Bullet Global 2025 Review: Everything You Need to Know

Executive Summary

Bullet Global Investment has become a concerning entity in the forex brokerage landscape. Multiple regulatory watchdogs and review platforms have flagged this broker with serious warnings. This comprehensive bullet global review reveals significant red flags that potential traders must consider before engaging with this broker.

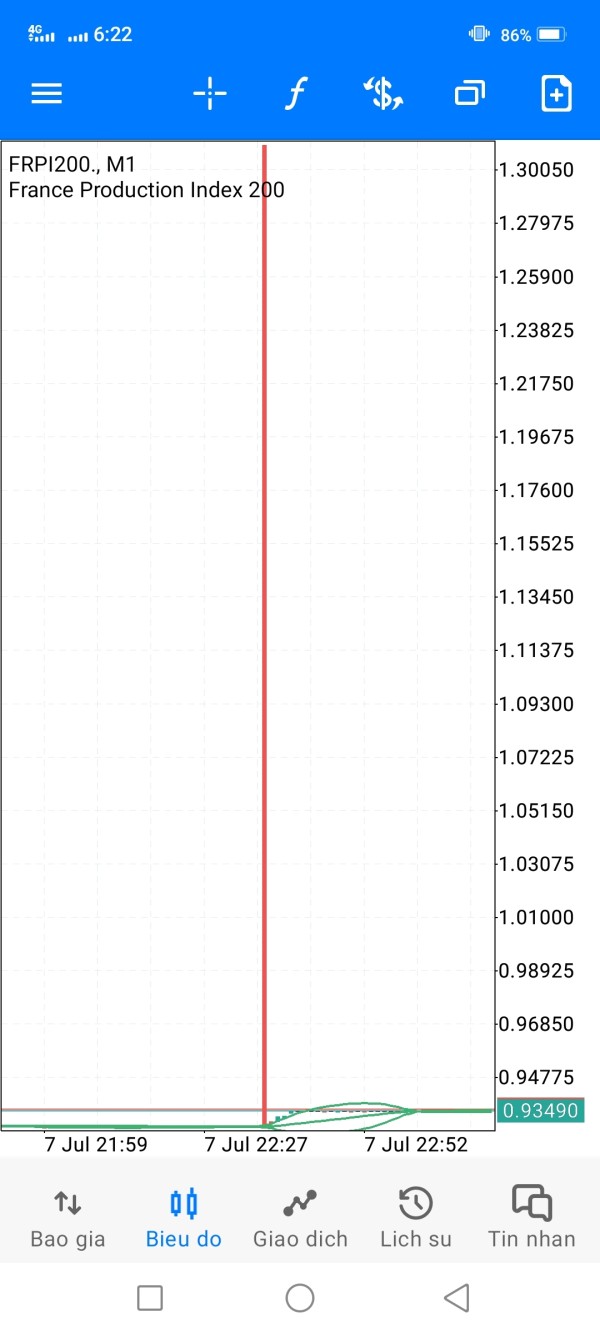

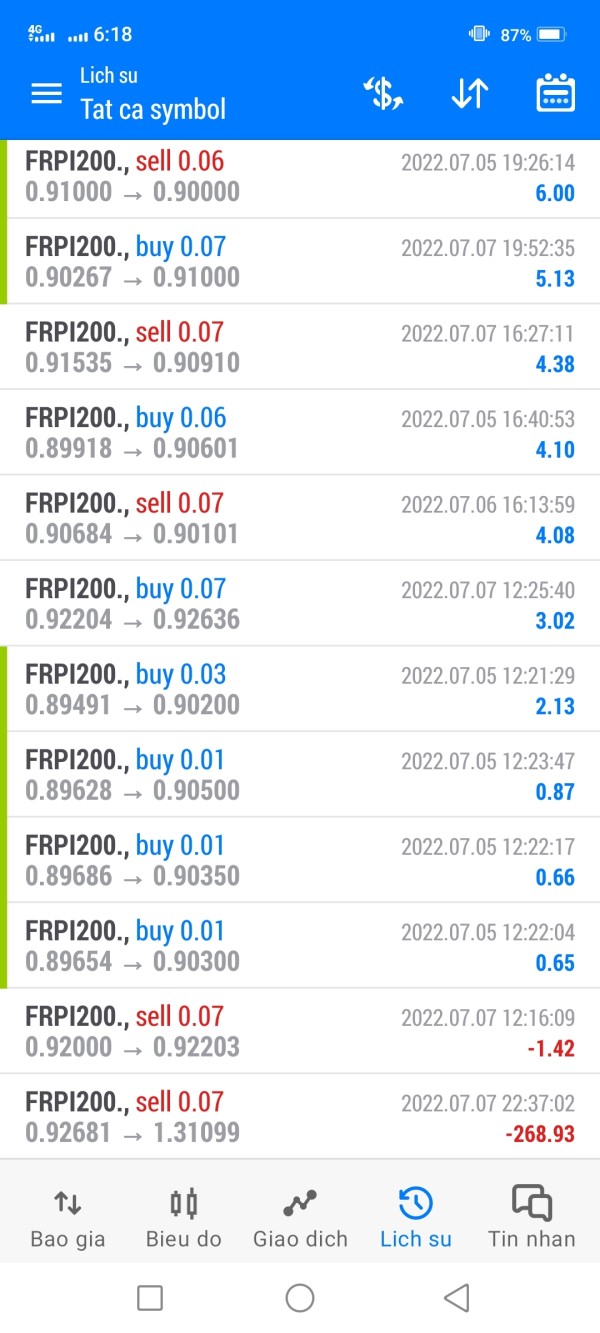

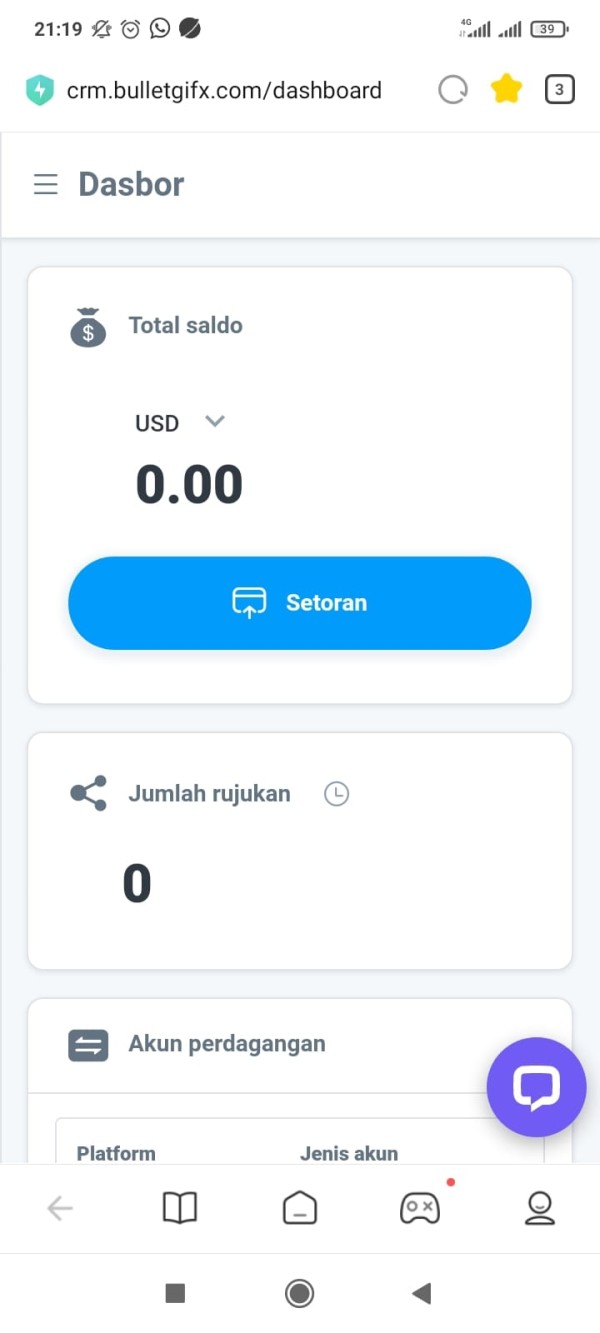

According to WikiBit reports, Bullet Global has been classified among problematic brokers. Serious questions surround its operational legitimacy and regulatory compliance. The broker claims to offer MetaTrader 5 platform access for forex trading, targeting investors seeking exposure to foreign exchange markets.

However, the lack of transparent regulatory information raises substantial concerns about the safety of client funds. Warning signals from industry monitoring services add to these concerns about the reliability of trading services. Our investigation found limited verifiable information about the company's background, operational history, and actual trading conditions.

This lack of information itself serves as a warning sign for potential clients. Given the current regulatory landscape and available information, this review aims to provide traders with essential insights. These insights will help traders make informed decisions about whether Bullet Global meets their trading needs and safety requirements.

Important Notice

Regulatory Warning: Bullet Global's regulatory status remains unclear across multiple jurisdictions. Significant discrepancies exist in available compliance information. WikiBit has flagged this broker with warning indicators, suggesting potential regulatory violations or operational irregularities.

Traders should exercise extreme caution and verify all regulatory claims independently before depositing funds.

Review Disclaimer: This evaluation is based on publicly available information and regulatory reports as of 2025. The analysis does not include direct user experience testing or account verification, as safety concerns preclude such engagement.

