Kemik 2025 Review: Everything You Need to Know

Summary

This Kemik review shows concerning patterns that potential traders should carefully consider before engaging with this forex broker. Based on available user feedback and industry analysis, Kemik presents a mixed picture with significant red flags that overshadow its limited positive features. The broker has attracted attention for offering zero-spread trading conditions. It also maintains a user-friendly interface that appeals to newcomers in the forex and cryptocurrency markets.

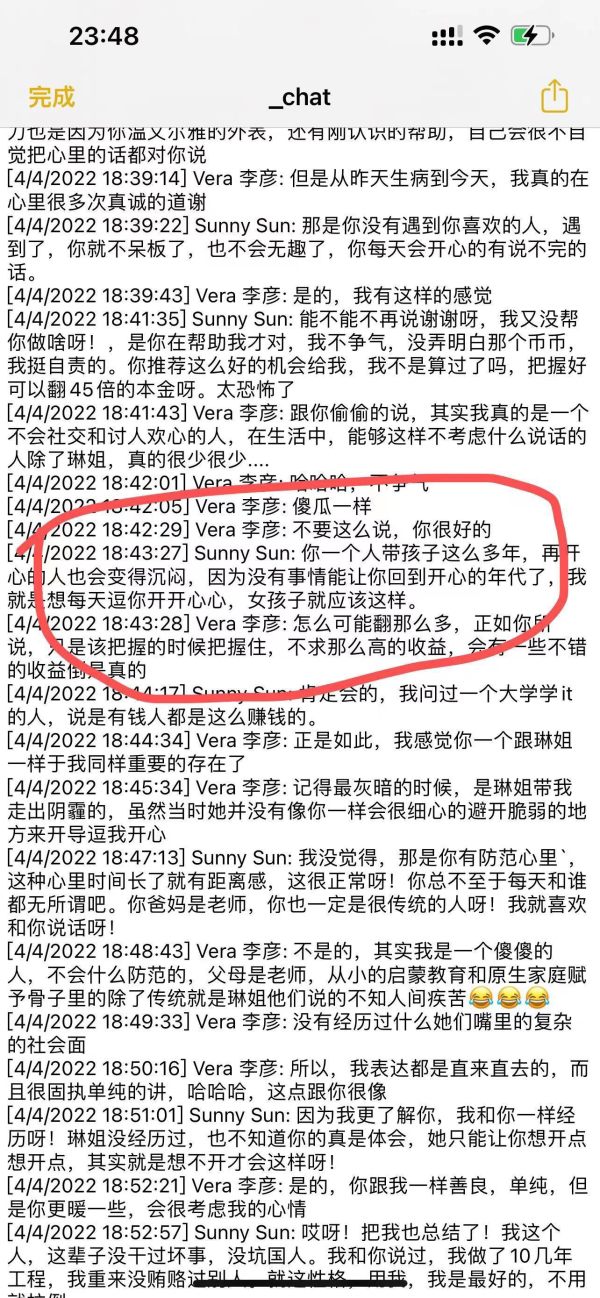

However, these apparent advantages are severely undermined by persistent user complaints regarding withdrawal difficulties and allegations of fraudulent practices. Multiple trader reports indicate systematic issues with fund retrieval. Some users describe the platform as potentially operating as a scam. The broker's target demographic appears to be small to medium-sized investors interested in forex and cryptocurrency trading. But the lack of transparent regulatory information and concerning user experiences suggest that even this audience should exercise extreme caution when considering Kemik's services.

Important Notice

Due to the absence of clear regulatory information in available sources, users should approach Kemik's services with heightened caution. Regional legal frameworks may significantly impact trading experiences. The lack of transparent regulatory oversight creates additional risks for international traders. This review is based on comprehensive analysis of user feedback and available information. Though specific regulatory details and complete company background information remain limited in accessible sources.

Rating Framework

Broker Overview

Kemik positions itself as a forex and cryptocurrency trading platform. Detailed information about its establishment date and corporate background remains notably absent from available sources. According to WikiFX monitor reports, the broker operates in the competitive online trading space. It targets investors interested in currency markets and digital assets. The platform's business model appears focused on attracting retail traders through competitive spread offerings. It particularly emphasizes zero-spread trading conditions that can appeal to cost-conscious traders.

The broker's operational structure centers around providing access to forex and cryptocurrency markets. Specific details about trading platform technology and infrastructure are not comprehensively detailed in available documentation. Based on user feedback patterns, Kemik appears to target small to medium-sized investors who are seeking entry-level access to international trading markets. However, the lack of transparent company information creates significant gaps in understanding the broker's true operational foundation. This includes regulatory status and corporate governance details, which affects long-term viability in the competitive brokerage landscape.

Regulatory Status: Available sources do not provide specific information about Kemik's regulatory oversight or licensing from recognized financial authorities. This represents a significant concern for potential traders seeking regulated trading environments.

Deposit and Withdrawal Methods: Specific information about supported payment methods and processing procedures is not detailed in accessible sources. User complaints suggest systematic issues with withdrawal processing.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in available documentation. This limits transparency for prospective account holders.

Promotions and Bonuses: Current promotional offerings and bonus structures are not detailed in available sources. This prevents comprehensive evaluation of additional value propositions.

Tradeable Assets: According to available information, Kemik provides access to forex currency pairs and cryptocurrency trading opportunities. It targets the growing demand for digital asset trading alongside traditional currency markets.

Cost Structure: The platform advertises zero-spread trading conditions. Specific commission structures and additional fees are not comprehensively detailed in accessible sources, limiting full cost analysis.

Leverage Options: Specific leverage ratios and margin requirements are not detailed in available documentation from the sources reviewed.

Platform Selection: Detailed information about trading platform options and technology infrastructure is not comprehensively available in current sources.

This Kemik review highlights the significant information gaps that potential traders should consider when evaluating the broker's suitability for their trading needs.

Account Conditions Analysis

The account conditions offered by Kemik present significant transparency issues that potential traders must carefully consider. Available sources do not provide detailed information about account types, tier structures, or specific features that differentiate various account offerings. This lack of clarity extends to minimum deposit requirements. They remain unspecified in accessible documentation, making it difficult for prospective traders to understand entry barriers or plan their initial investment strategies.

The account opening process details are similarly unclear. Limited information is available about verification procedures, documentation requirements, or timeline expectations for account activation. User feedback suggests mixed experiences with account setup. Specific procedural details are not comprehensively documented. Additionally, specialized account options such as Islamic accounts for Sharia-compliant trading are not mentioned in available sources.

Compared to established brokers in the industry, Kemik's lack of transparent account condition information represents a significant disadvantage. Most reputable brokers provide detailed account specifications, clear fee structures, and comprehensive terms of service. The absence of such transparency in this Kemik review raises concerns about the broker's commitment to regulatory compliance. It also questions customer service standards that are typically expected in professional trading environments.

