Equinox markets itself as a global brokerage based in the United Kingdom, with claims of a significant operational history despite a founding year of 2020. While the company asserts that it has been established for 5–10 years, reviews reveal a pattern of deceptive practices regarding its regulatory claims and historical presence. The dual headquarters claim—including both the UK and Saint Vincent and the Grenadines—adds to investor confusion and suspicion concerning its legitimacy.

Equinox offers a diverse range of financial instruments, including forex pairs, commodities, and indices. It promotes several trading platforms, primarily focusing on CTrader, and makes bold assertions about being regulated by both the SVG Financial Service Authority and the U.S. NFA; however, these claims are not backed by substantial verification. Potential investors should be wary of the lack of oversight that defines Equinoxs operational framework.

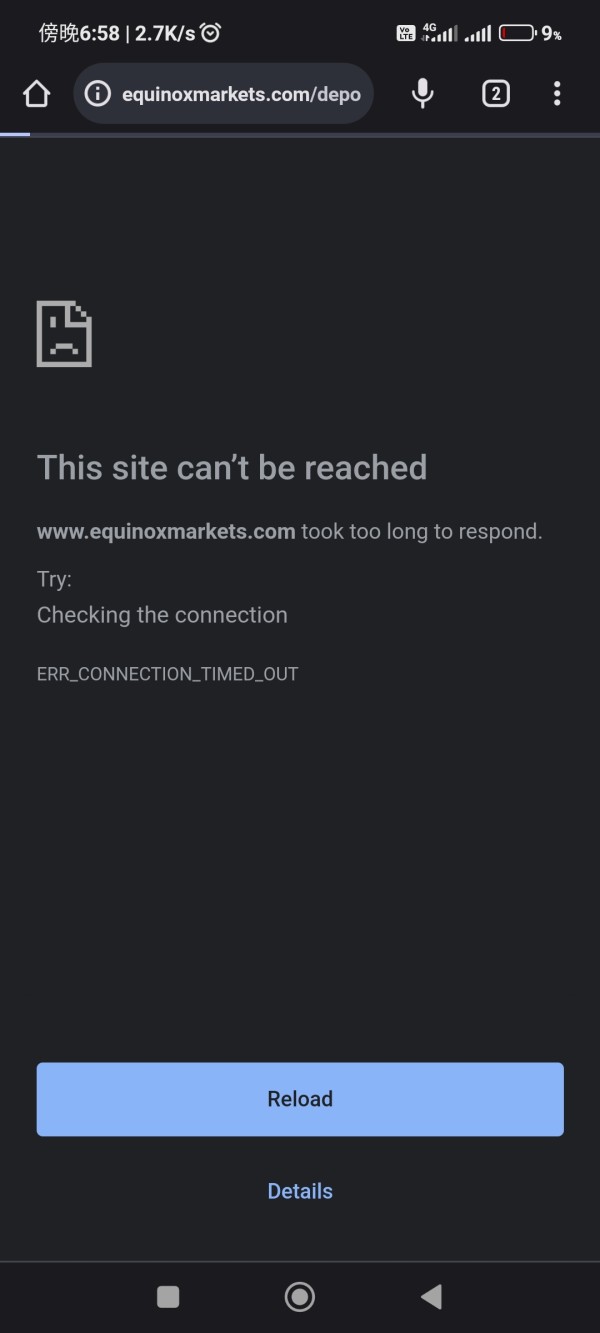

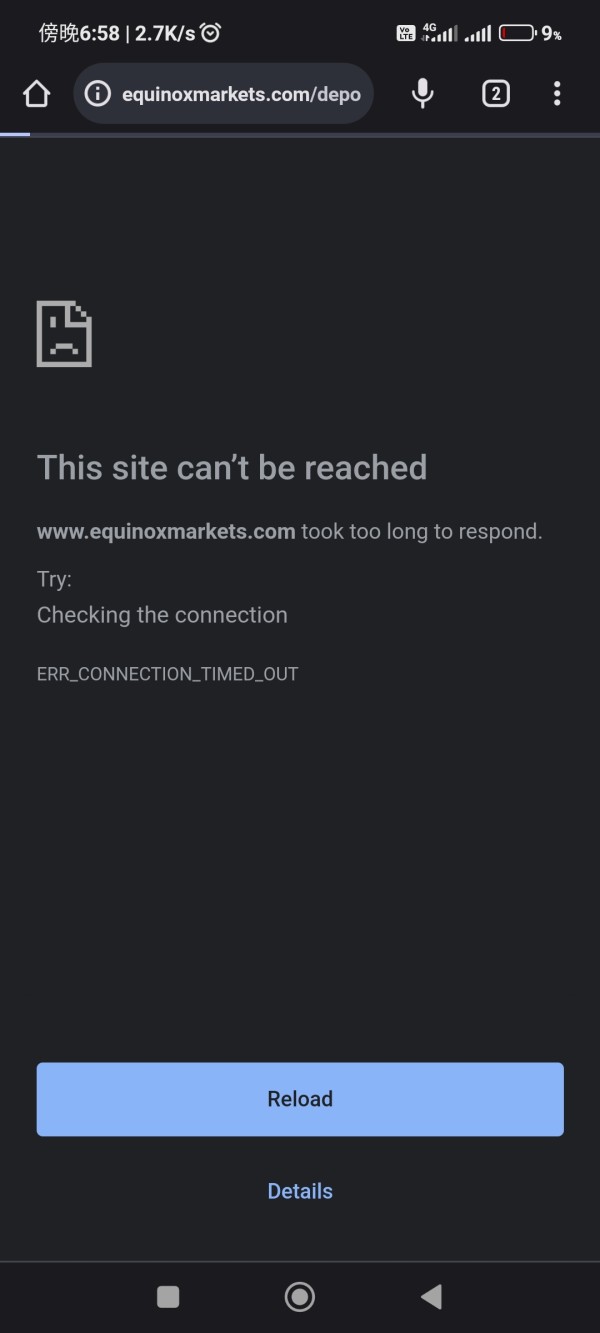

Equinox's claims of regulatory oversight, specifically with the NFA, have proven to be misplaced. The NFA has confirmed that Equinox is not a member and does not supervise brokerage activities, which poses a formidable risk to potential investors.

- Start with a search on the FCA’s official website.

- Use the NFA's BASIC tool to verify broker membership.

- Consult the Securities Commission Malaysia's website for regional warnings.

- Cross-reference user reviews on trusted forex forums for additional information.

