BSV Review 1

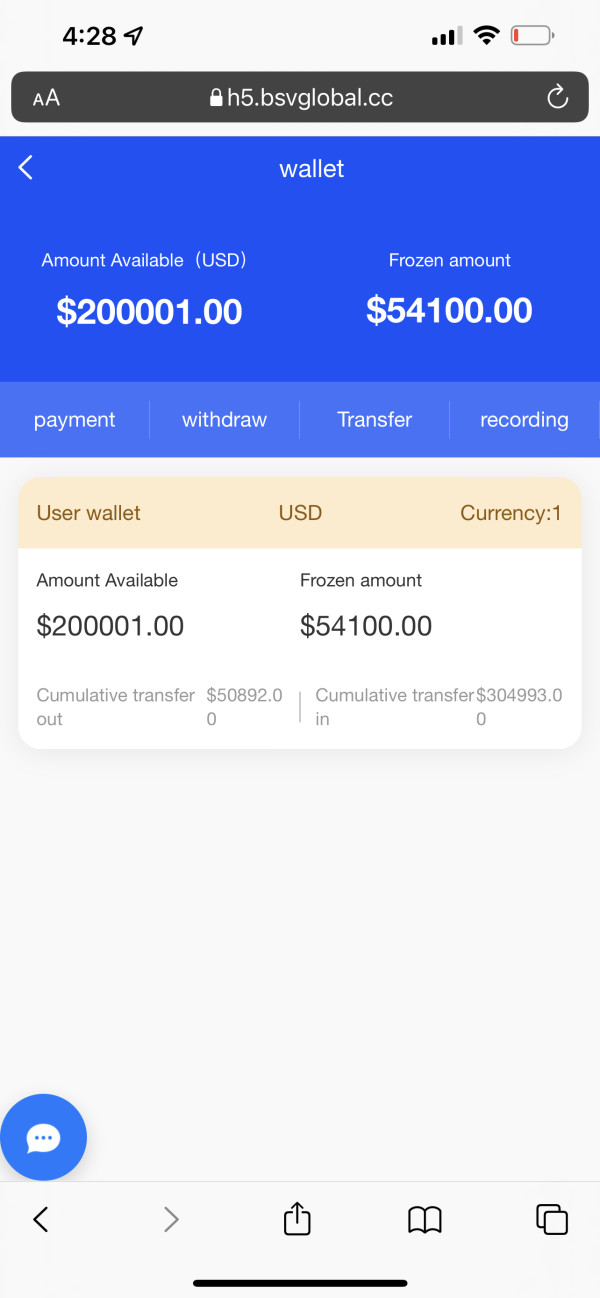

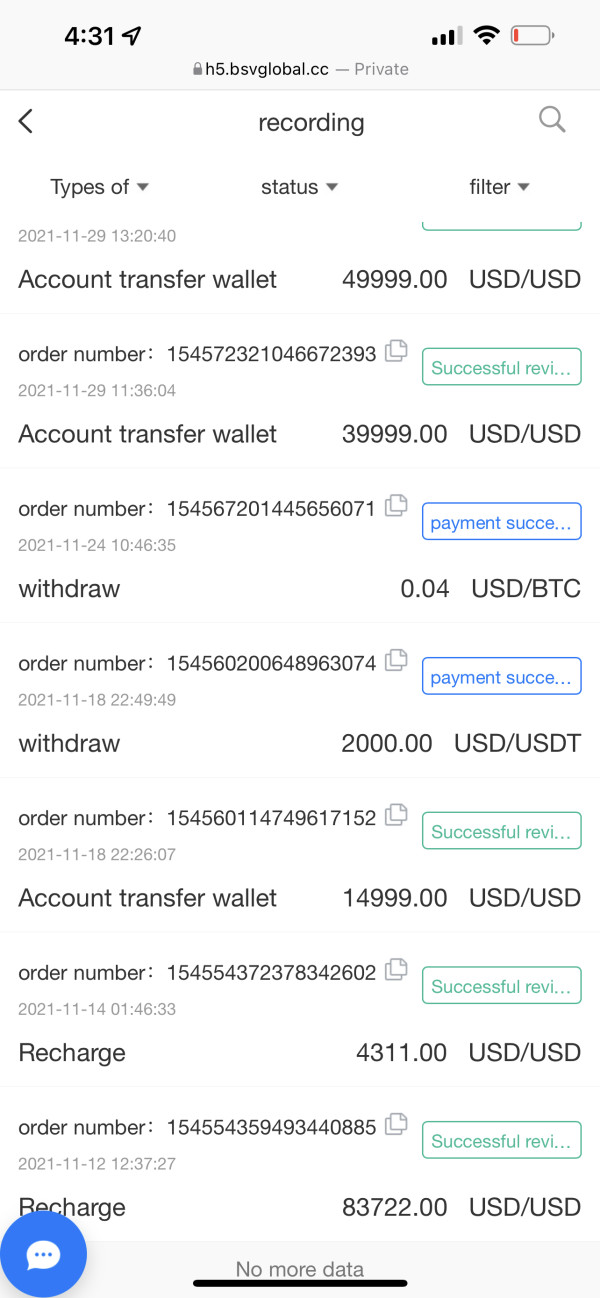

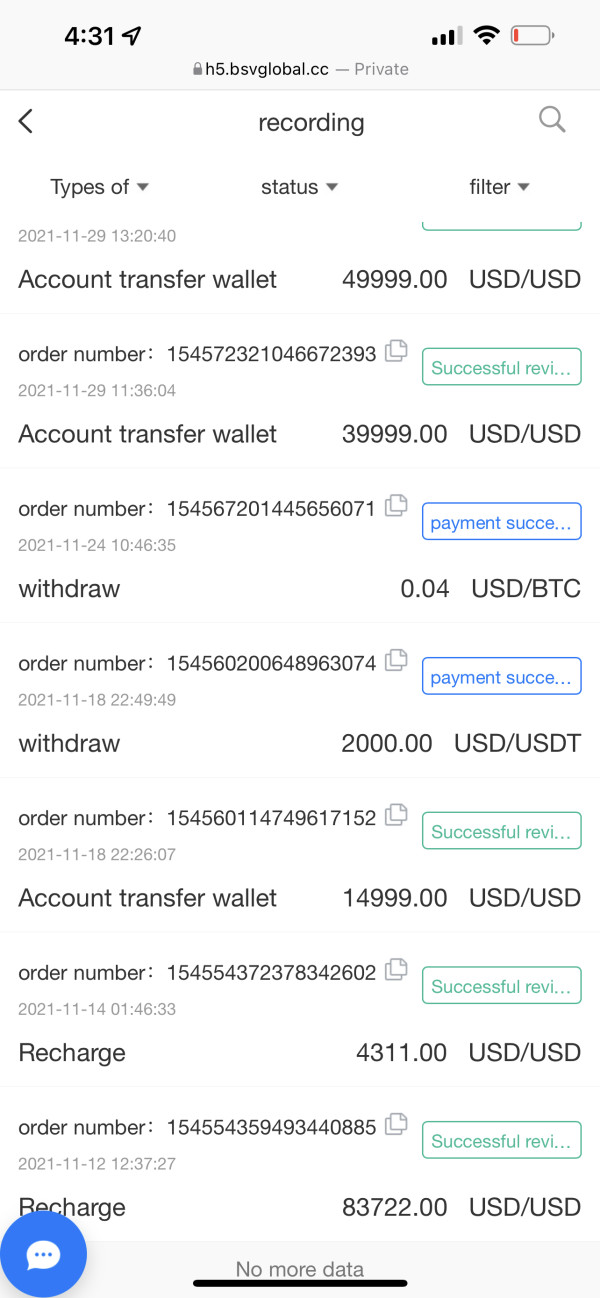

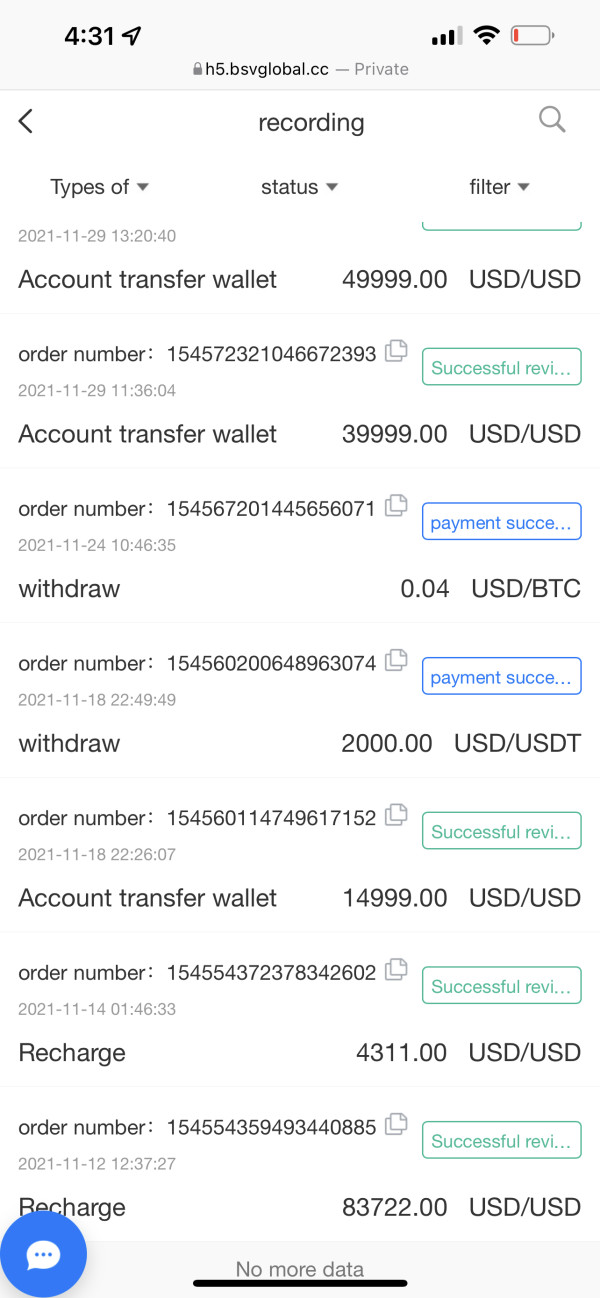

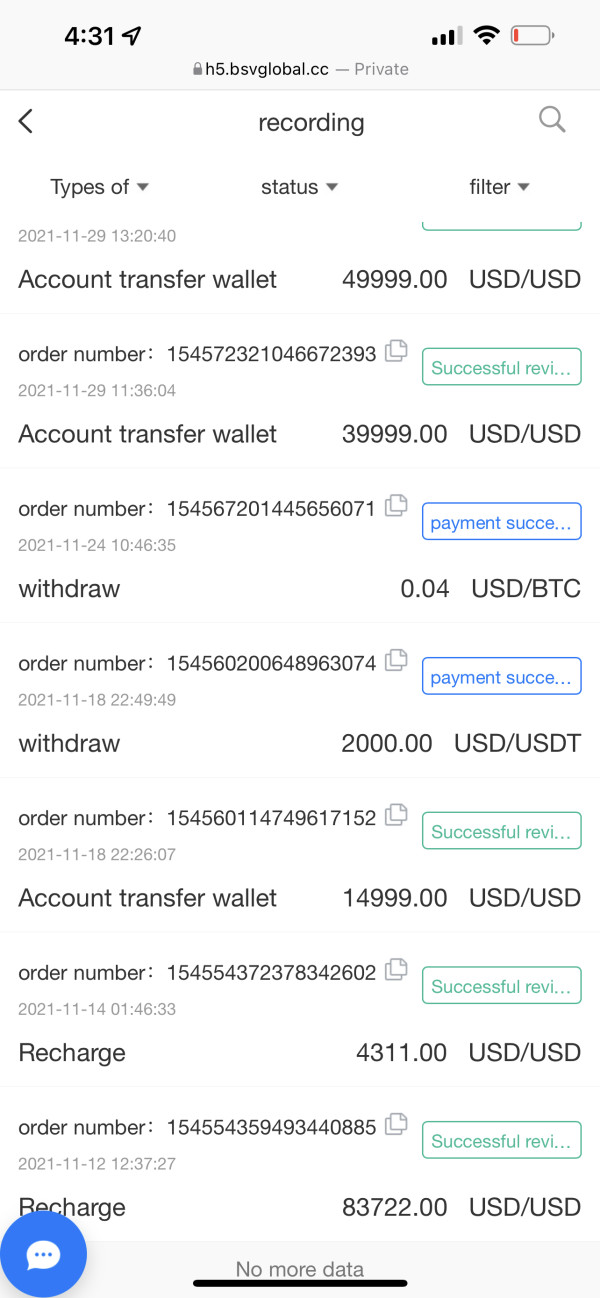

The customer service says that I have to pay taxes before they release the funds and will not provide any details on how to proceed. Very very slow customer service and sometimes not there, which can be disturbing.

BSV Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

The customer service says that I have to pay taxes before they release the funds and will not provide any details on how to proceed. Very very slow customer service and sometimes not there, which can be disturbing.

