C&S Review 1

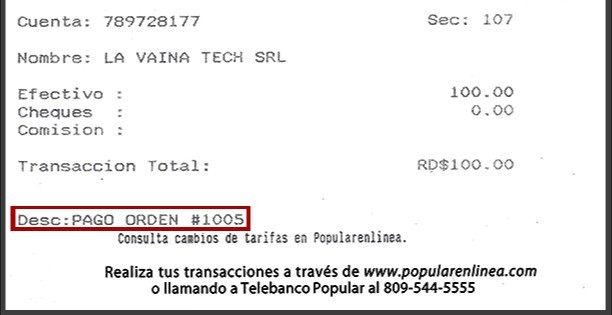

I deposited $100 on this broker. They had no customer service.

C&S Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I deposited $100 on this broker. They had no customer service.

This c s review looks at C & S Broker, Inc., a financial services company based in Hilliard, Florida. The company shows a mixed profile for potential traders and investors based on available public information. C & S Broker's main appeal comes from its U.S.-based operations and focus on providing various trading services to retail clients, especially day traders and forex investors who want domestic brokerage solutions.

Our analysis shows big information gaps about important trading conditions, regulatory oversight, and how transparent their operations are. C & S Broker, Inc. has a physical presence in Florida, but they lack detailed public information about their trading platforms, fee structures, and regulatory compliance, which creates uncertainty for potential clients. This c s review gives traders a balanced assessment based on available data to help them decide if this broker fits their trading goals and risk tolerance.

The company seems to focus mainly on U.S.-based traders who want domestic brokerage services. However, specific details about their target market and specialized offerings remain unclear from publicly available sources.

Regional Entity Differences: Potential clients should do extra research when considering C & S Broker, Inc. because limited regulatory information is available in public sources. Different regulatory areas may offer different levels of investor protection, and the lack of clear regulatory disclosure in available materials raises questions about oversight and compliance standards.

Review Methodology: This evaluation uses publicly available company information, regulatory filings where accessible, and industry standard assessment criteria. Given the limited information available about C & S Broker, Inc.'s specific operations, trading conditions, and client feedback, readers should do independent research and verification before making any trading or investment decisions.

The information presented shows data available as of 2025 and may not include recent changes in the company's operations, regulatory status, or service offerings.

| Assessment Category | Score | Rating Basis |

|---|---|---|

| Account Conditions | 5/10 | Limited information available about account types, minimum deposits, and specific trading conditions |

| Tools and Resources | 4/10 | No detailed information about trading platforms, analytical tools, or educational resources |

| Customer Service | 4/10 | Absence of publicly available customer service information or client feedback |

| Trading Experience | 5/10 | Insufficient data about platform performance, execution quality, or user interface |

| Trust and Security | 3/10 | Limited regulatory transparency and unclear compliance status |

| User Experience | 4/10 | No available user reviews or satisfaction metrics in public sources |

C & S Broker, Inc. works as a financial services company based in Hilliard, Florida. The company positions itself within the competitive landscape of U.S.-based brokerage firms. Their Florida headquarters suggests compliance with state-level business regulations, though specific details about the founding date, company history, and evolution of services remain undisclosed in available public materials.

The geographic location in Florida may appeal to traders seeking brokers with a physical U.S. presence. This particularly attracts those who prioritize domestic regulatory oversight and local business accountability. The company's business model appears focused on providing brokerage services to retail traders, though the specific scope of their operations, target market segments, and competitive positioning within the industry lack clear definition in publicly accessible sources.

This c s review finds that while the company maintains a legitimate business presence, the absence of detailed operational information creates challenges for potential clients seeking to understand their service offerings and trading capabilities. Available information does not specify which trading platforms C & S Broker, Inc. provides or whether they utilize proprietary technology or third-party solutions. Details about asset classes, market access, and trading instruments remain unclear, making it difficult for traders to assess whether the broker's offerings align with their specific trading strategies and market preferences.

Regulatory Status: Available information does not clearly specify the primary regulatory authorities overseeing C & S Broker, Inc.'s operations. This creates uncertainty about investor protection standards and compliance requirements.

Deposit and Withdrawal Methods: Specific information about funding options, processing times, and associated fees for deposits and withdrawals is not available in public sources.

Minimum Deposit Requirements: The broker's minimum deposit thresholds for different account types are not disclosed in available materials.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional programs are not mentioned in accessible company information.

