England Capital 2025 Review: Everything You Need to Know

Executive Summary

This england capital review gives traders and investors a complete analysis of what seems to be a trading platform or service linked to England's financial sector. London, as England's capital, has kept its spot as one of the world's top financial centers for almost 2,000 years. Its ancient core serves as a major hub for global finance. The City of London was founded by the Romans as Londinium and still keeps its medieval boundaries while working as a modern financial powerhouse.

However, we must note that specific information about England Capital as a separate brokerage company stays limited in available sources. This review looks at the broader context of UK-based trading platforms and the rules that control financial services in England's capital. London's reputation as an expensive city reaches into its financial services sector. Traders often face higher costs but get strong regulatory oversight and access to global markets.

Important Disclaimer

We have limited specific information about England Capital as a separate brokerage company. This review uses general information about UK-based trading platforms and the London financial market environment. Readers should know that regulatory requirements and service offerings can change a lot between different companies operating within the UK financial services sector.

The evaluation method used in this england capital review relies on publicly available information and industry standards for UK-based financial services providers. However, we lack detailed regulatory information and user feedback data. This means potential clients should do additional research before making any investment decisions.

Rating Framework

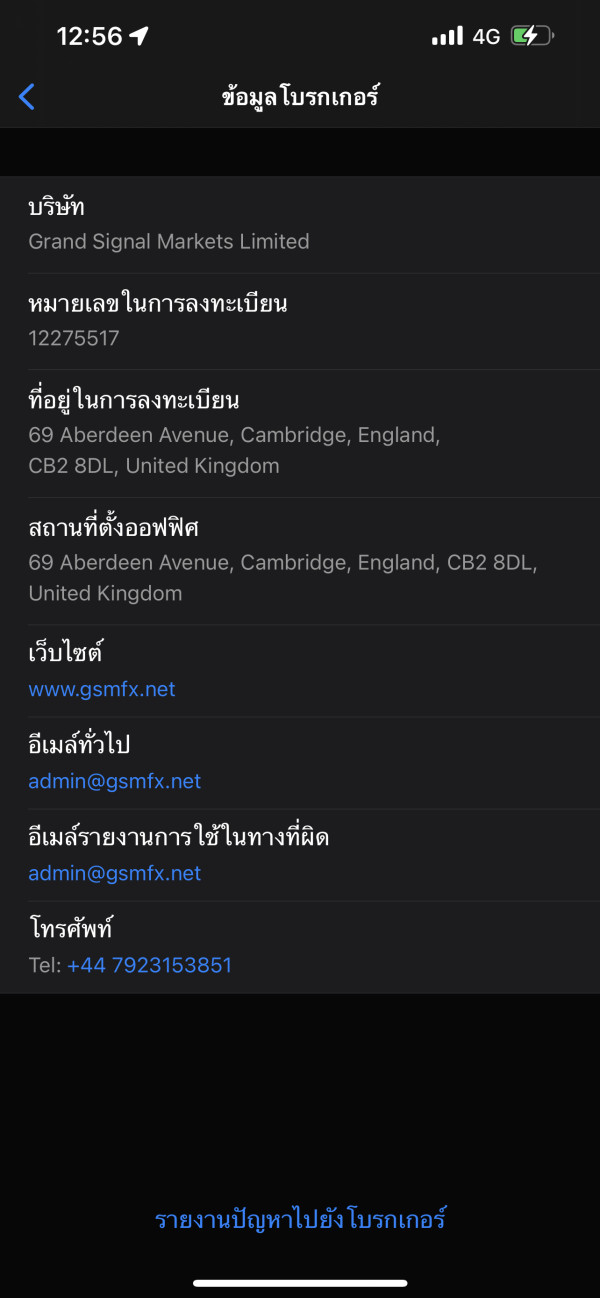

Broker Overview

England Capital operates within London's established financial ecosystem. This system has served as a major settlement and trading hub for almost two thousand years. The broader UK trading platform landscape shows significant diversity. Multiple FCA-regulated brokers serve both individual and institutional clients. According to industry sources, there are currently 11 major online brokers operating in the United Kingdom that work well for UK-based traders.

The London financial district provides the regulatory and infrastructural backbone for numerous trading platforms and investment services. This is especially true for the City of London. This historic financial center sits on the River Thames in southeast England. It continues to attract both domestic and international trading firms because of its established regulatory framework and global market access capabilities.

The UK brokerage industry has evolved significantly in recent years. Platforms offer various account types, trading tools, and asset classes to accommodate different investor profiles. However, specific details about England Capital's position within this competitive landscape require further investigation. Comprehensive information about their particular service offerings and regulatory status remains limited in current market analyses.

Regulatory Status: Specific regulatory information for England Capital was not detailed in available sources. UK-based trading platforms typically operate under FCA oversight.

