Cooper Markets 2025 Review: Everything You Need to Know

Summary

Cooper Markets started in 2018. This forex and CFD broker operates from Saint Vincent and the Grenadines as an offshore company. This cooper markets review shows major concerns about the broker's regulatory status and whether traders can trust it.

The company offers trading services across multiple asset classes including forex, precious metals, and indices. It targets traders who can handle higher risk levels. However, the lack of strong regulatory oversight has created big trust issues among potential clients.

User feedback always highlights concerns about fund security. There is also an absence of proper regulatory protection. While Cooper Markets provides access to various trading instruments, the basic question of safety and reliability remains unanswered due to insufficient regulatory framework and transparency issues.

The broker's offshore registration raises red flags for many traders seeking secure trading environments. Without proper licensing from recognized financial authorities, Cooper Markets operates in a regulatory gray area that may not provide adequate investor protection. This positioning makes it unsuitable for risk-averse traders who prioritize regulatory compliance and fund safety above all other considerations.

Important Notice

Cooper Markets operates from Saint Vincent and the Grenadines. This jurisdiction is known for minimal regulatory requirements for financial service providers. This offshore registration means the broker lacks oversight from major financial regulators such as the FCA, CySEC, or ASIC.

Potential clients should understand that this regulatory gap may result in limited recourse options in case of disputes or operational issues. This review is based on publicly available information and user feedback collected from various sources. The assessment has not been verified through direct testing or official broker cooperation.

Traders should conduct their own due diligence and consider their risk tolerance before engaging with any offshore broker. This is particularly important for those operating without established regulatory frameworks.

Rating Framework

Broker Overview

Cooper Markets entered the forex and CFD trading market in 2018. The company positions itself as a global service provider operating from Saint Vincent and the Grenadines. The company targets international clients seeking access to foreign exchange markets, precious metals trading, and various market indices.

