Regarding the legitimacy of USG forex brokers, it provides FCA and WikiBit, .

Is USG safe?

Business

License

Is USG markets regulated?

The regulatory license is the strongest proof.

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Union Standard International Group Limited

Effective Date:

2018-11-05Email Address of Licensed Institution:

compliance@ukusg.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

https://www.ukusg.co.uk/Expiration Time:

2022-12-16Address of Licensed Institution:

75 King William Street London EC4N 7BE UNITED KINGDOMPhone Number of Licensed Institution:

+4402078463712Licensed Institution Certified Documents:

Is USG Safe or Scam?

Introduction

In the fast-paced world of forex trading, choosing the right broker is crucial for both novice and experienced traders. USG, or United Strategic Group, has emerged as a player in the forex market, claiming to offer a range of trading options and competitive conditions. However, the question arises: Is USG safe? This article aims to provide a comprehensive evaluation of USG's legitimacy, focusing on its regulatory status, company background, trading conditions, customer safety, and user experiences. Our investigation is based on a thorough review of various online resources, including user reviews and expert analyses, to ascertain whether USG is a trustworthy broker or a potential scam.

Regulation and Legitimacy

Understanding a broker's regulatory status is essential in determining its safety. Regulation ensures that brokers adhere to specific standards that protect traders' interests. In the case of USG, the situation is complex. USG claims to operate under two entities: Union Standard International Group Limited, which is regulated by the UK's Financial Conduct Authority (FCA), and United Strategic Group LLC, which is registered in Saint Vincent and the Grenadines. However, the latter lacks any regulatory oversight for forex activities.

Here is a table summarizing USG's regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 798776 | UK | Verified |

| SVG FSA | 648 LLC 2020 | Saint Vincent | Not Regulated |

Despite the FCA's regulation, USG operates under a domain that is not recognized by the FCA, raising concerns about its legitimacy. Furthermore, the lack of stringent regulations from the SVG FSA indicates that USG may not be held accountable for any financial misconduct. The FCA has issued warnings against USG, suggesting that it provides financial services without proper authorization. This raises significant red flags regarding the broker's credibility. Therefore, traders should exercise caution when considering whether USG is safe for their investments.

Company Background Investigation

USG was established in 2022 and claims to offer a robust trading platform for forex and CFDs. However, the company's brief history raises questions about its stability and reliability. The ownership structure of USG is somewhat opaque, with limited information available about its management team and their qualifications.

A thorough investigation reveals that USG's management team lacks the experience typically found in reputable brokerage firms. The absence of a transparent ownership structure and detailed information about the team's professional backgrounds diminishes the broker's credibility. Moreover, the company's limited operational history does not provide sufficient evidence of its ability to navigate market challenges and protect client interests.

In terms of transparency, USG's website offers minimal information about its operations, which is a concerning factor for potential clients. The lack of detailed disclosures about its business practices, financial health, and regulatory compliance further contributes to the uncertainty surrounding its legitimacy. Given these factors, it is crucial for traders to consider whether USG is safe before committing their funds.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. USG claims to offer competitive spreads and leverage, but a closer examination reveals inconsistencies in its fee structure. Traders have reported various fees that are not clearly outlined on the broker's website, leading to confusion and frustration.

Here is a comparison of USG's trading costs against industry averages:

| Fee Type | USG | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.3 pips | From 1.0 pips |

| Commission Model | Varies | Typically Fixed |

| Overnight Interest Range | Unknown | 0.5% - 2% |

USG's spreads appear to be higher than the industry average, which could eat into traders' profits. Additionally, the lack of clarity regarding commission structures raises concerns about hidden fees that could impact overall trading costs. This ambiguity can lead to unexpected expenses, making it difficult for traders to gauge their potential returns accurately.

Furthermore, traders have reported issues with withdrawal processes, citing delays and complications when attempting to access their funds. Such experiences raise significant concerns about the broker's reliability and whether USG is safe for traders looking for a transparent and straightforward trading environment.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. USG claims to implement several measures to protect client funds, including segregated accounts and negative balance protection. However, the effectiveness of these measures is questionable, given the broker's regulatory status.

