Is ECLIPX safe?

Pros

Cons

Is Eclipx Safe or a Scam?

Introduction

Eclipx is a forex broker that has emerged in the competitive landscape of online trading, aiming to provide various financial services to traders. As the forex market continues to attract a diverse range of participants, from seasoned investors to novices, the importance of evaluating the credibility and safety of brokers cannot be overstated. Traders need to ensure that their chosen platform is not only legitimate but also offers a secure trading environment. This article aims to investigate whether Eclipx is safe or a scam by examining its regulatory status, company background, trading conditions, customer fund security, and user experiences. Our assessment is based on a thorough analysis of various sources, including customer reviews, regulatory information, and market reports.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor that affects its credibility. Eclipx claims to operate under the regulatory framework of New Zealand. However, its specific licensing details and compliance history raise questions about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Markets Authority (FMA) | Not Listed | New Zealand | Unverified |

The lack of a clear regulatory license from a reputable authority like the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC) is concerning. Regulation is essential as it provides oversight to protect traders from potential fraud and malpractice. Eclipx has faced allegations of being involved in financial fraud, with reports of users being lured into investment schemes promising high returns, which further complicates its standing in the market. The absence of a solid regulatory framework diminishes the trustworthiness of Eclipx, making it essential for traders to approach this broker with caution.

Company Background Investigation

Eclipx's history and ownership structure are vital indicators of its reliability. The company has been active in the financial services sector but lacks transparency regarding its ownership and management team. This opacity can be a red flag for potential investors.

Eclipx's management team has not provided sufficient information about their qualifications or experience, which raises concerns about their ability to manage the platform effectively. Transparency in operations and leadership is crucial in building trust with clients. Furthermore, the companys communication regarding its services and policies is often vague, which adds to the uncertainty surrounding its operations.

In conclusion, while Eclipx may present itself as a viable trading option, the lack of detailed company information and a questionable regulatory background makes it difficult to ascertain its legitimacy. Traders should be wary and conduct thorough research before engaging with this broker.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions and fees is paramount. Eclipx's fee structure appears competitive at first glance, but hidden fees and unusual policies have been reported by users, leading to confusion and dissatisfaction.

| Fee Type | Eclipx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Structure | Variable | Fixed/Variable |

| Overnight Interest Range | 2% | 1.5% |

The spreads offered by Eclipx are slightly higher than the industry average, which could impact trading profitability. Additionally, the variable commission structure could lead to unexpected costs for traders, especially those who frequently trade. Reports of hidden fees have surfaced, suggesting that Eclipx may not be entirely transparent about its cost structure. Such practices can lead to a negative trading experience and may indicate a lack of integrity in the broker's operations.

Traders should carefully read the terms and conditions before committing to Eclipx, as the potential for unexpected fees could significantly affect trading outcomes. Overall, while Eclipx may offer some appealing trading conditions, the lack of clarity around fees is a cause for concern.

Customer Fund Security

The safety of customer funds is a crucial aspect of any trading platform. Eclipx claims to implement various security measures to protect client funds; however, the specifics of these measures are not well-documented.

Eclipx reportedly uses segregated accounts for client funds, which is a common practice among reputable brokers. This means that traders' funds are kept separate from the broker's operational funds, providing a layer of protection in case of insolvency. However, there is no clear information regarding investor protection schemes or negative balance protection policies, which are essential for safeguarding traders against significant losses.

The historical context of Eclipx's operations raises additional concerns. There have been instances of complaints regarding fund withdrawals and delays, which indicate potential issues in managing client assets. Such experiences can lead to a loss of trust among traders and suggest that Eclipx may not prioritize the safety of its customers' funds.

In summary, while Eclipx claims to have measures in place to ensure fund security, the lack of transparency and historical complaints about fund management warrant cautious consideration. Traders should weigh these factors carefully before deciding to invest their money with Eclipx.

Customer Experience and Complaints

Customer feedback provides valuable insight into a broker's reliability and service quality. Eclipx has received mixed reviews from users, with several complaints highlighting issues related to customer support and withdrawal processes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Poor Customer Support | Medium | Inconsistent |

| Misleading Information | High | No Resolution |

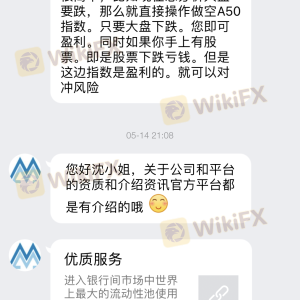

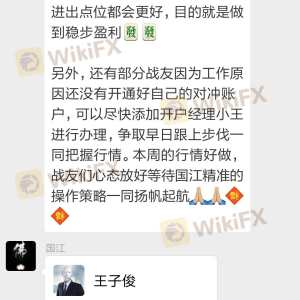

Common complaints include difficulties in withdrawing funds, which is a significant red flag for any broker. Users have reported long wait times for withdrawals and inadequate responses from customer support, indicating a lack of effective communication and service. Additionally, allegations of misleading information regarding trading conditions and fees have contributed to negative perceptions of Eclipx.

A typical case involved a trader who attempted to withdraw funds after several profitable trades but faced significant delays and a lack of communication from Eclipx's support team. This experience not only caused frustration but also raised concerns about the broker's integrity and reliability.

In conclusion, the customer experience with Eclipx has been largely negative, with numerous complaints about withdrawal issues and poor support. These factors should be carefully considered by potential traders, as they highlight significant operational shortcomings.

Platform and Execution

The performance of a trading platform is essential for traders to execute their strategies effectively. Eclipx offers a trading platform that has been described as user-friendly; however, there are concerns regarding its stability and execution quality.

Users have reported instances of slippage and order rejections, which can significantly impact trading outcomes. These issues raise questions about the platform's reliability and whether it operates fairly in executing trades. Additionally, there have been no clear indications of platform manipulation, but the lack of transparency in order execution processes leaves room for doubt.

Overall, while Eclipx may present a functional trading platform, the concerns surrounding execution quality and potential slippage warrant caution. Traders should prioritize platforms that offer transparent execution policies and reliable performance to ensure a positive trading experience.

Risk Assessment

Engaging with Eclipx presents several risks that traders should be aware of before committing their funds.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of clear regulation raises concerns. |

| Fund Security | Medium | Uncertainty around fund protection measures. |

| Customer Service | High | Poor support and withdrawal issues reported. |

The high regulatory risk associated with Eclipx is a significant concern, as it suggests that traders may have limited recourse in the event of disputes or issues. Additionally, the medium risk level regarding fund security indicates that while some measures may be in place, the lack of transparency and historical complaints could expose traders to potential losses.

To mitigate these risks, traders are advised to conduct thorough research, start with a small investment, and be prepared to switch brokers if issues arise. Utilizing well-regulated and reputable brokers can significantly reduce exposure to these risks.

Conclusion and Recommendations

Based on the evidence presented, Eclipx raises several red flags that suggest it may not be a safe trading environment. The lack of regulatory clarity, combined with numerous customer complaints and concerns about fund security, paints a troubling picture of this broker.

Traders should approach Eclipx with caution and consider the potential risks involved. For those seeking reliable alternatives, brokers regulated by top-tier authorities such as the FCA or ASIC are recommended. These brokers typically offer greater transparency, better customer service, and stronger protections for client funds.

In summary, while Eclipx may appeal to some traders, the overall assessment indicates that it is essential to exercise caution and consider more reputable options in the forex market.

Is ECLIPX a scam, or is it legit?

The latest exposure and evaluation content of ECLIPX brokers.

ECLIPX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ECLIPX latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.