GDL Review 1

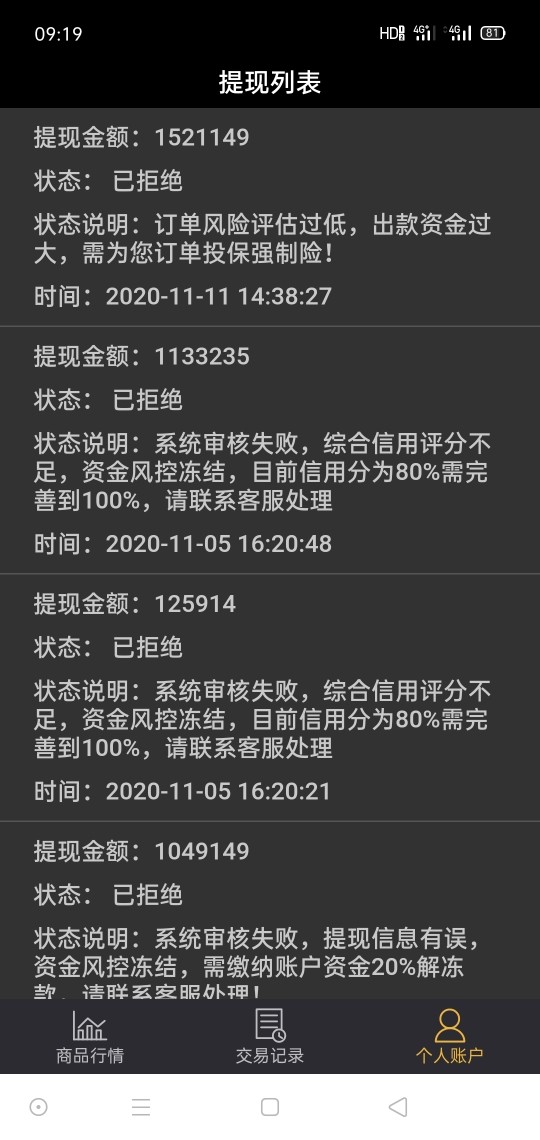

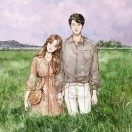

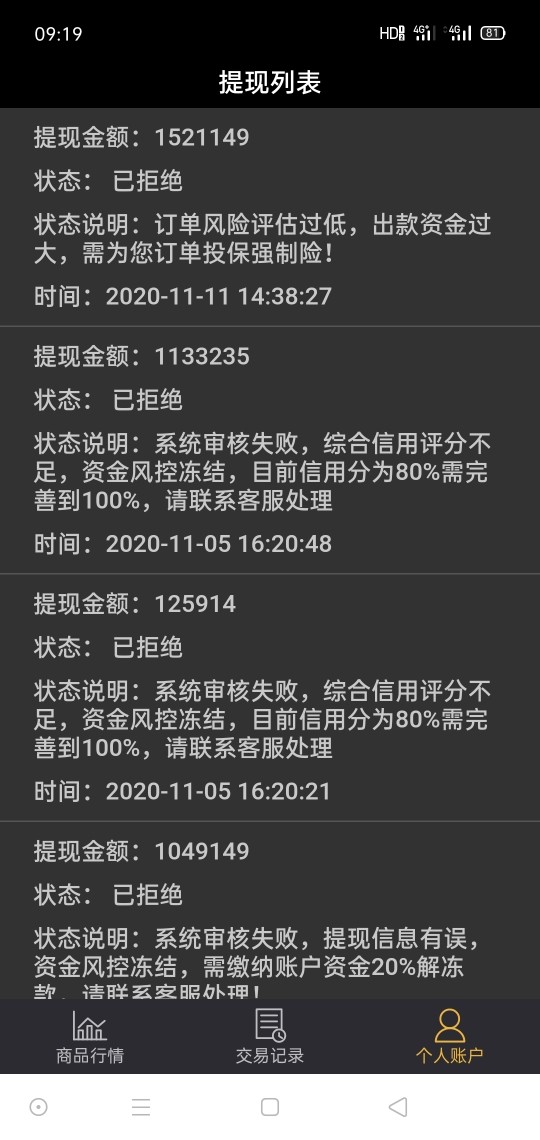

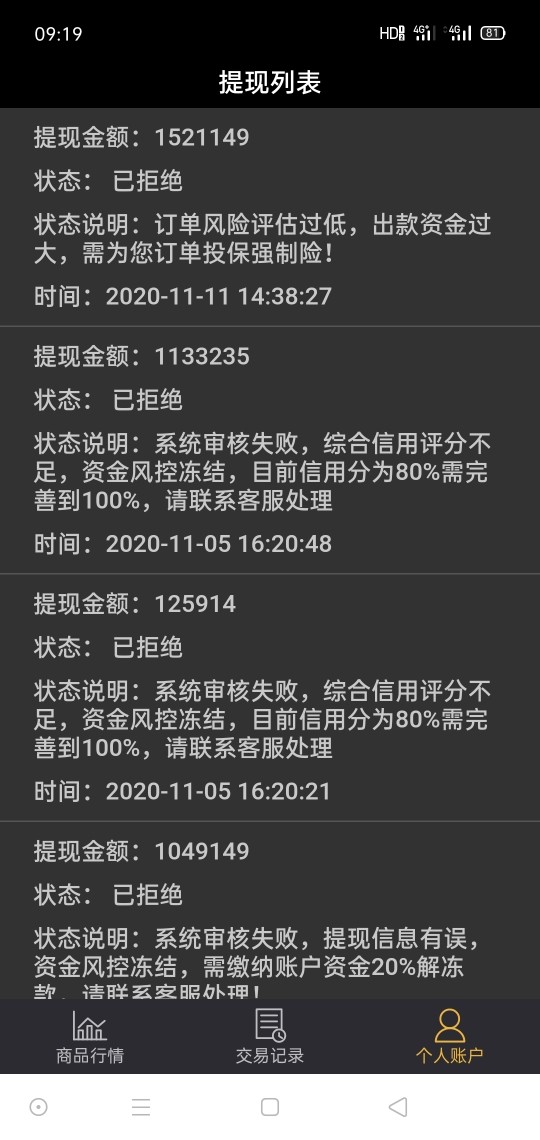

The broker scams customers. You can't witdhraw funds. You ahve to deposit maargin and unfreezing fund.

GDL Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

The broker scams customers. You can't witdhraw funds. You ahve to deposit maargin and unfreezing fund.

This gdl review provides a comprehensive analysis of GDL's services in 2025. It examines multiple entities operating under the GDL brand. Based on available information, GDL presents a mixed profile with several distinct business operations including logistics, brokerage, and fund management services. The company demonstrates considerable longevity in the market. GDL Logistics LLC was established in 1998 and GDL Brokerage, Inc. obtained customs brokerage licensing in 2003.

The evaluation reveals significant information gaps regarding specific trading conditions, regulatory oversight for retail forex operations, and detailed service specifications. While GDL shows some presence on review platforms like Trustpilot with 459 reviews, the lack of comprehensive trading-related information makes it challenging to provide definitive recommendations for retail forex traders. GDL appears most suitable for clients seeking logistics and customs brokerage services rather than traditional retail forex trading. This is given the emphasis on freight forwarding and customs operations in available documentation. The company's established history and C-TPAT certification indicate operational credibility in the logistics sector, though forex-specific credentials remain unclear from current sources.

