Wwm 2025 Review: Everything You Need to Know

Executive Summary

This detailed Wwm review looks at Wealth World Markets, which is a financial platform that has gotten mixed attention in the trading community. WWM says it provides investment services across multiple asset classes, including forex, commodities, indices, and cryptocurrencies. The platform has received positive user feedback about customer service quality on Trustpilot, but serious regulatory concerns hurt its overall credibility.

The broker offers MetaTrader 4 as its main trading platform. It seems to help investors who want diverse trading opportunities. However, losing its FCA license raises big compliance questions that potential users must think about carefully. User reviews suggest that the investment process is fairly simple, and customer service representatives show high levels of skill.

Despite these good points, the regulatory problems make WWM a platform that needs careful review before use.

Important Notice

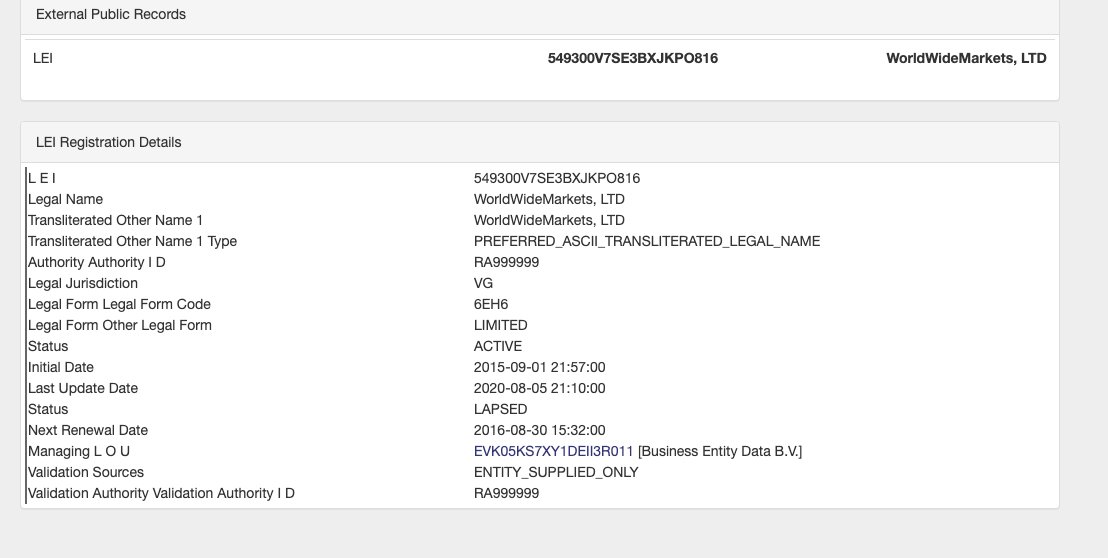

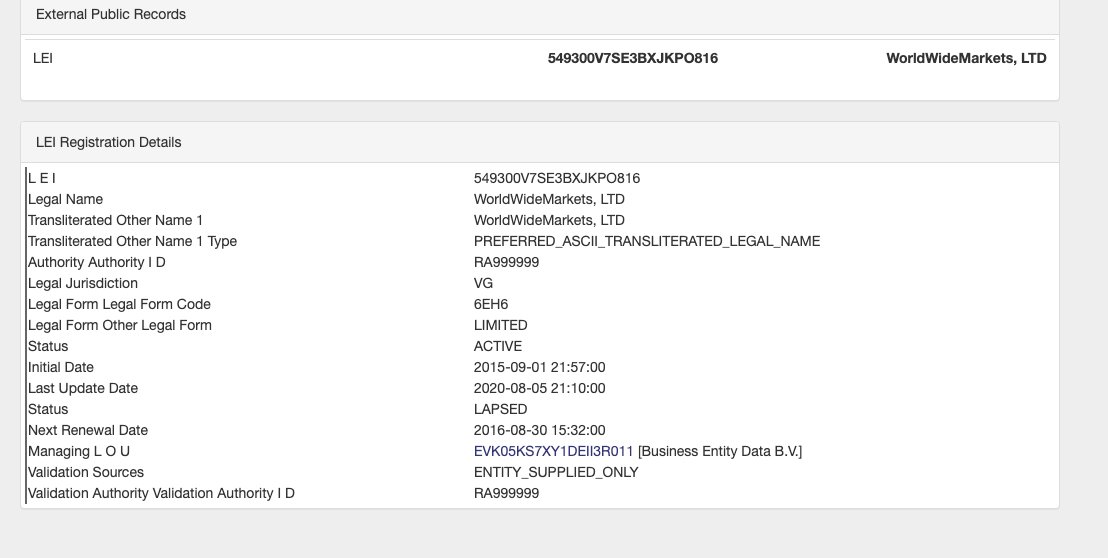

This review uses publicly available information and user feedback from various sources. WWM operates under different regulatory frameworks across regions, with notable differences in its compliance status. The company holds FSC regulation but has lost its FCA license, which greatly affects its regulatory standing in certain areas. Readers should check current regulatory status and consider their local legal requirements before making any investment decisions.

This evaluation represents an independent analysis and should not be considered as investment advice.

Overall Rating Framework

Broker Overview

Wealth World Markets positions itself as a complete financial platform that specializes in investment services across multiple market segments. The company focuses on giving access to foreign exchange markets, commodity trading, stock indices, and cryptocurrency investments. According to available information, WWM has built itself as a platform that emphasizes user-friendly investment processes, with customer reviews highlighting how simple their approach to trading and investment management is.

The platform's business model centers around offering diverse trading opportunities through established trading infrastructure. WWM seems to target both new and experienced traders who want exposure to various asset classes within a single platform environment. The company's approach emphasizes accessibility and customer service quality, which has helped create positive user ratings on review platforms.

WWM operates mainly through the MetaTrader 4 trading platform. This gives users access to forex pairs, commodity markets, major stock indices, and cryptocurrency trading opportunities. The broker's regulatory framework includes FSC oversight, though losing its FCA license has created compliance concerns that affect its operational credibility.

This Wwm review will examine how these regulatory changes impact the overall user experience and platform reliability for potential traders.

Regulatory Framework: WWM currently operates under FSC regulation, but losing its FCA license represents a major compliance setback. This regulatory change affects the broker's credibility and may impact user protection standards.

