Goccfx 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive goccfx review shows a troubling picture of an offshore forex broker. The broker has attracted significant negative attention from multiple industry watchdogs and user communities. Goccfx has been consistently flagged as a high-risk trading platform, with numerous sources warning potential investors about fraudulent activities and deceptive practices that could cost them money.

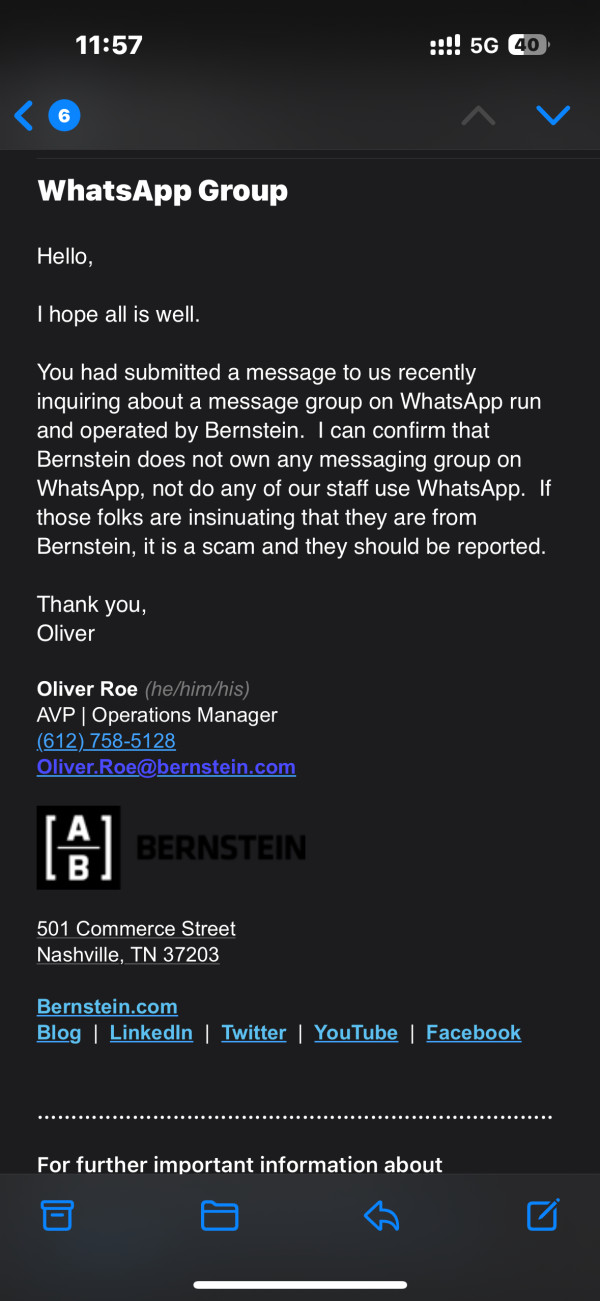

Fraud Recovery Experts says Goccfx operates as a cunning attempt to scam unwary traders. Scam Brokers Reviews explicitly advises traders not to trust this fraudulent broker. The platform has received overwhelmingly negative feedback across multiple review platforms, with Broker Complaint Alert categorizing it among scam brokers requiring immediate attention from regulatory authorities who need to take action quickly.

Multiple independent sources have documented concerning patterns in Goccfx's operations. The Forex Review and WikiBit report problems ranging from withdrawal difficulties to misleading marketing practices. The broker's trust score remains critically low, with industry analysts consistently recommending traders to avoid this platform entirely to protect their investments.

Important Notice

This goccfx review is based on extensive research from multiple independent sources and user testimonials. We collected information through 2024 and 2025. As an offshore broker operating without proper regulatory oversight, Goccfx may not be subject to the same legal protections available through regulated brokers that follow strict rules. Traders should be aware that regulatory differences across jurisdictions may affect their legal recourse in case of disputes. All information presented reflects the current understanding of the broker's operations based on available public data and should not be considered as financial advice that you should follow without doing your own research.

