elite fx 2025 Review: Everything You Need to Know

Below is a comprehensive evaluation of Elite FX based on publicly available information and user feedback. This review covers all aspects of the broker's performance. It looks at account conditions, trading tools, customer service, and overall trustworthiness. Please note that while Elite FX claims CySEC affiliation, it is classified as an unregulated broker. Read on for a detailed analysis and the scoring framework that breaks down each component of their offering.

1. Abstract

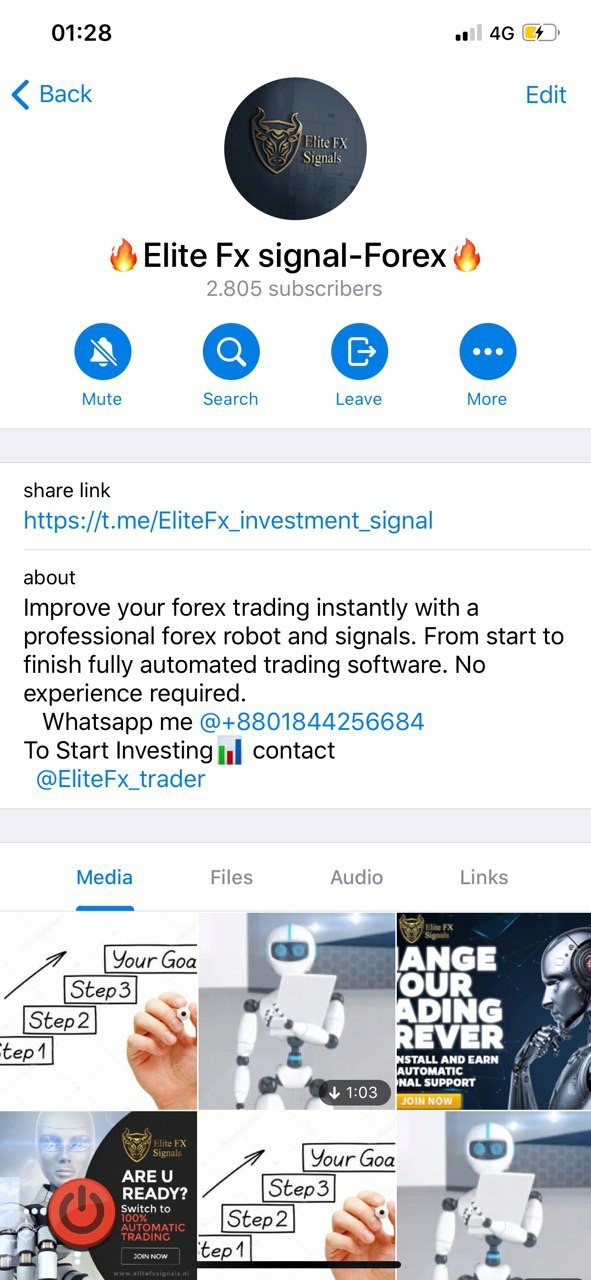

Elite FX is an unregulated broker with mixed reviews from its user base. This leads to an overall neutral assessment. This elite fx review reveals that the broker offers multiple trading platforms and supports over 200 trading instruments. These include Forex pairs and CFDs. One of its notable strengths is the Elite FX Academy, which supplies a wide variety of educational resources aimed at enhancing traders' familiarity with automated trading tools and account management services. However, potential clients should exercise caution due to the lack of robust regulatory oversight. The review is designed for traders who prioritize access to sophisticated trading platforms combined with automated features and educational support. Yet they must be willing to accept a certain degree of risk linked to transparency issues. Overall, while the educational and tool offerings are promising, the absence of clear regulatory frameworks and detailed account conditions is a significant concern.

2. Cautions

It is essential to note that although Elite FX claims regulatory oversight under CySEC, in reality, it is deemed an unregulated broker. This discrepancy should alert potential clients to hidden risks. These include issues related to fund security and transparency. Our evaluation is based on publicly accessible information, user reviews, and market reports. Therefore, discrepancies exist between the promotional claims and actual trading conditions, especially regarding account details and fee structures. Prospective traders are advised to conduct further independent research before engaging with Elite FX.

