Freyr 2025 Review: Everything You Need to Know

Summary

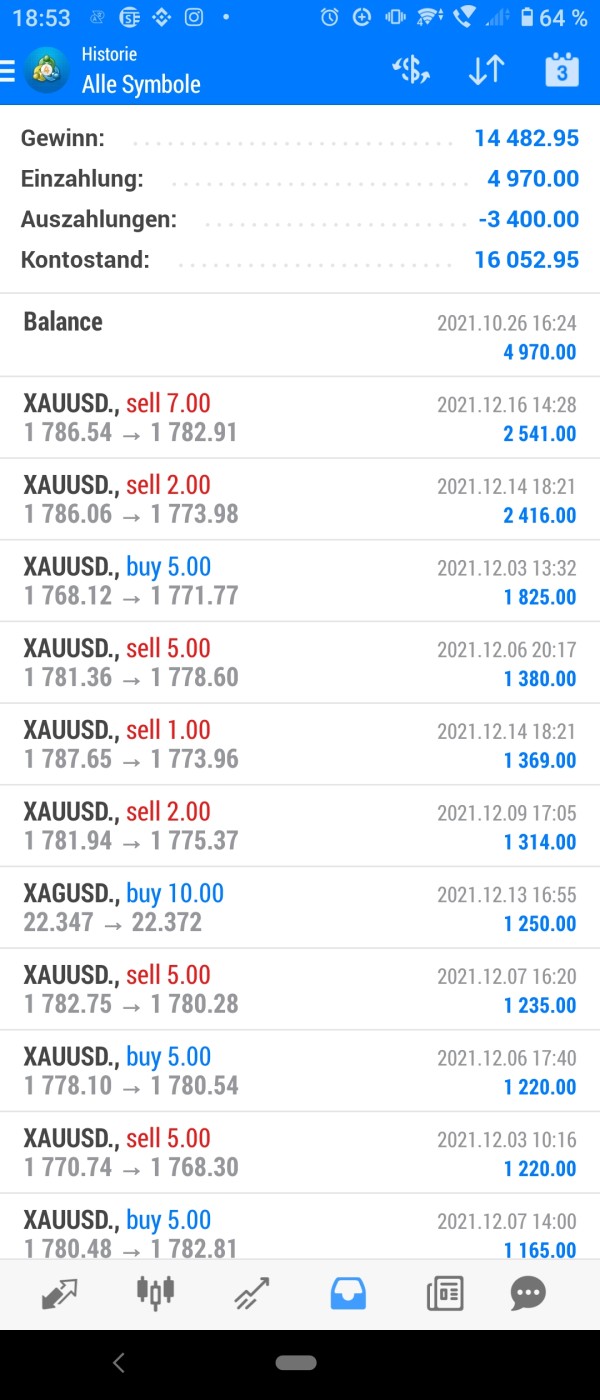

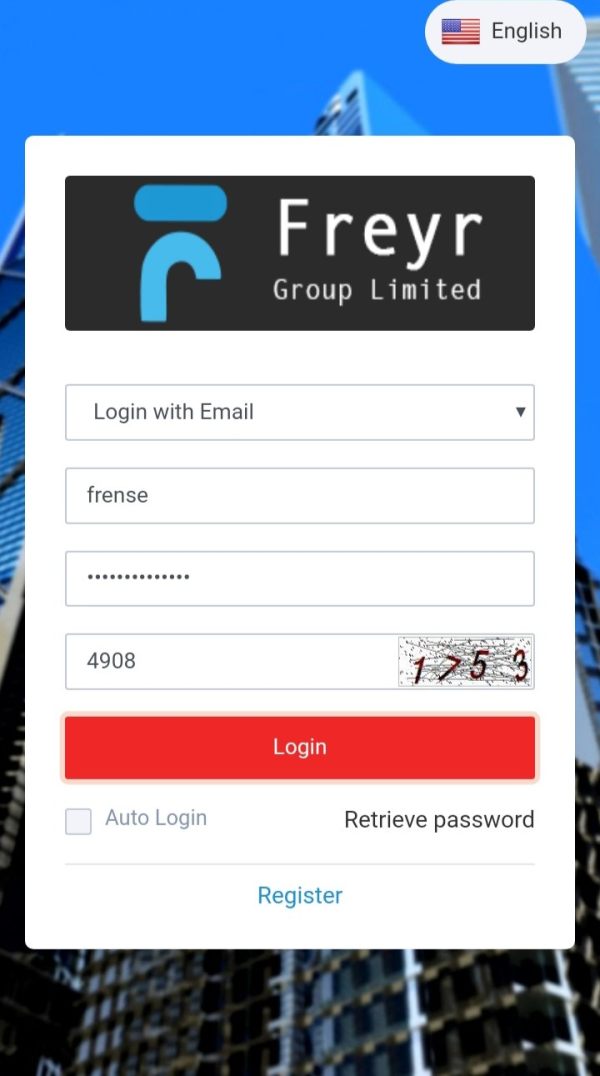

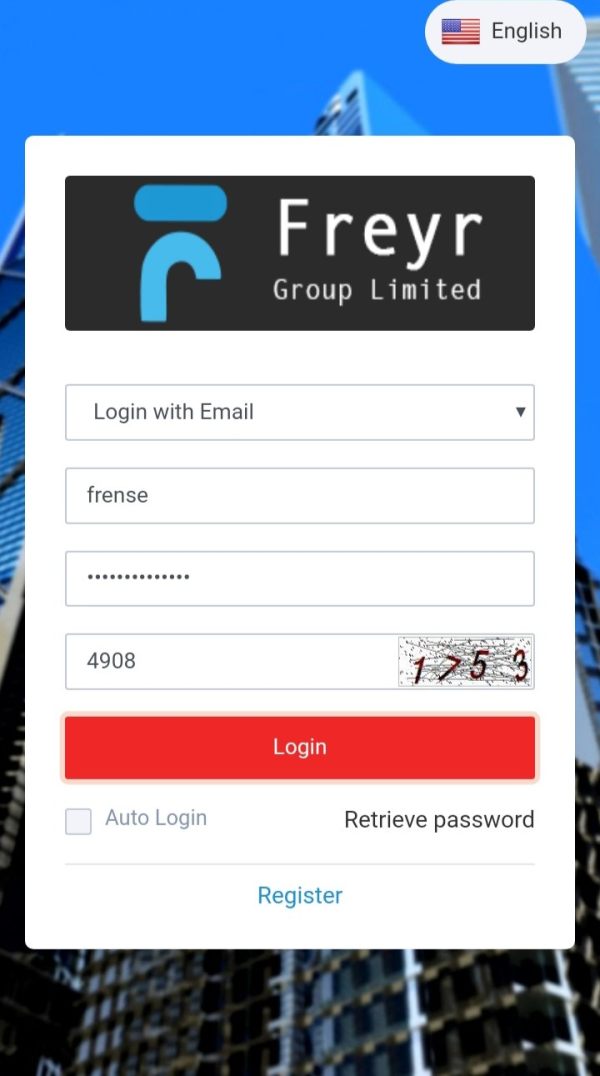

This comprehensive Freyr review reveals significant concerns about this forex broker's reliability and regulatory status. Freyr positions itself as a derivatives trading platform offering leveraged investment services across multiple asset classes including indices, crude oil, precious metals, and contracts for difference. However, our investigation shows that Freyr does not hold any licenses from major global forex regulatory authorities. This raises serious questions about its legitimacy and trader protection measures.

The platform appears to target investors seeking diversified trading instruments, particularly those interested in commodity and index trading through derivative products. While Freyr Solutions operates from Tokyo, Japan, the lack of proper regulatory oversight makes it unsuitable for most serious traders. The company's AmbitionBox rating of 3.7/5, with 65% of employees providing ratings of 4 or above, suggests mixed internal satisfaction. However, this doesn't address the fundamental regulatory concerns that affect client safety and fund security.

Important Notice

Regional Entity Differences: Freyr operates without authorization from any major forex regulatory bodies. This significantly impacts its legitimacy across all regions. Traders should be aware that the absence of regulatory oversight means limited recourse in case of disputes and no guarantee of fund protection through compensation schemes typically provided by licensed brokers.