Tradeable Assets: The range of financial instruments, including forex pairs, stocks, commodities, or other assets available for trading, remains unspecified in public sources.

Cost Structure: Complete information about spreads, commissions, overnight fees, and other trading costs is not available. This makes cost comparison with other brokers challenging.

Leverage Options: Maximum leverage ratios and margin requirements for different asset classes are not detailed in available information.

Platform Selection: Specific trading platforms offered, including mobile applications and desktop solutions, are not clearly outlined in public materials.

Geographic Restrictions: Information about service availability in different countries or regions is not specified.

Customer Support Languages: Available support languages and communication channels are not detailed in accessible sources.

This c s review notes that the lack of detailed service information significantly impacts the ability to provide complete guidance to potential clients.

The evaluation of C & S Broker, Inc.'s account conditions reveals big information gaps that potential clients should consider carefully. Traders cannot properly assess whether the broker's offerings match their trading volume, experience level, or specific requirements without specific details about account types, tier structures, or different service levels. Industry-standard account categories typically include basic retail accounts, premium accounts for high-volume traders, and specialized accounts such as Islamic accounts for clients requiring Sharia-compliant trading conditions.

The absence of publicly available minimum deposit information creates uncertainty about accessibility for different trader segments. Competitive brokers typically offer entry-level accounts with modest minimum deposits alongside premium accounts requiring substantial initial funding. Potential clients cannot determine whether C & S Broker, Inc. targets retail traders, institutional clients, or both market segments without this basic information.

Account opening procedures, verification requirements, and onboarding timelines remain unspecified in available materials. Modern brokers typically provide streamlined digital onboarding with document verification, though processing times and requirements vary significantly across firms.

The lack of transparency about these processes may concern traders seeking efficient account activation. This c s review emphasizes that account condition transparency represents a critical factor in broker selection, and the limited available information about C & S Broker, Inc.'s specific offerings creates challenges for informed decision-making. Potential clients should directly contact the broker to obtain detailed account information before proceeding with any trading relationship.

The assessment of trading tools and analytical resources offered by C & S Broker, Inc. encounters major limitations due to insufficient public information about their technology infrastructure and client support tools. Modern forex and trading brokers typically provide complete analytical suites including real-time charting, technical indicators, economic calendars, and market research reports to support informed trading decisions.

Professional trading platforms commonly integrate advanced order types, risk management tools, and automated trading capabilities that enable sophisticated trading strategies. Traders cannot evaluate whether the broker supports their preferred trading methods or technical analysis requirements without specific information about C & S Broker, Inc.'s platform features.

Educational resources represent another crucial component of broker services, particularly for developing traders seeking to enhance their market knowledge and trading skills. Industry-leading brokers typically offer webinars, tutorials, market analysis, and educational content covering various trading concepts and strategies.

The absence of information about C & S Broker, Inc.'s educational offerings limits assessment of their commitment to client development and support. Research and analysis capabilities, including market commentary, expert insights, and fundamental analysis, contribute significantly to trading success. The lack of detailed information about these resources makes it challenging to determine whether C & S Broker, Inc. provides the analytical support that serious traders require for effective market participation.

Customer service quality and accessibility represent basic aspects of the trading experience. Available information about C & S Broker, Inc.'s support infrastructure remains notably limited. Effective broker support typically includes multiple communication channels including live chat, telephone support, email assistance, and complete FAQ resources to address various client needs and urgency levels.

Response time expectations and service availability hours significantly impact trader satisfaction, particularly for active traders requiring immediate assistance during market hours. International traders often require 24/7 support or extended hours coverage to accommodate different time zones and global market sessions.

Potential clients cannot assess whether the service level meets their operational requirements without specific information about C & S Broker, Inc.'s support schedule and response commitments. Multilingual support capabilities often distinguish brokers serving diverse international client bases. Given the global nature of forex trading, brokers frequently provide support in multiple languages to accommodate clients from different regions.

The absence of information about language support options limits understanding of C & S Broker, Inc.'s international service capabilities. Problem resolution processes and escalation procedures represent critical components of customer service quality. Experienced traders value brokers with established protocols for addressing account issues, technical problems, and trading disputes efficiently.

The lack of publicly available information about these processes creates uncertainty about the broker's commitment to client satisfaction and issue resolution.

Platform performance and execution quality form the foundation of successful trading experiences. Complete information about C & S Broker, Inc.'s trading infrastructure remains unavailable in public sources. Modern traders expect fast order execution, minimal slippage, and reliable platform stability during volatile market conditions.