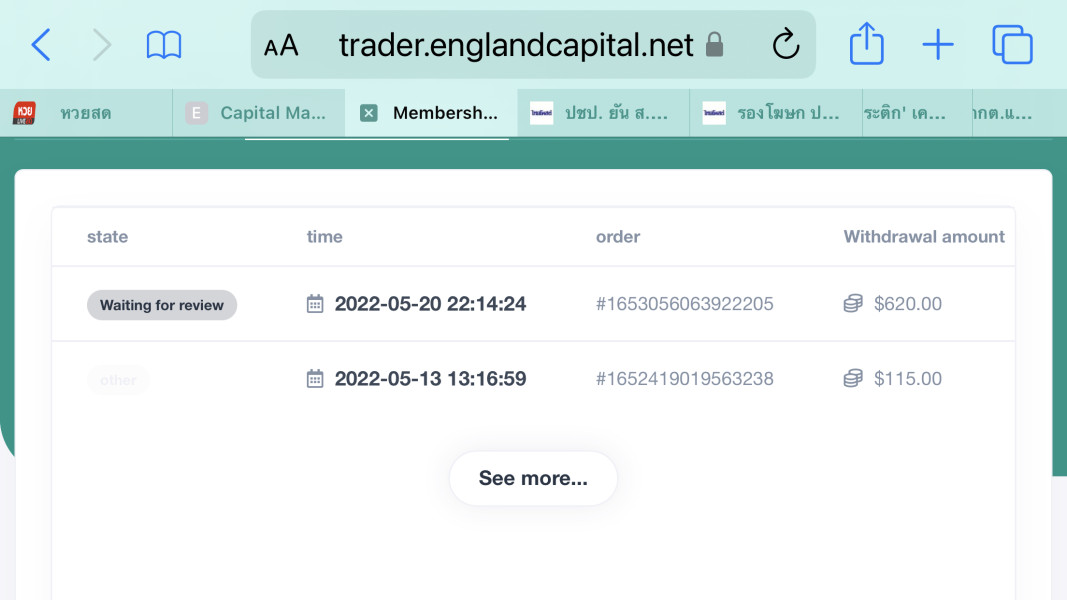

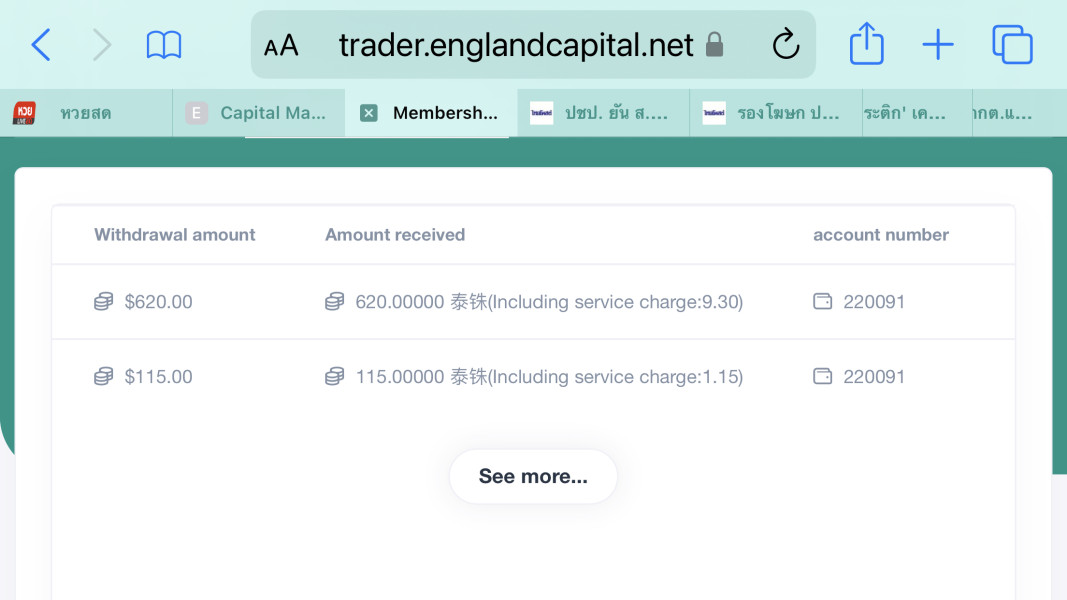

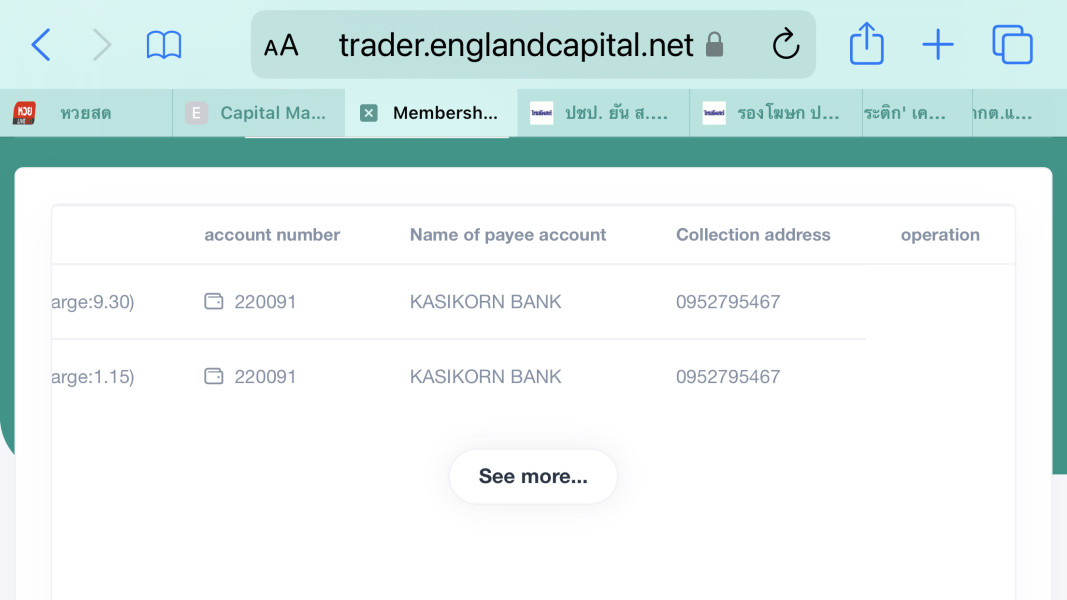

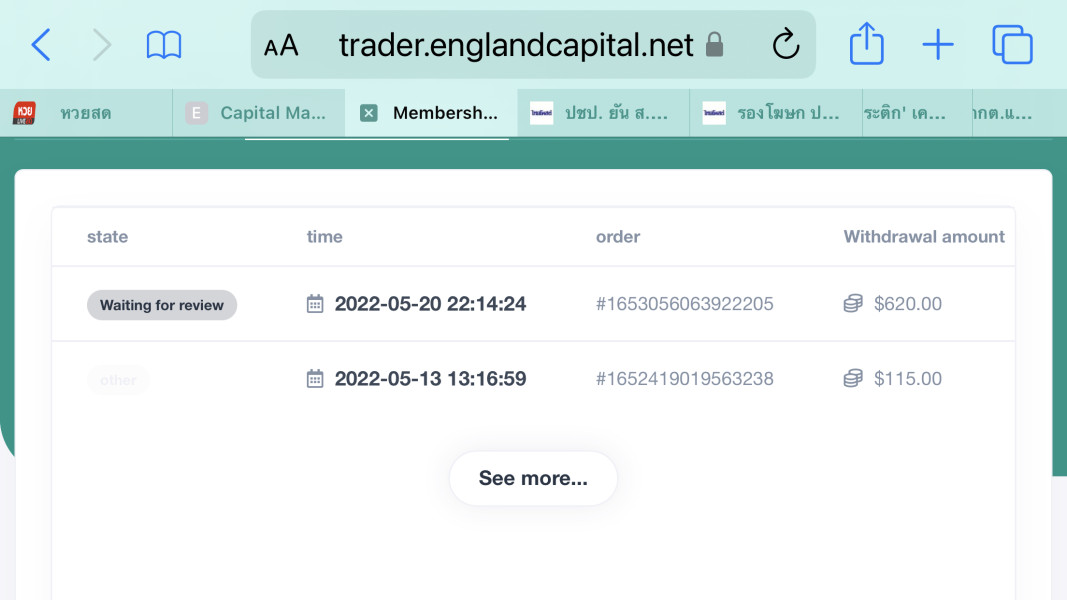

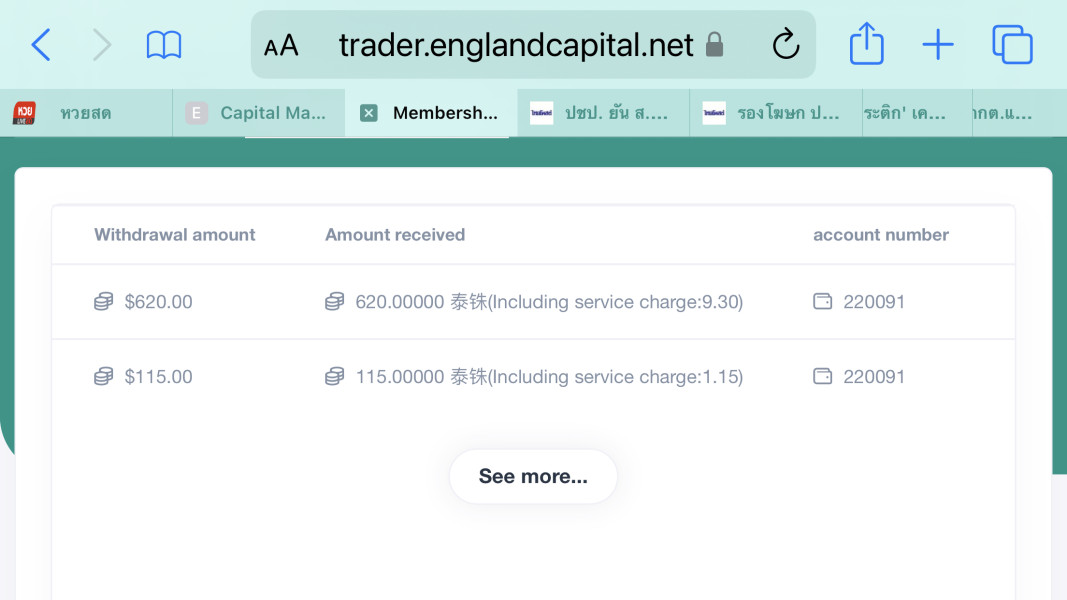

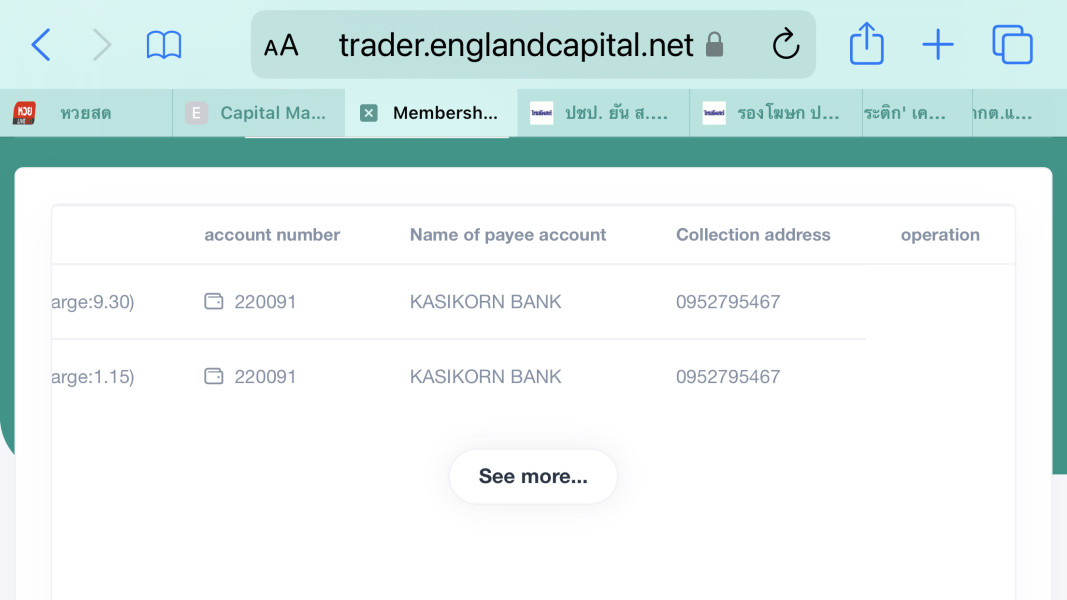

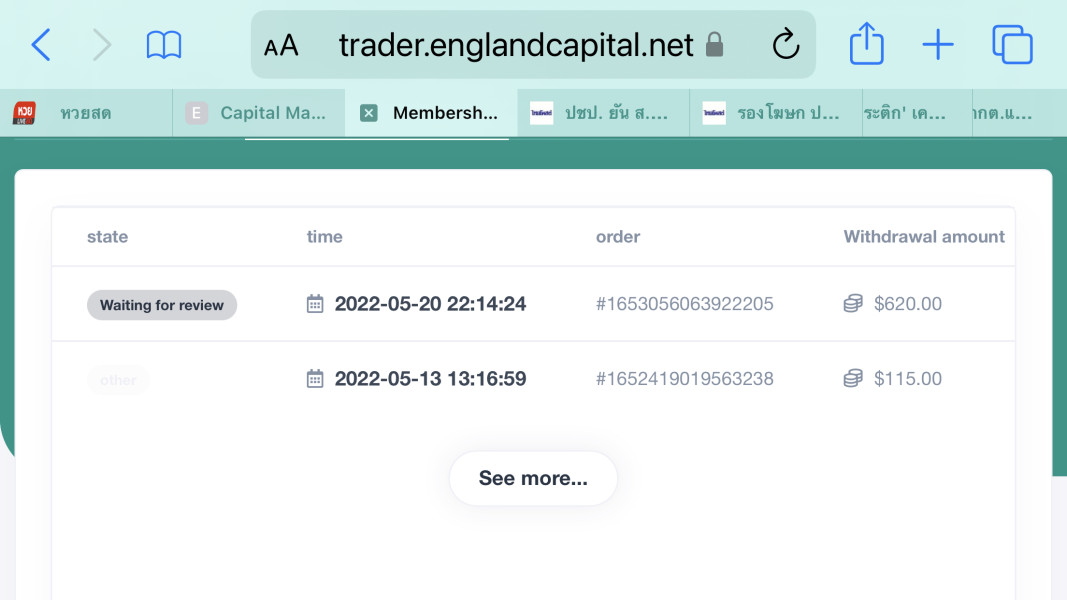

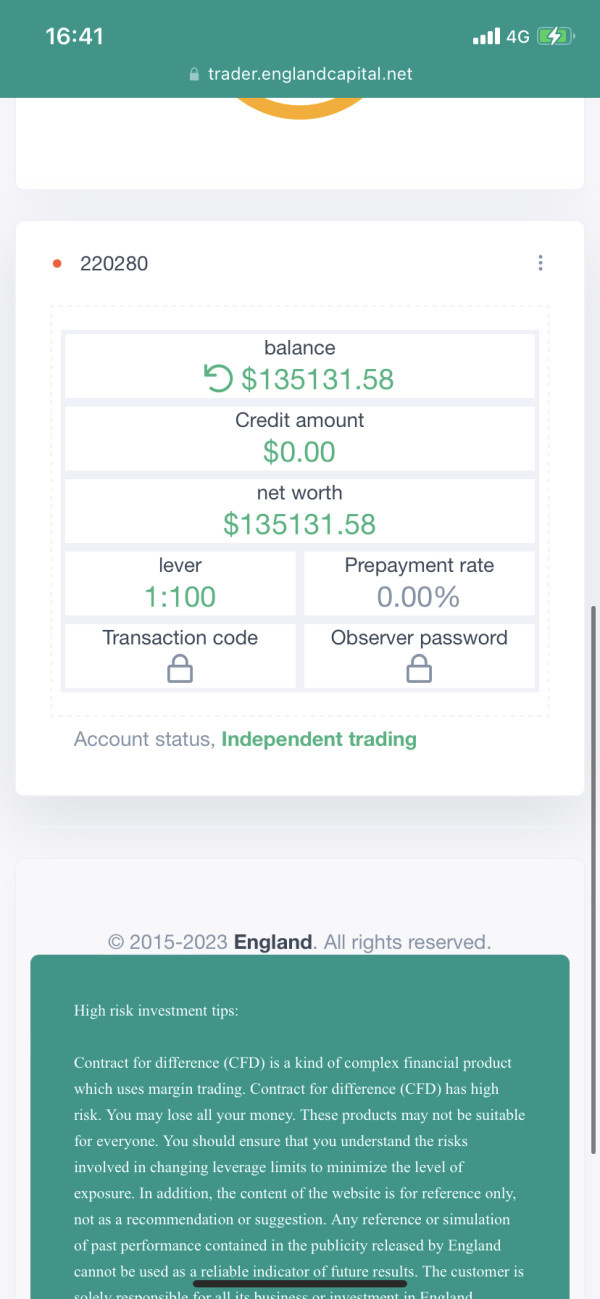

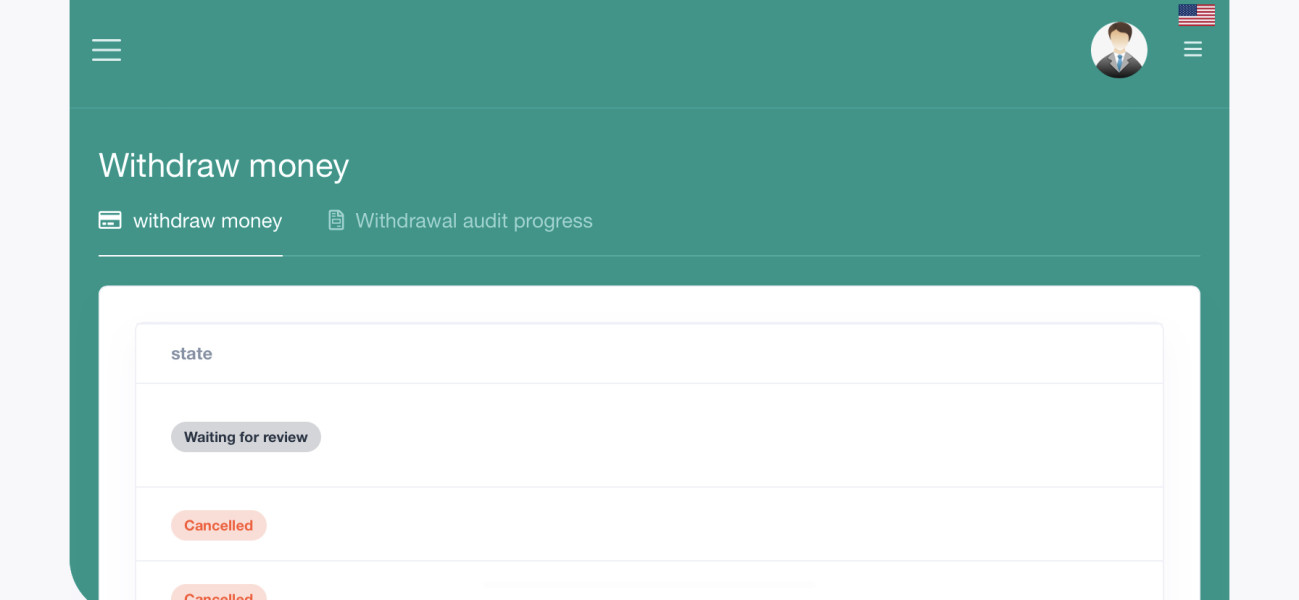

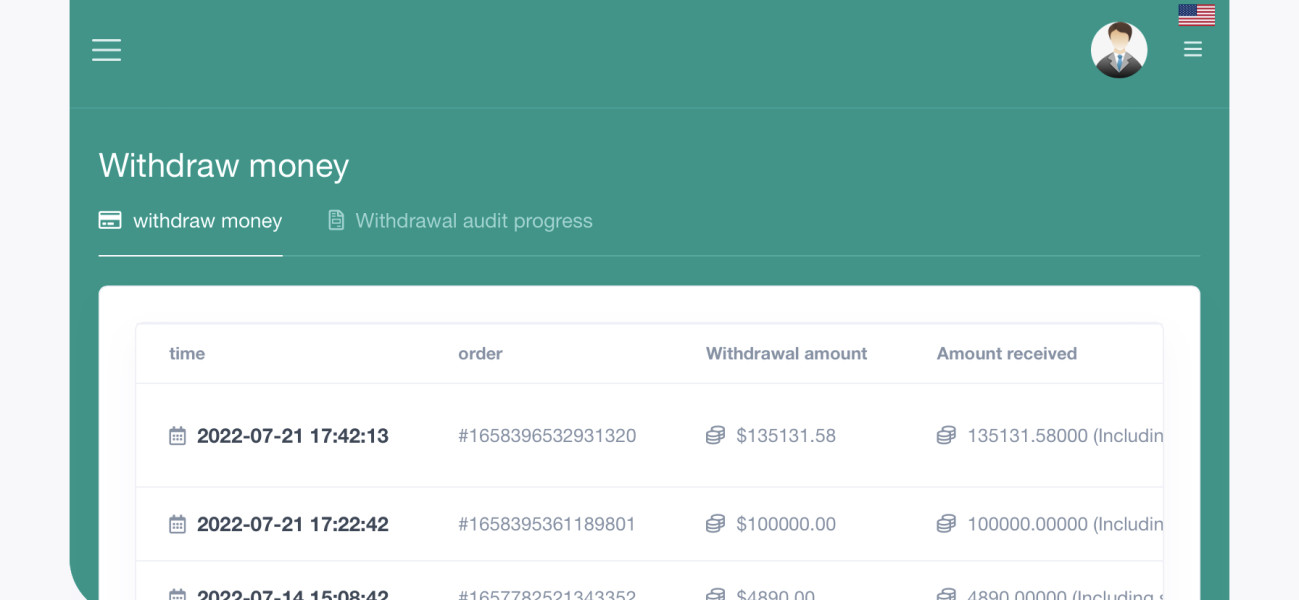

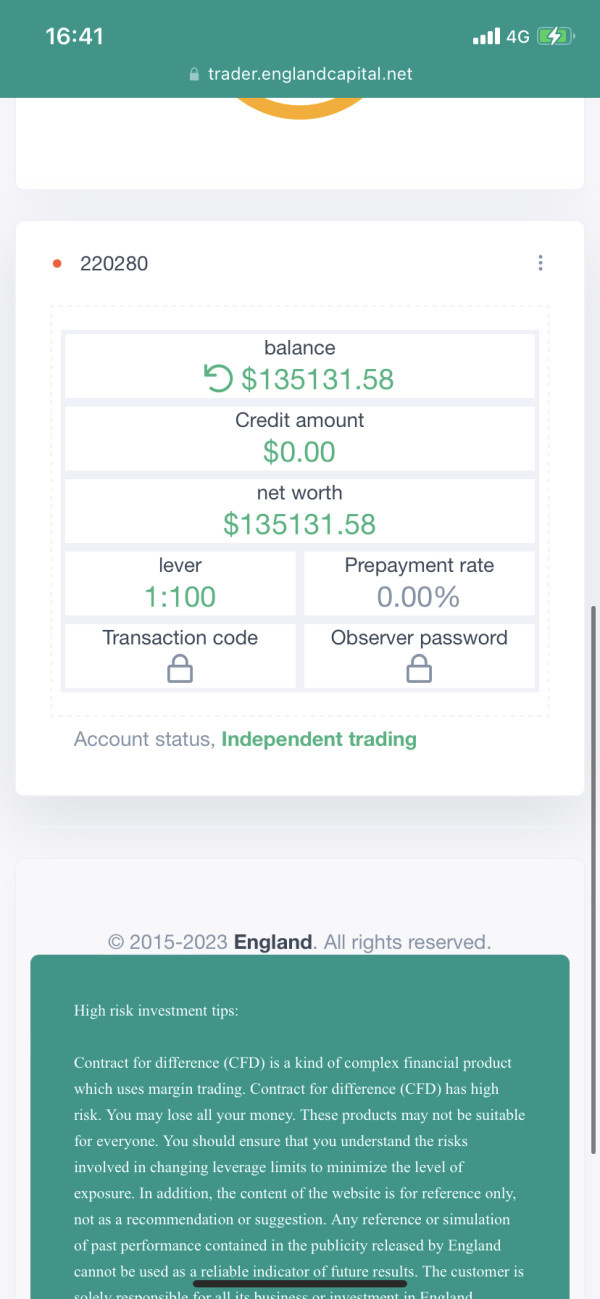

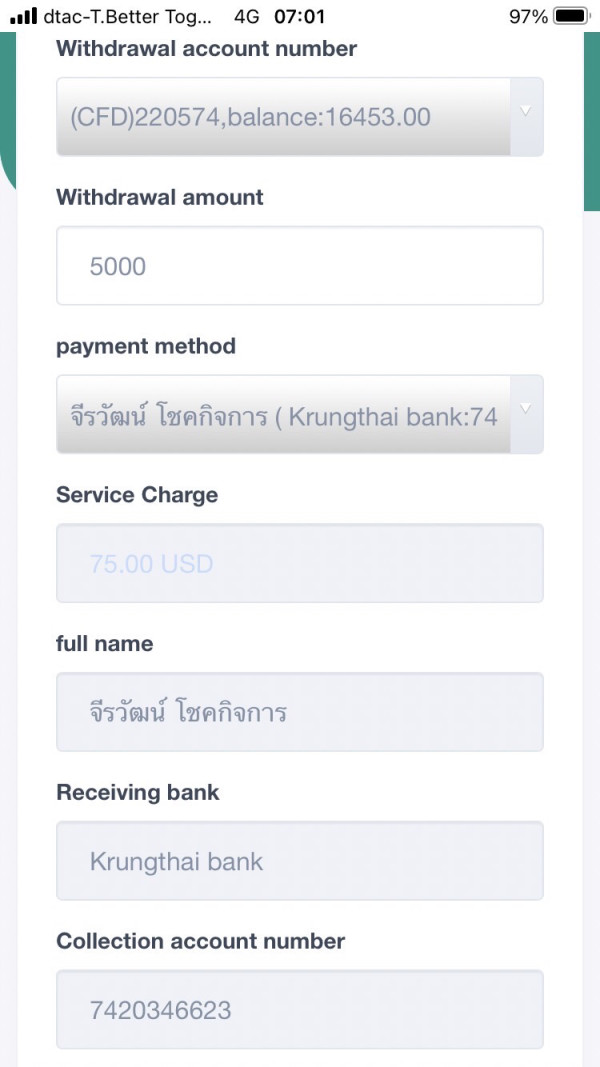

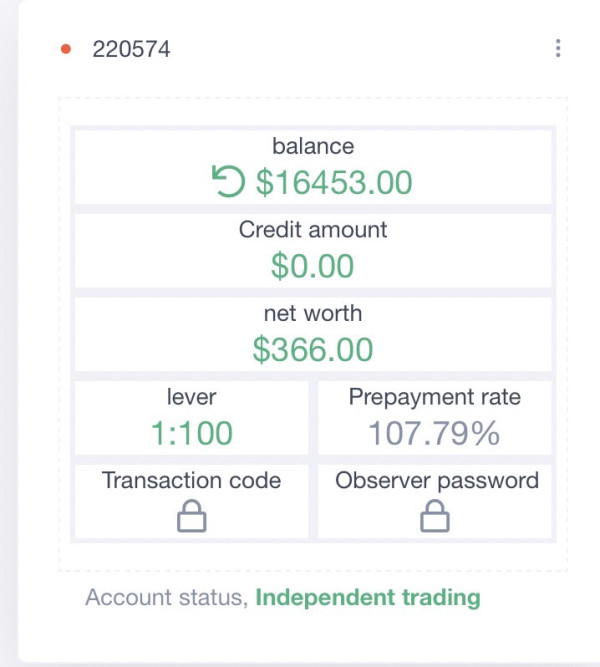

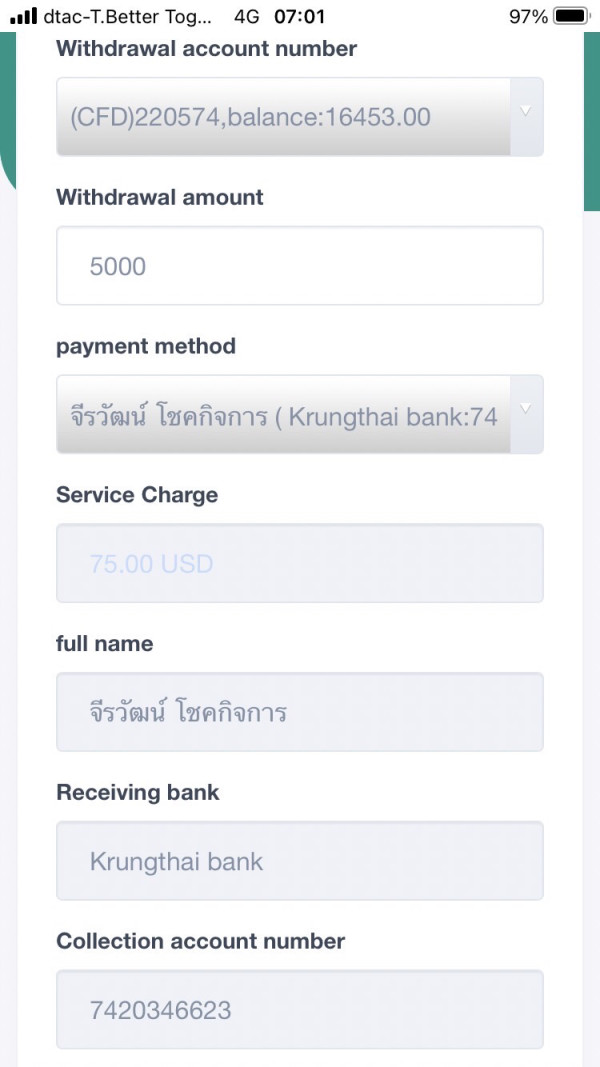

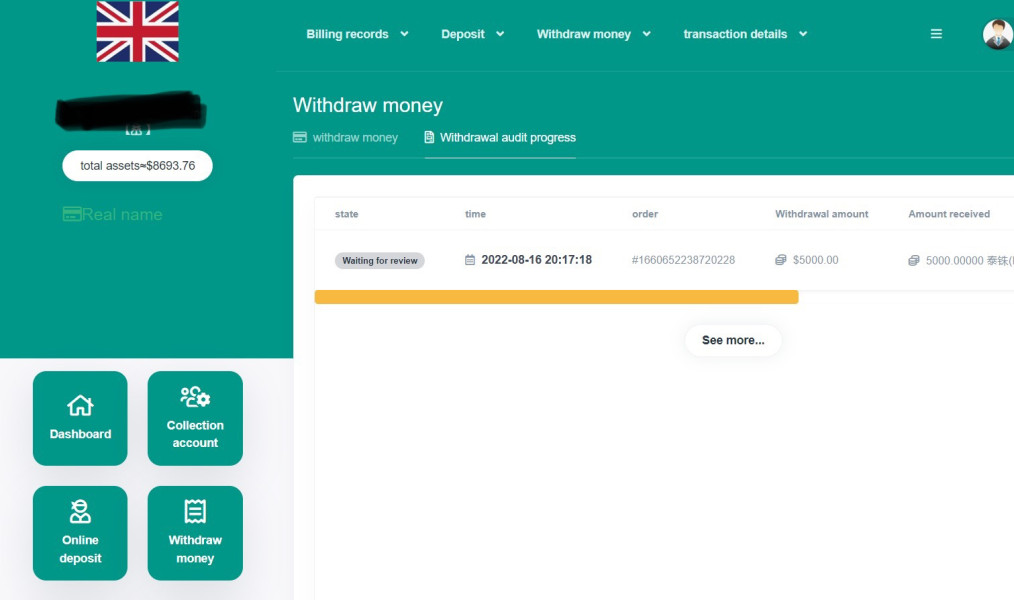

Deposit and Withdrawal Methods: Payment processing options and withdrawal procedures are not specified in current documentation.

Minimum Deposit Requirements: Entry-level investment thresholds have not been clearly defined in available materials.