Potential clients are strongly advised to conduct their own due diligence and consult with financial advisors before considering any investment with this broker.

Rating Framework

Broker Overview

Bullet Global Investment presents itself as a forex brokerage firm. Concrete information about its establishment date, founding team, and corporate structure remains notably absent from public records. The company's operational background lacks the transparency typically expected from legitimate financial services providers.

Unlike established brokers that readily provide detailed company histories, regulatory timelines, and management information, Bullet Global's corporate narrative appears deliberately obscured.

The broker's business model centers around forex trading services. Specific details about market making versus STP execution, liquidity partnerships, and operational infrastructure are not disclosed in available materials. This lack of operational transparency raises immediate concerns about the company's commitment to client education and informed trading decisions.

Regarding trading infrastructure, Bullet Global claims to provide access to the MetaTrader 5 platform. MT5 is indeed a legitimate and widely-used trading software. However, the mere claim of MT5 availability does not validate the broker's overall legitimacy or operational quality.

The absence of detailed platform specifications, server locations, execution speeds, or integration features suggests limited actual platform development or customization efforts. This bullet global review finds that while MT5 is a professional platform, its claimed availability through this broker requires independent verification before any trading activity.

Regulatory Jurisdiction: Available information does not specify any confirmed regulatory oversight from recognized financial authorities. This absence of clear regulatory compliance represents a significant risk factor for potential clients seeking protected trading environments.

Deposit and Withdrawal Methods: Specific information about funding options, processing times, and associated fees has not been disclosed in available materials. Legitimate brokers typically provide comprehensive details about payment processing, including supported currencies, minimum/maximum limits, and processing timeframes.

Minimum Deposit Requirements: No confirmed minimum deposit information is available. This prevents potential clients from understanding the financial commitment required to begin trading. Established brokers clearly communicate these requirements as part of their account opening process.

Promotional Offers: Current promotional activities, welcome bonuses, or trading incentives are not detailed in accessible broker information. The absence of clear promotional terms may indicate limited marketing transparency or operational constraints.

Available Trading Assets: While forex trading is mentioned, the specific currency pairs, exotic options, and additional asset classes remain unspecified. Professional brokers typically provide comprehensive asset lists with trading specifications.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs is not readily available. This lack of pricing transparency makes it impossible for traders to accurately assess the real cost of trading with this broker. Bullet global review findings indicate this opacity as a significant concern for cost-conscious traders.

Leverage Options: Maximum leverage ratios and margin requirements across different asset classes are not specified. This prevents traders from understanding their potential exposure and risk management parameters.

Platform Options: Beyond the claimed MetaTrader 5 access, no information about web-based platforms, mobile applications, or proprietary trading software is available.

Geographic Restrictions: Specific information about service availability across different countries and regions is not provided in available materials.

Customer Support Languages: Available language support for client services has not been specified in accessible broker documentation.

Account Conditions Analysis

The account structure offered by Bullet Global remains largely opaque. Insufficient information is available to properly evaluate the trading conditions and account benefits. Unlike established brokers that clearly outline multiple account tiers with specific features, minimum deposits, and trading benefits, Bullet Global's account offerings lack the transparency necessary for informed decision-making.

Without access to detailed account specifications, potential traders cannot assess whether the broker offers standard, premium, or VIP account levels. Each tier typically features different spread structures, leverage options, and additional services. The absence of Islamic account options, which are standard offerings from legitimate brokers serving Muslim traders, further indicates limited service development or market understanding.

Account opening procedures and verification requirements are not clearly documented. This raises questions about the broker's compliance with international KYC and AML standards. Legitimate brokers maintain transparent verification processes that protect both the institution and clients from regulatory violations.

The lack of detailed account information in this bullet global review reflects poorly on the broker's operational transparency. It suggests potential clients should seek alternatives with clearly defined trading conditions and account structures that meet professional trading standards.

Bullet Global's claimed offering of MetaTrader 5 represents the extent of verifiable trading tools. Even this claim requires independent confirmation. While MT5 is indeed a sophisticated trading platform capable of supporting advanced trading strategies, automated trading systems, and comprehensive market analysis, the mere claim of its availability does not guarantee proper implementation or reliable access.

Professional brokers typically supplement platform access with proprietary research tools, market analysis resources, economic calendars, and educational materials designed to support trader development and decision-making. The absence of any mention of such additional resources suggests a limited commitment to client success and market education.

Automated trading support, including Expert Advisors and algorithmic trading capabilities, while theoretically available through MT5, cannot be verified without direct platform access. The lack of information about server reliability, execution speeds, or platform customization options raises questions about the actual quality of the trading environment.

