Regarding the legitimacy of bestonFX forex brokers, it provides FSCA, FinCEN and WikiBit, (also has a graphic survey regarding security).

Is bestonFX safe?

Pros

Cons

Is bestonFX markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

BESTON INTERNET TECHNOLOGY (PTY) LTD

Effective Date:

2023-05-17Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

1014 ERASMUS WVENUE 29 SHARONDALE ELDORAIGNE 0157Phone Number of Licensed Institution:

061 660 7510Licensed Institution Certified Documents:

FinCEN Currency Exchange License (MSB)

Financial Crimes Enforcement Network

Financial Crimes Enforcement Network

Current Status:

RegulatedLicense Type:

Currency Exchange License (MSB)

Licensed Entity:

Beston Internet Technology Limited

Effective Date:

2023-03-01Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Flat/Rm A 12/F ZJ 300 300 Lockhart Road Wan Chai 00852Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is BestonFX A Scam?

Introduction

BestonFX is a relatively new player in the forex trading market, having been established in 2022. Positioned as a broker that offers a wide range of trading services, it aims to cater to both novice and experienced traders. However, with the rise of online trading platforms, the need for traders to meticulously evaluate the legitimacy and reliability of brokers has never been more critical. This article aims to provide a comprehensive analysis of BestonFX, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. The evaluation is based on a thorough review of multiple sources, including user feedback, regulatory disclosures, and expert assessments.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in determining its trustworthiness and safety for traders. BestonFX claims to be regulated by the Financial Crimes Enforcement Network (FinCEN) in the United States, which is primarily focused on anti-money laundering regulations rather than direct oversight of forex trading activities. This raises concerns about the adequacy of its regulatory framework.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FinCEN | 31000237824049 | United States | Verified |

While BestonFX's affiliation with FinCEN provides a certain level of legitimacy, it is essential to note that FinCEN does not provide comprehensive regulatory oversight typical of forex trading regulators like the FCA or ASIC. Moreover, there is no record of BestonFX being registered with the Hong Kong Securities and Futures Commission (SFC), which further complicates its regulatory standing. The lack of strict regulatory supervision may expose traders to higher risks, including potential fraud and mismanagement of funds.

Company Background Investigation

BestonFX is operated by Beston Internet Technology Limited, with its headquarters located in Hong Kong. The company has a relatively short history, having been established in 2022. The ownership structure and management team details are sparse, which raises questions about transparency. A thorough investigation into the management team's qualifications and backgrounds reveals limited information, suggesting that potential investors might not have access to vital details that could affect their trading experience.

The firm's transparency regarding its operational practices and financial disclosures is also questionable. Many reputable brokers provide detailed information about their team, financial health, and business practices, which helps build trust among clients. However, BestonFX's lack of such information may deter potential traders from engaging with the platform.

Trading Conditions Analysis

BestonFX offers a variety of trading conditions, including access to multiple financial instruments such as forex, commodities, and indices. However, the overall fee structure and trading costs require careful scrutiny.

| Fee Type | BestonFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Structure | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

While the broker advertises competitive spreads and trading conditions, user reviews often highlight inconsistencies and hidden fees that could lead to unexpected costs. Such practices can significantly affect a trader's profitability and should be a point of concern for potential users. Traders should conduct thorough due diligence to understand the complete fee structure before committing to trading with BestonFX.

Client Fund Security

The safety of clients' funds is a critical aspect of any trading platform. BestonFX claims to implement several measures to protect client funds, including segregating client accounts from company funds. However, without proper regulatory oversight, the effectiveness of these measures remains uncertain.

Additionally, there is no clear information regarding investor protection schemes, which are essential for safeguarding clients' investments in the event of broker insolvency. Historical issues related to fund security have not been reported, but the absence of robust regulatory frameworks raises concerns about the overall safety of client funds with BestonFX.

Customer Experience and Complaints

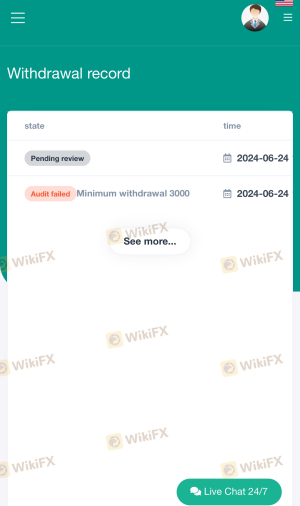

User feedback about BestonFX is mixed, with many traders expressing frustration over withdrawal issues and customer service responsiveness. Common complaints include delays in processing withdrawal requests and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | Medium | Fair |

For instance, some users have reported being unable to withdraw their funds despite having a profitable trading experience. Such patterns of behavior are indicative of potential operational issues within the brokerage. Additionally, the quality of customer service has been called into question, with reports of long waiting times for responses to inquiries. This could further exacerbate the overall trading experience for clients.

Platform and Trade Execution

BestonFX utilizes the widely recognized MetaTrader 4 (MT4) trading platform, known for its user-friendly interface and robust features. However, the performance of the platform, including order execution quality and slippage rates, is critical for traders. Users have reported varying experiences, with some noting instances of slippage and rejected orders during high volatility periods.

The stability of the trading platform is essential for traders, and any signs of manipulation or technical issues can significantly impact trading outcomes.

Risk Assessment

Engaging with BestonFX presents several risks that potential traders should consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of comprehensive regulatory oversight. |

| Fund Security Risk | Medium | Uncertainty regarding fund protection measures. |

| Operational Risk | Medium | Historical complaints about withdrawals and service responsiveness. |

To mitigate these risks, traders are advised to conduct thorough research before investing and consider using demo accounts to test the platform without financial commitment.

Conclusion and Recommendations

Based on the comprehensive analysis, BestonFX exhibits several red flags that potential traders should be aware of. While it is regulated by FinCEN, the lack of stronger regulatory oversight raises concerns about the safety and reliability of the platform. The mixed customer feedback, coupled with issues related to fund security and withdrawal processes, suggests that traders should approach this broker with caution.

For those seeking safer trading environments, it may be prudent to consider well-established brokers with robust regulatory frameworks, such as those regulated by the FCA or ASIC. These alternatives typically offer better protection for client funds and more transparent operational practices.

Is bestonFX a scam, or is it legit?

The latest exposure and evaluation content of bestonFX brokers.

bestonFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

bestonFX latest industry rating score is 5.79, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.79 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.