This comprehensive bsv review examines the current state of Bitcoin SV trading opportunities and available platforms in 2025. BSV presents itself as an alternative cryptocurrency option for investors seeking exposure to the Bitcoin SV ecosystem. The cryptocurrency is accessible through multiple established exchanges including KuCoin and Binance Futures. This provides traders with various platform choices for their investment strategies.

Bitcoin SV positions itself as a continuation of the original Bitcoin protocol, emphasizing scalability and enterprise-level applications. For investors interested in cryptocurrency diversification beyond mainstream options like Bitcoin and Ethereum, BSV offers an alternative approach to blockchain technology investment. The availability across multiple major exchanges suggests reasonable liquidity and market acceptance. However, specific trading conditions and regulatory frameworks require careful consideration.

The primary target audience for BSV trading consists of cryptocurrency enthusiasts and investors who understand the technical differences between various Bitcoin implementations. They must also be comfortable with the inherent volatility of alternative cryptocurrencies. However, potential traders should note that comprehensive regulatory and operational details remain limited in publicly available information.

This bsv review is based on publicly available information and market data as of 2025. Readers should be aware that cryptocurrency markets are highly volatile and regulatory environments vary significantly across jurisdictions. The information presented in this review reflects current market conditions and available trading platforms. However, specific terms, conditions, and regulatory compliance may differ based on your location and chosen trading platform.

Our evaluation methodology incorporates industry-standard assessment criteria including platform availability, market accessibility, and general market presence. However, due to limited comprehensive operational data, some traditional broker evaluation metrics may not be fully applicable to this cryptocurrency-focused analysis. Potential investors should conduct additional due diligence and consult with financial advisors before making investment decisions.

| Evaluation Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A/10 | Specific account terms not detailed in available information |

| Tools and Resources | 8/10 | Multiple platform availability with diverse access options |

| Customer Service and Support | N/A/10 | Support infrastructure details not specified in source materials |

| Trading Experience | N/A/10 | Platform-specific trading conditions not detailed |

| Trust and Reliability | N/A/10 | Regulatory compliance information not comprehensively available |

| User Experience | N/A/10 | User feedback and interface details not provided in source materials |

Bitcoin SV represents a significant fork in the cryptocurrency ecosystem. Specific establishment details and corporate background information are not comprehensively detailed in available materials. The cryptocurrency operates within the broader blockchain technology sector, focusing on scalability solutions and enterprise applications. Unlike traditional forex brokers, BSV functions as a decentralized cryptocurrency accessible through various established trading platforms.

The operational model centers around blockchain technology and cryptocurrency trading rather than traditional brokerage services. This fundamental difference means that evaluation criteria typically applied to forex brokers require adaptation for cryptocurrency assessment. The absence of centralized corporate control distinguishes BSV from conventional financial service providers.

Available trading platforms for BSV include major cryptocurrency exchanges such as KuCoin and Binance Futures. This indicates broad market acceptance and accessibility. These platforms provide the infrastructure necessary for BSV trading, though each maintains its own operational standards, fee structures, and regulatory compliance frameworks. The cryptocurrency's presence across multiple established exchanges suggests reasonable market liquidity and institutional support.

Regulatory oversight varies significantly depending on the chosen trading platform and user jurisdiction. Unlike traditional brokers with clear regulatory frameworks, cryptocurrency trading operates within evolving regulatory environments that differ substantially across geographical regions. This bsv review emphasizes the importance of understanding local cryptocurrency regulations before engaging in trading activities.

Regulatory Environment: Specific regulatory compliance details for BSV are not comprehensively outlined in available source materials. Cryptocurrency regulation varies significantly across jurisdictions, and traders must verify local compliance requirements independently.

