Executive Summary

Cometa is a new entrant into the highly competitive world of CFD trading, having launched in 2024. This platform presents traders with a diverse array of asset classes ranging from forex and commodities to cryptocurrencies. While Cometa claims to offer low-cost trading options, promising access to competitive spreads and various financial products, it is essential to examine the substantial regulatory and transparency concerns that accompany its offering. Novice traders or those who prioritize regulatory compliance may find Cometa unsuitable due to reported issues surrounding user safety and potential withdrawal difficulties. On the other hand, experienced traders might view Cometa as an opportunity to capitalize on its diverse asset offerings, provided they fully understand the inherent risks associated with CFD trading.

⚠️ Important Risk Advisory & Verification Steps

Warning: Trading on Cometa involves significant risk. Below are crucial details that traders must be aware of:

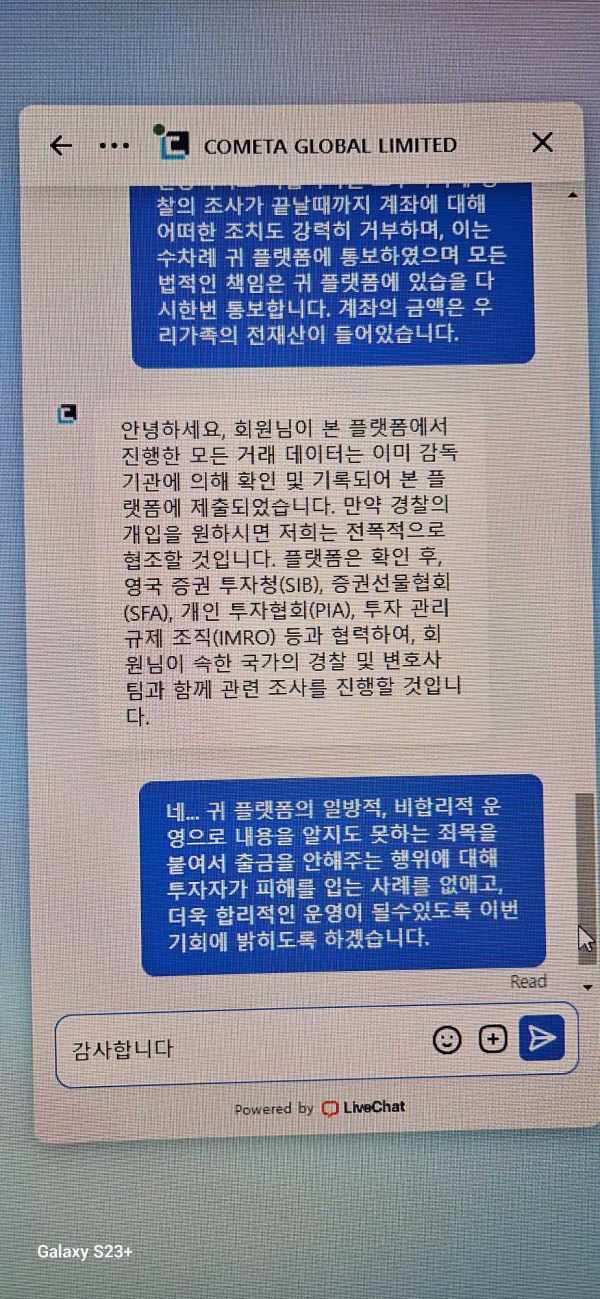

- Unclear Regulatory Oversight: Cometa has not demonstrated reliable regulatory compliance.