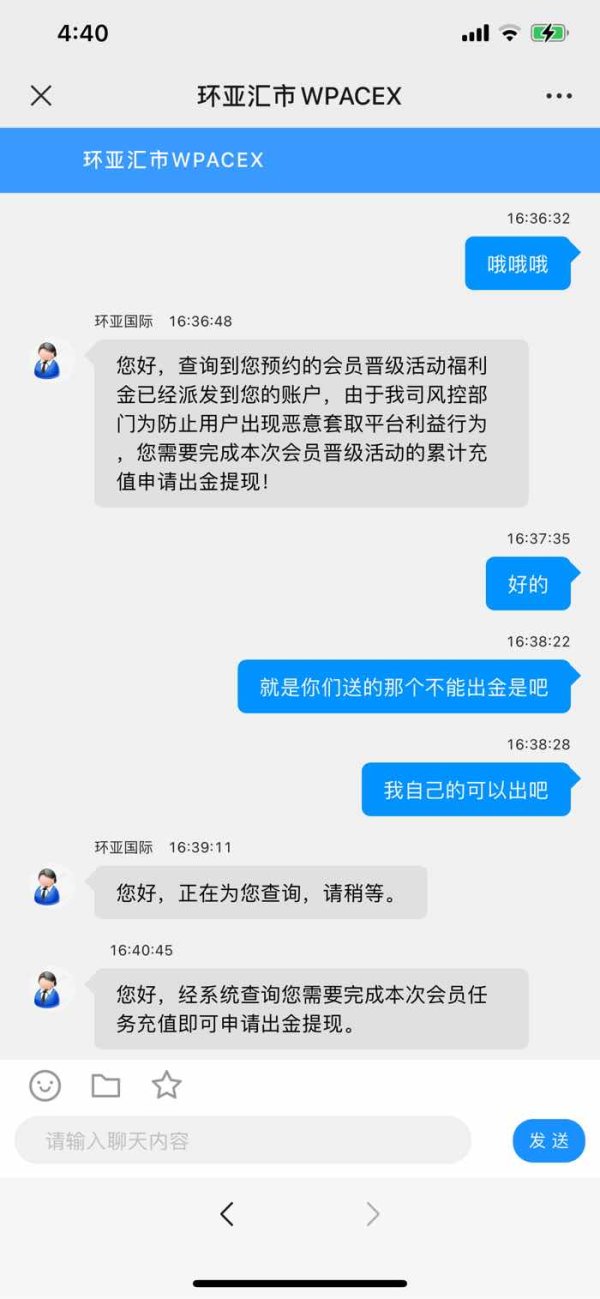

Deposit and Withdrawal Methods: Specific information about payment processing methods, supported currencies, and transaction procedures is not detailed in available documentation. This indicates a lack of transparency in financial operations.

Minimum Deposit Requirements: The platform has not disclosed specific minimum deposit amounts. This creates uncertainty for potential users planning their initial investment allocations.

Promotional Offerings: Details about bonus structures, promotional campaigns, or incentive programs are not specified in available materials. This suggests either absence of such offerings or limited marketing transparency.

Tradeable Assets: The platform provides access to four primary asset categories: foreign exchange pairs, commodity markets, stock market indices, and cryptocurrency instruments. This offers reasonable diversification opportunities for traders.

Cost Structure: Commission rates, spread information, and fee schedules are not transparently disclosed. This raises concerns about pricing transparency and potential hidden costs that could affect trading profitability.

Leverage Ratios: Specific leverage offerings and margin requirements are not detailed in available documentation. This limits users' ability to assess risk management parameters.

Platform Options: WWM primarily offers MetaTrader 4 as its trading platform. This provides users with a well-established and widely recognized trading environment.

Geographic Restrictions: Information about territorial limitations and restricted jurisdictions is not clearly specified in available materials.

Customer Support Languages: The range of supported languages for customer service communications is not detailed in accessible documentation. This Wwm review highlights the need for greater transparency in operational details.

Detailed Scoring Analysis

Account Conditions Analysis

The account conditions offered by WWM present several transparency challenges that affect the overall user experience. The platform has not provided clear information about different account types, their specific features, or the benefits associated with each tier. This lack of clarity makes it difficult for potential users to understand what services they can expect based on their investment levels or trading preferences.

Minimum deposit requirements remain undisclosed. This creates uncertainty for traders planning their initial capital allocation. Without clear deposit thresholds, users cannot effectively compare WWM's accessibility against other brokers in the market.

The absence of detailed account opening procedures or requirements further complicates the evaluation process for potential clients.

Special account features, such as Islamic accounts for Sharia-compliant trading or VIP accounts with enhanced services, are not mentioned in available documentation. This suggests either a limited account structure or insufficient marketing transparency. The lack of information about account-specific benefits, trading conditions, or exclusive features represents a significant gap in the platform's presentation to potential users.

User feedback does not provide specific insights into account management experiences or satisfaction with account-related services. This Wwm review identifies the need for greater transparency in account condition communications to help users make informed decisions about platform suitability.

WWM's tools and resources offering centers around the MetaTrader 4 platform. This provides users with a comprehensive and widely recognized trading environment. MT4 offers essential trading functionalities including technical analysis tools, automated trading capabilities through Expert Advisors, and customizable chart configurations that meet most traders' analytical needs.