Rating Framework

Broker Overview

Company Background and Business Model

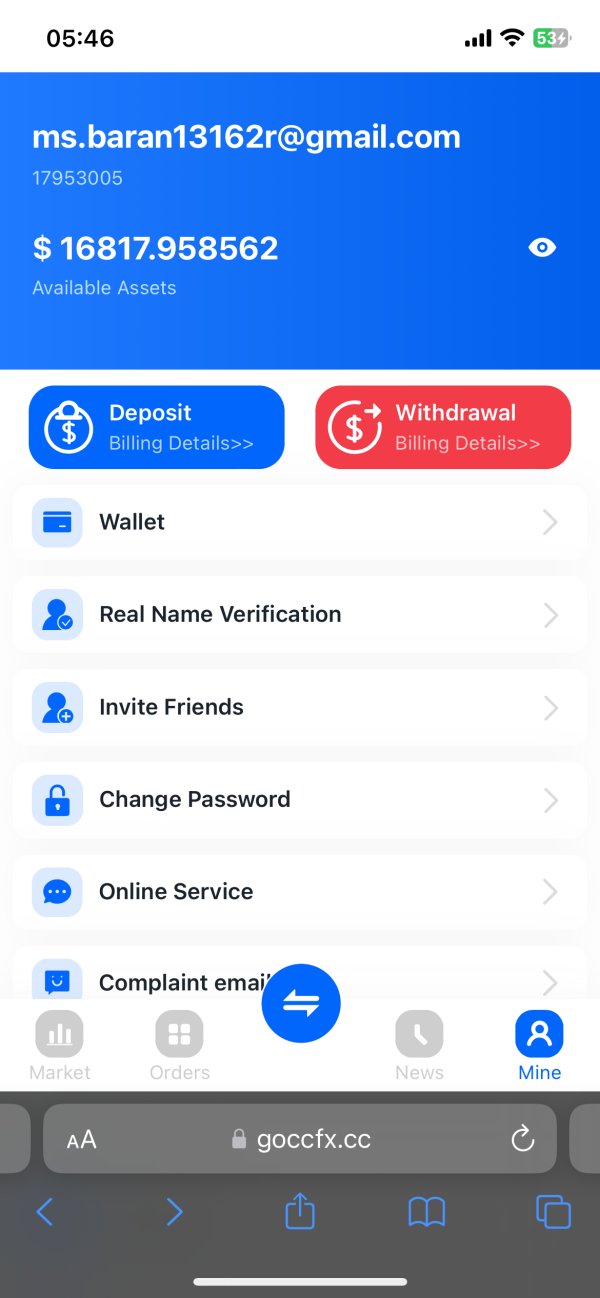

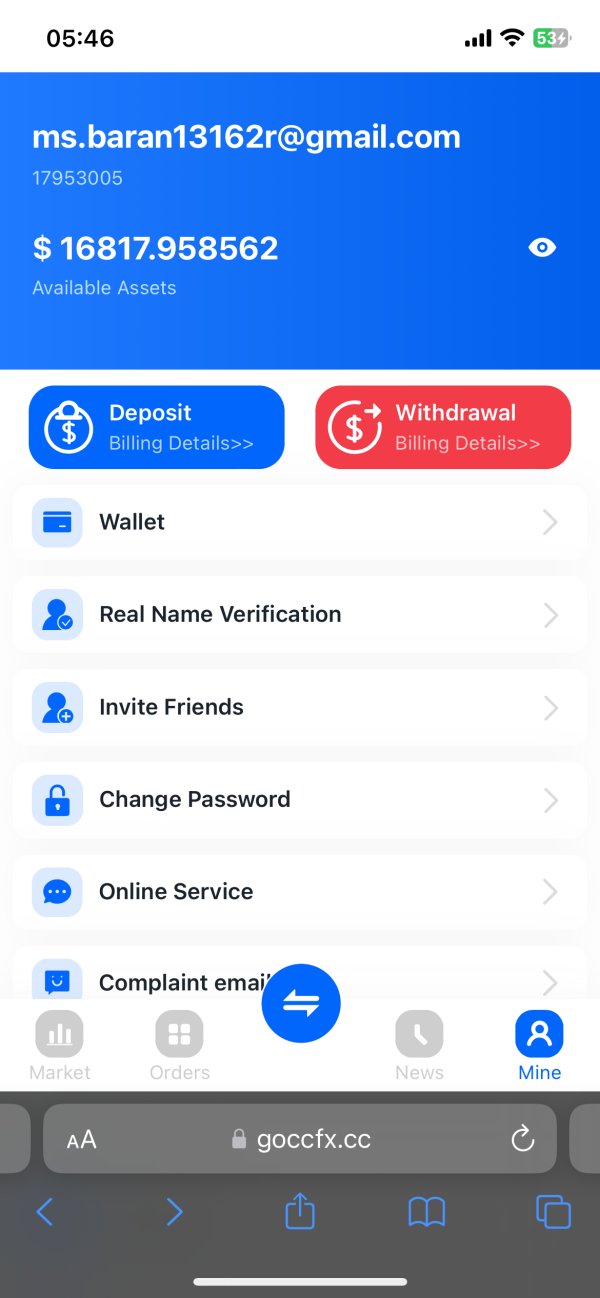

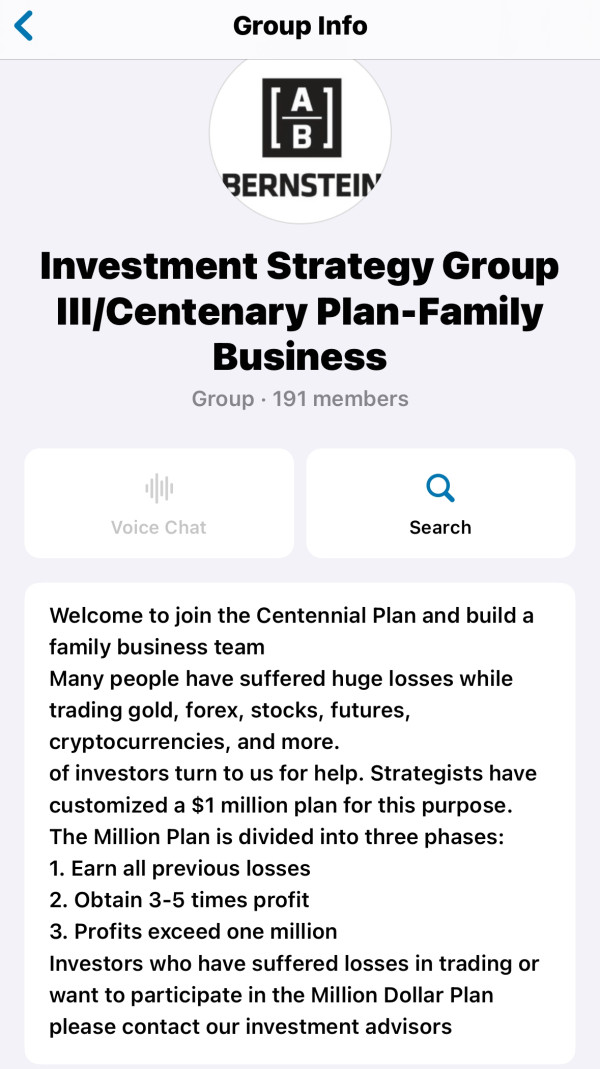

Goccfx positions itself as an offshore forex broker targeting retail traders. The company claims to offer access to currency markets. However, Scam Brokers Reviews reports that the platform operates as "a cunning attempt to scam unwary traders" rather than a legitimate trading service that actually helps people make money. The broker's actual establishment date and corporate structure remain unclear, with specific company background information not detailed in available public records.