Cross-Regional Entity Differences: This review encompasses multiple GDL entities including GDL Logistics LLC, GDL Brokerage, Inc., and The GDL Fund. GDL Logistics LLC focuses on freight brokerage and logistics, GDL Brokerage, Inc. provides customs brokerage services, and The GDL Fund is registered with the Securities and Exchange Commission. These entities operate in different business sectors and may have varying regulatory requirements and service offerings.

Review Methodology: This evaluation is based on publicly available information, regulatory filings, and user feedback from various sources. Due to limited specific information regarding retail forex trading services, some sections reflect the absence of detailed trading conditions and regulatory information typically expected for forex brokers.

| Dimension | Score | Rating |

|---|---|---|

| Account Conditions | 4/10 | Below Average |

| Tools and Resources | 3/10 | Poor |

| Customer Service and Support | 5/10 | Average |

| Trading Experience | 4/10 | Below Average |

| Trust and Regulation | 3/10 | Poor |

| User Experience | 5/10 | Average |

Company Background and Establishment

GDL operates through multiple business entities with varying establishment dates and operational focuses. GDL Logistics LLC was founded in 1998, initially concentrating on freight brokerage and logistics services. The company expanded its operations in 2003 when GDL Brokerage, Inc. obtained permission to provide customs brokerage services and operate bonded warehouse facilities. This allows goods storage for up to five years without customs duty payments.