However, the platform's additional tool offerings beyond MT4 are not clearly documented. Educational resources, market analysis reports, trading guides, or research materials are not mentioned in available information, which may limit the platform's appeal to traders seeking comprehensive learning and analytical support.

The absence of detailed information about proprietary tools, market research capabilities, or advanced analytical resources suggests that WWM relies primarily on MT4's built-in functionality rather than developing additional value-added services. This approach may satisfy experienced traders familiar with MT4 but could disappoint users seeking enhanced educational or analytical support.

Automated trading support through MT4's Expert Advisor functionality is presumably available. However, specific details about custom EA development, strategy optimization tools, or algorithmic trading support are not provided. The platform's tool portfolio appears functional but limited in scope compared to brokers offering comprehensive educational and analytical ecosystems.

Customer Service and Support Analysis

Customer service represents one of WWM's strongest performance areas. User feedback on Trustpilot indicates high satisfaction levels with support quality and professionalism. Users have reported positive experiences with customer service representatives, highlighting their ability to address concerns effectively and maintain professional communication standards.

The high customer service ratings suggest that WWM has invested in training competent support staff who can handle user inquiries and resolve issues satisfactorily. This positive feedback indicates that when users encounter problems or need assistance, they can expect responsive and helpful support from the platform's customer service team.

However, specific details about customer service availability, including operating hours, supported communication channels, or response time guarantees, are not provided in available documentation. The absence of information about multilingual support capabilities or specialized support for different user segments represents a gap in service transparency.

While user satisfaction appears high based on available feedback, the lack of detailed information about service structure, escalation procedures, or specialized support offerings limits the complete assessment of customer service capabilities. The positive user experiences documented on review platforms provide confidence in service quality, though more comprehensive service information would enhance user expectations management.

Trading Experience Analysis

The trading experience at WWM centers around the MetaTrader 4 platform. This provides users with a stable and feature-rich trading environment. MT4's proven track record in the industry offers traders access to comprehensive charting tools, technical indicators, and order management functionalities that support various trading strategies and approaches.

However, critical trading experience factors such as order execution quality, slippage rates, and re-quote frequency are not documented in available information. These elements significantly impact trading profitability and user satisfaction, making their absence a notable gap in platform transparency. Without execution quality data, traders cannot assess how effectively the platform handles their orders during various market conditions.

Platform stability and speed information is not provided through user feedback or technical performance documentation. Mobile trading experience details are also absent, which is increasingly important as traders seek flexible access to markets through smartphones and tablets. The lack of specific performance metrics or user experience data limits the ability to evaluate trading environment quality comprehensively.

Trading environment factors such as spread stability, liquidity provision, and market depth information are not disclosed. This makes it difficult for traders to understand the actual trading conditions they can expect. This information gap affects traders' ability to develop realistic expectations about their trading experience on the platform.

