BOK Financial Review 3

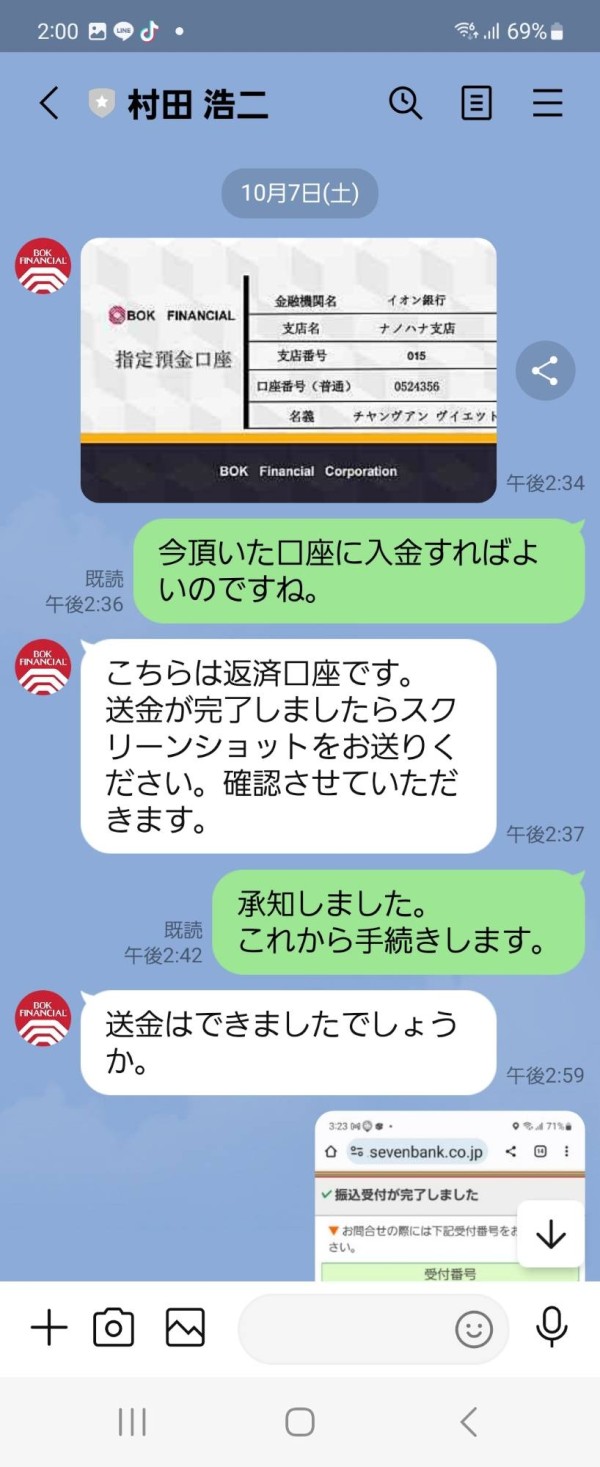

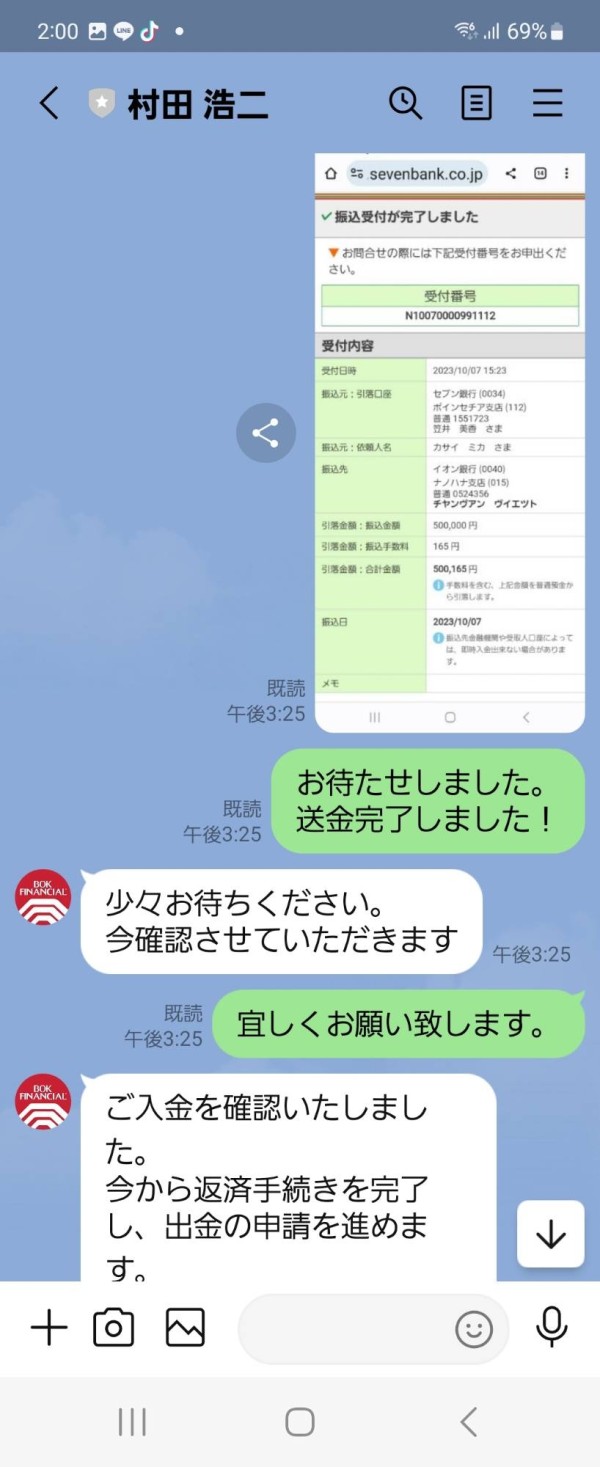

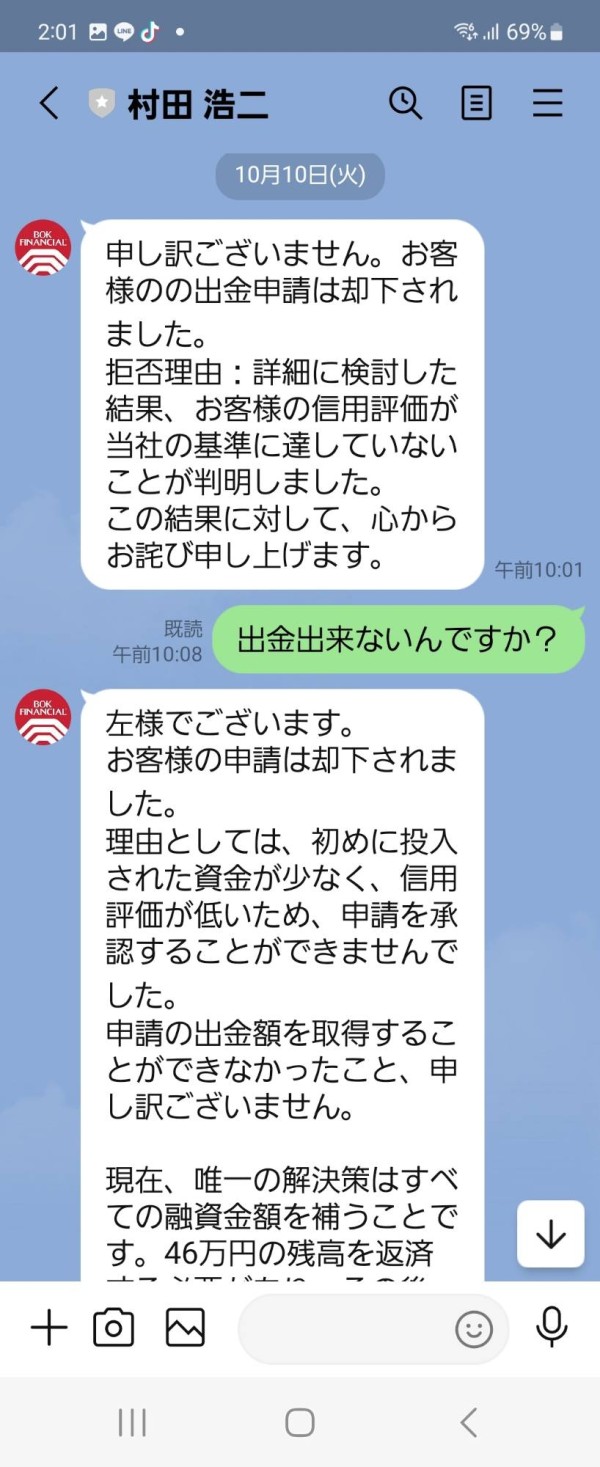

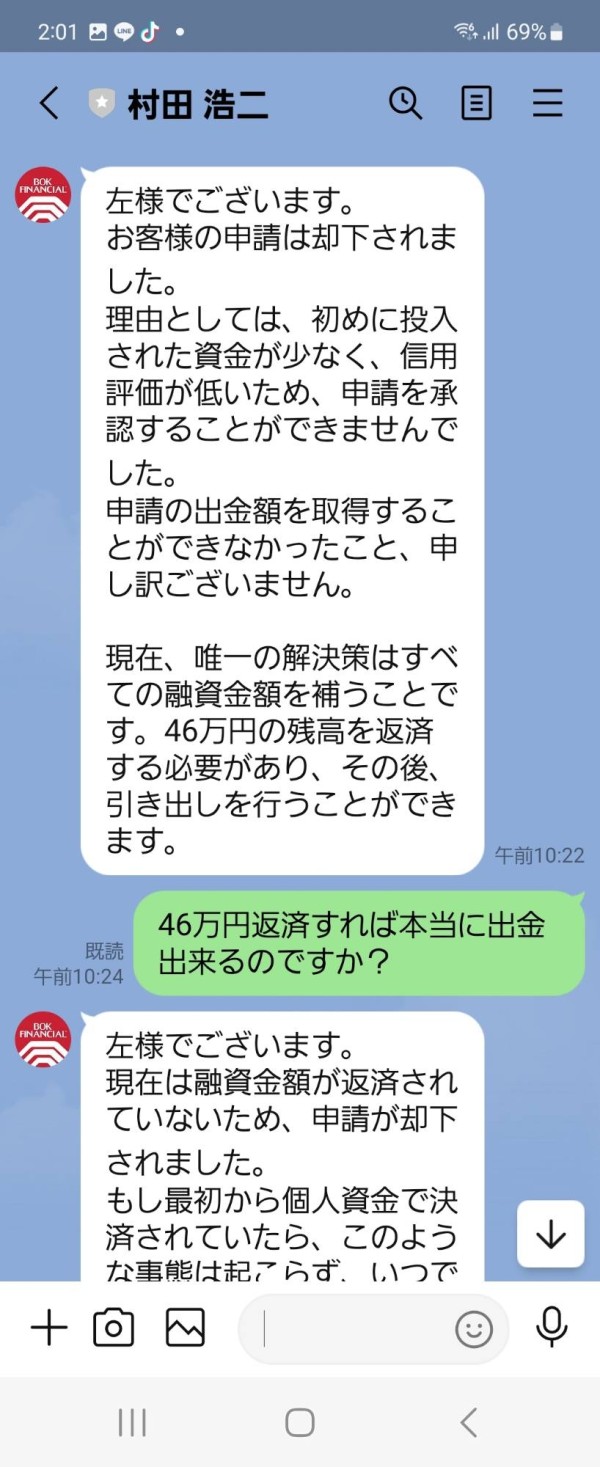

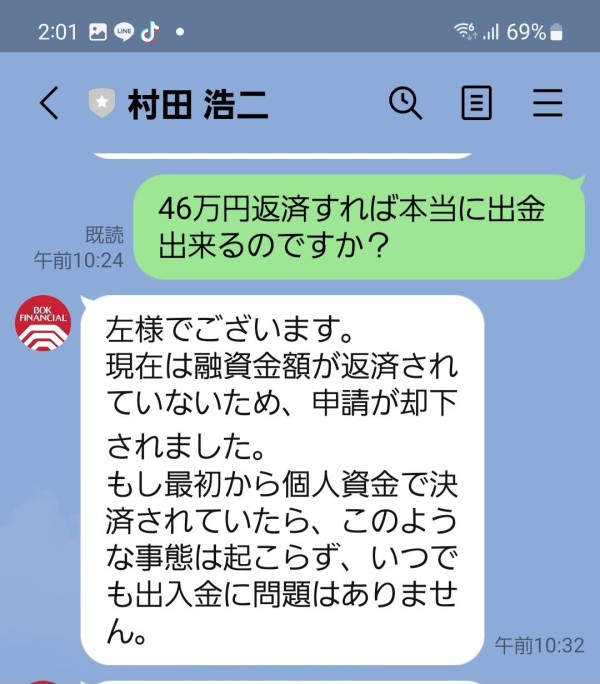

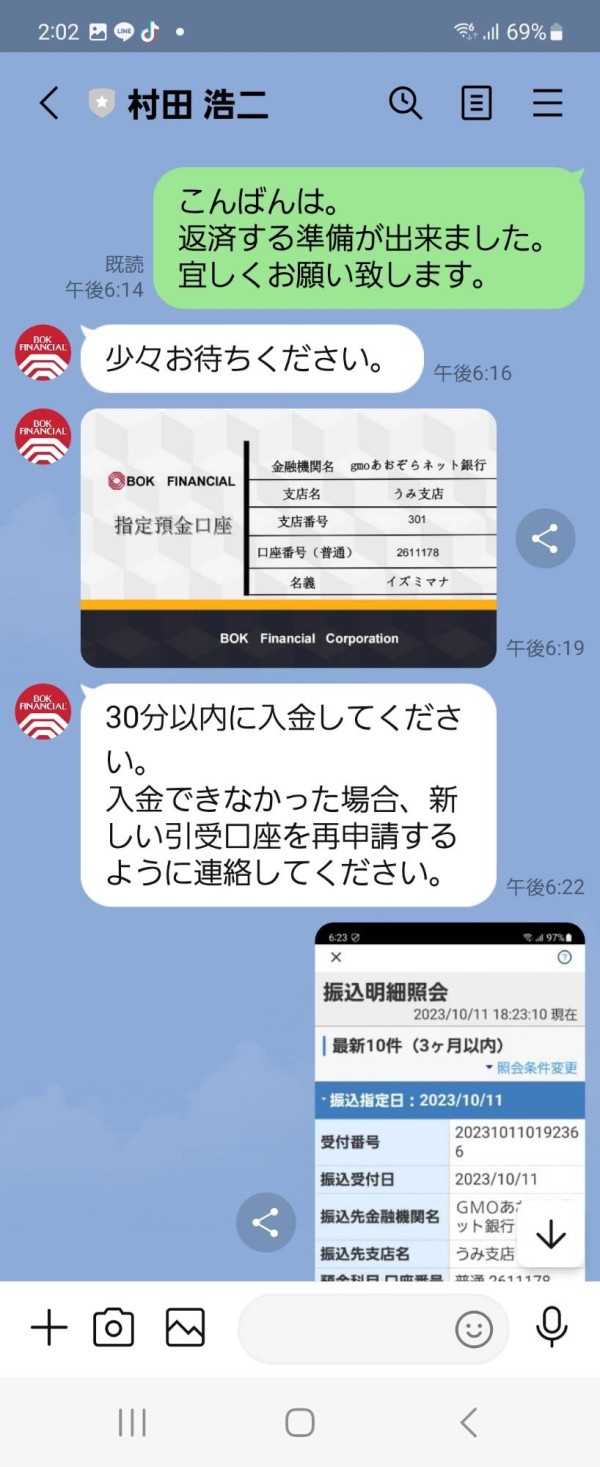

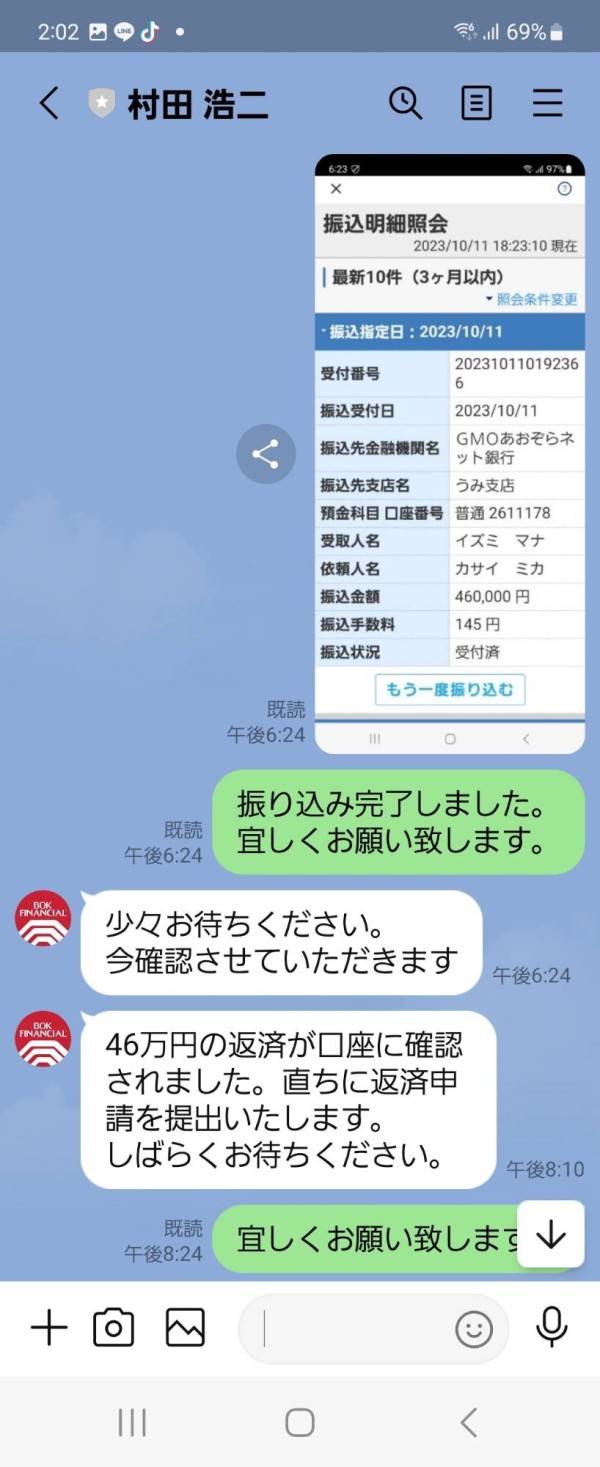