The trading tools and resources offered by Kemik appear limited based on available information. Specific details about analytical capabilities, research provisions, and educational materials are notably absent from accessible sources. This lack of comprehensive tool documentation suggests either limited platform functionality. It could also indicate insufficient transparency in communicating available features to potential users.

Research and analysis resources are not detailed in available sources. Most professional trading platforms provide market analysis, economic calendars, trading signals, and research reports to support trader decision-making. The absence of such information in Kemik's available documentation raises questions about the platform's commitment to supporting trader success. This particularly applies to comprehensive market intelligence.

Educational resources are similarly not documented in accessible sources. For a platform that appears to target newer traders interested in forex and cryptocurrency markets, the lack of educational support represents a significant limitation. Additionally, automated trading support, expert advisors, and algorithmic trading capabilities are not mentioned in available information. This limits appeal for more sophisticated trading strategies.

Customer Service and Support Analysis

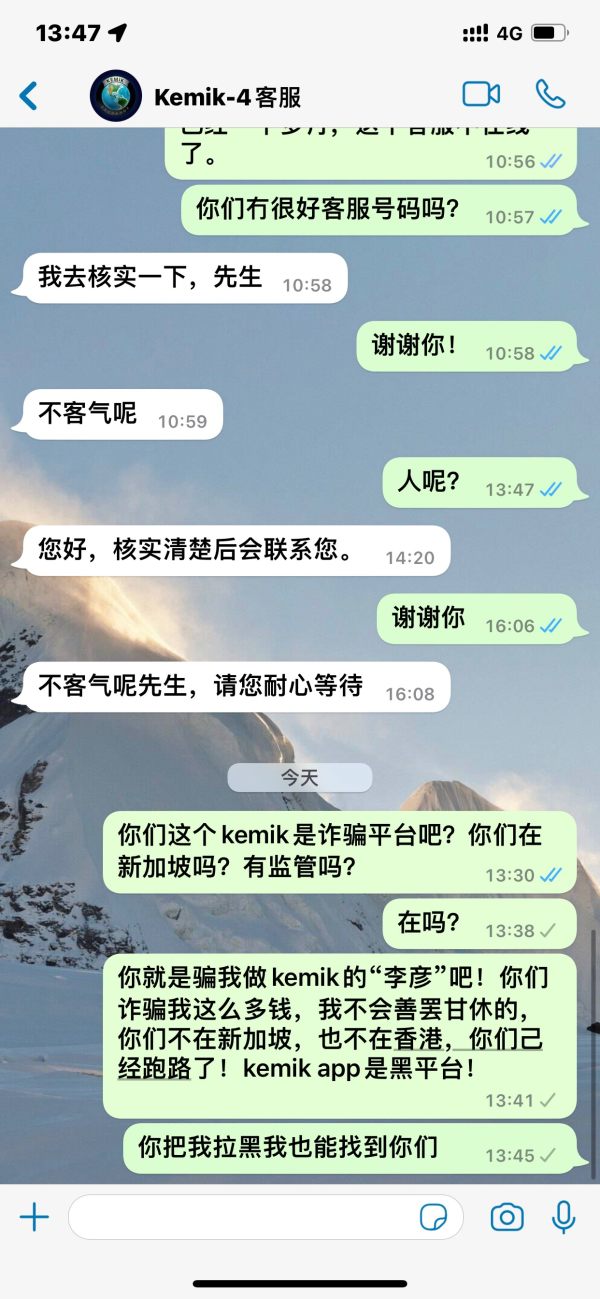

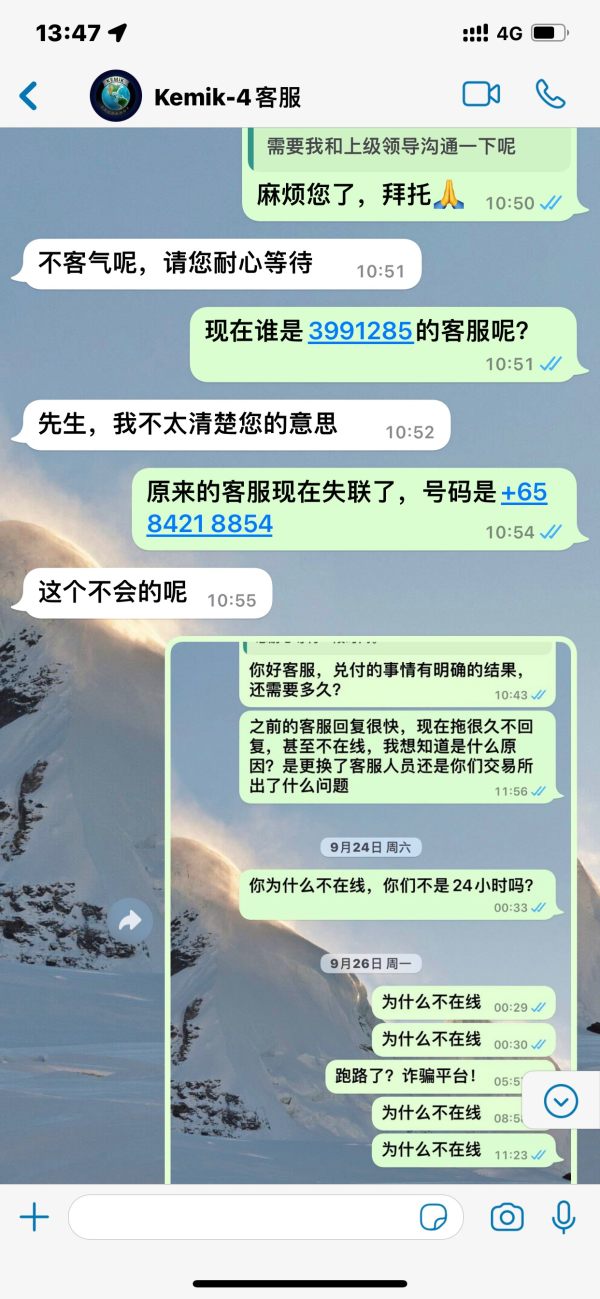

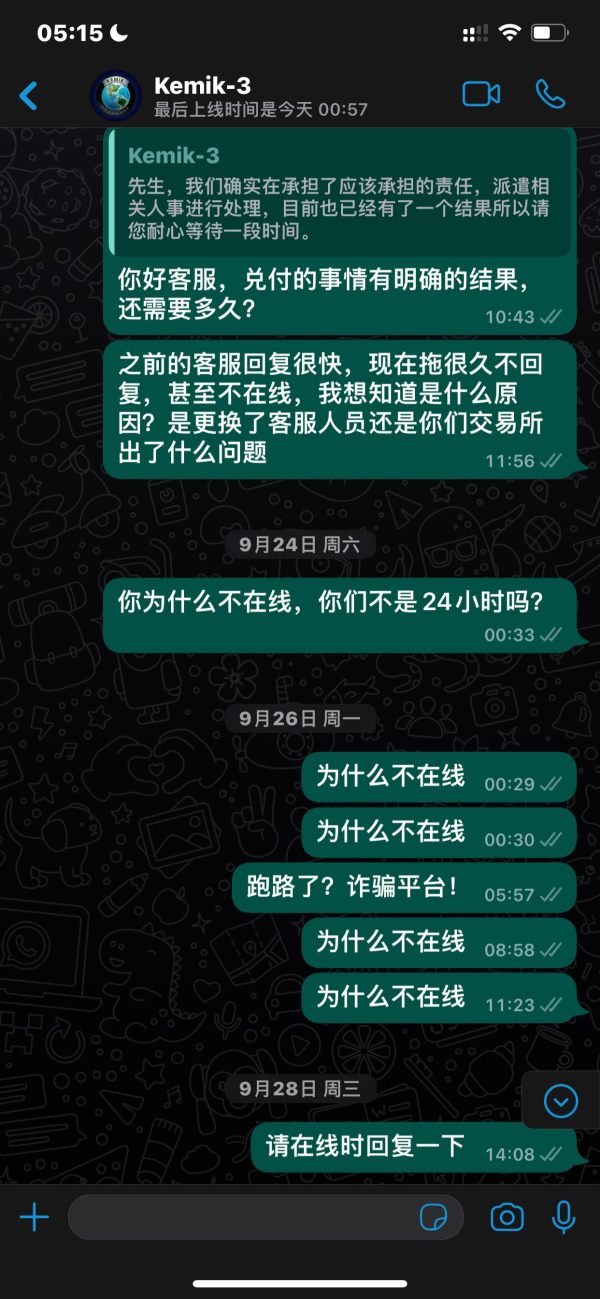

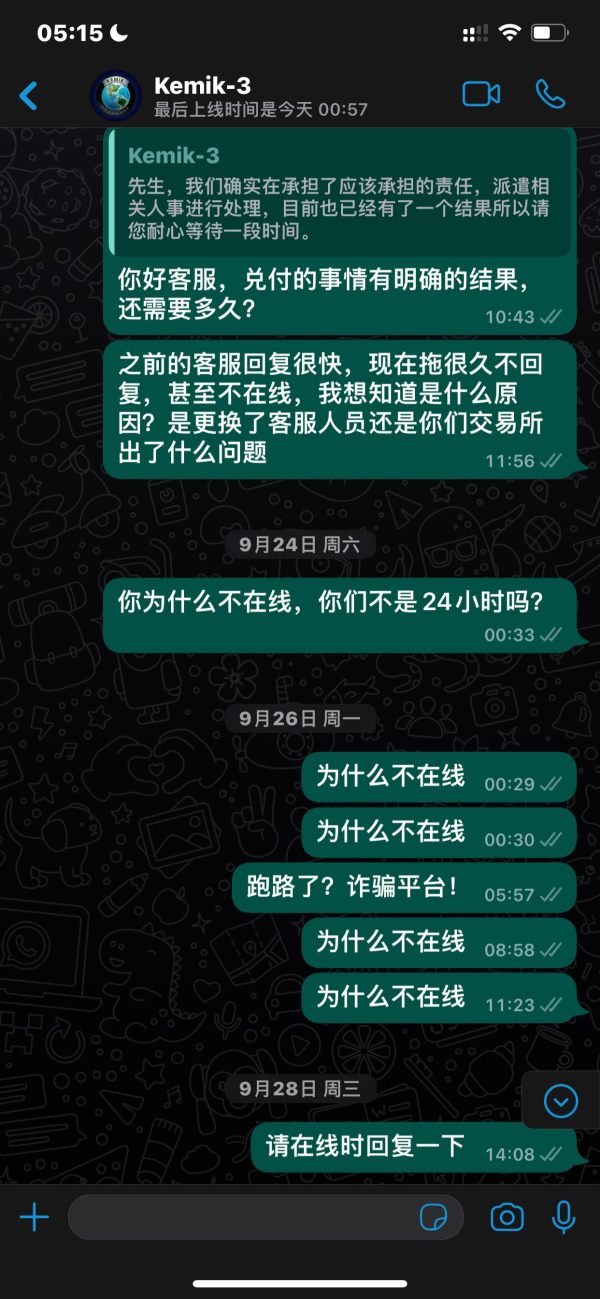

Customer service experiences with Kemik present a mixed picture based on available user feedback. Response times and service quality vary significantly according to different trader reports. Some users have noted professional interactions with support staff. Others report slower response times and difficulty reaching appropriate assistance for their concerns.

The availability of customer service channels is not comprehensively detailed in accessible sources. This limits understanding of how traders can access support when needed. Multi-language support capabilities are similarly undocumented. This could present barriers for international traders who require assistance in their native languages. Operating hours for customer support are not specified, creating uncertainty about availability during different trading sessions.