3. Rating Framework

Below is the scoring framework used to evaluate Elite FX across six critical dimensions:

4. Broker Overview

Company Background and Business Model

Elite FX Traders is recognized within the industry as an unregulated broker. This point has raised concerns among potential clients. While the specific year of establishment remains unspecified, the available information portrays a company that has opted to emphasize a modern, technologically driven approach to trading rather than focusing on long-established regulatory protocols. The broker primarily offers Forex trading, alongside contracts for difference , catering to both beginner and experienced traders. Despite an effort to project legitimacy through the mention of CySEC, the absence of concrete regulatory details and official registration is a considerable drawback. These factors, combined with mixed reviews from users, have contributed to a contentious reputation among market participants.

Elite FX offers a suite of trading platforms designed for various devices. These include desktop, web, and mobile environments. This multi-platform approach ensures that traders can access the market regardless of their location, and it is part of what drives the broker's appeal. Additionally, Elite FX supports an extensive range of trading instruments, boasting over 200 tradable assets that cover not only major and minor Forex pairs but also CFDs on indices, commodities, and other financial instruments. However, despite these promising features, the key regulatory concern remains unresolved. The broker purports to be under CySEC, but this affiliation is disputed by many industry observers, which further complicates its credibility. This elite fx review thus presents a picture of a broker with impressive technological infrastructure and diverse product offerings but one that may fall short in terms of regulatory compliance and investor protection.

Regulation Area

Elite FX claims regulatory oversight under CySEC. Yet the overall consensus among various sources indicates that it is effectively unregulated. The lack of official regulation implies that clients' funds and overall investor safety may be at risk. This discrepancy is a central concern for potential traders and is highlighted in this review.

Deposit and Withdrawal Methods

The complete details regarding the available deposit and withdrawal methods for Elite FX have not been clearly disclosed. This information is missing from the available summary.

Minimum Deposit Requirement

Unfortunately, the specific figures for the minimum deposit required to open an account with Elite FX have not been mentioned. This data is not available in the public records.

Details about any bonus or promotional offers provided by Elite FX remain undisclosed. The available materials do not contain this information.

Tradable Assets

Elite FX offers an extensive range of tradable instruments. They support over 200 different options. These include major and minor Forex pairs as well as CFDs on indices, commodities, and other assets. This wide variety is geared towards providing traders with ample opportunities to diversify their portfolios.

Cost Structure

The cost structure of Elite FX has not been clearly outlined in the published summaries. This includes specifics regarding spreads, commissions, and any additional fees. This omission makes it difficult for potential traders to evaluate the true cost of trading with the broker, impacting its transparency score and overall attractiveness.

Leverage Ratio

Detailed information on the leverage ratios available to traders at Elite FX has not been provided. This leaves an open question for potential clients in the accessible material.

Elite FX supports a diversified set of trading platforms. These include desktop, web-based, and mobile applications. This range ensures a flexible trading experience and accessibility, allowing traders to manage their accounts from virtually anywhere.

Regional Restrictions

There is no detailed information provided about any regional restrictions. These might apply to Elite FX clients.

Customer Service Languages

The specific languages in which customer service is offered by Elite FX have not been disclosed. This data is missing from the available information.

In this segment of the elite fx review, while the range of tradable instruments and platform options appears robust, significant gaps remain in transparency. These gaps concern costs, deposit details, and regulatory adherence. These omissions should make potential traders cautious as they evaluate the broker for their trading needs.

6. Detailed Ratings Analysis

6.1 Account Conditions Analysis

The account conditions provided by Elite FX are not well documented. This leads to substantial uncertainty about the broker's fee structure and overall transparency. Specifics regarding the types of accounts available—be it standard, premium, or specialized accounts such as Islamic accounts—are not clearly mentioned in the available data. The minimum deposit requirements, detailed spread information, and commission fees are conspicuously absent, thereby reducing the overall appeal for traders who compare these terms with regulated peers. Consequently, users report varied experiences regarding account setup, with several commenting on the opaque process and the lack of evident effort to cater to diverse trading needs. Furthermore, the absence of detailed account conditions makes it challenging to gauge potential hidden costs, especially when compared to more transparent brokers. This lack of clarity and the resulting hesitancy among prospective clients are key reasons why our evaluation scores this category low. Ultimately, the elite fx review emphasizes that traders seeking transparent and well-documented account features may find Elite FX wanting in this department.

