Bitso 2025 Review: Everything You Need to Know

Bitso, a leading cryptocurrency exchange based in Mexico, has garnered attention for its user-friendly interface and focus on trading cryptocurrencies against the Mexican Peso (MXN). However, user experiences vary significantly, with some praising its ease of use and others highlighting high fees and withdrawal issues. This review synthesizes information from various sources to provide a comprehensive overview of Bitso's offerings, strengths, and weaknesses.

Note: It's important to consider that Bitso operates through different entities across regions, which may influence user experiences and regulatory compliance. This review aims to present a balanced view based on multiple perspectives.

Rating Overview

We rate brokers based on a combination of user feedback, expert analysis, and factual data.

Broker Overview

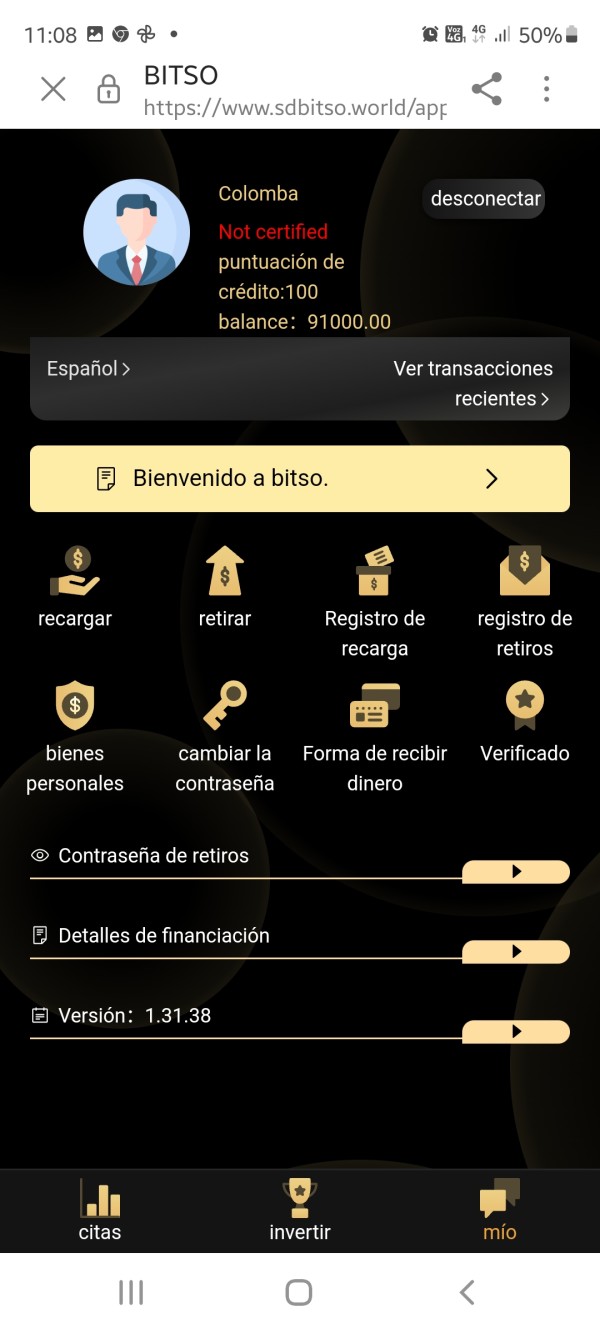

Founded in 2014, Bitso has established itself as a key player in the Mexican cryptocurrency market, allowing users to trade cryptocurrencies like Bitcoin, Ethereum, and Ripple against fiat currencies. The platform utilizes a proprietary trading terminal akin to TradingView and offers a mobile application for trading on the go. Bitso operates under a Distributed Ledger Technology (DLT) license granted by the Gibraltar Financial Services Commission (GFSC), but it faces scrutiny over its regulatory status and user complaints.

Detailed Breakdown

Regulatory Regions

Bitso primarily serves users in Mexico, Argentina, and Brazil, and operates under the regulations of the GFSC. However, many users express concerns about the lack of robust regulatory oversight, particularly when compared to exchanges regulated by tier-one authorities like the FCA or ASIC.

