Regarding the legitimacy of ZHONGYANG forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is ZHONGYANG safe?

Business

License

Is ZHONGYANG markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Zhong Yang Securities Limited

Effective Date:

2016-03-04Email Address of Licensed Institution:

cs@zyzq.com.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.zyzq.com.hkExpiration Time:

--Address of Licensed Institution:

香港干諾道西118號1101室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Zhongyang Safe or a Scam?

Introduction

Zhongyang Financial Group, operating primarily in Hong Kong, positions itself as a brokerage firm offering access to various financial markets, including forex, commodities, and futures. As the forex market continues to grow, traders must exercise caution when selecting a broker, as the industry is rife with potential scams and fraudulent practices. Evaluating a brokers legitimacy involves scrutinizing its regulatory status, company background, trading conditions, and customer experiences. This article aims to provide a comprehensive analysis of Zhongyang, focusing on the question: Is Zhongyang safe?

We will employ a multi-faceted approach, examining regulatory compliance, company history, trading conditions, customer fund security, and user feedback. By combining narrative insights with structured data, we aim to present a balanced perspective on whether Zhongyang can be considered a trustworthy broker or if it poses risks to its clients.

Regulatory and Legality

Zhongyang Financial Group is regulated by the Securities and Futures Commission (SFC) of Hong Kong. Regulatory oversight is a critical factor in determining a broker's legitimacy, as it ensures adherence to industry standards and protects clients from potential malpractices. Below is a summary of Zhongyang's regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities and Futures Commission (SFC) | BGT 529 | Hong Kong | Verified |

The SFC is known for its stringent regulatory framework, which mandates that brokers maintain adequate capital reserves, segregate client funds, and adhere to fair trading practices. However, despite being regulated, Zhongyang has faced scrutiny due to multiple complaints about fund withdrawals and alleged manipulation of trading software. The presence of such complaints raises concerns about the broker's operational integrity, leading to the question: Is Zhongyang safe? While the regulatory status provides some reassurance, prospective clients should remain vigilant and consider the reported issues.

Company Background Investigation

Zhongyang Financial Group was founded in 2015 and has since established itself in the Hong Kong financial market. The company operates through its subsidiary, Zhongyang Securities Limited, which is licensed to deal in futures contracts. The ownership structure appears straightforward, with the firm being privately held. The management team comprises individuals with experience in finance and trading, which is a positive indicator of the companys operational capabilities.

However, transparency regarding the company's operations and financial health is somewhat limited. While Zhongyang provides basic information about its services and regulatory compliance, detailed disclosures about its financial performance and management practices are less accessible. This lack of transparency can be concerning for potential investors and traders, further contributing to the question of Is Zhongyang safe? A brokerage with a clear and open communication strategy is generally more trustworthy than one that is less forthcoming.

Trading Conditions Analysis

Zhongyang offers a variety of trading conditions, including access to forex, commodities, and futures markets. The fee structure is an essential aspect of evaluating any broker. Below is a comparison of Zhongyang's core trading costs against industry averages:

| Fee Type | Zhongyang | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies by pair | 1.0 - 2.0 pips |

| Commission Model | Varies by account | $5 - $10 per lot |

| Overnight Interest Range | 0.5% - 2% | 0.5% - 1.5% |

While Zhongyang claims to offer competitive spreads, the variability in costs can lead to confusion for traders. Moreover, reports of hidden fees or unfavorable trading conditions have surfaced in user reviews, suggesting that not all clients experience the same trading environment. This inconsistency raises further concerns about whether Zhongyang is safe for trading.

Client Fund Security

The safety of client funds is paramount when evaluating any brokerage. Zhongyang states that it employs various measures to protect client deposits, including segregating client funds from its operational capital. This practice is crucial for ensuring that client funds remain secure and are not used for the broker's operational expenses. Additionally, the firm claims to offer negative balance protection, which is designed to prevent clients from losing more money than they have deposited.

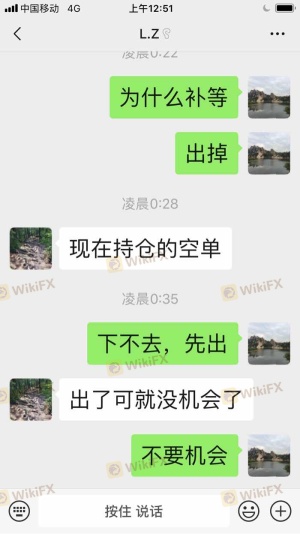

Despite these assurances, historical complaints indicate that clients have faced difficulties in withdrawing their funds. Several users have reported instances where their withdrawal requests were delayed or denied, leading to significant financial losses. Such incidents call into question the effectiveness of Zhongyang's fund security measures and contribute to the ongoing debate about whether Zhongyang is safe for potential clients.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of Zhongyang on various platforms reveal a mixed bag of user experiences. While some clients report satisfactory trading conditions and customer service, a significant number of complaints highlight issues related to fund withdrawals and unresponsive customer support.

Common complaint types include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Fund Withdrawal Delays | High | Poor |

| Account Liquidation Issues | High | Poor |

| Software Manipulation Claims | Medium | Poor |

Notably, several users have reported that after raising concerns, they faced account restrictions or were blocked from accessing their funds. Such patterns of behavior are alarming and suggest a potential lack of accountability on the part of the broker. This leads to the critical question: Is Zhongyang safe for traders who might find themselves in a similar situation?

Platform and Trade Execution

The trading platform offered by Zhongyang is designed to be user-friendly, with access to various markets and instruments. However, reviews indicate that the platform may experience stability issues, particularly during high volatility periods. Users have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

The quality of order execution is a vital aspect of trading, and any signs of manipulation or unfair practices can undermine a broker's credibility. While Zhongyang claims to provide reliable execution, the inconsistencies reported by users cast doubt on this assertion. Traders must consider whether they are comfortable using a platform that may not consistently deliver on its promises, further complicating the question of Is Zhongyang safe?

Risk Assessment

Using Zhongyang as a brokerage entails various risks that potential clients should consider. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Complaints against operational practices |

| Fund Security | High | Historical issues with withdrawals |

| Customer Support | High | Poor response to complaints |

Given the elevated risks associated with trading through Zhongyang, potential clients should approach with caution. It is advisable to conduct thorough research, possibly opting for smaller initial investments until they are confident in the broker's reliability.

Conclusion and Recommendations

In summary, while Zhongyang Financial Group is a regulated entity in Hong Kong, the presence of numerous complaints and issues related to fund withdrawals, customer support, and trading conditions raises significant concerns about its safety and reliability. The question remains: Is Zhongyang safe? The evidence suggests that traders should exercise caution.

For those considering trading with Zhongyang, it may be prudent to explore alternative brokers with stronger reputations and proven track records of customer satisfaction. Brokers that consistently demonstrate transparency, regulatory compliance, and robust customer support are generally safer options for traders.

Ultimately, potential clients must weigh the risks and make informed decisions based on thorough research and personal comfort levels with the broker's practices.

Is ZHONGYANG a scam, or is it legit?

The latest exposure and evaluation content of ZHONGYANG brokers.

ZHONGYANG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ZHONGYANG latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.