Is Cooper Markets safe?

Business

License

Is Cooper Markets Safe or Scam?

Introduction

Cooper Markets is a forex and CFD broker that has been operational since 2018, primarily registered in Saint Vincent and the Grenadines. This offshore broker offers a variety of trading instruments, including forex pairs, commodities, and indices, aiming to attract traders with its competitive leverage and low minimum deposit requirements. However, the forex market is rife with scams and unreliable brokers, making it crucial for traders to thoroughly evaluate any broker before committing their funds. In this article, we will investigate the legitimacy of Cooper Markets, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our analysis is based on a comprehensive review of available data, user feedback, and industry standards.

Regulation and Legitimacy

The regulatory framework within which a broker operates is a key indicator of its legitimacy and safety for traders. Cooper Markets claims to be licensed by the VSGFSA (the regulatory authority of Saint Vincent and the Grenadines), but it is important to note that this jurisdiction is known for its lax regulations regarding forex trading. The lack of stringent oversight raises concerns about the protection of investors' funds.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| VSGFSA | N/A | Saint Vincent and the Grenadines | Unverified |

While Cooper Markets holds a license from VSGFSA, this regulatory authority does not impose the same level of investor protection as Tier 1 regulators such as the FCA or ASIC. The absence of robust regulatory oversight means that traders may have limited recourse in the event of disputes or issues with fund withdrawals. Historical compliance records for brokers operating in such jurisdictions often reveal a troubling pattern of complaints and unresolved issues, further underscoring the risks associated with trading through Cooper Markets.

Company Background Investigation

Cooper Markets is owned by CP Markets Ltd., which is registered in Saint Vincent and the Grenadines. The company's history is relatively short, having been established in 2018. There is limited information available regarding the management team, which raises questions about their experience and qualifications in the financial services industry. A lack of transparency in company operations and ownership structure can be a significant red flag for potential investors.

The absence of comprehensive information about the company's founders and key executives further complicates the assessment of Cooper Markets' credibility. In a highly competitive and often deceptive market, transparency is critical for building trust with clients. The fact that Cooper Markets does not provide detailed information about its management team or operational practices may indicate a lack of accountability and oversight.

Trading Conditions Analysis

When evaluating the trading conditions offered by Cooper Markets, it is essential to analyze their fee structure and overall trading environment. The broker offers a relatively low minimum deposit of $100, which may attract novice traders. However, the cost of trading can be obscured by hidden fees and unfavorable conditions.

| Fee Type | Cooper Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

Cooper Markets' spreads are reported to start at 1.5 pips for major currency pairs, which is higher than the industry average. Additionally, the lack of clarity regarding commissions and overnight interest rates raises concerns about potential hidden costs. Traders should be wary of brokers that do not provide transparent information about their fee structures, as this can lead to unexpected expenses and reduced profitability.

Client Fund Security

The safety of client funds is a paramount concern when trading with any broker. Cooper Markets claims to implement various security measures; however, the lack of robust regulatory oversight significantly undermines these assertions.

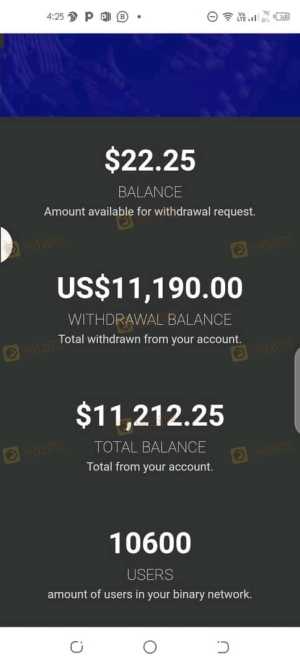

The broker does not provide clear information regarding fund segregation, investor protection schemes, or negative balance protection. This absence of safeguards can expose traders to significant risks, especially in volatile market conditions. Historical complaints and reports from users suggest that there have been issues with fund withdrawals, further highlighting the potential dangers of trading with Cooper Markets.

Customer Experience and Complaints

Analyzing customer feedback is crucial in assessing whether Cooper Markets is safe. Many users have reported negative experiences, particularly regarding withdrawal issues and unresponsive customer support. Common complaints include delays in processing withdrawals, lack of communication from the support team, and aggressive sales tactics from brokers.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Misleading Promotions | High | Poor |

Several users have shared their experiences of being unable to withdraw their funds after making deposits, with some claiming that their accounts were blocked or suspended without explanation. These patterns of complaints indicate a troubling trend that raises serious questions about the reliability of Cooper Markets as a trading platform.

Platform and Trade Execution

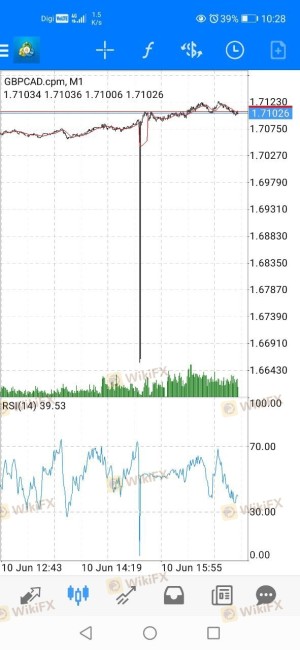

The trading experience provided by Cooper Markets is facilitated through the popular MetaTrader 4 platform. While MT4 is widely regarded for its user-friendly interface and robust trading capabilities, the performance of the platform is crucial to the overall trading experience.

Users have reported issues with order execution, including slippage and rejected orders. Such problems can significantly impact trading outcomes, especially for those employing high-frequency trading strategies. The lack of transparency regarding order execution quality raises concerns about potential market manipulation, a common issue among unregulated brokers.

Risk Assessment

Engaging with Cooper Markets carries inherent risks that traders should be aware of before making any financial commitments.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of robust regulation increases the risk of fraud. |

| Withdrawal Risk | High | Numerous complaints regarding withdrawal issues. |

| Transparency Risk | Medium | Limited information about the company and management. |

Given these risks, it is advisable for traders to approach Cooper Markets with caution. Utilizing risk mitigation strategies, such as setting strict limits on capital exposure and thoroughly researching alternative brokers, can help safeguard against potential losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that Cooper Markets may not be a safe option for traders. The lack of robust regulation, combined with numerous reports of withdrawal issues and customer complaints, raises significant red flags. While the broker may offer attractive features such as low minimum deposits and the use of a popular trading platform, these benefits are overshadowed by the potential risks involved.

Traders should consider seeking alternative brokers that are well-regulated and have a proven track record of reliability and transparency. Some recommended alternatives include brokers regulated by reputable authorities such as the FCA or ASIC, which offer comprehensive investor protection and a more secure trading environment. If you are considering trading with Cooper Markets, it is crucial to weigh these factors carefully and prioritize your financial safety.

Is Cooper Markets a scam, or is it legit?

The latest exposure and evaluation content of Cooper Markets brokers.

Cooper Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Cooper Markets latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.