Industry Reputation and Summary

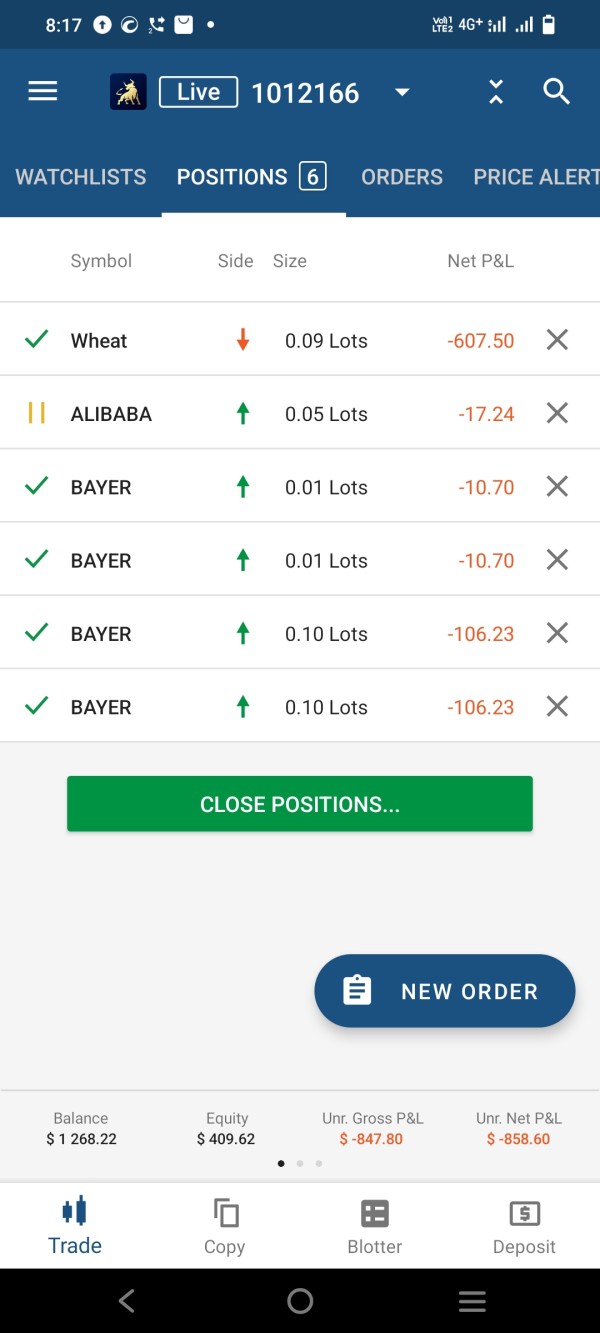

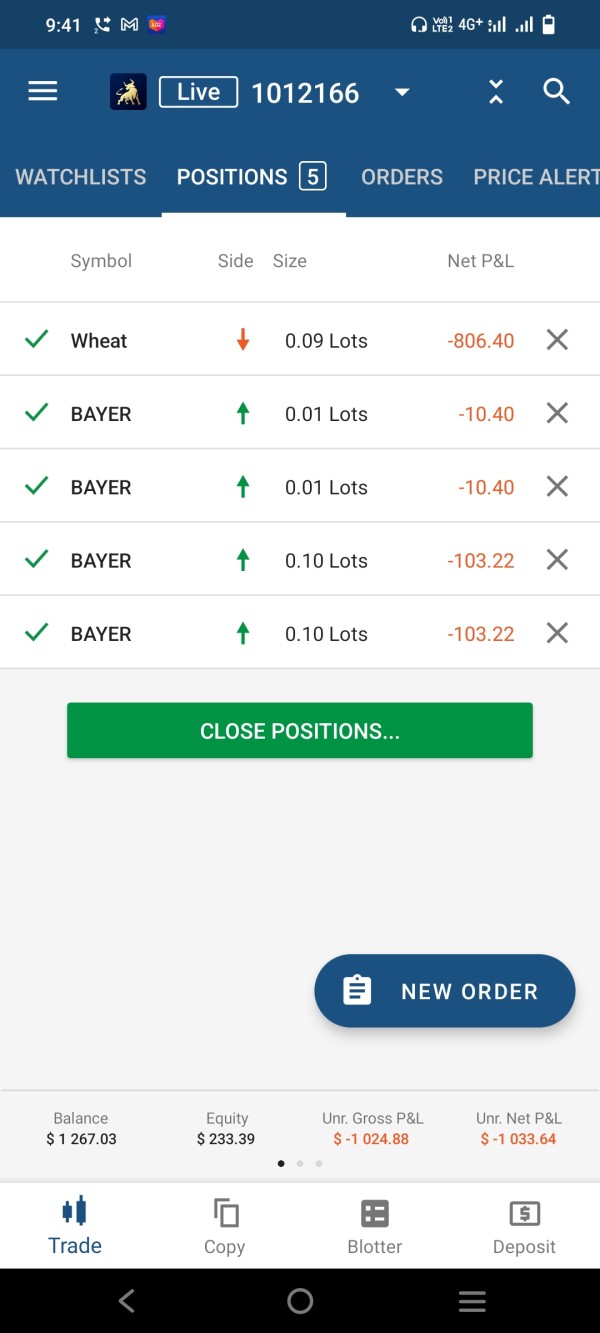

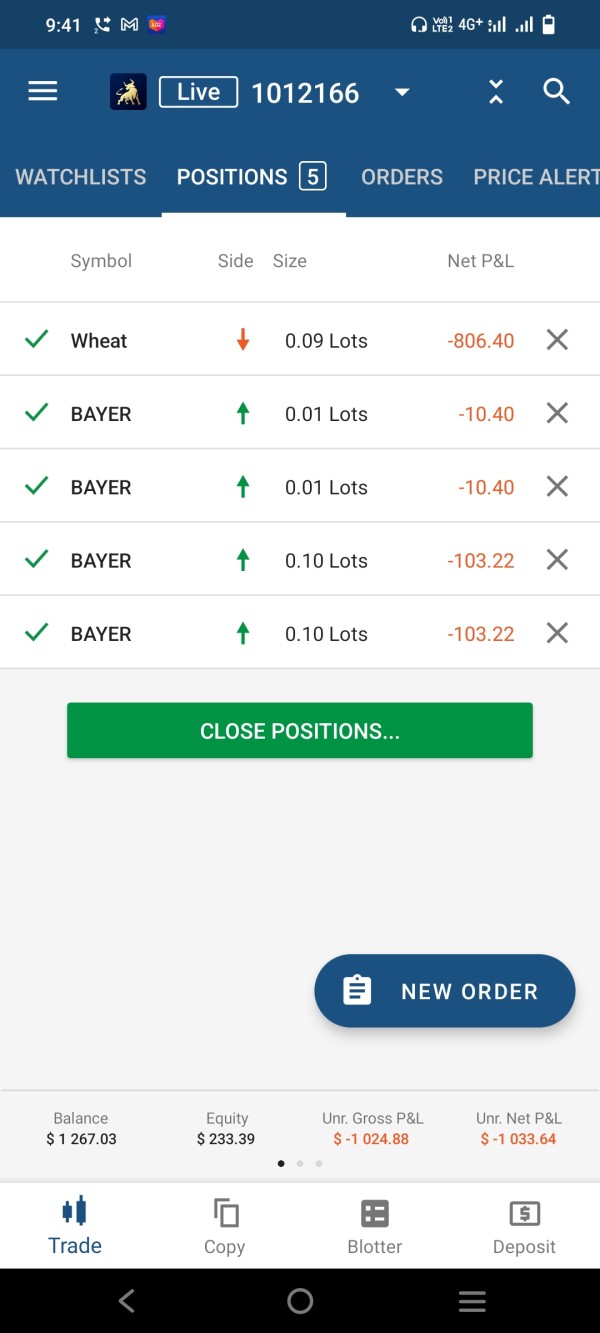

Collectively, user feedback highlights a pervasive fear surrounding fund safety, pointing to significant withdrawal problems and a dismissive customer service approach. Engaging with Equinox could yield financial distress for unguarded traders.

Trading Costs Analysis

"The double-edged sword effect."

Advantages in Commissions

Equinox boasts a low-cost commission structure compared to its peers, presenting an outwardly attractive proposal for traders looking to maximize their profits. However...

