Alliance 2025 Review: Everything You Need to Know

In this comprehensive review of Alliance, we delve into the broker's strengths and weaknesses as highlighted by various sources. The overall sentiment leans towards cautious optimism, noting the broker's innovative features and user-friendly platform, but also flagging significant concerns regarding regulatory oversight and customer service.

Note: Its important to highlight that Alliance operates under different entities across regions, which can affect user experience and regulatory compliance. This review aims to provide a balanced view based on multiple sources to ensure fairness and accuracy.

Rating Overview

We assess brokers based on user feedback, regulatory standing, and the breadth of services offered.

Broker Overview

Alliance is a relatively new player in the forex and CFD trading landscape, having emerged in recent years. While specific founding dates are often not disclosed, the broker has gained attention for its proprietary trading platform, which is designed to be more user-friendly than traditional options like MT4 or MT5. Alliance provides access to a diverse range of asset classes, including forex, cryptocurrencies, stocks, and commodities, catering to a broad audience of traders.

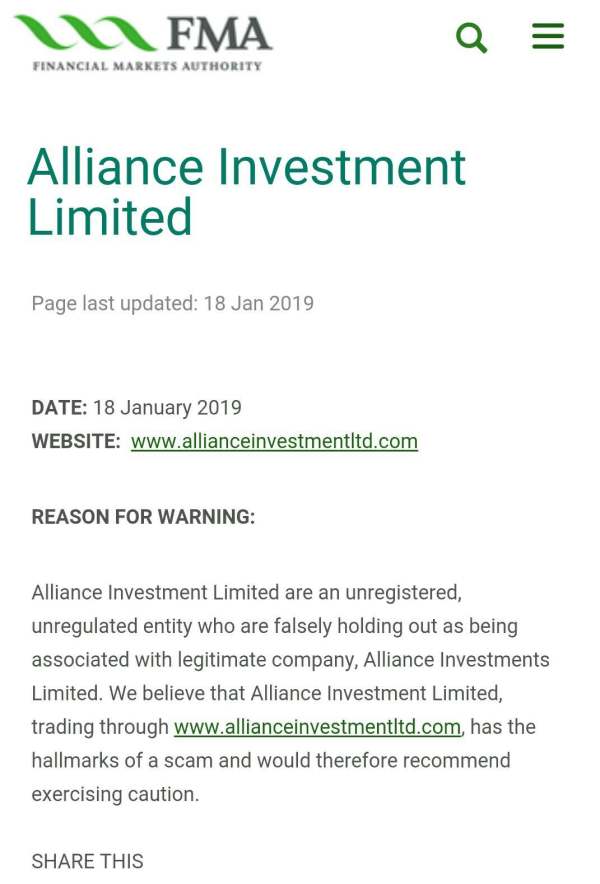

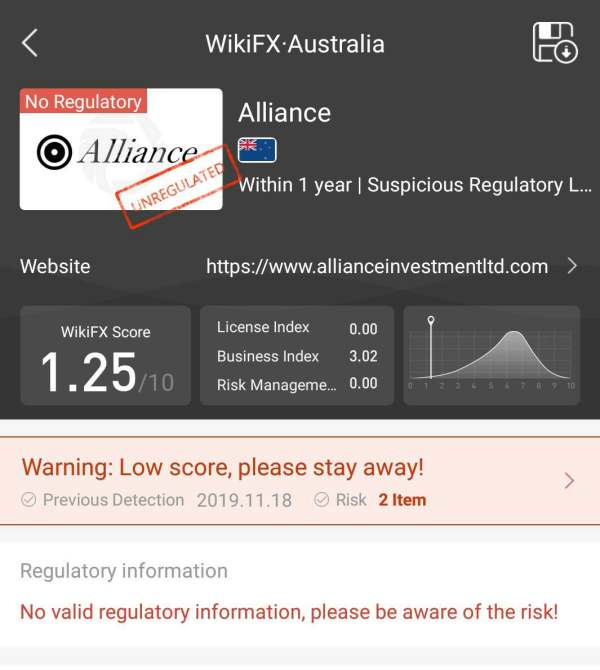

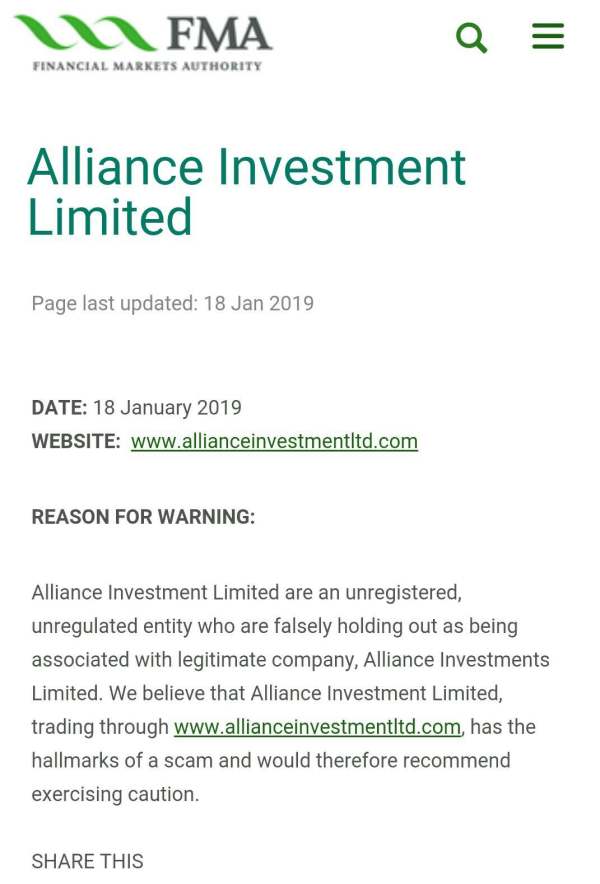

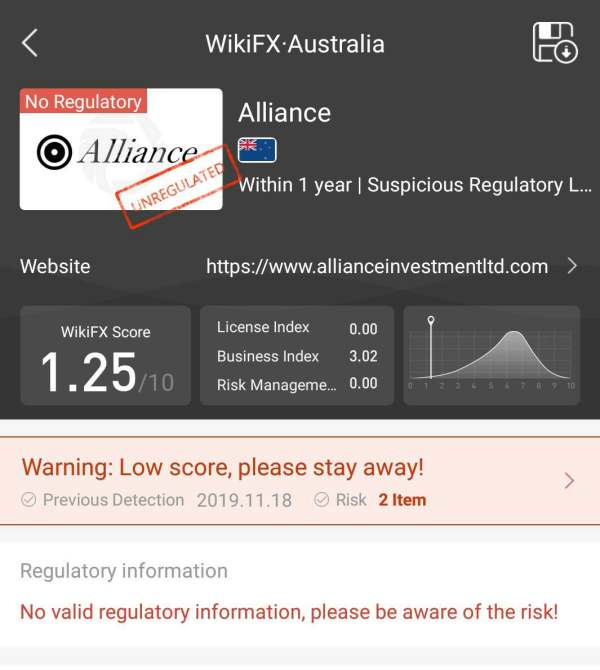

However, one of the significant concerns raised in various reviews is the lack of regulatory oversight. Alliance does not appear to be regulated by any major financial authority, which raises questions about the safety of customer funds and the overall trustworthiness of the broker.

Detailed Analysis

Regulatory Landscape

Alliance operates without any major regulatory oversight, which is a significant red flag for potential traders. According to sources, the absence of regulation can expose traders to higher risks, including potential fraud and mismanagement of funds. The lack of a regulatory body means that users have limited recourse should issues arise. This is a critical point to consider, especially for those new to trading who might not be aware of the implications of trading with an unregulated broker.

Deposit and Withdrawal Options

Alliance offers a minimum deposit requirement of $250, which is relatively accessible for new traders. However, the details regarding withdrawal processes and fees are not extensively covered in the reviews. Users have expressed concerns over the withdrawal times and the clarity of the procedures involved, indicating that this is an area where the broker could improve.

Asset Classes and Trading Costs