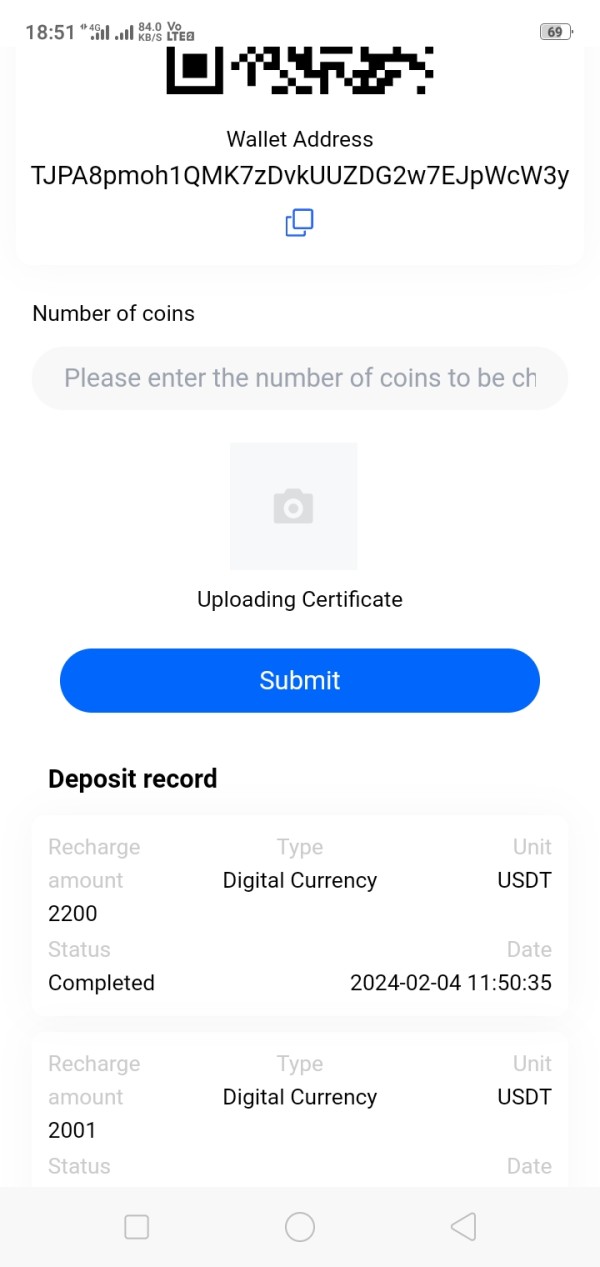

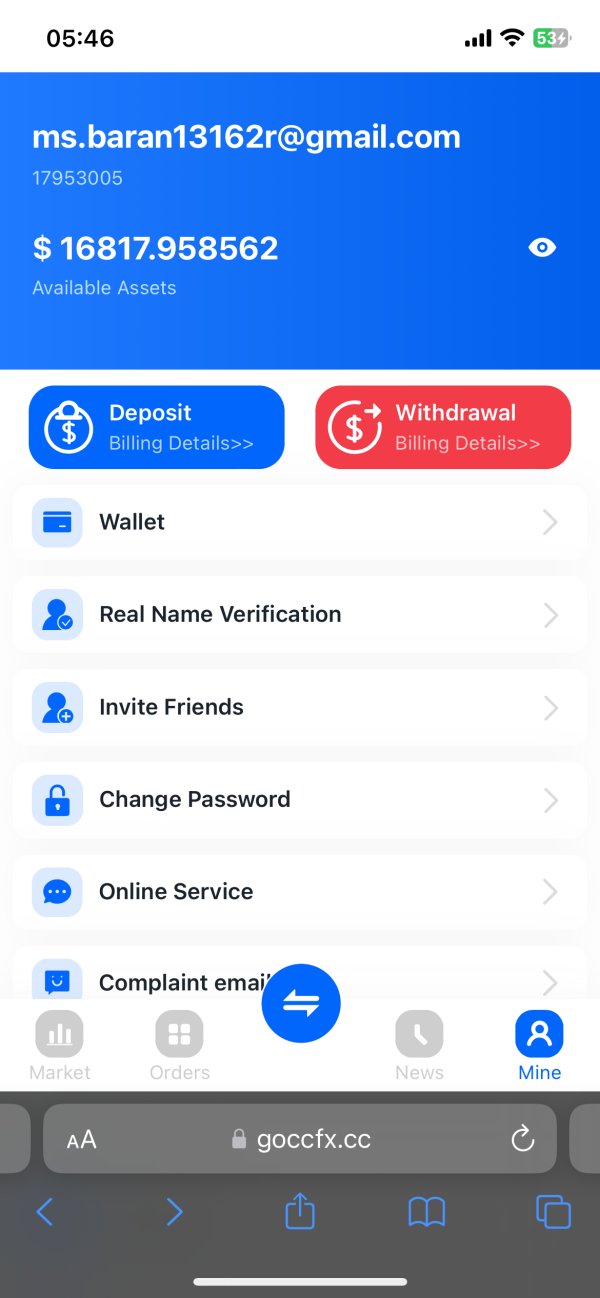

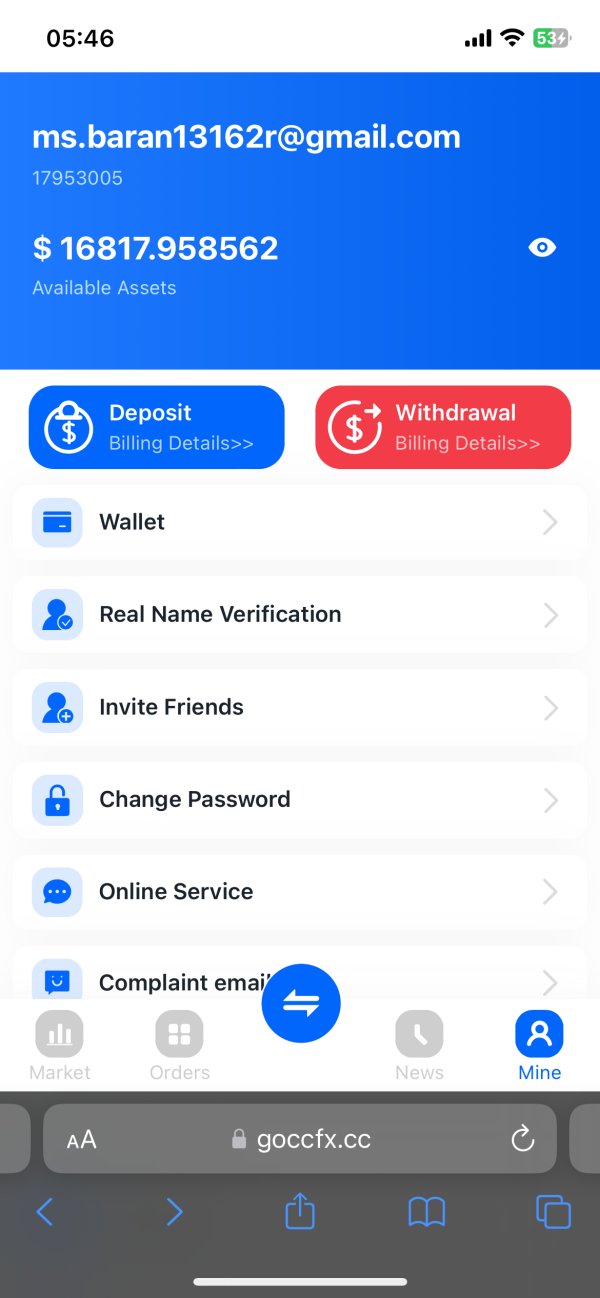

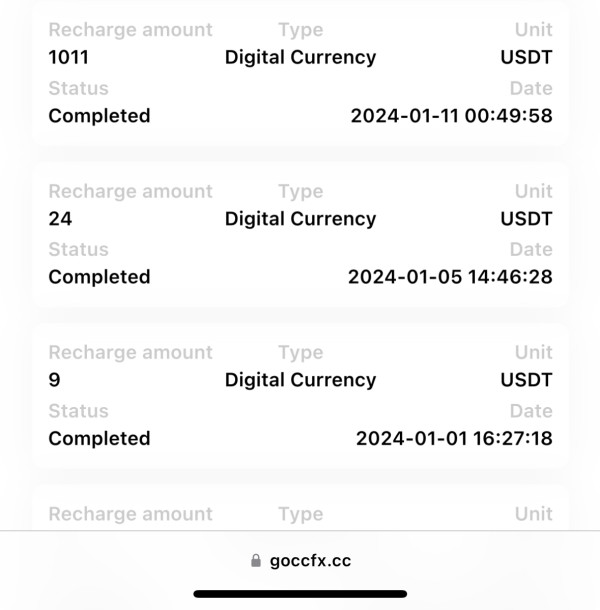

The business model appears to follow typical offshore broker patterns. It offers forex trading services without clear regulatory oversight. Fraud Recovery Experts reports that Goccfx employs deceptive marketing tactics to attract initial deposits while making subsequent withdrawals extremely difficult or impossible for traders who want their money back.

Trading Platform and Asset Coverage

Goccfx claims to offer forex trading services. However, the specific trading platform technology and available currency pairs are not clearly detailed in public documentation. The Forex Review indicates that the platform's technical infrastructure raises significant concerns about reliability and execution quality that could hurt traders.

The broker's asset coverage and trading conditions remain poorly documented. This lack of information serves as a red flag for potential traders. Industry standards typically require transparent disclosure of trading instruments, spreads, and execution policies - areas where Goccfx appears to fall short of professional standards that legitimate brokers follow.

Regulatory Status: Available sources do not indicate any legitimate regulatory oversight for Goccfx operations. Deposit and Withdrawal Methods: Specific payment processing information not clearly disclosed in public materials. Minimum Deposit Requirements: Exact minimum deposit amounts not transparently published in available documentation. Promotional Offers: Specific bonus and promotional structures not detailed in accessible sources. Available Trading Assets: Comprehensive asset listings not provided in public broker materials. Cost Structure: Detailed fee schedules and spread information not transparently disclosed to potential clients. Leverage Options: Specific leverage ratios not clearly stated in available public information. Platform Choices: Exact trading platform options not comprehensively detailed in accessible materials. Geographic Restrictions: Specific regional limitations not clearly outlined in public documentation. Customer Support Languages: Available language support options not specified in accessible sources.

This goccfx review reveals a concerning lack of transparency in basic operational details. Legitimate brokers typically provide this information clearly to potential clients.

Detailed Rating Analysis

Account Conditions Analysis (Score: 1/10)

The account conditions offered by Goccfx represent one of the most problematic aspects of this broker's operations. Scam Brokers Reviews reports that the platform fails to provide clear information about account types, making it impossible for traders to make informed decisions about their trading setup. This lack of transparency violates basic industry standards for broker disclosure that protect consumers.

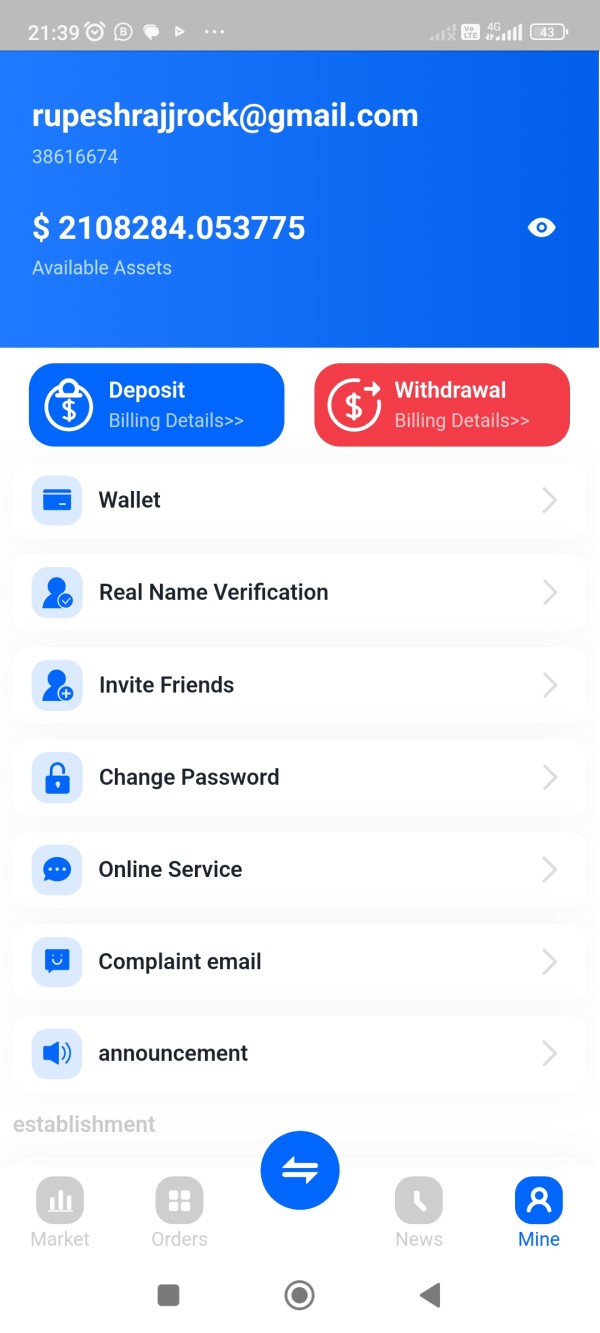

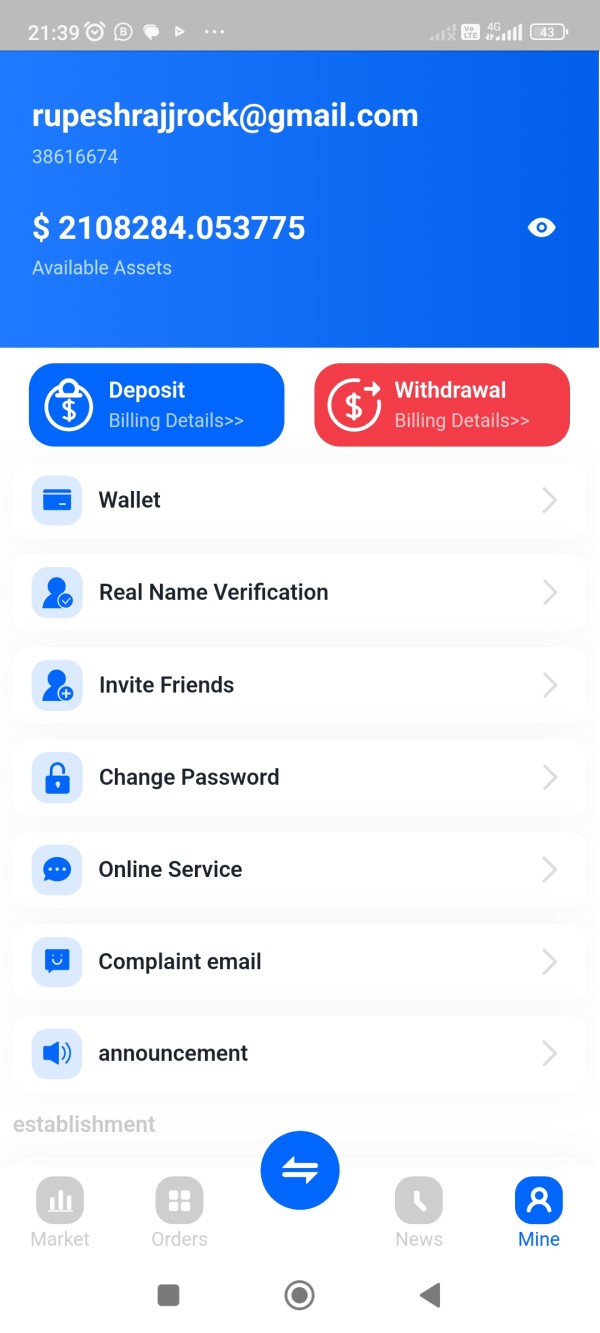

Broker Complaint Alert reports multiple instances where traders discovered hidden account conditions. These problems only appeared after traders made initial deposits. These undisclosed terms often included restrictive withdrawal clauses and mandatory trading volume requirements that were never mentioned during the account opening process, which misleads customers from the very beginning.

User feedback consistently highlights problems with account verification processes. Many traders report that their accounts were frozen during the verification stage without clear explanation. The Forex Review notes that legitimate brokers typically provide comprehensive account condition documentation upfront, something notably absent in Goccfx's operations that should raise red flags for potential users.

The platform fails to offer specialized account types, such as Islamic accounts for Muslim traders. This demonstrates a lack of professional service standards. This goccfx review finds that the broker's account conditions fall far below industry expectations that customers deserve.

Goccfx's trading tools and educational resources appear severely limited compared to industry standards. Fraud Recovery Experts indicates that the platform lacks essential trading tools that professional traders require for effective market analysis. The absence of comprehensive charting packages, technical indicators, and market research resources significantly hampers trading effectiveness for users who need these basic features.

