EDF Review 1

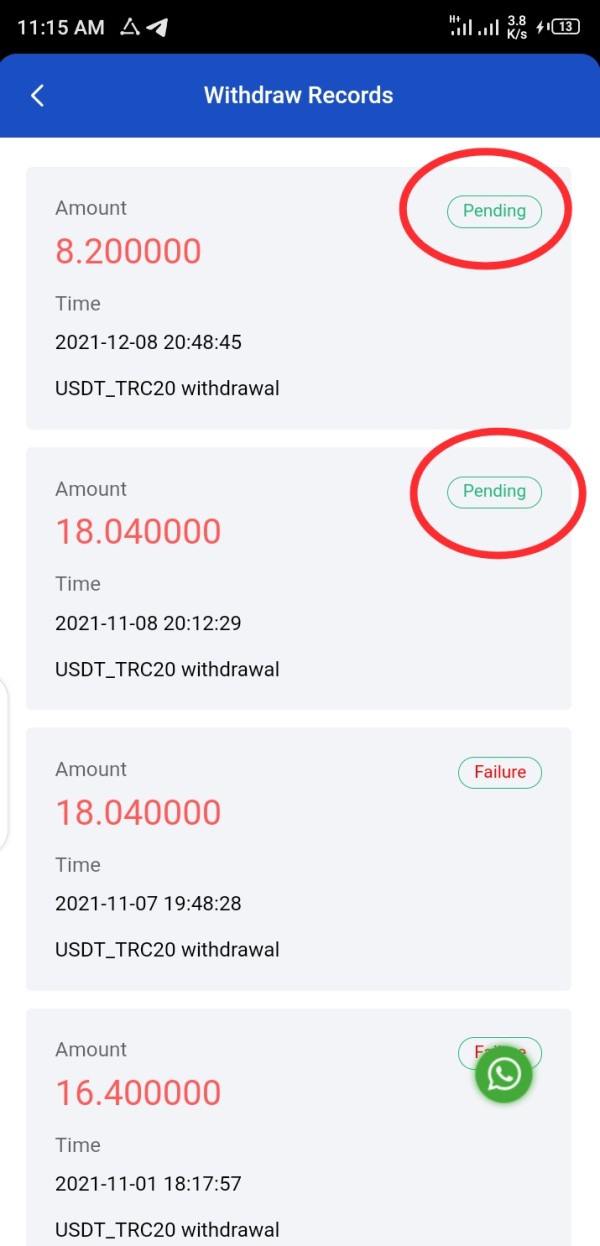

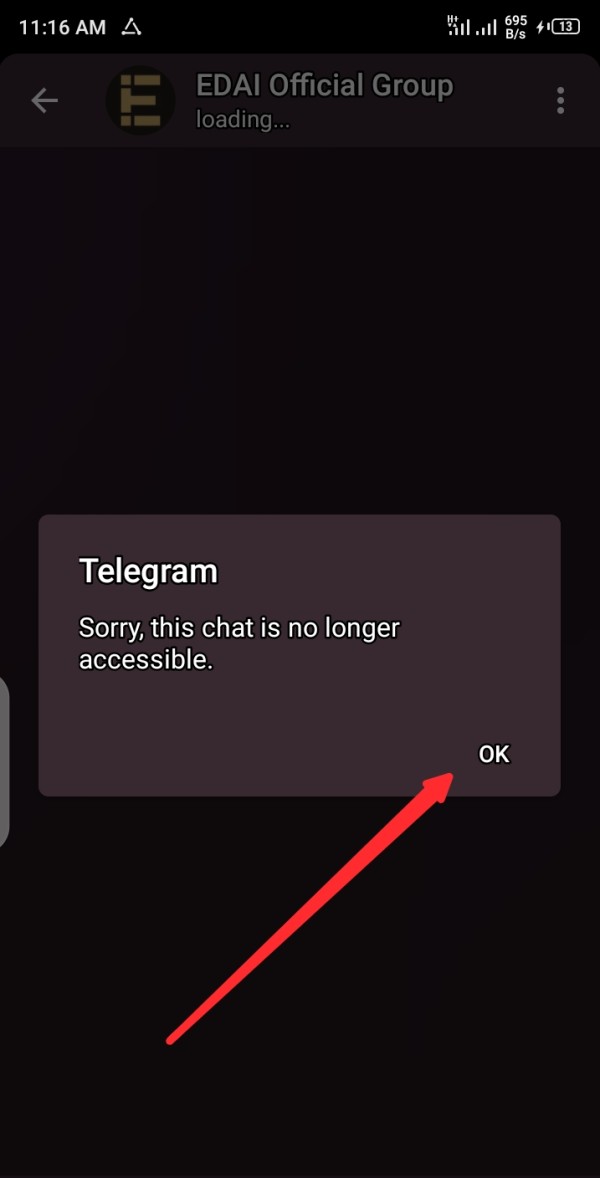

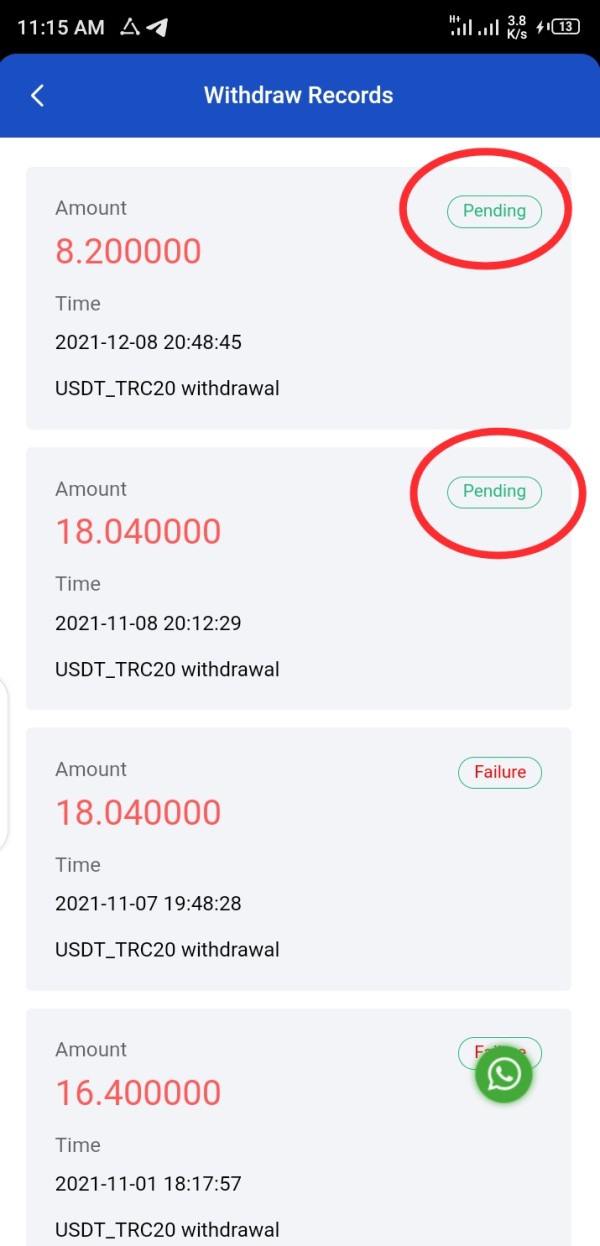

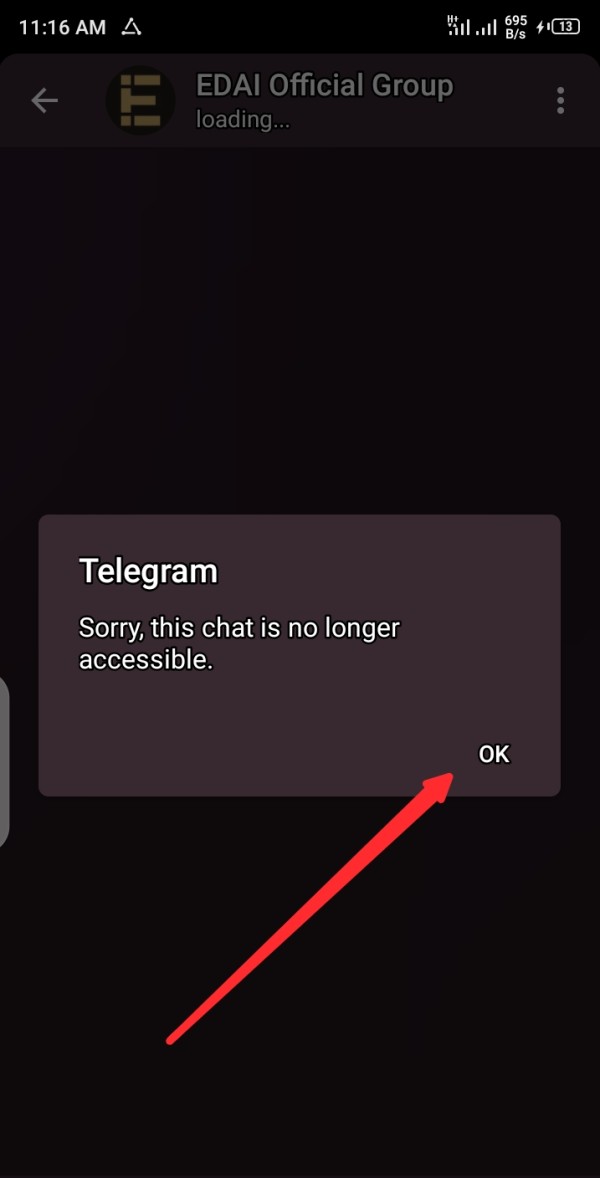

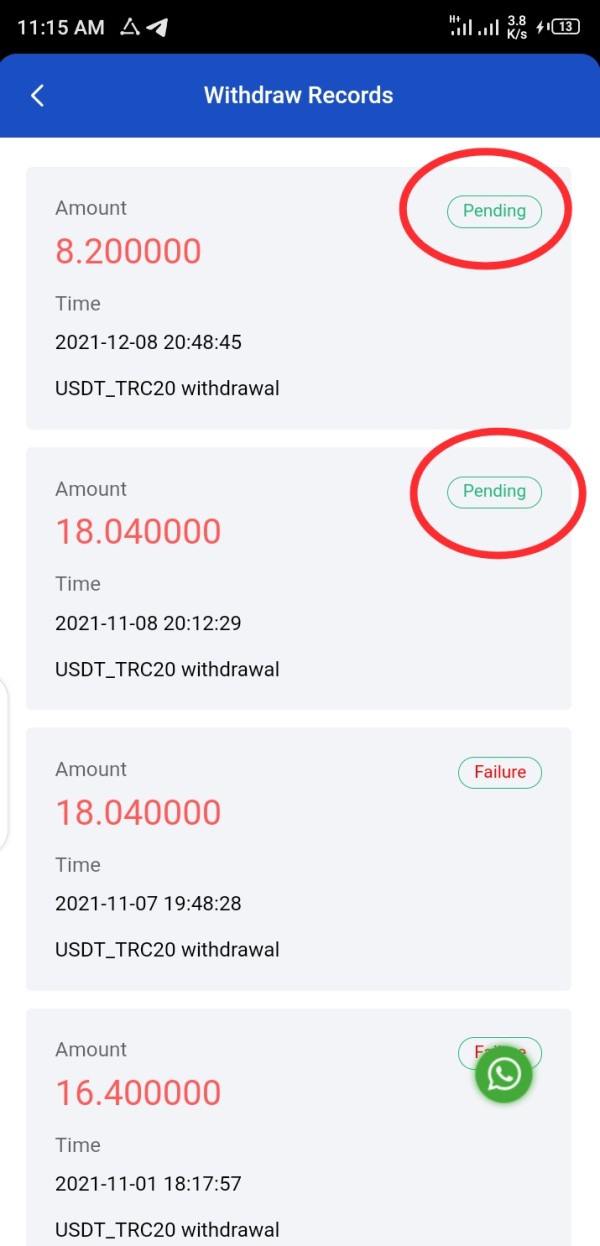

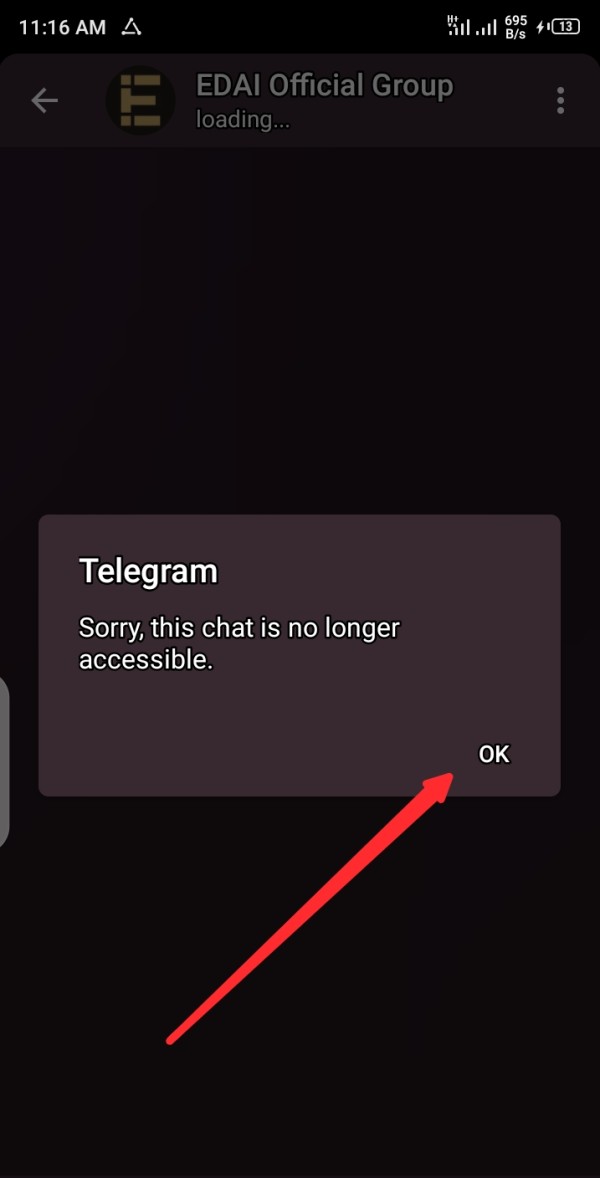

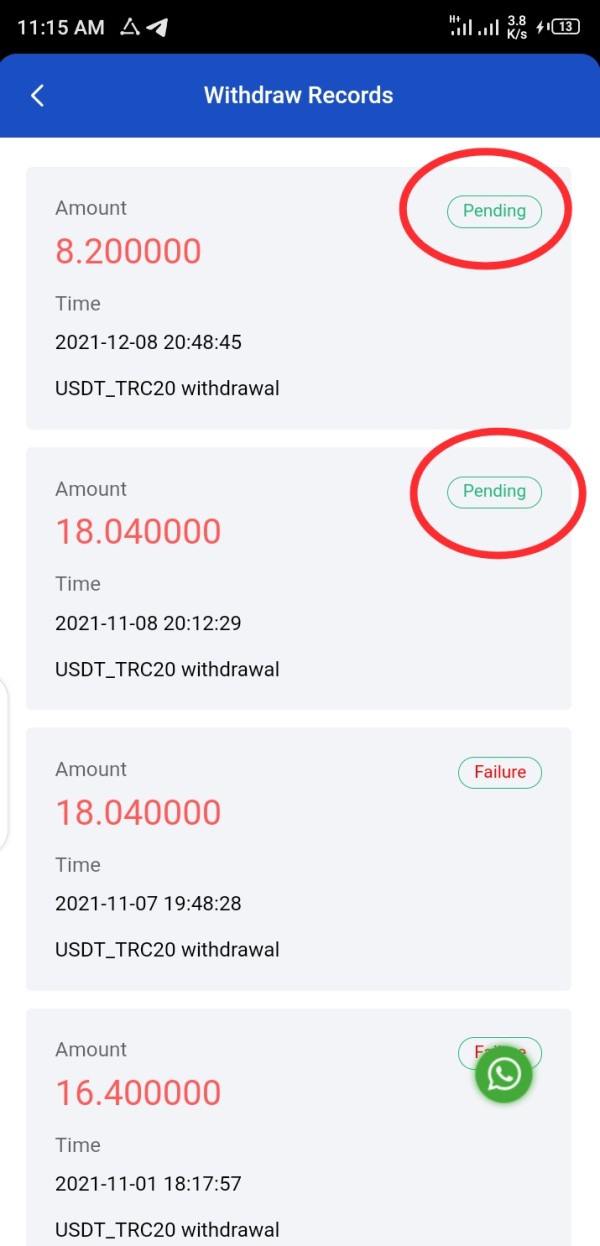

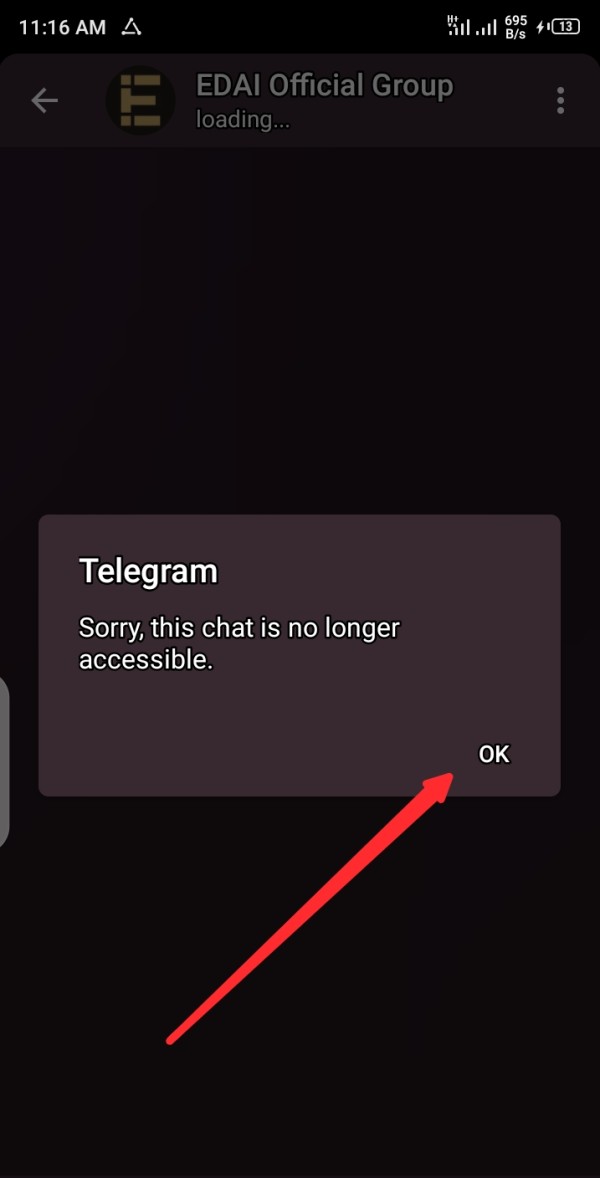

after Deposited money,we do all task but to withdraw,we withdraw but didn't recieve the payment up till now, since 2 weeks now,please stay away

EDF Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

after Deposited money,we do all task but to withdraw,we withdraw but didn't recieve the payment up till now, since 2 weeks now,please stay away

This Edf Trading review gives you a complete look at a specialized wholesale energy market participant that operates globally across multiple energy sectors. EDF Trading stands out as an asset-backed company operating from source to supply in wholesale power, natural gas, oil, LPG, and environmental products. The company also keeps a strategic one-third shareholding in JERA Global Markets, a leading utility-backed seaborne energy trader specializing in LNG, power, coal, and freight operations.

The broker mainly targets large institutional investors and smart traders with specific interests in energy markets. EDF Trading has built itself as an active participant in international carbon markets since 2005, supporting both EDF Group businesses and third-party customers worldwide in reaching their environmental goals. According to available information, the company keeps a Baa3 credit rating from Moody's, showing a moderate level of creditworthiness. However, customer service ratings on TrustPilot show concerning scores of 2 out of 5 stars, suggesting potential areas for improvement in client support services.