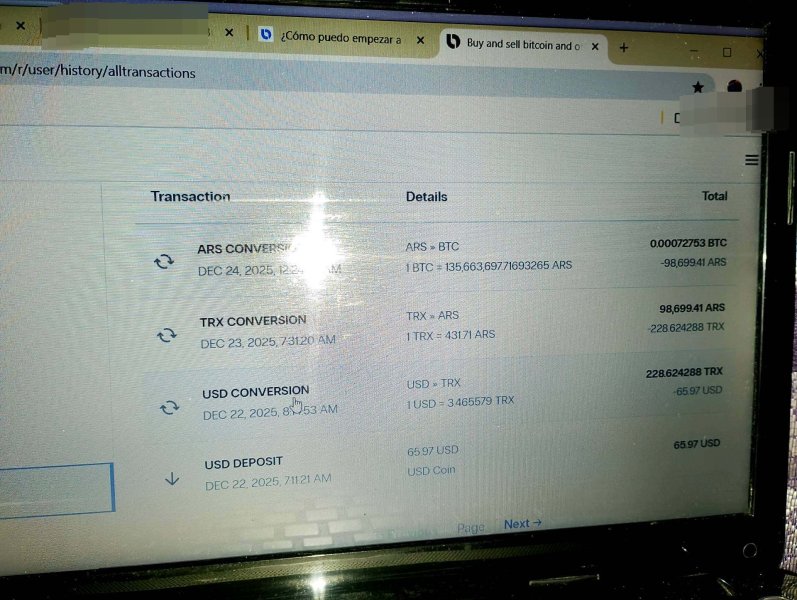

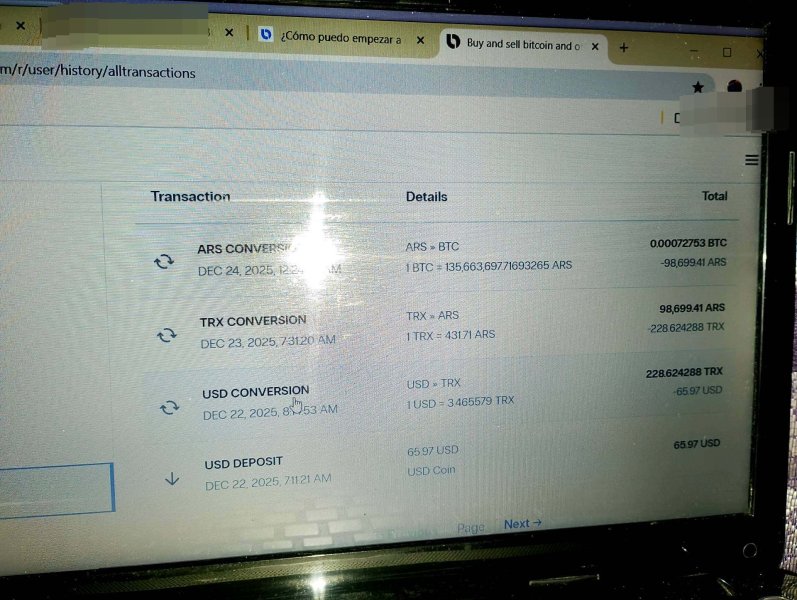

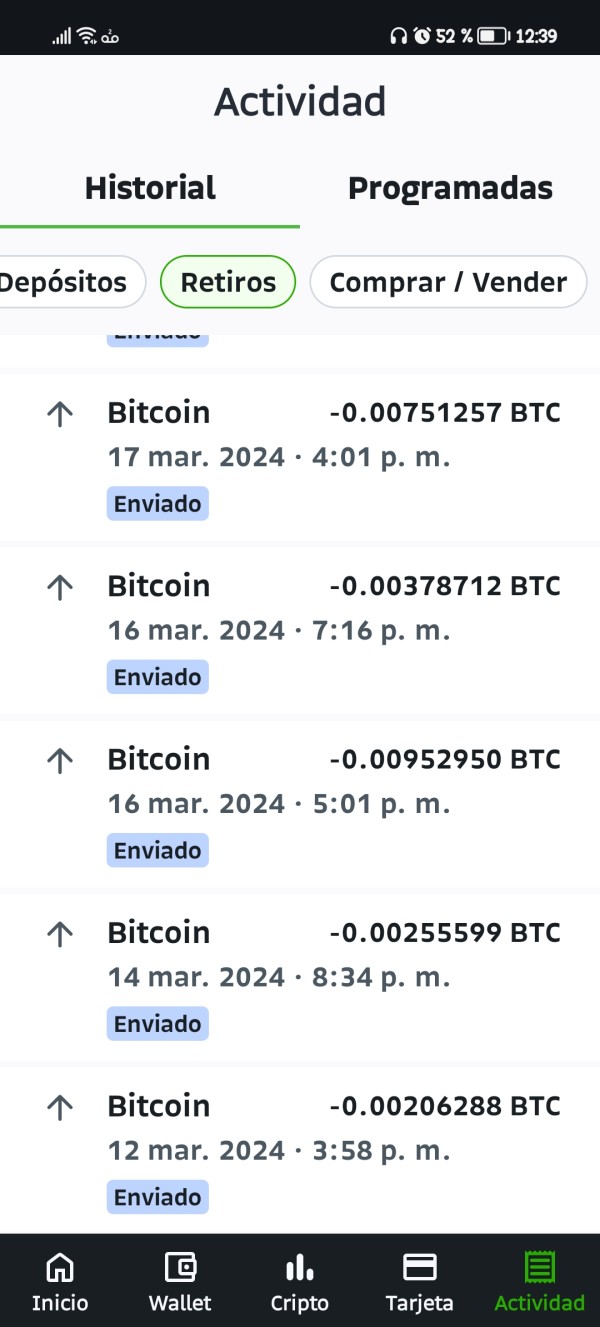

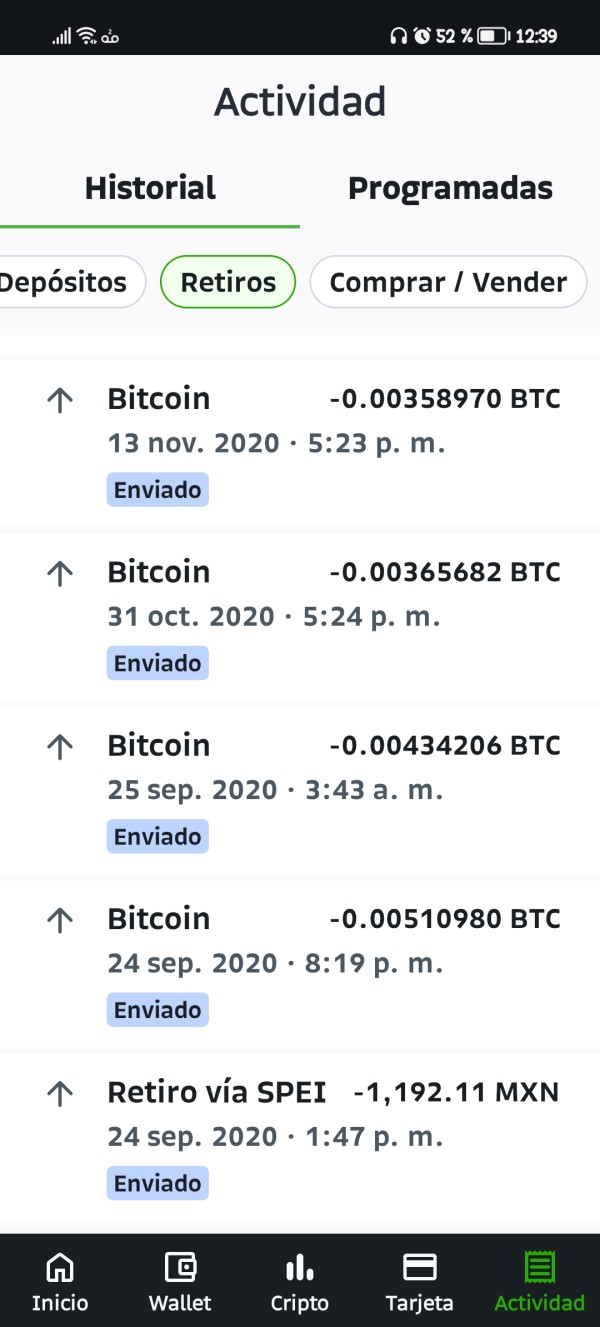

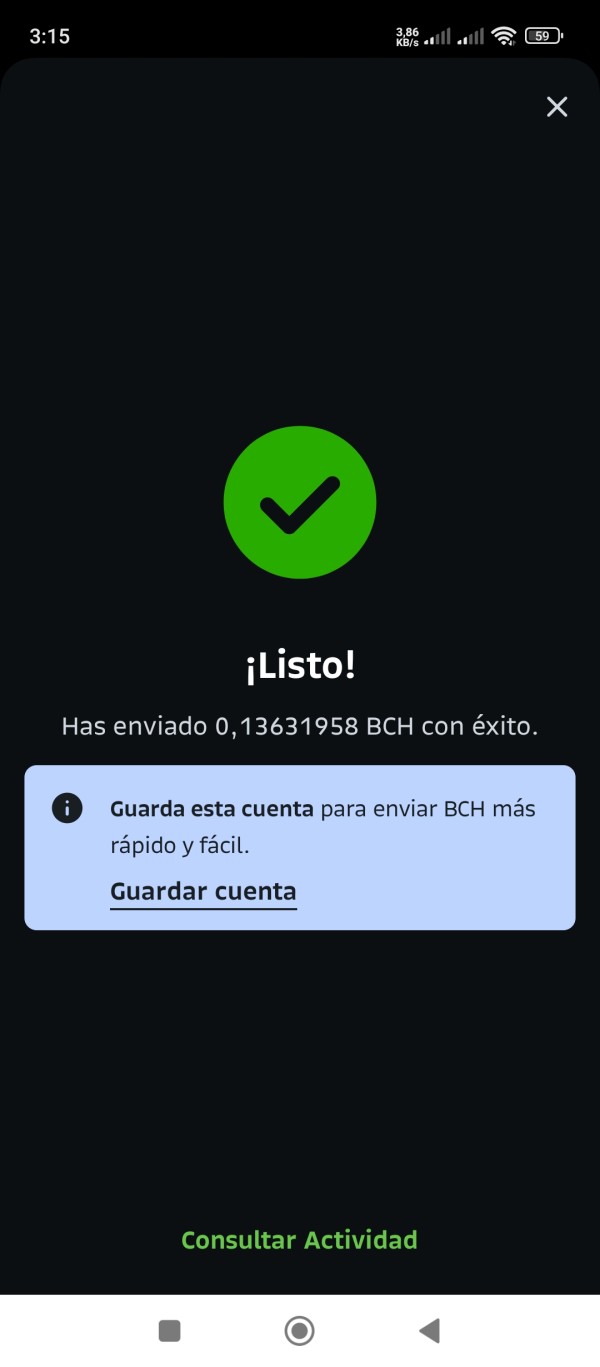

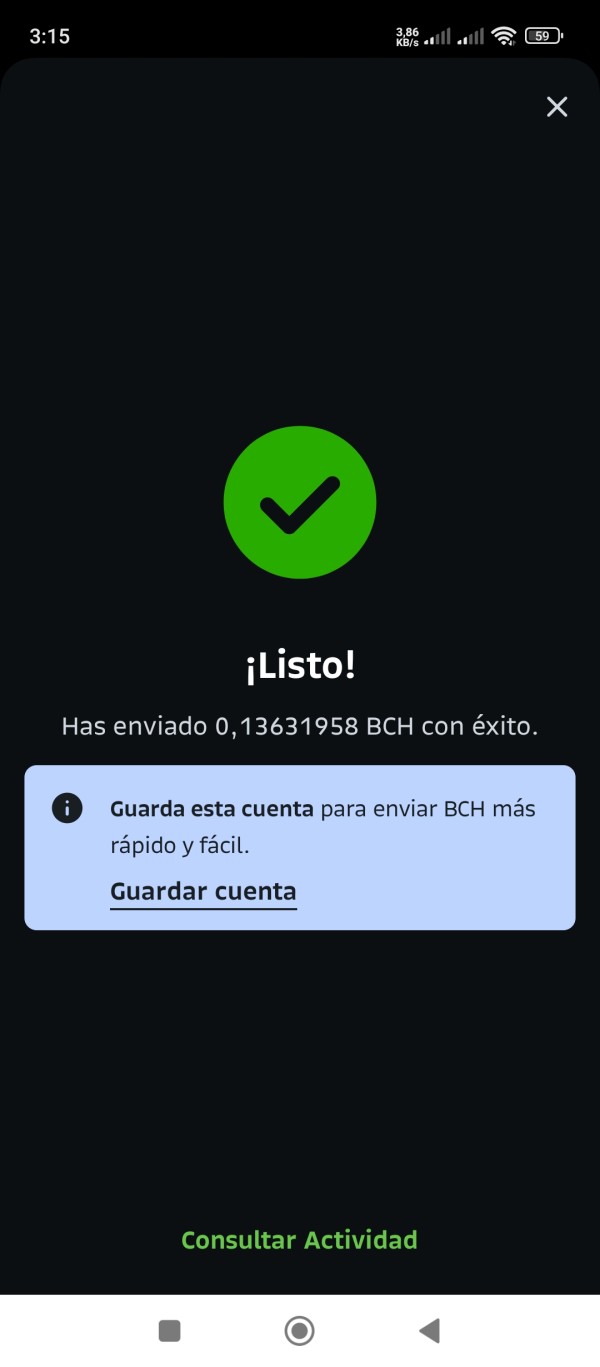

