Executive Summary

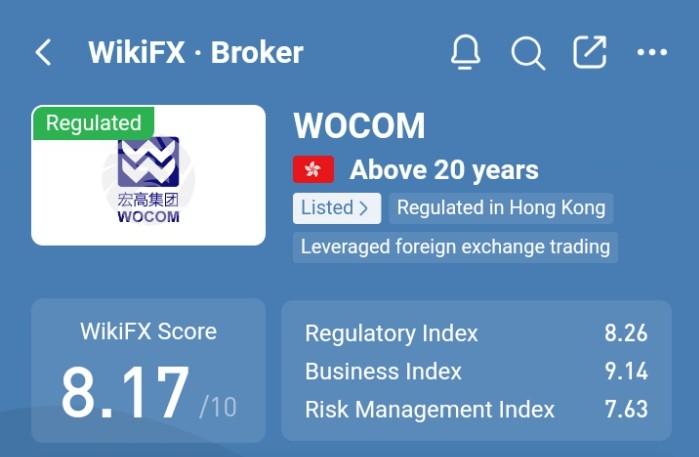

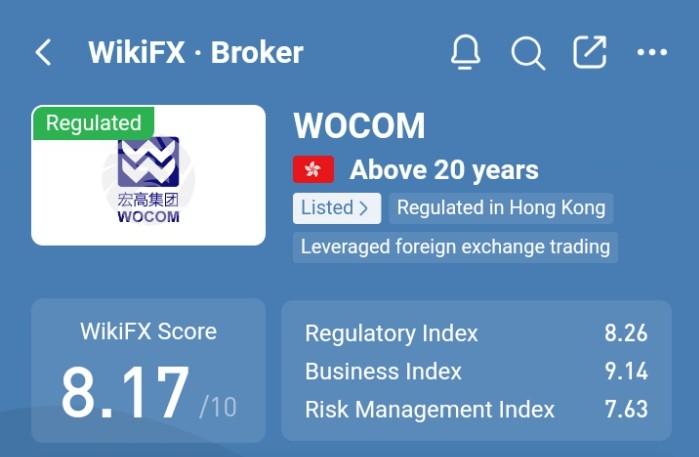

This wocom review looks at a new forex broker that has caused mixed reactions in the trading community. WOCOM says it is a global financial services company based in Hong Kong that focuses on forex trading and multi-asset investment opportunities. Some users are happy with parts of their services, but serious concerns have come up about the broker's safety and legitimacy that potential traders need to think about carefully.

