Orient 2025 Review: Everything You Need to Know

Summary

Orient Finance is a UAE-based financial services provider. It has over 30 years of operational history in the Middle Eastern market. This orient review reveals a broker that emphasizes regulatory compliance and investor protection through its registration with the Securities and Commodities Authority of the UAE. The company offers access to multiple trading opportunities including derivatives, spot markets, and CFDs across various asset classes.

Key distinguishing features include their dual-platform approach. They provide both MetaTrader 5 and their proprietary Saturn Trader platform for web and mobile trading. The broker positions itself as a comprehensive solution for traders seeking exposure to global markets with the security of stringent UAE regulatory oversight. Orient Finance targets professional traders and institutional clients who prioritize regulatory compliance and diverse market access over promotional offerings.

According to available information, the broker maintains a focus on technological advancement and regulatory evolution. The company has adapted their services over three decades to meet changing market conditions and regulatory requirements. The company's commitment to transparency and grievance redressal mechanisms aligns with SCA requirements for licensed brokers operating in the UAE jurisdiction.

Important Notice

This review is based on publicly available information and regulatory disclosures. Different regional entities may offer varying service levels and trading conditions depending on local regulatory requirements and licensing arrangements. The UAE regulatory framework may differ significantly from other jurisdictions. This could potentially affect the scope of services and investor protections available to international clients.

Our assessment methodology relies on official regulatory filings, company disclosures, and available user feedback. Prospective traders should verify current terms and conditions directly with the broker. Financial services regulations and offerings may change without prior notice.

Rating Framework

Broker Overview

Orient Finance established its presence in the UAE financial services sector over three decades ago. The company built its reputation on regulatory compliance and market adaptation. The company has positioned itself as a progressive broker that evolves with market opportunities, technological advances, and regulatory changes to maintain competitive advantage in the Middle Eastern trading landscape.

The broker's operational philosophy centers on delivering sustainable trading relationships. This is achieved through adherence to UAE government requirements for broker registration and regulatory compliance. Orient Finance operates under the oversight of the Securities and Commodities Authority. This authority mandates strict standards for liquidity management, operational transparency, and client grievance procedures.

Orient Finance provides access to global derivatives and spot market trading through two primary platforms. These are the industry-standard MetaTrader 5 and their proprietary Saturn Trader system. The orient review indicates that both platforms are available in web-based and mobile versions. This caters to different trader preferences and technical requirements. The broker's asset coverage spans multiple markets, including forex, derivatives, and spot trading opportunities. This allows clients to diversify their trading strategies across various financial instruments and market conditions.

Regulatory Jurisdiction: Orient Finance operates under the supervision of the UAE Securities and Commodities Authority. The SCA enforces stringent investor protection measures and requires registered brokers to maintain high standards of liquidity, transparency, and client service.

Deposit and Withdrawal Methods: Specific information about funding options and withdrawal procedures is not detailed in available company materials.

Minimum Deposit Requirements: The broker has not published specific minimum deposit amounts in accessible documentation.

Bonus and Promotional Offers: Current promotional strategies and bonus structures are not outlined in available sources.

Tradeable Assets: The platform provides access to global derivatives, spot markets, CFDs, and multiple stock market opportunities. This offers traders flexibility across various financial instruments and market segments.

Cost Structure: Detailed information about spreads, commissions, and trading fees is not available in current public materials.

Leverage Ratios: Specific leverage offerings and margin requirements are not documented in accessible sources.

