Is Wealth Accumulate safe?

Business

License

Is Wealth Accumulate Safe or a Scam?

Introduction

Wealth Accumulate is a forex broker that claims to operate from the United States, offering a range of trading instruments and platforms to its clients. As the forex market continues to grow, it becomes increasingly important for traders to evaluate the trustworthiness and safety of their chosen brokers. With numerous reports of scams and fraudulent activities in the financial sector, traders must exercise caution and conduct thorough due diligence before engaging with any broker. This article investigates whether Wealth Accumulate is a safe trading option or potentially a scam, employing a structured approach to assess its regulatory status, company background, trading conditions, client experiences, and overall risk profile.

Regulation and Legitimacy

One of the primary indicators of a broker's reliability is its regulatory status. Wealth Accumulate has been flagged as unregulated by multiple sources, raising significant concerns regarding its legitimacy. Regulation serves as a protective measure for traders, ensuring that brokers adhere to strict operational standards and safeguarding client funds. The absence of regulation can expose traders to potential risks, including the possibility of fraud or mismanagement of funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of regulatory oversight for Wealth Accumulate is alarming. Many reputable brokers are registered with recognized authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus), which provide a level of assurance for traders. In contrast, Wealth Accumulate's absence from such regulatory frameworks indicates a higher risk environment. Additionally, reports suggest that the broker may operate in regions with lax regulations, further complicating the safety of client funds.

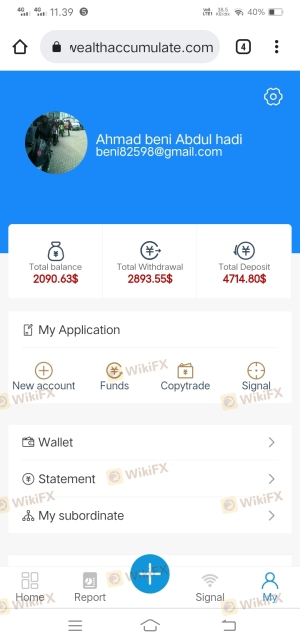

Company Background Investigation

Wealth Accumulate's company history and ownership structure are critical to understanding its operational credibility. The broker claims to have been in business for a few years, but specific details about its founding, ownership, and management team are scarce. A lack of transparency in these areas can be a red flag for potential clients.

The management teams background is also crucial, as experienced professionals typically foster a more trustworthy environment. However, there is little information available about the qualifications or professional history of the individuals behind Wealth Accumulate. This opacity raises questions about the broker's accountability and reliability. Furthermore, the absence of a clear and detailed company profile may indicate a deliberate attempt to obscure important information from potential clients.

Trading Conditions Analysis

When evaluating whether Wealth Accumulate is safe, it's essential to consider its trading conditions. The broker claims to offer competitive spreads and various trading instruments, but the lack of transparency regarding its fee structure raises concerns. Traders should be wary of any hidden fees or unusual cost structures that could impact their profitability.

| Fee Type | Wealth Accumulate | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Structure | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The absence of clear information regarding these fees can be indicative of potential issues. If a broker has a convoluted fee structure or imposes excessive charges, it can significantly affect a trader's bottom line. Traders should always look for brokers that provide transparent and easily understandable fee structures.

Client Funds Safety

The safety of client funds is paramount when assessing whether Wealth Accumulate is safe. Reports indicate that this broker does not offer adequate measures for fund protection, such as segregated accounts or investor protection schemes. Segregating client funds from the broker's operational funds is a critical practice that helps safeguard traders' capital in the event of financial difficulties faced by the broker.

Moreover, the absence of negative balance protection means that traders could potentially lose more than their initial investment. This lack of security measures raises significant concerns about the safety of funds held with Wealth Accumulate. Historical accounts of fund mismanagement or disputes with clients further exacerbate these concerns, leading to a higher risk profile for potential investors.