Educational resources are notably absent from Goccfx's offerings. These resources are a critical component for trader development. Legitimate brokers typically provide extensive educational materials, including webinars, tutorials, and market analysis. The lack of such resources suggests that Goccfx prioritizes quick customer acquisition over long-term trader success that would benefit their clients.

WikiBit reports that users have complained about the poor quality of available analytical tools. Many users indicate that basic features expected from modern trading platforms are either missing or non-functional. The platform's research capabilities appear particularly weak, with no evidence of professional market analysis or economic calendar integration that traders rely on for making informed decisions.

Automated trading support appears limited or non-existent based on available user feedback. This support is increasingly important in modern forex trading. This limitation significantly restricts trading strategies and efficiency for users who rely on algorithmic trading approaches to maximize their profits.

Customer Service and Support Analysis (Score: 1/10)

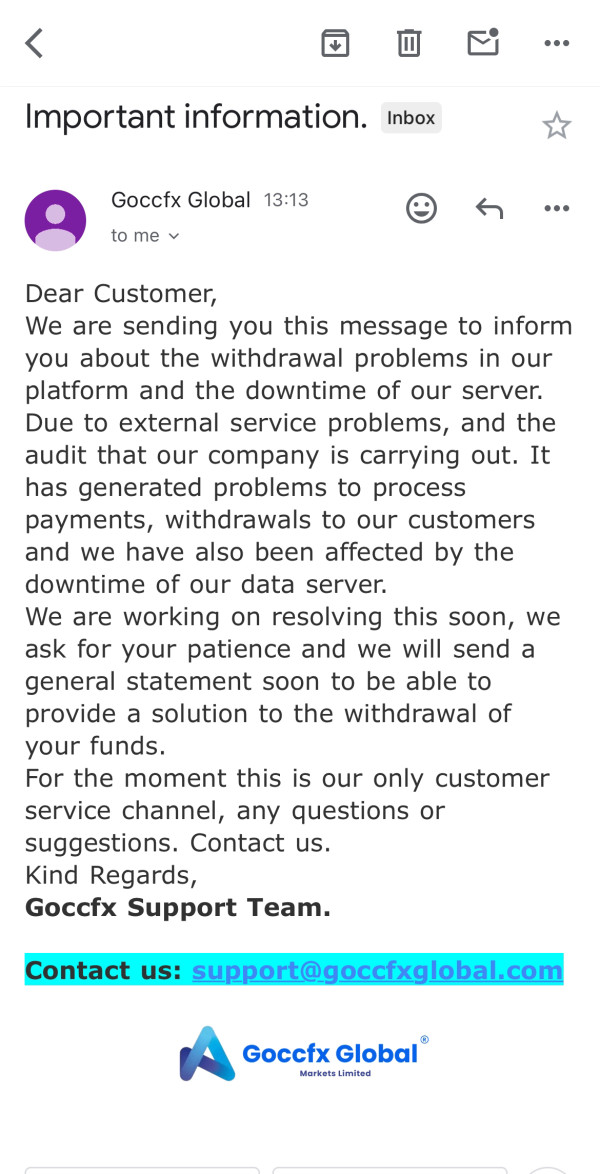

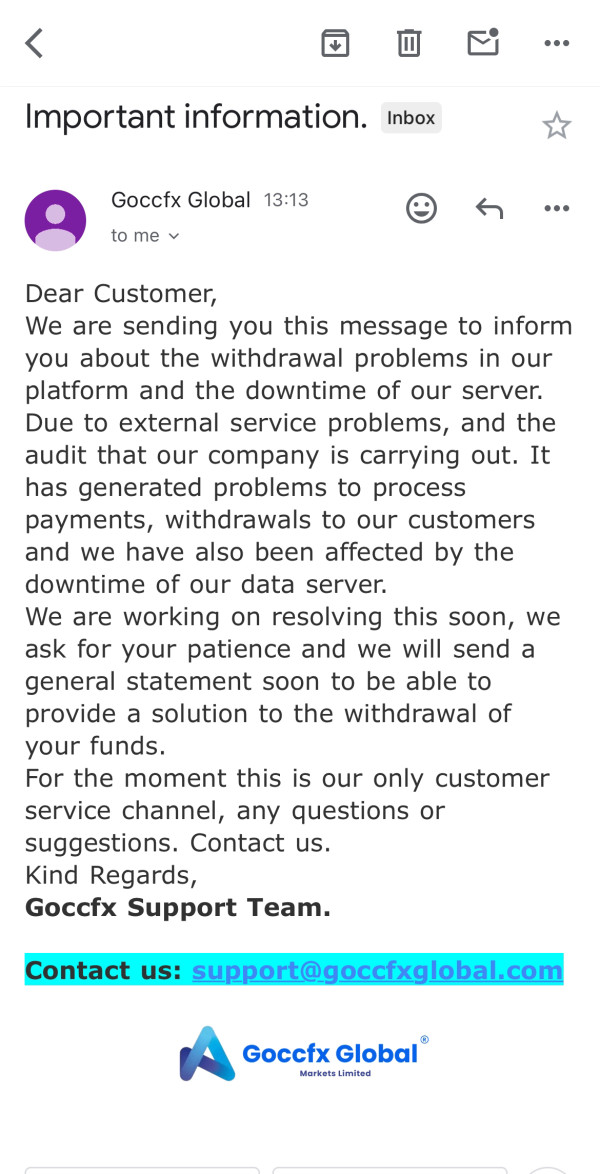

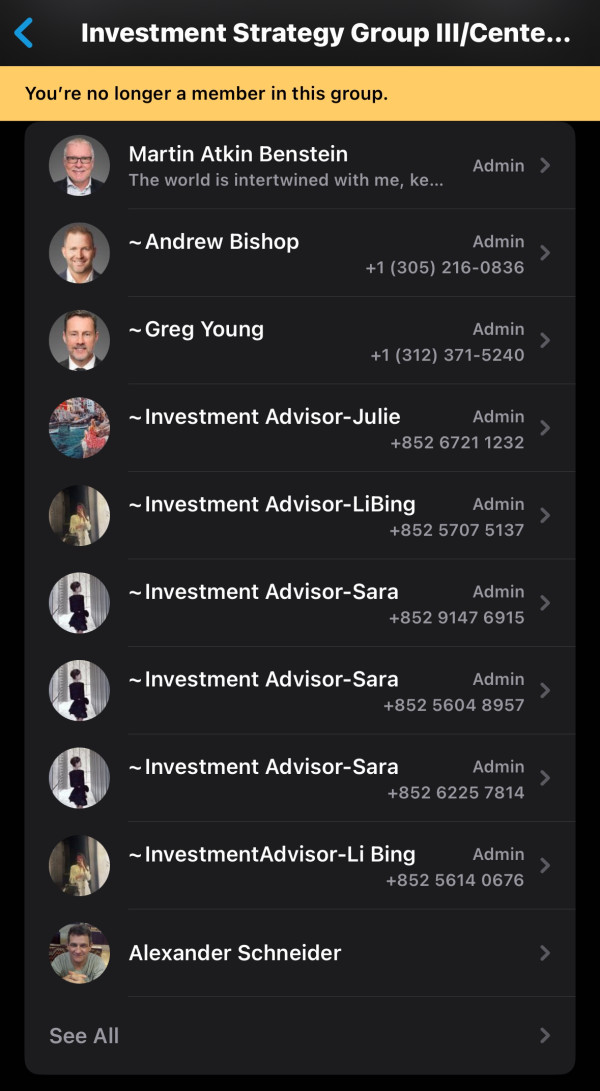

Customer service represents perhaps the most criticized aspect of Goccfx's operations. Broker Complaint Alert documents numerous cases where traders were unable to reach customer support during critical trading periods or when attempting to resolve withdrawal issues. Response times appear excessively long, with many users reporting complete lack of communication from support teams that should be helping them.

Scam Brokers Reviews highlights that when customer service does respond, the quality of assistance is typically poor. Representatives often provide misleading information or make promises they cannot fulfill. This pattern suggests either inadequate training or intentional deception on the part of support staff who are supposed to help customers succeed.

The availability of customer service channels appears limited. Specific contact methods are not clearly published in accessible materials. Professional brokers typically offer multiple communication channels including live chat, phone support, and email assistance with clearly defined response time commitments that customers can rely on.

Language support options remain unclear. This potentially creates additional barriers for international traders seeking assistance. The lack of professional customer service standards significantly undermines trader confidence and operational effectiveness that people need when trading.

Trading Experience Analysis (Score: 2/10)

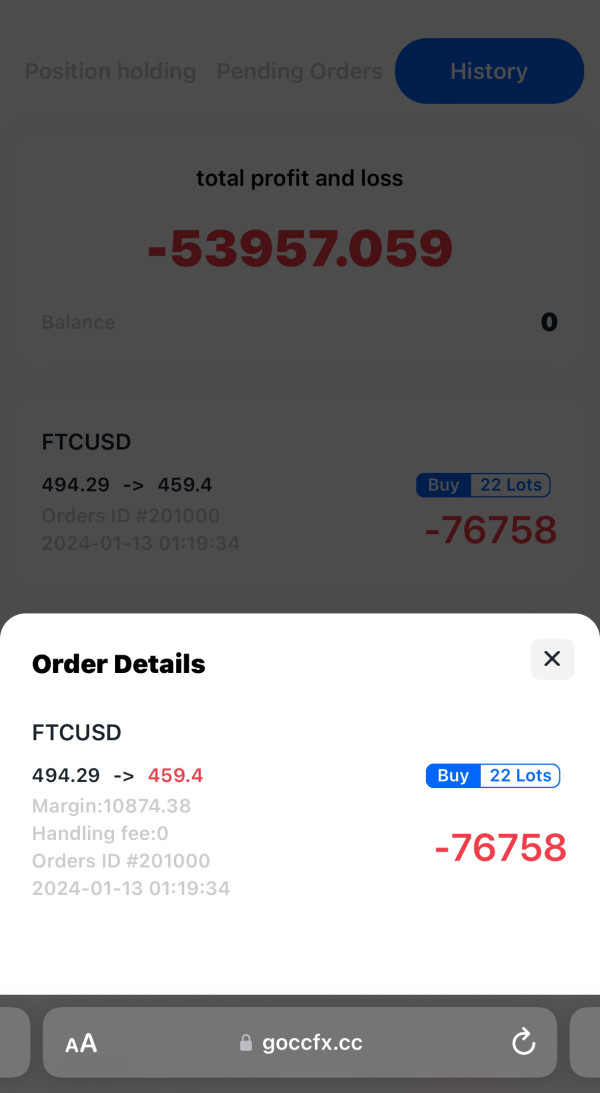

The trading experience provided by Goccfx has received consistently negative feedback from users across multiple review platforms. The Forex Review reports frequent platform stability issues, including unexpected disconnections during active trading sessions and delayed order executions that can result in significant losses for traders. These technical problems can cost people serious money when they're trying to trade.