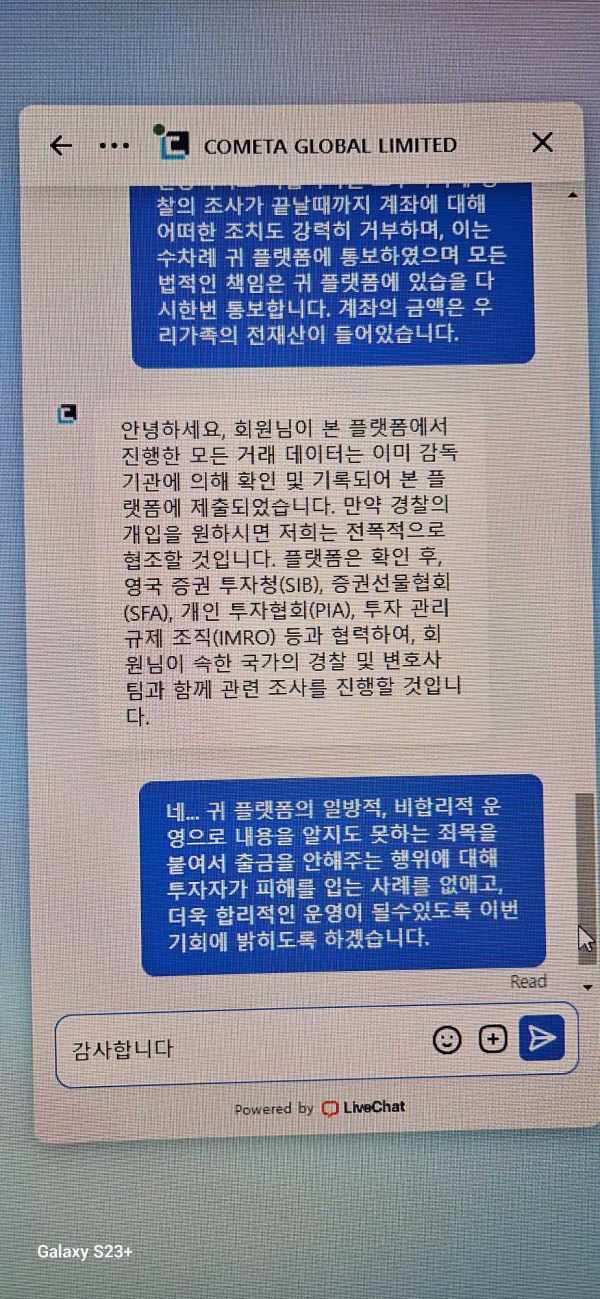

- User Complaints: Numerous users have reported issues with fund safety and withdrawal challenges.

- Fraudulent Activities: The broker has been flagged as suspected fraud in various reviews.

Steps to Verify the Broker:

- Check Regulatory Affiliations: Visit the official regulatory websites (such as the FCA, ASIC, or NFA) to see if Cometa is listed or regulated.

- Examine User Reviews: Look for forums and independent review sites to find credible user feedback.

- Contact Customer Support: Test customer support capabilities and responsiveness through emails or direct inquiries.

- Search for Broker History: Investigate other names that the broker might operate under to ascertain its legitimacy.

Rating Framework

Broker Overview

Company Background and Positioning

Cometa Global Limited launched the Cometa platform in September 2024, headquartered in China but claiming regulatory compliance in the United States under the Financial Crimes Enforcement Network (FinCEN). However, the company has not provided detailed licensing information, casting doubts on its operational legitimacy. Given its relatively recent establishment and lack of regulatory scrutiny, potential clients must approach with caution.

