Is VSH safe?

Pros

Cons

Is VSH Safe or Scam?

Introduction

VSH, a forex broker established in 2019, positions itself as a trading platform catering primarily to retail traders in the foreign exchange market. With the rapid growth of online trading, it has become increasingly important for traders to conduct thorough evaluations of brokerage firms before committing their funds. The forex market is rife with both legitimate brokers and potential scams, making it essential for traders to discern which platforms are trustworthy. This article aims to analyze the safety and legitimacy of VSH by investigating its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks. The assessment is based on a comprehensive review of various online sources and user feedback.

Regulation and Legitimacy

When evaluating a forex broker, understanding its regulatory status is crucial. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices that protect clients' interests. Unfortunately, VSH does not hold any valid regulatory licenses, which raises significant concerns regarding its legitimacy and operational transparency.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulatory oversight means that VSH is not subject to the same stringent regulations that govern licensed brokers. This lack of regulation can expose traders to higher risks, as unregulated brokers may not provide the necessary protections for client funds, nor are they obliged to adhere to ethical trading practices. Moreover, historical compliance issues are absent for VSH, but the lack of oversight raises questions about its operational integrity. As such, traders should approach VSH with caution and consider the implications of trading with an unregulated entity.

Company Background Investigation

VSH operates under the name VSH Finance Limited and is based in the United Kingdom. Although it has been in operation since 2019, the broker lacks a robust history and established reputation in the forex industry. The companys ownership structure remains unclear, as there is little publicly available information about its founders or stakeholders.

The management team behind VSH also lacks visibility, which can be a red flag for potential investors. A strong management team with relevant experience is often indicative of a brokers reliability and commitment to ethical trading practices. Furthermore, the transparency of the company is questionable, as it does not provide comprehensive information regarding its operations or financial standing. This lack of transparency can lead to uncertainty among traders regarding the safety of their investments with VSH.

Trading Conditions Analysis

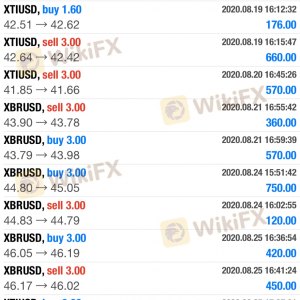

VSH offers a trading environment that primarily utilizes the MetaTrader 4 (MT4) platform, which is well-regarded in the forex community for its user-friendly interface and advanced trading tools. However, the fee structure of VSH raises concerns. While the specifics of their trading costs are not explicitly detailed, the absence of regulatory oversight often correlates with higher fees and unfavorable trading conditions.

| Fee Type | VSH | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | $5 - $10 per lot |

| Overnight Interest Range | N/A | Varies by broker |

Traders should be wary of any hidden fees or unusual pricing policies that may not be apparent at first glance. The lack of clarity around these costs can lead to unexpected expenses, which may erode trading profits. Therefore, it is crucial for traders to scrutinize VSHs fee structure and compare it with industry standards before proceeding.

Client Fund Security

The safety of client funds is paramount when selecting a forex broker. VSH has not provided sufficient information regarding its fund security measures. Typically, regulated brokers are required to segregate client funds from their operational accounts, ensuring that traders' money is protected in the event of insolvency. However, VSH's lack of regulatory oversight raises concerns about whether it implements similar safeguards.

Investors should also consider whether VSH offers negative balance protection, a feature that prevents traders from losing more money than they have deposited. Without this protection, traders could face significant financial risks, especially in volatile market conditions. Additionally, there have been no reported incidents of fund security breaches or disputes, but the absence of a solid framework for fund protection is alarming.

Customer Experience and Complaints

Customer feedback is an essential component in assessing the reliability of a broker. Reviews and testimonials from users can provide insight into the overall trading experience. Unfortunately, VSH has received a number of complaints regarding its service quality and responsiveness. Common issues reported include difficulties in withdrawing funds and poor customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Slow |

One notable complaint involved a trader who reported being unable to access their account and experiencing unresponsive customer service. Such issues can lead to frustration and distrust among clients, further indicating that VSH may not provide the level of service that traders expect. The accumulation of negative feedback should serve as a warning to potential users regarding the reliability of VSH.

Platform and Trade Execution

The performance of the trading platform is another critical aspect of a broker's service. VSH utilizes the MT4 platform, which is known for its stability and extensive features. However, the execution quality and reliability of VSH's trading environment are under scrutiny. There have been reports of slippage and order rejections, which can adversely affect trading outcomes.

The potential for platform manipulation is a significant concern, particularly with an unregulated broker. Traders should be vigilant and monitor their trades closely to ensure that they are not subjected to unfair practices. A transparent and efficient trading platform is vital for maintaining trust between the broker and its clients.

Risk Assessment

Engaging with VSH presents several inherent risks, primarily due to its unregulated status and lack of transparency.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Lack of information on fund protection |

| Customer Service Risk | Medium | Numerous complaints regarding support |

Traders should exercise caution and consider risk mitigation strategies when dealing with VSH. It may be advisable to limit the amount of capital allocated to this broker and to remain vigilant regarding any unusual trading activity or account issues.

Conclusion and Recommendations

In conclusion, the investigation into VSH raises significant concerns about its safety and legitimacy. The absence of regulatory oversight, coupled with a lack of transparency and numerous customer complaints, suggests that VSH may not be a safe option for traders. While there are no definitive signs of fraud, the risks associated with trading on this platform are high.

Traders seeking a reliable forex broker should consider alternatives that are well-regulated and have a proven track record of customer satisfaction. Brokers such as IG, OANDA, and Forex.com offer robust regulatory protections and transparent trading conditions, making them safer choices for traders.

Ultimately, the question "Is VSH safe?" leans towards a cautious "no." It is essential for traders to prioritize their financial safety by selecting brokers that adhere to regulatory standards and demonstrate a commitment to client protection.

Is VSH a scam, or is it legit?

The latest exposure and evaluation content of VSH brokers.

VSH Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VSH latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.