Order execution quality appears problematic. Users report instances of slippage, requotes, and orders being executed at prices different from those requested. These execution issues suggest either poor technical infrastructure or intentional manipulation of trading conditions to disadvantage clients who trust the platform with their money.

Platform functionality concerns extend to basic trading operations. Users report difficulties in placing orders, modifying positions, and accessing account information. Fraud Recovery Experts notes that these technical problems often coincide with periods when traders are attempting to close profitable positions that would make them money.

Mobile trading experience appears particularly poor based on available user feedback. This experience is crucial for modern traders. The lack of reliable mobile platform access limits trading flexibility and responsiveness to market opportunities that could help traders succeed.

Trust and Security Analysis (Score: 1/10)

Trust and security represent the most critical concerns regarding Goccfx operations. Multiple independent sources have issued explicit warnings about the platform's fraudulent activities. Fraud Recovery Experts and Scam Brokers Reviews both warn traders to stay away. The absence of legitimate regulatory oversight eliminates important investor protections typically available through licensed brokers that follow government rules.

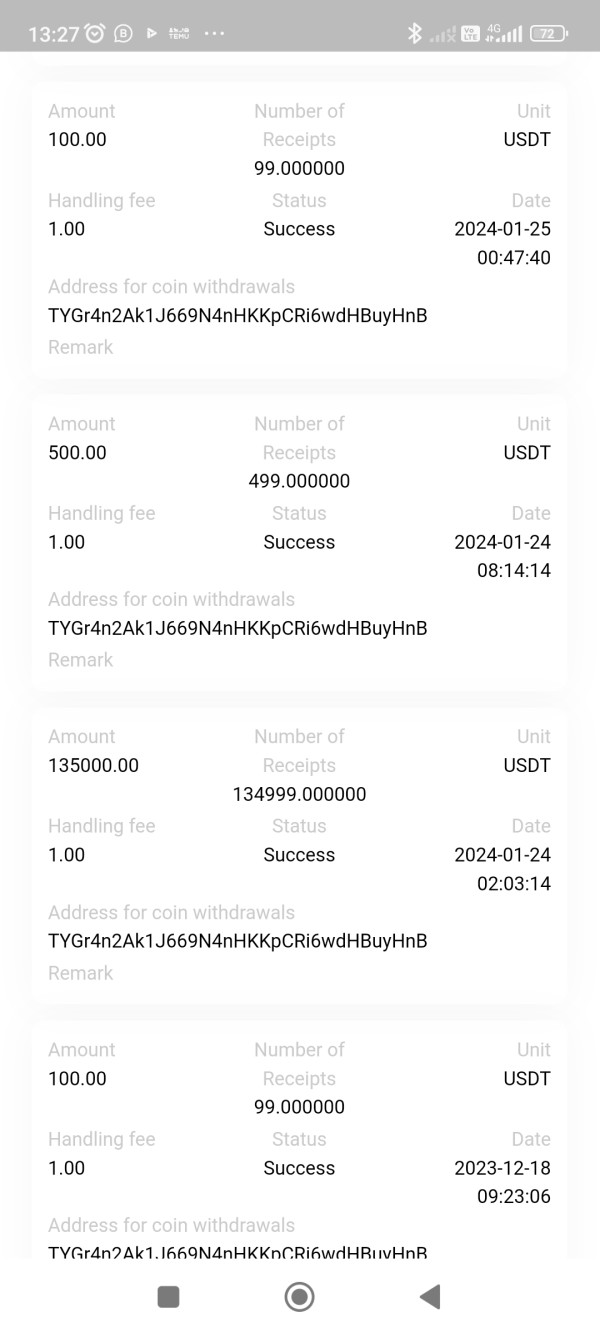

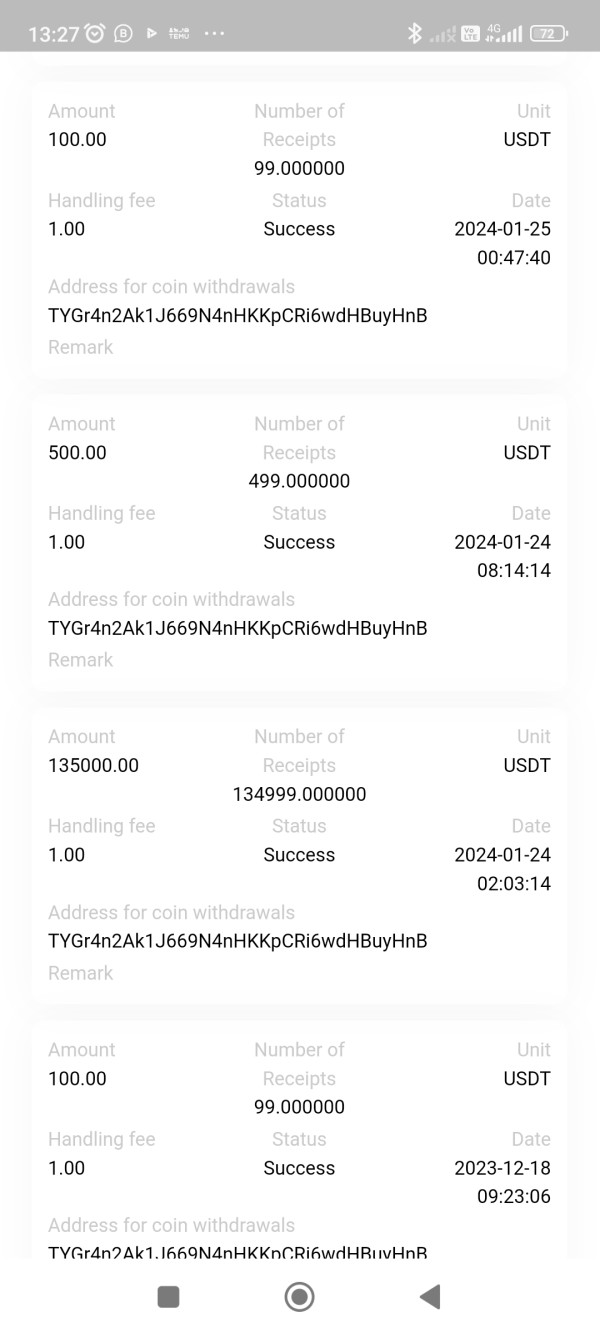

Broker Complaint Alert reports that Goccfx has been added to multiple scam broker blacklists. This indicates a pattern of deceptive practices recognized by industry watchdogs. The platform's inability to demonstrate proper licensing or regulatory compliance raises serious questions about fund security and operational legitimacy that should concern any potential user.

Client fund protection measures appear absent from Goccfx's operations. These measures are standard among legitimate brokers. Segregated client accounts, deposit insurance, and third-party auditing are not mentioned in available documentation, leaving trader funds vulnerable to misappropriation by people who might steal their money.

The broker's transparency regarding company ownership, operational procedures, and financial reporting falls well below industry standards. This lack of transparency prevents traders from conducting proper due diligence and assessing operational risks effectively before they invest their hard-earned money.