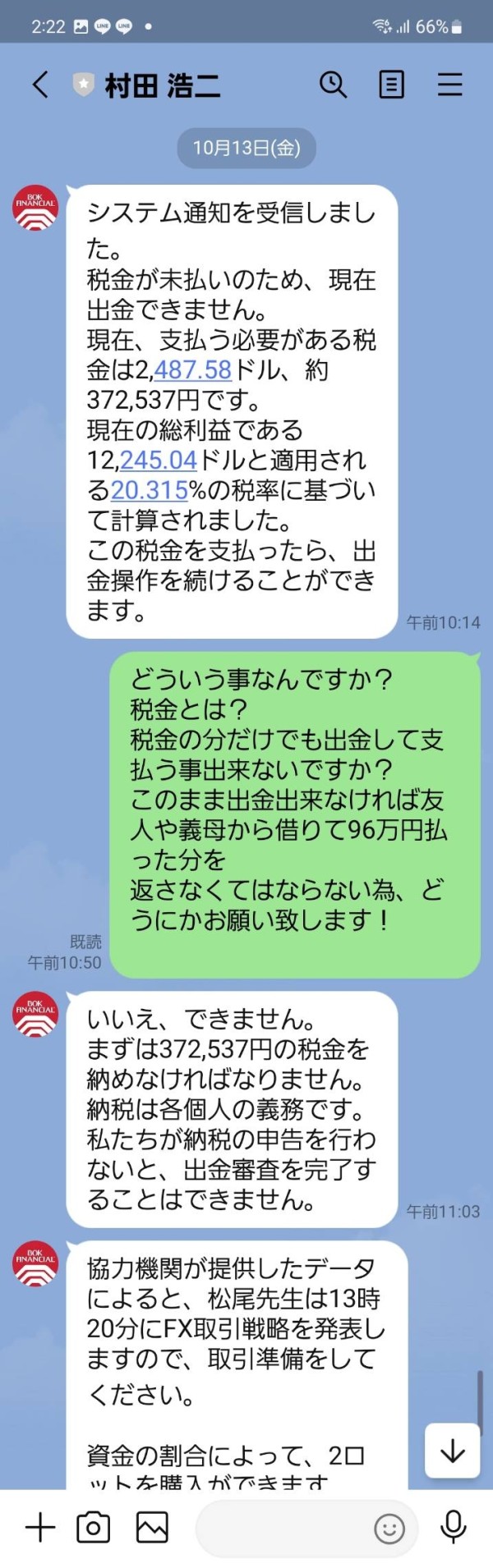

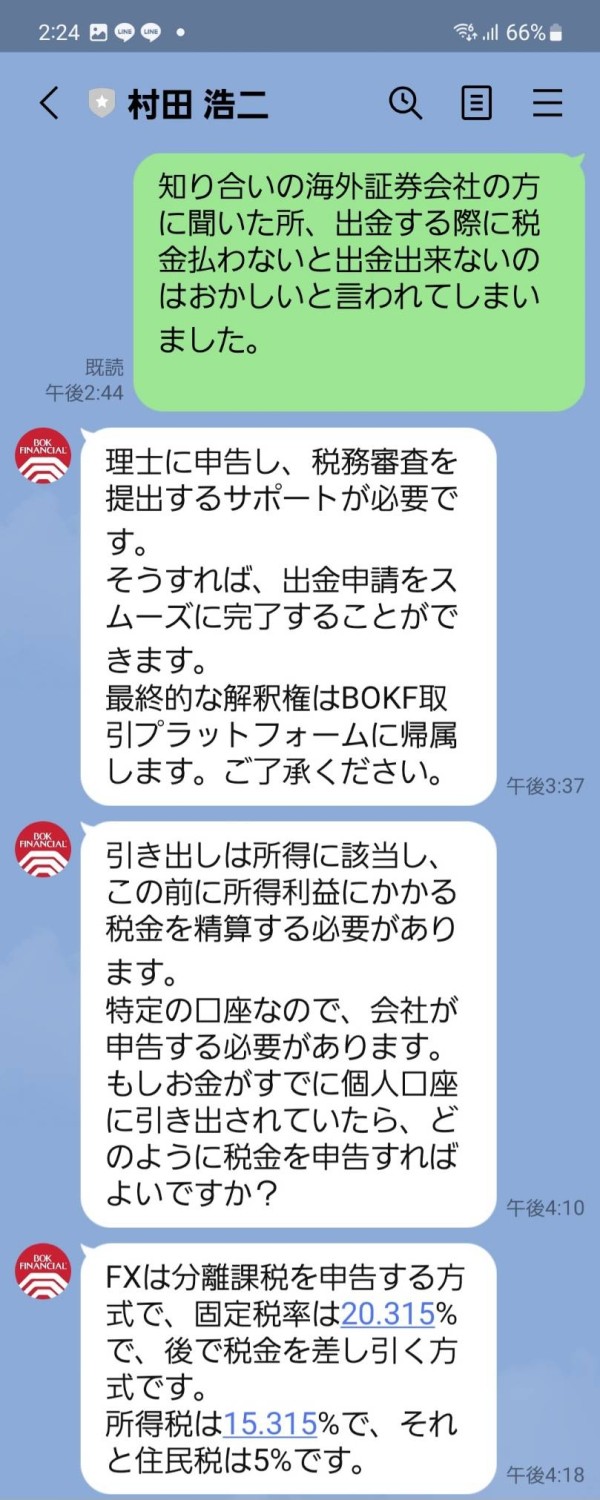

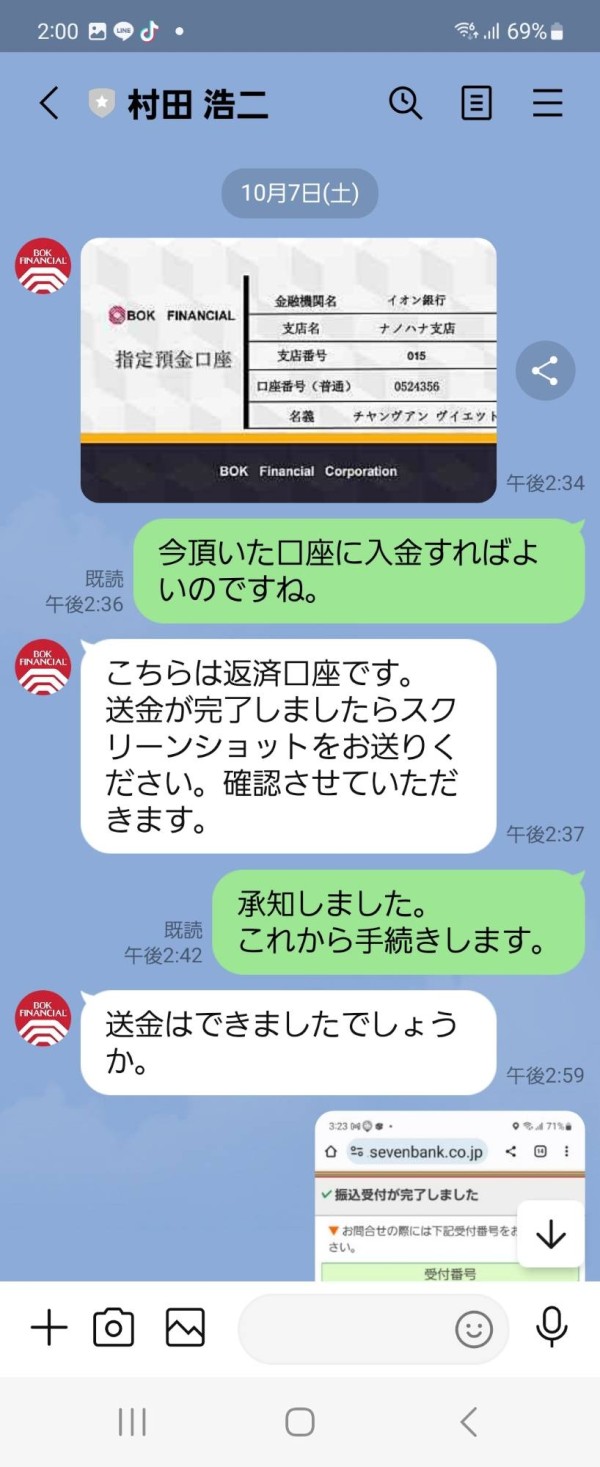

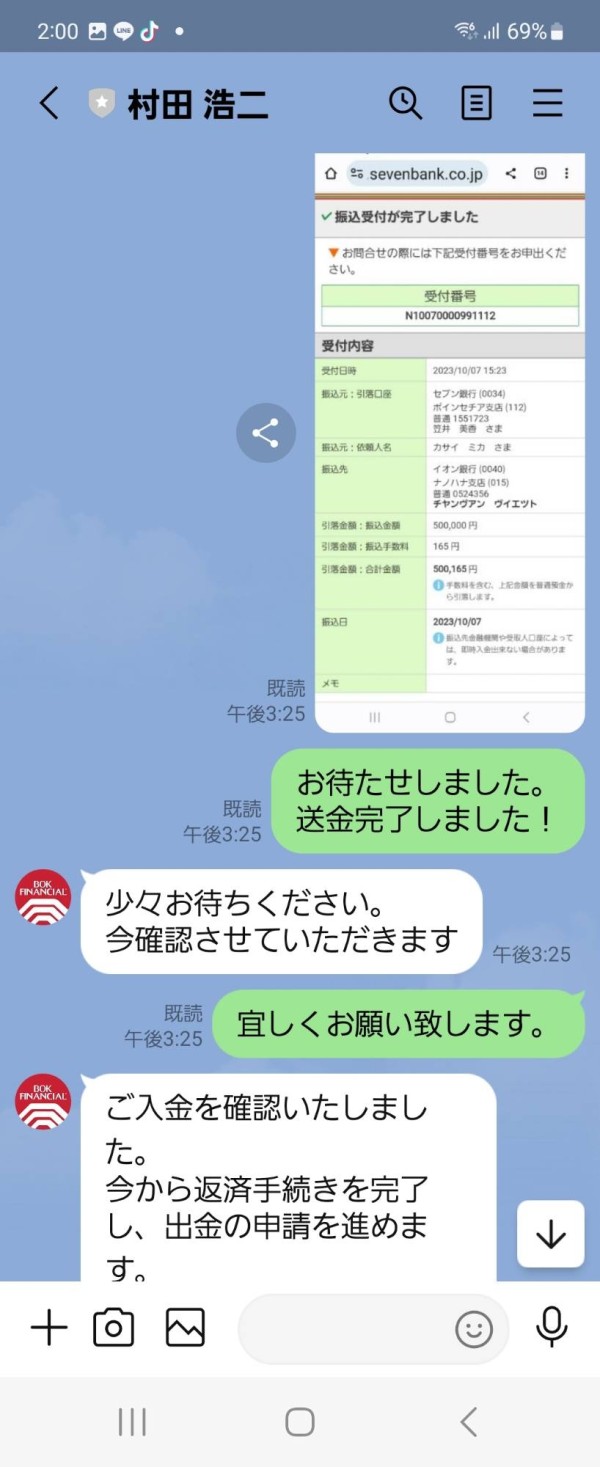

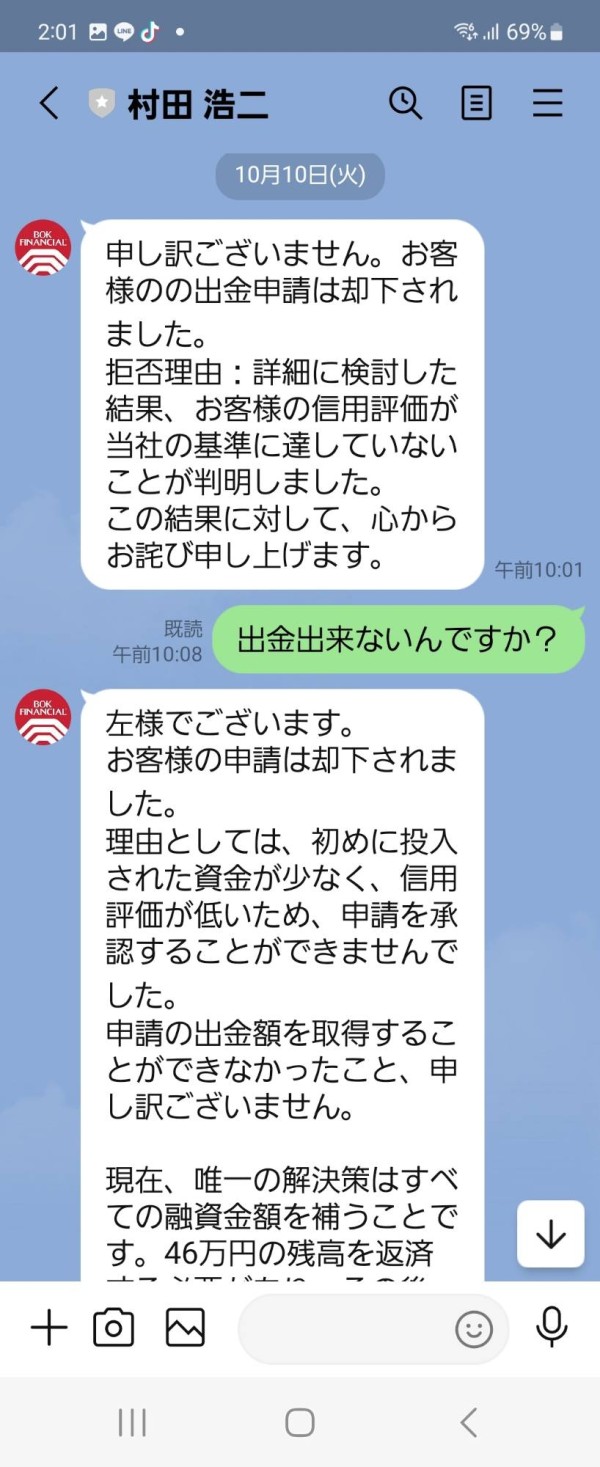

In the LINE group of a teacher called Shigeto Matsuoshi, he was recommended to trade from BOKF's FX app, and was trading