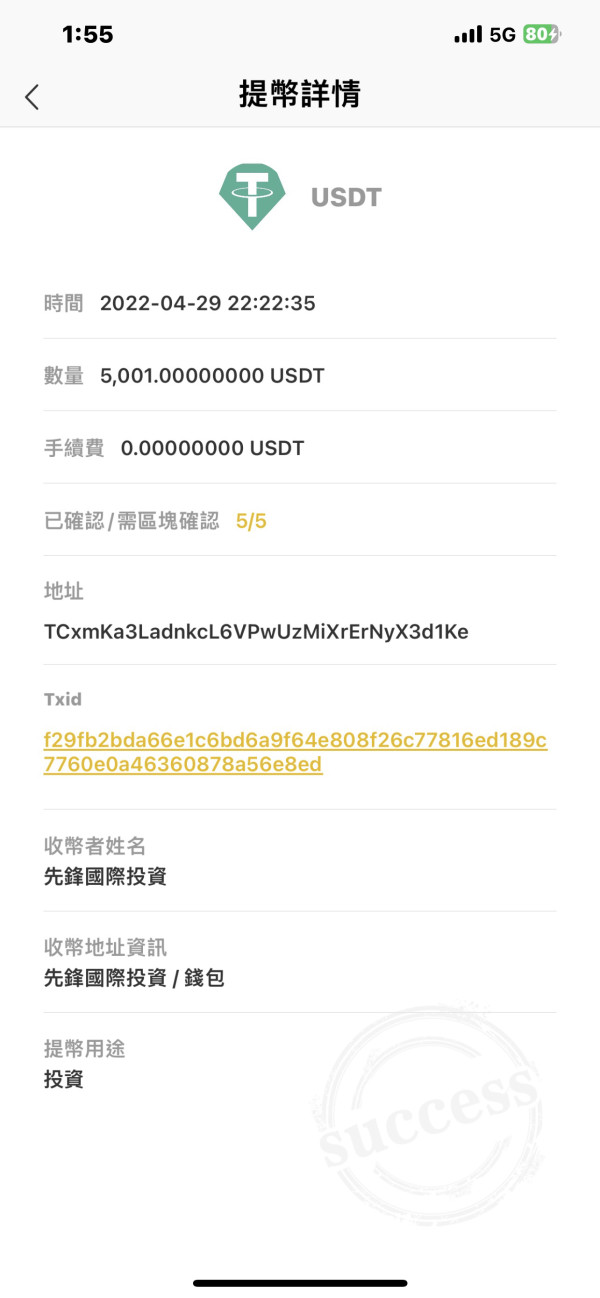

Deposit and Withdrawal Methods: Specific payment processing options, supported banking methods, and transaction procedures are not detailed in available documentation. This lack of information makes it impossible for traders to understand how they would fund their accounts or withdraw profits.

Minimum Deposit Requirements: The broker has not disclosed minimum account funding requirements or initial deposit thresholds for different account types. This basic information should be readily available from any legitimate broker.

Promotional Offers: Information regarding bonus programs, promotional campaigns, or incentive structures is not available in current materials. The absence of this information suggests poor marketing transparency or limited promotional activities.

Trading Assets: VIG Investment provides access to foreign exchange currency pairs, major stock market indices, commodity markets, and contracts for difference across multiple asset classes. This represents one of the few areas where the broker provides some level of service variety.

Cost Structure: Detailed information about spreads, commission rates, overnight financing charges, and other trading costs remains undisclosed in available materials. Traders cannot make informed decisions without understanding the true cost of trading with this broker.

Leverage Options: Specific leverage ratios and margin requirements for different asset classes are not specified in accessible documentation. This information is essential for risk management and trading strategy development.

Platform Selection: The broker primarily offers the MetaTrader 5 trading platform for executing trades and market analysis. This represents the main positive aspect of their service offering.

Geographic Restrictions: The service specifically targets investors located in the United States, Canada, and the Czech Republic. However, the legitimacy of this targeting is questionable given the regulatory concerns.

Customer Support Languages: Available customer service language options are not specified in current information. This vig investment review highlights the concerning lack of transparency in operational details that affects every aspect of the service.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by VIG Investment receive the lowest possible rating due to complete lack of transparency regarding essential account features and requirements. Available information provides no details about different account types, their specific characteristics, or the benefits associated with each tier, making it impossible for traders to understand what they would be signing up for. The absence of minimum deposit information makes it impossible for potential traders to understand the financial commitment required to begin trading. This represents a fundamental failure to meet basic industry standards for transparency and customer information.

