Regarding the legitimacy of WWM forex brokers, it provides FCA, FSC and WikiBit, (also has a graphic survey regarding security).

Is WWM safe?

Pros

Cons

Is WWM markets regulated?

The regulatory license is the strongest proof.

FCA Inst Forex Execution (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RevokedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

WorldWideMarkets Online Trading Limited

Effective Date:

--Email Address of Licensed Institution:

adembro@worldwidemarkets.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2018-12-18Address of Licensed Institution:

ST. MarTins House 16 ST. MarTin's Le Grand London EC1A 4EN UNITED KINGDOMPhone Number of Licensed Institution:

4402071939742Licensed Institution Certified Documents:

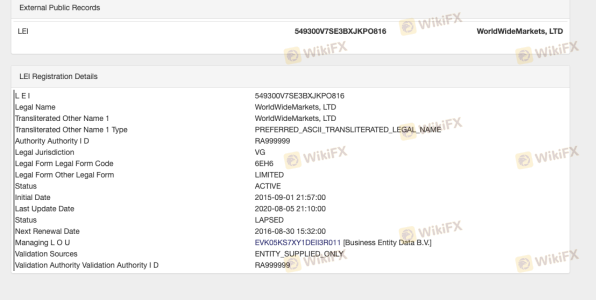

FSC Market Making License (MM)

British Virgin Islands Financial Services Commission

British Virgin Islands Financial Services Commission

Current Status:

RevokedLicense Type:

Market Making License (MM)

Licensed Entity:

WorldWideMarkets, Ltd.

Effective Date: Change Record

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Wwm Safe or Scam?

Introduction

Wwm, short for Worldwide Markets, is a forex broker that has positioned itself in the competitive landscape of online trading since its inception in 2017. With claims of offering a wide range of trading instruments and competitive spreads, Wwm aims to attract both novice and experienced traders. However, the forex market is rife with potential pitfalls, making it crucial for traders to thoroughly evaluate the legitimacy and safety of any broker before committing their funds. This article investigates the safety and reliability of Wwm by examining its regulatory status, company background, trading conditions, customer fund security, client experiences, and overall risk profile.

To conduct this assessment, we utilized a comprehensive methodology that includes reviewing regulatory filings, customer feedback, and expert analyses from reputable financial sources. The evaluation framework focuses on several critical aspects, such as compliance with regulatory standards, transparency in operations, and the overall trading environment provided by Wwm.

Regulation and Legitimacy

One of the first indicators of a broker's reliability is its regulatory status. Wwm claims to be regulated by the British Virgin Islands Financial Services Commission (BVIFSC), which raises questions about the quality of oversight provided. While the BVIFSC does provide a regulatory framework, it is often viewed as less stringent compared to top-tier regulators like the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| British Virgin Islands Financial Services Commission | SIBA/L/11/0960 | British Virgin Islands | Active |

Wwm's regulatory status is a mixed bag. While it is indeed licensed, the nature of its regulation—being offshore—often leads to concerns regarding investor protection and the broker's accountability. Furthermore, there have been numerous complaints and warnings from various financial watchdogs about Wwm, suggesting that traders should approach this broker with caution.

The historical compliance record of Wwm is also questionable, as multiple user reviews indicate issues related to fund withdrawals and customer service responsiveness. Such factors contribute to an overall impression that Wwm may not offer the level of security and trustworthiness expected from a reputable forex broker.

Company Background Investigation

Wwm was established in 2017 and operates under the brand name Worldwide Markets. The company claims to be headquartered in the United Kingdom, but there is limited information available regarding its actual physical location and ownership structure. This lack of transparency raises red flags for potential investors.

The management team behind Wwm has not been extensively documented, which makes it difficult to assess their qualifications and experience in the financial sector. A transparent company typically provides detailed information about its leadership, including their backgrounds and relevant expertise. Unfortunately, Wwm does not seem to adhere to this standard, which could indicate a lack of accountability.

Moreover, the information disclosure level is quite low; potential clients may find it challenging to obtain essential details about the company's operations and policies. This opacity is concerning, as it often correlates with higher risks for traders. A broker that is not forthcoming with information may be hiding critical issues, leading to a lack of trust among its users.

Trading Conditions Analysis

When evaluating whether "Is Wwm safe," it's crucial to analyze the trading conditions it offers. Wwm claims to provide competitive spreads and various trading instruments, but the specifics of its fee structure remain somewhat ambiguous. Traders must be aware of all costs associated with trading to avoid unexpected fees that can erode profits.

| Fee Type | Wwm | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (often higher than average) | 1.0 - 1.5 pips |

| Commission Model | None | $5 - $10 per lot |

| Overnight Interest Range | High | Varies by broker |

Wwm's spreads are reported to be variable, often higher than industry averages, which can significantly impact trading profitability. Additionally, while Wwm does not charge commissions, the potential for high overnight interest rates may deter traders who hold positions longer than a day. This fee structure raises concerns, as traders may find themselves facing costs that are not immediately apparent.