Deposit/Withdrawal Currencies

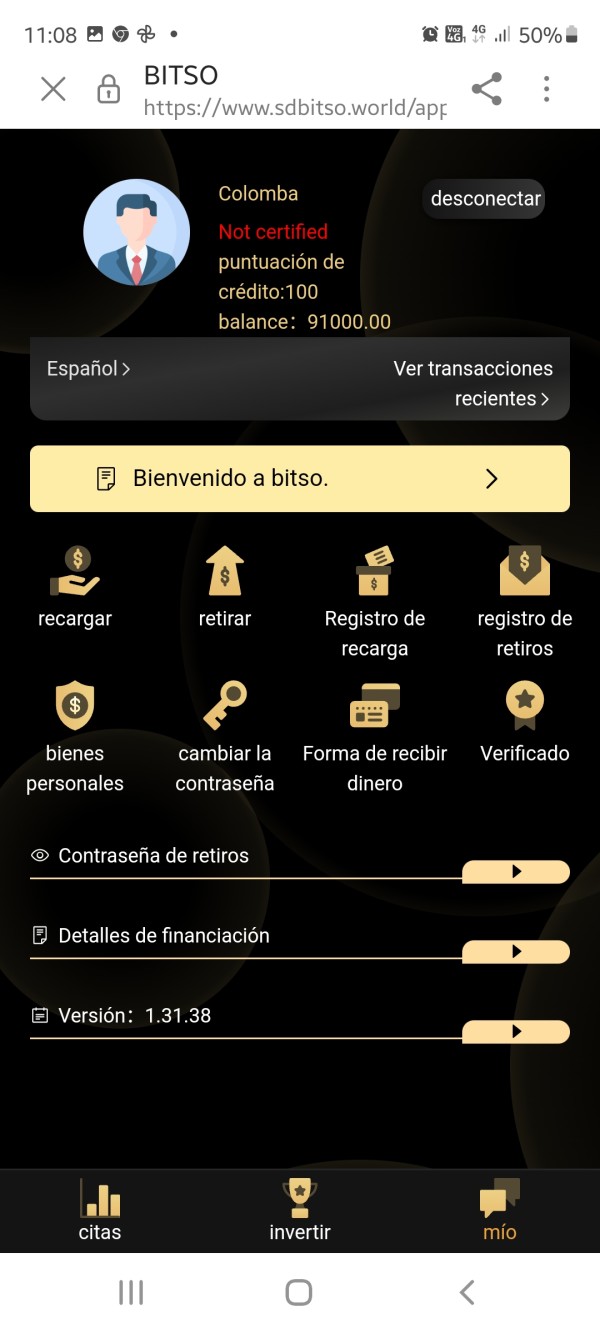

Users can deposit and withdraw in multiple fiat currencies, including the Mexican Peso (MXN), US Dollar (USD), Argentine Peso (ARS), and Brazilian Real (BRL). The minimum deposit requirement is set at $100, which some users find prohibitive.

Bitso does not offer any bonuses or promotional incentives, which could deter users looking for additional value from their trading experience.

Tradable Asset Classes

The platform supports trading in nine cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and others. However, the selection is limited compared to other exchanges, which may offer a broader range of altcoins.