The account opening process remains completely undocumented, with no clear guidance on verification procedures, required documentation, or timeline expectations for account activation. This lack of procedural transparency raises serious concerns about the broker's operational standards and commitment to regulatory compliance, suggesting they may not follow proper know-your-customer procedures. Additionally, there is no mention of specialized account options such as Islamic accounts for traders requiring Sharia-compliant trading conditions. These specialized accounts are standard offerings among reputable brokers and their absence suggests limited service development.

User feedback regarding account conditions is notably absent from available materials, suggesting either limited client engagement or potential suppression of customer experiences. The complete absence of account-related information in this vig investment review indicates that the broker fails to meet basic industry standards for transparency and customer information provision. This fundamental lack of information, combined with the fraud allegations, makes it impossible to recommend VIG Investment's account conditions to any trader profile or experience level.

VIG Investment's tools and resources receive a moderate rating primarily due to their provision of the MetaTrader 5 platform. This platform is widely recognized for its comprehensive trading capabilities and analytical tools, representing the single strongest aspect of VIG Investment's service offering. The MT5 platform provides access to advanced charting features, technical indicators, automated trading capabilities, and multi-asset trading functionality. These features represent industry-standard tools that experienced traders expect and need for effective market analysis and trade execution.

However, the evaluation is limited by the lack of information about additional research and analysis resources that complement the trading platform. There is no documentation of market research reports, economic calendars, trading signals, or fundamental analysis materials that experienced traders typically expect from full-service brokers, which limits the overall value proposition. Educational resources, including trading tutorials, webinars, market commentary, or beginner-friendly materials, are not mentioned in available information. This absence of educational support makes the platform less suitable for novice traders who need guidance and learning resources.

The absence of details about automated trading support, expert advisors, or algorithmic trading capabilities specifically offered by VIG Investment limits the assessment of their technological infrastructure. While the MT5 platform inherently supports these features, broker-specific implementations and restrictions remain unclear, creating uncertainty for advanced traders. User feedback about the quality and reliability of trading tools is not available in current materials, preventing a complete evaluation of practical tool performance and user satisfaction levels, though the fraud allegations suggest any positive aspects may be overshadowed by operational concerns.

Customer Service and Support Analysis

Customer service and support capabilities receive a very low rating due to significant gaps in service information and concerning user feedback patterns. Available materials provide no details about customer service channels, whether through phone support, live chat, email ticketing systems, or other communication methods that traders rely on for assistance and problem resolution, creating uncertainty about how clients can get help when needed. Response time commitments and service level agreements are not documented, leaving potential clients without expectations for support quality or availability. This lack of basic service information suggests poor preparation for client needs and inadequate service infrastructure.

The lack of information about service hours, timezone coverage, or emergency support procedures indicates poor preparation for international client needs. Most concerning is the absence of positive user feedback about customer service experiences, which typically indicates either limited service quality or insufficient client engagement with the platform. The broader context of fraud allegations against VIG Investment significantly impacts confidence in their customer support capabilities. Legitimate customer service requires trustworthy operational foundations, which appear to be lacking in this case.

Without clear service protocols, multilingual support information, or documented problem resolution procedures, potential traders face significant uncertainty about receiving adequate assistance when needed. The poor rating reflects both the lack of transparent service information and the concerning operational context surrounding the broker, making it unlikely that traders would receive satisfactory support. This vig investment review concludes that the customer service deficiencies, combined with the broader credibility issues, make VIG Investment unsuitable for traders who value reliable customer support and professional service standards.

Trading Experience Analysis

The trading experience evaluation receives an average rating based on the limited positive aspects of MetaTrader 5 platform availability balanced against significant information gaps about practical trading conditions. The MT5 platform provides solid foundational trading functionality, including order execution capabilities, chart analysis tools, and multi-asset trading support, which meets basic trader requirements for market access and represents the main strength of VIG Investment's offering. However, critical aspects of the trading experience remain undocumented, including platform stability reports, execution speed statistics, or user feedback about order processing quality. These missing details make it impossible to assess whether the platform performs reliably under real trading conditions.

The reliability of trade execution, particularly during volatile market conditions, is not addressed in available materials. Information about slippage rates, requote frequency, or order rejection patterns is absent, preventing assessment of execution quality standards that directly impact trading profitability and user satisfaction. Mobile trading experience details are not provided, despite mobile platform access being essential for modern trading operations. This gap in mobile trading information limits the platform's appeal for traders who need flexible access to their accounts and positions.

