Is ORYX safe?

Business

License

Is Oryx Safe or Scam?

Introduction

Oryx is a forex broker that has garnered attention in the trading community, particularly for its offerings in the foreign exchange market. Positioned as a platform for traders seeking to leverage high trading volumes and access various financial instruments, Oryx claims to cater to both novice and experienced traders. However, the importance of thoroughly assessing forex brokers cannot be overstated, as the industry is rife with scams and unregulated entities. Traders must ensure that they are working with a reputable broker to safeguard their investments and avoid potential financial losses.

This article aims to investigate the legitimacy of Oryx by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk assessment. The analysis is based on a review of multiple sources, including user testimonials, regulatory databases, and expert evaluations, to provide a comprehensive overview of whether Oryx is safe or a potential scam.

Regulation and Legitimacy

The regulatory framework surrounding a forex broker is crucial for ensuring the safety of client funds and adherence to industry standards. Oryx operates without any regulatory oversight, which raises significant concerns regarding its legitimacy. The absence of a governing body to oversee its operations means that traders have little recourse in the event of disputes or financial mismanagement.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of regulatory oversight is a glaring red flag, as it suggests that Oryx may not adhere to the necessary compliance standards expected of reputable brokers. Historically, unregulated brokers have been linked to fraudulent activities, including misappropriation of client funds and refusal to process withdrawals. The absence of a regulatory license means that Oryx is not subject to the rigorous checks and balances that protect traders in regulated environments, further emphasizing the need for caution when considering whether Oryx is safe.

Company Background Investigation

Oryx's company history is another critical aspect to consider when assessing its trustworthiness. The broker claims to be based in the United Arab Emirates and has been in operation for approximately 5 to 10 years. However, details regarding its ownership structure and management team are scarce, leading to questions about transparency and accountability.

The lack of publicly available information about the company's founders and key personnel raises concerns about the broker's credibility. A reputable broker typically provides clear information about its management team, including their professional backgrounds and qualifications. In Oryx's case, the absence of such details may indicate a lack of transparency, which is often associated with untrustworthy entities.

Furthermore, the company's website has been reported as non-functional at times, further diminishing its credibility. When evaluating if Oryx is safe, the lack of transparency in its operations and the questionable reliability of its online presence are significant factors to consider.

Trading Conditions Analysis

Oryx offers a variety of trading accounts with different minimum deposit requirements and leverage options, which can be attractive to traders. However, the overall fee structure and trading conditions warrant scrutiny.

Oryx's fee structure includes spreads that start from 2 pips for basic accounts, with commissions applicable for premium and VIP accounts. While these fees may appear competitive at first glance, they can significantly impact profitability, especially for high-frequency traders.

| Fee Type | Oryx | Industry Average |

|---|---|---|

| Spread on Major Pairs | From 2 pips | From 1.5 pips |

| Commission Model | $5 per lot | $3 per lot |

| Overnight Interest Range | High | Moderate |

The potential for high overnight interest rates and the lack of clarity regarding withdrawal fees are additional concerns. Traders have reported complications when attempting to withdraw funds, which raises questions about Oryx's commitment to fair trading practices. When assessing whether Oryx is safe, the opacity surrounding its trading conditions and the potential for unexpected costs are significant factors to consider.

Client Fund Security

The security of client funds is paramount in the forex trading environment. Oryx's lack of regulatory oversight means that there are no mandated protections in place for client deposits. Without the assurance of fund segregation or investor protection schemes, traders may be at risk of losing their investments in the event of the broker's insolvency or fraudulent activities.

Furthermore, reports of historical issues surrounding fund withdrawals and complaints about the broker's practices further underscore the risks associated with trading with Oryx. Traders have expressed concerns about the broker's ability to process withdrawals in a timely manner, raising alarms about the safety of their funds.

In summary, the absence of robust security measures and the lack of transparency regarding fund management practices contribute to the perception that Oryx may not be a safe option for traders.

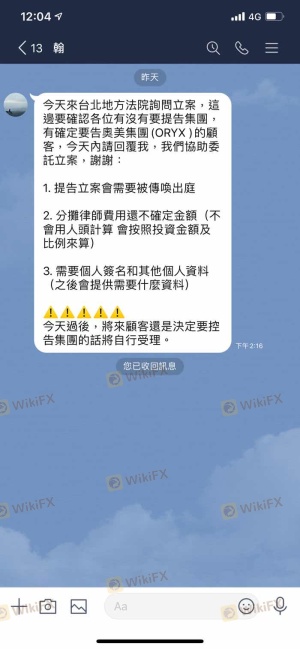

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability and service quality. Reviews of Oryx reveal a pattern of complaints regarding withdrawal issues, lack of customer support, and overall dissatisfaction with trading conditions.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Transparency Concerns | High | Poor |

Many users have reported being unable to withdraw their funds, with some alleging that their accounts were liquidated without consent. The company's response to these complaints has been criticized as inadequate, further damaging its reputation.

For instance, one user recounted difficulties in accessing their funds, leading to frustration and financial loss. Such testimonials highlight the potential risks associated with trading through Oryx and raise serious questions about whether Oryx is safe for prospective clients.

Platform and Trade Execution

The trading platform is another critical component of the overall trading experience. Oryx claims to offer a robust trading environment, but user experiences suggest otherwise. Reports indicate issues with platform stability, execution speed, and instances of slippage.

Traders have noted that order execution can be slow, leading to missed opportunities in fast-moving markets. Additionally, there have been allegations of price manipulation, which can be particularly detrimental to traders relying on precise execution for their strategies.

Given the importance of a reliable trading platform in forex trading, these concerns about Oryx's platform performance further exacerbate the question of whether Oryx is safe for traders.

Risk Assessment

When evaluating the risks associated with trading with Oryx, several key areas emerge as concerning.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight raises concerns about fund safety. |

| Financial Risk | High | Reports of withdrawal issues and fund mismanagement. |

| Operational Risk | Medium | Complaints about platform performance and execution quality. |

The lack of regulatory oversight and the reported issues with customer funds significantly heighten the risk for traders considering Oryx. As such, it is advisable for potential clients to approach this broker with extreme caution and to consider regulated alternatives that provide greater security and transparency.

Conclusion and Recommendations

In conclusion, the investigation into Oryx reveals multiple red flags that suggest it may not be a safe option for traders. The absence of regulatory oversight, coupled with numerous complaints regarding fund withdrawals and customer service, raises significant concerns about the broker's legitimacy.

For traders seeking a reliable platform, it is recommended to explore alternatives that are fully regulated and have a proven track record of protecting client interests. Brokers with established regulatory frameworks, transparent trading conditions, and positive customer feedback should be prioritized to ensure a safer trading experience.

Ultimately, the evidence strongly indicates that Oryx is not a safe option for forex trading and that potential clients should exercise extreme caution when considering their investment choices.

Is ORYX a scam, or is it legit?

The latest exposure and evaluation content of ORYX brokers.

ORYX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ORYX latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.