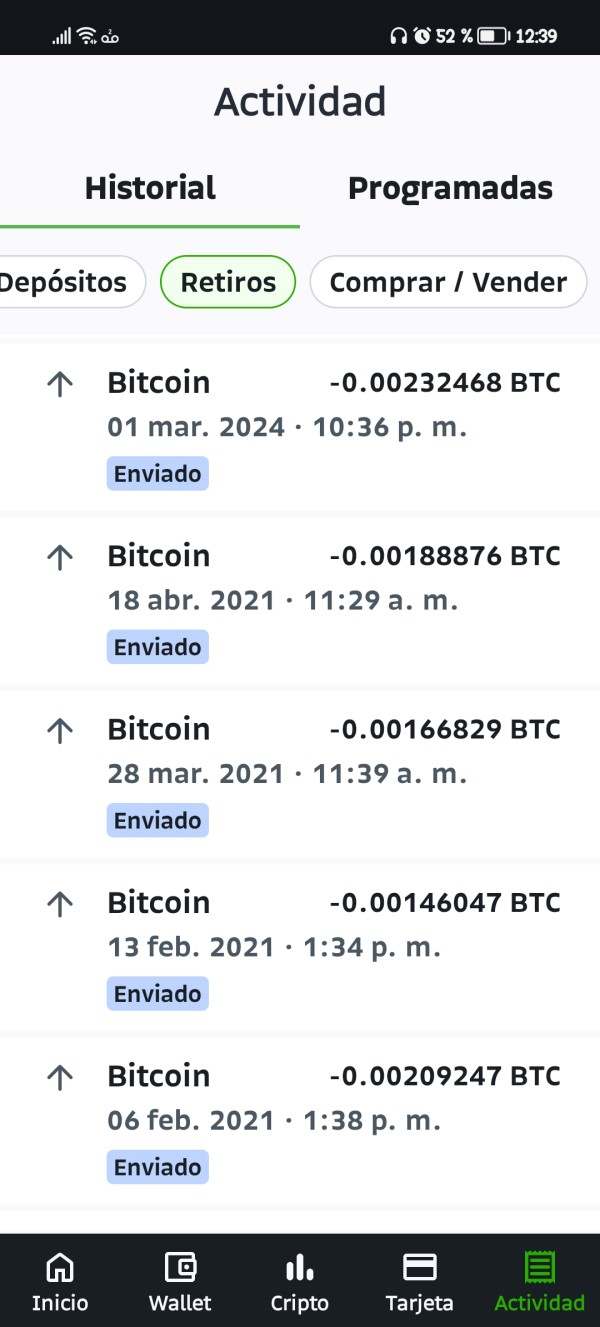

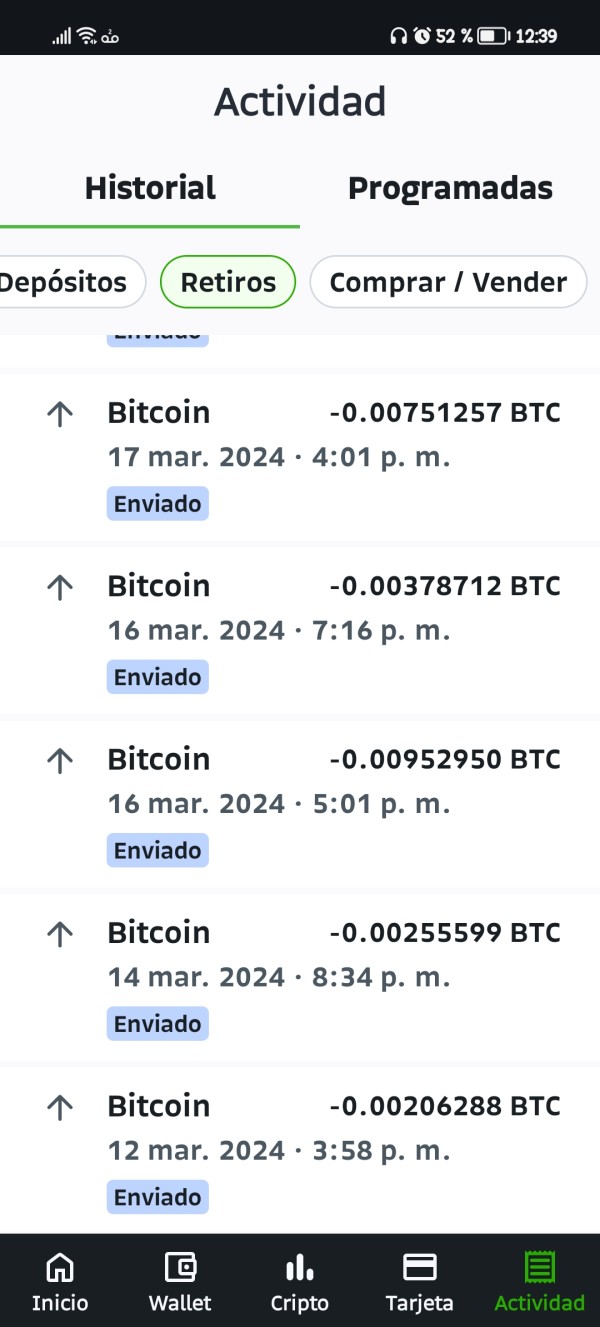

Costs (Spreads, Fees, Commissions)

Trading fees on Bitso are relatively high. The maker fee starts at 0.075% while the taker fee is 0.098%. Additionally, users report withdrawal fees that vary depending on the method, with some transactions incurring significant costs. These fees can deter smaller traders or those not engaging in high-volume trading.

Leverage

Bitso does not offer leveraged trading, which may limit opportunities for traders looking to maximize their positions in a volatile market.

Bitso provides a proprietary trading platform and a mobile app, but it lacks support for popular platforms like MetaTrader 4 or 5, which may limit advanced trading features.

Restricted Regions

While Bitso has expanded its services to various Latin American countries, it is not available to users in regions with strict cryptocurrency regulations, which could limit its reach.