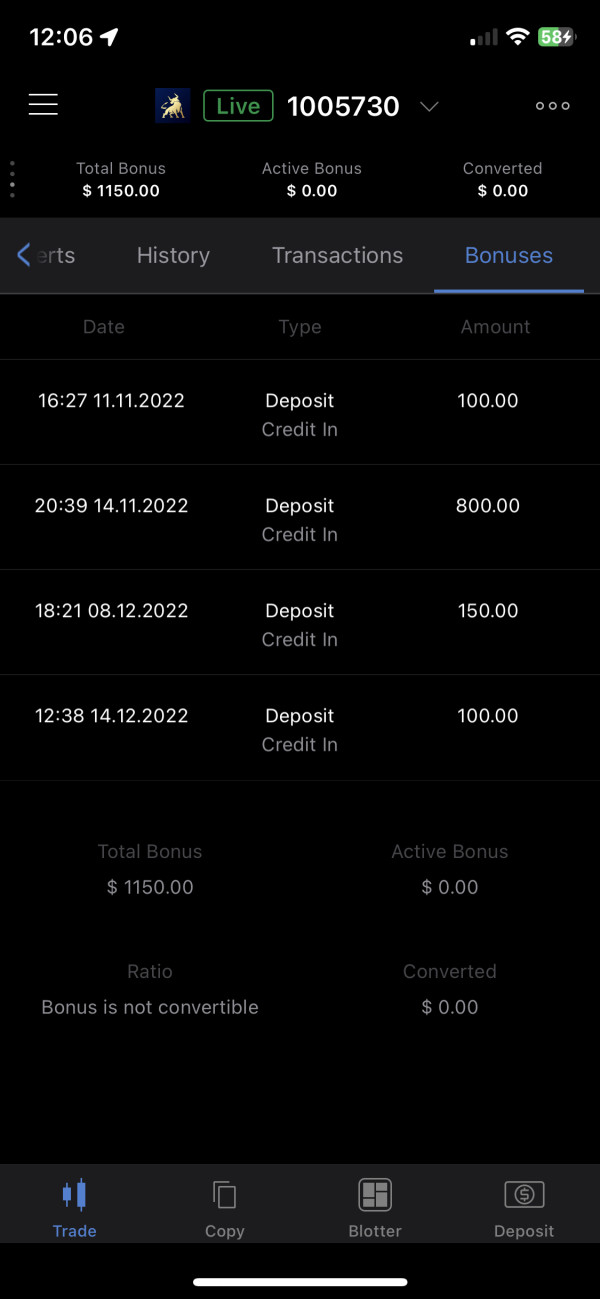

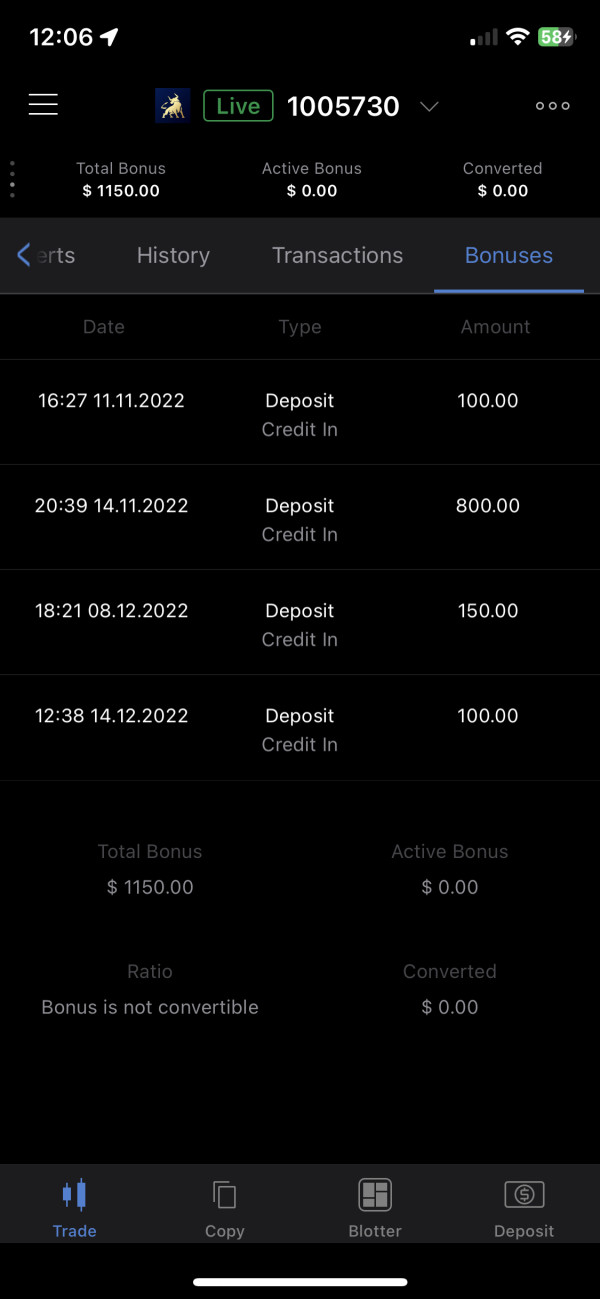

The "Traps" of Non-Trading Fees

Numerous user complaints reveal hidden withdrawal fees, often catching traders off-guard:

"The broker requested $30 for a withdrawal which has been a constant issue."

— User Feedback

Cost Structure Summary

The overall cost structure at Equinox offers both appeal and pitfalls. Retail traders may find their initial trading costs attractive, yet the associated non-trading fees could erode profitability, particularly for smaller investors.

"Professional depth vs. beginner-friendliness."

Equinox provides access to CTrader, widely recognized for its user interface. However, claims about additional platforms like MetaTrader 4 raise concerns due to lack of visibility on their offering.

Educational resources from Equinox claim to provide essential information for traders, yet many users report limited availability of meaningful content.

Despite the user-friendly interface of CTrader, many users have mentioned difficulties in accessing support and resources, rendering trading a frustrating experience.

User Experience Analysis

"Portfolio constraints vs. expansive choices."

