AUSFOREX Review 1

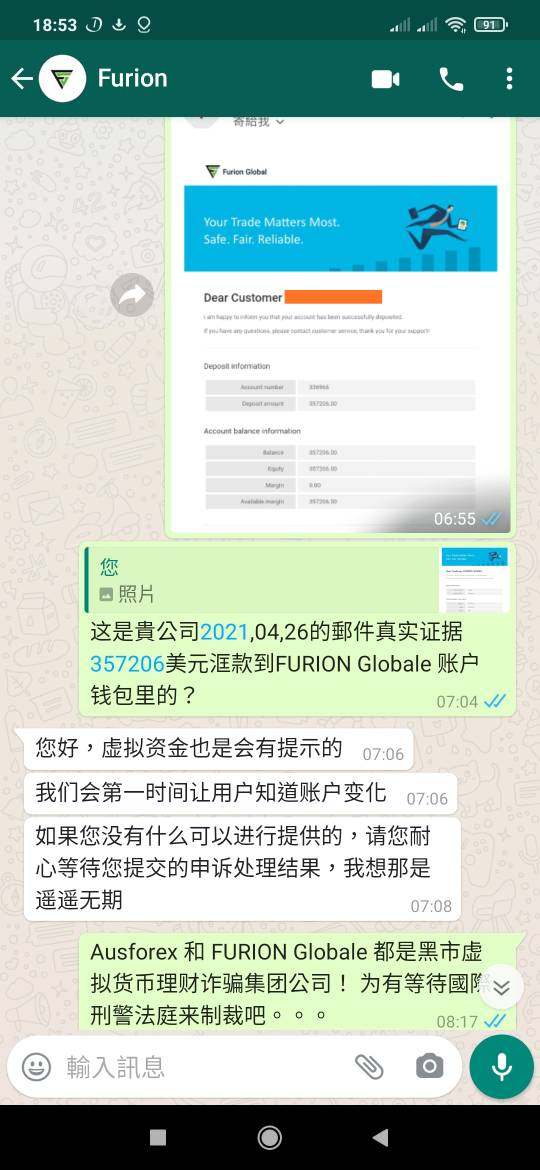

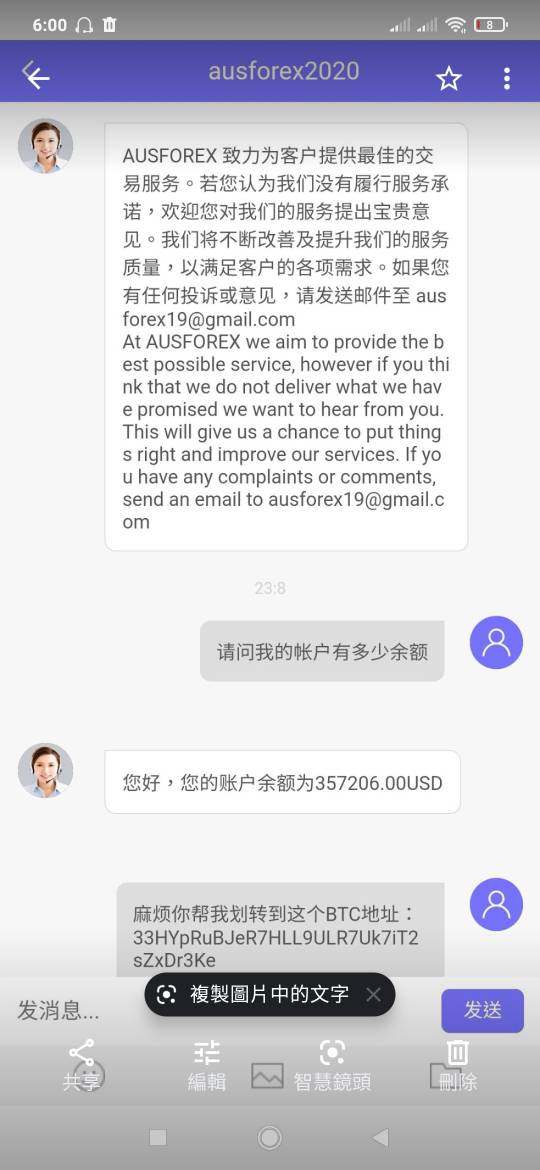

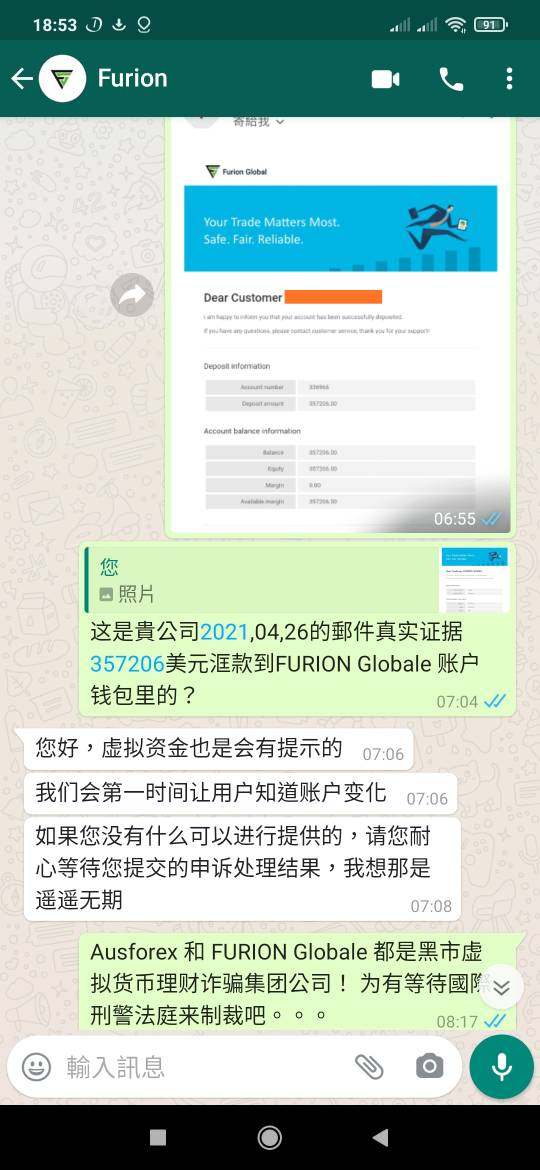

If you wanna withdraw funds, they will ask u to pay 20% as the individual income tax! Please pay attention.

AUSFOREX Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

If you wanna withdraw funds, they will ask u to pay 20% as the individual income tax! Please pay attention.

In the ever-evolving landscape of online trading, AUSForex has garnered a controversial reputation. Founded in 2003 and originally based in Melbourne, this broker has since relocated to the UK and claims to be regulated by multiple authorities. However, recent investigations reveal significant discrepancies regarding its regulatory status and user experiences. This review aims to provide a comprehensive analysis of AUSForex, highlighting both its offerings and the concerns raised by users and experts alike.

Note: It is crucial to consider that AUSForex operates under various entities across different regions, leading to potential discrepancies in regulatory compliance. This review is based on an aggregation of user experiences and expert opinions to ensure fairness and accuracy.

| Category | Rating (out of 10) |

|---|---|

| Account Conditions | 4 |

| Tools and Resources | 5 |

| Customer Service and Support | 3 |

| Trading Setup (Experience) | 4 |

| Trustworthiness | 2 |

| User Experience | 3 |

We rate brokers based on user feedback, regulatory information, and feature offerings.

AUSForex, established in 2003, initially gained approval from the Australian Securities and Investments Commission (ASIC) in 2005. The broker later moved its headquarters to London in 2015, claiming regulatory compliance with the UK's Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Hong Kong Securities and Futures Commission (SFC). However, recent reports indicate that AUSForex's claims of regulation may be misleading, as it lacks valid licenses from these authorities.