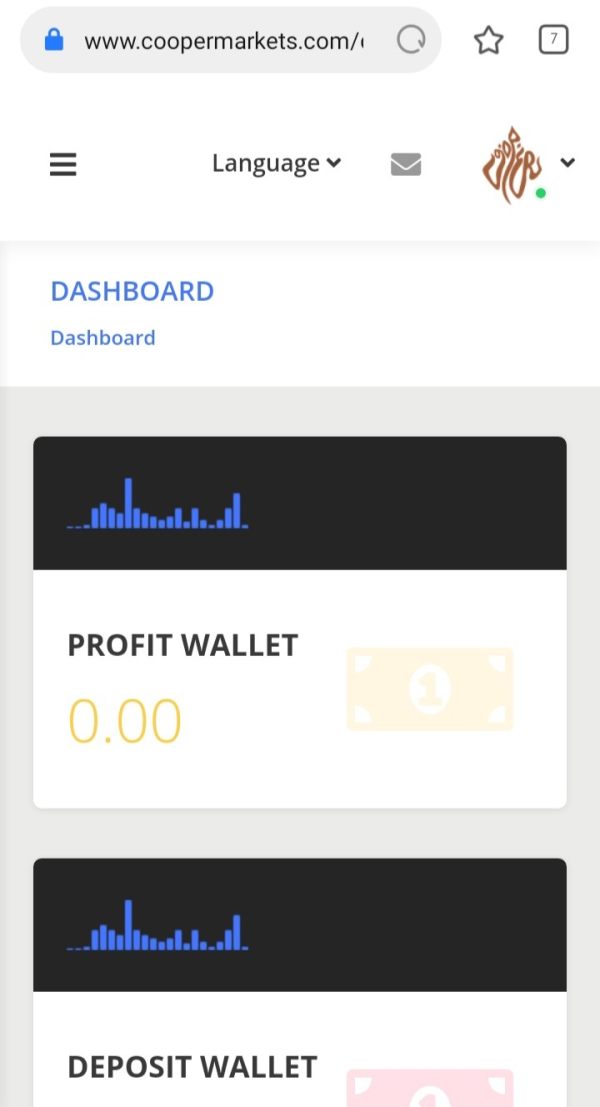

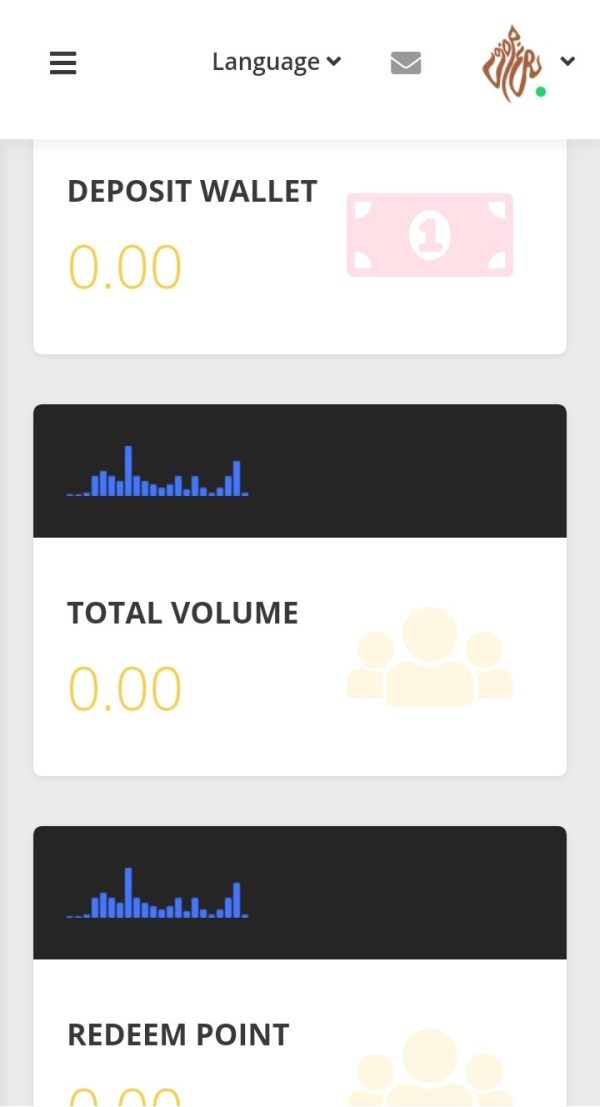

Despite its relatively recent establishment, the broker has attempted to build a presence in the competitive online trading sector. The business model focuses on providing CFD trading services across multiple asset classes. However, specific details about trading conditions, platform offerings, and account structures remain largely undisclosed in available public information.

This lack of transparency regarding fundamental trading parameters has contributed to user skepticism about the broker's legitimacy and operational standards. Operating from an offshore jurisdiction, Cooper Markets benefits from relaxed regulatory requirements but simultaneously faces credibility challenges. The absence of authorization from recognized financial regulators has created a significant trust deficit among potential clients.

This cooper markets review highlights how the regulatory void impacts user confidence and overall market perception of the broker's reliability and long-term viability.

Regulatory Jurisdiction

Cooper Markets operates under Saint Vincent and the Grenadines registration. This provides minimal regulatory oversight compared to major financial centers. The jurisdiction lacks comprehensive investor protection schemes typically found in established regulatory frameworks.