Experiences with Account Setup

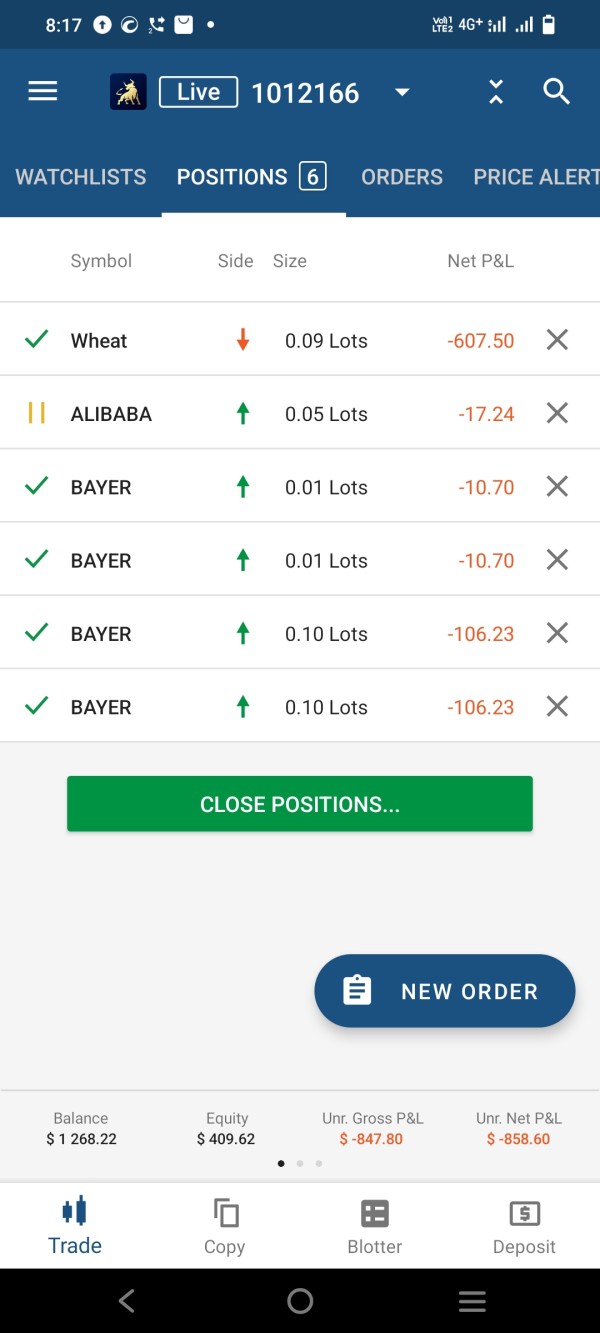

Users have reported a relatively straightforward account creation process, though many have expressed frustration upon encountering hurdles when trying to withdraw funds.

Trading Experiences

Investors engaged with Equinox expressed varied experiences:

"At first, everything felt smooth until I hit withdrawal roadblocks."

— Anonymous User Review

Customer Support Analysis

"Promised assistance amidst uncertainty."

Responsiveness and Availability

Equinox claims to offer support in multiple languages but reviews suggest that timely assistance is not guaranteed, further deepening the complexity for clients encountering issues.

Account Conditions Analysis

"Minimum deposits as barriers to entry."

Account Types Breakdown

Equinox features a tiered account system with minimum deposits ranging from $1,000 to $25,000. This setup inherently limits participation from less capitalized traders.

Conclusion

While Equinox markets itself as an accessible trading venue for diverse asset classes and high leverage, the unregulated status paired with numerous user complaints paints a troubling picture. Potential investors need to weigh the opportunities against the considerable risks, particularly surrounding fund safety and reliable access to their capital. Opting for regulated brokers may provide a more secure trading experience, allowing traders to focus on strategy rather than navigate a complex landscape fraught with caution.

FAQs

- Is Equinox regulated?

- No, Equinox lacks valid regulatory oversight, posing significant risks to investor funds.

- What financial instruments can I trade with Equinox?

- A variety of financial instruments, including forex, commodities, and indices.

- What are the different account types offered by Equinox?

- Equinox offers three account types: Mercury, Saturn, and Pluto.

- What leverage options are available with Equinox?

- Leverage options are as high as 1:500 across all account types.

- What deposit and withdrawal methods are provided by Equinox?

- Equinox lists various deposit methods, including credit cards and cryptocurrencies, with a minimum deposit of $1,000.

- How can I contact Equinox customer support?