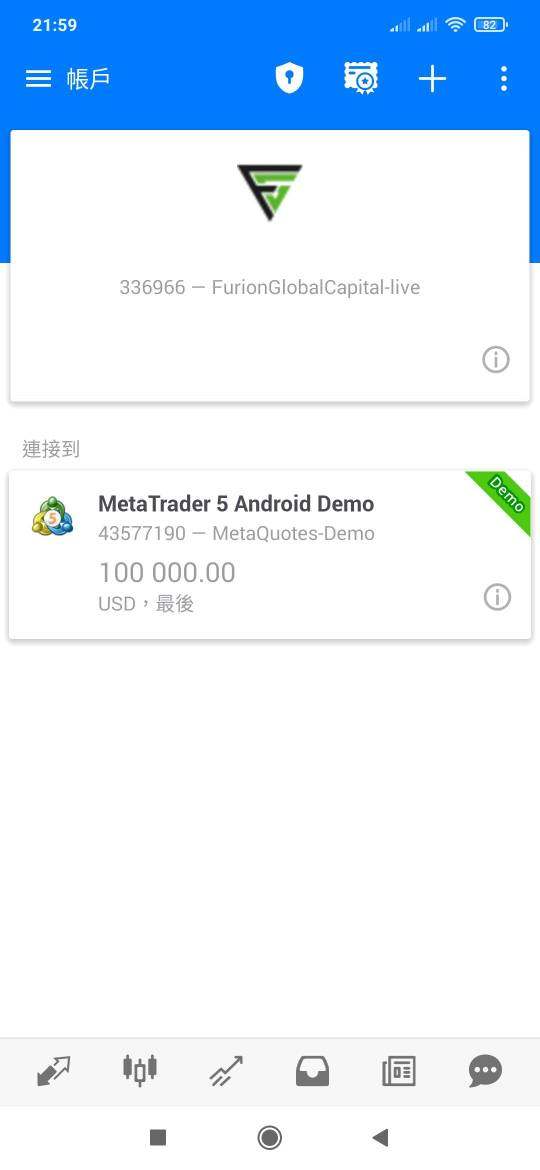

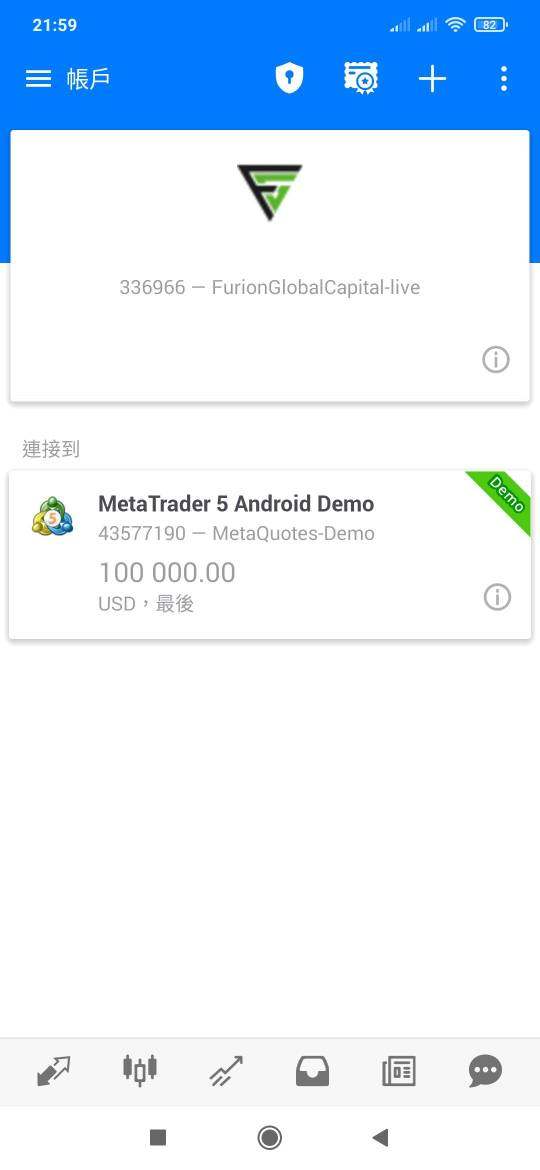

AUSForex offers trading through the widely-used MetaTrader 4 and MetaTrader 5 platforms, providing access to a variety of asset classes, including forex, CFDs on indices, commodities, and cryptocurrencies. However, user reviews have raised concerns about the broker's transparency and reliability.

AUSForex claims to be regulated in multiple jurisdictions, including the UK, Cyprus, and Hong Kong. However, it has been reported that AUSForex is not currently authorized by the FCA, with its previous authorization status being revoked. This raises significant red flags regarding the broker's legitimacy and the safety of client funds.