Educational resources, including webinars, trading guides, market analysis, and strategy development materials, appear to be entirely absent from the broker's disclosed offerings. This bullet global review finds that the lack of educational support indicates minimal investment in client development and long-term trading success. This contrasts sharply with legitimate brokers that prioritize trader education and market knowledge development.

Customer Service and Support Analysis

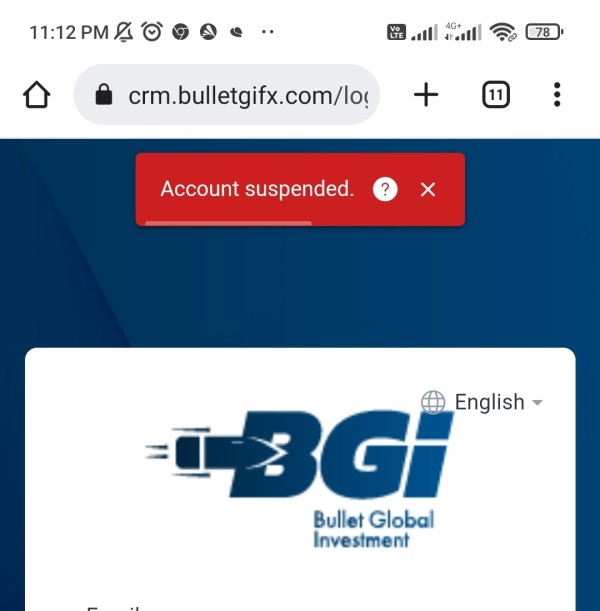

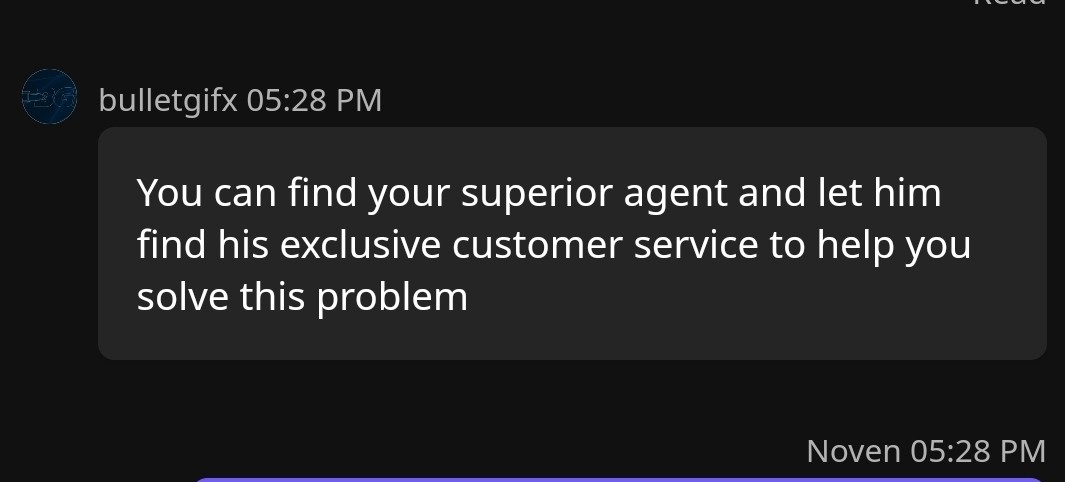

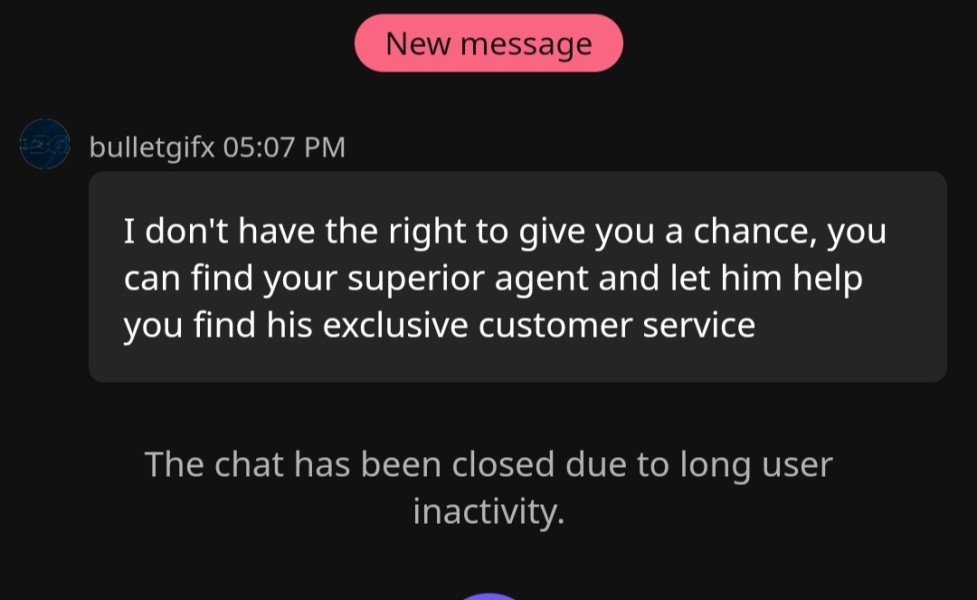

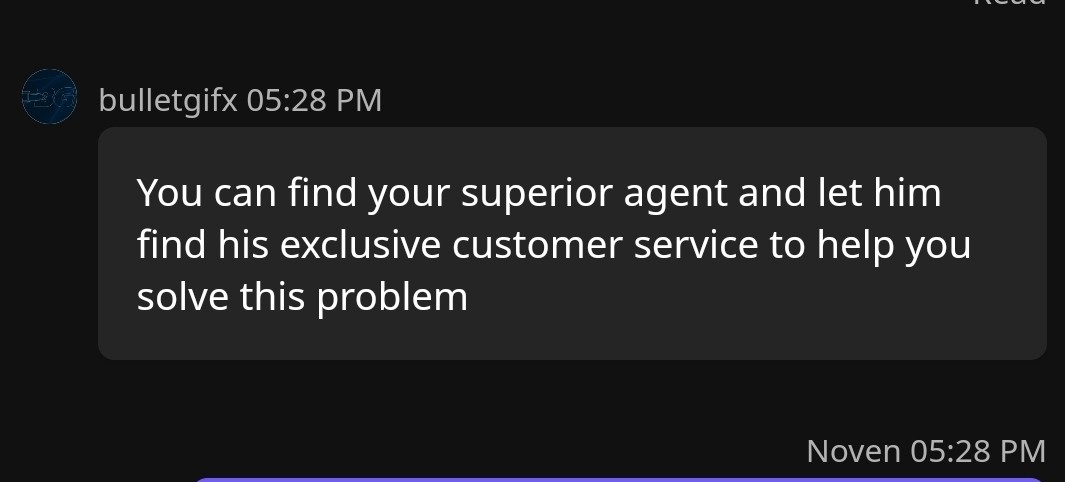

Customer service capabilities represent one of the most concerning aspects of Bullet Global's operations. Virtually no verifiable information is available about support channels, availability, or service quality. Legitimate forex brokers typically maintain multiple contact methods including live chat, email, phone support, and comprehensive FAQ sections to address client needs promptly and effectively.

The absence of clearly published customer service contact information, operating hours, and response time commitments suggests either inadequate support infrastructure or deliberate opacity in client communication channels. Professional brokers understand that responsive customer service is essential for addressing trading issues, account problems, and technical difficulties that can directly impact client profitability.

Multi-language support capabilities, which are standard among international brokers serving diverse client bases, are not specified in available materials. This limitation could significantly impact non-English speaking traders who require native language assistance for complex trading or account-related issues.

Problem resolution procedures, escalation processes, and client complaint handling mechanisms are not documented. This leaves potential clients without clear recourse in case of disputes or technical problems. The lack of transparent customer service standards in this evaluation raises serious concerns about the broker's commitment to client satisfaction and operational professionalism.