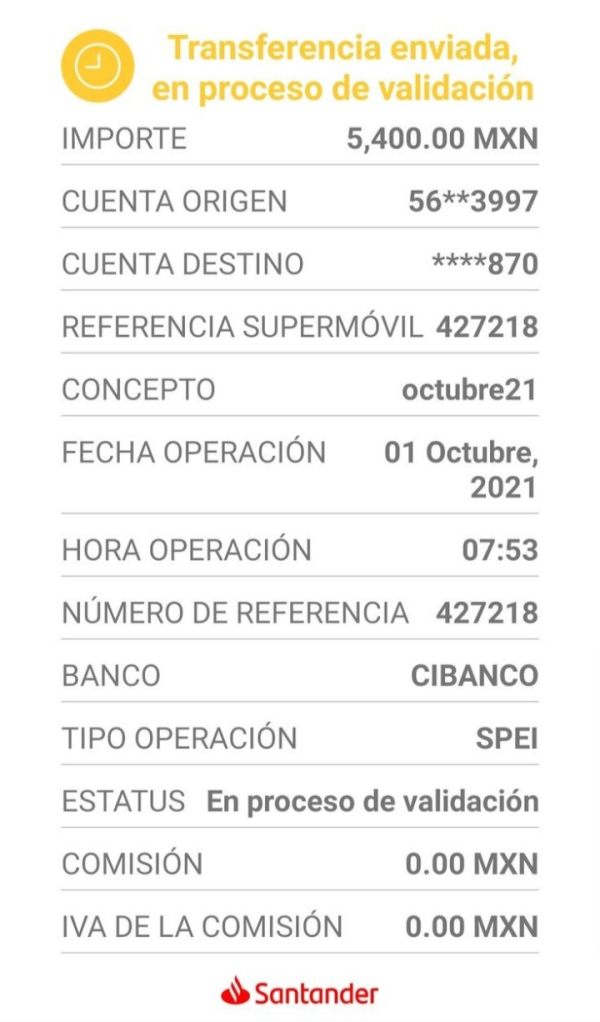

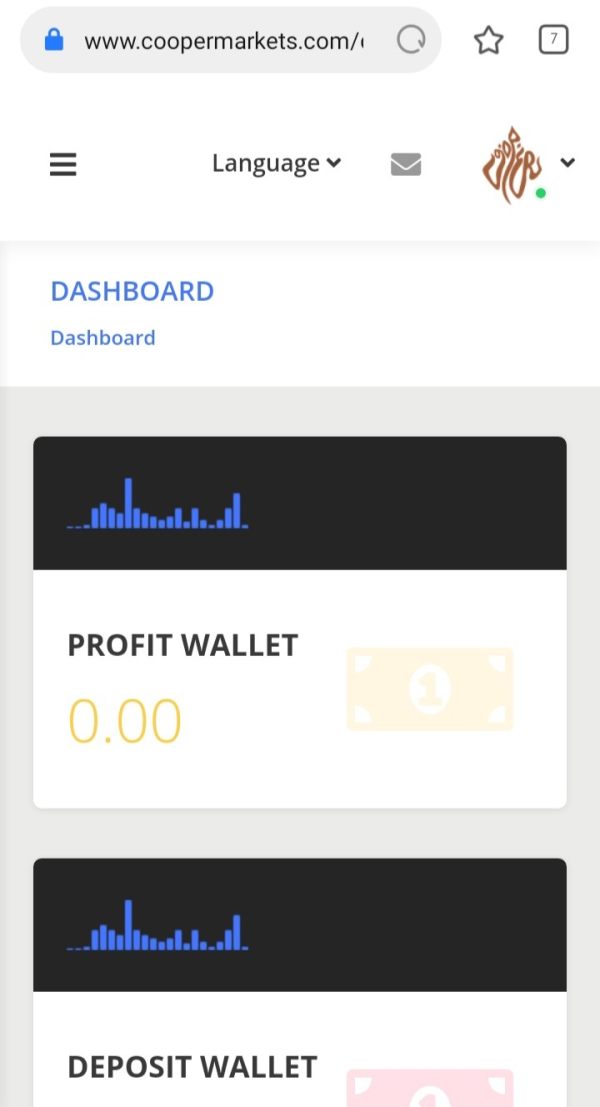

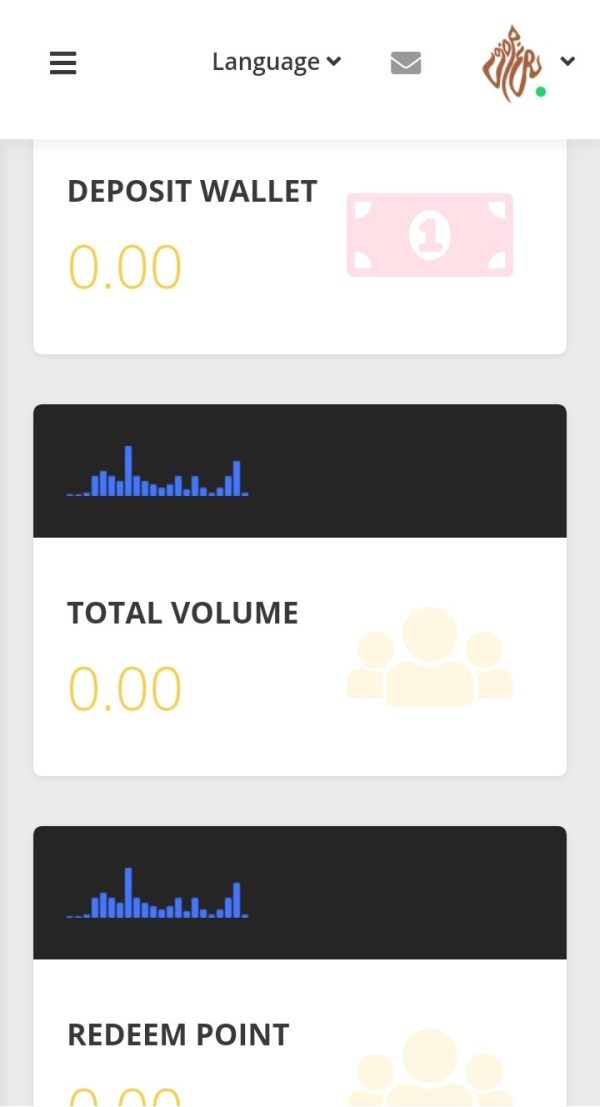

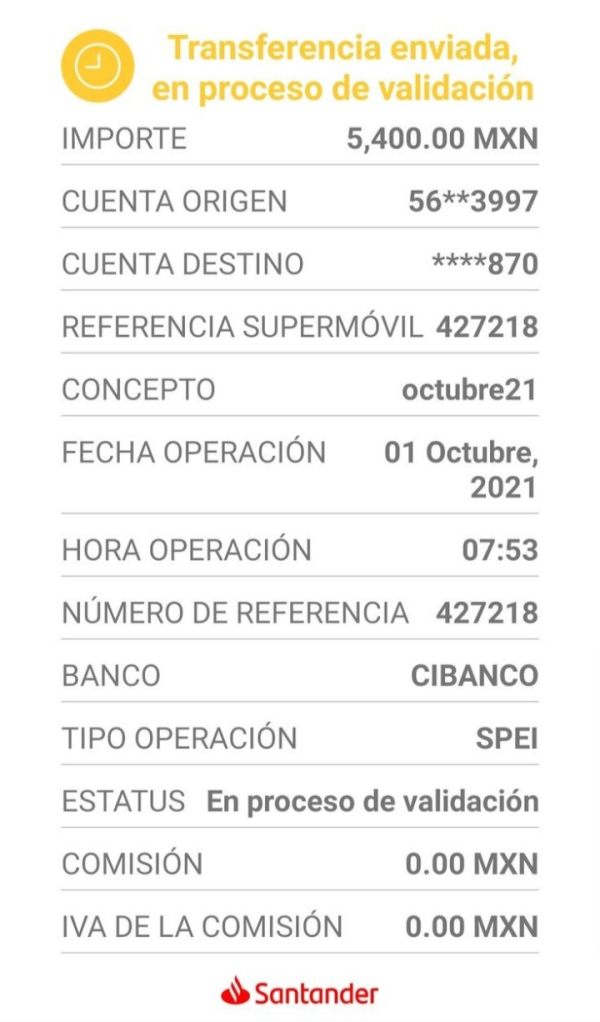

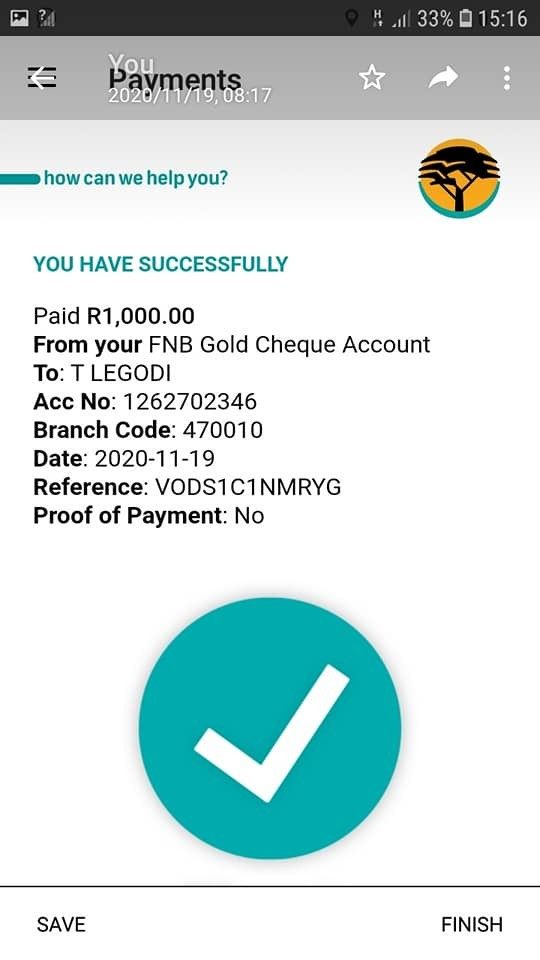

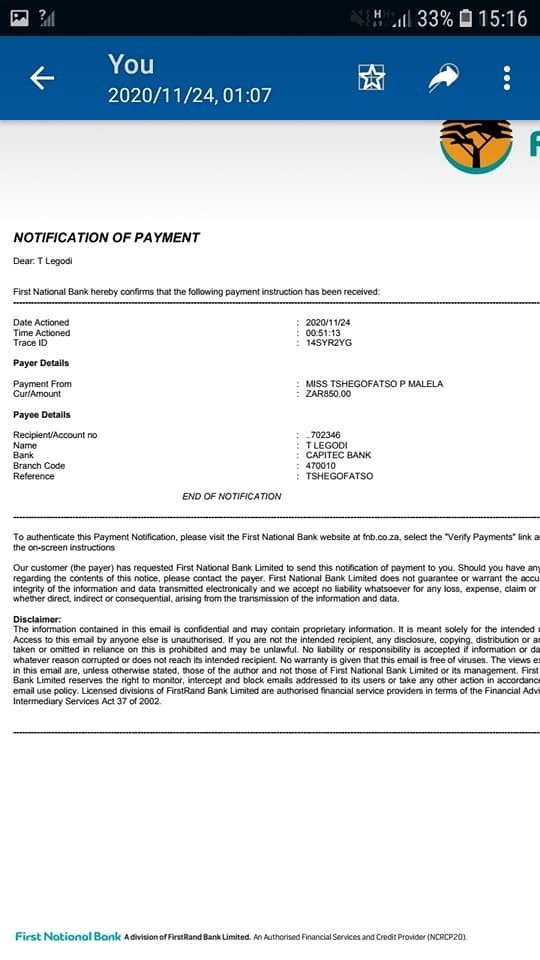

Deposit and Withdrawal Methods

Specific information regarding available payment methods is not detailed in available public materials. Processing times and associated fees for deposits and withdrawals also raise transparency concerns.

Minimum Deposit Requirements

The broker has not publicly disclosed minimum deposit amounts for different account types. This makes it difficult for potential clients to assess accessibility and initial investment requirements.

Available information does not include details about promotional offers. Welcome bonuses or ongoing incentive programs that might be available to new or existing clients are also not mentioned.

Tradeable Assets

Cooper Markets offers trading opportunities across forex pairs, precious metals including gold and silver, and various market indices. This provides some diversification options for traders interested in multiple asset classes.

Cost Structure

Critical information regarding spreads, commission structures, overnight financing charges, and other trading costs remains undisclosed in publicly available materials. This hinders proper cost assessment.

Leverage Ratios

Specific leverage offerings for different asset classes and account types are not detailed in available information. This prevents accurate evaluation of trading conditions and risk parameters.

Details about trading platforms are not specified in accessible public information. Whether they use proprietary or third-party solutions like MetaTrader limits assessment of technological capabilities.