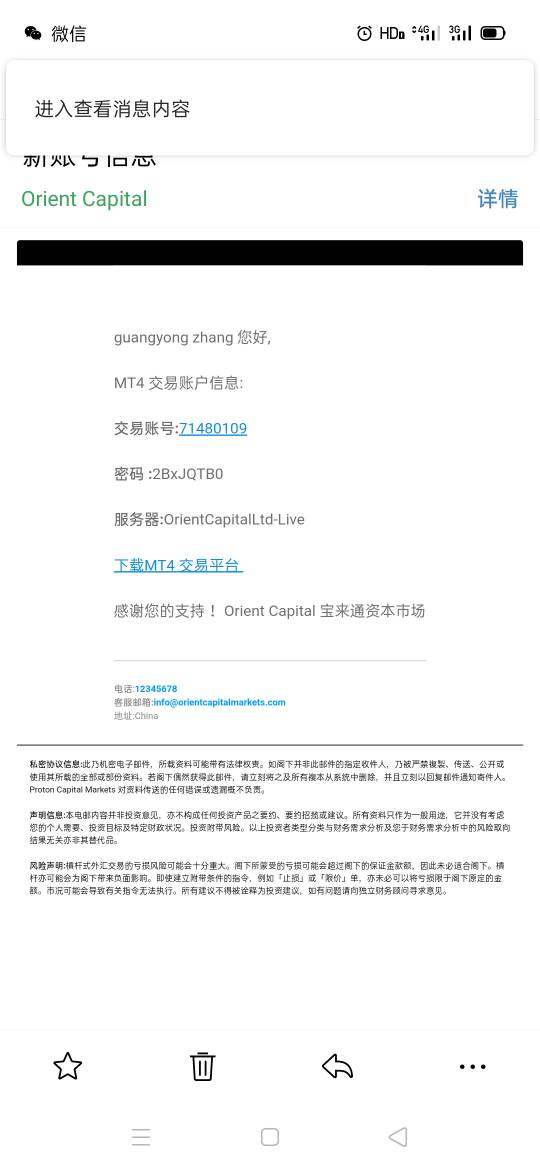

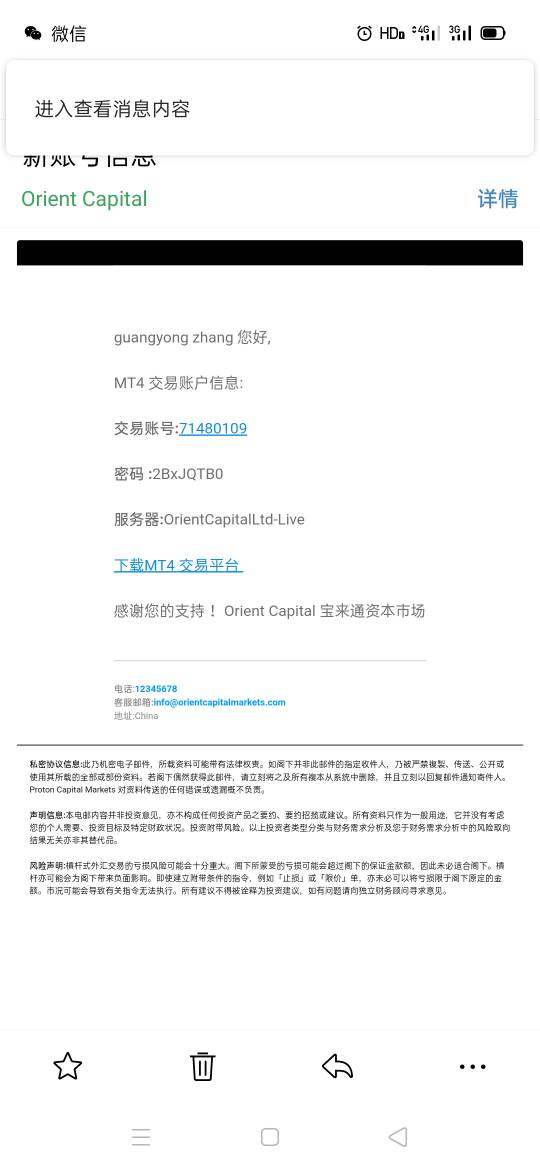

Platform Options: Traders can choose between MetaTrader 5 and Saturn Trader. Both are available in web and mobile formats to accommodate different trading styles and technical preferences.

Geographic Restrictions: Information about regional limitations and client acceptance policies is not specified in available documentation.

Customer Support Languages: The range of supported languages for customer service is not detailed in current materials.

This orient review highlights the importance of contacting the broker directly for specific terms and conditions. Many operational details are not publicly disclosed.

Account Conditions Analysis

The account structure and conditions offered by Orient Finance remain largely undisclosed in publicly available materials. This makes it challenging to provide a comprehensive assessment of their account offerings. Without specific information about account types, minimum deposit requirements, or fee structures, potential clients must rely on direct communication with the broker to understand available options.

The absence of detailed account information in public documentation suggests that Orient Finance may operate on a more consultative approach. The broker potentially tailors account conditions to individual client needs rather than offering standardized retail packages. This approach is common among brokers focusing on professional and institutional clients who require customized trading solutions.

The lack of transparent pricing information may be a consideration for traders who prefer to compare costs across multiple brokers before making decisions. However, this approach may also indicate that the broker prioritizes relationship-building and personalized service over mass-market appeal.

Given the UAE regulatory environment and SCA oversight, account holders can expect compliance with local investor protection standards. Specific details about account features, Islamic account availability, or special trading conditions require direct inquiry with the broker.

This orient review recommends that prospective clients request detailed account documentation directly from Orient Finance. This will help them fully understand available options and associated costs.

Orient Finance demonstrates a solid commitment to platform diversity by offering both MetaTrader 5 and their proprietary Saturn Trader system. MetaTrader 5 provides traders with access to the industry's most widely recognized trading platform. It features advanced charting capabilities, automated trading support, and extensive technical analysis tools that professional traders expect.

The inclusion of Saturn Trader as a proprietary platform suggests that Orient Finance has invested in developing customized trading solutions. These may offer unique features or enhanced functionality specific to their client base and market focus. Both platforms are available in web and mobile formats, ensuring that traders can access markets and manage positions across different devices and locations.

The multi-asset trading capability across derivatives, spot markets, and CFDs provides traders with comprehensive market access through a single broker relationship. This diversity allows for portfolio diversification and the implementation of complex trading strategies that span multiple asset classes and market conditions.

However, the lack of detailed information about research resources, educational materials, or advanced trading tools limits our ability to fully assess the broker's commitment to trader development and market analysis support. The absence of information about automated trading capabilities, API access, or third-party integrations may be relevant for traders requiring advanced functionality.

