DCFX 2025 Review: Everything You Need to Know

Summary

DCFX is an STP forex broker that started in 2004. It operates under multiple regulatory jurisdictions including FCA, MAS, BAPPEBTI, and JFX, which means different authorities watch over its activities in different countries. This dcfx review reveals a broker with a mixed reputation in the forex industry.

The company offers high leverage up to 1:1000 and provides access to over 80 trading instruments across various asset classes including forex, commodities, cryptocurrencies, and CFDs. Based on available user feedback and industry reports, DCFX presents itself as a technically competent platform utilizing MetaTrader 5, with a low minimum deposit requirement of $30 making it accessible to beginner traders.

However, the broker faces scrutiny regarding its legitimacy and safety, with some users expressing concerns about its operational practices. The platform appears to target traders seeking diverse asset options and high leverage capabilities. Potential investors should carefully consider the mixed user reviews and regulatory complexities before engaging with this broker.

Important Notice

DCFX operates through different entities across various jurisdictions. Each entity follows distinct regulatory frameworks and legal requirements that vary by location.

Traders should verify which specific entity they are dealing with and understand the applicable regulations in their region. The regulatory oversight includes FCA (UK), MAS (Singapore), BAPPEBTI (Indonesia), and JFX, though the specific protection levels and compensation schemes may vary significantly between jurisdictions.

This review is based on publicly available information, user feedback from various review platforms, and industry reports. The assessment reflects conditions as of 2025 and may be subject to change, so information could become outdated. Prospective traders should conduct their own due diligence and verify current terms and conditions directly with the broker before making any investment decisions.

Rating Framework

Broker Overview

DCFX was established in 2004 and operates as an STP (Straight Through Processing) forex broker. The company has its headquarters in Saint Vincent and the Grenadines, a small island nation in the Caribbean.

The company has positioned itself in the competitive forex market by offering multiple asset classes and maintaining regulatory compliance across several jurisdictions. According to available information, DCFX has received recognition in the industry, including awards for best fund management, though the specific details and timing of these accolades require verification.

The broker operates under an STP business model, which theoretically provides clients with direct market access and faster execution speeds. This model aims to eliminate dealing desk conflicts of interest by routing client orders directly to liquidity providers, which should mean fairer pricing for traders. DCFX's multi-jurisdictional regulatory approach suggests an attempt to serve a global client base while maintaining compliance with various international standards.

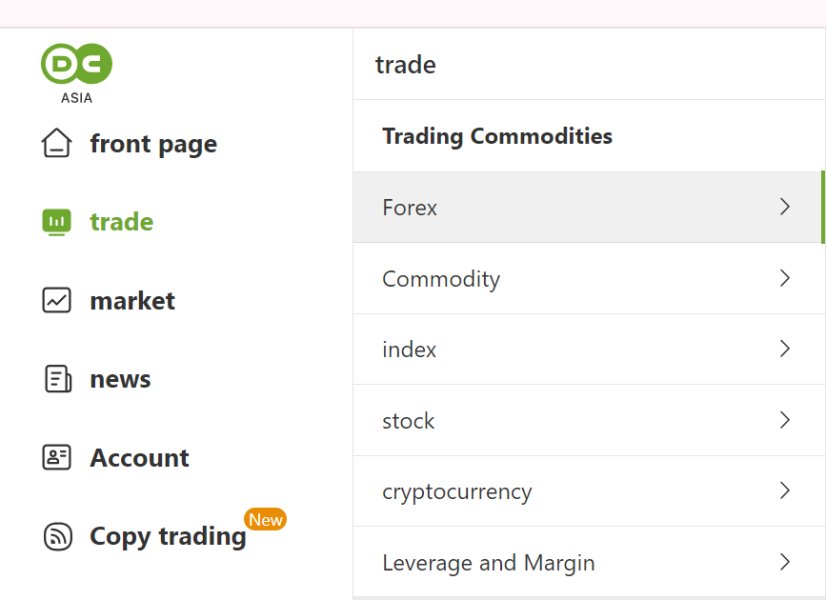

The trading environment at DCFX centers around the MetaTrader 5 platform. This setup provides access to forex pairs, commodities, stock indices, cryptocurrencies, and CFDs all in one place. The broker's asset portfolio spans over 80 trading instruments, catering to traders with diverse investment strategies, from beginners to advanced professionals. The regulatory framework includes oversight from FCA, MAS, BAPPEBTI, and JFX, though the specific protections and operational standards may vary depending on the client's jurisdiction and the particular DCFX entity they engage with.