This review uses publicly available information and user feedback analysis. Specific regulatory details and comprehensive trading conditions are not extensively detailed in available sources. Regional entity differences and regulatory variations may exist but are not comprehensively documented in accessible materials. Readers should conduct independent verification of regulatory status and trading terms before making investment decisions. This evaluation method relies on corporate disclosures, third-party ratings, and customer feedback platforms to provide an objective assessment.

| Evaluation Criteria | Score | Rationale |

|---|---|---|

| Account Conditions | N/A | Specific account terms not detailed in available sources |

| Tools and Resources | 7/10 | Diverse energy asset coverage across multiple markets |

| Customer Service | 4/10 | TrustPilot rating of 2/5 stars indicates service concerns |

| Trading Experience | N/A | Platform specifics not documented in available materials |

| Trust and Reliability | 6/10 | Moody's Baa3 credit rating provides moderate confidence |

| User Experience | N/A | Comprehensive user interface details not available |

EDF Trading operates as a specialist in wholesale energy markets with global reach and asset-backed operations. The company works across the entire energy supply chain, from source to supply, covering wholesale power, natural gas, oil, LPG, and environmental products. Through its strategic partnership with JERA Global Markets, EDF Trading extends its capabilities into LNG and Japanese Power markets. The company's business model centers on applying corporate strength and physical and financial market presence to add value for both EDF Group assets and third-party customers.

The organization keeps significant market presence across multiple regions, with particular strength in European power and gas markets. In North America, EDF Trading operates as a major participant providing coast-to-coast coverage of financial and physical products across power, natural gas, NGLs, financial crude oil, and environmental markets. The company's environmental focus is evident through its active participation in international carbon markets since 2005, positioning itself as a reliable counterparty for clients pursuing environmental objectives. According to available information, EDF Trading keeps a solid financial foundation supported by a Baa3 credit rating from Moody's rating agency.

Regulatory Oversight: Specific regulatory information is not comprehensively detailed in available sources, though the company operates across multiple jurisdictions including Europe, Asia, and North America.

Deposit and Withdrawal Methods: Available sources do not provide specific information regarding deposit and withdrawal mechanisms or supported payment methods.

Minimum Deposit Requirements: Minimum deposit thresholds are not specified in accessible documentation, likely reflecting the institutional nature of the client base.

Promotional Offers: Information regarding bonus structures or promotional offerings is not detailed in available sources.

Tradeable Assets: EDF Trading offers access to wholesale power, natural gas, oil, liquefied petroleum gas, environmental products, and through JERA Global Markets partnership, liquefied natural gas, coal, and freight services.

Cost Structure: Specific fee schedules, spreads, and commission structures are not detailed in publicly available information, suggesting customized pricing for institutional clients.

Leverage Options: Leverage ratios and margin requirements are not specified in accessible documentation.

Platform Selection: Trading platform specifications and technology infrastructure details are not comprehensively documented in available sources.

Geographic Restrictions: Specific regional limitations or restricted territories are not detailed in accessible materials.

Customer Support Languages: Available support languages and communication options are not specified in current documentation.

This Edf Trading review shows that many operational details appear tailored for institutional relationships rather than standardized retail offerings.

The available information does not provide comprehensive details regarding account types, structures, or specific conditions offered by EDF Trading. This lack of transparency in account specifications suggests the company primarily operates through customized institutional arrangements rather than standardized retail account offerings. The absence of publicly available minimum deposit requirements, account tier structures, or standard terms and conditions shows a business model focused on custom solutions for large-scale energy market participants.

The account opening process details are not documented in accessible sources, which may reflect the institutional nature of the client base requiring individual assessment and customized onboarding procedures. Without specific information about account features, maintenance fees, or special functionalities, potential clients would need direct consultation with the company to understand available options. This Edf Trading review cannot provide definitive assessment of account conditions due to limited publicly available information, suggesting prospective clients should engage directly with the company for detailed account specifications and requirements.

EDF Trading shows substantial strength in tools and resources through its comprehensive coverage of energy markets and asset classes. The company provides access to wholesale power, natural gas, oil, LPG, environmental products, and through strategic partnerships, LNG, coal, and freight markets. This diverse portfolio suggests sophisticated trading infrastructure capable of handling multiple energy commodities across various geographic markets.