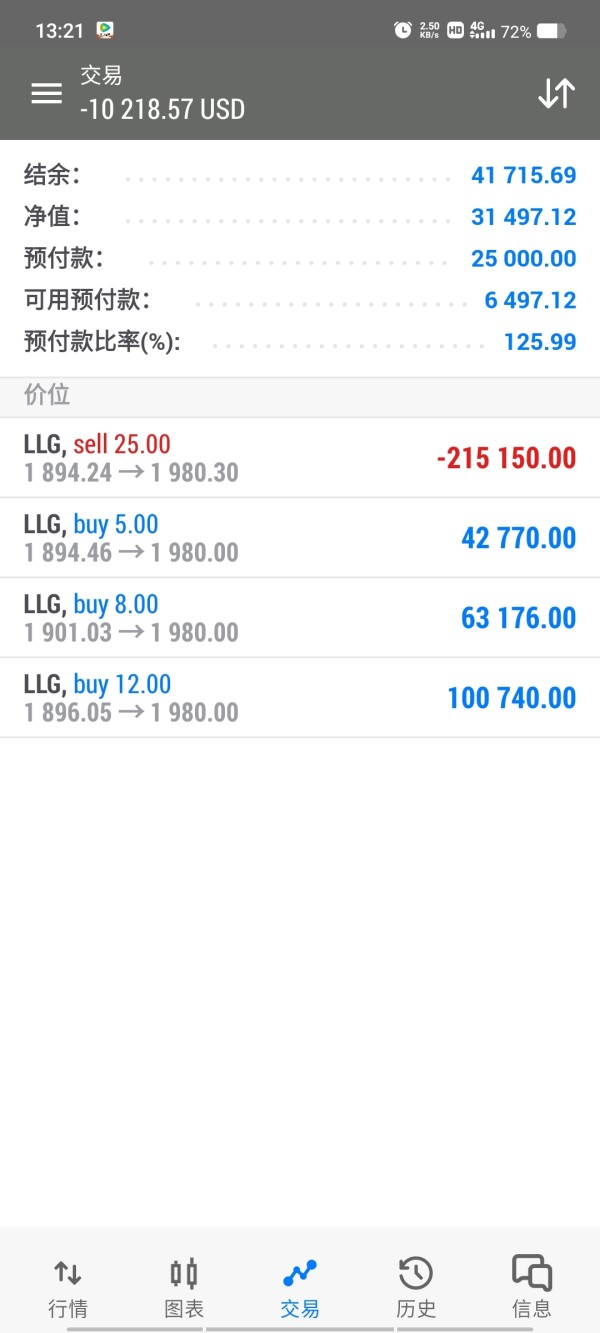

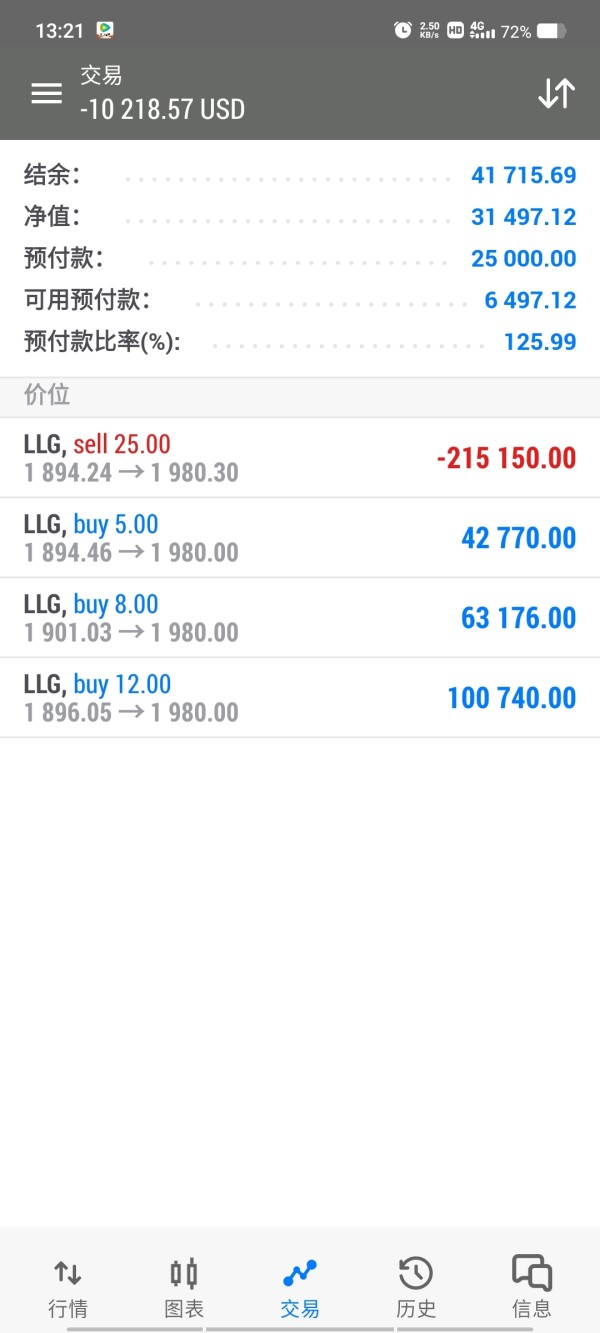

WOCOM's platform lets you trade multiple asset classes including forex, precious metals, crude oil, indices, and stocks. The broker gives you both web-based and dedicated application platforms to fit different trading preferences. Their trading system reportedly delivers execution speeds averaging 0ms with zero spread costs, though detailed information about slippage and clearing rates is limited.

The broker seems to target traders who want portfolio diversification through multi-asset trading capabilities. However, the lack of clear regulatory information and the presence of scam-related complaints in user feedback create major red flags that potential clients must carefully evaluate before using their services.

Important Notice

Regional Entity Differences: WOCOM has not provided specific regulatory information across different jurisdictions, and traders should be extremely careful when considering this broker. The lack of transparent regulatory oversight significantly impacts the safety profile of this platform.

Review Methodology: This evaluation is based on publicly available information and user feedback collected from various sources. The assessment may not cover all trader experiences, and individual results may vary significantly from the general findings presented in this review.

Scoring Framework

Broker Overview

WOCOM presents itself as a global financial services company based in Hong Kong that specializes in forex trading and comprehensive financial product offerings. While the exact establishment date is not specified in available documentation, the broker has positioned itself as a technology-focused trading platform that caters to modern traders' needs. The company operates under a business model that emphasizes multi-asset trading capabilities and attempts to serve as a one-stop solution for traders seeking diversified investment opportunities.

The broker's operational framework centers around providing access to various financial markets through both web-based platforms and dedicated mobile applications. WOCOM's service portfolio includes foreign exchange trading, precious metals, crude oil, stock indices, and individual equity trading. However, the absence of detailed information about the company's management structure, founding team, or corporate governance raises questions about operational transparency that potential clients should consider.

WOCOM's trading infrastructure supports web browser access and specialized applications designed for different trading preferences. The platform architecture reportedly facilitates trading across forex pairs, precious metals including gold and silver, energy commodities such as crude oil, major global indices, and individual stock offerings. Despite these technical capabilities, the lack of specific regulatory oversight from recognized financial authorities represents a significant concern that distinguishes this wocom review from evaluations of more established, regulated brokers.