Regional Restrictions

Information about geographical limitations, restricted countries, or regional compliance requirements is not clearly outlined in available materials.

Customer Service Languages

Specific details about supported languages for customer service are not mentioned in accessible information. The availability of multilingual support is also unclear. This cooper markets review emphasizes the information gaps that potential clients face when evaluating the broker.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The account conditions evaluation for Cooper Markets reveals significant transparency issues. These directly impact the rating. Without publicly available information about account types, minimum deposit requirements, or specific features offered to different client categories, potential traders cannot make informed decisions about suitability for their trading needs.

The absence of detailed account specifications raises questions about the broker's commitment to transparency and client education. Established brokers typically provide comprehensive information about account tiers, associated benefits, and qualification criteria. Cooper Markets' failure to disclose these fundamental details suggests either poor marketing practices or deliberate opacity regarding trading conditions.

Furthermore, the lack of information about special account features indicates limited service customization. Features such as Islamic accounts for Muslim traders or professional accounts for qualified investors are not mentioned. The account opening process, verification requirements, and documentation needs remain unclear, potentially creating obstacles for prospective clients seeking straightforward onboarding experiences.

This cooper markets review identifies the information void surrounding account conditions as a significant weakness. It undermines client confidence and suggests operational deficiencies in customer communication and service transparency.

The evaluation of Cooper Markets' trading tools and resources suffers from insufficient publicly available information. Details about the broker's technological offerings and educational support systems are lacking. Without details about analytical tools, charting capabilities, or research resources, traders cannot assess whether the broker provides adequate support for informed decision-making.

Educational resources play a crucial role in trader development, particularly for newcomers to forex and CFD markets. The absence of information about webinars, tutorials, market analysis, or educational content suggests either limited educational support or poor communication of available resources. This gap particularly affects novice traders who rely on broker-provided education to develop trading skills.

Automated trading support remains unspecified, including expert advisor compatibility and algorithmic trading capabilities. Modern traders increasingly rely on automated systems, and the lack of clarity regarding such support limits the broker's appeal to technically sophisticated clients. Additionally, mobile trading capabilities and cross-platform synchronization features are not detailed in available information.

The limited information about research and analysis tools provided by Cooper Markets suggests either minimal investment in client support infrastructure or inadequate marketing of existing capabilities. Both of these negatively impact the overall service evaluation.

