Is Inception Financial Group safe?

Business

License

Is Inception Financial Group Safe or Scam?

Introduction

Inception Financial Group positions itself as a player in the forex market, offering trading services to a diverse clientele. As the forex market is known for its volatility and the potential risks involved, traders need to carefully evaluate the brokers they choose to work with. The significance of this assessment cannot be overstated; a reliable broker can mean the difference between successful trading and significant financial loss. This article aims to provide an objective analysis of Inception Financial Group's safety by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our investigation is based on a comprehensive review of various online sources, including user reviews, regulatory databases, and financial assessments.

Regulation and Legitimacy

The regulatory status of a forex broker is a crucial factor in determining its legitimacy. A broker that operates under a reputable regulatory framework is generally considered safer for traders. In the case of Inception Financial Group, multiple sources indicate that it lacks valid regulation. This absence raises significant concerns about the broker's operational transparency and the protection of client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | No valid regulation |

The lack of oversight from established regulatory bodies like the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC) is alarming. Unregulated brokers are often associated with higher risks, including potential fraud, market manipulation, and inadequate customer service. Inception Financial Group has been reported to have a low trust score, which further emphasizes the need for caution when considering this broker.

Company Background Investigation

Inception Financial Group, established in recent years, has not provided extensive information about its history or ownership structure. The companys website lacks transparency regarding its management team and their qualifications. This lack of information can lead to skepticism about the broker's credibility. A broker's management team should ideally have a proven track record in finance and trading, as this experience can significantly impact the quality of service provided to clients.

Moreover, the absence of detailed disclosures about the companys operational practices and financial status is concerning. Transparency is vital in the financial industry, and brokers that fail to provide clear information may be hiding unfavorable practices. In the case of Inception Financial Group, the lack of transparency may contribute to the perception that it is not a trustworthy entity.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for traders looking to maximize their profits. Inception Financial Group presents various trading options, but its fee structure and trading conditions have raised eyebrows among industry experts. Reports suggest that the broker may impose unusual fees or unfavorable trading conditions, which could erode traders' profits.

| Fee Type | Inception Financial Group | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | N/A | N/A |

| Commission Model | N/A | N/A |

| Overnight Interest Range | N/A | N/A |

The absence of specific data regarding spreads and commissions is a red flag. Traders should be wary of brokers that do not clearly outline their fee structures, as this can lead to unexpected costs. Additionally, if the trading conditions are not competitive, traders may find it challenging to achieve their financial goals.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. Inception Financial Group's approach to safeguarding client funds has been called into question. Reports indicate that the broker does not provide sufficient measures for fund protection, such as segregated accounts and negative balance protection.

Traders should always seek brokers that prioritize the safety of their funds through robust security measures. The absence of such protections can expose traders to significant risks, especially in volatile market conditions. Furthermore, any historical issues related to fund security or customer complaints can further diminish trust in the broker.

Customer Experience and Complaints

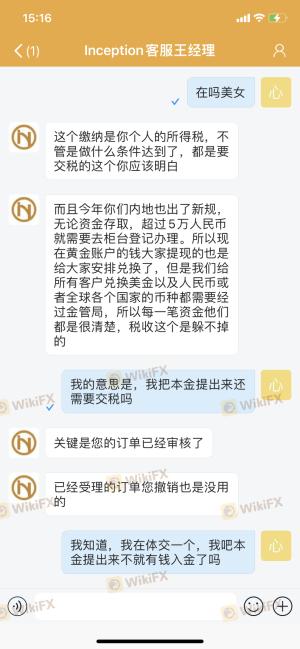

Customer feedback plays a crucial role in assessing a broker's reliability. In the case of Inception Financial Group, numerous complaints have surfaced regarding difficulties in withdrawing funds and poor customer service. These issues are often indicative of deeper systemic problems within the broker's operations.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Complaints | Medium | Poor |

The prevalence of withdrawal issues raises alarms about the broker's financial health and operational integrity. A broker that consistently struggles to process withdrawals may be facing liquidity issues or may be engaging in unethical practices. The company's inadequate response to customer complaints further exacerbates these concerns.

Platform and Execution

The trading platform provided by a broker can significantly impact the trading experience. Inception Financial Group's platform has been reported to have performance issues, including potential slippage and order rejections. These problems can hinder traders' ability to execute their strategies effectively.

A reliable trading platform should offer stability, speed, and an intuitive user interface. If traders experience frequent technical issues, it can lead to frustration and financial losses. Furthermore, any signs of platform manipulation should be taken seriously, as they can indicate a lack of ethical practices within the broker.

Risk Assessment

Using Inception Financial Group poses several risks that traders should consider. The absence of regulation, poor customer feedback, and questionable trading conditions collectively contribute to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Financial Risk | High | Issues with fund withdrawals reported |

| Operational Risk | High | Poor customer service and platform issues |

To mitigate these risks, traders should conduct thorough research and consider alternative brokers with established regulatory oversight and positive customer reviews.

Conclusion and Recommendations

In conclusion, the evidence suggests that Inception Financial Group may not be a safe choice for traders. The lack of regulation, combined with numerous complaints and operational issues, raises significant red flags. Traders should exercise caution and consider whether they are comfortable with the inherent risks associated with this broker.

For those seeking a more secure trading environment, it is advisable to explore alternative brokers that are regulated by reputable authorities and have a proven track record of positive customer experiences. Ultimately, the safety of your funds and the integrity of your trading experience should be the top priority when choosing a forex broker.

Is Inception Financial Group a scam, or is it legit?

The latest exposure and evaluation content of Inception Financial Group brokers.

Inception Financial Group Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Inception Financial Group latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.