Regulatory Status: Available information does not specify concrete regulatory oversight from recognized financial authorities, creating substantial uncertainty about the broker's compliance framework and client protection measures.

Deposit and Withdrawal Methods: Specific information regarding funding options, processing times, and associated fees has not been detailed in accessible documentation.

Minimum Deposit Requirements: Exact minimum deposit amounts for different account types are not specified in available materials.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns are not mentioned in current documentation.

Tradeable Assets: The platform supports trading in foreign exchange pairs, precious metals (gold, silver), crude oil, major stock indices, and individual equities across various markets.

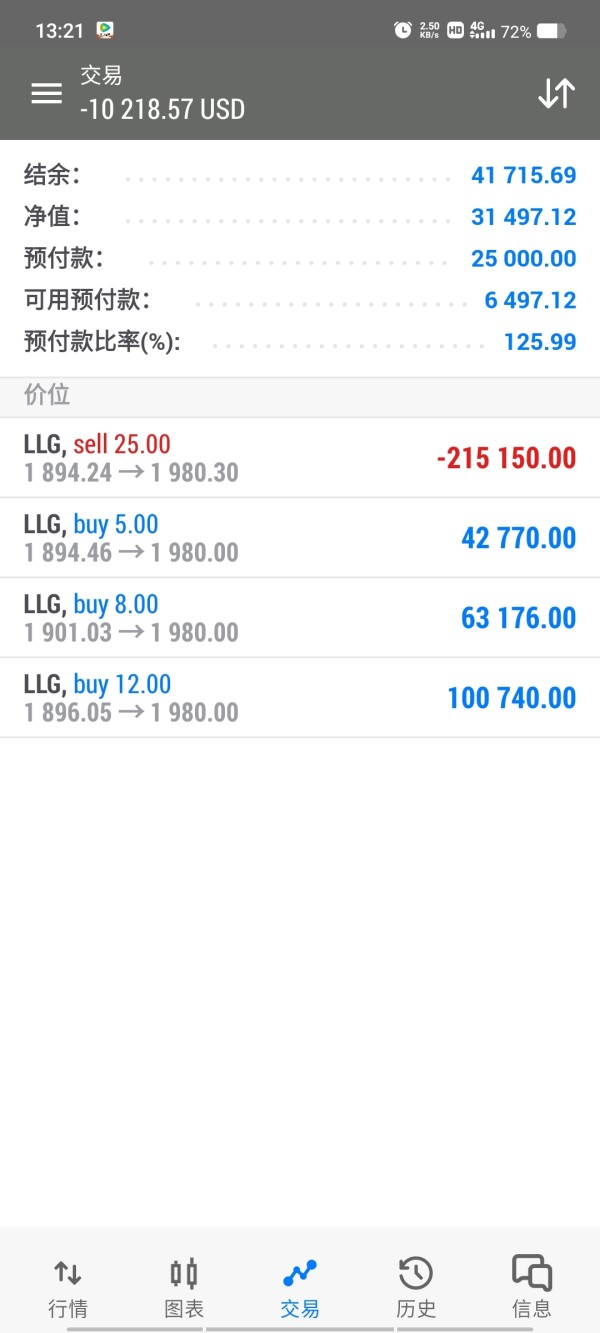

Cost Structure: While spread costs are reported as zero, comprehensive information about commissions, overnight financing charges, withdrawal fees, and other trading-related costs remains unclear, limiting traders' ability to assess total trading expenses.

Leverage Options: Specific leverage ratios available to different account types and asset classes are not detailed in available information.

Platform Options: WOCOM provides trading access through web browsers and dedicated applications, though detailed feature comparisons between platforms are not specified.

Geographic Restrictions: Information about restricted countries or regional limitations is not mentioned in available documentation, making this wocom review incomplete in terms of accessibility guidance.

Customer Support Languages: Specific language support options for customer service are not detailed in accessible materials.

Detailed Scoring Analysis

Account Conditions Analysis (Score: 5/10)

WOCOM's account conditions receive an average rating due to limited transparency about specific account types and their respective features. Available information does not detail different account tiers, their minimum deposit requirements, or unique benefits associated with each level. This lack of clarity makes it challenging for potential traders to understand what they can expect when opening an account with the broker.

The absence of information about Islamic accounts, professional trader classifications, or institutional account options suggests either limited product diversity or poor communication of available services. Without clear details about account opening procedures, verification requirements, or approval timeframes, traders cannot adequately prepare for the onboarding process.

Furthermore, the lack of specific information about account maintenance fees, inactivity charges, or other ongoing costs associated with different account types prevents traders from making informed decisions about long-term trading relationships. This opacity in account conditions significantly impacts the overall evaluation and contributes to concerns about the broker's operational transparency.