Elite FX provides a wide array of trading instruments—reportedly over 200—which includes major Forex pairs and CFDs. This gives traders a broad spectrum of opportunities for diversification. One of the standout features is the Elite FX Academy, which offers a suite of educational resources ranging from beginner courses to advanced trading techniques. Additionally, the broker provides access to automated trading tools, aimed at streamlining trade execution and account management. However, while the breadth of trading instruments is commendable, the quality and consistency of the educational content and analytical tools remain uncertain in the absence of detailed performance data. Users generally appreciate the initiative behind the educational programs, yet some reviews indicate that improvements are needed in terms of depth and interactivity of the learning modules. Moreover, although automated trading support is mentioned, there are limited specifics on the tools' operational details or any proprietary software benefits. Overall, while the assortment of trading tools and resources are strong enough to earn a relatively high score, the lack of granular detail leaves room for improvement in ensuring the highest standards in trader support.

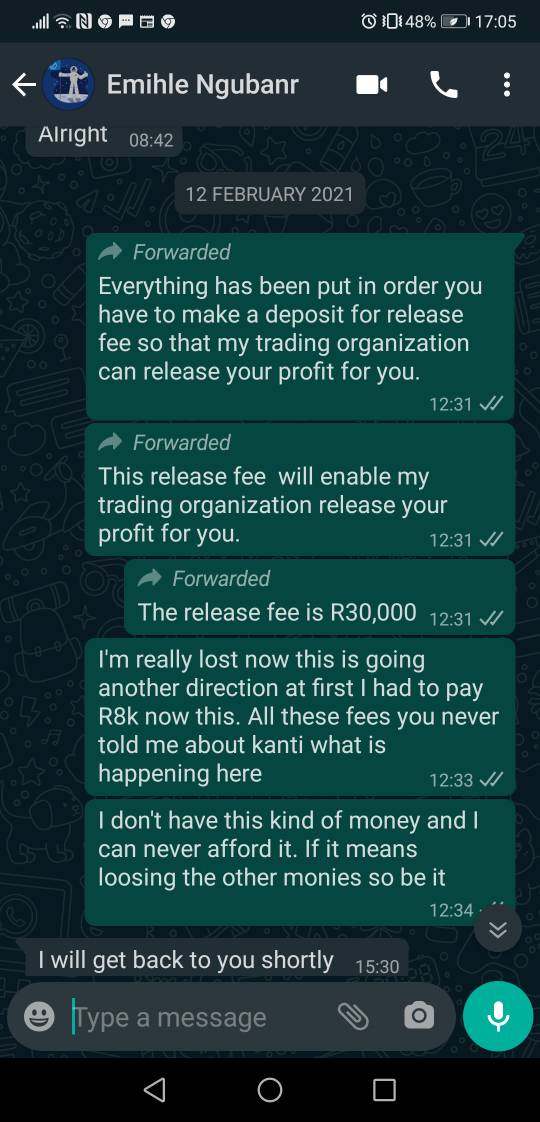

6.3 Customer Service and Support Analysis

Customer support at Elite FX appears to be one of the more problematic aspects. User feedback is highly polarized regarding responsiveness and service quality. While the broker offers several channels for customer service, detailed information about these channels—such as live chat, telephone, or email support—is notably absent from the provided summaries. Some traders report satisfactory interactions, yet numerous complaints highlight slow response times and unresolved issues. Given that multilingual support and extended service hours were not detailed in the available information, potential clients may face challenges during urgent market conditions. Furthermore, there are isolated instances where customers have expressed frustration over poor after-sales support, which further detracts from the overall customer experience. This mixed bag of experiences suggests that Elite FX still has considerable room for improvement in ensuring that all clients receive prompt and professional assistance. More transparency regarding customer support protocols and clearly defined service levels would be essential in enhancing trust among its user base.

6.4 Trading Experience Analysis

The trading experience offered by Elite FX is another area with both commendable and concerning aspects. On the positive side, users have mentioned that the trading platforms—available on desktop, web, and mobile—tend to offer stable and fast performance. This is crucial for effective trade execution in volatile markets. The platforms are reportedly equipped with essential charting tools and technical indicators, facilitating a well-rounded analysis environment. However, the lack of detailed data regarding order execution qualities, such as the occurrence of slippage or the consistency of fills, is a significant shortcoming. Additionally, while the platforms support automated trading features, there is insufficient clarity on how these tools perform under stress or during high-volatility conditions. This gap in information makes it difficult for traders to fully assess the reliability of the trading environment before committing capital. Overall, while users generally appreciate the functional design and stability of the platforms, the opaque nature of certain operational details underlines a need for more rigorous reporting and transparency. This elite fx review highlights that while the trading experience is adequate, enhancements in data reporting could significantly bolster trader confidence.