Customer Experience and Complaints

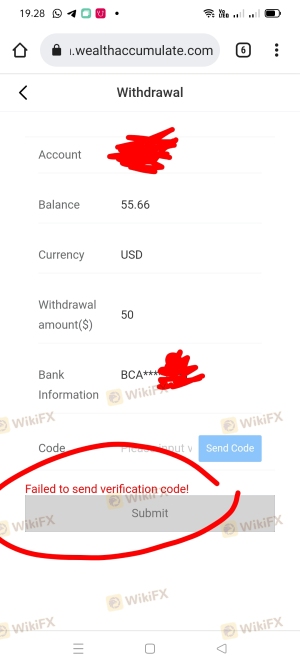

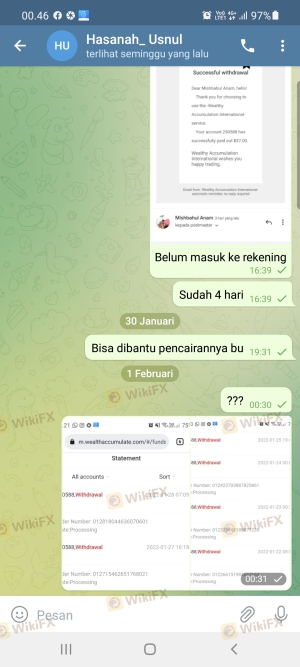

Customer feedback is a vital component in determining whether Wealth Accumulate is safe. Numerous reviews and complaints have surfaced, indicating a pattern of negative experiences among clients. Common complaints include difficulties with withdrawals, lack of responsive customer service, and aggressive sales tactics aimed at convincing traders to deposit more funds.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Misleading Information | High | Poor |

Two notable case studies highlight these concerns. In one instance, a trader reported being unable to withdraw their funds despite multiple requests, leading to frustration and distrust in the broker's operations. Another client indicated that the broker's customer service representatives were unhelpful and dismissive when addressing concerns about misleading promotional offers. These patterns suggest a troubling trend that potential clients should consider seriously.

Platform and Execution

The trading platform offered by Wealth Accumulate is another critical factor in evaluating its safety. A reliable trading platform should be stable, user-friendly, and efficient in executing trades. However, there are mixed reviews regarding the performance of Wealth Accumulate's platform. Traders have reported issues with order execution, including slippage and rejected orders, which can significantly impact trading outcomes.

Such performance issues may indicate underlying problems with the broker's infrastructure or operational practices. If a broker cannot ensure reliable execution of trades, it poses a risk to traders' capital and can lead to substantial financial losses.

Risk Assessment

When assessing the overall risk of using Wealth Accumulate, several key areas warrant attention. The lack of regulation, poor client feedback, and questionable trading conditions contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Financial Risk | High | Potential mismanagement of funds. |

| Operational Risk | Medium | Issues with platform stability and execution. |

To mitigate these risks, traders are advised to conduct thorough research before engaging with Wealth Accumulate. It may be prudent to consider alternative brokers with established regulatory frameworks and a solid reputation for customer service.

Conclusion and Recommendations

In conclusion, the evidence suggests that Wealth Accumulate poses significant risks for traders. The lack of regulation, poor customer feedback, and questionable trading conditions raise serious concerns about the broker's safety. Traders should approach Wealth Accumulate with caution, as the potential for fraud and mismanagement appears high.

For those seeking safer trading options, it is advisable to consider brokers that are regulated by reputable authorities and have a proven track record of positive client experiences. Brokers such as Interactive Brokers, OANDA, or IG may provide more reliable alternatives for traders looking to safeguard their investments while navigating the forex market. Ultimately, ensuring the safety of your trading activities should be the top priority, and due diligence is essential in achieving that goal.

Is Wealth Accumulate a scam, or is it legit?

The latest exposure and evaluation content of Wealth Accumulate brokers.

Wealth Accumulate Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Wealth Accumulate latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.