The scoring reflects these information gaps and the resulting uncertainty that traders face when considering WOCOM's account offerings. This wocom review emphasizes the importance of obtaining comprehensive account details before committing to any trading relationship.

WOCOM demonstrates strength in its multi-asset trading capabilities, offering access to forex, precious metals, crude oil, indices, and stocks through both web-based and application platforms. This diversity in tradeable instruments provides traders with significant opportunities for portfolio diversification and risk management across different asset classes.

The platform's technical infrastructure, supporting both browser-based trading and dedicated applications, shows consideration for different trader preferences and trading styles. This flexibility allows users to choose their preferred trading environment based on their specific needs and technical requirements.

However, the evaluation is limited by the absence of detailed information about research tools, market analysis resources, educational materials, or advanced trading features such as algorithmic trading support. Without comprehensive details about charting capabilities, technical indicators, or fundamental analysis tools, it's difficult to assess the platform's suitability for different trading strategies.

The lack of information about automated trading support, copy trading features, or social trading capabilities also limits the assessment of the platform's modern trading tools. Despite these limitations, the multi-asset approach and platform flexibility contribute positively to this aspect of the evaluation.

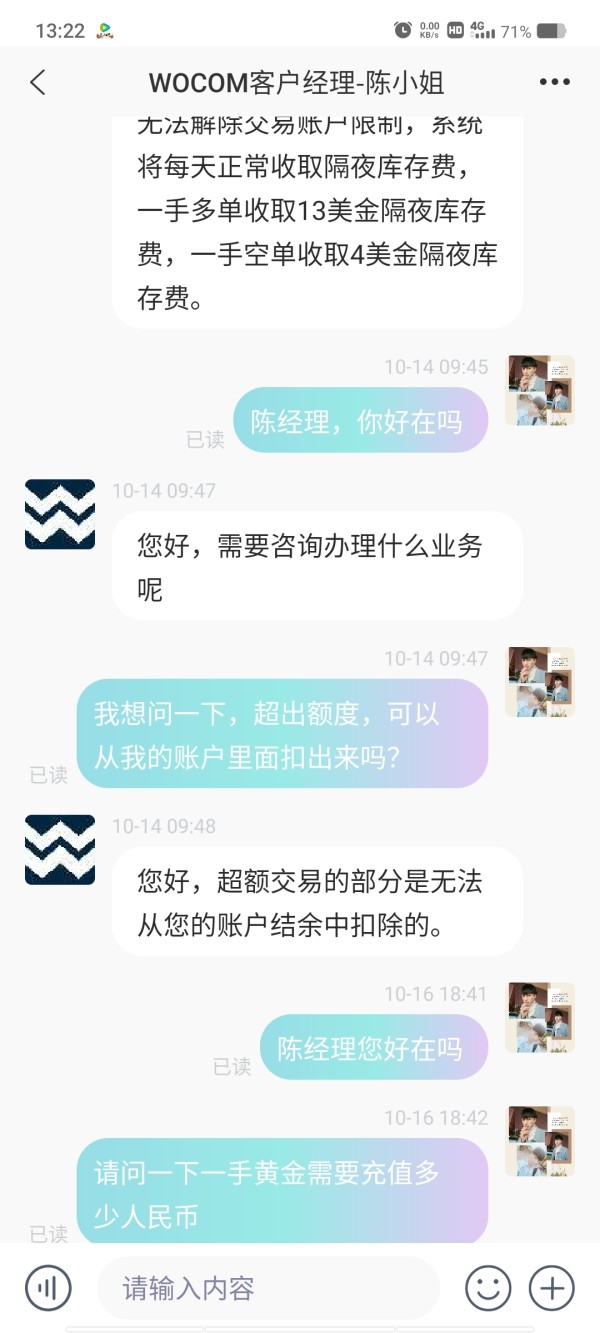

Customer Service and Support Analysis (Score: 4/10)