Review Methodology: This evaluation is based on publicly available information, user feedback, and industry analysis. Due to limited transparency from Freyr regarding its operations, some aspects of this review rely on available data sources and may not reflect the complete operational picture.

Rating Framework

Broker Overview

Freyr Solutions operates as a derivatives trading platform headquartered in Tokyo, Japan. The company focuses on leveraged investment services across various financial instruments. The company positions itself in the competitive derivatives market by offering access to indices, crude oil, precious metals, and CFD trading. However, the broker's operational model lacks the fundamental regulatory framework that characterizes legitimate forex and derivatives brokers in the global market.

The platform's business approach centers on providing traders with exposure to multiple asset classes through derivative products. This typically appeals to investors seeking portfolio diversification beyond traditional forex pairs. Freyr's service structure appears designed for traders who want access to commodity markets and equity indices through leveraged positions. However, the absence of regulatory oversight from recognized authorities such as the FCA, ASIC, CySEC, or other major financial regulators significantly undermines its credibility and operational legitimacy in the international trading community.

Regulatory Status: Freyr does not hold any licenses from major global forex regulatory authorities. This represents a critical red flag for potential clients. This absence of regulatory oversight means traders have no protection through established compensation schemes or regulatory complaint procedures.

Available Assets: The platform provides access to indices, crude oil, precious metals, and contracts for difference. This offers a diverse range of trading instruments for those interested in commodity and equity index exposure.