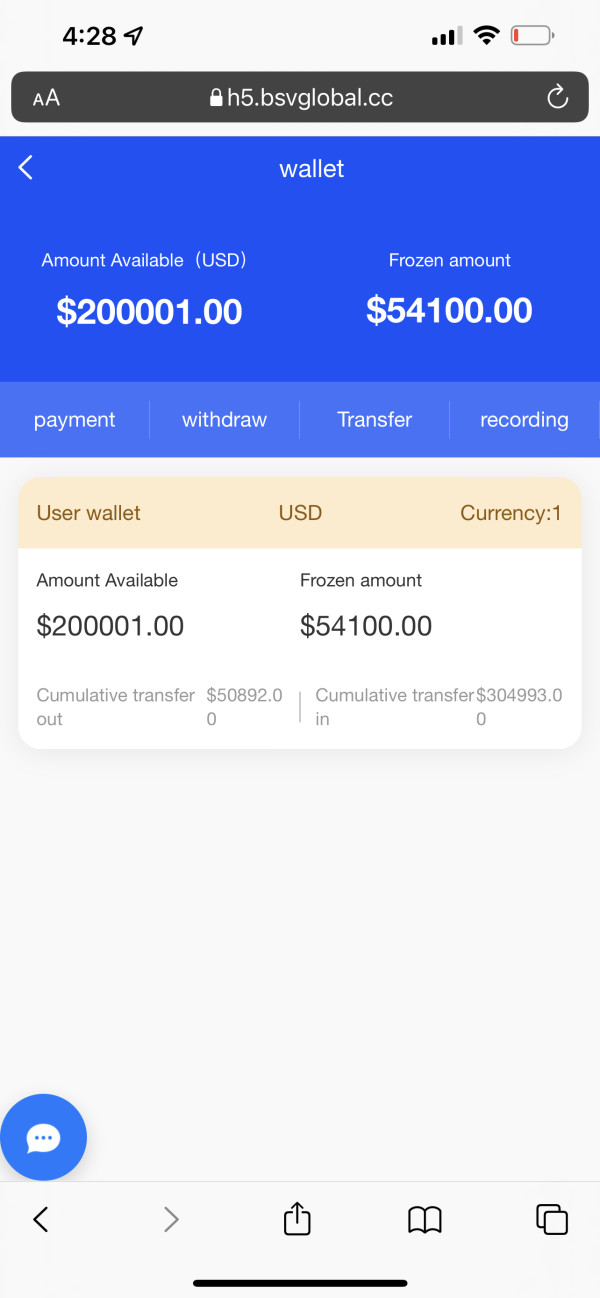

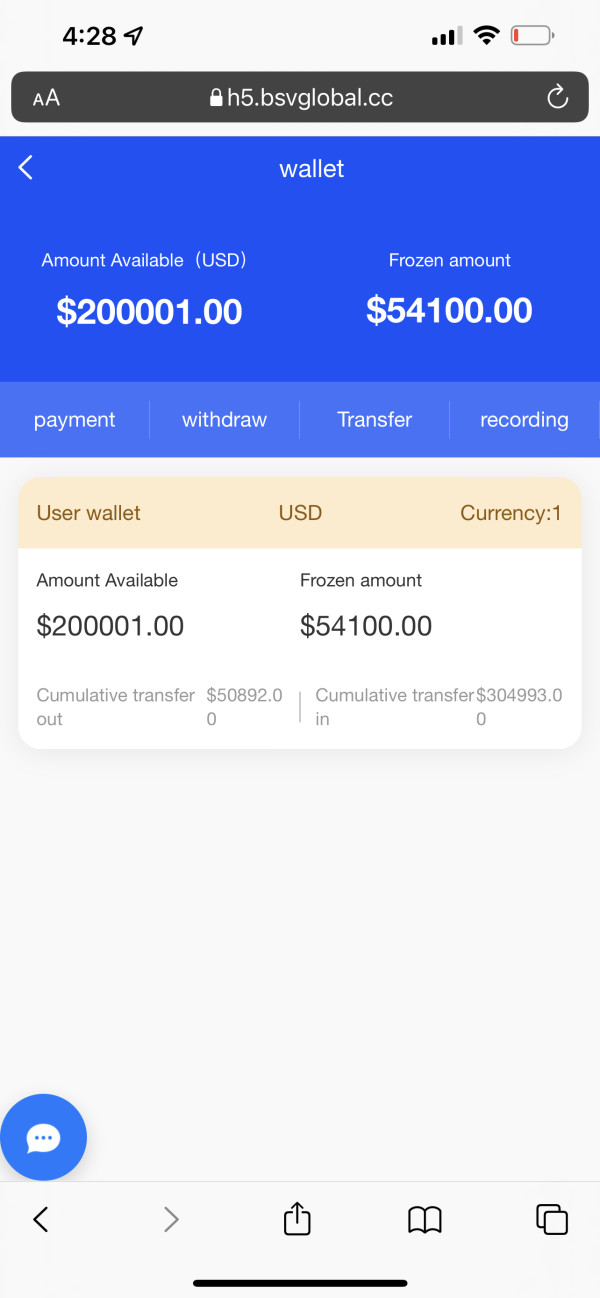

Deposit and Withdrawal Methods: Funding mechanisms depend entirely on the chosen trading platform. Each exchange supporting BSV maintains its own deposit and withdrawal procedures. These typically involve cryptocurrency transfers and various fiat currency options.