The lack of user testimonials about trading experience quality, platform performance, or overall satisfaction levels limits confidence in practical trading conditions. This vig investment review notes that while the platform foundation may be adequate, the absence of performance data and user experience feedback prevents a more positive evaluation of the overall trading environment. The fraud allegations and credibility concerns also cast doubt on whether any positive trading experience aspects would be sustainable or reliable for serious traders.

Trust and Security Analysis

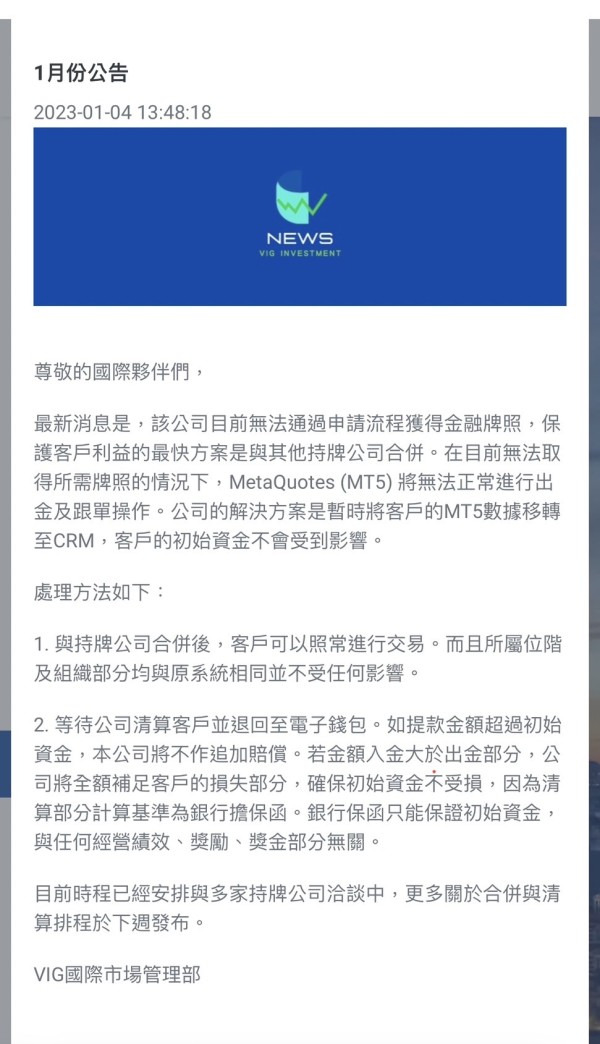

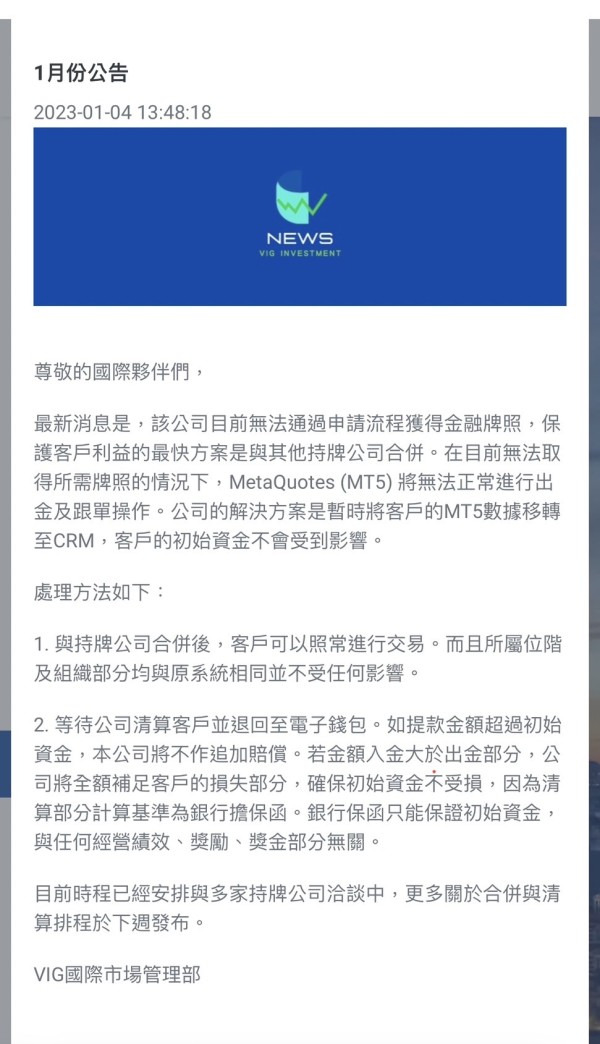

Trust and security receive the lowest possible rating due to serious allegations of fraudulent activity and the complete absence of regulatory oversight information. The fundamental issue of VIG Investment being characterized as a dishonest broker with fraud risks immediately disqualifies the platform from consideration by any risk-conscious trader or investor, regardless of other features or services they may offer. The lack of specific regulatory authority oversight represents a critical security flaw, as legitimate brokers operate under strict regulatory frameworks that provide client protection, fund segregation requirements, and operational oversight. Without regulatory supervision, traders have no institutional protection for their funds or recourse for dispute resolution, creating unacceptable risks for any investment activity.

The absence of information about client fund protection measures, insurance coverage, or segregated account structures further compounds security concerns. Company transparency is severely lacking, with no clear information about corporate structure, ownership details, or operational history that would allow independent verification of legitimacy, making it impossible for potential clients to conduct proper due diligence. The broker's industry reputation is fundamentally compromised by fraud allegations, and there is no evidence of proper handling of these serious concerns. Third-party regulatory verification is impossible due to the lack of regulatory registration information, making this one of the most concerning aspects of the entire evaluation.

This complete absence of trust and security foundations makes VIG Investment unsuitable for any type of trading or investment activity. The combination of fraud allegations, lack of regulatory oversight, and missing transparency measures creates a risk profile that no responsible trader should accept, regardless of any other features the platform might offer.

User Experience Analysis

User experience receives a very low rating due to overwhelmingly negative feedback patterns and the absence of positive user testimonials or satisfaction indicators. The general lack of documented user experiences suggests either limited client engagement or potential issues with service delivery that discourage customer feedback sharing, both of which are concerning for potential new clients. Interface design and usability information is not available beyond the basic MetaTrader 5 platform provision, leaving questions about broker-specific customizations, user interface improvements, or additional usability features. This lack of customization information suggests limited investment in user experience development and poor attention to client needs.