The company's position as an active participant in international carbon markets since 2005 shows specialized tools and expertise in environmental product trading. However, specific details regarding research and analysis resources, educational materials, or automated trading support capabilities are not detailed in available sources. The lack of information about proprietary research, market analysis tools, or educational resources suggests these may be provided through direct client relationships rather than standardized offerings. Technical trading tools, charting capabilities, and analytical resources would require direct inquiry with the company to assess comprehensively.

Customer service performance presents significant concerns based on available third-party feedback. TrustPilot ratings show a customer service score of 2 out of 5 stars, showing substantial dissatisfaction among users who have provided feedback. This low rating suggests potential issues with responsiveness, problem resolution, or overall service quality that prospective clients should consider carefully.

The specific channels for customer support, response times, and service availability are not detailed in accessible sources. Multi-language support capabilities, regional service teams, and escalation procedures are not documented, making it difficult to assess the comprehensiveness of support infrastructure. Without information about customer service hours, preferred communication methods, or specialized support for different market segments, clients may face uncertainty about available assistance levels. The concerning TrustPilot ratings warrant careful consideration and direct discussion with the company about service level expectations and support procedures.

Comprehensive trading experience details are not available in accessible sources, limiting the ability to assess platform stability, execution quality, or overall trading environment. The absence of information about trading platforms, order execution speeds, or system reliability makes it challenging to evaluate the technical aspects of the trading experience. Mobile trading capabilities, platform functionality, and user interface design are not documented in available materials.

Without specific information about order types, execution methods, or trading tools, potential clients cannot adequately assess whether the trading environment meets their operational requirements. The lack of documented performance metrics, system uptime statistics, or execution quality data suggests this Edf Trading review cannot provide comprehensive trading experience evaluation. Prospective clients would need direct platform demonstrations and detailed discussions with the company to assess trading capabilities and system performance adequately.

EDF Trading keeps moderate trust indicators through its Moody's Baa3 credit rating, which suggests adequate financial stability though with some credit risk considerations. This rating provides a degree of confidence in the company's financial foundation and ability to meet obligations, though it shows investment-grade status at the lower end of the spectrum. The company's position as part of the broader EDF Group structure may provide additional stability and backing.

However, the absence of detailed regulatory information in available sources raises questions about oversight and compliance frameworks. Without comprehensive information about regulatory licenses, capital adequacy requirements, or client fund protection measures, the complete trust profile remains unclear. The company's long-standing presence in energy markets since 2005 and institutional client base suggest operational stability, but specific transparency measures, audit procedures, or regulatory reporting are not detailed in accessible documentation. Prospective clients should verify regulatory status and protection measures directly with the company.

User experience assessment is significantly limited by the absence of detailed information about interface design, platform usability, and overall client journey. The institutional focus of EDF Trading suggests user experience may be tailored for sophisticated market participants rather than standardized retail interfaces. Registration and verification processes are not documented in available sources, making it impossible to assess onboarding efficiency or complexity.

The concerning customer service ratings on TrustPilot may show broader user experience challenges, though specific interface or platform issues are not detailed. Without information about account management tools, reporting capabilities, or client portal functionality, comprehensive user experience evaluation cannot be completed. The lack of documented user feedback regarding platform navigation, feature accessibility, or overall satisfaction suggests direct consultation with existing clients or company demonstrations would be necessary for adequate user experience assessment.

This Edf Trading review reveals a specialized wholesale energy market participant with significant market coverage but limited transparency in operational details. EDF Trading shows strength in asset diversity and market reach, particularly through its comprehensive energy commodity offerings and strategic partnerships. However, concerning customer service ratings and absence of detailed regulatory and operational information present notable considerations for prospective clients.

The company appears most suitable for large institutional investors and sophisticated energy market participants who can engage in customized relationship arrangements. The primary advantages include extensive energy market coverage and established market presence, while key drawbacks involve limited transparency in trading conditions and concerning customer service feedback. Potential clients should conduct thorough due diligence and direct engagement with the company to assess suitability for their specific requirements.

FX Broker Capital Trading Markets Review