Is Topclasspips safe?

Business

License

Is Topclasspips A Scam?

Introduction

Topclasspips positions itself as a promising player in the forex market, catering to both novice and experienced traders. With claims of advanced trading tools and strategies, it aims to simplify the investment process for its users. However, the rapid growth of online trading platforms has also led to an increase in scams and unregulated brokers, making it crucial for traders to conduct thorough evaluations before committing their funds. This article aims to assess the safety and legitimacy of Topclasspips through a rigorous investigation of its regulatory status, company background, trading conditions, and user experiences.

To ensure a comprehensive evaluation, we have employed a multi-faceted approach that includes an analysis of regulatory compliance, company history, customer feedback, and overall trading conditions. By synthesizing information from various credible sources, we aim to provide a balanced view of whether Topclasspips is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in assessing its legitimacy. A regulated broker is subject to strict oversight, which can offer traders a level of protection against fraudulent activities. In the case of Topclasspips, information regarding its regulatory compliance is sparse, raising concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not Regulated | - | - | Not Verified |

The absence of a regulatory license from a recognized authority is a significant red flag. Top-tier regulators, such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the United States, enforce stringent standards that protect traders. Without such oversight, Topclasspips operates in a regulatory void, which could expose traders to various risks, including potential fraud and mismanagement of funds.

Moreover, the lack of historical compliance records or regulatory scrutiny raises questions about the broker's operational integrity. Traders should be extremely cautious when dealing with unregulated brokers, as they often lack accountability and transparency.

Company Background Investigation

Understanding the company behind a trading platform is essential for evaluating its credibility. Topclasspips claims to be a dynamic and innovative investment platform, but detailed information about its history, ownership structure, and management team is notably absent.

A thorough background check reveals that the company lacks transparency regarding its founding members and operational history. This absence of information can be concerning for traders who wish to know who is managing their investments. A reputable broker typically discloses information about its founders and key personnel, along with their qualifications and experience in the financial sector.

Furthermore, the company's commitment to transparency and information disclosure appears to be minimal. This lack of clarity can lead to distrust among potential clients, as traders may feel uncertain about the safety of their funds and the reliability of the trading services offered by Topclasspips.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience and profitability. Topclasspips advertises competitive fees and a user-friendly trading environment, but a closer examination reveals potential issues.

The overall fee structure is a crucial aspect to consider. Traders should be wary of any unusual or hidden fees that can eat into their profits. Below is a comparison of core trading costs associated with Topclasspips versus industry averages:

| Fee Type | Topclasspips | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.5 pips | 1.0 pips |

| Commission Model | None | $5 per lot |

| Overnight Interest Range | TBD | 0.5% - 2.0% |

While Topclasspips claims to offer low spreads, the average spread on major currency pairs is higher than the industry average. This discrepancy could indicate that traders may not receive the most competitive pricing, which is a critical factor in forex trading.

Additionally, the absence of a clear commission structure raises concerns. A lack of transparency regarding fees can lead to unexpected costs, which could significantly impact trading outcomes. Traders should always seek brokers that provide clear and comprehensive fee disclosures.

Client Funds Security

The security of client funds is paramount when evaluating a forex broker. Topclasspips has yet to demonstrate robust measures to protect client funds, which is a significant concern for potential investors.

A reliable broker typically employs various security measures, including segregated accounts, investor protection schemes, and negative balance protection policies. However, the absence of information regarding these safety measures for Topclasspips raises alarms about the potential risk of fund mismanagement.

Traders should be particularly cautious if a broker does not provide clear details about how client funds are handled. Without proper safeguards, there is a heightened risk of losing investments due to fraud or bankruptcy. Historical disputes or controversies regarding fund security can further complicate a brokers reputation, but no such information is available for Topclasspips.

Customer Experience and Complaints

User feedback is an invaluable resource for assessing the reliability of a broker. A review of customer experiences with Topclasspips reveals a mixed bag of opinions, with several users expressing concerns about the platform's reliability and customer support.

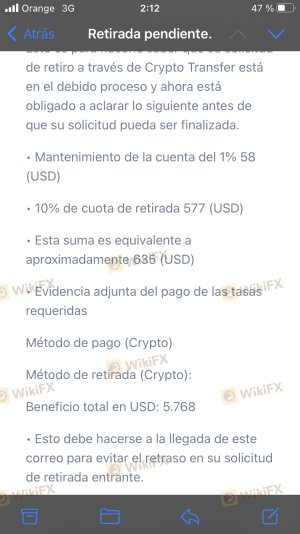

Common complaints include issues with fund withdrawals, lack of responsiveness from customer support, and unclear communication regarding trading conditions. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Poor Customer Support | Medium | Unresolved |

| Lack of Transparency | High | No Clarification |

For instance, some users have reported significant delays in processing withdrawals, which is a major red flag in the forex industry. A broker that does not facilitate timely withdrawals may be engaging in questionable practices, potentially indicating that it is not a safe option for traders.

Additionally, the lack of effective customer support can exacerbate these issues, leaving traders feeling frustrated and unsupported. A reliable broker should have a responsive customer service team to address client concerns promptly.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. Topclasspips claims to offer a user-friendly platform, but a deeper analysis is necessary to evaluate its execution quality, stability, and overall user experience.

Traders have reported mixed experiences with the platform's performance, including instances of slippage and order rejections. These issues can significantly impact trading outcomes, particularly for strategies that rely on precise entry and exit points.

Moreover, any signs of platform manipulation should be scrutinized. A broker that engages in practices such as price manipulation or excessive slippage can undermine the integrity of the trading experience.

Risk Assessment

Using Topclasspips carries several risks that potential traders should consider. A comprehensive risk assessment reveals key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Fund Security Risk | High | Lack of transparency regarding fund management. |

| Customer Support Risk | Medium | Complaints about slow responses and unresolved issues. |

| Trading Conditions Risk | Medium | Higher-than-average spreads and unclear fees. |

To mitigate these risks, traders should conduct extensive research and consider alternative brokers that offer better regulatory oversight and transparency. It is advisable to choose brokers that are well-regulated and have a proven track record of reliability.

Conclusion and Recommendations

In conclusion, the investigation into Topclasspips raises several concerns regarding its legitimacy and safety. The absence of regulatory oversight, coupled with a lack of transparency and mixed user experiences, suggests that traders should exercise caution when considering this broker.

While it may offer appealing features, the risks associated with trading through Topclasspips, including potential fund mismanagement and poor customer service, cannot be overlooked. For traders seeking a reliable and safe trading environment, it is advisable to explore alternatives with established regulatory compliance and positive user feedback.

In summary, is Topclasspips safe? The evidence suggests that it may not be the most secure option for traders, and potential clients are encouraged to seek out brokers with stronger regulatory frameworks and a proven history of client satisfaction.

Is Topclasspips a scam, or is it legit?

The latest exposure and evaluation content of Topclasspips brokers.

Topclasspips Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Topclasspips latest industry rating score is 1.34, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.34 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.