Regulatory Coverage: DCFX maintains regulatory relationships with multiple authorities including the Financial Conduct Authority (FCA) in the UK, Monetary Authority of Singapore (MAS), Indonesia's BAPPEBTI, and JFX. This multi-jurisdictional approach provides coverage across different regions but may create complexity in terms of client protections and dispute resolution.

Minimum Deposit Requirements: The broker sets a relatively accessible minimum deposit threshold of $30. This low barrier to entry aligns with the broker's apparent strategy to attract a broad range of clients, from beginners to experienced traders.

Available Trading Assets: DCFX offers access to over 80 trading instruments spanning multiple asset categories. The portfolio includes major and minor currency pairs, precious metals, energy commodities, stock indices, and cryptocurrency CFDs, providing traders with diverse opportunities across different markets.

Leverage Options: The platform provides leverage up to 1:1000, which represents among the higher leverage ratios available in the retail forex market. While this can amplify potential profits, it significantly increases risk exposure and requires careful risk management from traders.

Trading Platform: DCFX utilizes MetaTrader 5 as its primary trading platform. The platform offers advanced charting capabilities, algorithmic trading support, and comprehensive market analysis tools that professional traders expect. The platform supports automated trading strategies and provides access to various technical indicators and analytical tools.

Cost Structure: Specific information regarding spreads, commissions, and other trading costs was not detailed in available sources. This means potential clients need to contact the broker directly for comprehensive cost analysis.

This dcfx review indicates that while the broker provides competitive basic conditions, potential clients should thoroughly investigate all cost structures and terms before committing funds.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

DCFX's account conditions present a mixed picture of accessibility and flexibility. The $30 minimum deposit requirement stands out as particularly attractive for new traders, representing one of the lower thresholds in the industry.

This low barrier enables traders to test the platform and services without significant financial commitment, which is especially valuable for those new to forex trading or evaluating multiple brokers. The leverage offering of up to 1:1000 provides significant trading power, though it comes with proportionally increased risk that inexperienced traders might not fully understand. While experienced traders may appreciate this flexibility for specific strategies, the high leverage requires sophisticated risk management knowledge.

The broker appears to offer multiple account types to accommodate different trading needs. However, specific details about account tiers, their respective benefits, and any associated costs were not comprehensively detailed in available sources, which creates uncertainty for potential clients.

According to user feedback referenced in this dcfx review, account opening processes appear straightforward, though some users have reported varying experiences with verification procedures. The absence of detailed information about Islamic accounts, VIP services, or other specialized account features suggests potential clients should directly inquire about specific requirements.

DCFX demonstrates strength in its trading tools and resource offerings, primarily through its MetaTrader 5 platform implementation. The platform provides comprehensive charting capabilities, technical analysis tools, and support for automated trading strategies that appeal to serious traders.

With over 80 trading instruments available, traders have access to diverse markets including forex, commodities, indices, and cryptocurrencies, enabling portfolio diversification and multiple trading opportunities. The MetaTrader 5 platform includes advanced order types, one-click trading capabilities, and extensive customization options that experienced traders value. The platform's built-in economic calendar, market news feeds, and analytical tools provide traders with essential market information for making informed decisions.

Support for Expert Advisors (EAs) enables automated trading strategies, appealing to algorithmic traders and those seeking to implement systematic trading approaches. However, detailed information about proprietary research resources, educational materials, market analysis reports, or trading webinars was not extensively documented in available sources, which represents a gap in the overall offering.

The quality and depth of additional educational resources, market commentary, and trading guides would require direct evaluation to fully assess the broker's commitment to trader development and support.

Customer Service and Support Analysis (6/10)

DCFX claims to provide 24/7 customer support, which is essential for forex trading given the market's continuous operation. However, user feedback reveals inconsistent experiences with response times and service quality that suggest the reality may not match the promise.

While some users report satisfactory support interactions, others have expressed frustration with delayed responses or insufficient resolution of their concerns. The availability of multiple communication channels appears standard, though specific details about live chat, email response times, phone support availability, and multilingual capabilities were not comprehensively documented, making it difficult to assess the full scope of support options.

User reviews suggest that while basic support is available, the quality and efficiency may vary depending on the nature of the inquiry and the specific support representative. Some user feedback indicates challenges with more complex issues, particularly those related to account verification, withdrawal processes, or technical platform problems that require specialized knowledge to resolve. The mixed nature of customer service reviews suggests that while DCFX maintains support infrastructure, the consistency and quality of service delivery may need improvement to meet industry standards consistently.