USG's funds are reportedly held in segregated accounts, which is a positive aspect as it ensures that client funds are kept separate from the broker's operating capital. However, the lack of regulatory oversight means that there is no guarantee that these funds are adequately protected. Additionally, the absence of investor protection schemes, such as those offered by FCA-regulated brokers, leaves clients vulnerable in the event of insolvency or fraud.

Historically, USG has faced allegations related to fund withdrawal issues, with numerous clients reporting difficulties in accessing their funds. Such incidents raise concerns about the broker's financial stability and commitment to safeguarding client assets. Therefore, traders must carefully consider whether USG is safe before investing their hard-earned money.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. A review of user experiences with USG reveals a pattern of complaints, particularly regarding withdrawal issues and customer service responsiveness. Many users have reported being unable to withdraw their funds, leading to frustration and distrust.

Here is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Often unresponsive |

| Poor Customer Support | Medium | Generic responses |

| Account Management Issues | High | Lack of follow-up |

Typical cases involve clients waiting months for their withdrawal requests to be processed, with little to no communication from the broker. In some instances, users have reported being told to open new accounts or deposit additional funds to facilitate withdrawals, which raises further red flags about the broker's practices.

These complaints highlight a concerning trend that suggests USG may not be safe for traders looking for a reliable and responsive trading experience.

Platform and Trade Execution

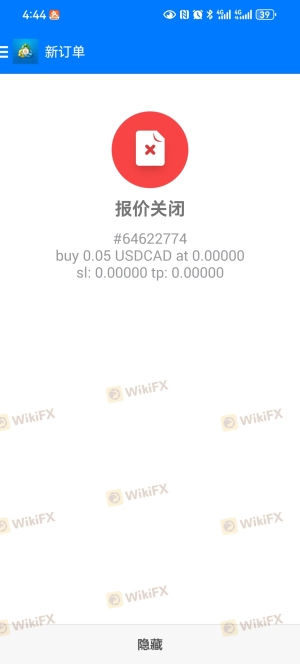

The trading platform is a critical component of any forex broker's offering. USG utilizes well-known platforms like MetaTrader 4 and 5, which are generally regarded as reliable and user-friendly. However, user reviews indicate that there may be issues with order execution quality, including slippage and rejected orders.

Traders have reported instances of significant slippage during volatile market conditions, which can adversely affect trading outcomes. Additionally, the frequency of rejected orders raises concerns about the broker's execution capabilities. Such issues can be particularly detrimental for traders employing scalping strategies, where quick execution is vital for success.

Given these factors, it is essential for prospective clients to consider whether USG is safe for their trading needs, especially if they rely on a seamless trading experience.

Risk Assessment

Every trading environment comes with inherent risks, and USG is no exception. An analysis of the potential risks associated with trading through USG reveals several areas of concern.

Here is a summary of key risk categories:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns |

| Withdrawal Risk | High | Complaints about fund accessibility |

| Execution Risk | Medium | Reports of slippage and rejections |

To mitigate these risks, traders should conduct thorough due diligence before engaging with USG. It is advisable to start with a demo account to assess the platform's performance and customer service. Additionally, traders should only invest funds they can afford to lose, given the uncertainties surrounding USG's operations.

Conclusion and Recommendations

In conclusion, the evidence suggests that USG may not be a safe choice for forex traders. The broker's questionable regulatory status, coupled with a history of customer complaints and withdrawal issues, raises significant concerns about its legitimacy. While USG offers a range of trading options and platforms, the risks associated with trading through this broker outweigh the potential benefits.

For traders seeking reliable alternatives, consider brokers that are fully regulated by reputable authorities, such as the FCA or ASIC. These brokers typically offer better protection for client funds and a more transparent trading environment. Overall, it is crucial for traders to prioritize safety and due diligence when selecting a forex broker, as the consequences of poor choices can be financially devastating.

Is USG a scam, or is it legit?

The latest exposure and evaluation content of USG brokers.

USG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

USG latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.