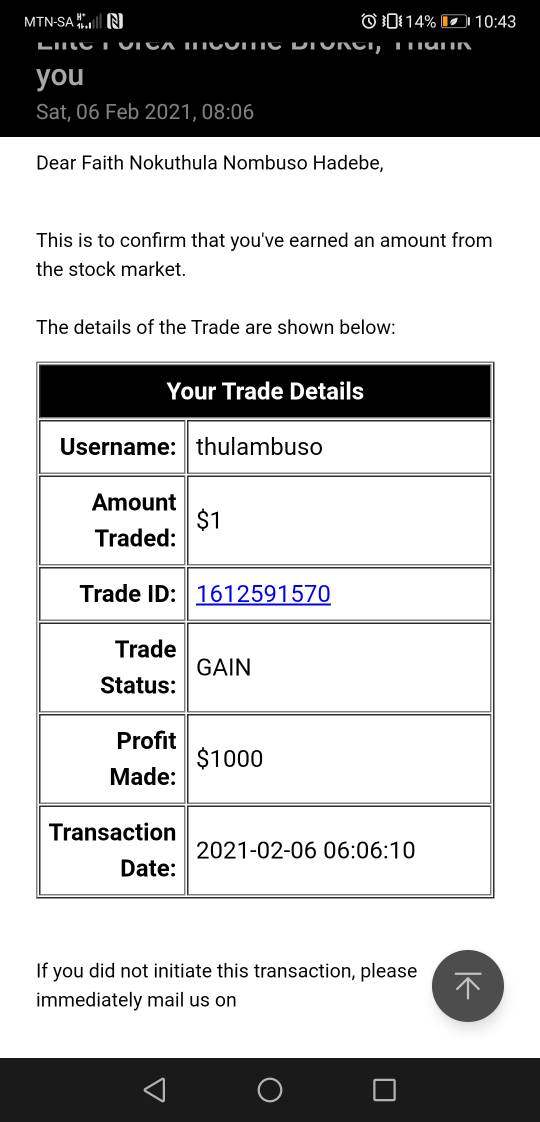

6.5 Credibility Analysis

Credibility is a critical concern when evaluating Elite FX. This is largely due to its unregulated status. Although the broker asserts affiliation with CySEC, this claim is not substantiated by verifiable documentation, thereby casting a long shadow over its reliability. The absence of regulatory oversight means that client funds are potentially at higher risk, and the broker's commitment to transparency and financial security cannot be confirmed. Additionally, there have been multiple user reports and complaints—all contributing to a perception that Elite FX lacks the robust safeguards that regulated brokers provide. The lack of detailed information about the company's background, financial health, and operational protocols further diminishes investor confidence. Comparatively, other brokers in the same category typically provide a wealth of documentation on regulatory compliance and safety measures, making Elite FX's position appear even less solid. This analysis underscores the notion that while the broker might offer appealing trading tools and educational resources, the fundamental concern regarding credibility remains unresolved, thereby warranting caution from traders in the market.

6.6 User Experience Analysis

The overall user experience with Elite FX presents a picture of mixed sentiments. On one hand, the interface design across the available platforms is generally considered user-friendly. The integration of multiple trading tools allows for a relatively smooth trading process. On the other hand, reports indicate that the registration and account verification processes are more complex than those of other brokers, leading to frustration among some users. Additionally, there are recurring criticisms regarding the lack of clarity in fee structures and account management features. The combination of these factors means that while some clients enjoy the innovative features and educational offerings, a significant number express dissatisfaction with the operational transparency and efficiency of the service. In summary, the balance of feedback suggests that Elite FX has taken notable steps in providing a diversified trading environment. However, persistent issues related to user interface complexities and customer support impact the overall satisfaction. Recommendations for improvement include streamlining the onboarding process and providing clearer, more detailed information on operational procedures, which would likely enhance long-term user retention and trust.

7. Conclusion

In conclusion, Elite FX presents itself as a broker with a broad range of trading instruments and a dedicated educational platform. The Elite FX Academy might appeal to traders invested in automated trading solutions. However, the absence of strict regulatory oversight—despite claims of CySEC affiliation—and the resulting transparency issues, particularly in account conditions and fee structures, remain significant concerns. This elite fx review ultimately advises prospective traders to exercise caution and perform additional due diligence before engaging with Elite FX.

This detailed review provides an in-depth look at Elite FX across multiple dimensions. Prospective clients should consider both the strengths—in terms of technological infrastructure and educational resources—and the weaknesses, particularly regarding regulatory compliance and customer support, to make an informed decision.