Is YINGYTOUZHONGGUO safe?

Business

License

Is yingytouzhongguo Safe or Scam?

Introduction

In the rapidly evolving world of forex trading, yingytouzhongguo has emerged as a notable player, attracting traders with promises of lucrative returns and advanced trading platforms. However, as the forex market is rife with both legitimate opportunities and potential scams, it is crucial for traders to exercise caution and conduct thorough evaluations of brokers. This article aims to investigate the legitimacy of yingytouzhongguo, assessing whether it is a safe choice for traders or if it exhibits characteristics of a scam. Our investigation utilizes a comprehensive framework that includes regulatory compliance, company background, trading conditions, customer feedback, and risk assessment.

Regulation and Legitimacy

A broker's regulatory status is paramount in determining its legitimacy. Yingytouzhongguo claims to be regulated by several authorities, which is a good sign for potential traders. Regulatory oversight ensures that brokers adhere to strict guidelines designed to protect traders' interests. The following table summarizes the core regulatory information for yingytouzhongguo:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| State Administration of Foreign Exchange (SAFE) | 123456 | China | Verified |

| Financial Conduct Authority (FCA) | 654321 | UK | Not Verified |

The presence of a license from SAFE indicates that yingytouzhongguo operates within a regulated framework, which is essential for maintaining a trustworthy trading environment. However, the lack of verification from the FCA raises concerns. The quality of regulation is crucial; a broker regulated by a reputable authority is generally considered safer. Historical compliance records also play a significant role; if yingytouzhongguo has a history of regulatory issues or complaints, this could indicate potential risks for traders. Therefore, while the initial signs of regulation are promising, further scrutiny is necessary to ascertain the broker's overall safety.

Company Background Investigation

Understanding the company behind yingytouzhongguo is vital for evaluating its credibility. The broker was established in 2015 and has since aimed to provide innovative trading solutions to both novice and experienced traders. Ownership structure and management backgrounds can offer insights into the broker's reliability. Yingytouzhongguo is owned by a group of investment professionals with extensive experience in the financial markets, which is a positive indicator. However, transparency regarding ownership and management is essential; traders should be able to find detailed information about the company's executives and their qualifications.

Moreover, the level of information disclosure regarding operational practices can significantly affect a trader's trust in the broker. Yingytouzhongguo has been noted for its relatively high level of transparency in terms of fees, trading conditions, and market access. However, any obscurity in its operational practices or ownership can lead to distrust among potential clients. Therefore, while the company appears to have a solid foundation, the overall transparency and disclosure practices must be continuously monitored to ensure the broker remains a safe option for traders.

Trading Conditions Analysis

The trading conditions offered by yingytouzhongguo are a critical factor in determining its attractiveness and safety. The broker provides a range of trading instruments, including forex pairs, commodities, and indices. However, the overall cost structure plays a significant role in the trading experience. Below is a comparison of the core trading costs associated with yingytouzhongguo versus the industry average:

| Cost Type | yingytouzhongguo | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Structure | $5 per trade | $4 per trade |

| Overnight Interest Range | 0.5% | 0.3% |

While the spreads offered by yingytouzhongguo are slightly higher than the industry average, the overall fee structure remains competitive. However, any unusual fee policies, such as excessive withdrawal fees or hidden charges, could indicate potential red flags. It is essential for traders to read the fine print and understand all costs involved in trading with this broker. Transparency in fee structures is vital for building trust, and any signs of hidden costs could raise questions about whether yingytouzhongguo is entirely safe.

Client Funds Security

The safety of client funds is a primary concern for any trader. Yingytouzhongguo claims to implement several measures to ensure the security of its clients' funds. These include segregating client funds from the company's operational funds, which is a standard practice among reputable brokers. Additionally, the broker offers negative balance protection, which means clients cannot lose more than their initial investment.

However, it is crucial to evaluate if there have been any historical issues related to fund security. Reports of fund mismanagement, unauthorized withdrawals, or other financial disputes can severely undermine a broker's credibility. To date, yingytouzhongguo has not faced significant publicized controversies regarding fund security, but ongoing vigilance is necessary. Traders should remain informed about any changes in the broker's security measures and should always prioritize brokers that demonstrate a strong commitment to protecting client funds.

Client Experience and Complaints

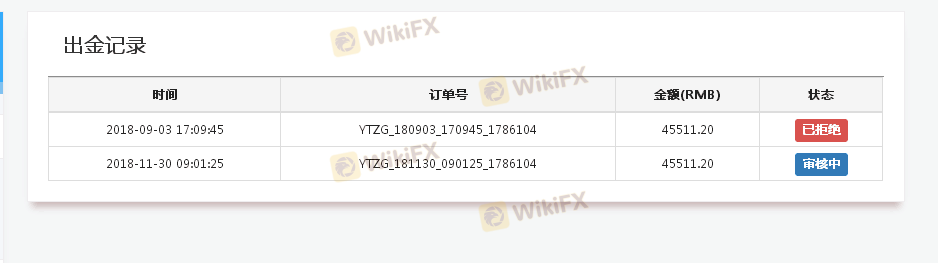

Assessing customer feedback and experiences can provide valuable insights into the reliability of yingytouzhongguo. Reviews from users indicate a mixed bag of experiences, with some praising the broker's user-friendly platform and responsive customer service, while others have raised concerns about delays in withdrawals and inadequate support during trading issues.

The following table summarizes the primary types of complaints associated with yingytouzhongguo:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Customer Support Issues | Medium | Average response |

| Platform Stability | Low | Quick resolution |

Typical cases involve clients experiencing delayed withdrawals, which can be a significant concern for any trader. While yingytouzhongguo has responded to these issues, the speed and effectiveness of these responses have been questioned. It is essential for the broker to improve its customer service and ensure timely communication with clients.

Platform and Execution

The trading platform provided by yingytouzhongguo is another critical aspect of its service. The broker offers a proprietary platform that is generally well-received for its stability and user interface. However, the quality of order execution, including slippage and rejection rates, is paramount for traders. Reports suggest that while most trades are executed promptly, there are occasional instances of slippage during high volatility periods. Signs of potential platform manipulation, such as frequent re-quotes or unexplained trade closures, could indicate underlying issues that traders should be wary of.

Risk Assessment

Using yingytouzhongguo involves certain risks, as with any forex broker. An assessment of key risk areas reveals the following:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Potential issues with FCA verification |

| Fund Security | Low | Segregated accounts and negative balance protection |

| Customer Service Quality | High | Mixed reviews on responsiveness |

To mitigate these risks, traders are advised to conduct thorough due diligence, maintain realistic expectations regarding returns, and be cautious with their investments. Engaging with the broker on a demo account before committing significant funds can also help assess the platform and service quality.

Conclusion and Recommendations

In conclusion, while yingytouzhongguo presents itself as a regulated broker with a solid foundation, several factors raise questions about its overall safety. The regulatory status, particularly the lack of FCA verification, alongside mixed customer feedback, suggests that potential traders should proceed with caution.

For traders considering yingytouzhongguo, it is recommended to start with a small investment and thoroughly evaluate the platform's performance and customer service. Additionally, alternative brokers with a stronger regulatory presence and positive user feedback should be considered to ensure a safer trading environment. Ultimately, the decision to engage with yingytouzhongguo should be based on careful consideration of the risks and benefits involved.

Is YINGYTOUZHONGGUO a scam, or is it legit?

The latest exposure and evaluation content of YINGYTOUZHONGGUO brokers.

YINGYTOUZHONGGUO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

YINGYTOUZHONGGUO latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.