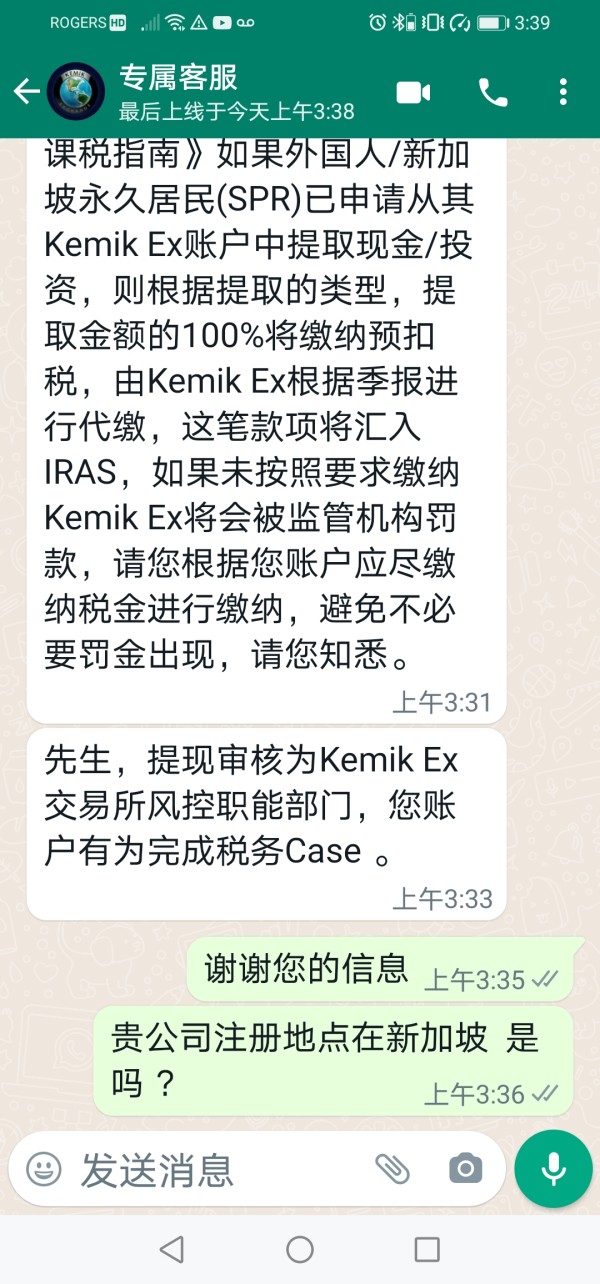

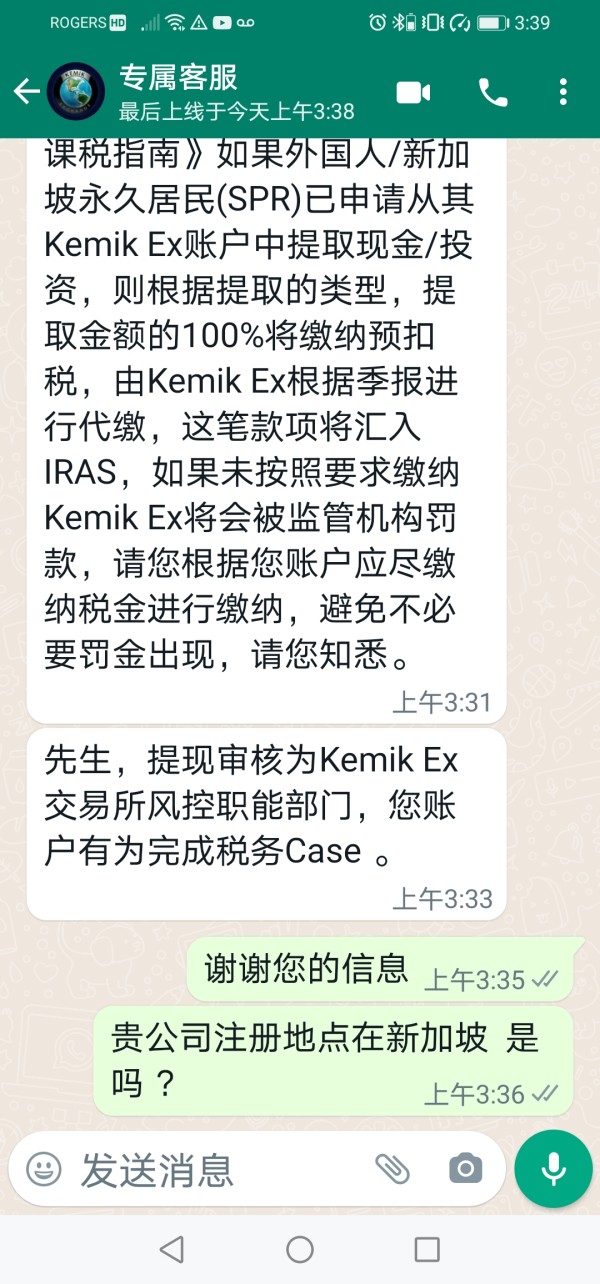

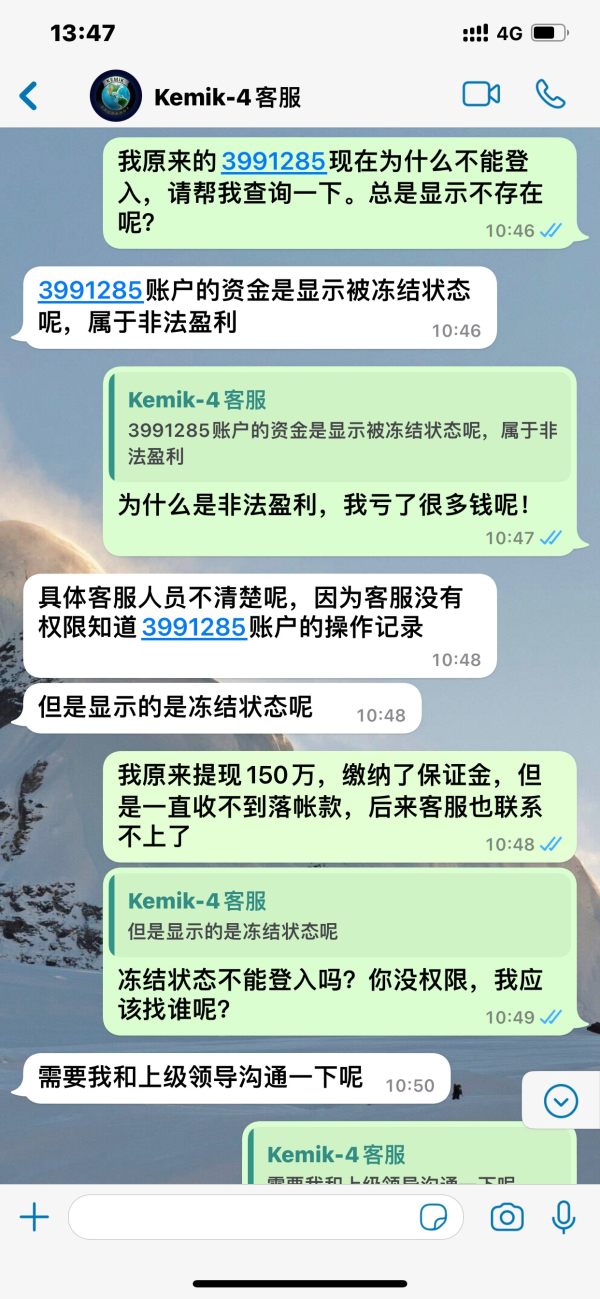

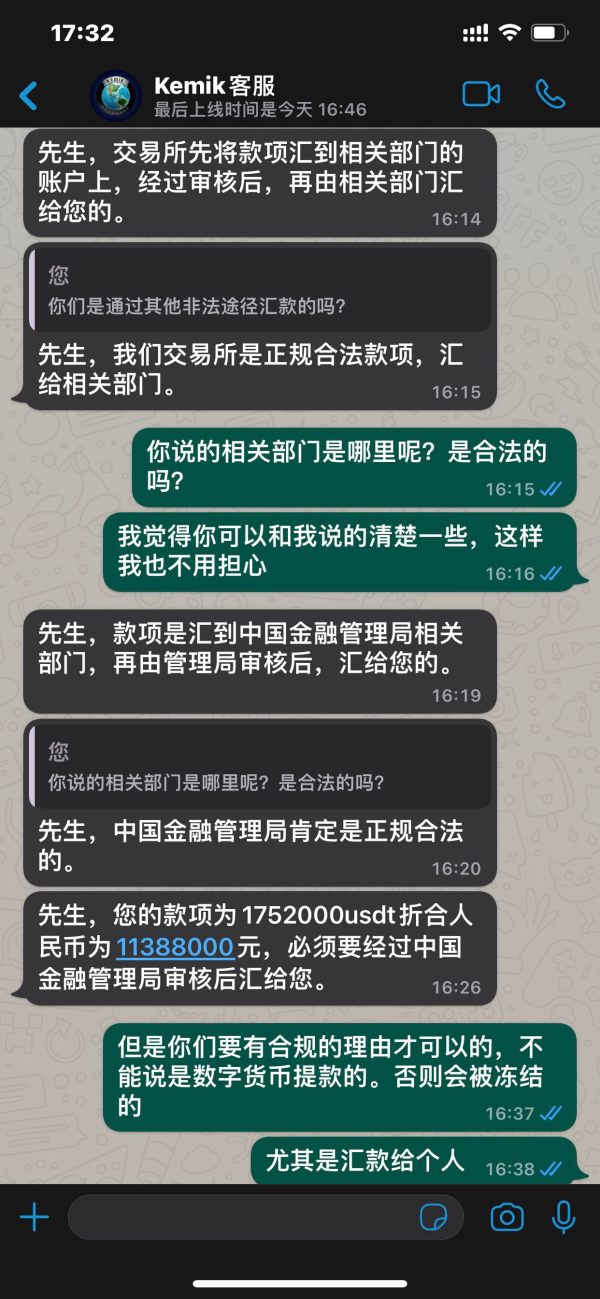

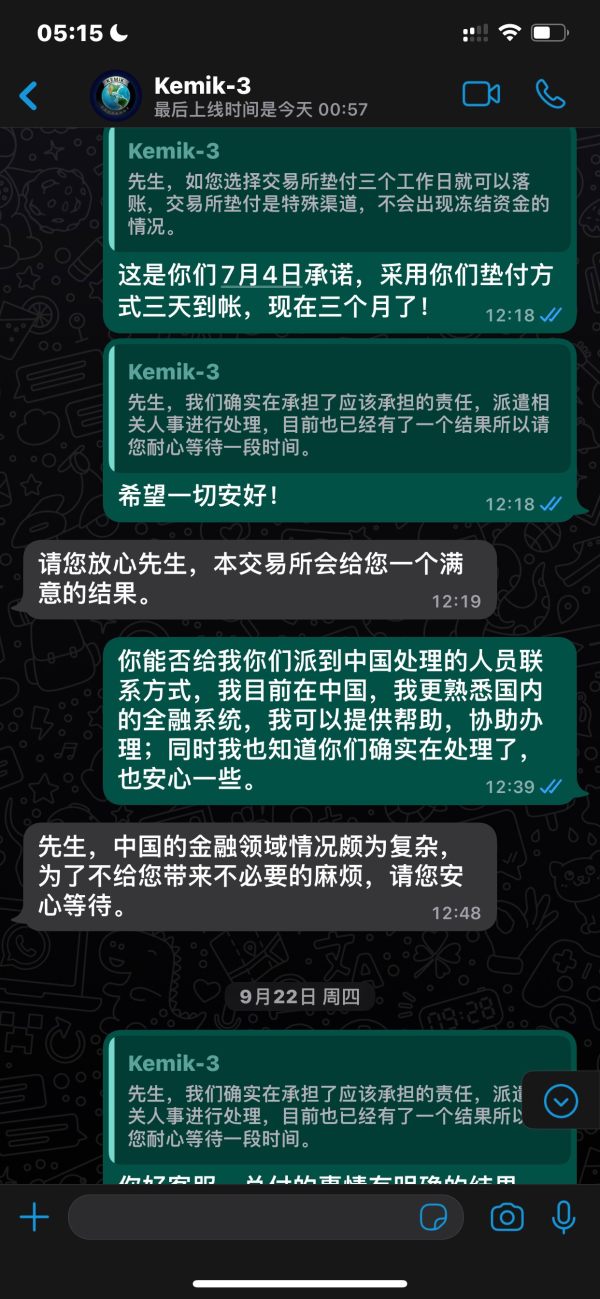

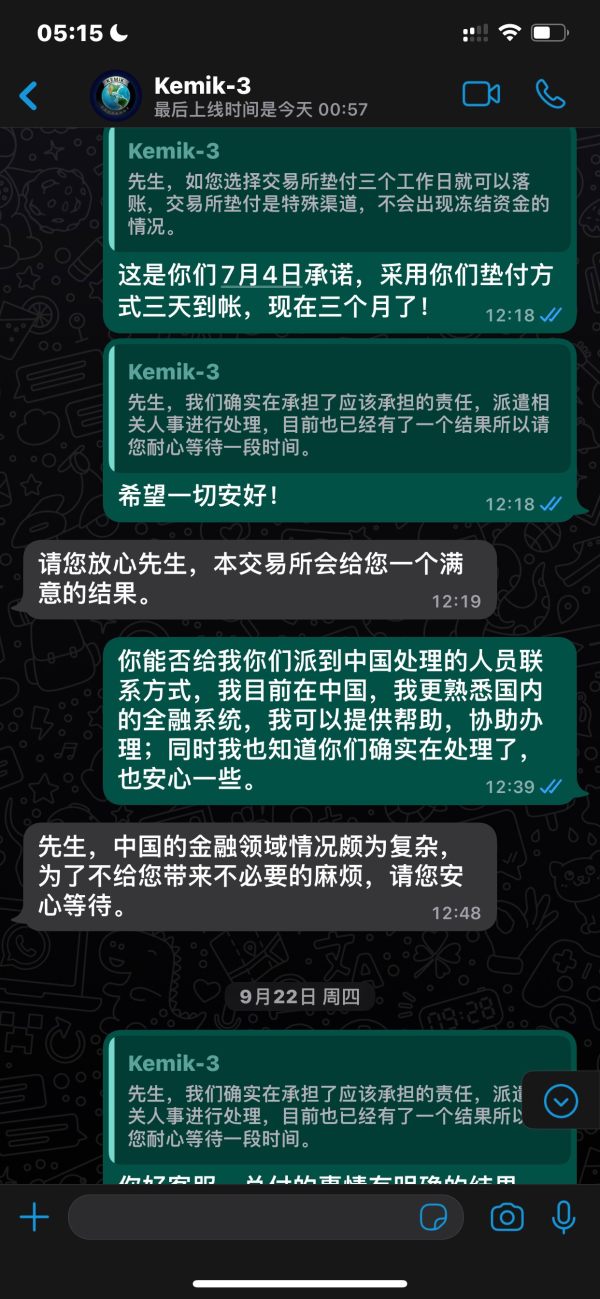