Customer Service and Support Analysis (3/10)

Customer service evaluation for Cooper Markets is severely hampered by limited information about support infrastructure. Concerning user feedback regarding trust and reliability issues also affects this evaluation. The absence of detailed information about customer service channels, response times, and support quality creates uncertainty about the broker's commitment to client assistance.

User concerns about fund security and regulatory oversight directly impact perceptions of customer service effectiveness. When traders express doubts about basic safety and regulatory protection, it suggests fundamental failures in customer relationship management and trust-building efforts. These concerns extend beyond traditional support metrics to encompass existential questions about broker reliability.

The lack of information about multilingual support, service hours, and escalation procedures indicates either limited support infrastructure or poor communication of available services. International brokers typically emphasize their customer service capabilities to build confidence among diverse client bases. Cooper Markets' silence on these matters is particularly concerning.

Without clear communication channels, published response time commitments, or evidence of proactive customer support initiatives, the broker fails to meet modern expectations for client service. The combination of transparency issues and user trust concerns creates a customer service environment that appears inadequate for serious trading operations.

Trading Experience Analysis (4/10)

The trading experience evaluation for Cooper Markets is constrained by the absence of specific information about platform stability, execution quality, and technological infrastructure. Without details about the trading platforms offered, users cannot assess whether the broker provides reliable, feature-rich trading environments. These should be suitable for different trading styles and experience levels.

Order execution quality remains undisclosed, including information about slippage rates, requotes frequency, and fill rates. These factors are crucial for traders seeking consistent execution and fair trading conditions. The lack of transparency regarding execution statistics suggests either suboptimal performance or reluctance to share performance data with potential clients.

Platform functionality cannot be properly evaluated due to insufficient information, including charting capabilities, order types, and analytical tools. Mobile trading experience, which has become essential for modern traders, also lacks detailed coverage in available materials. The absence of platform demonstrations or feature descriptions limits traders' ability to assess technological suitability.

The overall trading environment assessment is further complicated by regulatory concerns that may impact the reliability and consistency of trading conditions. This cooper markets review highlights how regulatory uncertainty can undermine confidence in the fundamental trading experience, regardless of technological capabilities.