Alliance provides a diverse array of trading instruments, including forex, cryptocurrencies, indices, and commodities. The cost structure includes competitive spreads starting from 0.0 pips, but users should be aware of additional fees that may apply. The leverage offered can go up to 1:500, which can be appealing to experienced traders looking to maximize their trading strategies. However, this high leverage also introduces significant risk, and traders should exercise caution.

The proprietary trading platform provided by Alliance has received positive feedback for its intuitive design and ease of use. Users appreciate the advanced charting tools and the range of order types available. However, the absence of a demo account has been noted as a drawback, particularly for beginners who may want to practice trading without financial risk. The platform is accessible on both web and mobile, making it versatile for various trading styles.

Customer Service

Customer service appears to be a mixed bag for Alliance. While some users report positive experiences with prompt responses, there are numerous complaints regarding the lack of support channels, particularly the absence of live chat and phone support. The primary mode of communication is through email, which can lead to delays in resolving urgent issues. This aspect could significantly impact user satisfaction and overall trading experience.

User Experience

Overall, user experience with Alliance has been largely favorable, with many users highlighting the ease of navigation and the quality of educational resources available on the platform. However, there are calls for improvements in customer service and withdrawal processes. Some users have reported issues with understanding the trading conditions and fee structures, indicating a need for clearer communication from the broker.

Final Rating Overview

Detailed Breakdown

-

Account Conditions (7/10): The minimum deposit is reasonable, but the lack of regulatory oversight raises concerns.

Tools and Resources (8/10): The proprietary platform is user-friendly and includes advanced features, though the absence of a demo account is a drawback.

Customer Service and Support (6/10): Mixed reviews on customer support; improvements in response times and additional support channels are needed.

Trading Setup (7/10): High leverage and diverse asset classes are appealing, but potential hidden fees should be clarified.

Trustworthiness (5/10): The lack of regulation is a significant concern, making potential traders wary of their funds' safety.

User Experience (8/10): Generally positive feedback on platform usability, but clarity around trading conditions and fees needs improvement.

In conclusion, this Alliance review highlights both the potential benefits and significant risks associated with trading through this broker. While the platform offers a range of attractive features, prospective users should carefully consider the implications of trading with an unregulated entity.