Trading Experience Analysis

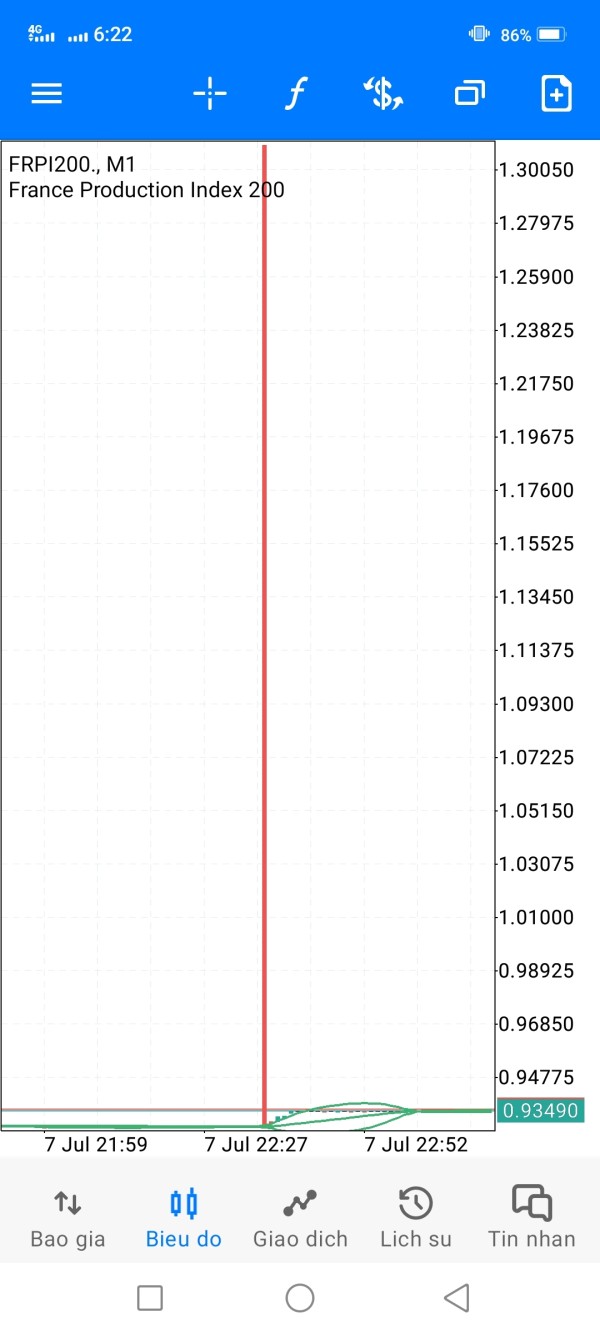

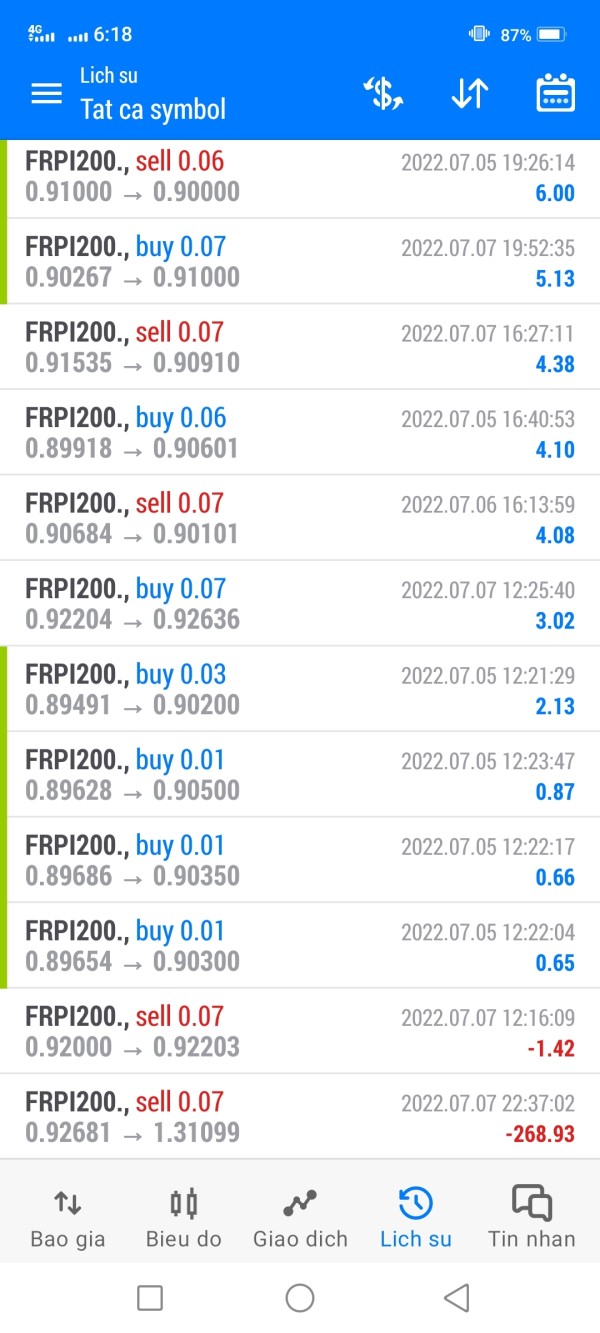

The trading experience with Bullet Global cannot be properly assessed due to the lack of verifiable platform access and the regulatory warnings surrounding the broker's operations. While the claimed MetaTrader 5 platform could theoretically provide professional trading capabilities, the absence of confirmed implementation details raises questions about actual execution quality and platform reliability.

Platform stability and execution speed are critical factors for successful forex trading, particularly for scalping strategies and high-frequency trading approaches. Without access to performance data, server specifications, or execution statistics, potential clients cannot evaluate whether the trading environment meets their operational requirements.

Order execution quality, including slippage rates, requote frequency, and fill quality during volatile market conditions, remains unverified. Professional traders require transparent execution statistics to assess whether a broker's infrastructure can support their trading strategies effectively.

Mobile trading capabilities, while standard with legitimate MT5 implementations, cannot be confirmed without direct platform access. The quality of mobile applications, synchronization with desktop platforms, and full functionality access are essential for modern trading but remain unverifiable with this broker.