Trading Experience Analysis (7/10)

The trading experience at DCFX centers around the MetaTrader 5 platform, which generally receives positive feedback from users familiar with the MT5 environment. The platform's stability, execution speed, and feature set contribute to a generally satisfactory trading experience for most users who understand how to use its capabilities effectively.

Order execution appears reliable under normal market conditions, though specific data on execution speeds, slippage rates, or requote frequencies was not detailed in available sources. The diversity of available instruments enhances the trading experience by providing opportunities across multiple markets and asset classes, allowing traders to diversify their portfolios without switching platforms. Traders can access major currency pairs, exotic currencies, commodities, and cryptocurrency CFDs from a single platform.

The high leverage availability appeals to traders seeking maximum capital efficiency, though it requires careful risk management that not all traders possess. User feedback suggests that the overall platform functionality meets standard expectations, with most core trading features working as intended for daily operations. However, some users have reported occasional technical issues or connectivity problems, though these appear relatively infrequent based on available feedback.

The mobile trading experience and platform compatibility across different devices would require direct testing to fully evaluate. This dcfx review finds that while the basic trading infrastructure appears sound, the overall experience may vary based on individual trading requirements and technical expectations.

Trust and Reliability Analysis (5/10)

Trust and reliability represent significant concerns in this DCFX evaluation. While the broker maintains regulatory relationships with multiple authorities including FCA, MAS, BAPPEBTI, and JFX, some users have raised questions about the company's legitimacy and operational practices that cannot be ignored.

User reviews include concerning references to the broker being "technically fraudulent," though the specific basis for these claims requires careful verification. The multi-jurisdictional regulatory approach, while providing some oversight, creates complexity in understanding which specific protections apply to individual clients, making it difficult for traders to know their rights.

The regulatory frameworks vary significantly between jurisdictions, and the level of investor protection, compensation schemes, and dispute resolution mechanisms may differ substantially depending on the applicable regulatory entity. DCFX has received some industry recognition, including awards for fund management, which suggests some level of industry acknowledgment that provides a counterpoint to negative feedback. However, the mixed user feedback and concerns about transparency create uncertainty about the broker's overall reliability.

The company's operational history since 2004 provides some stability indication, though this must be weighed against current user experiences and concerns. Potential clients should thoroughly verify regulatory status, understand applicable protections, and carefully evaluate user feedback before committing significant funds, especially given the serious nature of some allegations.

The trust concerns highlighted in various reviews warrant careful consideration and independent verification.

User Experience Analysis (6/10)

User experience at DCFX presents a divided picture, with some traders reporting satisfactory experiences while others express significant concerns. The platform's user rating shows "excellent" in some sources, yet this appears inconsistent with other feedback highlighting various operational issues and concerns about the broker's practices.

The MetaTrader 5 platform interface generally receives positive feedback for its functionality and familiarity among experienced traders. The platform's comprehensive feature set, customization options, and analytical tools contribute positively to the user experience for those comfortable with the MT5 environment, which is widely used in the industry. New traders may find the platform's extensive capabilities initially overwhelming but generally appreciate the growth potential it provides as they develop their skills.

However, user feedback reveals concerns about various operational aspects including account management, withdrawal processes, and customer service interactions. Some users report difficulties with verification procedures, delays in processing requests, or unsatisfactory responses to support inquiries that can significantly impact their overall satisfaction. These operational challenges can significantly impact the overall user experience despite satisfactory platform functionality.

The broker's target demographic appears to include traders seeking high leverage opportunities and diverse asset access. However, the mixed feedback suggests that user satisfaction may depend significantly on individual trading requirements, experience levels, and specific interactions with the broker's services, making it difficult to predict any individual trader's experience.

Conclusion

This comprehensive dcfx review reveals a broker with both strengths and significant areas of concern. DCFX offers competitive basic conditions including low minimum deposits, high leverage options, and access to diverse trading instruments through the reliable MetaTrader 5 platform.

These features make it potentially attractive to traders seeking flexibility and market access with limited initial capital. However, the trust and reliability concerns, inconsistent customer service experiences, and mixed user feedback create substantial cautionary factors that cannot be overlooked. While DCFX maintains multiple regulatory relationships, the complexity of its jurisdictional structure and user concerns about legitimacy require careful consideration.

The broker may suit experienced traders comfortable with higher-risk environments and capable of conducting thorough due diligence, but may not be appropriate for beginners or those seeking maximum security and transparency. Potential clients should thoroughly verify current regulatory status, carefully evaluate all terms and conditions, and consider starting with minimal deposits while assessing the broker's suitability for their specific trading requirements and risk tolerance.