Is VOFX safe?

Business

License

Is VOFX Safe or Scam?

Introduction

VOFX is a forex broker that has been operational since 2017, positioning itself in the competitive landscape of online trading. As a New Zealand-based entity, VOFX primarily caters to traders looking for forex and CFD trading opportunities. However, in a market rife with potential scams and unreliable brokers, it is crucial for traders to conduct thorough evaluations of any trading platform before committing their funds. The legitimacy and safety of a broker can significantly influence the trading experience and the security of clients' investments.

This article aims to provide a comprehensive analysis of VOFX, focusing on its regulatory status, company background, trading conditions, client fund safety, user experiences, platform performance, and overall risk assessment. The evaluation is based on various sources, including regulatory disclosures, user reviews, and expert analyses, allowing for an objective assessment of whether VOFX is safe or a potential scam.

Regulation and Legitimacy

Understanding a broker's regulatory status is vital for assessing its legitimacy and reliability. VOFX claims to be registered with the Financial Service Providers Register (FSPR) in New Zealand. However, the broker has received a low score of 1.99/10 on WikiFX, indicating significant concerns regarding its regulatory compliance. The following table summarizes the core regulatory information for VOFX:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSPR | 551866 | New Zealand | Suspicious Clone |

The importance of regulatory oversight cannot be overstated. Brokers regulated by reputable authorities are required to adhere to strict guidelines that protect investors, such as maintaining segregated accounts and offering negative balance protection. Unfortunately, VOFX's association with the FSPR raises red flags, as the regulatory quality in New Zealand is not as stringent as in jurisdictions like the UK or Australia. Moreover, the absence of any negative regulatory disclosures could be misleading, as it does not eliminate the risks associated with a broker that operates under a suspicious clone status.

Company Background Investigation

VOFX, established in 2017, operates under the ownership of Prosperity International Finance Limited. The company's history is relatively short, which may lead to concerns about its stability and experience in managing client funds. The management teams background and expertise in the financial sector are critical factors that can influence the broker's operational integrity. Unfortunately, there is limited information available regarding the qualifications and experiences of VOFX's management team, which further complicates the assessment of its trustworthiness.

Transparency is a key factor in evaluating any financial institution. VOFX does not provide comprehensive information about its ownership structure or management team, which can be a significant concern for potential clients. The lack of detailed disclosures on the company's website may lead to skepticism about its operations and intentions. In a market where trust is paramount, the absence of transparency can be a strong indicator that traders should approach VOFX with caution.

Trading Conditions Analysis

An in-depth analysis of VOFX's trading conditions reveals a mixed picture. The broker offers a trading environment that utilizes the popular MetaTrader 4 platform, widely recognized for its user-friendly interface and robust trading tools. However, the overall cost structure and trading conditions warrant further scrutiny. The following table outlines the core trading costs associated with VOFX:

| Cost Type | VOFX | Industry Average |

|---|---|---|

| Spread (Major Currency) | 1.5 - 2.1 pips | 0.6 - 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

While VOFX does not charge commissions on trades, its spreads are notably higher than the industry average, which could erode potential profits for traders. Additionally, the broker's lack of clarity regarding overnight interest rates raises concerns about hidden costs that could impact overall trading profitability. Traders should be aware of these factors when considering VOFX as their trading platform.

Client Fund Safety

The safety of client funds is paramount when evaluating any broker. VOFX claims to implement various measures to ensure the security of clients' funds, including segregated accounts. However, the effectiveness of these measures remains questionable given the broker's regulatory status. The lack of clear information regarding investor protection and negative balance protection policies is concerning.

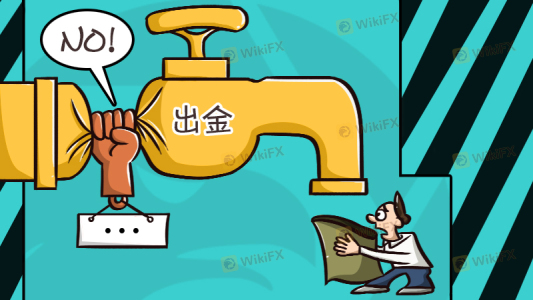

Historically, there have been instances of complaints regarding fund safety and withdrawal issues with VOFX. While there have been no significant scandals reported, the absence of robust investor protection mechanisms raises questions about the broker's reliability. Traders should be cautious and consider the potential risks associated with entrusting their funds to a broker with a questionable regulatory background.

Customer Experience and Complaints

User feedback is a valuable resource for assessing the reliability of any broker. In the case of VOFX, reviews indicate a mixed experience among clients. Common complaints include difficulties in withdrawing funds and delays in customer service responses. The following table summarizes the primary complaint types and their severity levels:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Service Delays | Medium | Inconsistent |

Several users have reported challenges in accessing their funds, which is a significant red flag in the forex trading environment. Moreover, the response quality from customer service has been criticized, leading to frustration among clients seeking assistance. Two notable cases involved users who experienced prolonged delays in fund withdrawals, raising concerns about the broker's operational transparency and responsiveness.

Platform and Trade Execution

VOFX utilizes the MetaTrader 4 platform, which is widely regarded for its reliability and user-friendly interface. However, the platform's performance and execution quality are critical aspects that can significantly impact the trading experience. Users have reported varying levels of order execution quality, with some experiencing slippage during volatile market conditions. The broker's execution speed and order rejection rates are essential factors to consider when evaluating its overall performance.

While the platform offers a range of analytical tools and features, any signs of platform manipulation or execution issues can be detrimental to traders' success. It is essential for potential clients to investigate the platform's performance thoroughly and consider user experiences before committing to VOFX.

Risk Assessment

Using VOFX as a trading platform presents several risks that potential clients should be aware of. The following risk assessment table summarizes the key risk areas associated with the broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operates under questionable regulation |

| Fund Safety Risk | Medium | Lack of clarity on investor protection |

| Execution Risk | Medium | Reports of slippage and order rejections |

| Customer Support Risk | High | Delays in response and unresolved issues |

To mitigate these risks, traders should conduct thorough research and consider alternative brokers with stronger regulatory backgrounds and better customer service records. It is advisable to maintain a cautious approach when trading with VOFX, especially for those new to forex trading.

Conclusion and Recommendations

In conclusion, the investigation into VOFX raises several concerns about its safety and reliability as a forex broker. While it operates under a regulatory framework, the quality of that regulation is questionable, and the lack of transparency regarding its management and operational practices is alarming. The higher-than-average trading costs, coupled with reports of withdrawal issues and inadequate customer support, suggest that traders should exercise caution.

For those considering VOFX, it is crucial to weigh the potential risks and challenges against their trading objectives. New traders or those with limited experience may want to seek alternatives that offer stronger regulatory protections and more transparent operations. Reliable brokers such as IG, OANDA, or Forex.com may provide safer environments for trading, with better support and lower costs.

Ultimately, the question "Is VOFX safe?" leans towards skepticism, and potential clients are advised to thoroughly evaluate their options before proceeding with this broker.

Is VOFX a scam, or is it legit?

The latest exposure and evaluation content of VOFX brokers.

VOFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VOFX latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.