The overall trading environment assessment is severely hampered by regulatory concerns and the lack of transparent operational information. This makes it impossible to recommend this broker for serious trading activities.

Trustworthiness Analysis

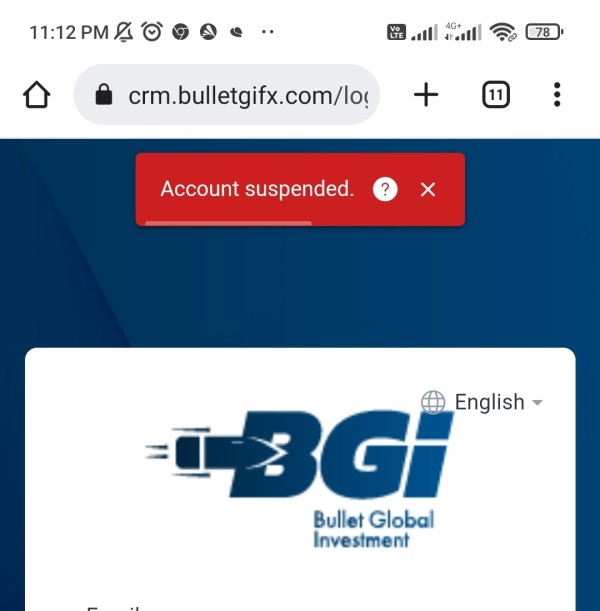

Trustworthiness represents the most critical deficiency in Bullet Global's profile. Multiple red flags indicate serious concerns about the broker's legitimacy and operational integrity. According to WikiBit reports, the broker has been flagged with warning indicators that suggest potential regulatory violations or fraudulent activities.

This immediately disqualifies it from consideration by safety-conscious traders.

Regulatory compliance forms the foundation of broker trustworthiness, yet Bullet Global fails to provide clear evidence of oversight by recognized financial authorities. Legitimate brokers maintain transparent regulatory relationships with bodies such as the FCA, ASIC, CySEC, or other respected regulators. These relationships provide clients with legal protections and recourse mechanisms.