Promotional Offers: Current bonus structures or promotional campaigns are not detailed in existing information sources.

Available Trading Assets: The range of tradeable instruments and asset classes remains unspecified in this england capital review.

Fee Structure: Commission rates, spreads, and other trading costs are not outlined in accessible documentation.

Leverage Options: Maximum leverage ratios and margin requirements are not clearly stated.

Platform Selection: Trading software options and platform compatibility details are not provided.

Geographic Restrictions: Service availability by region or country-specific limitations are not specified.

Customer Support Languages: Multi-language support capabilities are not documented.

Account Conditions Analysis

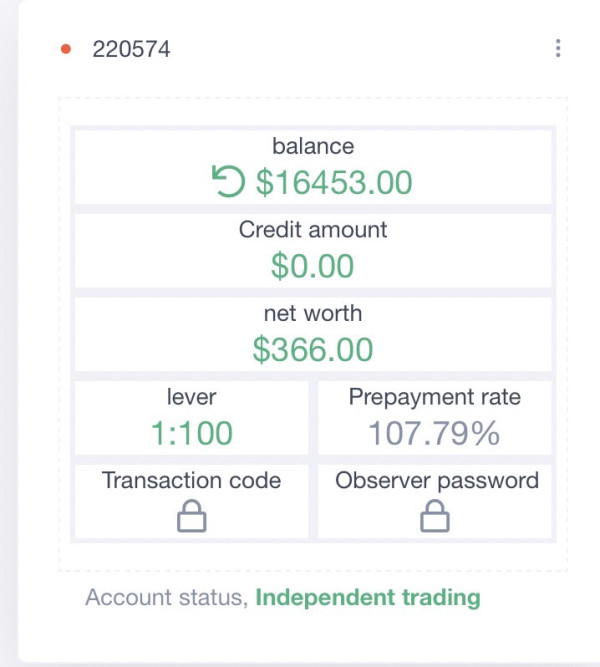

The account conditions evaluation for this england capital review faces significant limitations. We lack sufficient specific information about account