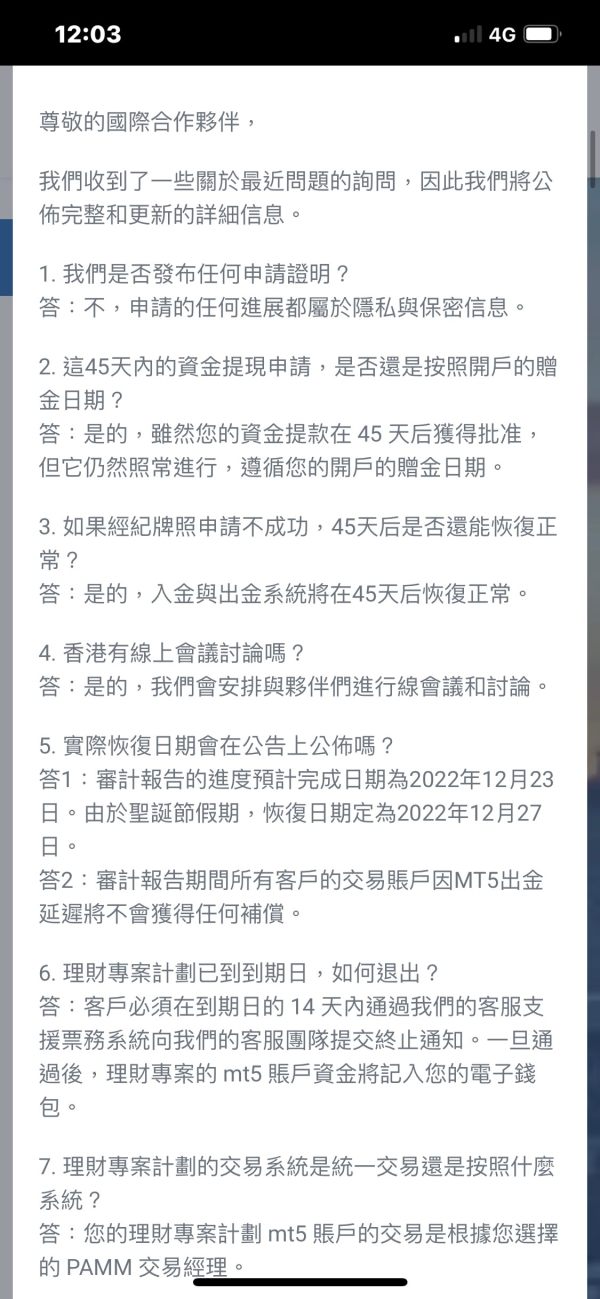

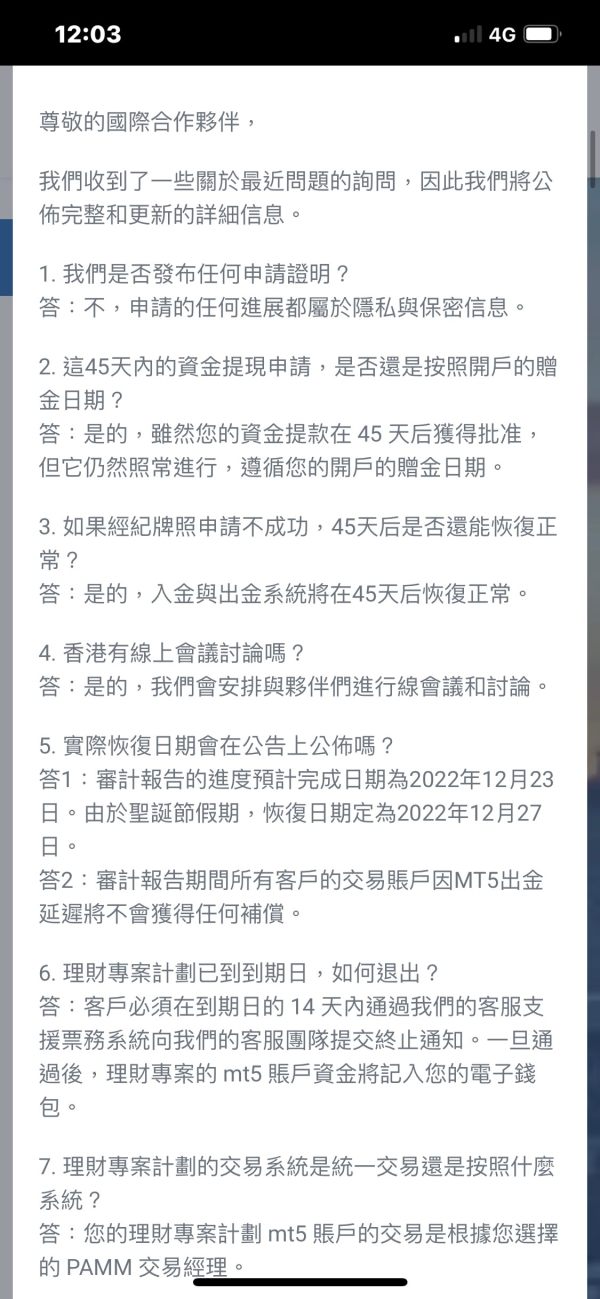

The registration and verification process details are undocumented, preventing assessment of onboarding experience quality or efficiency measures that impact initial user satisfaction. Fund operation experiences, including deposit and withdrawal procedures, processing times, and user satisfaction with financial transactions, are not documented in available materials, creating uncertainty about basic account management functions. The common user complaints and concerns are not specifically detailed, though the overall negative context suggests significant user experience problems. This absence of positive feedback and the presence of fraud allegations indicate that users likely face serious problems when trying to use the platform.

Given the fraud allegations and lack of positive user feedback, it is impossible to recommend VIG Investment to any trader profile or experience level. The fundamental user experience appears to be compromised by operational and trust issues that would affect every aspect of platform interaction, from account opening to trade execution to fund withdrawal.

Conclusion

This comprehensive vig investment review concludes that VIG Investment presents unacceptable risks and cannot be recommended for any type of trader or investor. The combination of fraud allegations, lack of regulatory oversight, and absence of transparent operational information creates a risk profile that far exceeds any potential benefits from the limited positive aspects such as MetaTrader 5 platform access, making this broker unsuitable for serious trading activities. The broker's fundamental lack of credibility, evidenced by dishonesty accusations and missing regulatory compliance information, makes it unsuitable for both novice and experienced traders. The primary disadvantages include complete absence of trust and security measures, inadequate transparency in account conditions and costs, and concerning gaps in customer service information that suggest poor operational standards and potential fraud risks.

Potential traders should look elsewhere for legitimate, regulated brokers that provide transparent operations, proper regulatory oversight, and positive user feedback. The risks associated with VIG Investment are simply too high to justify any potential benefits, and traders would be better served by choosing established, regulated brokers with proven track records and positive industry reputations.