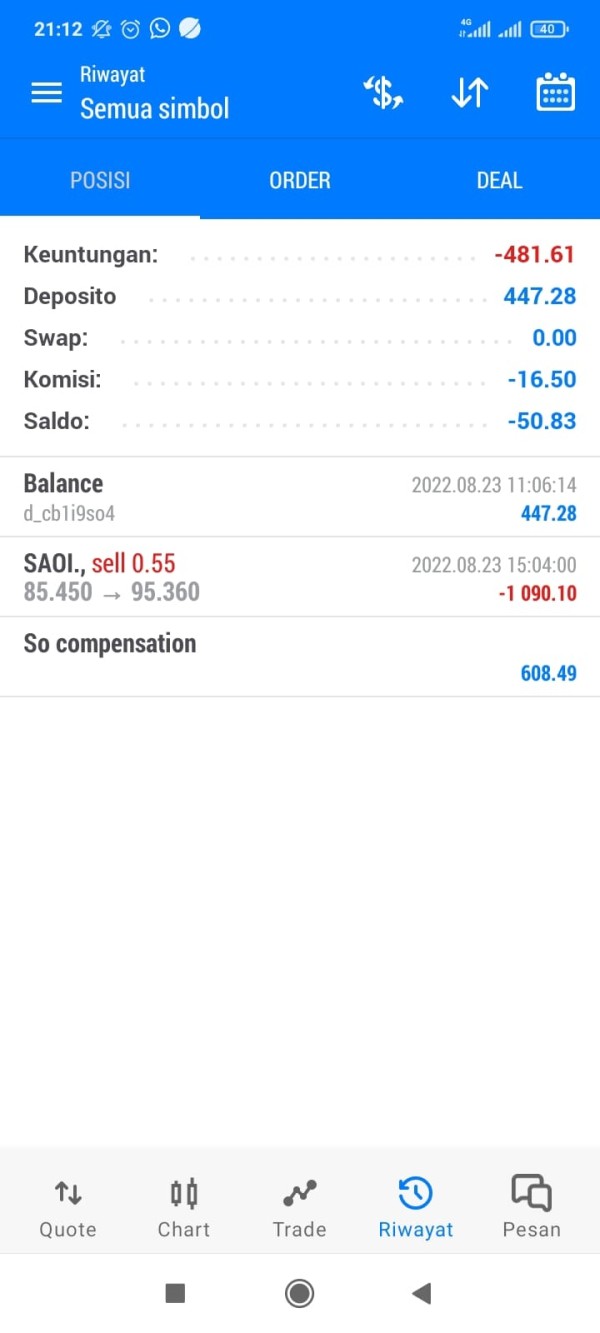

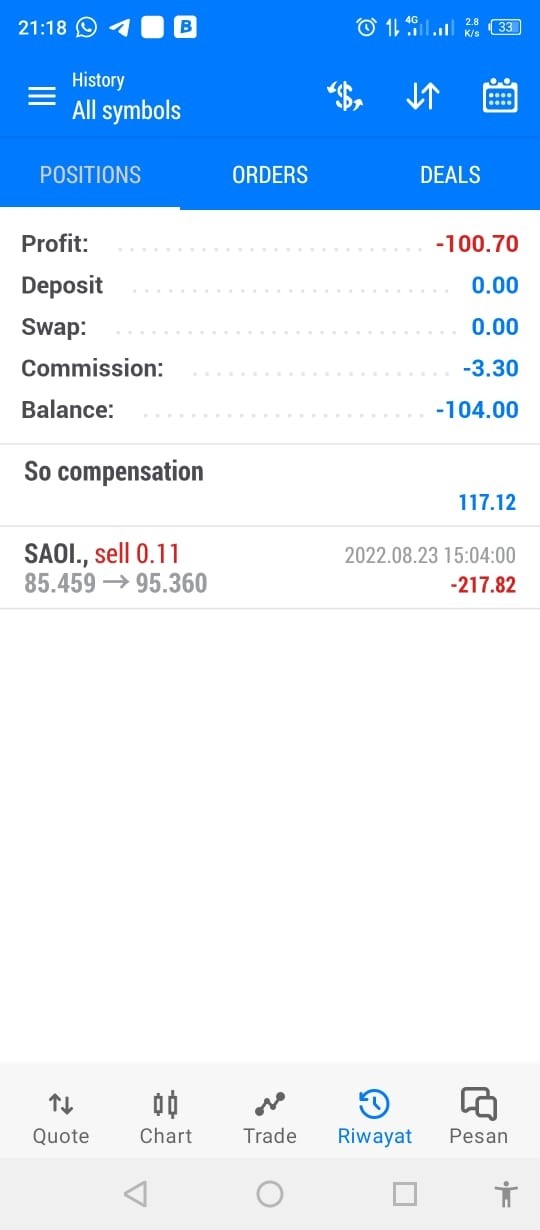

Client fund protection measures, including segregated accounts, investor compensation schemes, and third-party fund custody arrangements, are not documented in available materials. These protections are essential for safeguarding client deposits and ensuring funds remain accessible even in cases of broker insolvency or operational difficulties.

Corporate transparency, including detailed company registration information, management team backgrounds, and financial reporting, appears deliberately obscured. Professional financial services providers maintain open corporate structures that allow clients and regulators to verify their operational legitimacy and financial stability.

The combination of regulatory warnings, operational opacity, and lack of verifiable compliance measures makes Bullet Global unsuitable for traders seeking secure and regulated trading environments.

User Experience Analysis

User experience evaluation is severely limited by the absence of credible user feedback and the regulatory concerns surrounding Bullet Global's operations. Unlike established brokers that maintain extensive user review databases, testimonials, and community feedback, this broker lacks verifiable client experiences that could inform potential users about actual service quality.

Interface design and platform usability cannot be assessed without direct access to the claimed MetaTrader 5 implementation. While MT5 generally provides professional interface design and comprehensive functionality, the quality of broker-specific customizations, server performance, and additional features remains unknown.

Registration and account verification processes are not clearly documented. This prevents assessment of user onboarding efficiency and compliance procedures. Legitimate brokers maintain streamlined yet thorough verification processes that balance regulatory compliance with user convenience.

Funding operations, including deposit and withdrawal experiences, processing times, and fee structures, cannot be evaluated due to insufficient operational transparency. User experiences with payment processing often reveal critical information about broker reliability and operational efficiency.

Common user complaints and satisfaction metrics are not available for analysis, though the regulatory warnings suggest that user experiences would likely be negative. This bullet global review cannot recommend the broker based on the absence of positive user feedback combined with regulatory concerns about operational legitimacy.

Conclusion

Based on this comprehensive analysis, Bullet Global fails to meet the standards expected of a legitimate and trustworthy forex broker. The combination of regulatory warnings, operational opacity, and lack of verifiable service information creates an unacceptable risk profile for potential clients seeking secure trading environments.

The broker's primary deficiencies include the absence of clear regulatory oversight, lack of transparent operational information, and warning flags from industry monitoring services. While the claimed MetaTrader 5 platform access might appear attractive, this single feature cannot compensate for the fundamental trust and safety concerns identified throughout this evaluation.

Traders seeking reliable forex trading services should prioritize brokers with clear regulatory compliance, transparent operational practices, and positive user feedback from verified sources. The current state of Bullet Global's operations does not support confident trading decisions or secure fund management. This makes it unsuitable for both novice and experienced traders who value account safety and regulatory protection.