Is WorldMarkets safe?

Pros

Cons

Is Worldmarkets A Scam?

Introduction

Worldmarkets is a broker that positions itself within the forex market, offering a variety of trading options, including precious metals and cryptocurrencies. However, the legitimacy of Worldmarkets has been a subject of concern among traders and financial analysts alike. As the forex market continues to grow, it becomes increasingly vital for traders to evaluate brokers thoroughly before committing their funds. This article aims to provide an objective assessment of Worldmarkets, exploring its regulatory status, company background, trading conditions, customer experience, and overall safety. Our investigation is based on a comprehensive review of online resources, user feedback, and regulatory warnings concerning Worldmarkets.

Regulation and Legitimacy

The regulatory status of a broker is crucial for ensuring the safety of clients' funds and maintaining fair trading practices. Worldmarkets claims to operate under various jurisdictions; however, it lacks oversight from any top-tier regulatory authority. This absence raises significant red flags for potential investors. Below is a table summarizing the core regulatory information for Worldmarkets:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulation means that Worldmarkets is not subject to the stringent compliance requirements imposed by reputable authorities such as the FCA (Financial Conduct Authority) in the UK or ASIC (Australian Securities and Investments Commission). This lack of oversight can expose traders to higher risks, including potential fraud and mismanagement of funds. Additionally, historical compliance issues have been reported, with several regulatory bodies warning against Worldmarkets for unauthorized operations. The absence of a robust regulatory framework is a significant factor that leads many to conclude that Worldmarkets is not safe.

Company Background Investigation

Worldmarkets was established in 2003, initially focusing on precious metals trading. Over the years, it has expanded its offerings to include various trading instruments, such as forex, stocks, and cryptocurrencies. However, the company's ownership structure and management team remain opaque, raising questions about its transparency. Information about the company's executives and their professional backgrounds is scarce, which is concerning for potential investors seeking accountability and trustworthiness.

The lack of transparency extends to the company's operational practices, with many users reporting difficulties in retrieving information about their accounts and the trading conditions offered. This opacity is a significant factor that contributes to the perception that Worldmarkets may not be a legitimate broker. Potential investors should be cautious and consider the implications of dealing with a broker that does not provide clear and accessible information about its operations.

Trading Conditions Analysis

The trading conditions offered by Worldmarkets are another critical aspect to evaluate. The broker claims to provide competitive spreads and various account types, including an AI-managed account. However, the overall fee structure appears to be complex and potentially unfavorable for traders. Below is a comparison of core trading costs:

| Fee Type | Worldmarkets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 pips |

| Commission Model | 20% on profits | 0.1% - 0.5% |

| Overnight Interest Range | Variable | 0.5% - 3% |

While Worldmarkets advertises low spreads, the high commission on profits can significantly reduce traders' earnings, especially for those who engage in frequent trading. Moreover, the lack of clarity regarding overnight interest rates and other fees can lead to unexpected costs for traders. This complexity in the fee structure is a cause for concern, further supporting the notion that Worldmarkets may not be safe for traders seeking straightforward trading conditions.

Customer Funds Safety

The safety of customer funds is paramount when evaluating any broker. Worldmarkets claims to implement various security measures, including fund segregation and investor protection policies. However, the effectiveness of these measures is questionable given the broker's lack of regulatory oversight. The absence of a credible regulatory framework means that clients' funds are not guaranteed by any compensation schemes, leaving them vulnerable in the event of the broker's insolvency.

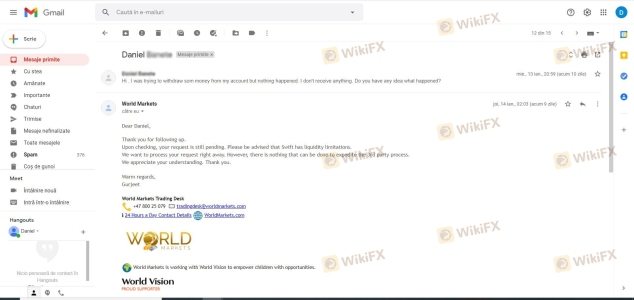

Furthermore, historical complaints and reports of difficulties in withdrawing funds from Worldmarkets raise significant concerns. Many users have reported being unable to access their funds or experiencing excessive delays in processing withdrawal requests. These issues point to a potential lack of financial stability within the broker, making it imperative for traders to consider the risks involved. Overall, the safety of customer funds at Worldmarkets remains uncertain, reinforcing the idea that Worldmarkets is not a safe option for investors.

Customer Experience and Complaints

Customer feedback is an essential component of evaluating a broker's reliability. Reviews of Worldmarkets reveal a concerning trend of negative experiences reported by users. Common complaints include difficulties in withdrawing funds, lack of customer support, and issues with account management. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Poor |

| Account Management | High | Poor |

Several users have shared their experiences of being unable to withdraw their funds, with some claiming that their accounts were blocked without explanation. These patterns indicate a troubling trend that suggests Worldmarkets may not provide adequate support or transparency, contributing to the perception that it operates more like a scam than a legitimate broker.

Platform and Trade Execution

The performance of a trading platform is vital for a seamless trading experience. Worldmarkets offers a proprietary trading platform, which users have reported to be stable but lacking in advanced features. However, concerns have been raised regarding order execution quality, including instances of slippage and rejected orders. The potential for manipulation within the platform is another factor that traders should consider when evaluating the reliability of Worldmarkets.

A robust trading platform should provide users with real-time data, fast execution speeds, and minimal slippage. Unfortunately, the feedback regarding Worldmarkets suggests that these standards may not be consistently met. This inconsistency raises further doubts about the broker's integrity and whether Worldmarkets is a safe choice for traders.

Risk Assessment

Engaging with Worldmarkets presents several risks that traders should be aware of. The absence of regulation, coupled with historical complaints and a lack of transparency, creates an environment where traders' funds may be at risk. Below is a summary of the key risk areas associated with Worldmarkets:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Unregulated broker with no oversight. |

| Fund Security | High | No investor protection or compensation schemes. |

| Customer Support | Medium | Poor response to complaints and support requests. |

To mitigate these risks, traders are advised to conduct thorough research before engaging with Worldmarkets. Seeking alternatives with robust regulatory oversight and positive user feedback can help safeguard investments.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Worldmarkets is not a safe broker. The lack of regulatory oversight, coupled with numerous complaints and transparency issues, raises significant concerns about the legitimacy of the broker. Traders should exercise caution when considering Worldmarkets for their trading activities and may be better served by exploring reputable alternatives.

For those seeking reliable forex brokers, consider options that are regulated by top-tier authorities such as the FCA or ASIC. These brokers typically offer better protection for your investments and a more transparent trading environment. Always prioritize safety and regulatory compliance when choosing a broker to ensure a secure trading experience.

Is WorldMarkets a scam, or is it legit?

The latest exposure and evaluation content of WorldMarkets brokers.

WorldMarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

WorldMarkets latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.