Is Alliance safe?

Business

License

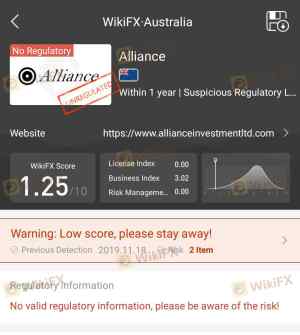

Is Alliance Safe or Scam?

Introduction

In the dynamic world of forex trading, selecting a reliable broker is crucial for both novice and experienced traders. One such broker that has garnered attention is Alliance. Positioned as a competitive player in the forex market, Alliance claims to provide a variety of trading options, attractive spreads, and advanced trading platforms. However, the influx of online trading scams has made it imperative for traders to evaluate brokers meticulously before committing their funds. This article aims to investigate whether Alliance is indeed a trustworthy broker or if it falls into the category of scams. We will assess the broker's regulatory standing, company background, trading conditions, client fund security, and overall customer experience, utilizing a comprehensive evaluation framework that includes industry benchmarks and user feedback.

Regulation and Legitimacy

The first step in evaluating the safety of any forex broker is to examine its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict operational standards and provide a level of protection for client funds. Unfortunately, our investigation reveals that Alliance is not regulated by any top-tier financial authority. This lack of oversight raises significant concerns about the broker's legitimacy and operational integrity.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of a regulatory framework means that traders using Alliance may not have access to the same protections offered by brokers regulated by reputable authorities like the SEC (Securities and Exchange Commission) in the United States or the FCA (Financial Conduct Authority) in the United Kingdom. This raises a red flag, as the lack of regulation can lead to potential issues such as unfair trading practices, lack of transparency, and inadequate client fund protection.

In summary, the regulatory quality of a broker is paramount, and Alliance's lack of regulation significantly undermines its credibility. Traders should exercise caution and consider this broker's unregulated status when deciding whether to engage with them.

Company Background Investigation

Understanding the company behind a broker is essential for assessing its reliability. Alliance appears to have a relatively obscure history, with limited information available regarding its ownership structure and management team. This lack of transparency can be a cause for concern, as reputable brokers typically provide detailed information about their founders, management, and operational history.

The management teams background is also critical; a team with a proven track record in finance and trading can inspire confidence among clients. However, the absence of publicly available bios or professional histories for the key figures at Alliance leaves traders with more questions than answers. Furthermore, the overall transparency and information disclosure level of the company seem inadequate, which can lead to increased skepticism about their operations.

In conclusion, the lack of accessible information about Alliance's history and management raises doubts about its reliability. Traders must be wary of engaging with brokers that do not provide clear insights into their background and operations.

Trading Conditions Analysis

Evaluating the trading conditions offered by a broker is a crucial aspect of determining its suitability for traders. Alliance claims to provide competitive spreads and various trading instruments; however, the specifics of their fee structure raise some concerns. A detailed examination of their trading costs reveals a potentially misleading fee model that could impact traders negatively.

| Fee Type | Alliance | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Model | Variable | Fixed |

| Overnight Interest Range | Up to 3% | Up to 2% |

The spread for major currency pairs at Alliance is higher than the industry average, which could erode potential profits for traders. Additionally, the variable commission model can lead to unexpected costs, especially for frequent traders. The overnight interest rates also appear to be on the higher side, which could be detrimental for traders holding positions overnight.

Overall, while Alliance presents itself as a competitive option, the higher-than-average trading costs and lack of clarity in their fee structure warrant caution. Traders should be mindful of these factors when considering their trading strategy.

Client Fund Security

The security of client funds is a paramount concern for traders when selecting a broker. Alliance's practices regarding fund safety are not well-documented, leading to uncertainty about their policies on fund segregation and investor protection. A reliable broker typically segregates client funds from their operational accounts to ensure that traders' money is safe, even in the event of bankruptcy or financial difficulties.

Moreover, the absence of information regarding negative balance protection policies raises further concerns. Traders need to be aware that without such protections, they could potentially lose more than their initial investment in volatile market conditions.

Historically, if Alliance has faced any issues related to fund security, such as client complaints or regulatory warnings, this could significantly impact their reputation. However, due to the lack of transparency and available data, it is challenging to ascertain the company's track record in safeguarding client funds.

In conclusion, the uncertainty surrounding fund security practices at Alliance is a significant concern. Traders must prioritize brokers that offer clear and robust protections for client funds to mitigate risks.

Customer Experience and Complaints

Analyzing customer feedback is vital for understanding the overall experience with a broker. Alliance has received mixed reviews from users, with many expressing dissatisfaction regarding the quality of customer support and responsiveness to complaints. Common complaints include issues with withdrawal processes, lack of communication, and difficulties in resolving trading disputes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Support | Medium | Average |

| Misleading Information | High | Poor |

Two notable cases highlight the challenges faced by clients. In one instance, a trader reported significant delays in withdrawing funds, which took weeks to resolve, leading to frustration and loss of trust in the broker. In another case, a user claimed that the information provided during the account opening process was misleading, resulting in unexpected fees.

Overall, the customer experience with Alliance appears to be subpar, with several complaints indicating systemic issues within their operations. Traders should consider these factors carefully before choosing to trade with this broker.

Platform and Execution

The trading platform's performance and reliability are critical for successful trading. Alliance claims to offer a user-friendly platform with advanced features; however, user experiences suggest that there may be issues with platform stability and execution quality. Reports of slippage, order rejections, and slow execution times have been common among users.

A thorough evaluation of the platform's performance reveals that while it may have appealing features, the execution quality and reliability leave much to be desired. Traders must be cautious, as poor execution can lead to significant financial losses, especially in fast-moving markets.

In conclusion, while Alliance offers a trading platform with potential, the execution issues reported by users raise concerns about their overall reliability. Traders should prioritize brokers with proven track records in platform performance and execution quality.

Risk Assessment

Engaging with any forex broker carries inherent risks, and Alliance is no exception. The lack of regulation, combined with customer complaints and execution issues, contributes to a higher risk profile for traders considering this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation by top-tier authorities |

| Financial Risk | Medium | Potential for high trading costs |

| Operational Risk | High | Reports of execution and withdrawal issues |

To mitigate these risks, it is advisable for traders to conduct thorough due diligence, maintain a diversified trading strategy, and avoid committing significant capital to unregulated brokers like Alliance.

Conclusion and Recommendations

After a comprehensive analysis of Alliance, it is evident that this broker presents several red flags that warrant caution. The lack of regulation, coupled with customer complaints regarding fund safety, execution quality, and overall transparency, raises significant concerns about its legitimacy.

For traders seeking reliable options, it is advisable to consider brokers regulated by top-tier authorities, offering robust client fund protections and transparent trading conditions. Some recommended alternatives include brokers with established reputations and proven track records in customer service and regulatory compliance.

In summary, while Alliance may appear to offer attractive trading opportunities, the associated risks and concerns suggest that traders should approach this broker with caution and consider safer, regulated alternatives.

Is Alliance a scam, or is it legit?

The latest exposure and evaluation content of Alliance brokers.

Alliance Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Alliance latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.