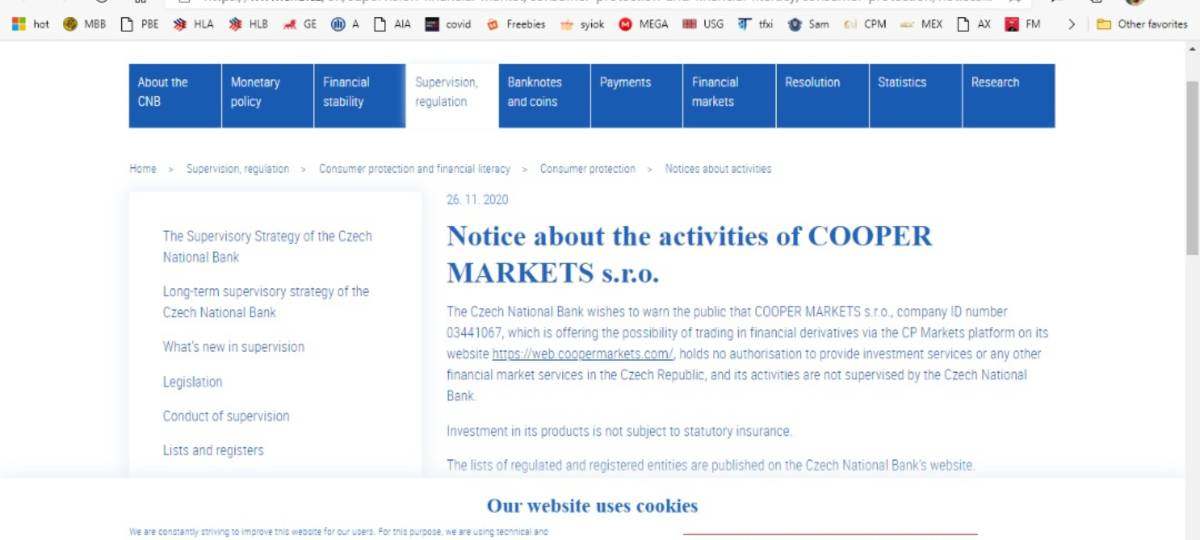

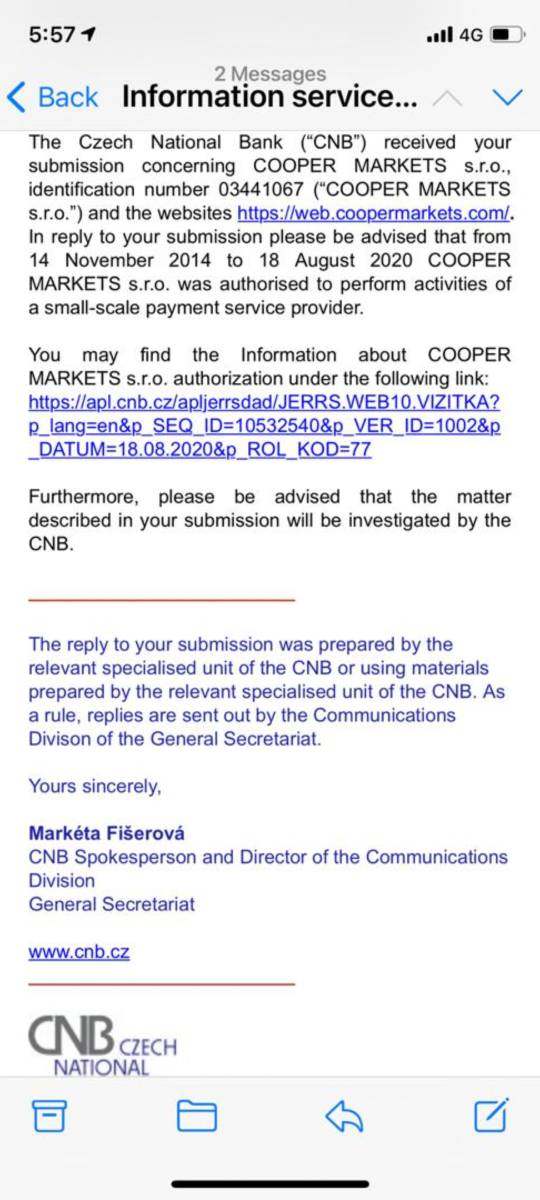

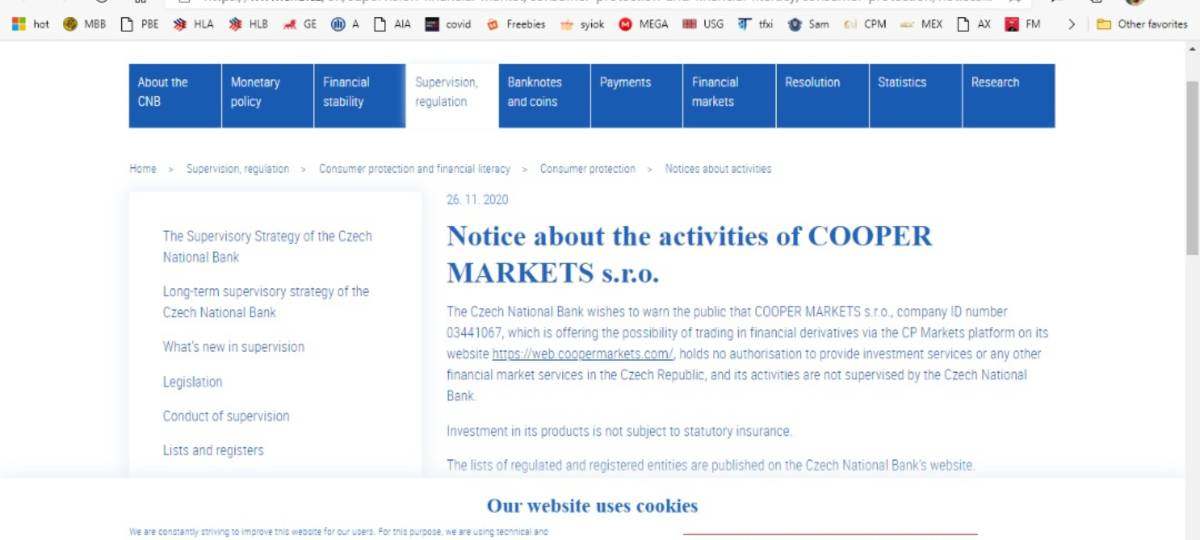

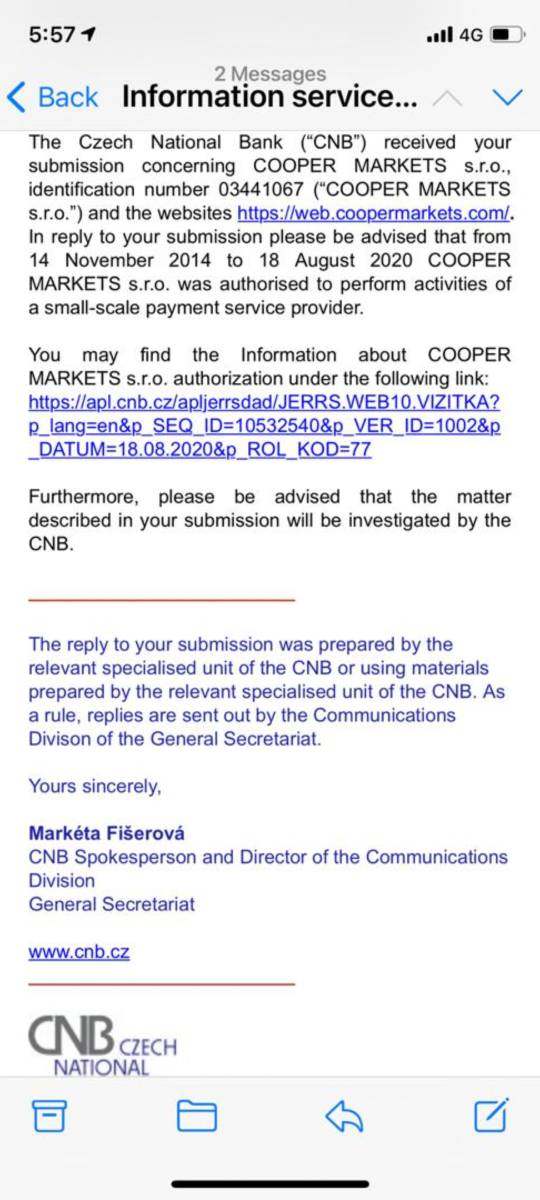

Trustworthiness Analysis (2/10)

Trustworthiness represents Cooper Markets' most significant challenge. The broker receives the lowest rating in this critical category. The absence of regulation from recognized financial authorities creates fundamental trust issues that permeate all aspects of the broker's operations and client relationships.

Operating from Saint Vincent and the Grenadines without specific regulatory oversight means Cooper Markets lacks the investor protection mechanisms typically associated with reputable brokers. The absence of regulatory authorization numbers, compliance reports, or oversight from established financial authorities raises serious questions about operational legitimacy and client fund safety.

Fund security measures are not detailed in available information, including segregated accounts, compensation schemes, and audit procedures. This transparency gap is particularly concerning given the regulatory void, as clients have limited recourse options in case of operational failures or disputes. The lack of clear information about fund protection mechanisms significantly undermines client confidence.

User feedback indicates concerns about potential fraud risks and safety issues, reflecting the broader trust deficit facing the broker. When combined with regulatory concerns and transparency issues, these factors create a trust environment that falls well below industry standards for reputable financial service providers.

User Experience Analysis (4/10)

User experience evaluation for Cooper Markets reveals significant challenges stemming from transparency issues and trust concerns. These fundamentally impact client satisfaction and confidence. The combination of limited public information and regulatory uncertainty creates an environment where users struggle to make informed decisions about broker suitability.