The organization further enhanced its credentials in 2008 by obtaining C-TPAT certification. This demonstrates commitment to supply chain security standards. Additionally, The GDL Fund operates as a registered investment entity with the Securities and Exchange Commission, filing under Securities Act File No. 811-21969. The principal offices are located in Rye, New York.

Business Model and Service Structure

The GDL business model primarily centers around logistics and customs brokerage services rather than traditional retail forex trading. GDL Logistics LLC operates as a freight broker with a fleet of modern vehicles, focusing on secure and efficient transportation services. The customs brokerage division provides specialized services for import and export operations. It leverages bonded warehouse capabilities and regulatory compliance expertise.

However, specific information regarding forex trading platforms, asset classes, and retail trading services remains notably absent from available documentation. This gdl review finds limited evidence of traditional forex broker offerings such as MetaTrader platforms, currency pairs, or retail trading accounts. This suggests the company's primary focus lies outside conventional forex brokerage services.

Regulatory Oversight: Available information does not specify primary financial services regulators for retail forex operations. The GDL Fund maintains SEC registration, while customs brokerage operations likely fall under CBP oversight.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods for trading accounts is not detailed in available sources. This indicates potential limitations in retail forex service offerings.

Minimum Deposit Requirements: Current documentation does not specify minimum deposit requirements for trading accounts. This suggests either absence of such services or lack of publicly available information.

Promotional Offers: No specific bonus promotions or trading incentives are mentioned in available materials. This may indicate a focus on institutional rather than retail client acquisition.

Tradeable Assets: Specific information about tradeable asset classes, currency pairs, commodities, or indices is not provided in current sources. This raises questions about the scope of trading services offered.

Cost Structure: Details regarding spreads, commissions, overnight fees, and other trading costs are not specified in available documentation. This makes cost comparison with other brokers impossible based on current information.

Leverage Ratios: Maximum leverage ratios and margin requirements are not detailed in accessible sources.

Platform Options: Specific trading platform options and software solutions are not mentioned in available materials.

Geographic Restrictions: Regional availability and service restrictions are not clearly outlined in current documentation.

Customer Support Languages: Available customer service languages are not specified in current sources.

This gdl review highlights significant information gaps that potential clients should consider when evaluating services.

The account conditions evaluation for GDL reveals substantial information deficiencies that impact the overall assessment. Available sources do not provide specific details about account types. Whether standard, premium, or institutional accounts are offered remains unclear. The absence of minimum deposit information makes it impossible to assess accessibility for different trader segments or compare competitiveness with industry standards.

Account opening procedures and verification requirements are not detailed in current documentation. This creates uncertainty about onboarding processes. Special account features such as Islamic accounts, demo accounts, or managed account options are not mentioned in available sources. The lack of specific account condition information suggests either limited retail trading focus or insufficient public disclosure of service terms.

User feedback regarding account opening experiences and account management is notably absent from accessible sources. This makes it difficult to assess practical account operation quality. Without concrete information about account features, fees, or requirements, potential clients cannot make informed decisions about account suitability. This gdl review finds the account conditions dimension significantly hampered by information unavailability, resulting in a below-average rating that reflects uncertainty rather than confirmed service quality issues.

The trading tools and resources analysis reveals significant shortcomings in available information about GDL's offerings. Current sources do not specify analytical tools, charting software, or technical analysis resources that might be available to clients. Research capabilities, market analysis, and economic calendar features are not mentioned in accessible documentation.

Educational resources such as webinars, tutorials, trading guides, or market commentary are absent from available materials. This suggests limited support for trader development and learning. Automated trading support, including Expert Advisors, algorithmic trading capabilities, or API access, is not detailed in current sources.

Third-party tool integration, mobile applications, and advanced trading features remain unspecified. This creates significant gaps in understanding the technological infrastructure available to users. The absence of tool-related user feedback makes it impossible to assess practical functionality and reliability of any existing resources.

Without specific information about trading tools, analytical capabilities, or educational support, this dimension receives a poor rating. This reflects the substantial uncertainty about resource availability rather than confirmed inadequacies in service provision.