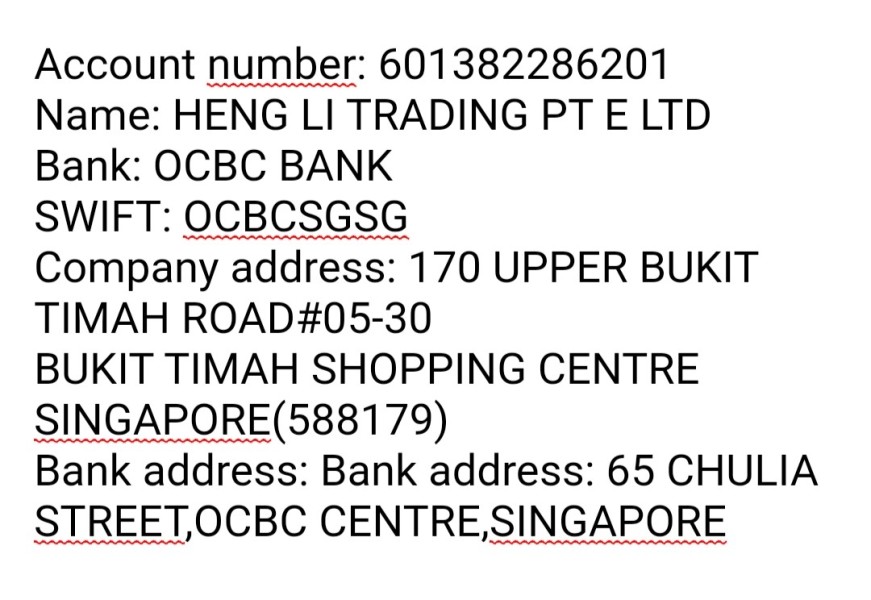

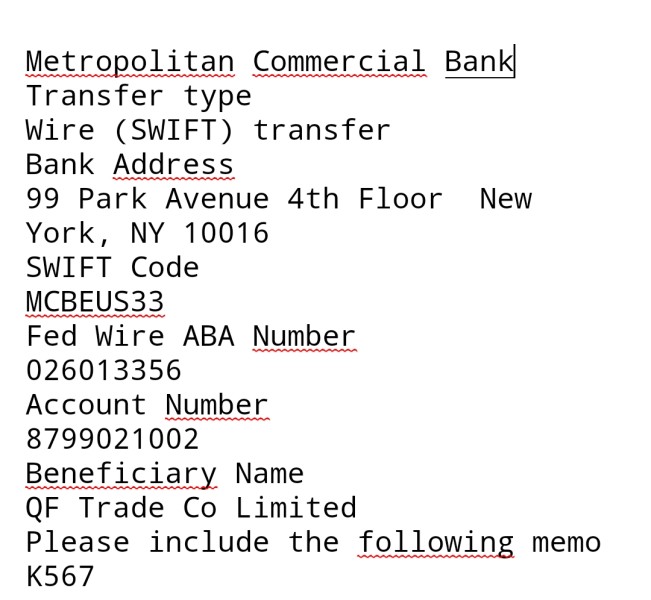

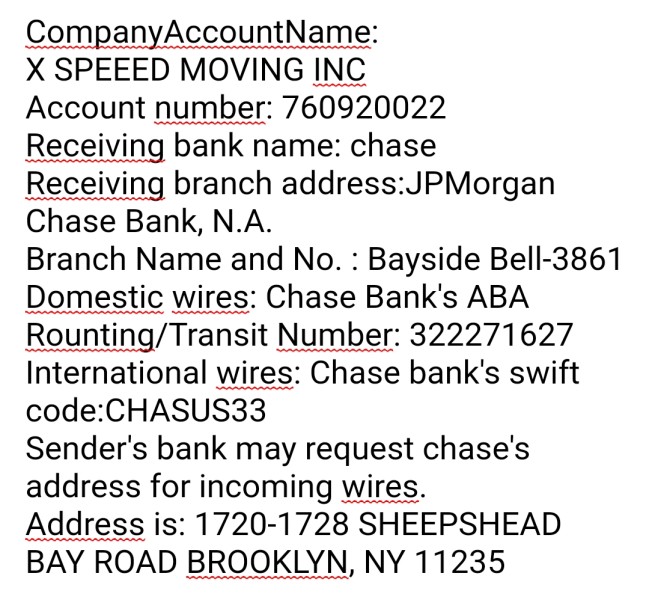

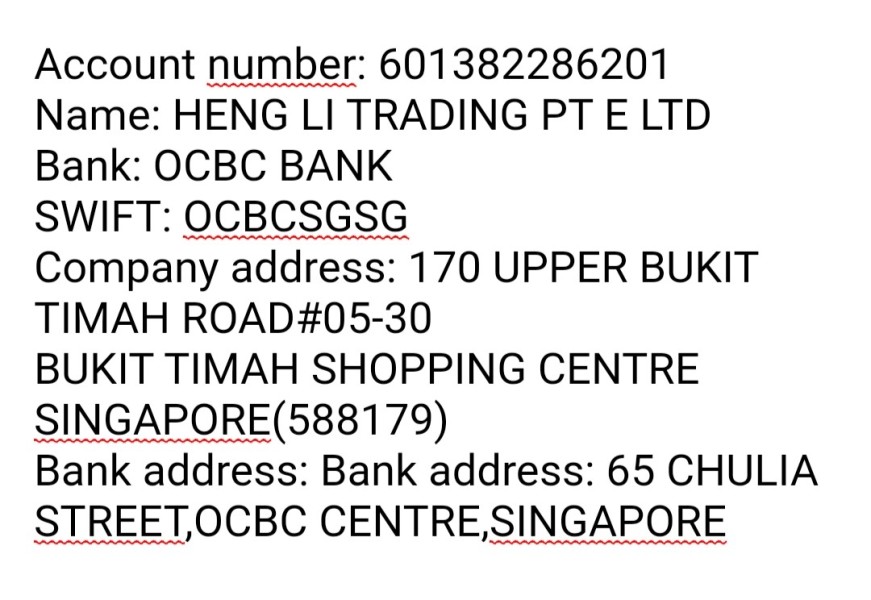

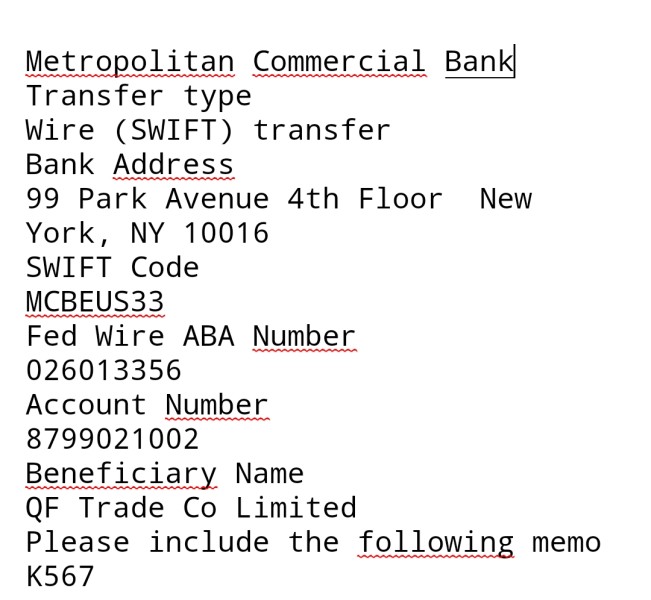

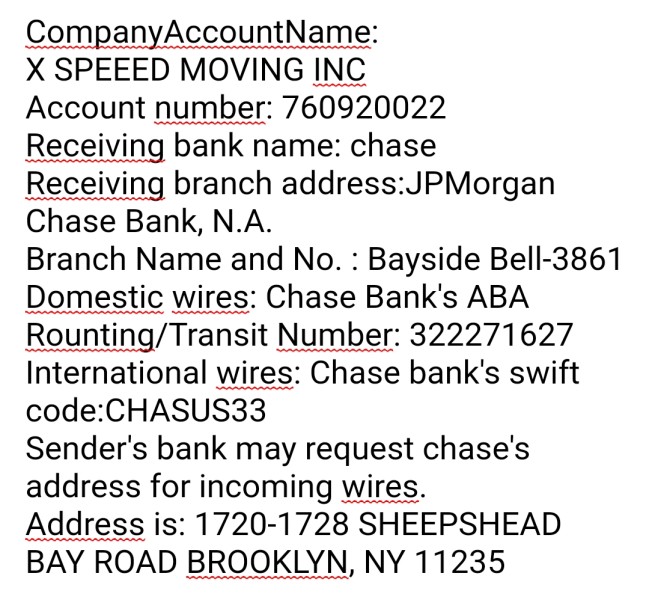

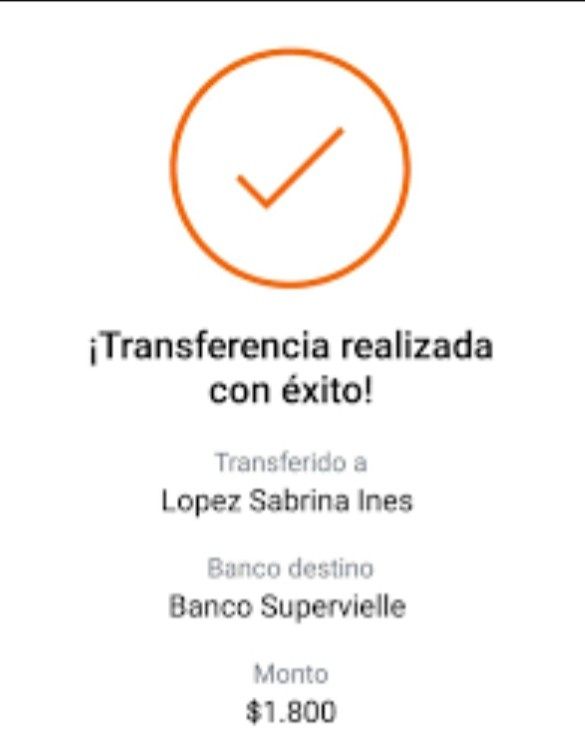

Deposit and Withdrawal Methods: Specific information about payment processing methods is not detailed in available sources. This raises additional transparency concerns about the platform's operational procedures.

Minimum Deposit Requirements: The broker has not publicly disclosed minimum deposit requirements. This makes it difficult for potential clients to assess accessibility and account opening procedures.

Promotional Offers: No information is available regarding bonus structures or promotional campaigns offered by Freyr.