Customer Service and Support Analysis

Customer service information for Orient Finance is not detailed in available public materials. This makes it difficult to assess the quality and availability of client support services. The lack of publicly available information about support channels, response times, or service hours represents a significant gap in transparency for potential clients.

Without specific details about customer service languages, regional support availability, or escalation procedures, traders cannot adequately evaluate whether the broker's support infrastructure meets their needs. This is particularly important for international clients who may require assistance outside standard UAE business hours.

The absence of customer service information may reflect the broker's focus on institutional or high-net-worth clients. These clients typically receive dedicated account management rather than relying on general support channels. However, this approach may not be suitable for individual traders who require accessible customer support.

Given the SCA regulatory framework, Orient Finance must maintain adequate grievance redressal mechanisms. The specific implementation and accessibility of these procedures are not detailed in available documentation. Prospective clients should inquire directly about support availability, response times, and escalation procedures before establishing trading relationships.

Trading Experience Analysis

The trading experience offered by Orient Finance cannot be comprehensively evaluated due to limited user feedback and technical performance data in available sources. While the broker offers both MetaTrader 5 and Saturn Trader platforms, specific information about execution speed, platform stability, or order processing quality is not documented.

The availability of both web and mobile trading platforms suggests attention to accessibility and user convenience. Detailed functionality comparisons or user interface assessments are not available. The multi-asset trading capability indicates that traders can execute diverse strategies across different markets through a single platform relationship.

Without specific user testimonials or performance metrics, it's challenging to assess how well the platforms perform during high-volatility periods. It's also unclear whether the broker maintains competitive execution standards. The lack of information about slippage, requotes, or execution statistics represents a significant gap for traders prioritizing execution quality.

The orient review process reveals that prospective clients should request demonstration accounts or trial periods. This allows them to personally evaluate platform performance and trading conditions before committing to live trading relationships. Direct testing may be the most reliable method for assessing whether the trading experience meets individual requirements.

Trust and Safety Analysis

Orient Finance demonstrates a strong commitment to regulatory compliance through its registration with the UAE Securities and Commodities Authority. The SCA regulatory framework provides substantial investor protection measures. These include requirements for broker registration, liquidity management, operational transparency, and established grievance redressal procedures.

The UAE government's emphasis on stringent investor protection creates a robust regulatory environment that requires brokers to maintain high operational standards. SCA oversight includes monitoring of broker compliance with transparency requirements and ensuring adequate mechanisms for addressing client concerns and disputes.

Orient Finance's 30+ year operational history in the UAE market suggests institutional stability and long-term commitment to the regional financial services sector. This extended operational period indicates the broker's ability to adapt to changing regulatory requirements and market conditions while maintaining business continuity.

However, the lack of detailed information about specific safety measures, segregated account policies, or insurance coverage limits our ability to fully assess the comprehensive protection available to client funds. The absence of third-party security audits or additional regulatory certifications may be considerations for traders seeking maximum protection levels.

The regulatory foundation provided by SCA oversight offers significant confidence in the broker's operational integrity. Clients should verify current compliance status and protection details directly with the broker.

User Experience Analysis

User experience assessment for Orient Finance is limited by the absence of detailed user feedback and interface evaluations in available sources. Without specific user testimonials or satisfaction surveys, it's challenging to determine how well the broker meets client expectations for platform usability, account management, and overall service delivery.

The provision of both web and mobile trading platforms suggests attention to user accessibility and convenience. This allows traders to manage positions and access markets across different devices and locations. However, specific information about interface design, navigation efficiency, or user workflow optimization is not available.

The lack of publicly available user reviews or ratings makes it difficult to assess common user concerns, satisfaction levels, or areas where the broker excels or requires improvement. This information gap is particularly significant for individual traders who rely on peer experiences to guide broker selection decisions.

The broker's focus on professional and institutional clients may result in a user experience that prioritizes functionality and compliance over consumer-oriented features. These features might include educational resources or simplified interfaces. However, without specific user feedback, this assessment remains speculative.

Prospective clients should consider requesting platform demonstrations or trial accounts. This allows them to personally evaluate the user experience and determine whether the broker's approach aligns with their trading style and technical requirements.

Conclusion

Orient Finance presents itself as a regulated UAE-based broker with over three decades of market experience and strong regulatory oversight from the Securities and Commodities Authority. The broker's commitment to compliance and investor protection, combined with multi-platform trading capabilities and diverse asset access, positions it as a potentially suitable choice for traders prioritizing regulatory security and market diversity.

The broker appears best suited for professional traders and institutional clients who value regulatory compliance. These clients are comfortable with a more consultative approach to account setup and service delivery. However, the limited transparency regarding account conditions, costs, and customer service may be challenging for individual traders seeking detailed comparisons with other brokers.

Key strengths include strong regulatory oversight, platform diversity through MetaTrader 5 and Saturn Trader, and comprehensive asset class coverage. Primary limitations involve the lack of detailed public information about trading conditions, customer service capabilities, and user experience feedback. This requires prospective clients to engage directly with the broker for comprehensive service evaluation.