Trust Factor Analysis

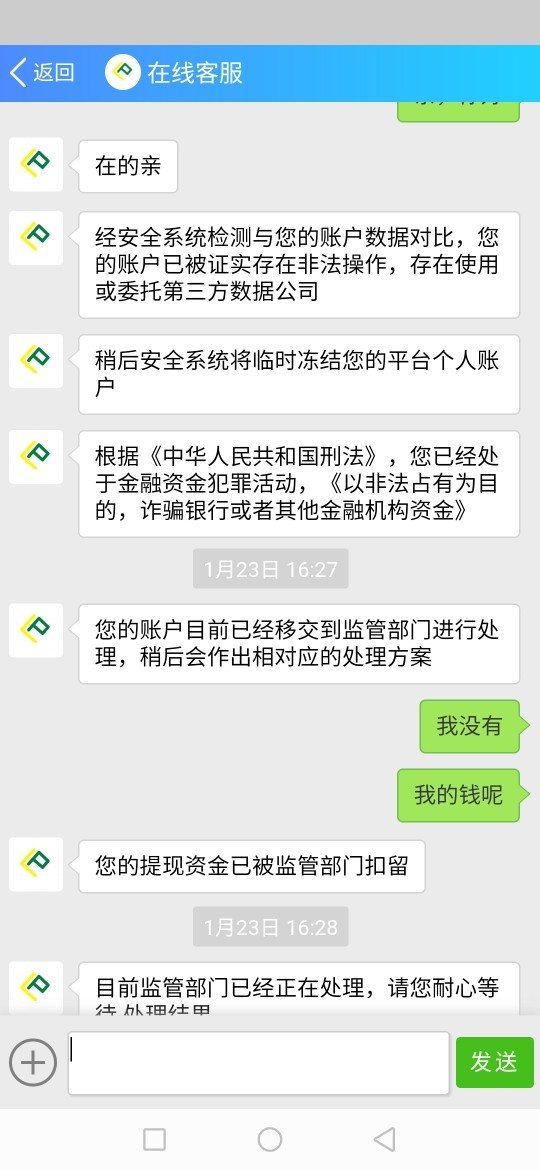

Trust represents WWM's most significant challenge. This is primarily due to regulatory compliance concerns stemming from the revocation of its FCA license. This regulatory setback raises serious questions about the platform's ability to maintain compliance standards and protect user interests effectively.

The loss of FCA authorization represents a substantial credibility issue that affects user confidence.

While WWM maintains FSC regulation, the regulatory framework differences and the circumstances surrounding the FCA license revocation create uncertainty about the platform's regulatory standing. Users must carefully consider the implications of these regulatory changes when evaluating platform safety and compliance standards.

Fund safety measures, client protection protocols, and segregation of client funds are not detailed in available documentation. This lack of transparency regarding security measures compounds the regulatory concerns and makes it difficult for users to assess their fund protection levels. The absence of clear information about insurance coverage or compensation schemes further affects trust assessment.

The platform's transparency regarding company operations, financial reporting, and regulatory communications appears limited based on available information. Industry recognition, third-party certifications, or independent audits are not mentioned, which could otherwise help mitigate regulatory concerns. The combination of regulatory issues and limited transparency creates significant trust challenges for potential users.

User Experience Analysis

User experience feedback indicates generally positive satisfaction levels. Trustpilot reviews suggest that users find the investment process straightforward and accessible. This positive feedback suggests that WWM has designed user-friendly procedures that facilitate smooth platform interaction for traders with varying experience levels.

However, specific details about platform interface design, navigation convenience, or user interface quality are not provided in available feedback. The absence of detailed user experience information regarding website functionality, account management interfaces, or trading platform usability limits comprehensive experience assessment.

Registration and verification process experiences are not documented. This makes it difficult to evaluate account opening convenience and efficiency. Fund operation experiences, including deposit and withdrawal processes, speed, and user satisfaction, are also not detailed in available user feedback.

The target user profile appears to include investors interested in diversified asset exposure across forex, commodities, indices, and cryptocurrencies. User feedback suggests satisfaction with the platform's approach to investment facilitation, though specific user demographics or experience level preferences are not clearly defined. The positive Trustpilot ratings provide confidence in overall user satisfaction, despite limited detailed experience information.

Conclusion

This Wwm review reveals a platform with mixed strengths and significant concerns that potential users must carefully evaluate. WWM demonstrates competency in customer service delivery and provides access to established trading infrastructure through MetaTrader 4, along with diversified asset class offerings that appeal to traders seeking market variety.

However, the revocation of the FCA license represents a substantial regulatory concern that overshadows the platform's positive aspects. Combined with limited transparency regarding trading conditions, costs, and operational details, these factors create significant uncertainty for potential users. The platform appears most suitable for traders who prioritize customer service quality and are comfortable with regulatory uncertainties, though most users would benefit from seeking more transparent and comprehensively regulated alternatives.

The lack of detailed information about account conditions, trading costs, and platform features suggests that WWM may need to improve its communication transparency to build user confidence effectively.