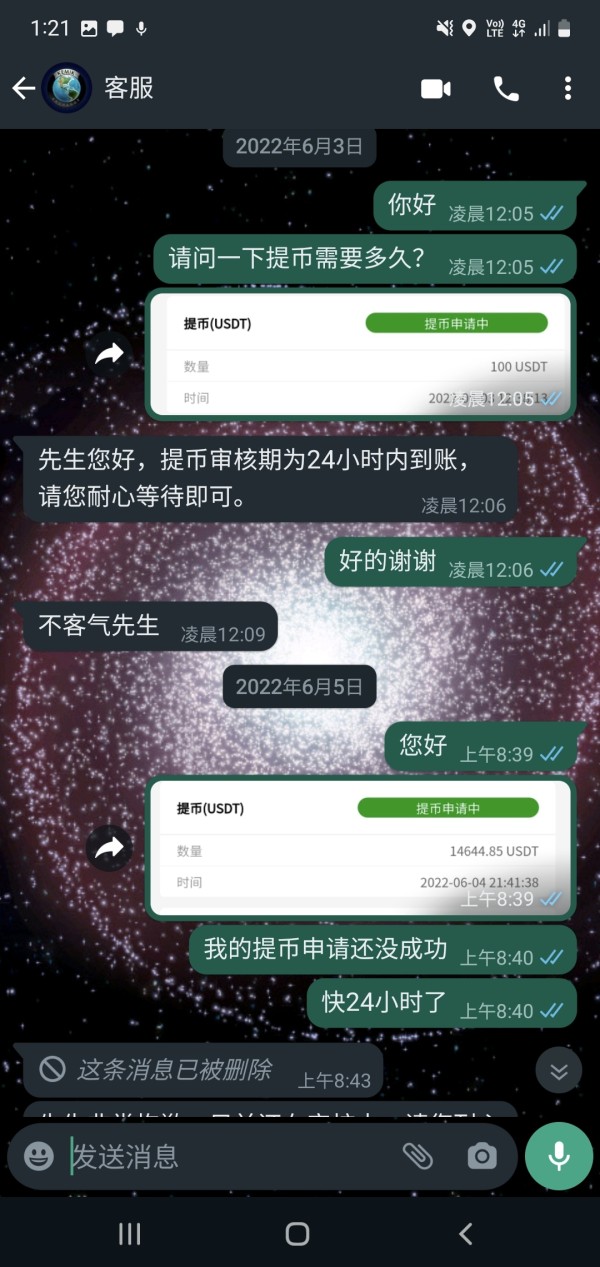

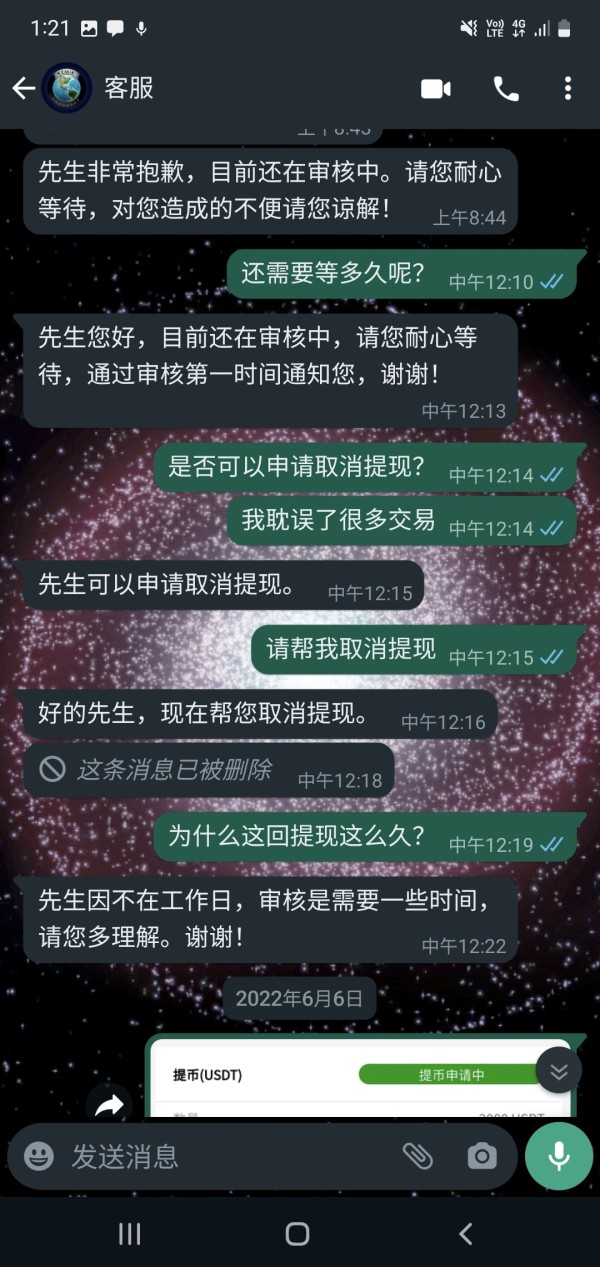

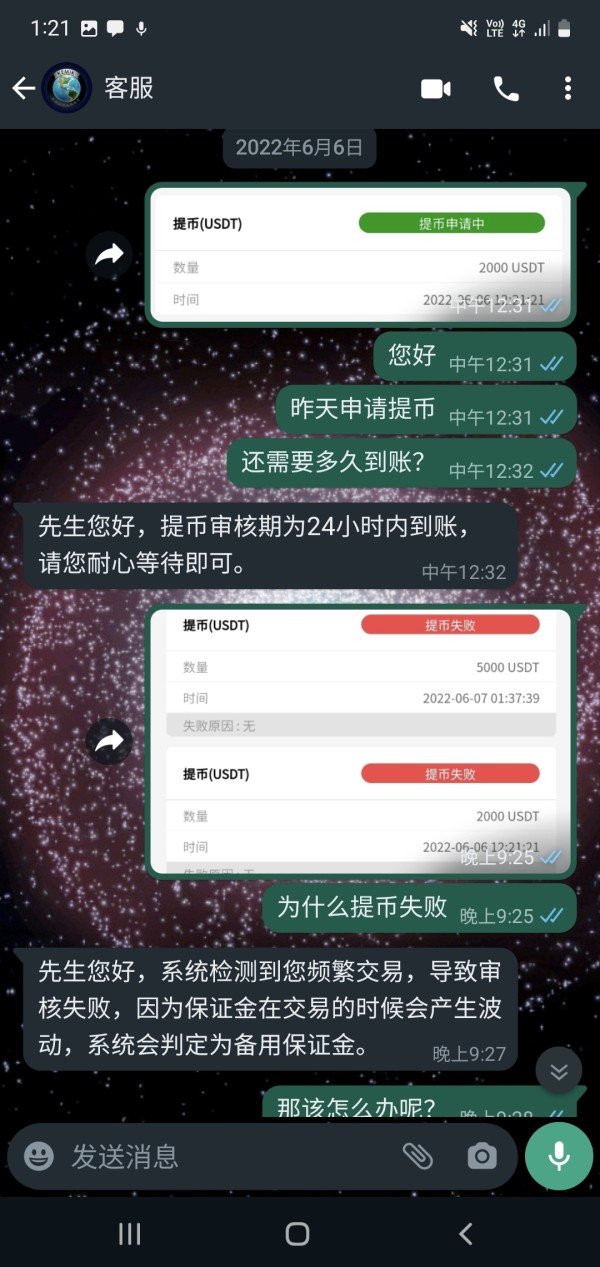

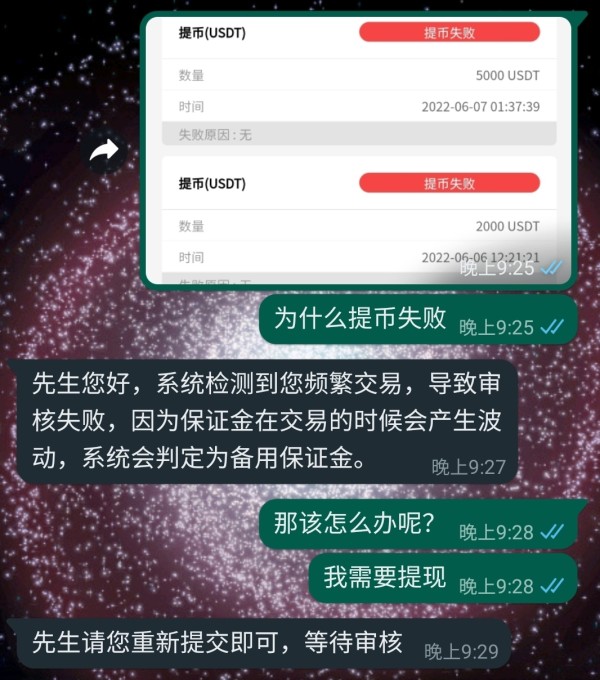

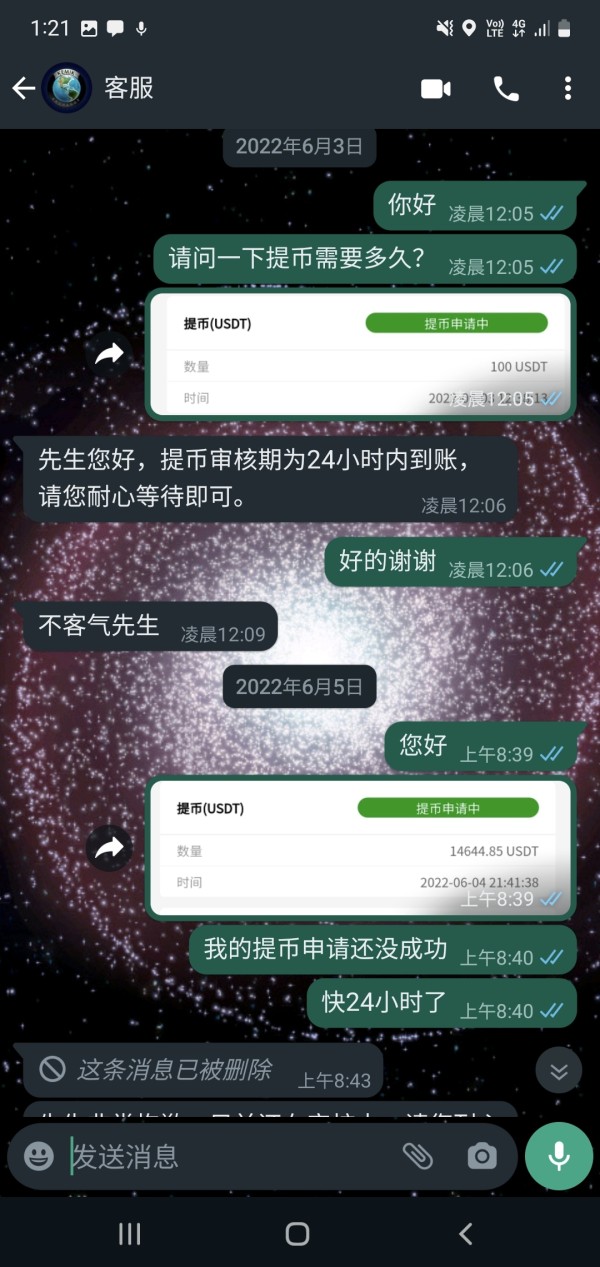

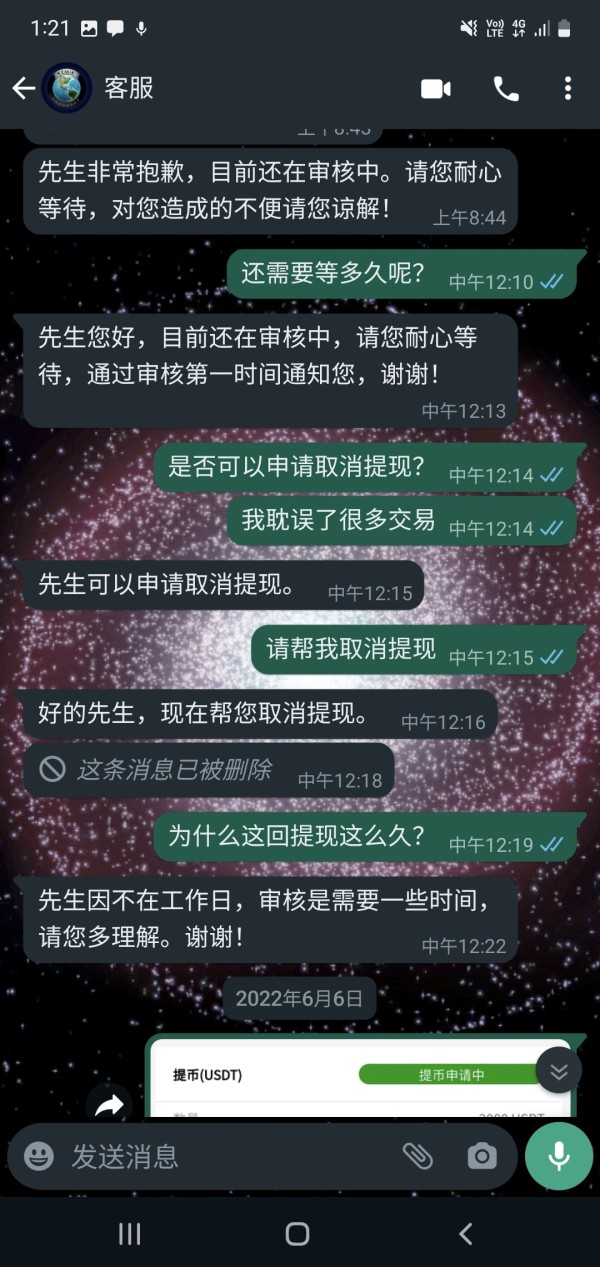

User feedback indicates particular challenges with support related to withdrawal processes. Several reports suggest inadequate assistance when traders encounter difficulties accessing their funds. Problem resolution effectiveness appears inconsistent. Some users report satisfactory outcomes while others describe ongoing issues that remain unresolved. These service inconsistencies contribute to the overall concerns about Kemik's operational reliability and commitment to customer satisfaction.