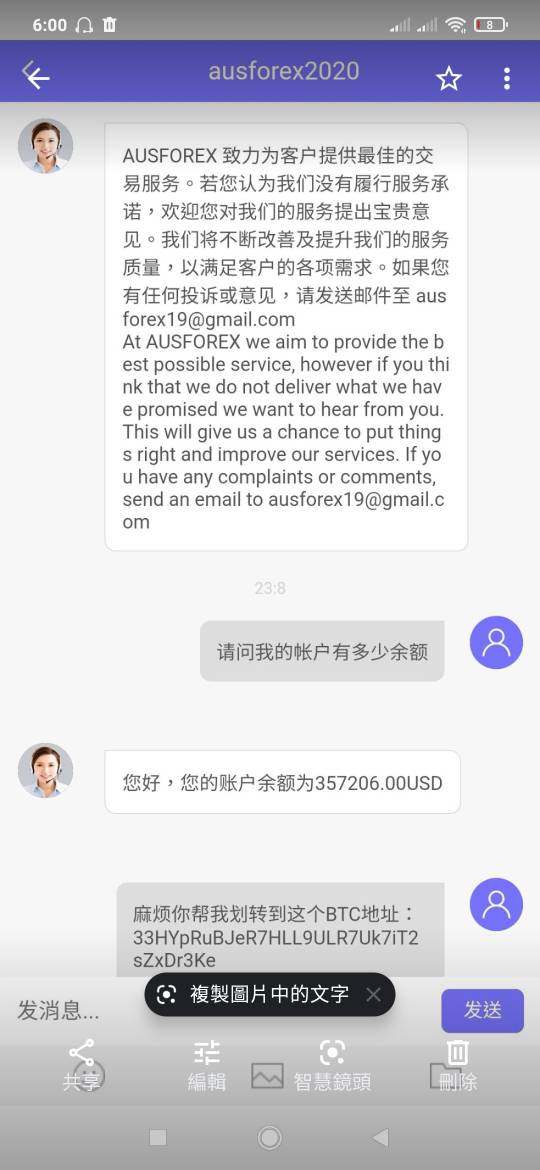

Clients can deposit and withdraw funds in several currencies, including GBP, EUR, USD, AUD, and SGD. However, popular e-wallets like Skrill and Neteller are not supported, which can limit options for many traders. The minimum deposit required to open an account is relatively high at $1,000, which may deter new traders.

AUSForex does not currently offer any bonuses or promotions, which is a notable disadvantage compared to other brokers that often provide attractive incentives to attract new clients.

AUSForex provides access to a diverse range of trading instruments, including over 50 forex pairs, commodities like gold and oil, and various CFDs. However, the spreads on these instruments can be higher than average, particularly on the STP account, which typically sees spreads around 2.0 pips for the EUR/USD pair.

The trading costs at AUSForex vary between account types. The STP account has no commission but higher spreads, while the ECN account offers lower spreads (around 0.5 pips) but incurs a commission of $10 per standard lot. This structure may not be competitive when compared to other brokers in the market.

AUSForex offers leverage up to 1:400, which is relatively high and can amplify both potential profits and losses. However, traders should exercise caution, as high leverage increases the risk of significant losses.