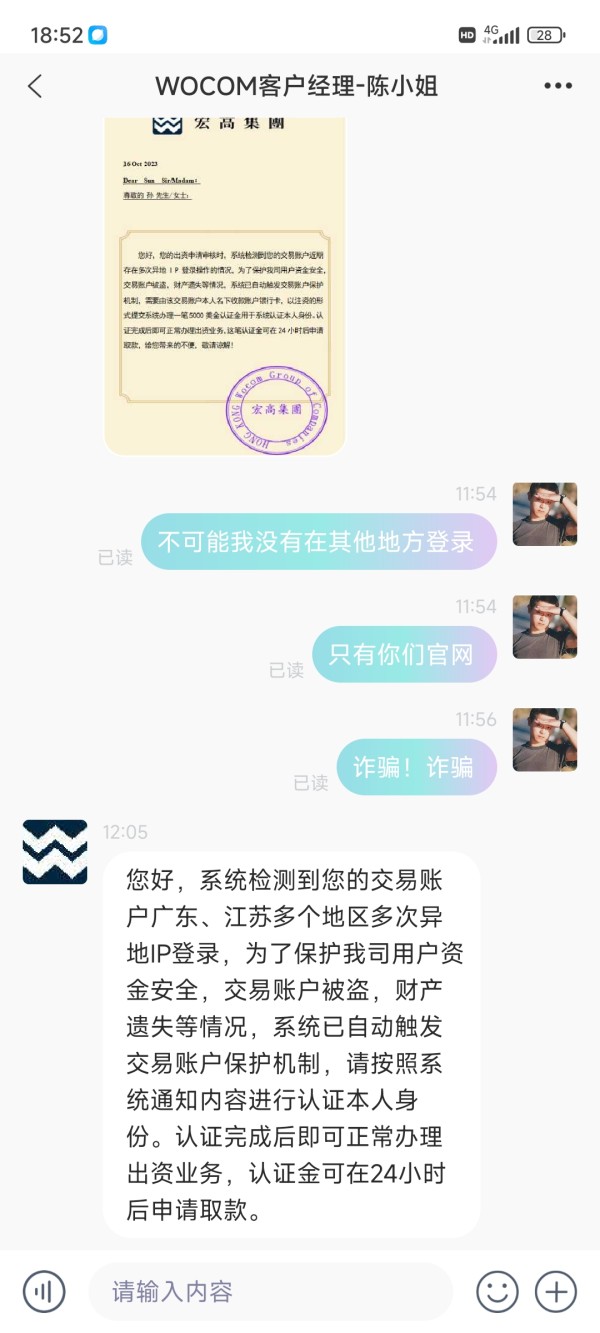

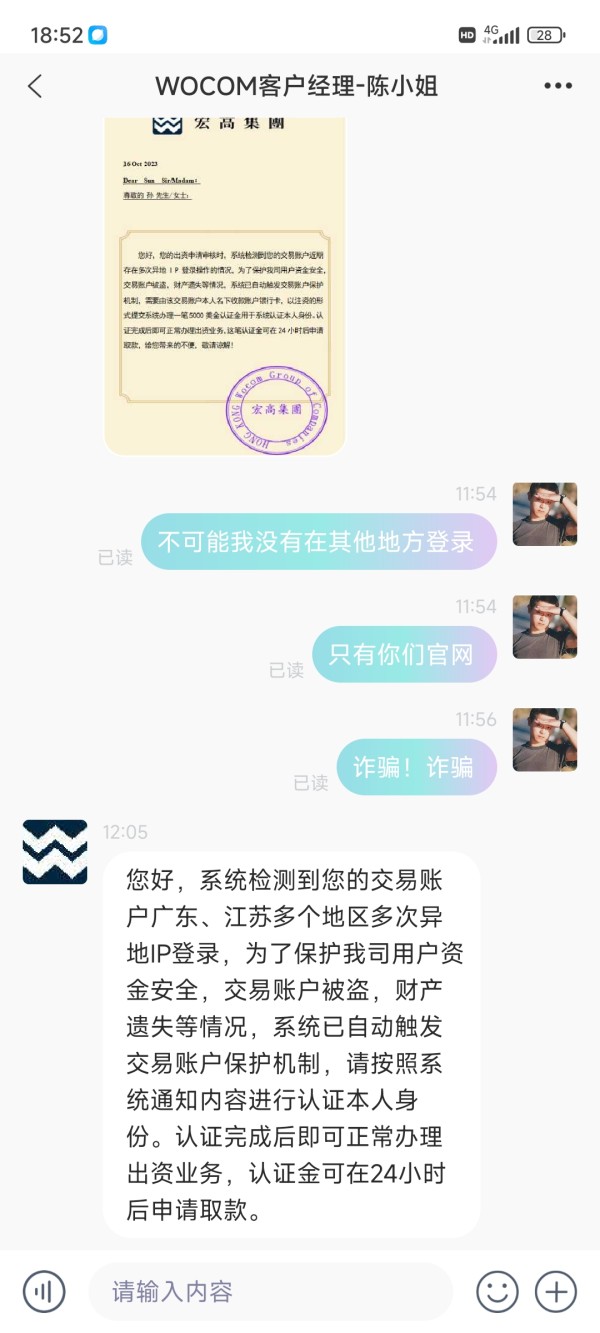

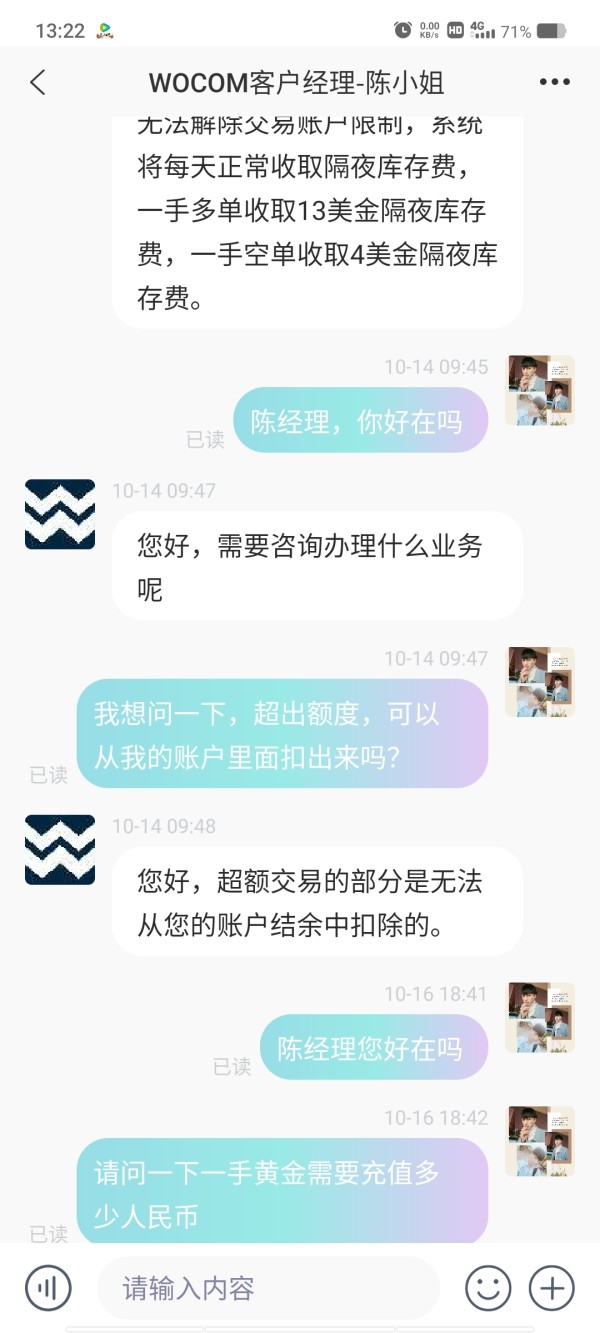

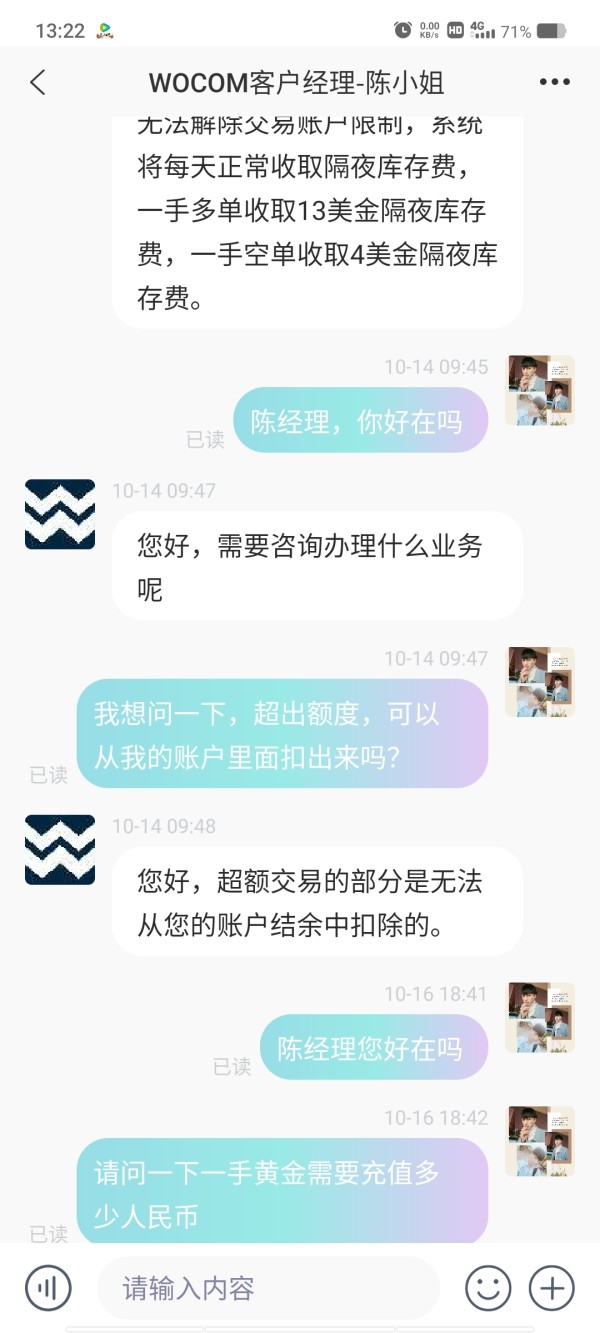

Customer service represents a significant weakness in WOCOM's offering, primarily due to reports of scam-related complaints and negative user feedback regarding the broker's legitimacy. These concerns substantially impact confidence in the broker's ability to provide reliable customer support and dispute resolution services.