User Experience Analysis (Score: 1/10)

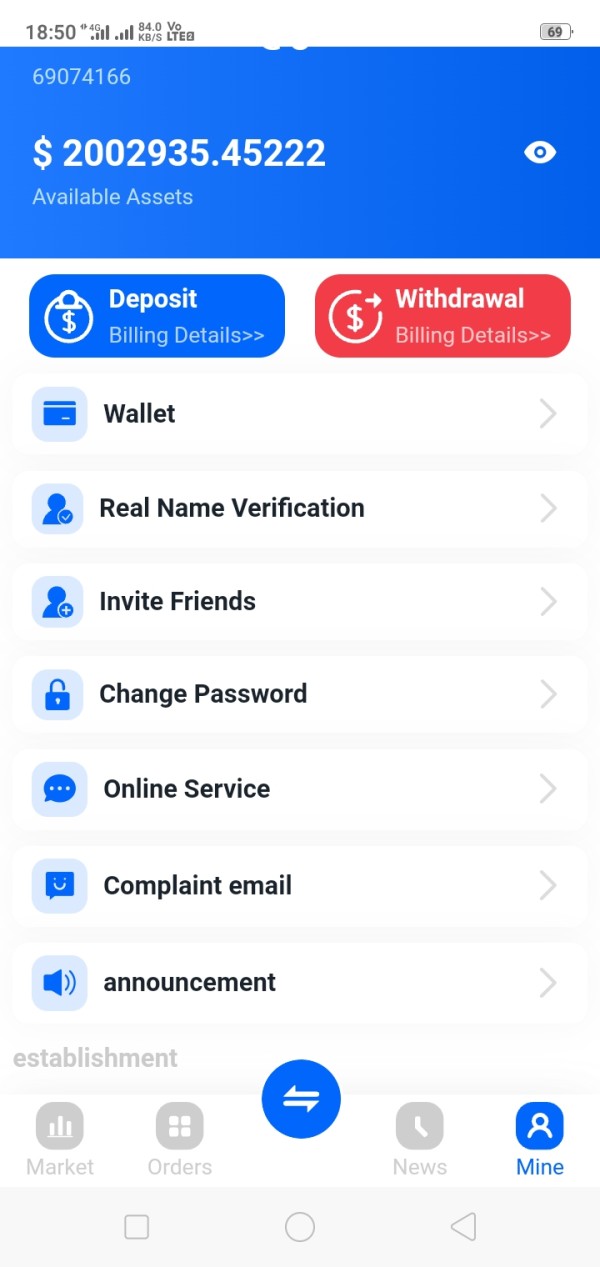

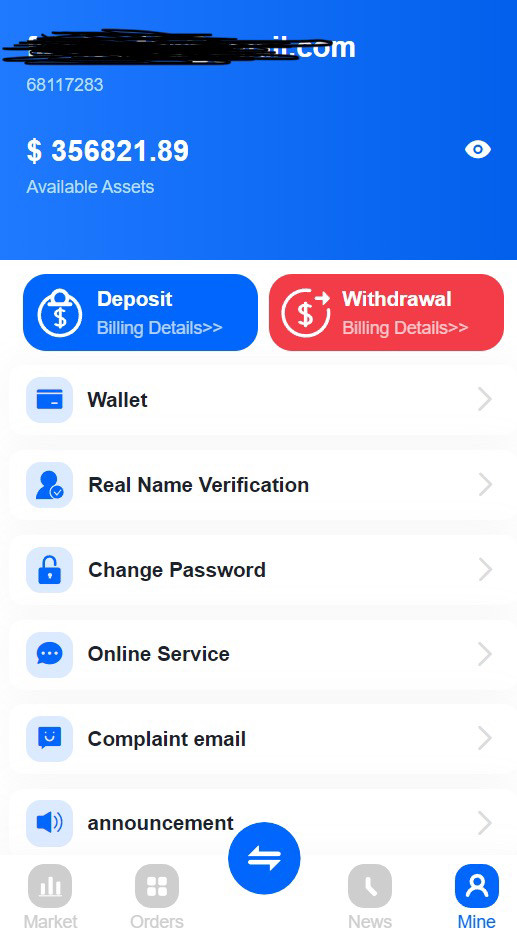

User experience with Goccfx has been overwhelmingly negative across all available feedback channels. WikiBit aggregates user reviews showing consistent patterns of dissatisfaction with platform performance, customer service, and withdrawal processing. The majority of user testimonials warn other traders to avoid the platform entirely to protect themselves from losing money.

Registration and account verification processes appear designed more to collect personal information than to facilitate legitimate trading. Users report complex verification requirements that often result in account restrictions rather than approved trading access. This pattern suggests potential misuse of collected personal data that could harm users in ways beyond just financial loss.