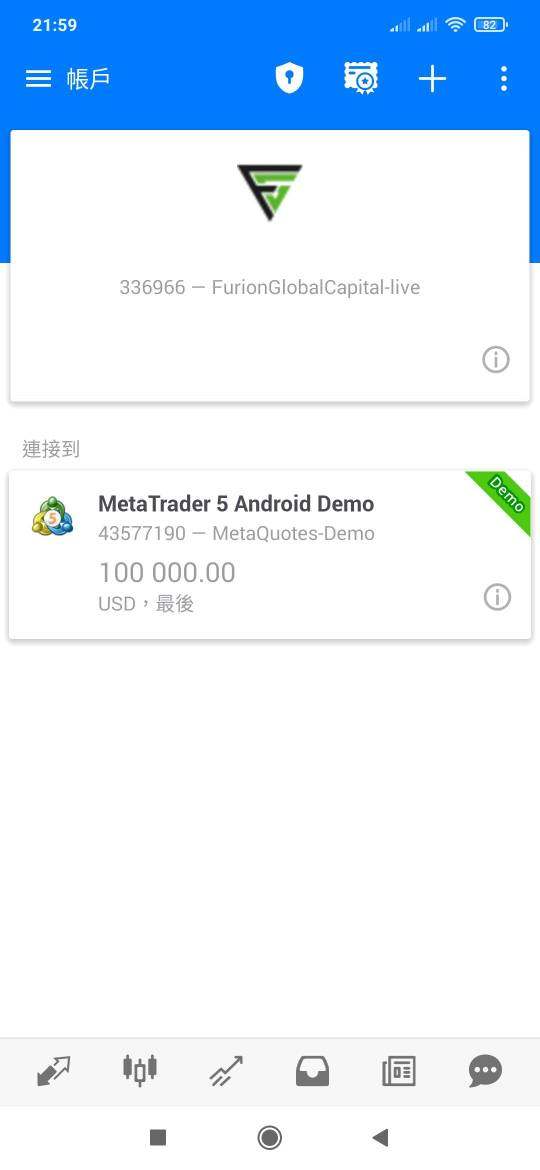

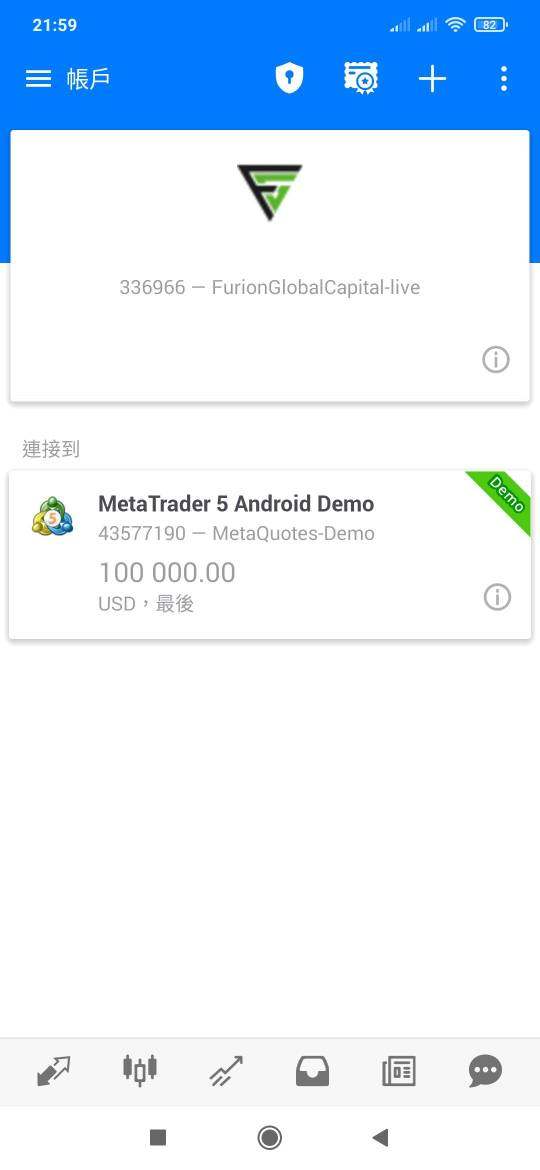

AUSForex supports both MetaTrader 4 and MetaTrader 5, both of which are well-regarded in the trading community for their user-friendly interfaces and extensive features. However, the reliability of these platforms is called into question given the broker's questionable regulatory status.

AUSForex does not provide services to clients located in several countries, including the United States, Japan, and other jurisdictions where it is not authorized to operate. This restriction can limit its appeal to a broader audience.