Customer service evaluation for GDL shows mixed indicators with limited specific information about support quality and availability. The presence of 459 Trustpilot reviews suggests some level of customer interaction and feedback collection. However, specific service quality metrics are not detailed in available sources.

Support channel availability, including phone, email, live chat, or ticket systems, is not clearly specified in current documentation. Response time commitments, service level agreements, and support hour coverage remain unclear from accessible information. The geographical distribution of support teams and multilingual capabilities are not detailed in available sources.

Problem resolution procedures and escalation processes are not outlined in current materials. This makes it difficult to assess support effectiveness for complex issues. While the company's established history since 1998 suggests operational stability, specific customer service quality indicators are not available for detailed analysis.

The average rating reflects the presence of some customer feedback mechanisms balanced against the lack of specific service quality information and support structure details. These would enable a more comprehensive assessment.

The trading experience evaluation encounters significant challenges due to limited information about actual trading services and platform functionality. Platform stability, execution speed, and order processing capabilities are not detailed in available sources. This makes it impossible to assess core trading performance metrics.

Order execution quality, including slippage rates, requote frequency, and fill rates, is not specified in current documentation. Platform functionality, user interface design, and navigation efficiency remain unclear from accessible information. Mobile trading capabilities and cross-device synchronization features are not mentioned in available sources.

Trading environment factors such as market depth, liquidity provision, and pricing transparency are not detailed in current materials. Real-time data quality, chart functionality, and order management tools are not specified. This creates substantial gaps in understanding the practical trading experience.

User feedback specifically related to trading performance and platform reliability is notably absent from available sources. This gdl review assigns a below-average rating based on the substantial uncertainty about trading experience quality rather than confirmed service deficiencies. This reflects the need for more comprehensive information disclosure.

The trust and regulation assessment reveals concerning information gaps regarding financial services oversight and client protection measures. While The GDL Fund maintains SEC registration, specific regulatory oversight for retail forex operations is not clearly established in available documentation. Primary financial services regulators, licensing numbers, and compliance frameworks are not detailed in current sources.

Client fund protection measures, including segregated accounts, deposit insurance, or compensation schemes, are not specified in available materials. Financial reporting transparency, audit procedures, and regulatory compliance history are not accessible through current sources. The absence of specific regulatory information creates uncertainty about client protection standards and operational oversight.

Company transparency regarding ownership structure, financial statements, and regulatory relationships is limited in available documentation. While the established operational history suggests business continuity, specific trust indicators such as regulatory warnings, compliance issues, or industry recognition are not detailed in current sources.

The poor rating reflects significant regulatory information gaps that potential clients should consider carefully. This emphasizes the importance of direct verification of regulatory status and client protection measures before engaging services.

User experience evaluation shows moderate indicators with some positive elements balanced against information limitations. The presence of Trustpilot reviews suggests active customer engagement and feedback collection. However, specific satisfaction metrics and user sentiment analysis are not detailed in available sources.

Interface design quality, navigation efficiency, and overall usability are not specifically addressed in current documentation. Registration and account verification processes are not detailed. This makes it difficult to assess onboarding experience quality. Fund management procedures and withdrawal processes are not specified in available sources.

User feedback themes, common complaints, and satisfaction drivers are not comprehensively available through current sources. This limits the ability to identify specific experience strengths or weaknesses. The established company history suggests operational stability that may contribute to user confidence.

Platform accessibility, technical support quality, and user guidance resources are not detailed in available materials. The average rating reflects the presence of some user interaction mechanisms balanced against limited specific information about experience quality and user satisfaction levels.

This gdl review concludes that GDL presents a complex profile with established business operations primarily focused on logistics and customs brokerage services rather than traditional retail forex trading. The company demonstrates operational longevity and regulatory compliance in its core business areas. C-TPAT certification and SEC registration for fund operations indicate legitimate business credentials.

However, significant information gaps regarding retail forex trading services, specific trading conditions, and client protection measures limit the ability to recommend GDL for traditional forex trading activities. The company appears most suitable for clients requiring logistics, customs brokerage, or specialized transportation services rather than retail currency trading.

Potential users should conduct direct verification of services, regulatory status, and trading conditions before engaging with GDL. This is particularly important given the limited publicly available information about retail trading offerings and client protection frameworks.

FX Broker Capital Trading Markets Review