Core Business Overview

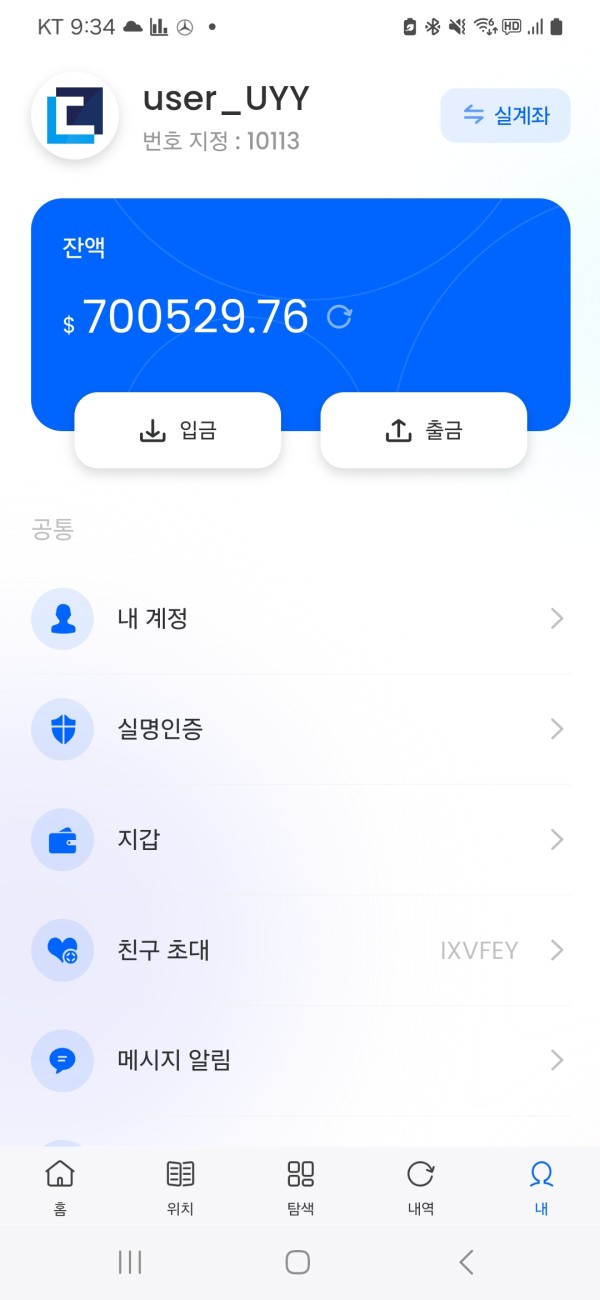

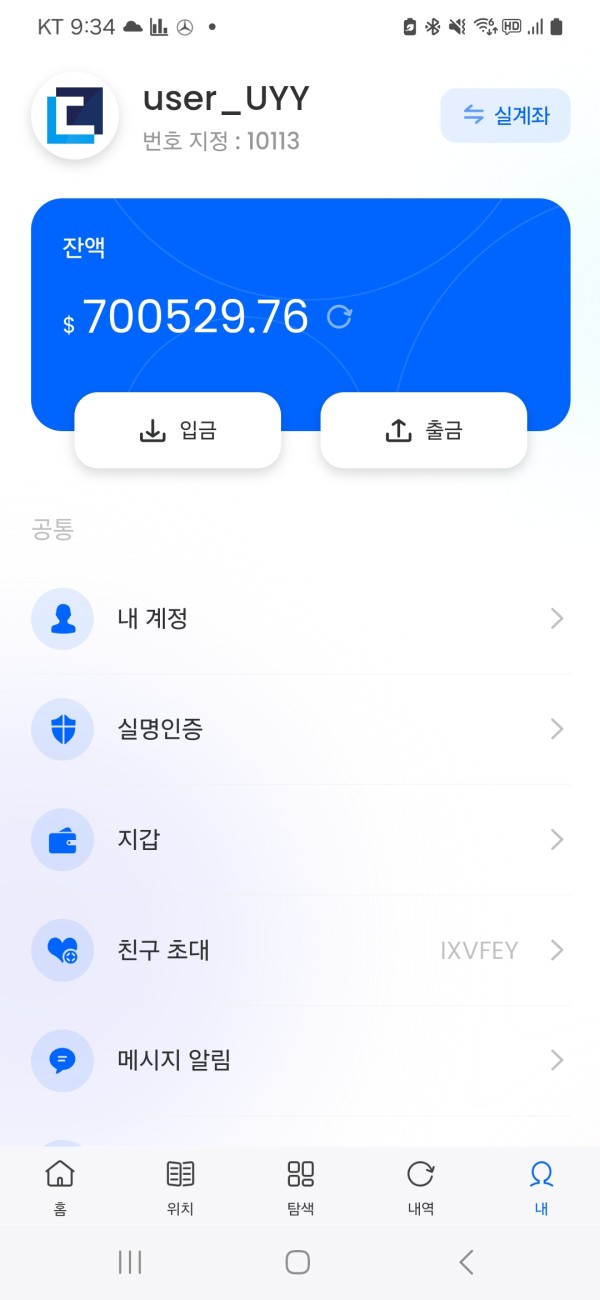

Cometa positions itself as a multi-asset CFD broker, offering trading across various categories, including forex, precious metals, crude oil, indices, and cryptocurrencies. Despite its broad asset offerings, the platform has drawn scrutiny for not disclosing key operational details such as minimum deposit requirements, leverage options, and trading commissions—crucial information that traders need for informed decision-making.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Interpretative Focus: Understanding and managing uncertainty in trading practices is vital for any prospective user looking to engage with a broker like Cometa.

Regulatory Information Conflicts: The lack of clear registration with leading regulatory bodies raises serious questions regarding Cometas legitimacy. Users are encouraged to scrutinize any conflicting information, as the broker's homepage inconsistently mentions varying affiliations.

User Self-Verification Guide: Heres a step-by-step guide on how to verify Cometa using authoritative regulatory websites:

Visit the NFA's BASIC database.

