Is ZANK safe?

Pros

Cons

Is Zank Safe or a Scam?

Introduction

In the vast landscape of the forex market, Zank has emerged as a trading platform that offers various financial instruments and trading opportunities. However, as more traders venture into this domain, the importance of assessing the legitimacy and reliability of brokers like Zank cannot be overstated. The forex market is notorious for its lack of regulation, making it a fertile ground for scams and fraudulent activities. Therefore, it is essential for traders to conduct thorough research before committing their funds to any broker. This article aims to evaluate the safety and legitimacy of Zank by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk factors. Our investigation is based on a comprehensive analysis of credible online sources, user reviews, and regulatory databases.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor that determines its legitimacy and the safety of traders' funds. Zank claims to be regulated under the Australian Securities and Investments Commission (ASIC), but further investigation reveals discrepancies in its licensing. The following table summarizes the core regulatory information related to Zank:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 246943 | Australia | Exceeded Business Scope |

Although Zank is registered with ASIC, it operates beyond the scope of its business license, which raises significant concerns about its regulatory compliance. The lack of a robust regulatory framework can lead to a higher risk of fund misappropriation and poor trading conditions. In addition, Zank's claims of being a legitimate broker are further undermined by its failure to appear in other reputable regulatory registries, such as the UK's Financial Conduct Authority (FCA). This lack of oversight and transparency makes it imperative for potential traders to question whether Zank is safe or merely a facade for a scam.

Company Background Investigation

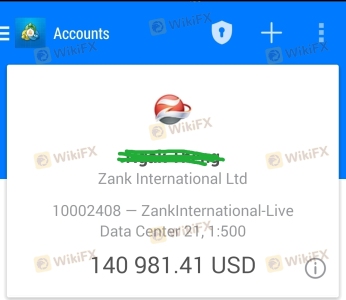

Zank's history and ownership structure play a vital role in assessing its credibility. The broker is said to be operated by Zank International Ltd, with claims of having a presence in multiple countries, including China and Australia. However, the company's actual history is murky, with little information available about its founding or ownership. The absence of transparency regarding the management team raises further questions about the broker's reliability.

Moreover, the lack of verifiable information about the company's executives and their qualifications is alarming. A broker's management team should ideally have a proven track record in the financial industry, contributing to the broker's credibility. In Zank's case, the opacity surrounding its management and operational history leads to skepticism about its legitimacy. As such, traders must remain cautious and consider whether Zank is safe to engage with, given the potential risks associated with an unregulated broker.

Trading Conditions Analysis

Zank offers various account types and trading conditions, which can be appealing to traders. However, it is essential to scrutinize the overall fee structure and any unusual practices that may indicate a lack of integrity. The following table highlights the core trading costs associated with Zank:

| Fee Type | Zank | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 1.4 pips | 1.0 pips |

| Commission Model | Not disclosed | Varies |

| Overnight Interest Range | Not specified | Varies |

While Zank offers competitive spreads, the lack of transparency around commission structures and overnight interest rates is concerning. Traders should be wary of hidden fees that could erode their profits. The absence of clear information regarding these costs raises red flags about whether Zank is safe for trading. Additionally, the broker's high leverage offerings, up to 1:500, may attract traders seeking high-risk, high-reward opportunities, but such leverage can also lead to significant losses. Therefore, potential clients must consider the potential risks of engaging with Zank and whether the trading conditions are conducive to a safe trading environment.

Customer Funds Security

The safety of customer funds is a paramount concern when evaluating any broker. Zank claims to implement various security measures, but the lack of regulatory oversight raises questions about the effectiveness of these measures. The broker does not provide clear information on fund segregation, investor protection, or negative balance protection policies. Without these safeguards, traders' funds may be at risk in the event of financial instability or mismanagement.

Historically, unregulated brokers have been known to engage in practices that jeopardize the security of client funds. Reports of fund misappropriation and withdrawal issues are common among such brokers. Given Zank's questionable regulatory status and lack of transparency regarding its security measures, potential clients must assess whether Zank is safe for their investments. It is advisable to prioritize brokers with established regulatory frameworks that provide clear protections for client funds.

Customer Experience and Complaints

Analyzing customer feedback is crucial in understanding the overall experience of traders using Zank. While some users report satisfactory experiences, a significant number of complaints have surfaced regarding withdrawal delays, lack of customer support, and issues with trade execution. The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Average |

| Trade Execution Issues | High | Poor |

Common complaints regarding withdrawal delays and poor customer support indicate that Zank may not prioritize customer satisfaction. Moreover, the company's failure to address these issues effectively raises concerns about its operational integrity. Traders must weigh these experiences against their own risk tolerance and consider whether Zank is safe for their trading activities.

Platform and Execution

The trading platform's performance is a critical factor for traders, as it directly impacts their trading experience. Zank utilizes the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and advanced trading tools. However, reports of execution issues, including slippage and order rejections, have been noted by users. These issues can significantly affect a trader's ability to execute trades effectively and can lead to financial losses.

Furthermore, the lack of transparency regarding the platform's operational stability and any potential signs of manipulation raises concerns about the overall trading environment. Traders must be vigilant and consider whether Zank is safe for their trading activities, given the potential for execution-related issues that could hinder their trading success.

Risk Assessment

Using Zank comes with inherent risks that traders must understand before engaging with the broker. The following risk scoring card summarizes key risk areas associated with Zank:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of oversight |

| Fund Security Risk | High | Unclear safety measures |

| Customer Service Risk | Medium | Poor support response |

| Trading Execution Risk | High | Issues with slippage |

Given the high-risk levels across multiple categories, potential traders must approach Zank with caution. It is advisable to consider alternative brokers with established regulations and better customer service records to mitigate these risks.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Zank exhibits several characteristics typical of a potentially unsafe broker. The lack of robust regulatory oversight, transparency issues, and negative customer experiences raise significant red flags. Therefore, it is crucial for traders to exercise caution and conduct thorough due diligence before engaging with Zank.

For those considering trading, it may be prudent to explore alternative brokers that are well-regulated and have a proven track record of reliability and customer satisfaction. Ultimately, the question of whether Zank is safe remains unanswered, and potential traders should prioritize their financial security by opting for more reputable options in the forex market.

Is ZANK a scam, or is it legit?

The latest exposure and evaluation content of ZANK brokers.

ZANK Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ZANK latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.