Is BOK Financial safe?

Pros

Cons

Is Bok Financial Safe or Scam?

Introduction

Bok Financial is an online trading platform that claims to provide services in the foreign exchange (forex) market, commodities, and contracts for difference (CFDs). Established in the United States but reportedly operating offshore in Japan, Bok Financial positions itself as a viable option for traders looking to engage in forex trading. However, the importance of thoroughly assessing forex brokers cannot be overstated, as the industry is rife with scams and unregulated entities that can jeopardize traders' investments. This article aims to provide an objective analysis of Bok Financial's credibility, focusing on its regulatory status, company background, trading conditions, customer experience, and overall risk assessment.

To compile this evaluation, we conducted extensive research using various online resources, including customer reviews, regulatory databases, and expert analyses. The findings will be structured to offer a comprehensive overview of whether Bok Financial is a safe trading platform or a potential scam.

Regulation and Legitimacy

When evaluating the safety of a brokerage, regulatory oversight is a crucial factor. Regulatory bodies enforce compliance with industry standards, providing a layer of protection for traders. In the case of Bok Financial, the broker operates under the National Futures Association (NFA) but has been flagged as unauthorized. This raises significant concerns regarding its legitimacy and adherence to regulatory requirements.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0557967 | United States | Unauthorized |

The lack of a valid license from a credible regulatory authority like the NFA implies that Bok Financial may not be compliant with industry norms. This unauthorized status is alarming, as it suggests that the broker could be operating outside the bounds of legal and ethical trading practices. Furthermore, the absence of a functioning official website raises suspicions that the broker may have ceased operations or is attempting to evade scrutiny. The combination of these factors significantly amplifies the risk for potential traders considering whether Bok Financial is safe.

Company Background Investigation

Understanding a company's history and ownership structure is vital in assessing its reliability. Bok Financial claims to have been established for several years, yet specific details about its founding, ownership, and management team remain elusive. The lack of transparency regarding its corporate structure and operational history raises red flags for potential investors.

Moreover, the management team's background and professional experience are crucial indicators of a company's credibility. However, Bok Financial does not provide sufficient information about its leadership, making it challenging to evaluate their qualifications and expertise in the financial industry. The opacity surrounding the company's operations and the lack of accessible information diminish its trustworthiness. As a result, traders must approach Bok Financial with caution and consider the potential implications of investing with a broker that lacks transparency.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience. Bok Financial advertises high leverage of up to 1:1000, which can be attractive for traders looking to amplify their profits. However, such high leverage also entails substantial risk, particularly for inexperienced traders.

In terms of fees and costs, Bok Financial's structure appears to be less favorable compared to industry standards. The minimum deposit requirement of $1,000 is relatively high, potentially limiting access for novice traders. Additionally, the specifics of spreads and commissions remain undisclosed, which is a significant concern for transparency.

| Fee Type | Bok Financial | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 1-2 pips |

| Commission Model | Not Disclosed | Varies (typically $5-$10 per lot) |

| Overnight Interest Range | Not Disclosed | 1-3% |

The lack of clear information regarding trading costs and the absence of transparent fee structures may indicate that Bok Financial is not fully committed to providing a fair trading environment. This lack of transparency further complicates the assessment of whether Bok Financial is safe for traders.

Customer Fund Security

The safety of customer funds is paramount when considering a forex broker. Bok Financial's approach to fund security is a critical aspect of its overall risk profile. Unfortunately, there is limited information available regarding the broker's security measures, such as whether customer funds are kept in segregated accounts or if there are any investor protection schemes in place.

Without robust measures for fund protection, traders' investments may be at risk. Furthermore, any historical issues related to fund security or disputes would further exacerbate concerns about the broker's reliability. Given the current lack of information, potential clients must be cautious and conduct thorough due diligence before engaging with Bok Financial.

Customer Experience and Complaints

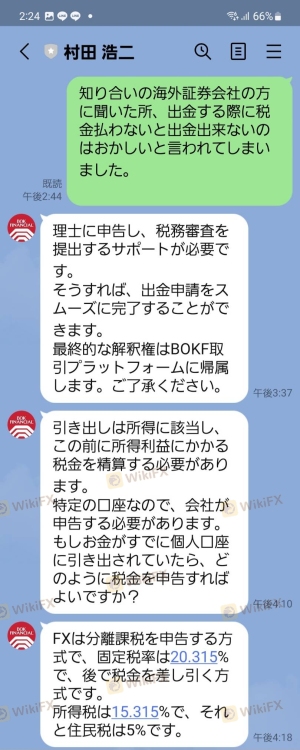

Customer feedback serves as an invaluable resource for assessing a broker's reliability. Reviews of Bok Financial reveal a mix of experiences, with several users reporting difficulties in withdrawing funds and receiving inadequate customer support. Common complaints include issues with fund accessibility and slow response times from the customer service team.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Availability | Medium | Average |

One notable case involved a trader who reported being unable to withdraw profits due to alleged tax obligations imposed by the broker. This pattern of complaints raises serious concerns about Bok Financial's operational practices and customer service quality. For those contemplating whether Bok Financial is safe, these reviews highlight significant risks associated with trading on this platform.

Platform and Execution

The performance and reliability of the trading platform are crucial for a seamless trading experience. Unfortunately, there is limited information available regarding the user experience on Bok Financial's trading platform. The absence of reviews or detailed analyses makes it difficult to gauge the platform's stability, execution quality, and potential issues like slippage or order rejections.

In a market where execution speed and reliability can significantly impact trading outcomes, the lack of transparency surrounding Bok Financial's platform raises concerns. Traders must be wary of potential platform manipulation or technical issues that could adversely affect their trading activities.

Risk Assessment

Engaging with Bok Financial presents several risks that potential traders should consider. The overall regulatory status, lack of transparency, and mixed customer feedback contribute to a heightened risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Unauthorized by NFA |

| Customer Support | Medium | Poor responsiveness |

| Fund Security | High | Lack of information on fund protection |

To mitigate these risks, traders are advised to conduct thorough research, seek regulated alternatives, and remain vigilant about their investments.

Conclusion and Recommendations

In summary, the evaluation of Bok Financial reveals significant concerns regarding its safety and legitimacy. The unauthorized regulatory status, lack of transparency, and mixed customer experiences suggest that traders should exercise extreme caution before engaging with this broker.

For those considering whether Bok Financial is safe, the evidence points toward potential risks and operational deficiencies that could jeopardize investments. It is advisable for traders, especially beginners, to seek out regulated alternatives with a proven track record of reliability and customer support. Brokers that are licensed and have positive user feedback should be prioritized to ensure a safer trading environment.

Is BOK Financial a scam, or is it legit?

The latest exposure and evaluation content of BOK Financial brokers.

BOK Financial Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BOK Financial latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.