types, minimum deposit requirements, and opening procedures. Industry standards in the UK typically require brokers to offer multiple account tiers. These accommodate different trader profiles, from beginners to institutional clients.

UK-based trading platforms generally implement tiered account structures with varying minimum deposits. These range from basic retail accounts with lower entry requirements to premium accounts offering enhanced features and reduced trading costs. However, without specific documentation about England Capital's account offerings, we cannot assess how their conditions compare to industry benchmarks.

The account opening process for UK brokers typically involves identity verification, address confirmation, and financial suitability assessments. These comply with FCA requirements. Most platforms also implement risk warnings and appropriateness tests. These ensure clients understand the risks associated with leveraged trading products.

Account management features such as negative balance protection, segregated client funds, and deposit insurance coverage are standard expectations for FCA-regulated brokers. However, England Capital's specific implementation of these protective measures requires further clarification from official sources.

Trading tools and educational resources represent critical components of any comprehensive brokerage offering. Yet specific information about England Capital's platform capabilities remains unavailable in current market documentation. The broader UK trading platform landscape typically includes advanced charting packages, technical analysis indicators, and automated trading system support.

Research and analysis resources commonly provided by UK brokers include daily market commentary, economic calendar integration, and fundamental analysis reports covering major asset classes. However, without detailed information about England Capital's research department or analytical capabilities, we cannot assess their competitive position in this crucial service area.

Educational resources have become increasingly important for UK brokers. Many platforms offer webinar series, trading courses, and risk management tutorials to support client development. The absence of specific information about England Capital's educational initiatives limits our ability to evaluate their commitment to trader education and skill development.

Platform integration capabilities include API access for algorithmic trading and third-party tool compatibility. These represent advanced features that distinguish premium brokers from basic service providers. However, England Capital's technical capabilities in these areas remain undefined.

Customer Service and Support Analysis

Customer service quality represents a fundamental aspect of broker evaluation. However, specific information about England Capital's support infrastructure is not available in current documentation. UK-based brokers typically provide multiple contact channels including telephone support, live chat functionality, and email correspondence systems.

Response time standards vary across the industry. Premium brokers often guarantee response times within specific timeframes for different inquiry types. Phone support availability during London trading hours is generally expected. Some brokers extend coverage to accommodate international client bases across different time zones.

Multi-language support capabilities have become increasingly important as UK brokers expand their international client acquisition efforts. However, England Capital's specific language support options and geographic service coverage remain unspecified in available materials.