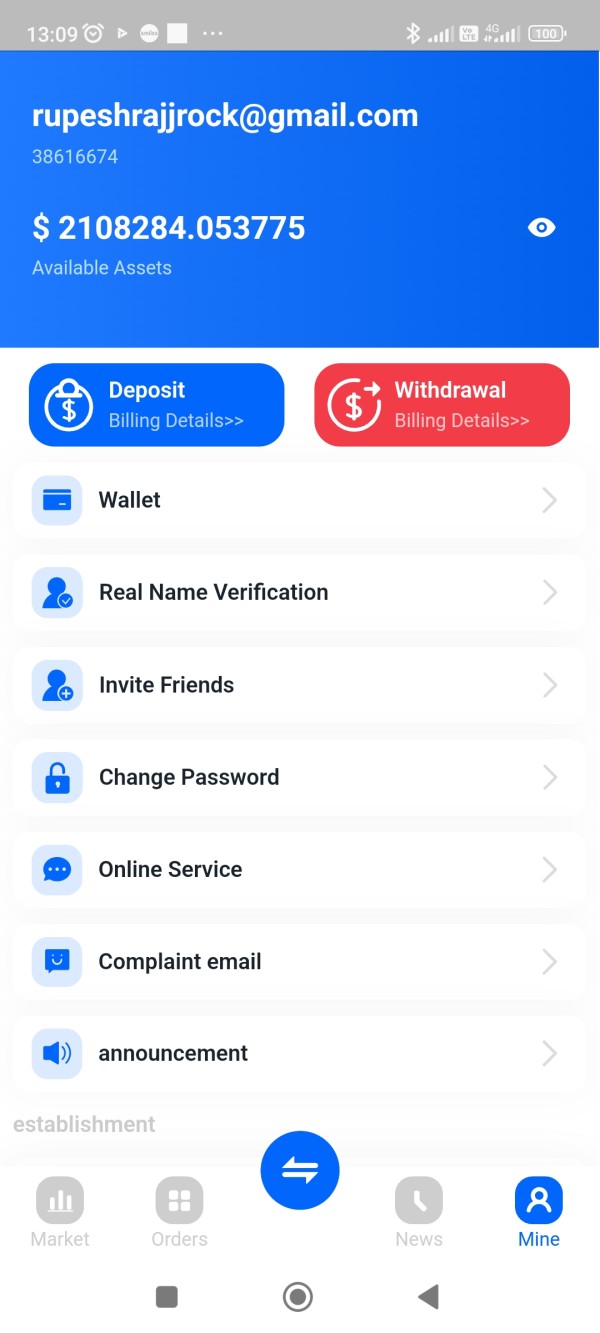

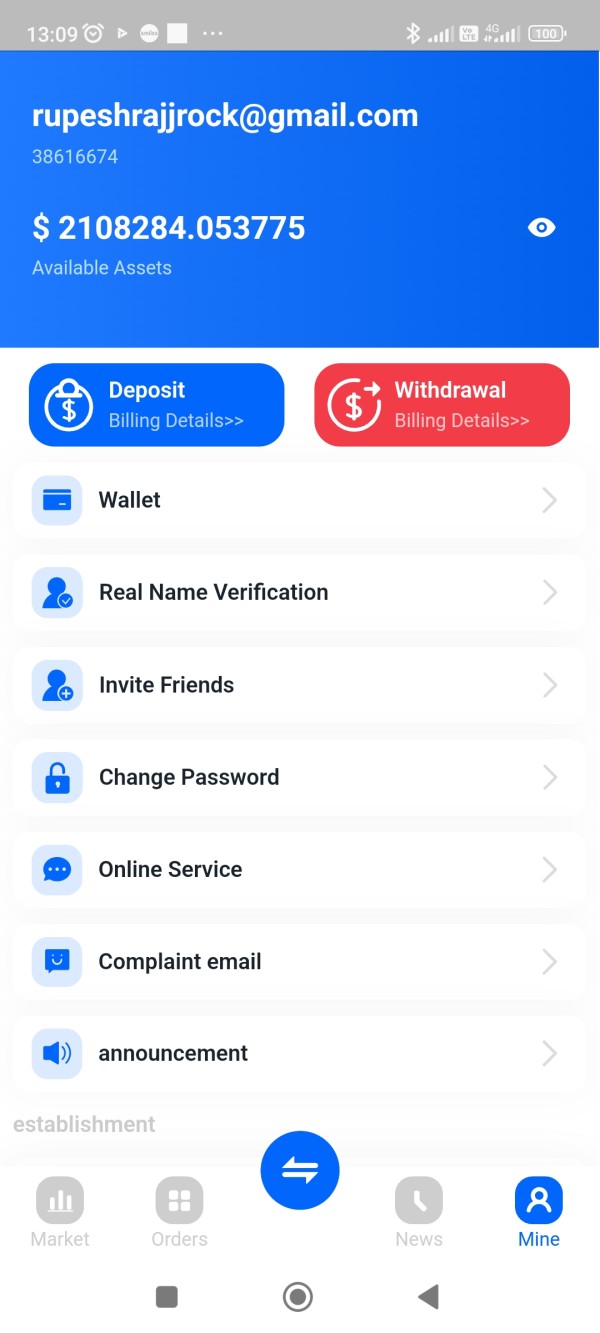

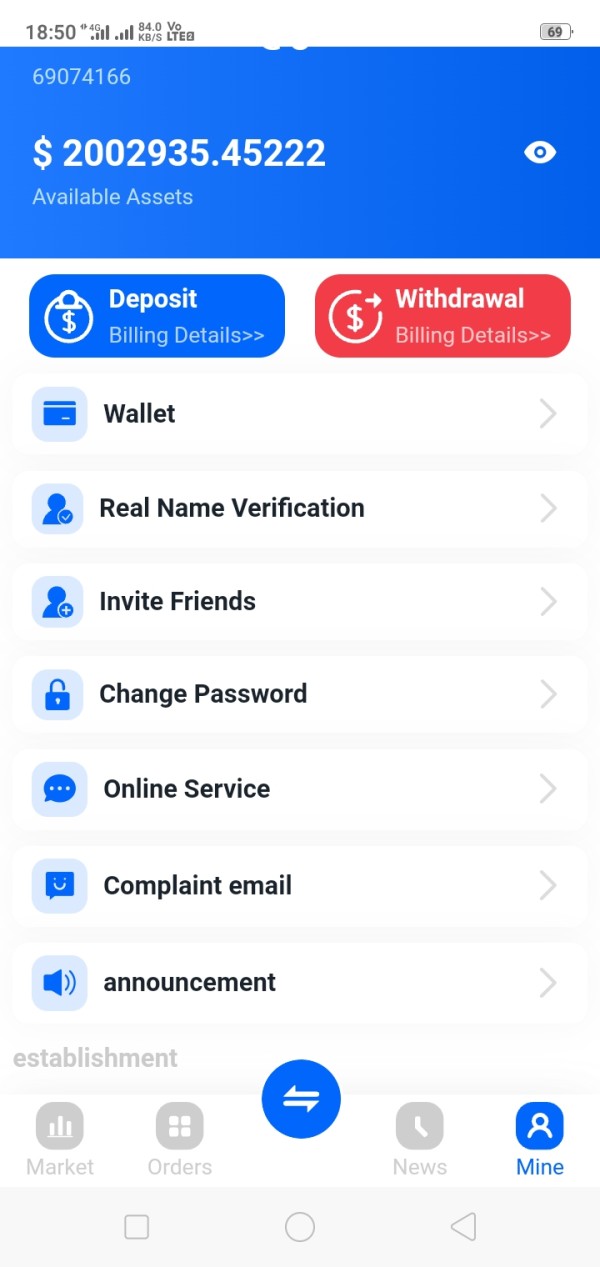

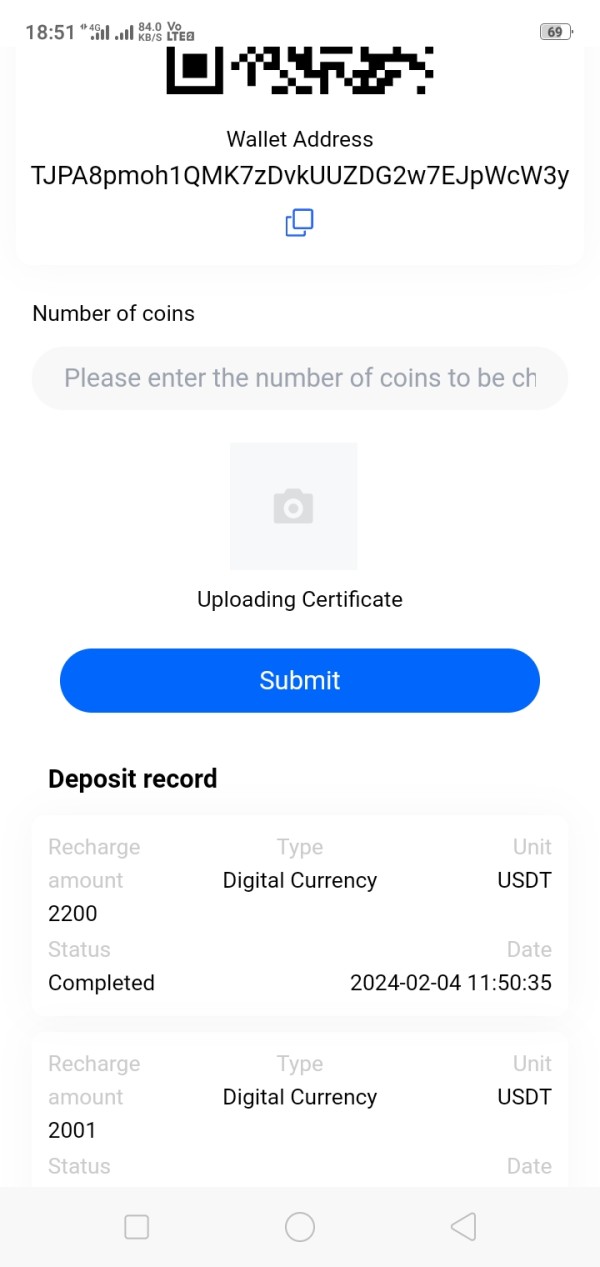

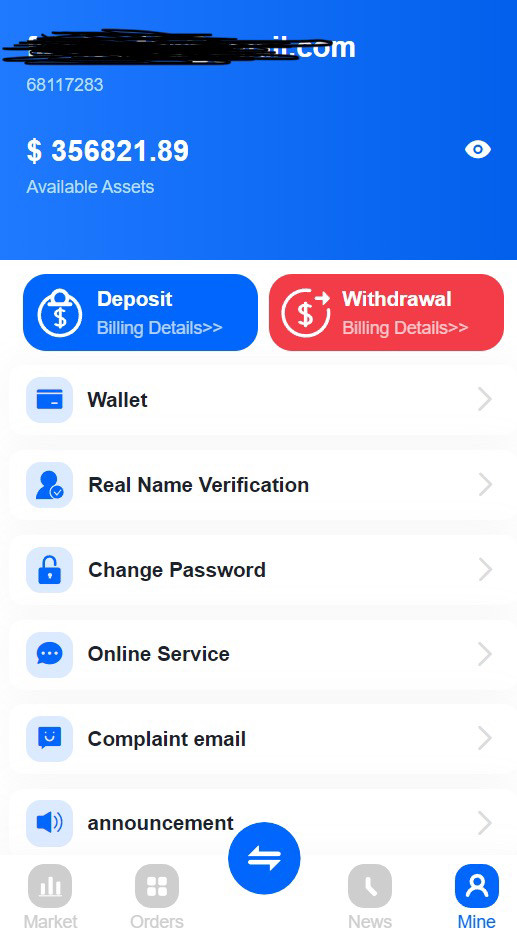

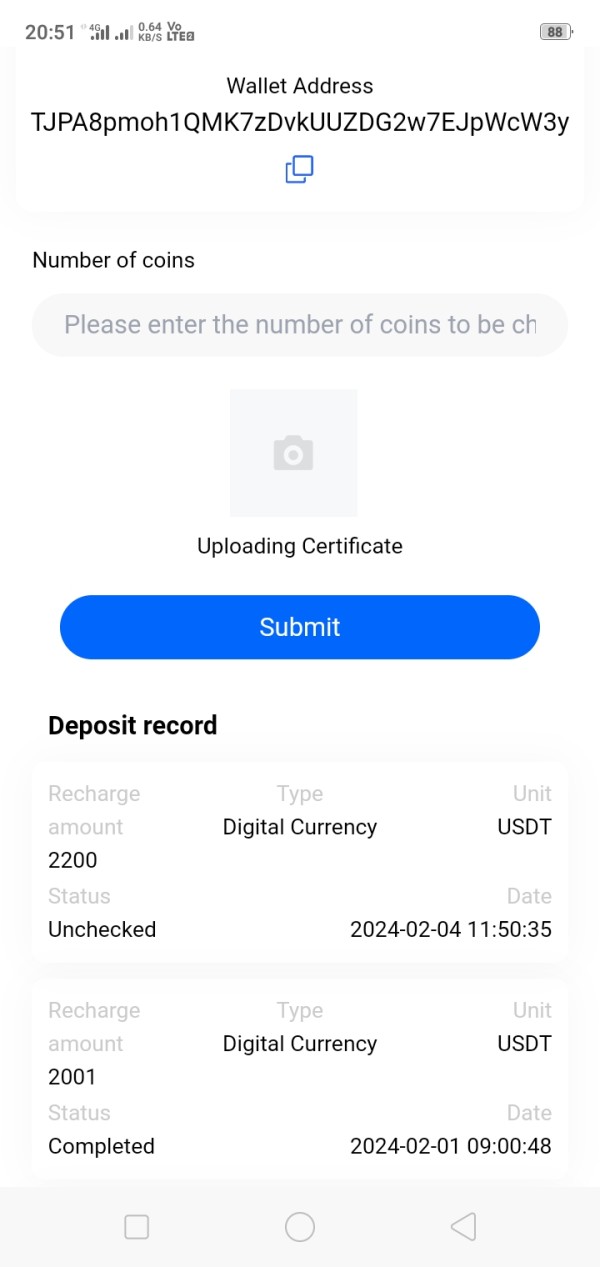

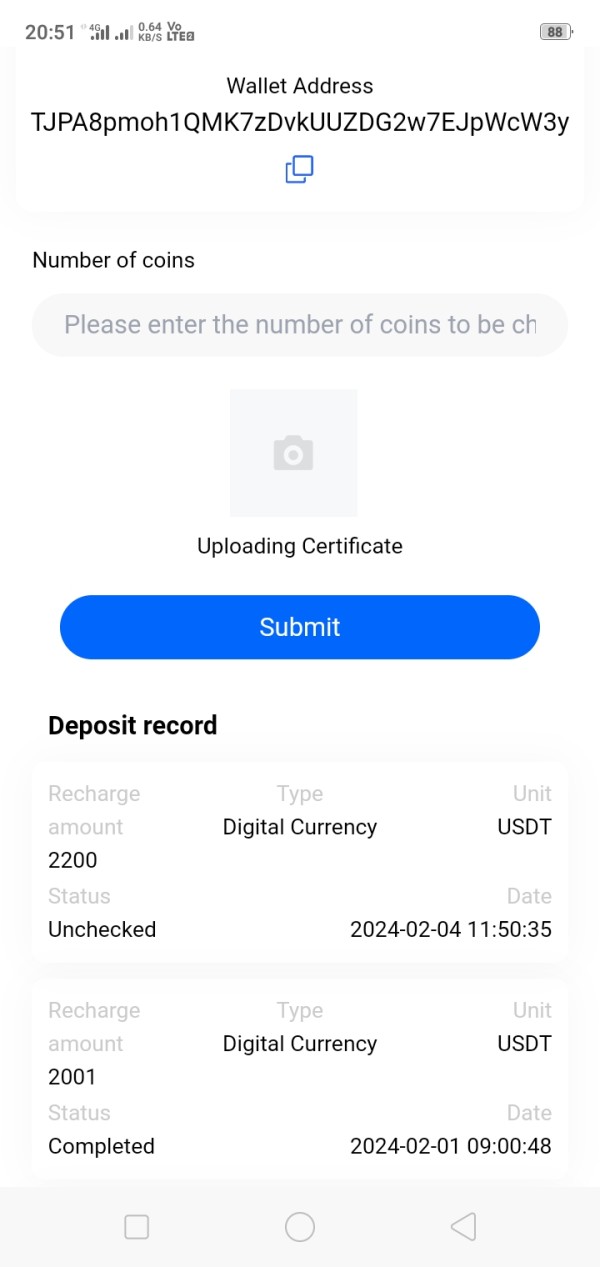

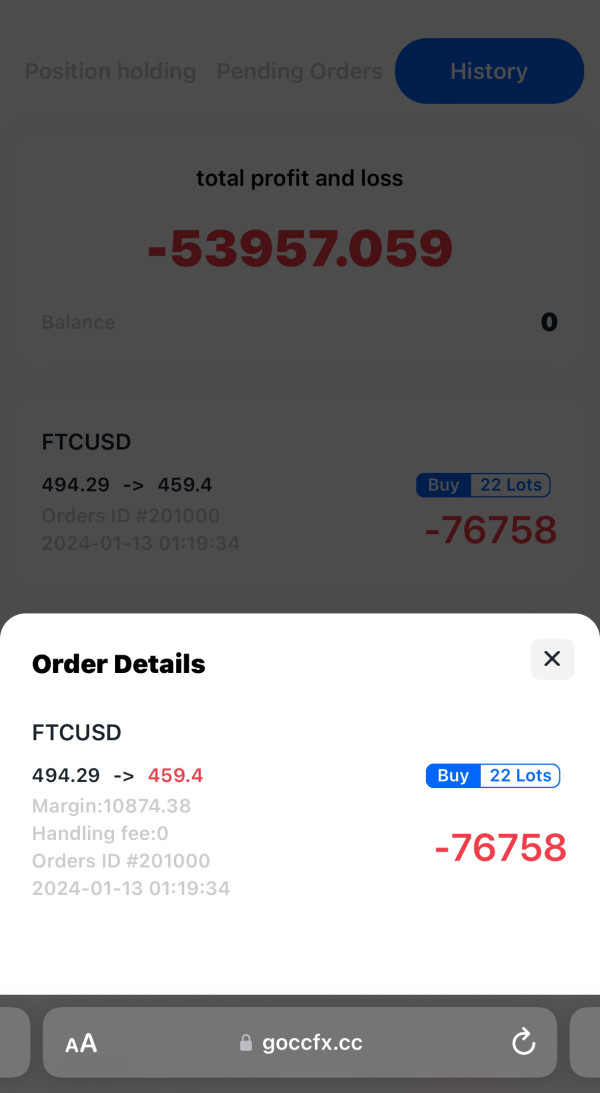

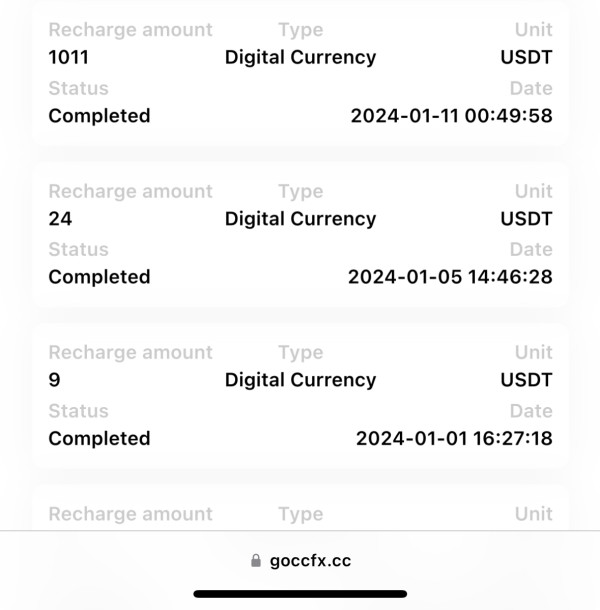

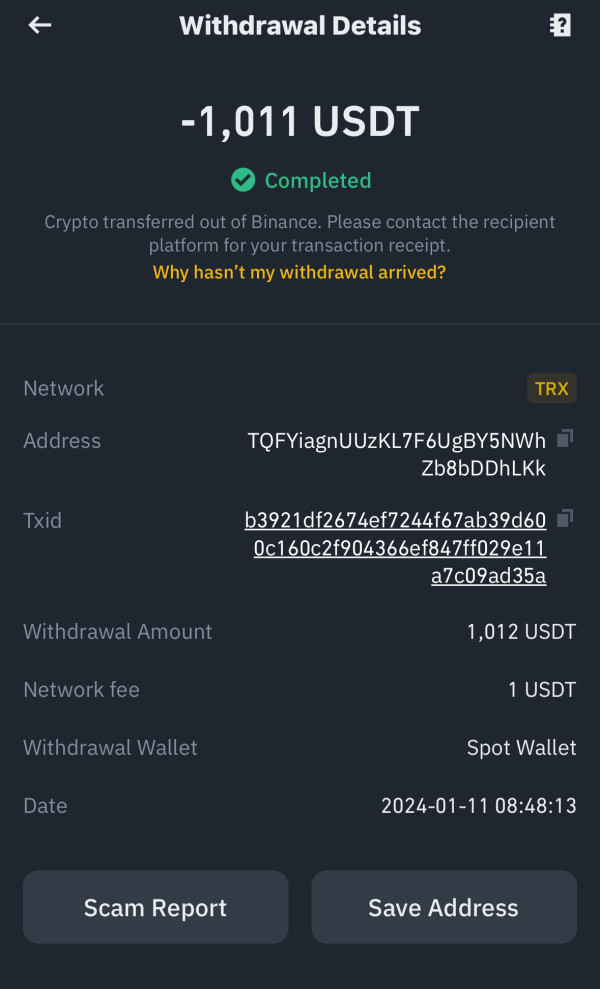

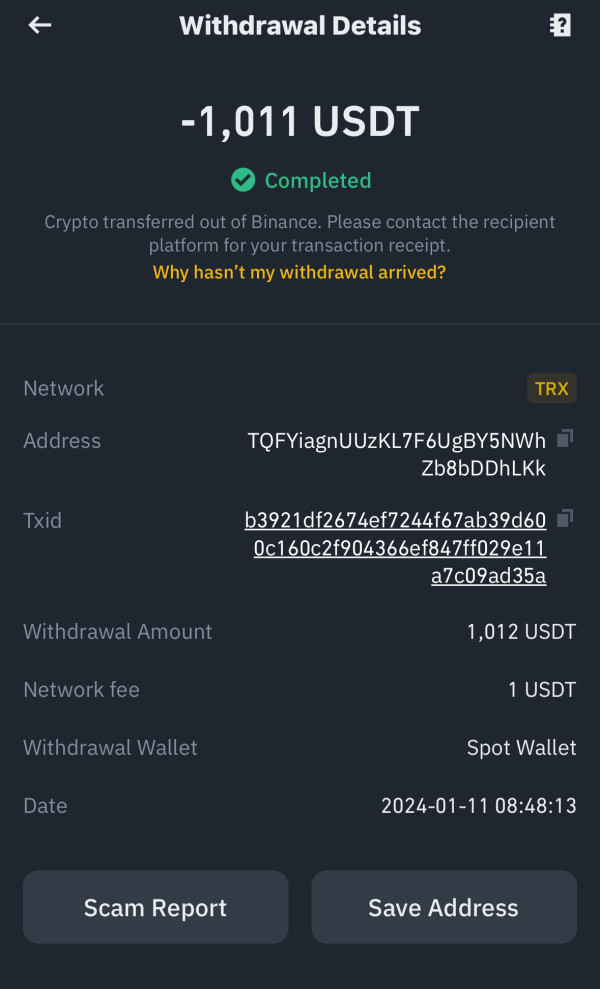

The withdrawal process represents the most frequently cited user complaint. Scam Brokers Reviews documents numerous cases where traders were unable to retrieve their deposited funds. These withdrawal difficulties often emerge after initial deposits are made, suggesting intentional deception in the onboarding process that tricks people into giving up their money.

Interface design and platform usability receive consistently poor ratings from users who have attempted to use the platform. The combination of technical issues, poor customer service, and withdrawal difficulties creates an overall user experience that falls far below acceptable standards for financial services that people should be able to trust.

Conclusion

This comprehensive goccfx review reveals a broker that poses significant risks to trader funds and should be avoided entirely. The overwhelming evidence from multiple independent sources consistently warns against engaging with this platform. Fraud Recovery Experts, Scam Brokers Reviews, and Broker Complaint Alert all recommend staying away from this dangerous broker that could steal your money.

The broker's complete lack of regulatory oversight creates serious problems for traders. Combined with numerous reports of fraudulent activities and withdrawal difficulties, this makes it unsuitable for any level of trading activity. Traders seeking legitimate forex trading opportunities should focus exclusively on properly regulated brokers with transparent operations and positive user feedback that shows they actually help people succeed.

The critical deficiencies identified across all evaluation criteria demonstrate serious problems with this platform. Issues range from account conditions to customer service and show that Goccfx fails to meet basic professional standards expected in the forex industry. The platform's low trust scores and inclusion on multiple scam broker blacklists provide clear warning signals that potential traders should heed to protect their financial future.