Cost Structure: Details about spreads, commissions, and trading fees are not readily available. This limits traders' ability to assess the true cost of trading with this broker.

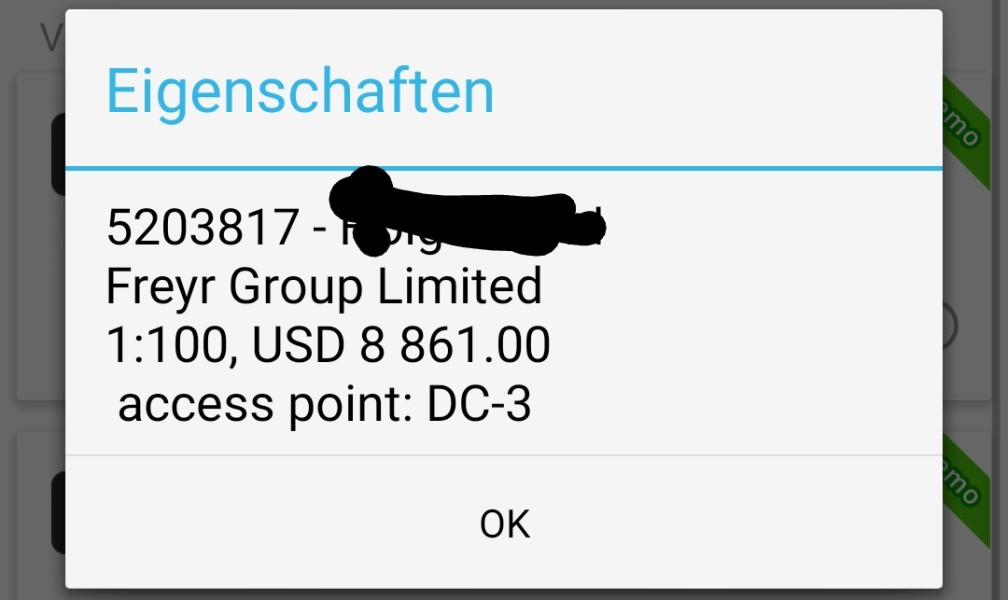

Leverage Ratios: Specific leverage offerings are not detailed in public information. The platform does advertise leveraged investment services.

Platform Selection: The trading platform technology and software options are not specified in available documentation.

Geographic Restrictions: Information about regional trading restrictions and client acceptance policies is not publicly available.

Customer Support Languages: The range of languages supported by customer service is not documented in accessible sources.

Detailed Rating Analysis

Account Conditions Analysis

The lack of detailed information about Freyr's account conditions represents a significant transparency issue. Potential clients should consider this carefully. Without clear documentation of account types, minimum balance requirements, or specific terms and conditions, traders cannot make informed decisions about whether the platform meets their trading needs. Legitimate brokers typically provide comprehensive account information including different tier structures, associated benefits, and clear fee schedules.

The absence of publicly available account opening procedures raises questions about the broker's operational standards and regulatory compliance. Most regulated brokers maintain detailed account documentation to meet regulatory requirements and provide transparency to potential clients. This Freyr review cannot provide specific account condition ratings due to insufficient available information. This itself serves as a warning sign about the broker's commitment to transparency and client service standards.

Freyr demonstrates some strength in its asset offering by providing access to leveraged investment services across multiple derivative products. These include indices, crude oil, precious metals, and CFDs. This diversified approach potentially appeals to traders seeking exposure beyond traditional forex markets. The platform's focus on derivatives trading suggests an understanding of trader demand for commodity and equity index access through leveraged positions.

However, the lack of detailed information about research tools, analytical resources, educational materials, or automated trading support significantly limits the platform's appeal to serious traders. Professional trading platforms typically offer comprehensive market analysis, economic calendars, technical analysis tools, and educational resources to support trader decision-making. The absence of documented research and educational support suggests limited commitment to trader development and success. This contrasts sharply with industry-leading brokers who invest heavily in client education and market analysis tools.