Problem resolution procedures and escalation processes are critical service elements. This is particularly true for time-sensitive trading issues or account access problems. Without detailed information about England Capital's support protocols and service level commitments, potential clients cannot adequately assess their customer service standards against industry benchmarks.

Trading Experience Analysis

Platform performance and execution quality represent core elements of the trading experience. However, specific technical specifications for England Capital's trading infrastructure are not available in current market documentation. UK brokers typically emphasize execution speed, price accuracy, and platform stability as key competitive differentiators.

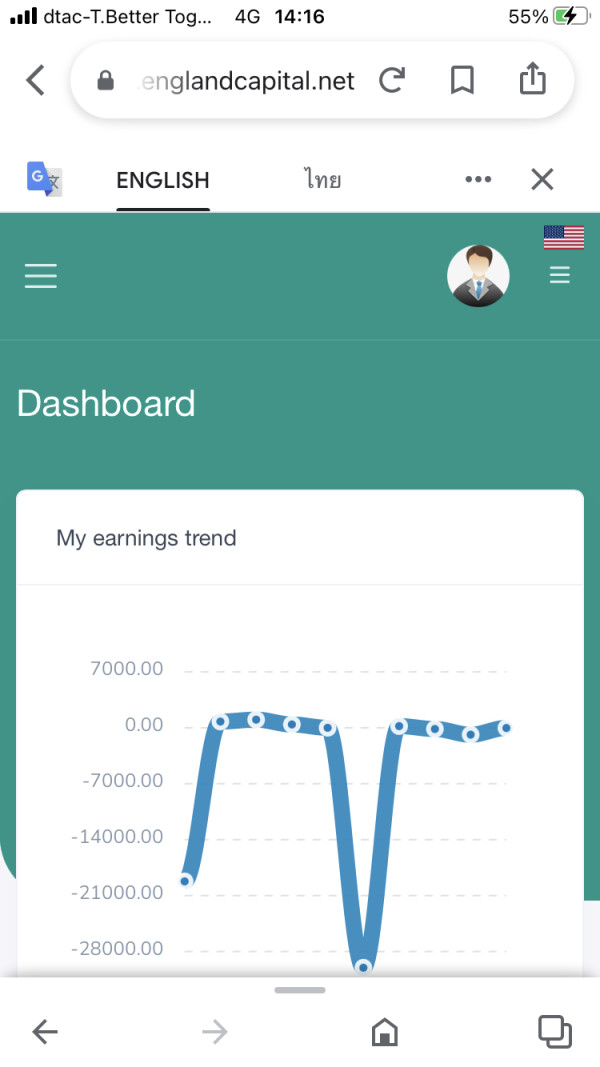

Order execution quality includes fill rates, slippage statistics, and rejection rates. These provide measurable indicators of platform performance that informed traders use to evaluate potential brokers. However, this england capital review cannot provide specific execution metrics. This is due to the absence of detailed performance data in available sources.

Mobile trading capabilities have become essential features for modern brokers. Most UK platforms offer dedicated mobile applications for iOS and Android devices. Cross-platform synchronization, offline chart access, and mobile-optimized order management represent standard expectations for contemporary trading applications.

Platform functionality assessments typically examine charting capabilities, order type variety, and risk management tools. Advanced features such as one-click trading, algorithmic strategy deployment, and multi-asset portfolio management distinguish professional-grade platforms from basic retail offerings. However, England Capital's specific feature set requires further investigation.

Trust and Reliability Analysis

Regulatory compliance and financial security represent paramount concerns for traders selecting a broker. This is particularly true in the current environment of increased regulatory scrutiny. The Financial Conduct Authority serves as the primary regulator for UK-based brokers. It implements comprehensive oversight procedures and consumer protection measures.

Client fund segregation requirements mandate that regulated brokers maintain client deposits in separate accounts from operational funds. This provides essential protection against potential business failures. Additionally, the Financial Services Compensation Scheme typically provides coverage up to £85,000 per client for authorized firms.

Company transparency measures include published financial statements, regulatory disclosures, and ownership structure documentation. These enable clients to assess broker stability and operational integrity. However, specific information about England Capital's regulatory status, financial backing, and transparency measures is not available in current documentation.

Industry reputation assessment typically involves examining regulatory history, client complaint records, and third-party ratings from financial industry organizations. The absence of detailed regulatory and reputational information limits this review's ability to provide definitive trust assessments for England Capital.

User Experience Analysis

Overall user satisfaction represents the culmination of all service elements. This includes everything from initial account opening through ongoing trading activities and customer support interactions. However, specific user feedback and satisfaction metrics for England Capital are not available in current market documentation.

Interface design and usability factors significantly impact trader productivity and satisfaction levels. Modern trading platforms typically emphasize intuitive navigation, customizable layouts, and efficient order placement procedures. These minimize execution delays and reduce user errors.

Registration and verification processes vary among UK brokers. Some implement streamlined digital onboarding while others maintain more traditional documentation requirements. Account verification timeframes and document acceptance procedures represent practical concerns for prospective clients evaluating different broker options.

Common user concerns in the UK brokerage industry include withdrawal processing times, customer service responsiveness, and platform reliability during volatile market conditions. Without access to England Capital's user feedback data and satisfaction surveys, this review cannot provide specific insights into client experiences or recurring service issues.

Conclusion

This england capital review highlights the challenges of evaluating a trading platform when comprehensive information remains limited. While London's position as a leading global financial center provides a strong regulatory and infrastructural foundation for trading services, we lack specific details about England Capital's offerings, regulatory status, and client feedback. This prevents a definitive assessment.

The neutral evaluation reflects the information limitations rather than any specific service deficiencies. Potential clients interested in England Capital should conduct additional research, verify regulatory compliance, and request detailed information about trading conditions, fees, and platform capabilities before making investment decisions.

For traders seeking UK-based brokerage services, the broader market offers numerous FCA-regulated alternatives. These come with transparent fee structures, comprehensive educational resources, and established track records of regulatory compliance and client service.