Trading Experience Analysis

The trading experience offered by Kemik shows some positive elements alongside significant concerns that potential users must carefully evaluate. According to user feedback, the platform demonstrates reasonable stability during normal trading operations. Some traders report smooth execution and minimal technical disruptions during their trading sessions. The zero-spread trading conditions represent the platform's most attractive feature. They potentially offer cost advantages for high-frequency traders or those focused on minimizing transaction costs.

Order execution quality receives mixed feedback. Some users note absence of significant slippage during their trading activities, while others express concerns about overall platform reliability. Platform functionality completeness is not comprehensively detailed in available sources. This limits assessment of advanced trading features, charting capabilities, and analytical tools that experienced traders typically require.

Mobile trading experience details are not specified in accessible documentation. This represents an increasingly important consideration for modern traders who require platform access across multiple devices. The trading environment's technical infrastructure appears adequate for basic operations. But the lack of detailed performance metrics and comprehensive user feedback makes it difficult to assess platform capabilities under various market conditions. This Kemik review emphasizes that while certain trading aspects may function adequately, the overall experience is significantly impacted by broader operational concerns.

Trust and Safety Analysis

Trust and safety represent the most concerning aspects of Kemik's operations. Multiple red flags exist that potential traders must seriously consider. The absence of clear regulatory information in available sources creates fundamental questions about oversight, compliance, and legal protections for trader funds. Reputable brokers typically maintain transparent regulatory status with recognized financial authorities. This lack of clarity represents a significant warning sign.

Fund security measures are not detailed in accessible sources. This limits understanding of how client deposits are protected, whether segregated accounts are maintained, or what insurance protections might exist. Company transparency is notably lacking. Limited information is available about corporate structure, management team, or operational history that would typically build confidence in a financial services provider.

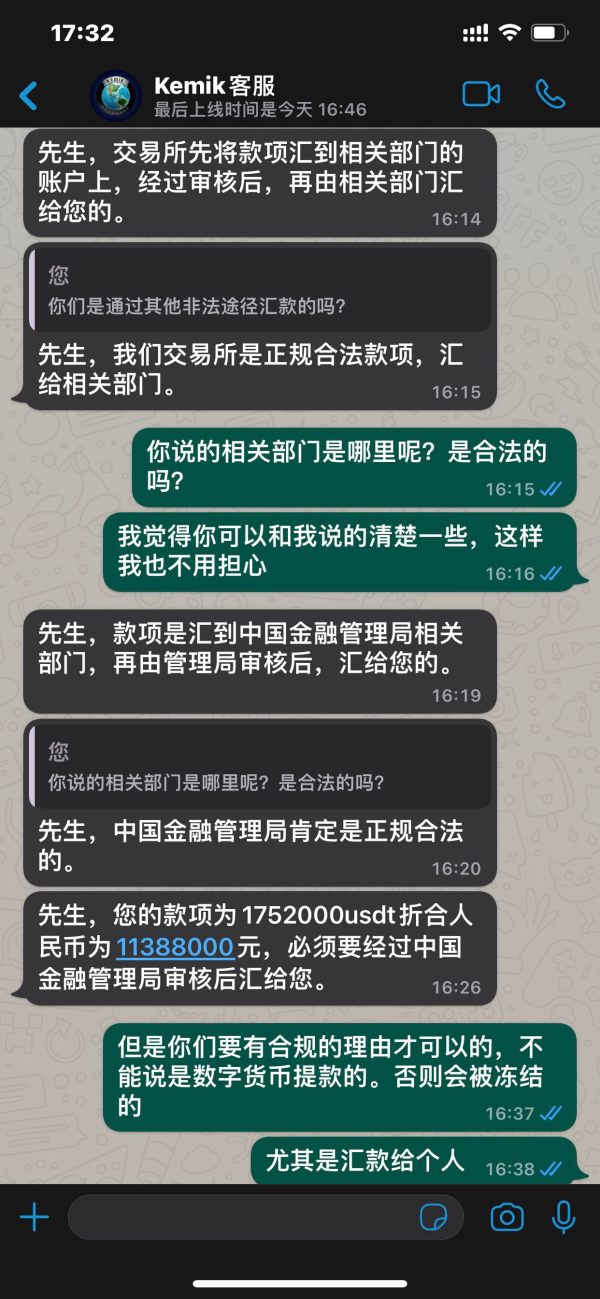

Industry reputation appears significantly damaged by user reports of fraudulent behavior and systematic withdrawal difficulties. Multiple trader complaints describe patterns suggesting potential scam operations. These include requests for additional payments during withdrawal processes and directing funds to private accounts rather than legitimate business accounts. These allegations, combined with the lack of regulatory oversight, create a highly concerning trust profile. Experienced traders would typically avoid such situations.

User Experience Analysis

Overall user satisfaction with Kemik shows significant polarization. Experiences range from satisfactory basic operations to severe difficulties that have led to fraud allegations. Interface design receives some positive feedback. Users note that the platform presents a friendly and accessible appearance that can appeal to newcomers in forex and cryptocurrency trading.

Registration and verification processes are not comprehensively detailed in available sources. The streamlined appearance suggests relatively straightforward account setup procedures. However, fund operation experiences reveal the platform's most significant weaknesses. Withdrawal difficulties represent the primary source of user complaints and negative feedback.

Common user complaints center around systematic withdrawal problems. Traders report delays, additional fee requests, and in some cases, complete inability to access their deposited funds. These operational issues significantly overshadow any positive interface elements. They create substantial barriers to user satisfaction. The user profile that might find Kemik initially appealing includes small to medium-sized investors seeking entry-level trading access. But the operational risks make it unsuitable for any trader prioritizing fund security and reliable access to their capital.

Conclusion

This comprehensive Kemik review reveals a broker with significant operational risks that substantially outweigh any potential benefits. While the platform offers zero-spread trading conditions and maintains a user-friendly interface, these positive elements are overshadowed by serious concerns. These include withdrawal difficulties, potential fraudulent practices, and lack of regulatory transparency. The broker is not recommended for investors who prioritize security, reliability, and regulatory protection in their trading activities. Traders seeking legitimate forex and cryptocurrency trading opportunities should consider established, regulated alternatives. These provide transparent operations and reliable fund access.