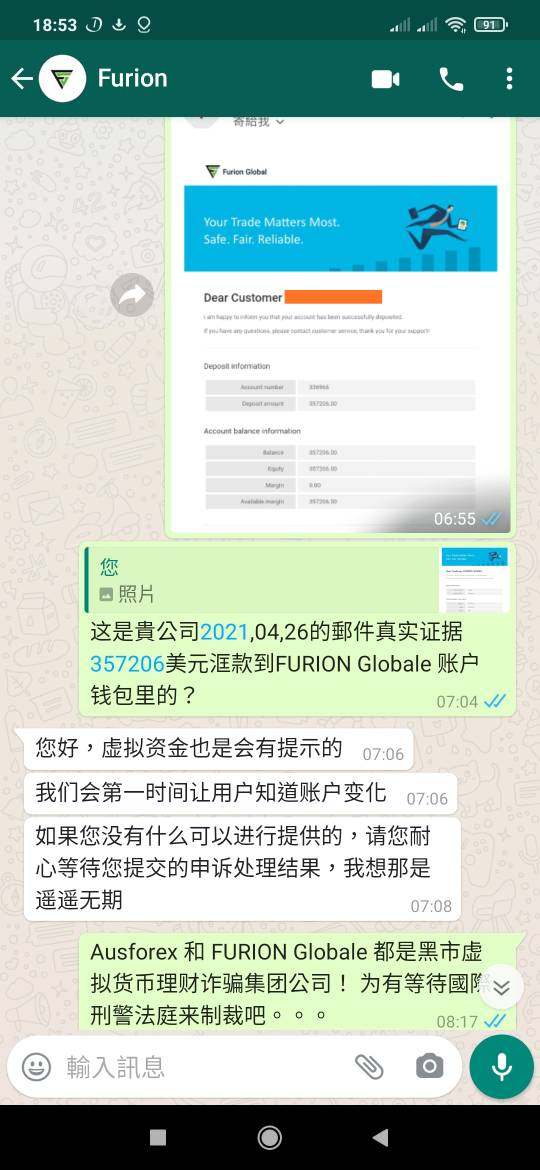

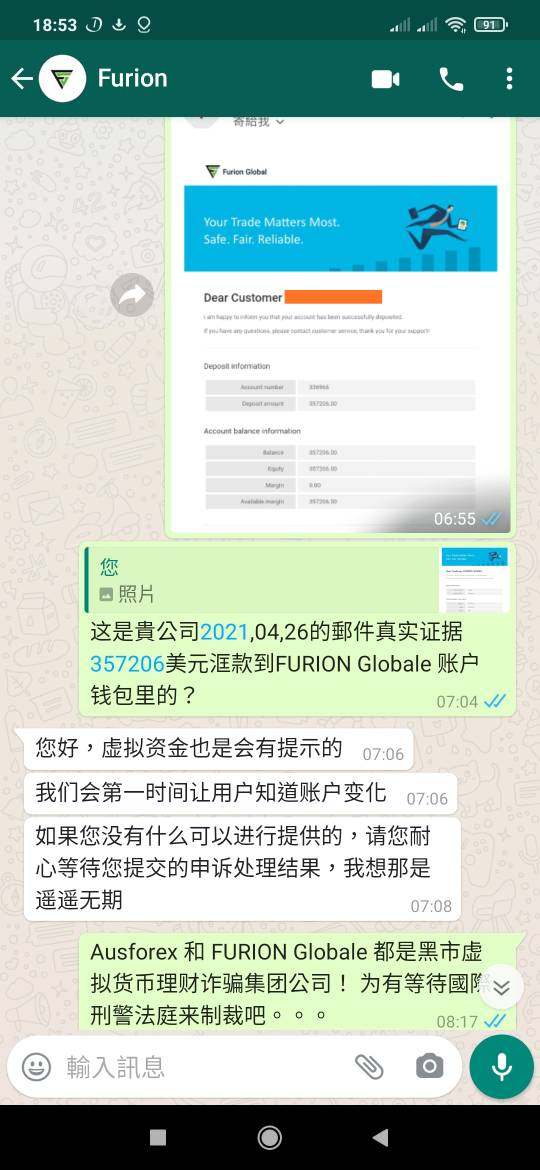

Customer support is available primarily in English, and users have reported mixed experiences with the responsiveness and effectiveness of the support team. There have been numerous complaints regarding unresponsive customer service, particularly when it comes to withdrawal requests.

| Category | Rating (out of 10) |

|---|---|

| Account Conditions | 4 |

| Tools and Resources | 5 |

| Customer Service and Support | 3 |

| Trading Setup (Experience) | 4 |

| Trustworthiness | 2 |

| User Experience | 3 |

Account Conditions (4/10): The minimum deposit requirement of $1,000 is high compared to other brokers. The availability of only two account types may limit options for traders with varying needs.

Tools and Resources (5/10): While AUSForex offers popular trading platforms, the lack of educational resources and market analysis tools is a drawback for novice traders seeking guidance.

Customer Service and Support (3/10): User reviews indicate significant issues with customer support, particularly regarding withdrawal requests and response times.

Trading Setup (Experience) (4/10): The trading experience is marred by concerns over the broker's regulatory status, leading to a lack of trust among users.

Trustworthiness (2/10): With reports of unregulated status and user complaints about withdrawals, AUSForex's trustworthiness is highly questionable.

User Experience (3/10): Overall user experiences are mixed, with several users reporting issues with account access and withdrawal processes.

In conclusion, AUSForex presents a mixed bag of features and significant concerns. While it offers popular trading platforms and a variety of tradable assets, the lack of valid regulation, high minimum deposit, and poor customer service experiences raise serious red flags. Potential traders should exercise caution and consider alternative brokers with a more transparent and trustworthy reputation.

FX Broker Capital Trading Markets Review