Interface design and platform usability cannot be properly assessed due to insufficient information about the trading platforms and user interfaces provided by the broker. Modern traders expect intuitive, responsive platforms with comprehensive functionality. However, the lack of detailed platform information prevents proper evaluation of user experience quality.

The registration and verification process remains unclear, potentially creating obstacles for prospective clients seeking straightforward account opening procedures. Without clear guidance about documentation requirements, verification timelines, and onboarding steps, users may encounter unexpected complications during the initial engagement process.

User feedback indicates skepticism about trustworthiness and safety concerns, directly impacting overall experience ratings. When traders express fundamental doubts about broker reliability, it suggests systemic issues that extend beyond technical platform considerations. These encompass the entire client relationship and service delivery framework.

Conclusion

Cooper Markets presents significant challenges for traders seeking a reliable and transparent forex and CFD broker. The lack of regulatory oversight from recognized financial authorities creates substantial concerns about the broker's suitability for most traders. Limited transparency regarding trading conditions and operational procedures compounds these issues.

While the broker offers access to multiple asset classes including forex, precious metals, and indices, these limited advantages are overshadowed by fundamental trust and transparency issues. The absence of detailed information about account conditions, trading costs, and platform capabilities suggests either operational deficiencies or deliberate opacity that undermines client confidence.

This cooper markets review concludes that the broker may only be suitable for traders with exceptionally high risk tolerance. These traders must be able to accept the uncertainties associated with offshore, unregulated operations. Most traders would benefit from considering alternative brokers with established regulatory credentials and transparent operational frameworks that provide better protection and clearer terms of service.