Is ZYQH safe?

Business

License

Is ZYQH Safe or Scam?

Introduction

ZYQH, a forex broker operating primarily in China, has garnered attention for its trading services in the foreign exchange market. As with any financial service provider, traders must exercise caution and conduct thorough evaluations to ensure they are engaging with a legitimate and trustworthy broker. The forex market is rife with potential risks and scams, making it imperative for traders to scrutinize brokers before committing their funds. This article aims to provide an objective analysis of ZYQH's credibility, utilizing a comprehensive evaluation framework that includes regulatory status, company background, trading conditions, customer safety, and user experiences.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its legitimacy. ZYQH currently operates without any valid regulatory oversight, which raises significant concerns regarding its trustworthiness. Below is a summary of the regulatory information related to ZYQH:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not verified |

The absence of regulation means that ZYQH is not subject to any oversight or compliance requirements that protect traders' interests. This lack of regulatory framework can expose traders to various risks, including the potential for fraud, mismanagement of funds, and poor customer service. Historically, unregulated brokers have been associated with high-risk trading environments and have often faced allegations of misconduct. Therefore, it is essential for traders to be aware of the risks associated with trading with unregulated entities like ZYQH.

Company Background Investigation

ZYQH, officially known as 中阳国际期货有限公司, has been operating for approximately 2 to 5 years. However, the company's history and ownership structure remain largely opaque. There is limited information available regarding the management team and their professional backgrounds. A lack of transparency in a broker's operations can be a red flag for potential clients, as it raises concerns about accountability and ethical practices.

Moreover, ZYQH's website provides minimal information about its services, which further complicates efforts to assess its credibility. Traders should be cautious when dealing with brokers that do not provide clear disclosures about their operations. The absence of detailed information about the company's history and ownership may indicate a lack of commitment to transparency, which is crucial for building trust with clients.

Trading Conditions Analysis

An essential aspect of evaluating ZYQH's credibility involves analyzing its trading conditions. The broker's fee structure and trading costs play a significant role in determining its overall value to traders. ZYQH has been reported to have a complex fee structure that may include hidden costs, which can be detrimental to traders' profitability. Below is a comparison of ZYQH's core trading costs with industry averages:

| Fee Type | ZYQH | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | High | Low |

| Commission Model | Unclear | Clear |

| Overnight Interest Range | Varies | Standard |

Traders have reported high spreads on major currency pairs, which can significantly impact trading costs. Additionally, the lack of clarity regarding the commission structure raises concerns about potential hidden fees. Traders should be vigilant and inquire about all associated costs before opening an account with ZYQH to avoid unexpected charges that could erode their capital.

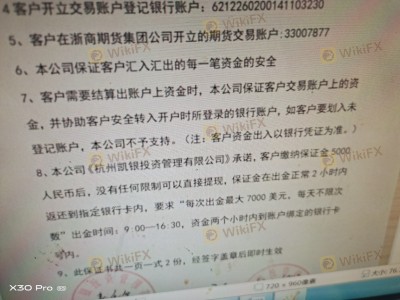

Customer Funds Safety

When assessing whether ZYQH is safe, it is crucial to consider the measures in place to protect customer funds. A reputable broker should implement robust security protocols, including segregated accounts, investor protection schemes, and negative balance protection policies. Unfortunately, ZYQH has not provided sufficient information on its fund safety measures.

The absence of clear policies regarding fund segregation and investor protection significantly increases the risk for traders. In the event of financial difficulties or mismanagement, traders could potentially lose their investments without any recourse. Furthermore, historical complaints regarding withdrawal issues and fund accessibility have been reported by users, indicating a lack of reliability in managing customer funds.

Customer Experience and Complaints

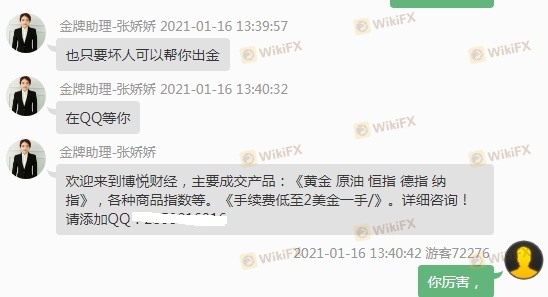

Analyzing customer feedback is vital in determining the overall experience with ZYQH. Numerous complaints have been lodged against the broker, primarily concerning withdrawal difficulties and unresponsive customer service. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Issues | Medium | Poor |

| Transparency Concerns | High | Poor |

Many users have reported being unable to withdraw their funds, often citing various reasons provided by the broker. This pattern of complaints raises significant concerns about ZYQH's operational integrity and its commitment to customer satisfaction. A broker's responsiveness to complaints is critical, and ZYQH's poor track record in this area suggests that traders may face challenges in resolving issues effectively.

Platform and Trade Execution

The performance of ZYQH's trading platform plays a crucial role in the overall trading experience. Traders have reported mixed experiences with the platform's stability and execution quality. The presence of slippage and order rejections has been noted, which can adversely affect trading outcomes.

Additionally, any signs of platform manipulation should be closely monitored. Traders must ensure that they are using a reliable and efficient trading platform to avoid unnecessary losses. The lack of transparency regarding the platform's performance and execution metrics adds to the concerns about whether ZYQH is safe for trading.

Risk Assessment

In summary, the overall risk associated with trading with ZYQH can be categorized as high. Below is a concise risk scorecard summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No regulation |

| Fund Safety | High | Lack of protections |

| Trading Costs | Medium | High spreads |

| Customer Service | High | Poor responsiveness |

Given these factors, traders should approach ZYQH with caution. It is essential to consider risk mitigation strategies, such as limiting initial deposits and conducting thorough due diligence before engaging in trading activities.

Conclusion and Recommendations

Based on the evidence presented, ZYQH raises several red flags that indicate it may not be a safe broker for forex trading. The absence of regulatory oversight, coupled with a lack of transparency and numerous customer complaints, suggests that traders should be wary of engaging with this broker.

For traders seeking reliable alternatives, it is advisable to consider brokers that are regulated by reputable financial authorities and have a proven track record of customer satisfaction. Brokers such as FXTM, IG, and OANDA offer robust regulatory frameworks, transparent fee structures, and positive user experiences, making them safer options for forex trading.

In conclusion, while ZYQH may present itself as a trading option, the risks associated with it significantly outweigh any potential benefits, leading to the recommendation that traders avoid this broker altogether. Always prioritize safety and due diligence in your trading endeavors.

Is ZYQH a scam, or is it legit?

The latest exposure and evaluation content of ZYQH brokers.

ZYQH Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ZYQH latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.