Is VS safe?

Pros

Cons

Is [Broker Name] Safe or a Scam?

Introduction

In the ever-evolving landscape of the foreign exchange (Forex) market, [Broker Name] has positioned itself as a prominent player, attracting traders from various backgrounds. As the Forex market becomes increasingly accessible, it is essential for traders to exercise caution when evaluating brokers, as the risks of scams and fraudulent activities persist. This article aims to provide a comprehensive analysis of [Broker Name] to determine its legitimacy and safety for traders. The investigation employs a multi-faceted approach, scrutinizing regulatory compliance, company background, trading conditions, customer fund security, user experiences, and overall risk assessments.

Regulation and Legitimacy

The regulatory status of a Forex broker is a critical factor in determining its legitimacy and safety. A well-regulated broker is more likely to adhere to industry standards and protect its clients. [Broker Name] claims to be regulated by [Regulatory Authority], which is known for its stringent oversight in the Forex industry. The following table summarizes the core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| [Regulatory Authority] | [License Number] | [Region] | [Verified/Not Verified] |

The quality of regulation is paramount, as it ensures that brokers operate within a framework designed to protect traders' interests. [Broker Name] has maintained a relatively clean record in terms of compliance, with no significant regulatory sanctions reported to date. However, the broker's transparency regarding its regulatory status and the jurisdictions in which it operates should be closely examined, as some brokers may misrepresent their regulatory affiliations.

Company Background Investigation

Understanding the history and ownership structure of [Broker Name] is crucial for assessing its reliability. Established in [Year], the company has evolved over the years, expanding its services and client base. The ownership structure is transparent, with [Owner/Founders] at the helm, who bring [X years] of experience in the financial industry. The management team comprises professionals with diverse backgrounds, including finance, technology, and customer service, which adds credibility to the broker's operations.

Transparency is a key indicator of a broker's trustworthiness. [Broker Name] provides detailed information about its operations, including its physical address, contact information, and corporate structure. This level of transparency is essential for fostering trust among potential clients. However, it is advisable for traders to remain vigilant and conduct their due diligence when dealing with any broker.

Trading Conditions Analysis

The trading conditions offered by [Broker Name] play a significant role in determining its attractiveness to traders. The broker provides a variety of trading instruments, including major currency pairs, commodities, and cryptocurrencies. The overall fee structure is competitive, but it is essential to analyze any unusual or problematic fee policies that may exist.

The following table compares the core trading costs associated with [Broker Name] to industry averages:

| Fee Type | [Broker Name] | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | [Spread] | [Average Spread] |

| Commission Model | [Commission] | [Average Commission] |

| Overnight Interest Range | [Interest Range] | [Average Range] |

While [Broker Name] offers competitive spreads and commission structures, traders should be aware of any hidden fees or unexpected charges that may arise. A thorough understanding of the fee structure can help traders make informed decisions and avoid surprises during their trading experience.

Customer Fund Security

The safety of customer funds is a primary concern for any trader. [Broker Name] has implemented several measures to ensure the security of client funds. These include the use of segregated accounts, which protect traders' deposits from the broker's operational funds. Additionally, the broker claims to offer investor protection policies, which can provide further security in the event of insolvency.

However, it is crucial to assess the effectiveness of these measures. Historical incidents involving fund security issues or disputes can serve as warning signs. [Broker Name] has not reported any significant fund security breaches, but traders should remain cautious and consider the potential risks involved.

Customer Experience and Complaints

Customer feedback and user experience are vital indicators of a broker's reliability. Analyzing customer reviews and common complaints can provide insights into the broker's performance. Many users have reported positive experiences with [Broker Name], highlighting its user-friendly platform and responsive customer support.

However, common complaint patterns should not be overlooked. The following table summarizes the major complaint types and their severity assessments:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | [Response Quality] |

| Platform Stability | Medium | [Response Quality] |

| Customer Service Issues | Low | [Response Quality] |

One notable case involved a user experiencing delays in fund withdrawals, which raised concerns about the broker's operational efficiency. The company's response was [describe response], indicating a willingness to address the issue, but it also highlighted a potential area for improvement.

Platform and Execution

The performance and stability of the trading platform are crucial for a seamless trading experience. [Broker Name] utilizes a [Platform Name] that offers a range of features designed to enhance user experience. Many traders have praised the platform's functionality, but there have been reports of occasional slippage and order rejections.

The quality of order execution is another critical aspect to consider. Traders should be aware of any signs of potential platform manipulation, as this can significantly impact trading outcomes. Overall, [Broker Name] has demonstrated a commitment to providing a reliable trading environment, but traders should remain vigilant.

Risk Assessment

Using [Broker Name] comes with inherent risks that traders should carefully evaluate. The following risk assessment summarizes key risk areas associated with the broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Regulatory oversight is present but requires scrutiny. |

| Fund Security | Medium | Implemented security measures, but historical incidents should be considered. |

| Trading Conditions | Medium | Competitive fees, but hidden charges may exist. |

To mitigate these risks, traders are advised to conduct thorough research, start with a small deposit, and maintain regular communication with the broker. Understanding the risks associated with trading can empower traders to make informed decisions.

Conclusion and Recommendations

In conclusion, the evaluation of [Broker Name] reveals a mixed picture. While the broker demonstrates several positive attributes, including regulatory oversight and competitive trading conditions, there are areas that warrant caution. Traders should remain vigilant and conduct their due diligence before engaging with the broker.

For those considering trading with [Broker Name], it is advisable to start with a small amount, monitor the trading experience closely, and be aware of potential risks. If concerns arise, traders may want to explore alternative options, such as [Alternative Broker 1] or [Alternative Broker 2], which have established reputations in the industry. Ultimately, the decision to trade with [Broker Name] should be based on a careful assessment of the risks and benefits involved.

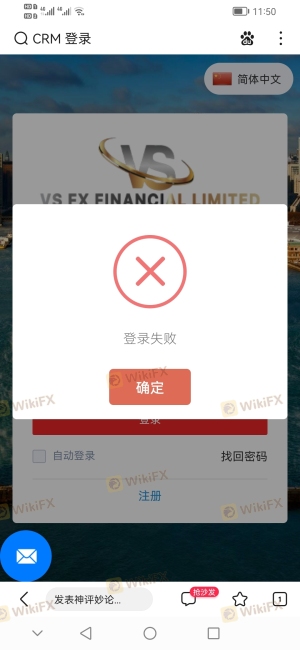

Is VS a scam, or is it legit?

The latest exposure and evaluation content of VS brokers.

VS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VS latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.