The absence of detailed information about customer service channels, availability hours, response times, or multilingual support capabilities further diminishes the assessment of this critical service area. Without clear communication about how traders can reach support staff or what level of assistance they can expect, users face uncertainty about problem resolution processes.

Reports of fraud-related complaints create additional concerns about the broker's commitment to customer protection and ethical business practices. The lack of transparent information about complaint handling procedures or dispute resolution mechanisms compounds these concerns and suggests potential difficulties for traders who encounter problems.

The scoring reflects both the negative user feedback and the absence of comprehensive customer service information, indicating that potential clients should exercise extreme caution and thoroughly investigate support capabilities before engaging with the platform.

Trading Experience Analysis (Score: 6/10)

WOCOM's trading experience receives a moderate rating based on reported technical performance metrics, including average execution speeds of 0ms, which suggests competitive order processing capabilities. The zero spread cost structure, if accurate, could provide cost advantages for high-frequency traders or those focusing on short-term trading strategies.

The platform's support for multiple asset classes through both web and application interfaces provides flexibility for different trading approaches and preferences. This technical diversity allows traders to access various markets through their preferred platform configuration, potentially enhancing overall trading efficiency.

However, the evaluation is significantly limited by the absence of detailed information about slippage rates, requote frequency, server stability during market volatility, or comprehensive liquidity data. Without these critical performance metrics, traders cannot fully assess the platform's reliability during different market conditions.

The lack of specific information about advanced order types, risk management tools, or platform-specific features also limits the assessment of trading experience quality. This wocom review emphasizes the need for more comprehensive performance data to properly evaluate trading conditions.