Enter the brokers name, "Cometa Global Limited."

Review any available licensing information.

Check for user complaints or negative reports on trader forums.

Assess the information against user experiences shared on trusted review platforms.

User Feedback Summary: "Multiple users have expressed concerns regarding safety and withdrawals, labeling the platform as potentially fraudulent."

Trading Costs Analysis

Interpretative Focus: The complexity of trading costs reveals both advantages and potential pitfalls.

Advantages in Commissions: Users have reported competitive trading commissions with spreads starting from 0, which could be appealing for high-frequency traders who focus on minimizing trading costs.

The "Traps" of Non-Trading Fees: Users have cited additional fees that may apply. For instance, "$25 withdrawal fee," highlighting hidden costs that could affect overall trading profitability.

Cost Structure Summary: Cometa's low commissions could attract experienced traders, but the additional costs associated with withdrawals could mislead novice traders about the real cost of trading on this platform.

Interpretative Focus: Balancing the depth of functionality against the ease of use.

Platform Diversity: Cometa reports offering various platforms such as MT5 and a self-developed application. However, inconsistencies regarding the availability and functionality of these platforms have surfaced.

Quality of Tools and Resources: While the advertised self-developed platform features advanced charting tools and more than 50 built-in technical indicators, users have expressed frustration over discrepancies in the mobile application availability.

User Feedback Summary: "While the tools seem robust, the application issues frustrated many users, negatively impacting their trading experience."

User Experience Analysis

Interpretative Focus: Understanding user satisfaction levels and areas needing improvement.

Interface and Navigation: The platform's design aims to provide an intuitive experience, but users often report challenges in navigating its features, resulting in a steep learning curve.

Withdrawal and Deposit Processes: Many users have noted complications in the withdrawal process, which has led to dissatisfaction and reduced overall trust in the platform.

User Feedback Summary: "The withdrawal frustrations have led to a predominantly negative sentiment regarding the overall user experience on Cometa."

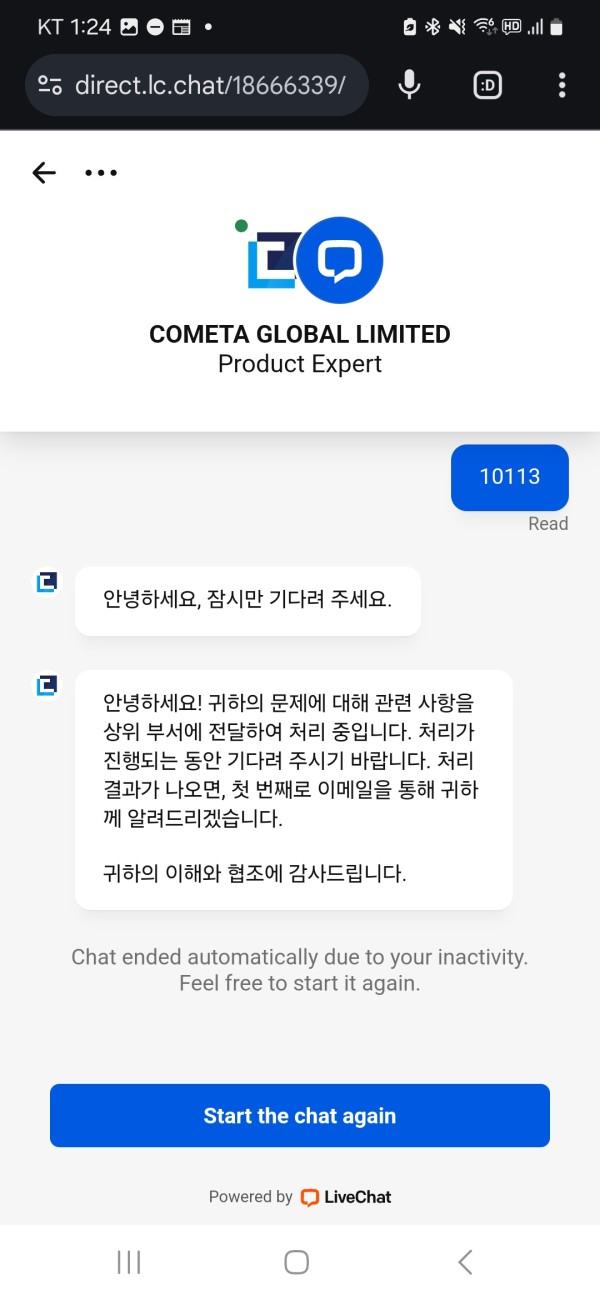

Customer Support Analysis

Interpretative Focus: Evaluating the effectiveness of support systems in resolving user issues.