Available Customer Service Languages

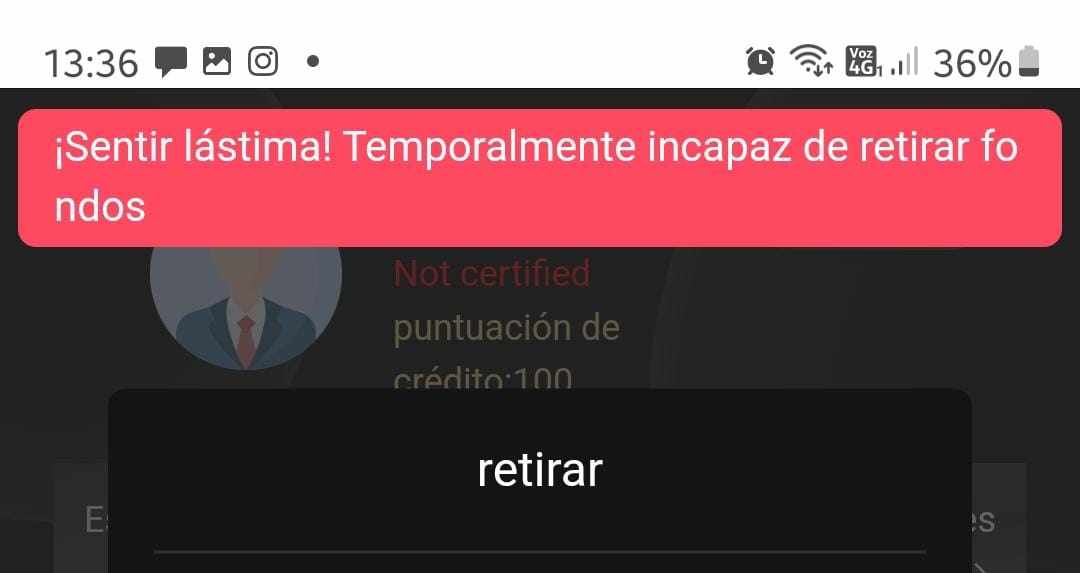

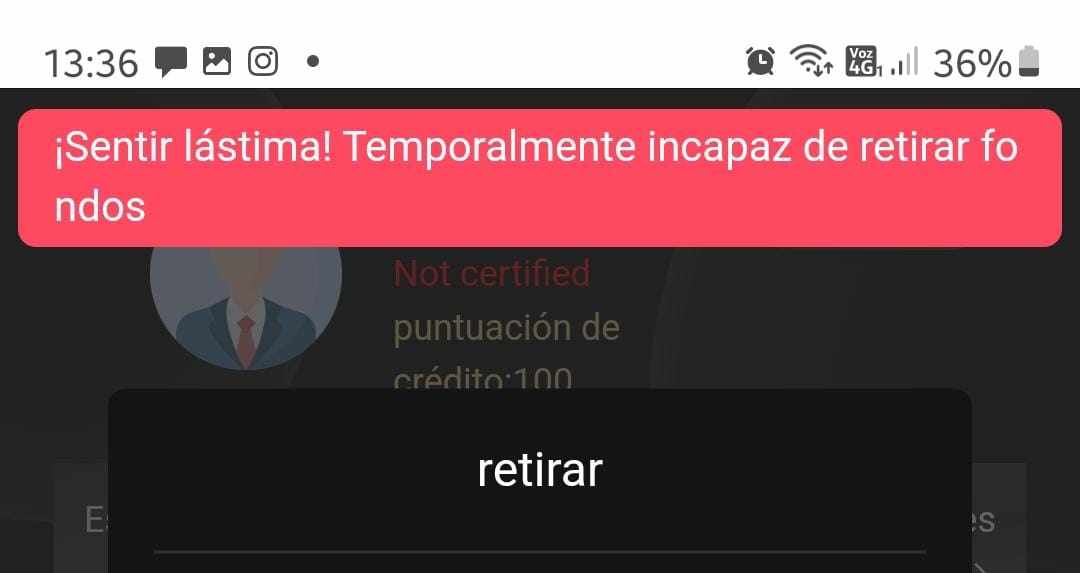

Customer support is primarily available in Spanish and English. However, many users have reported issues with the responsiveness and effectiveness of customer support, often citing long wait times for ticket responses.

Ratings Recap

Detailed Breakdown of Ratings

-

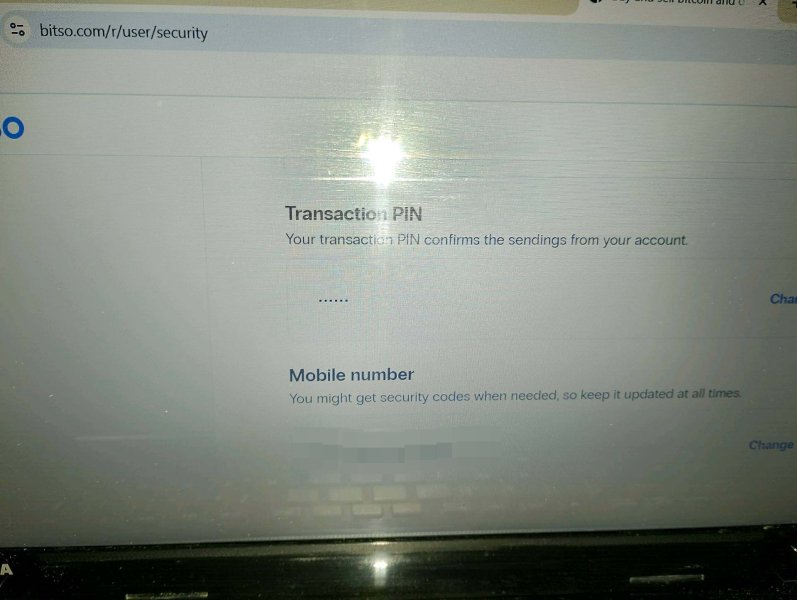

Account Conditions (6/10): The minimum deposit of $100 is a barrier for some users, but the platform does allow deposits in multiple fiat currencies.

Tools and Resources (5/10): Bitso's trading tools are basic, lacking advanced features found in more established platforms. While it offers a mobile app, it does not support popular trading platforms like MT4 or MT5.

Customer Service and Support (4/10): Users report difficulties in reaching customer support and long response times. While there is a help center, many have expressed dissatisfaction with the support quality.

Trading Setup (6/10): The trading experience is generally smooth, but the absence of leveraged trading and limited asset selection may deter some traders.

Trust Level (5/10): Although Bitso is regulated by the GFSC, user reviews indicate concerns regarding withdrawal issues and customer service, leading to a moderate trust rating.

User Experience (6/10): The platform is user-friendly, particularly for beginners, but the high fees and limited cryptocurrency options may frustrate more experienced traders.

Fees and Costs (4/10): The trading fees are higher than many competitors, with additional withdrawal costs that can add up, making it less appealing for cost-sensitive traders.

In conclusion, while Bitso presents a viable option for cryptocurrency trading in Mexico and surrounding regions, potential users should weigh the high fees and customer service issues against the platform's ease of use and regulatory compliance. As always, conducting thorough research and considering alternative platforms may lead to better trading experiences.