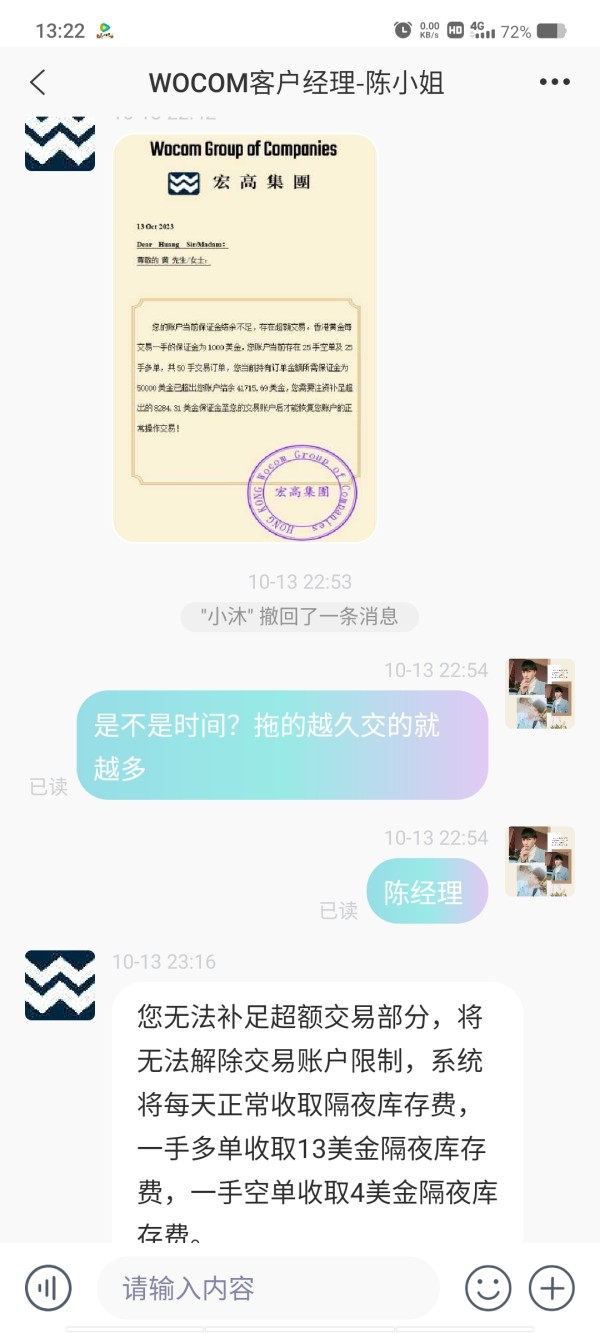

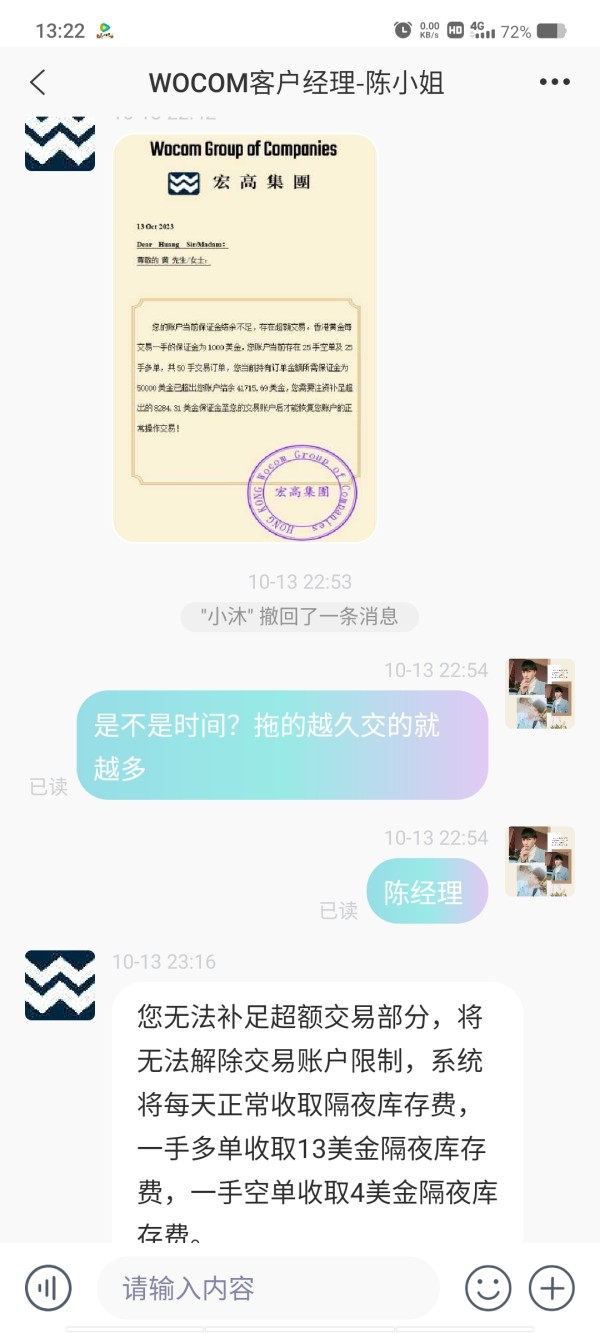

Trust and Safety Analysis (Score: 3/10)

Trust and safety represent WOCOM's most significant weakness, primarily due to the absence of verifiable regulatory oversight from recognized financial authorities. This lack of regulatory transparency creates substantial uncertainty about client fund protection, operational compliance, and dispute resolution mechanisms.

The presence of scam-related complaints and negative user feedback regarding the broker's legitimacy raises serious red flags about operational integrity and business practices. These concerns are compounded by the absence of detailed information about fund segregation, insurance coverage, or other client protection measures.

Without transparent information about company management, ownership structure, or operational history, potential clients cannot adequately assess the broker's stability and long-term viability. The lack of third-party audits, regulatory reporting, or independent verification of business practices further diminishes confidence in the platform's trustworthiness.

The scoring reflects these substantial concerns and emphasizes the critical importance of regulatory oversight and operational transparency in forex broker selection. Potential traders should carefully consider these trust-related issues before engaging with the platform.

User Experience Analysis (Score: 5/10)

User experience evaluation is limited by the absence of comprehensive user satisfaction data and detailed feedback about platform usability, registration processes, or overall service quality. While the broker targets traders seeking diversified investment opportunities, specific user experience metrics are not available for thorough assessment.

The multi-platform approach, supporting both web-based and application trading, suggests consideration for different user preferences and technical requirements. This flexibility potentially enhances accessibility and convenience for traders with varying technological needs and trading styles.

However, negative feedback regarding scam-related concerns significantly impacts overall user experience assessment. These complaints suggest potential difficulties with trust, communication, or service delivery that could substantially affect user satisfaction and platform adoption.

Without detailed information about user interface design, navigation efficiency, account management processes, or mobile application functionality, it's challenging to provide a comprehensive user experience evaluation. The scoring reflects both the limited positive aspects and the significant concerns raised by negative user feedback.

Conclusion

This comprehensive wocom review reveals a broker with mixed characteristics that require careful consideration from potential traders. While WOCOM offers multi-asset trading capabilities and reportedly competitive technical performance, significant concerns about regulatory oversight and user complaints create substantial red flags that cannot be ignored.

The broker may appeal to traders seeking diversified asset trading opportunities through flexible platform options. However, the absence of clear regulatory protection and the presence of fraud-related complaints make WOCOM unsuitable for risk-averse traders or those prioritizing safety and regulatory compliance.

Key Advantages: Multi-asset trading platform, reported fast execution speeds, zero spread costs, and flexible platform access options.

Major Concerns: Lack of regulatory oversight, scam-related user complaints, limited transparency about costs and account conditions, and insufficient customer protection information.

Potential traders should exercise extreme caution and conduct thorough due diligence before considering WOCOM for their trading activities, prioritizing regulated alternatives that provide comprehensive client protection and transparent operational frameworks.