after receiving trading instructions from Koji Murata of BOK Financial's Japan branch. After that, I was advised to trade crude oil and was told that I could do so with a margin of $68, so I bought it. However, on the settlement day, I was told that I had to pay in cash and that I needed $6,800. However, when I said I didn't have the money, they said they would lend me a loan and took the money as a deposit. After that, when I tried to withdraw my profits, I was told that I could not withdraw the money unless I repaid the loan in cash, so I borrowed money from friends and managed to repay the $6,800 (960,000 yen). I was told that I could withdraw the money at any time if I repaid the money, so I applied for a withdrawal, but this time I was told that I could not withdraw the money unless I paid the tax in cash, and the withdrawal was refused. I would like my friends to refund me the money I borrowed. please help me!

BOK Financial got me feeling some type of way. First off, their NFA unauthorized status got me paranoid about the safety of my money. Tried visiting their website, but it's like a ghost town – not a good sign. The high minimum deposit requirement is straight-up highway robbery for someone like me just starting out. And don't even get me started on their customer service – limited options and slow response times. It's like they're running a shady operation offshore. I'm steering clear and looking for a broker that's more legit and user-friendly.

I recently started trading with BOK Financial, and so far, the experience has been quite impressive. The wide range of market instruments, including Forex, commodities, and CFDs, gives me plenty of options to diversify my portfolio. The high leverage of up to 1:1000 is a game-changer, allowing me to maximize my potential profits. BOK Financial seems like a solid choice for traders looking for diverse trading opportunities with substantial leverage.