Minimum Deposit Requirements: Platform-specific minimum deposit information is not detailed in source materials. Requirements vary among different exchanges offering BSV trading services.

Promotional Offers: Specific bonus structures and promotional campaigns are not mentioned in available information. Individual exchanges may offer various incentives independently.

Tradeable Assets: The primary focus centers on Bitcoin SV cryptocurrency trading. Additional asset availability depends on the chosen platform's broader cryptocurrency offerings.

Cost Structure: Detailed fee information including spreads, commissions, and trading costs are not specified in source materials. Each supporting exchange maintains independent fee schedules that require individual investigation.

Leverage Options: Leverage availability and ratios are not detailed in available information. Platform-specific leverage terms vary among different exchanges supporting BSV trading.

Platform Selection: BSV trading is available through established exchanges including KuCoin and Binance Futures. This provides multiple access points for interested traders.

Geographic Restrictions: Specific regional limitations are not outlined in source materials. Access restrictions vary by chosen platform and local regulatory requirements.

Customer Support Languages: Language support details are not specified in available information and depend on individual exchange policies. This bsv review highlights the decentralized nature of cryptocurrency trading, where specific operational details depend heavily on chosen platform selection rather than centralized broker policies.

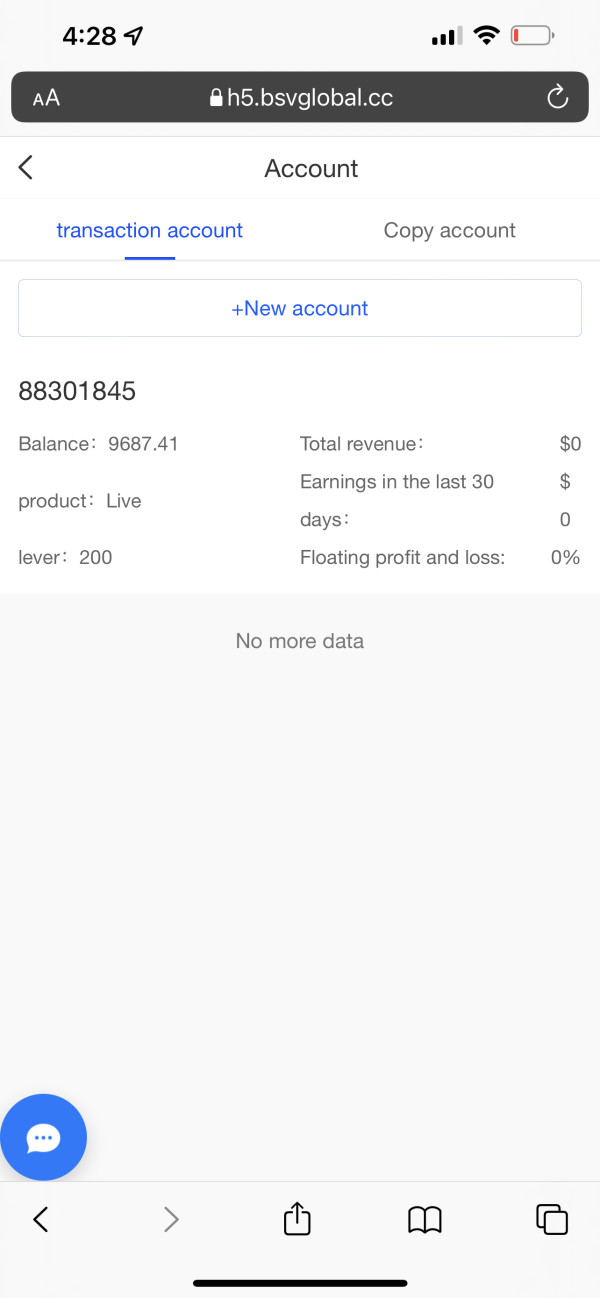

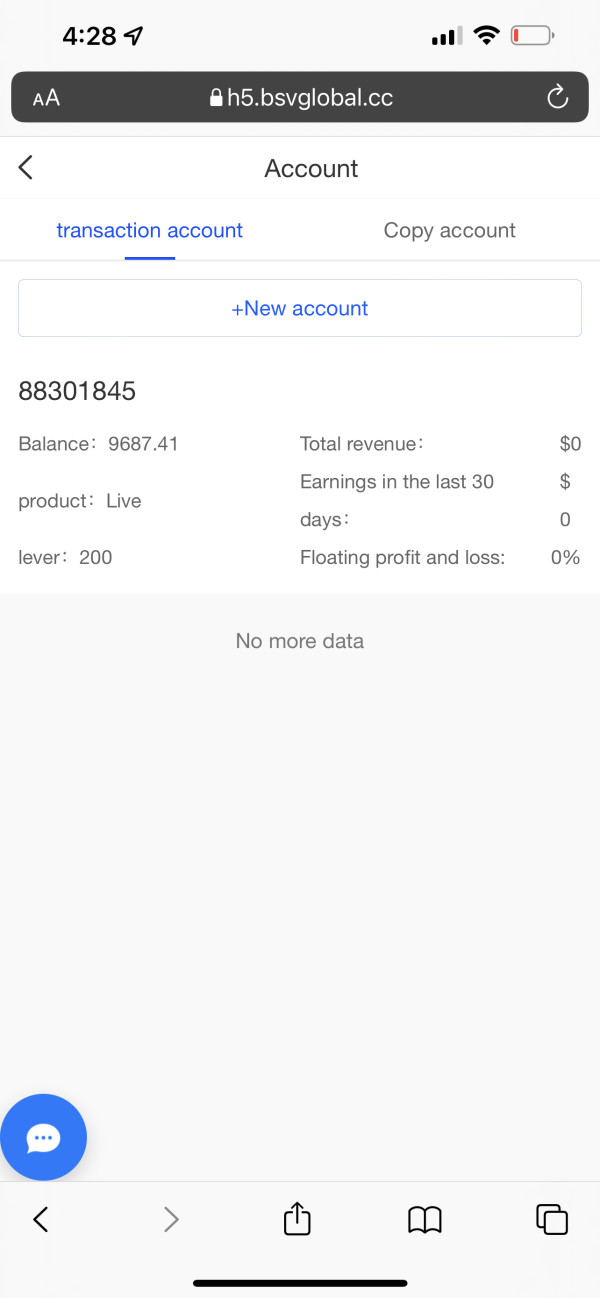

The account conditions for BSV trading cannot be comprehensively evaluated based on available information. Cryptocurrency trading operates fundamentally differently from traditional forex brokerage accounts. Unlike conventional brokers offering standardized account types, BSV access depends entirely on the policies of chosen cryptocurrency exchanges.

Account opening procedures vary significantly among platforms supporting BSV trading. Major exchanges like KuCoin and Binance Futures each maintain independent verification requirements, minimum deposit standards, and account tier structures. The absence of centralized account management means that traders must navigate different requirements for each platform.

Minimum deposit requirements are platform-specific and not detailed in available source materials. Some exchanges may offer low-barrier entry points, while others might require substantial initial investments. The decentralized nature of cryptocurrency trading means that account conditions reflect individual exchange policies rather than standardized industry practices.