Channels of Support: User-reported limitations on support channels raise concerns about how effectively Cometa resolves user queries given the lack of mainstream social media presence.

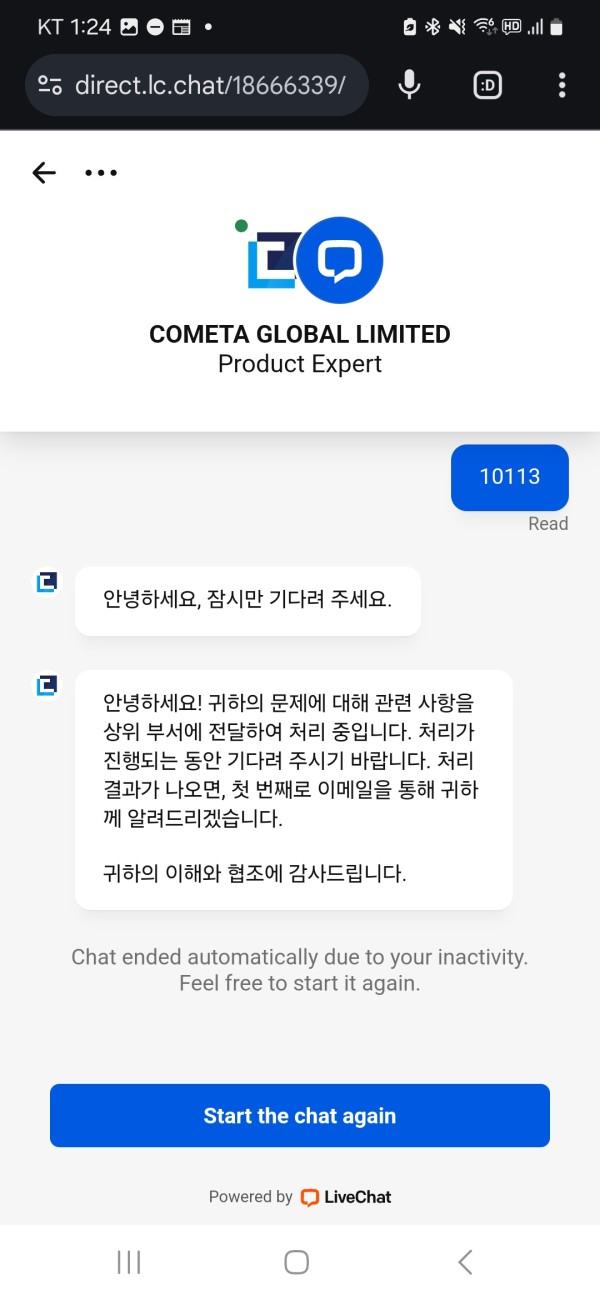

Responsiveness: Feedback indicates slow responses from customer support, resulting in long wait times and inadequate resolutions to user issues.

User Feedback Summary: "Users expressed dissatisfaction with long response times and limited support options."

Account Conditions Analysis

Interpretative Focus: Ensuring comprehensive knowledge of account requirements and conditions to mitigate trader risks.

Required Information Disclosure: The absence of transparency regarding essential trading conditions, including deposit minimums, leverage capabilities, and margin policies, frustrates prospective clients.

Risk Assessment Criteria: Users seeking to evaluate their risk in CFD trading should be wary of engaging with a platform that fails to provide necessary operational insights.

User Feedback Summary: "The vague information regarding account conditions makes it challenging for users to understand the risks they're taking."

Conclusion and Final Thoughts

In summary, while Cometa may appear to offer lucrative trading opportunities with low-cost trading fees across a broad spectrum of assets, serious regulatory and transparency issues loom overhead, cautioning potential investors. With numerous users flagging concerns over fund safety and the brokers overall credibility, it is paramount that traders conduct exhaustive due diligence. As such, novice participants should be particularly wary, whereas experienced traders must weigh the potential rewards against the considerable risks present.

To safely navigate the complexities of CFD trading, begin by carefully assessing the regulatory landscape, comprehensively reviewing user feedback, and establishing clear self-verification measures. In this volatile trading environment, awareness and due diligence are the keys to safeguarding investments on platforms like Cometa.