Customer Service and Support Analysis

The evaluation of Freyr's customer service capabilities is severely hampered by the lack of available information. There is no data about support channels, response times, service quality, or multilingual capabilities. Professional forex brokers typically maintain multiple customer service channels including live chat, phone support, email assistance, and comprehensive FAQ sections. The absence of documented customer service information raises concerns about the broker's commitment to client support and problem resolution.

Without clear information about customer service hours, available languages, or response time commitments, potential clients cannot assess whether the broker can provide adequate support for their trading activities. This lack of transparency about customer service capabilities represents a significant operational concern. This is particularly true for traders who may require assistance with technical issues, account problems, or trading disputes. The absence of documented customer service standards suggests limited infrastructure for client support and relationship management.

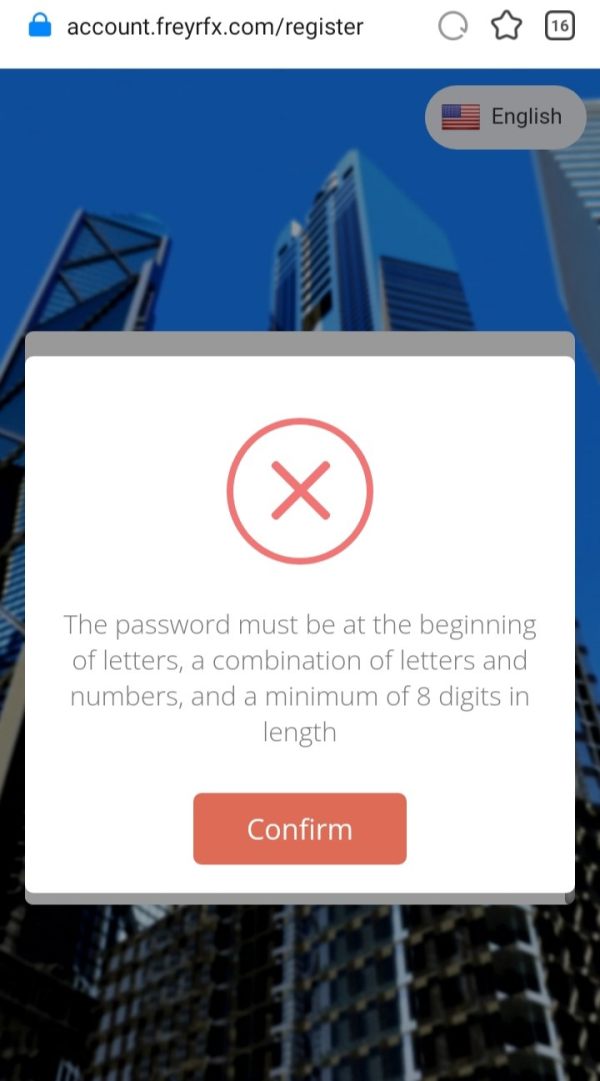

Trading Experience Analysis

The assessment of Freyr's trading experience is complicated by insufficient information about platform stability, execution speed, order processing quality, mobile trading capabilities, and overall trading environment. Professional trading platforms typically provide detailed specifications about execution speeds, platform uptime statistics, mobile app functionality, and trading tools availability. The lack of documented trading experience information makes it impossible to evaluate whether the platform meets modern trading standards.

Without specific data about platform performance, order execution quality, or trading environment characteristics, this Freyr review cannot provide meaningful insights into the actual trading experience. Professional brokers typically publish platform performance statistics, execution quality reports, and detailed platform feature descriptions to demonstrate their technological capabilities. The absence of such information suggests either limited platform capabilities or insufficient commitment to operational transparency. Both of these represent significant concerns for potential clients.

Trust and Reliability Analysis

Freyr's trust and reliability rating reflects serious concerns about its regulatory status and industry reputation. The broker's failure to obtain licensing from any major global forex regulatory authority represents a fundamental flaw that undermines client protection and operational legitimacy. Regulatory oversight provides essential safeguards including segregated client funds, dispute resolution procedures, and compensation schemes that protect traders from broker insolvency or misconduct.