Special account features, such as Islamic-compliant trading options or professional trader designations, depend entirely on individual exchange offerings. The cryptocurrency sector generally operates with different religious and professional compliance frameworks compared to traditional forex markets. This bsv review emphasizes that account condition evaluation requires platform-specific research rather than universal standards.

BSV trading benefits from availability across multiple established cryptocurrency exchanges, including KuCoin and Binance Futures. This multi-platform accessibility provides traders with options for comparing features, fees, and trading environments. The presence on major exchanges suggests reasonable market support and liquidity infrastructure.

Trading tools and analytical resources vary significantly among supporting platforms. Major cryptocurrency exchanges typically provide basic charting capabilities, order management systems, and market data feeds. However, the sophistication and comprehensiveness of these tools depend on individual platform development priorities and target user segments.

Educational resources specific to BSV are not detailed in available information. General cryptocurrency education may be available through supporting exchanges, but BSV-specific guidance requires independent research. The technical nature of Bitcoin SV's positioning within the broader cryptocurrency ecosystem demands substantial background knowledge for effective trading.

Automated trading support depends on individual exchange capabilities and API availability. Major platforms typically offer programmatic trading interfaces, but specific implementation details and supported strategies vary. The decentralized nature of cryptocurrency markets provides different automation opportunities compared to traditional forex environments.

Customer service frameworks for BSV trading depend entirely on chosen platform policies. There is no centralized support infrastructure for the cryptocurrency itself. Major exchanges supporting BSV maintain independent customer service operations with varying quality levels, response times, and available communication channels.

Response time expectations vary significantly among different platforms. Established exchanges typically provide multiple support channels including email, live chat, and ticket systems, but service quality and availability hours differ substantially. The 24/7 nature of cryptocurrency markets creates unique support challenges that platforms address with varying degrees of success.