Potential clients cannot evaluate whether the broker's technology meets professional trading standards without specific performance metrics or platform specifications. Order execution models significantly impact trading costs and outcomes. Brokers typically operate as market makers, ECN providers, or STP facilitators, each offering different execution characteristics and cost structures.

The absence of clear information about C & S Broker, Inc.'s execution model creates uncertainty about pricing transparency and potential conflicts of interest. Mobile trading capabilities have become essential for modern traders who require market access and portfolio management functionality across multiple devices. Complete mobile applications typically offer full trading functionality, real-time market data, and account management features equivalent to desktop platforms.

Traders cannot assess the broker's commitment to technological accessibility without specific information about mobile offerings. Platform stability during high-volatility periods represents a crucial factor for active traders.

Reliable brokers maintain consistent platform performance during major economic announcements and market stress events. The lack of available performance data or client feedback about C & S Broker, Inc.'s platform reliability creates uncertainty about their operational resilience. This c s review emphasizes that trading experience quality directly impacts profitability and trader satisfaction, making platform evaluation essential for broker selection decisions.

Regulatory oversight and compliance standards represent basic pillars of broker trustworthiness. Available information about C & S Broker, Inc.'s regulatory status presents significant transparency concerns. Reputable brokers typically maintain clear regulatory disclosure, including license numbers, supervisory authorities, and compliance certifications that enable client verification of their operational legitimacy.

Client fund protection mechanisms, including segregated accounts and deposit insurance, provide critical safeguards for trader capital. Regulated brokers commonly maintain client funds separately from operational capital and participate in compensation schemes that protect deposits up to specified limits.

The absence of detailed information about C & S Broker, Inc.'s fund protection measures raises questions about capital security standards. Corporate transparency, including ownership structure, financial reporting, and business disclosures, contributes to broker credibility assessment. Established brokers typically provide accessible information about company leadership, financial stability, and operational history that enables client due diligence.

Limited public information about C & S Broker, Inc.'s corporate structure creates challenges for complete trust evaluation. Industry reputation and third-party recognition often reflect broker quality and reliability.

Established firms frequently receive industry awards, regulatory recognition, and positive coverage from financial media outlets. The absence of readily available information about C & S Broker, Inc.'s industry standing limits assessment of their market reputation and peer recognition.

Overall user satisfaction and platform usability represent critical factors in broker selection. Available information about C & S Broker, Inc.'s client experience remains notably limited. Complete user experience evaluation typically includes interface design, navigation efficiency, feature accessibility, and overall platform intuitiveness that enables effective trading execution.

Registration and account verification processes significantly impact initial client experience and onboarding satisfaction. Modern brokers typically provide streamlined digital onboarding with clear documentation requirements and reasonable processing timelines.

Potential clients cannot anticipate the complexity or duration of the setup process without specific information about C & S Broker, Inc.'s account opening procedures. Funding and withdrawal experiences often determine long-term client satisfaction, particularly regarding processing times, fee transparency, and transaction reliability. Efficient brokers typically provide multiple funding options with clear fee disclosure and predictable processing schedules.

The absence of detailed information about C & S Broker, Inc.'s payment processes creates uncertainty about operational efficiency. Common client concerns and complaint patterns typically emerge through user reviews, regulatory reports, and industry feedback.

The limited availability of client testimonials or regulatory complaint data about C & S Broker, Inc. restricts complete user experience assessment and identification of potential operational issues.

This complete c s review reveals a brokerage firm with limited publicly available information. This creates significant challenges for potential clients seeking to evaluate their services thoroughly. C & S Broker, Inc. maintains a legitimate business presence in Hilliard, Florida, but the absence of detailed information about trading conditions, regulatory oversight, platform capabilities, and client feedback raises important considerations for prospective traders.

The broker may appeal to traders specifically seeking U.S.-based brokerage services or those prioritizing domestic business relationships. However, the lack of transparency regarding crucial factors such as regulatory compliance, trading costs, platform features, and customer support capabilities requires extensive research before establishing any trading relationship.

Potential clients should directly contact C & S Broker, Inc. to obtain complete information about their services, trading conditions, and regulatory status before making any commitment. Given the competitive landscape of forex and trading brokers, traders may benefit from comparing multiple options with more transparent operational disclosure and established industry reputations.

FX Broker Capital Trading Markets Review