Regarding the legitimacy of WOCOM forex brokers, it provides SFC, SFC and WikiBit, (also has a graphic survey regarding security).

Is WOCOM safe?

Risk Control

Software Index

Is WOCOM markets regulated?

The regulatory license is the strongest proof.

SFC Market Making License (MM)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Wocom Foreign Exchange Co. Limited

Effective Date:

2004-11-24Email Address of Licensed Institution:

wocom@wocom.com.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.wocom.com.hkExpiration Time:

--Address of Licensed Institution:

香港中環干諾道中111號永安中心1002室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Wocom Limited

Effective Date:

2004-11-09Email Address of Licensed Institution:

wocom@wocom.com.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.wocom.com.hkExpiration Time:

--Address of Licensed Institution:

香港中環干諾道中111號永安中心1002室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Wocom A Scam?

Introduction

Wocom is a financial services company based in Hong Kong, primarily operating in the forex trading market. Established in the 1970s, Wocom has evolved to offer a range of trading services, including forex, equities, and futures. As the forex market continues to grow, the need for traders to evaluate the credibility and safety of their brokers has become paramount. With the proliferation of online trading platforms, some of which may engage in unethical practices, traders must approach their choices with caution. This article aims to provide a comprehensive analysis of Wocom, assessing its legitimacy, regulatory status, and overall safety for potential investors. The evaluation is based on a review of available online resources, user feedback, and regulatory information.

Regulation and Legitimacy

The regulatory environment plays a crucial role in determining the safety and legitimacy of a trading platform. Wocom claims to be regulated by the Securities and Futures Commission (SFC) of Hong Kong, which is known for its stringent oversight of financial markets. Regulatory compliance is essential as it provides a framework for investor protection and ensures that brokers adhere to established financial standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SFC | AAH 843 | Hong Kong | Verified |

Wocom operates under multiple licenses issued by the SFC, which includes licenses for dealing in futures contracts and leveraged foreign exchange trading. However, it is essential to note that while Wocom is regulated, the quality of that regulation and the firm's historical compliance must also be scrutinized. Some reviews indicate that Wocom's regulatory status is sometimes questioned due to a lack of transparency regarding its operational practices. Therefore, while the SFC's oversight offers a level of credibility, potential clients should remain vigilant and conduct thorough due diligence before engaging with the broker.

Company Background Investigation

Wocom's history and ownership structure provide insight into its credibility. Founded in the 1970s, Wocom began as a branch of an international commodities trading house. The Wing On Group became a significant investor in Wocom in 1986, leading to its current operational structure. This long-standing presence in the market may suggest a level of stability; however, the lack of detailed information about its management team and their professional backgrounds raises concerns about transparency.

The management team's experience and expertise in the financial sector are critical factors in assessing the broker's reliability. A competent management team can significantly influence a brokerage's operational integrity and customer service quality. Unfortunately, Wocom's website and available reviews do not provide substantial information about its executives or their qualifications, which is a potential red flag for prospective clients. Furthermore, the broker's transparency regarding its business practices and financial disclosures remains limited, making it challenging for potential investors to gauge the company's overall reliability.

Trading Conditions Analysis

Wocom's trading conditions, including its fee structure and trading costs, are essential considerations for traders. The broker offers various trading products, including forex, equities, and futures, but the specifics of its fee structure can significantly impact profitability.

Core Trading Costs Comparison

| Fee Type | Wocom | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not specified | 1-2 pips |

| Commission Model | Negotiable | Fixed/Variable |

| Overnight Interest Range | Not specified | 1-3% |

While Wocom does not provide explicit details on its spreads or commission structure, it claims that commissions are negotiable. This lack of transparency may be concerning for traders who prefer clear and predictable pricing. Additionally, the absence of information regarding overnight interest rates could lead to unexpected costs for traders holding positions overnight.

Traders should be aware of any unusual or hidden fees that may arise, as these can significantly affect overall trading costs. The absence of a clear fee structure may also indicate a lack of professionalism or transparency, raising further questions about Wocom's reliability.

Customer Funds Safety

The safety of customer funds is a critical concern when selecting a trading broker. Wocom claims to implement various measures to ensure the security of client funds, including segregated accounts and adherence to regulatory requirements. Segregated accounts are essential as they prevent the broker from using client funds for operational purposes, providing an additional layer of protection.

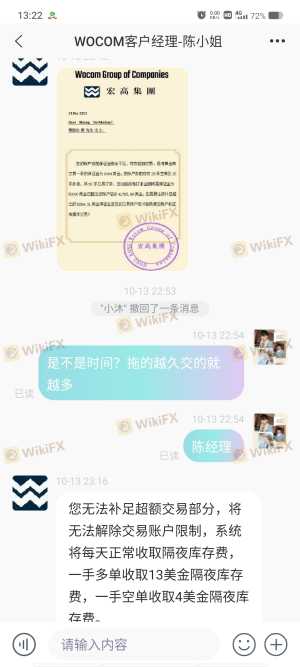

However, the effectiveness of these safety measures can only be ascertained through historical performance and user experiences. There have been reports of difficulties in fund withdrawals and complaints regarding the responsiveness of the customer service team. Such issues can indicate underlying problems with fund management and raise concerns about the overall safety of client deposits.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding the overall experience with Wocom. Various online reviews highlight a mixed bag of experiences, with some users praising the platform's range of services while others express dissatisfaction, particularly regarding customer service and withdrawal processes.

Major Complaint Types and Severity Assessment

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service Accessibility | Medium | Limited options |

| Transparency of Fees | Medium | Lacks clarity |

Common complaints include difficulties in withdrawing funds, which is a significant concern for many traders. Reports suggest that clients have experienced delays in processing withdrawal requests, which can be particularly frustrating for those looking to access their capital. Additionally, the limited options for customer support, such as the absence of live chat, can hinder effective communication and resolution of issues.

Platform and Execution

The performance of Wocom's trading platform is another critical aspect to consider. A user-friendly and stable platform is essential for executing trades efficiently. Wocom offers a web-based trading platform, but reviews regarding its performance vary. Some users report satisfactory experiences, while others mention concerns regarding order execution quality, including instances of slippage and rejected orders.

Traders should be cautious of any signs of platform manipulation, as this can undermine trust in the broker. A reliable trading platform should provide accurate pricing, fast execution, and minimal slippage to ensure a positive trading experience.

Risk Assessment

Evaluating the risks associated with trading through Wocom is essential for informed decision-making. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Potential gaps in regulatory oversight |

| Fund Withdrawal Issues | High | Reports of difficulties accessing funds |

| Transparency and Fees | Medium | Lack of clarity on fee structure |

| Customer Support Availability | Medium | Limited channels for assistance |

To mitigate these risks, potential clients should conduct thorough research, seek reviews from multiple sources, and consider starting with a small investment to gauge the broker's performance before committing significant capital.

Conclusion and Recommendations

In conclusion, while Wocom is regulated by the SFC in Hong Kong, there are several areas of concern that potential clients should consider. The lack of transparency regarding fees, mixed customer feedback, and reports of withdrawal issues raise red flags about the broker's reliability.

Traders should approach Wocom with caution and consider their risk tolerance before engaging with the platform. For those seeking alternative options, brokers with a strong reputation for transparency, responsive customer service, and a proven track record of reliability may be more suitable. Recommended alternatives include brokers with robust regulatory oversight and positive user reviews, ensuring a safer trading environment.

Is WOCOM a scam, or is it legit?

The latest exposure and evaluation content of WOCOM brokers.

WOCOM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

WOCOM latest industry rating score is 7.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.