Service quality assessment requires platform-specific evaluation rather than universal standards. Some exchanges prioritize rapid response times and comprehensive problem resolution, while others may offer more limited support infrastructure. The absence of regulatory standardization means that support quality depends on individual platform policies and resource allocation.

Multilingual support availability varies among exchanges supporting BSV trading. Major international platforms typically offer multiple language options, but coverage comprehensiveness and native speaker availability differ. Regional exchanges may provide superior local language support but limited international communication capabilities.

Trading experience evaluation for BSV requires platform-specific assessment rather than universal standards. The cryptocurrency operates across multiple independent exchanges. Each supporting platform maintains different trading engines, user interfaces, and execution capabilities that significantly impact user experience.

Platform stability and execution speed vary among exchanges offering BSV trading. Established platforms like KuCoin and Binance Futures generally provide robust infrastructure, but performance characteristics differ based on technical architecture and resource allocation. High-volume trading periods may reveal platform-specific limitations or advantages.

Order execution quality depends on individual exchange liquidity pools and matching engines. BSV liquidity varies among platforms, potentially affecting execution prices and slippage characteristics. Traders must evaluate platform-specific execution quality rather than relying on universal standards.

Mobile trading capabilities vary significantly among supporting exchanges. Major platforms typically offer mobile applications with varying feature comprehensiveness and user interface quality. The effectiveness of mobile trading depends on individual platform development priorities and technical implementation approaches. This bsv review emphasizes the importance of platform-specific mobile experience evaluation.

Trust assessment for BSV trading requires evaluation of supporting exchange platforms rather than the cryptocurrency itself. Regulatory compliance varies significantly among different exchanges, with some operating under comprehensive oversight while others function in less regulated environments.

Security measures depend entirely on chosen platform policies and technical implementations. Major exchanges typically employ various security protocols including cold storage, two-factor authentication, and withdrawal verification procedures. However, security effectiveness varies substantially among different platforms supporting BSV trading.

Company transparency levels differ significantly among exchanges offering BSV access. Some platforms provide comprehensive operational information, regulatory compliance details, and financial transparency, while others maintain more limited disclosure policies. The decentralized nature of cryptocurrency trading creates unique transparency challenges.

Industry reputation assessment requires platform-specific evaluation rather than universal standards. Established exchanges may have long operational histories and regulatory compliance records, while newer platforms may lack comprehensive track records. Historical incident handling and regulatory compliance demonstrate platform reliability more effectively than general market presence.

User experience evaluation for BSV trading depends heavily on chosen platform characteristics rather than universal standards. Interface design, functionality, and ease of use vary dramatically among different exchanges supporting BSV access. Major platforms typically invest in user experience development, but implementation approaches and effectiveness differ substantially.

Registration and verification procedures vary among exchanges offering BSV trading. Some platforms provide streamlined onboarding processes, while others require extensive documentation and verification steps. The complexity and time requirements for account setup depend on individual platform policies and regulatory compliance requirements.

Fund management experiences differ significantly among supporting exchanges. Deposit and withdrawal procedures, processing times, and available payment methods vary based on platform policies and regional compliance requirements. The effectiveness of fund operations represents a crucial user experience component that requires platform-specific evaluation.

Common user concerns in cryptocurrency trading typically include security, execution quality, and customer support responsiveness. However, specific feedback regarding BSV trading experiences is not detailed in available information. User satisfaction assessment requires independent research and platform-specific review analysis for comprehensive understanding.

This bsv review reveals that Bitcoin SV presents a cryptocurrency trading opportunity with multi-platform accessibility but limited comprehensive operational information. The availability across established exchanges like KuCoin and Binance Futures suggests reasonable market acceptance and liquidity support. However, specific trading conditions require platform-specific investigation.

BSV trading appears most suitable for cryptocurrency enthusiasts and investors who understand the technical distinctions between various Bitcoin implementations. They must also be comfortable navigating multiple exchange platforms. The decentralized nature of cryptocurrency trading means that user experience depends heavily on chosen platform selection rather than standardized service delivery.

The primary advantages include multi-platform availability and access to established cryptocurrency exchanges with developed infrastructure. However, significant limitations include the absence of comprehensive regulatory clarity, limited specific operational details, and the requirement for platform-specific due diligence. Potential traders should thoroughly research chosen platforms and understand local regulatory requirements before engaging in BSV trading activities.

FX Broker Capital Trading Markets Review