Overall, the trading conditions offered by Wwm do not seem to be competitive when compared to other brokers, which may lead traders to question the broker's commitment to providing a fair trading environment.

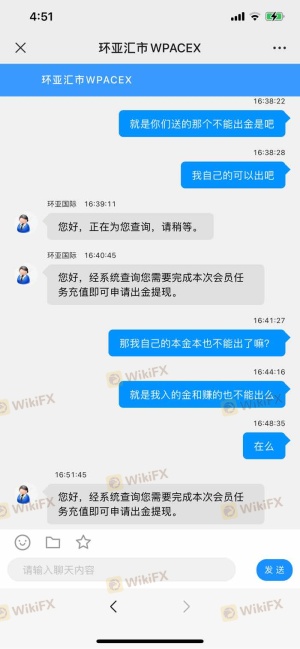

Client Fund Security

The safety of client funds is paramount when considering whether "Is Wwm safe." Wwm claims to implement various security measures to protect client deposits, including segregating client funds from company funds. However, the effectiveness of these measures remains unclear due to the lack of transparency regarding their implementation.

Wwm does not provide comprehensive information on investor protection schemes, such as negative balance protection or compensation funds, which are crucial in safeguarding traders' investments. The absence of these measures can expose clients to significant risks, especially in volatile market conditions.

Moreover, historical complaints indicate that clients have faced difficulties in withdrawing their funds, raising serious concerns about the broker's ability to manage client money responsibly. Such issues not only affect trust but also highlight potential operational inefficiencies or even fraudulent practices.

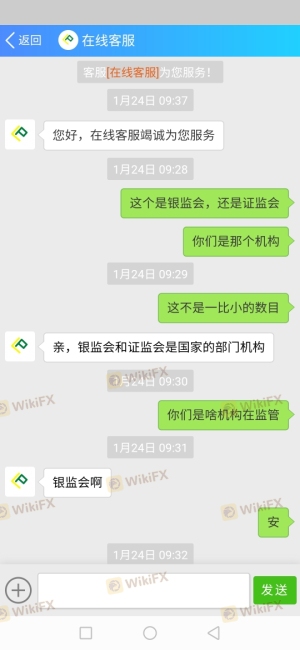

Customer Experience and Complaints

Customer feedback is a vital component in assessing the reliability of a broker. In the case of Wwm, numerous reviews and complaints have surfaced, indicating a troubling pattern of negative experiences among clients.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Poor Customer Service | Medium | Slow response |

| Account Suspension | High | No resolution |

Common complaints include difficulties in withdrawing funds, unresponsive customer service, and sudden account suspensions. Many users report feeling misled by the broker's promises of easy withdrawals and responsive support. For instance, one user claimed that after attempting to withdraw their funds, they faced multiple delays and eventually had their account suspended without explanation.

These complaints suggest a pattern of operational issues within Wwm that could be indicative of deeper problems. Traders should carefully consider these experiences before engaging with the broker.

Platform and Trade Execution

The trading platform provided by Wwm is a crucial aspect of the trading experience. Wwm utilizes the widely recognized MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and robust functionality. However, user reviews indicate that the platform may suffer from performance issues, including slow execution speeds and occasional downtime.

Moreover, the quality of order execution is a significant concern. Reports of slippage and rejected orders have been noted, particularly during high volatility periods. Such issues can severely impact trading outcomes, leading to frustration among traders who rely on timely execution to capitalize on market movements.

The potential for platform manipulation is another area of concern. Traders should be wary of any broker that exhibits signs of unfair practices, such as altering trade conditions or manipulating spreads during critical market events.

Risk Assessment

Using Wwm for trading involves several risks that potential clients should be aware of.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation may lack strict oversight. |

| Fund Security Risk | High | Complaints about withdrawal issues raise concerns. |

| Operational Risk | Medium | Customer service and platform performance issues. |

Given the high regulatory and fund security risks, traders should approach Wwm with caution. It is advisable to conduct thorough research and consider alternative brokers that offer more robust regulatory oversight and better customer experiences.

To mitigate these risks, traders should consider using smaller amounts when testing the broker and ensure they have a clear understanding of the terms and conditions before proceeding.

Conclusion and Recommendations

In conclusion, the evidence suggests that Wwm exhibits several characteristics that may classify it as a risky choice for forex trading. The combination of questionable regulatory oversight, a lack of transparency, numerous client complaints, and potential operational issues raises significant concerns about the broker's reliability.

While Wwm may not be outright fraudulent, the risks associated with trading through this broker are substantial. Therefore, it is crucial for traders to exercise caution and consider alternative options.

For those seeking reliable forex brokers, it is advisable to explore options regulated by top-tier authorities such as the FCA or ASIC, which provide stronger investor protections and a more transparent trading environment.

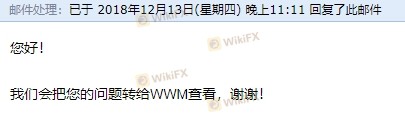

Is WWM a scam, or is it legit?

The latest exposure and evaluation content of WWM brokers.

WWM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

WWM latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.