The characterization of Freyr as an unreliable forex broker by industry sources further reinforces concerns about its operational standards and client treatment. Without regulatory oversight, clients have limited recourse in case of disputes, fund withdrawal problems, or operational issues. The absence of regulatory protection means traders risk losing their entire investment without access to compensation schemes or regulatory complaint procedures that are standard with licensed brokers. This regulatory deficit represents an unacceptable risk level for serious traders who prioritize fund security and operational reliability.

User Experience Analysis

The user experience evaluation is based on limited available data, primarily the AmbitionBox rating of 3.7/5, where 65% of employees provided ratings of 4 or above. While this internal rating suggests moderate employee satisfaction, it doesn't address the client experience or platform usability concerns that are more relevant for trading evaluation. The platform appears designed for investors seeking diversified trading tools, but the lack of detailed interface information limits comprehensive user experience assessment.

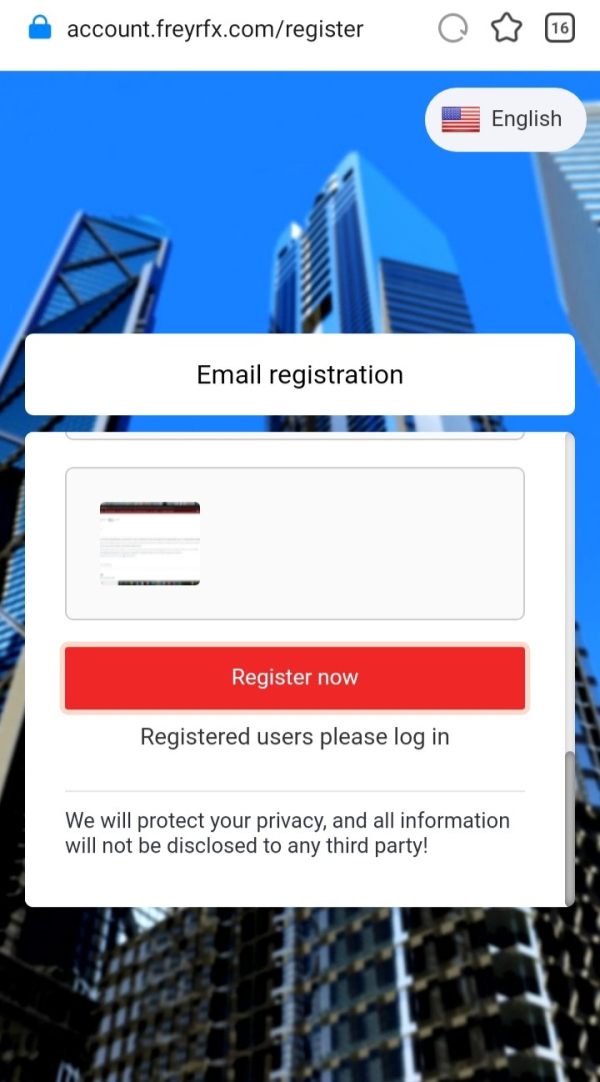

Without specific information about registration procedures, verification processes, fund operation experiences, or common user complaints, this evaluation cannot provide comprehensive user experience insights. Professional brokers typically maintain detailed user experience documentation, client satisfaction surveys, and platform usability studies to demonstrate their commitment to client satisfaction. The absence of such information suggests limited focus on user experience optimization and client satisfaction measurement. These are critical components of modern trading platform operations.

Conclusion

This comprehensive Freyr review reveals significant concerns that make this broker unsuitable for serious forex and derivatives trading. The broker's lack of regulatory authorization from any major financial authority represents an unacceptable risk that overshadows any potential benefits from its diverse asset offerings. While Freyr may appeal to investors seeking exposure to multiple derivative products including commodities and indices, the absence of proper regulatory oversight and limited operational transparency create substantial risks for client funds and trading operations.

The platform's strengths in offering diverse derivative products are completely undermined by fundamental weaknesses in regulatory compliance, transparency, and documented operational standards. Traders seeking reliable, regulated alternatives should consider licensed brokers that provide comprehensive client protection, transparent operations, and established track records in the forex and derivatives markets.